Hello everyone and welcome to a new dividend income update.

We started focusing on dividend growth investing in 2011. Since then, we have built up a seven-figure dividend portfolio. Looking back, back in 2007 I purchased my first dividend stock in 2007 not knowing too much about the investing world.

I sure was fearless and had nothing to lose!

After many years of investing, I realized and learned how important diversification is. Hence we went from holding individual stocks to holding both individual stocks and index ETFs. We have never looked back since.

Our reasons?

- We hold individual Canadian and US dividend paying stocks to create our own index. These dividend stocks provide dividend growth.

- Index ETFs like XAW and QQQ provide long term growth, asset diversification, and geographical diversification.

Although we create our own index via #1, we only hold a limited number of stocks. Many of these stocks (44 of them at the time of writing) are Canadian and concentrate in the financial sector. In other words, not very diversified Thus, the reason for utilizing index ETFs for diversification purposes.

As many readers know, we don’t invest in GICs and we don’t invest in cryptocurrencies, precious metals, and bonds.

Is it riskier to invest more or less 100% in equities? Yes and no. We hold some cash reserves in our chequing and savings accounts to make sure we have sufficient cash buffers. Having a relatively high savings rate and having full time salary income coming in every two weeks also help.

On the other hand, we only invest with money that we don’t need for at least three years, so we aren’t forced to sell stocks when the market is down.

Over the last little while, we have been focusing more and more on lower dividend yield but higher dividend growth stocks. This is our way to ensure our dividend income can continue to grow organically and keep up with inflation when we do eventually live off dividends or use dividends to supplement our part time income.

For the most part, life was relatively pretty low-key in February.

Mrs. T and I believe that life skills are important, so we try to get both kids involved in making healthy snacks and meals.

Below are some stuff both kids made (with some help from us):

We try to teach both kids important life skills whenever we can. Nowadays, both kids can make simple breakfasts like oatmeal and scrambled eggs in the morning. This is making our lives as parents a little bit easier.

Thanks to drier weather in February, we were able to take the Beaver Scouts outside for several hikes and the family also spent some time on the local beach.

We were fortunate that my parents were able to look after both kids one Saturday to allow Mrs. T and I to have a date day. First, we went to North Vancouver to check out a Himalayan salt cave.

It was a calming experience to spend about 30 minutes in the salt cave (aka taking a much needed nap).

After the salt cave, the two of us walked around town, had a nice lunch, went to Ikea, Costco, and Home Depot for some shopping, and had a nice Japanese dinner, before picking up both kids from my parents. It was nice to spend half a day just the two of us, without kids. We need to do this more regularly!

February was Lord Baden Powell’s birthday, the creator of Scouts. So our Scouts group got together and had a nice banquet. To my surprise, I was given a little gift for helping out at both Beavers and Cubs meetings every week.

The award was “double bubble”

Six years as a Scouter volunteer so far and eight years as a Scouts/Venturer/Rover as a youth, Scouting has become a pretty big part of my life… and in a very good way.

Dividend Income – February 2024

In February we received dividends from the following stocks:

- Apple (AAPL)

- AbbVie (ABBV)

- Bank of Montreal (BMO.TO)

- Costco (COST)

- Emera (EMA.TO)

- Granite REIT (GRT.UN)

- National Bank (NA.TO)

- Power Corp (POW.TO)

- Procter & Gamble (PG)

- Royal Bank (RY.TO)

- Starbucks (SBUX)

- SmartCentres REIT (SRU.UN)

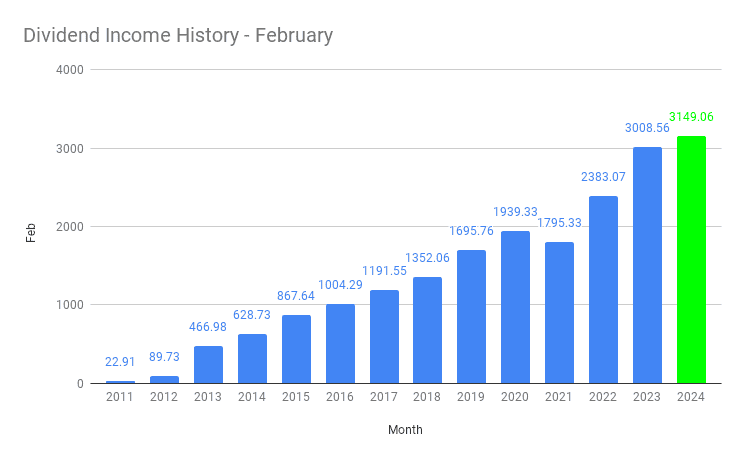

The 12 dividend paycheques added up to $3,149.06. Since February is one of the low dividend income months for us (due to fewer companies paying out dividends per the dividend calendar), we are happy with receiving over $3,100 in dividends. Furthermore, after a record setting month in January, it’s expected to see a lower dividend total the month after.

Looking at our February dividend income history above, you’ll see there was a decrease in 2021. This was due to some dividend cuts from the pandemic as well as the fact that we closed some positions. It certainly was nice to see the February dividend income is on an upward projection once again.

Compared to February 2023, we saw a YoY growth of 4.67%. It’s not the best YoY growth number but I will take any growth over no growth at all.

After two months of the year, we are averaging a YoY growth of 20.3%. One thing to keep in mind is that our goal for this year is $55,000 in dividend income and that’d put us at around a 9.5% YoY growth rate. Therefore, the average YoY percentage will likely continue to drop throughout the year.

Dividend Hikes

February was a fantastic month in terms of dividend hikes. We were very happy to see the following companies raising dividends:

- Brookfield Asset Management (BAM.TO) raised its dividend payout by 18.75% to $0.38 per share.

- BCE (BCE.TO) raised its dividend payout by 3.1% to $0.9975 per share.

- Brookfield Renewable Corp (BEPC.TO) raised its dividend payout by 5% to $0.355 per share

- Brookfield Corporation (BN.TO) raised its dividend payout by 14.3% to $0.08 per share.

- Canadian Natural Resources (CNQ.TO) raised its dividend payout by 5% to $1.05 per share.

- Intact Financial (IFC.TO) raised its dividend payout by 10% to $1.21 per share.

- Coca-Cola (KO) raised its dividend payout by 5% to $1.94 per share.

- Manulife Financial (MFC.TO) raised its dividend payout by 9.6% to $0.40 per share.

- Magna International (MG.TO) raised its dividend payout by 3% to $0.475 per share.

- Pepsi (PEP) raised its dividend payout by 7% to $1.355 per share.

- TC Energy (TRP.TO) raised its dividend payout by 3% to $0.96 per share.

- Walmart (WMT) raised its dividend payout by 9.2% to $0.6224 per share (pre-split).

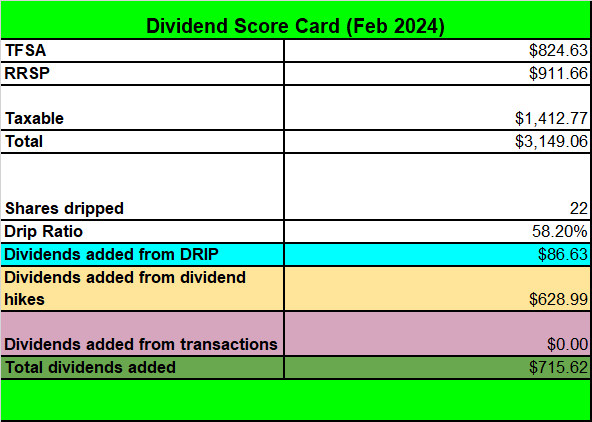

It’s quite unbelievable to see a total of 12 dividend hikes in 29 days. All of these hikes increased our forward dividend annual dividend by $628.99.

At a 4% dividend yield that’s equivalent to investing $15,724.75 worth of new capital.

Regardless of what your income is, almost $16k is a sizable amount of new cash to add to an investment portfolio. Instead of having to add this amount of cash, we gained forward dividend income from dividend hikes (aka organic dividend growth). This is the key reason why organic dividend growth is so important… one shouldn’t just chase for the initial high yield.

Dividend Reinvestment Plans (DRIP)

When we initiate a position in our dividend portfolio, we always aim to accumulate enough shares one day to enroll in DRIP. Once we are dripping additional shares for each dividend payout, we put the position on auto-pilot and take advantage of dollar cost average over time.

Over time we have dripped many shares. For example, we have dripped over 450 shares of Enbridge and 50 shares of Coca-Cola.

Because of the “lower” dividend income in February, we only managed to drip the following shares:

- 3 shares of Bank of Montreal

- 3 shares of Emera

- 5 shares of National Bank

- 5 shares of Royal Bank

- 6 shares of SmartCentres REIT

These additional shares increased our forward annual dividend income by $86.63. It’s not a lot increase but over the long term every little bit counts.

Stock transactions

After a busy January where we added over $26,000 in dividend stocks and ETF (i.e. QQQ), February was a quiet month for us as we didn’t add any new shares.

But it’s totally OK not to make any purchases. As an investor, you want to avoid buying just for the sake of buying and the same thing for selling. Just because it’s a new month and you have some cash on hand, it doesn’t mean you must buy something. Similarly, just because you are considering selling some shares, it doesn’t mean you have to sell at that exact moment.

Waiting and being patient is a critical skill to learn on your investing and financial independence journey.

I’ll admit, I’m not perfect. From time to time, I still make the mistake of buying or selling for the sake of doing something. But whenever I get that urge, I try to remind myself of the lessons I have learned over the last 17 or so years of DIY investing.

The key is not to make any mistakes. We as investors will make mistakes and mistakes will always happen. (It’s also critically important that you learn from the mistake – that’s the key!) The important part comes down to two things:

- To limit the dollar impact of your potential mistakes. This is why you don’t put all of your money in one stock. Diversification is important.

- To avoid making the same mistake over and over. Learn from your mistakes.

I have mentioned the five stocks we plan to buy in 2024. We plan to stick to that plan mostly. Hopefully we will see some pullbacks for Costco to make it more enticing to purchase additional shares.

Since one of my annual goals is to reduce the number of holdings down to 40 (we’re at 44 right now), here are some potential stocks that we may close this year:

- Canadian Tire – Surprisingly, the warmer winter has impacted Canadian Tire’s revenues. Although Canadian Tire has been growing dividends for 13 years straight with a 10-year dividend growth rate of 17.3%, the price performance over the last five years isn’t all that impressive.

- Magna International – Magna International is the smallest position percentage-wise in our dividend portfolio. The stock has dropped quite a bit due to the ongoing Russia-Ukraine war. Magna International provides a lot of parts to auto companies and is building toward an EV future. However, the EV market has slowed down and that’s negatively impacting MG’s stock price performance.

- Qualcomm – I have a love-hate relationship with Qualcomm. Professionally I work very closely with Qualcomm so I know they make a lot of money from their cellular chipsets. I also know that they make even more money from royalties. But the stock price has bounced around in the last couple of years. Would Qualcomm see a bit of a tailwind from the AI hype? Qualcomm is a relatively small position for us, does it make sense to reinvest the money elsewhere? (Qualcomm is a multi-bagger position for us, does it make sense to close out?).

Again, I don’t want to close any position simply because I want to achieve my goals. I want to be methodical whenever we decide to close out a position.

Dividend Scorecard – February 2024

Here’s our dividend scorecard for February:

A pretty solid month overall, especially in the form of dividends added from dividend hikes.

Two months into the year we already added over $1,300 toward our forward annual dividend income. We are very pleased with this solid progress so far.

Dividend Income – February 2024 Summary

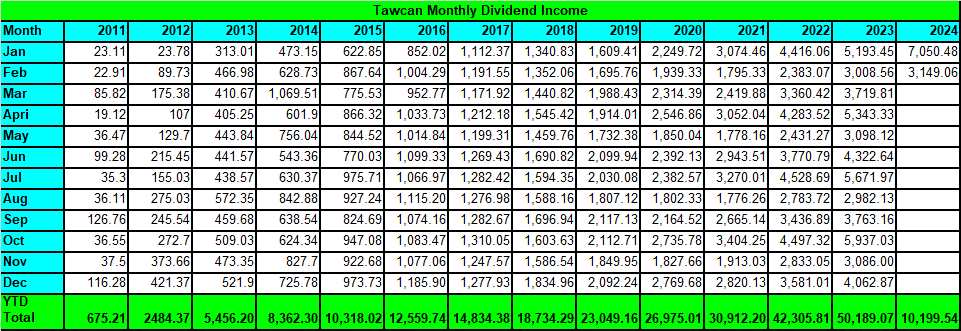

With two months in the books, we have received a total of $10,199.54 in dividends.

Looking back, it’s amazing that after two months we’re almost exceeding the annual dividend total from 2015. We have made a lot of progress since we started focusing on the dividend growth investing strategy.

To put things in perspective, $10,199.54 is equivalent of:

- $169.99 per day or $7.08 per hour. This was a big drop compared to last month.

- $1,133.28 per week or $28.33 per hour after 9 working weeks. Again, this was a big drop compared to last month.

We are very grateful for our dividend portfolio working hard for us so we don’t have to.

How was your February dividend income?

Great blog, been following for a while now and appreciate your thoughts.

My portfolio has been rather wild as I have taken significant risks in my 40 (now 50) and I have started to de-risk things a fair bit over the last few years. Rather than huge bets on individual holdings, I moved money to XEQT. That is still 100% equity but diversified across various global markets and sectors. I hope to retire in 4-5 years so I’m looking to reduce risk further.

I do hold a number of Canadian and US dividend holdings (usual suspects) though I recently found ZGRO-T. This fund, which is not the more commonly known ZGRO (or VGRO, XGRO funds which are similar), is still focused on growth with an 80/20 split of equity/bonds, but has a much higher divident (currently 5.6%) though with a reduced growth profile vs the lower yielding ZGRO.

Thinking of moving some US dividend holdings, and my XEQT shares over to ZGRO-T. Seems like it would reduce overall risk by reducing individual holdings and adding a bond element, while maintaining a high yield. Thoughts?

I like XEQT a lot so there’s nothing wrong with holding that. Depending on your risk tolerance, you may want to shift your equity exposure as you get closer to retirement. Moving more money over to ZGRO seems to make sense.

Hi, you are well on your way to early retirement- congratulations! Middle months of each quarter produce way less income for me compared to the other months.

Recently I bought some QQC (instead of QQC) to increase tech exposure I have a workplace pension which severely limits my RRSP contributions…I choose mainly to buy individual US stocks in that account to avoid withholding tax.

Personally I think the Canadian telecoms are a major bargain right now even with all the headwinds- I don’t see any dividend cuts coming, but even if this happens I will likely keep buying as I believe they will recover over the long term. I don’t view this situation the same as Algonquin which had poor management and identity crisis- I sold after it started talking about getting rid of its renewable assets at the worst possible time.

Any plans to release an updated a top US dividend growth stock list?

There is no edit so I meant to say QQC.TO instead of QQQ.

And have you considered something like AVGO instead of QCOM stock?

Thought about AVGO but decided not buying it. Instead, getting that exposure through QQQ and XAW.

Thank you. QQC.TO is a good choice as you don’t have to convert to USD (for QQQ).

The Canadian telecoms are getting hammered due to the interest rates. Like you, I don’t see any cuts coming but we’ll see what happens. Will take a look regarding updating top US dividend growth stock list.

Hi, what do you think abut Parker Hannifin (NYSE: PH) ?

Sorry, don’t really follow PH.

Hey Bob, I’ve been silently reading your site since 2017. The new intrusive video and pop-over ads are a big turn-off, as a long time reader I’m probably done if this is how it will be from now on. I hope it’s good for your bottom line, but I thought you might want some feedback that it’s not coming without a cost on regular readers.

Hi Dave,

Thank you for the feedback, I’ll see what I can do to limit the video & pop-over ads. Sorry about that.

Any plans om BCE sel, considering the downfall it is going through? Do you believe, Telus will follow BCE story in a few qtrs – they are much more diversified than BCE, but we never know.

No plan to sell BCE or Telus.

Hallo, ich Verfolge als begeisterter Deutscher ihren Blog schon seit mehreren Jahren. Den Verkauf von Enbridge habe ich nicht mitbekommen oder war der erst im Februar. Gibt es dafür eine Begründung?

Beste Grüße Stefan

Hi Stefan,

A little bit confused, we haven’t sold Enbridge, what made you think we did?

Hi there

Really enjoying your blog!

Question:

Of the $50,000 you earned in dividends in 2023, how is that total dividend amount allocated between your RRSP, TFSA and Non-Registered Trading account? Do you wait to have a sizable amount of cash from your dividends to either buy a new stock or ETF or dollar-cost average on one of your stocks in that particular trading account…..or…..do you take money OUT of your trading accounts to “live on”?

My husband just retired from his full time job July 1, 2023 but is working a few hours a week to add a little income. We were wondering what the best strategy would be to tax-efficiently WITHDRAW money from our accounts (RRIFs, TFSAs and non-Registered Trading account). Looks like the best place to initially withdraw money to live on is from our RRIF accounts. It’s kinda scary to see the amounts in our accounts now decreasing as we have now entered the decumulation period of our lives! Accumulation is much easier phase of investing than decumulation.

We do not have enough dividends in our accounts to live on so must sell some of our holdings….ouch.

Hi Jan,

You can take a look at the breakdown here – https://www.tawcan.com/dividend-income-december-2023-update-2023-summary/

You can take a look at our withdrawal assumptions/plans here- https://www.tawcan.com/revisit-our-financial-independence-assumptions/

Hope this helps.

I agree with you, seeing those dividend hikes always reminds me why we do what we do as Dividend growth investors. It definitely gives a psychological boost when you know your overall portfolio can give you raises above inflation and in my case even beats my work raises.

For sure, love these dividend hikes.

Ah, Thinking Day celebration, such good memories. Growing up I was a brownie/girl guide/ranger, best 12 years of my life. Guiding provided tremendous opportunities for personal growth and development that has served me well. 20+ years since I said my last promise, I’m still cashing in those dividends!

Love that you were involved in Guides. Both Scouts and Guides are great for personal growth.

Now that is a great month! Congrats!

Very impressive dividend raises. Keep up the great work!

Thank you!