It’s never too early to start looking forward. I’ve been doing this on my site for some time and doing a bunch of assumptions and simulations on what our financial independence retire early might look like.

- Our financial independence assumptions

- Our financial independence assumptions – what about taxes?

- Revisit our financial independence assumptions

I also have interviewed many Canadians who are financially independent and/or retired early in my FIRE Canada Interviews.

Having some plans on your hands is better than no plans at all – but as we’ll see today in this updated post – it’s the process of planning that’s critical for your retirement plan.

Doing so will help you to stay focused and provide the roadmap to achieve your goals

If you aspire to retire or semi-retire earlier than most people, how much do you need to retire early at age 40, 45, 50 or 55? Thanks to my friends at Cashflows & Portfolios and I have that answer today.

‘Traditional’ retirement vs. the ‘new’ retirement

For those not familiar with Cashflows & Portfolios, it’s a site started by two long time Canadian bloggers, Mark and Joe. Mark runs My Own Advisor, which I started reading before I started this blog. Joe was the brain behind Million Dollar Journey, which I have been following for over a decade.

All three of us believe we need to retire the term: retirement. To be more specific, we believe it’s time to change the ‘traditional’ definition of retirement. It is also important to make sure you know what you’re retiring to.

Back in the day, when you turned 60 or 65, and once you had grown tired of working, people retired and never worked again. At the time of retirement, they could trade decades of factory time for a workplace pension to supplement income for the golden years.

Well, workplace pensions are dwindling and more and more, pursuing retirement in any traditional sense seems rather unhealthy today. A traditional retirement can be unhealthy physically, emotionally and financially.

On a physical level, retirement has traditionally meant a decrease in activity. You no longer have a driving reason to get out of bed in the morning, grab a coffee and get to the office – so you take it easier. That may not be beneficial to your wellness and based on my personal fitness experiences, not something that appeals to me.

On an emotional level, retirement for some could lead to social isolation. Potentially, you’ve identified and linked your self-worth to your organization, your co-workers and your manager.

Retirement means you’re leaving your workplace but the organization will undoubtedly continue to work without you being there. Unfortunately, life just works that way, it doesn’t stop for anyone. So, I believe it’s important to maintain a modest level of stimulation at any age, including retirement.

Not remaining socially engaged with other people in retirement could lead to mental health struggles.

Finally, retirement is not cheap, financially. Unless you have that aforementioned workplace pension (and let’s face it, many Canadians don’t, me included!), you’ll need to rely on your disciplined, multi-decade savings rate to maximize your retirement income stream at age 40, 45, 50 or 55.

Sure, while there are other retirement income streams to eventually enjoy, like Canada Pension Plan (CPP) and Old Age Security (OAS), many readers of this blog probably don’t want to wait until ages 60 or 65 to tap those income streams respectively.

Let’s get one point straight, it’s a privilege to be able to retire early at age 40, 45, 50 or 55. Early retirement isn’t for everyone and those who can “retire” early typically enjoy some sort of privileges in their lives. Such privileges need to be highlighted more within the FIRE community.

The reality is that you do need to have a certain level of income to build up enough assets by your 40s so your portfolio can withstand some drawdowns in the subsequent decades. A relatively high savings rate combined with a certain level of income will help and in my opinion crucial.

Frankly, if your income level isn’t high enough (e.g., working in a minimum wage job), it will be extremely hard to achieve a relatively high savings rate. The math is just stacked against you on all fronts. It is also extremely difficult to cut expenses to the barebone minimum without depriving yourself… And I certainly wouldn’t recommend going down that approach (believe me, I’ve tried and realized that would only lead to disasters).

Should FIRE just RIP?

I’ve written about this many times, but it’s worth mentioning again in the context of these case

studies today – to see how much you need to retire early at age 40, 45, 50 or 55.

To summarize the previous section… I think FIRE should just RIP (Rest In Peace).

What I mean is, unless you are like Jacob Fisker, at times just living off $7,000 per year (not a typo!) in an RV, in dorms, not many of us are going to retire early through extreme ways – nor do we want to!

Here is an actual quote from Jacob’s site:

“Keep in mind I’ve spent between $5-7k/year for more than a decade while living in several different situations: being single and married, living in three different countries, in dorms, apartments and house rentals, in an RV and as a homeowner. There are many different solutions at this spending level. For more examples, look through the forum journals.”

Jacob’s case is definitely on the extreme side and very few people would be able to pull that off for an extended period of time. To me, you probably won’t enjoy your life all that much when living on such an extreme budget.

Where I am going with this is, many FIRE (Financial Independence, Retire Early) stories tend to

sensationalize early retirement. Many of these articles tend to focus on just the upside of early

retirement in some misleading ways. It seems either very relaxed and/or quite luxurious for some – travelling around the world, leaving the 9-5 rat race, saying FU to the employers, and sipping piña coladas on the beach.

Essentially, many FIRE stories are drawing a picture that there are no drawbacks and no negatives to early retirement.

But this is not true!

Because no matter where you go, you will always bring yourself. What I mean is, if you’re not in a happy, well, and fulfilled place while pursuing FIRE, then you’re probably not going to find happiness once you reach it.

In other words, FIRE shouldn’t be seen as a finish line and crossing this finish line will magically make you happy. Life doesn’t work that way and it shouldn’t. We should see FIRE as a journey and we should evolve as individuals throughout this life long journey.

Furthermore, more to my point, many of these articles also fail to acknowledge that some of these early retirees are not really “retired” in the traditional sense. They still make money in retirement, just different in the traditional sense of a 9-5 job.

Many of these early retirees are still earning money through their side-hustles or even part-time jobs. The difference is that they choose to work because they enjoy it, not because they have to. Often, some of these money earning potentials come from hobbies that they enjoy doing and eventually lead to some small amount of income (i.e. Mr. Money Mustache makes money via carpentry because he enjoys doing that).

You also need to carefully differentiate between those that retired early because they have enough in their portfolio and those that are “retired early” but are trying to sell you courses and eBooks to “help” you achieve financial retirement.

Are they actually retired? Or are they using you to help them achieve/sustain early retirement?

Be careful what you read!!!

I’ve tinkered with the concept of a mini-retirement and if not that, definitely some form of semi-

retirement as I work part-time. I believe it’s important to retire “to” something vs. run away from something.

You need a purpose in life, which doesn’t have an age-expiry date.

So, like my friends Mark and Joe at Cashflows & Portfolios do, if you’re considering any form of retirement or semi-retirement in a few years, then start practicing and thinking early and often about how you might spend your time, over time.

It’s a great start to have a financial roadmap that’s designed around your needs, your goals and your objectives with your family. But let’s not forget that your financial future is also a lot more about what you do with your time. You need to consider the need to be physically, mentally and socially engaged as well.

How much do you need to retire early at age 40, 45, 50 or 55?

In thinking about my readership and the questions I often get on this site, I asked Mark and Joe to consider a series of mini-case studies below related to retirement savings by age – to retire early at age 40, 45, 50 or 55, now.

In this updated series, I share a couple’s plan to retire earlier without pursuing homeownership and by staying out of debt.

Before we get to that analysis, a reminder for all of us that retirement projections and some form of planning is a never-ending process. Retirement planning has a start, but it doesn’t really have an end… like I said before, having a plan is better than having no plans at all.

To have a comfortable, secure-and-fun-retirement or semi-retirement, you need to define what that means for you and revisit any assumptions routinely. A good retirement plan with your family, partner, or just for you alone, while it starts with goals and dreams, it also looks at revisiting these things usually every year as you get older to see if any of those things have changed. Given plans change, it’s the process of planning and re-planning that’s key.

Life has a way of throwing us all a curveball now and then, and we grow and learn too. So, when it comes to retirement planning I agree with Mark and Joe that it’s important to both validate and revalidate any personal assumptions along the way. I look forward to writing more content about this topic as we get closer to financial independence and early retirement.

The new retirement

The traditional/old norms of retirement meant working to age 60 or 65 (again, for many there was no choice) and then maybe, hopefully, you had another ‘good’ 10-20 years to live.

I think the “new” retirement should be and really is, completely different. People are retiring or semi-retiring earlier and living longer, so it’s possible some form of semi-retirement for many people could be 30, 40 or more years!

To figure out how much you might need to retire early at age 40, 45, 50 or 55, Mark and Joe worked with me to finalize some assumptions and inputs for each age – for today’s oldest millennials and GenX. Boomers will also benefit from the analysis below.

While I will leave it to you to figure out how you want to spend a bit more of your time, what keeps you motivated, highlighting your favourite hobbies and activities for retirement or semi-retirement, we figured it would be great to demonstrate what it would take to retire early.

Let’s look at those updated case studies now!

How much do you need to retire early at age 40?

For our first data point, we’ll look at how much you need to retire early at age 40, now.

Here are our assumptions for our age 40 couple:

- Assume they have maxed out both TFSAs = $125k each / $250k total since TFSA inception.

- Assume they have no company pensions.

- Assume they have maxed out both RRSPs, now worth a combined $500k. Mind you, this assumes a very high savings rate sustained over time. Remember, FIRE is not for lower-income individuals unless you are ruthless with your spending/managing like Jacob Fisker above! This assumes a couple is saving over $1,500 per month, for 15 years, and earning 7% returns. We used RBC’s RRSP calculator.

- Being conservative, we’ll assume they only get 30% max CPP at age 65, since they have not been working full-time to achieve the maximum contribution rate.

- They will get 100% max OAS at age 65, since they will have lived in Canada most of their lives at this point.

- They will however need to work part-time earning $2k per month each from ages 40-50 / $4k total per month, indexed income with inflation. Remember, this couple is a good example of a partnership that wants to retire “to” something.

- They keep a small emergency fund of $10k which is NOT part of their drawdown plan.

- They rent and do not own a home.

- Assumed total return going forward = 6%.

- Inflation = 3% sustained.

Assuming some very aggressive savings by any 20- and 30-somethings as a couple, here is a summary of their account values and some other assumptions to retire at age 40 knowing part-time work is critical to any “retirement” plan:

- TFSA balances @ 40: $250k total.

- RRSP balances @ 40: $500k total.

Total portfolio value at age 40: $750k while part-time work remains essential.

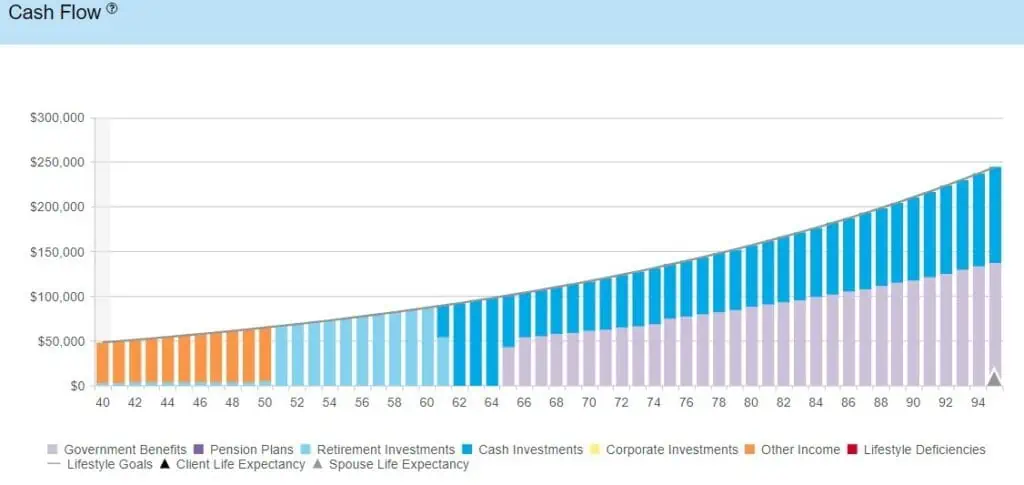

The cashflow results:

The punchline: while any couple would have done very, very well to have a portfolio worth $750k by age 40, early retirement is not possible without some prolonged part-time work if you want to spend about $4,000 per month / $48,000 per year after tax rising by 3% inflation – which is very modest living with inflation running hot and rental costs running higher as well.

How much do you need to retire early at age 45?

For our second data point, we will look at how much you need to retire early at age 45, now.

For this new scenario, Cashflows & Portfolios used similar registered account inputs but given our couple is a bit older, we adjusted a few things.

Here are our assumptions for this couple:

- At age 45, our couple has maxed out both TFSAs = $125k each / still $250k total.

- There are still no company pensions to rely on.

- Thanks to compounding power and additional contributions, to age 45, a couple this age could have upwards of $700k total invested for very diligent and aggressive savers.

- At age 45, let’s assume this couple doesn’t hustle as hard but likes working a bit. Between them, they make $2,000 per month on average and will work part-time for 10 years between ages 45-55.

- This couple also has $10k/year in a joint non-reg account but that’s not part of any drawdown plan.

- They rent and do not own a home.

- Assumed total return going forward = 6%.

- Inflation = 3% sustained.

- They will get 40% max CPP at age 65.

- They will get 100% max OAS at age 65.

Total portfolio value at age 45: $950k while some minimal part-time work must occur.

- TFSA balances @ 45: $250k total.

- RRSP balances @ 45: $700k total.

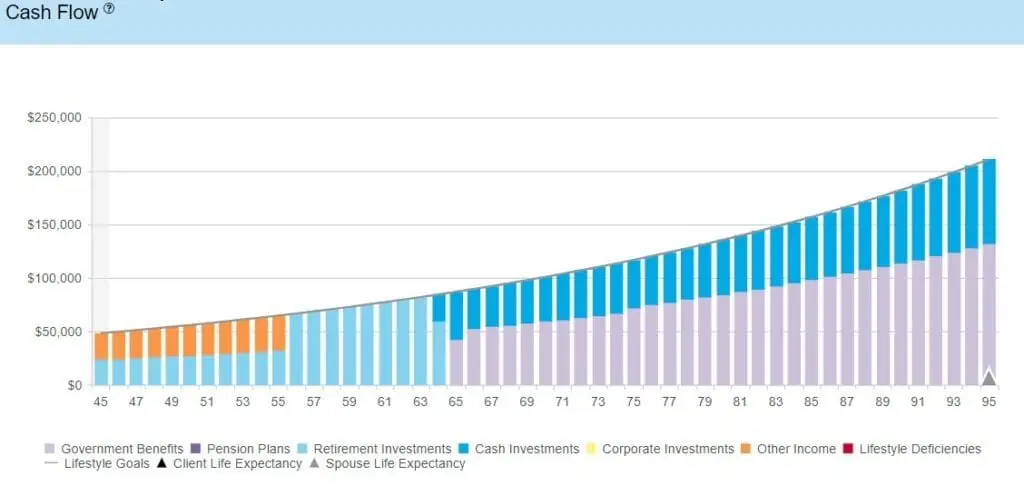

The cashflow results:

Max spend = $71.6k/year or $5,966.67/month (in today’s dollars and until age 95)

The punchline: any couple approaching a $1M investment portfolio is very impressive, around age 45, the reality is they must continue to work a bit to realize some desired spending needs with 3% sustained inflation and even then, they can still only spend just over $49,000 after-tax in their first year of retirement.

A reminder this is not all doom-and-gloom given inflation calculations mean spending $49,000 this year equates to spending close to $86,000 per year at age 65 and spending over $135,000 at age 80 in today’s dollars.

How much do you need to retire early at age 50?

In our third data point, we’ll look at how much you need to retire early at age 50, now.

Here are our updated assumptions for this couple:

- They will get 50% max CPP at age 65.

- They will get 100% max OAS at age 65.

- They continue to keep a small emergency fund of $10k which is NOT part of their drawdown plan.

- They rent and do not own a home.

- At age 50, our couple will find it difficult to stop full-time work, for good, so let’s assume this couple picks away at odd jobs for income and earns $500 each, per month, on average between the ages of 50-55.

- Assumed total return going forward = 6%.

- Inflation = 3% sustained.

- No part-time work or any work.

- TFSA balances @ 50: $250k total.

- RRSP balances @ 50: $800k total.

- Non-reg balance @ 50: $100k total.

In this scenario, we will assume any couple that has been aggressively saving and investing for more than 25+ years might have started a non-registered account with registered accounts like RRSPs, TFSAs, full of assets and maxed out of contribution room. Again, high salaries for savings purposes help anyone on the FIRE-path!

Total portfolio value: $1.15M with minimal work at age 50.

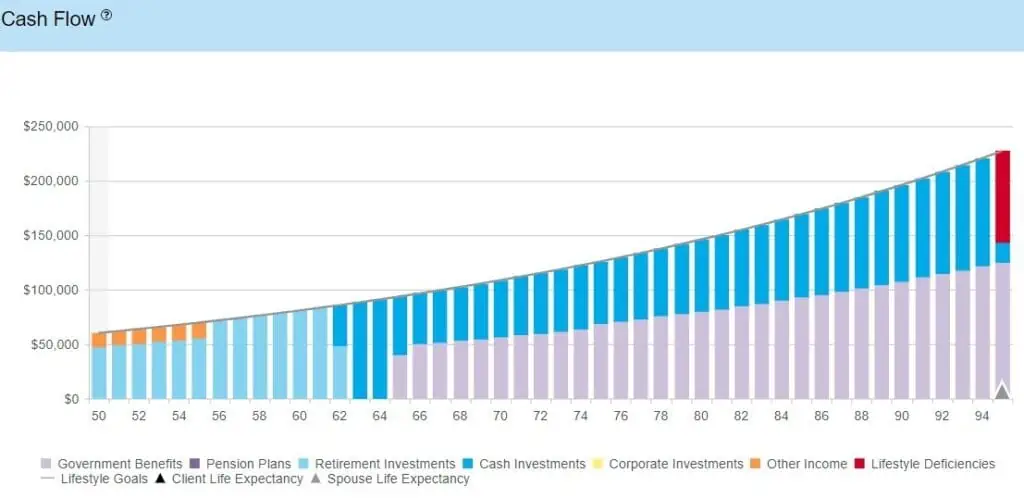

The cashflow results:

The punchline: any couple with over $1.1M in invested assets, could likely retire but they run some risks in their 90s; spending would need to be modest starting out spending around $5,000 per month or $60,000 per year after-taxes if you also assume 3% sustained inflation and 6% portfolio returns for the coming decades.

Another reminder this is not all doom-and-gloom given inflation calculations mean straightline spending over $93,000 per year will occur at age 65 and spending over $145,000 at age 80 will occur in today’s dollars. Some spending is very likely to decline as folks age.

How much do you need to retire early at age 55?

In our fourth and final data point, we’ll look at how much you need to retire early at age 55, now.

Here are our updated assumptions for this couple:

- They will get 60% max CPP at age 65.

- They will get 100% max OAS at age 65.

- They keep a small emergency fund of $10k which is NOT part of their drawdown plan.

- They rent and do not own a home.

- Assumed total return going forward = 6%.

- Inflation = 3% sustained.

- No part-time work or any work.

- TFSA balances @ 55: $250k total.

- RRSP balances @ 50: $900k total.

- Non-reg balance @ 50: $200k total.

In this final scenario, we will assume any couple that has been aggressively saving and investing for at least 30 years could likely have a good mix of stocks and bonds as retirement assets. Depending on spending needs, no work may be necessary.

Total portfolio value: $1.35M and no work at age 55.

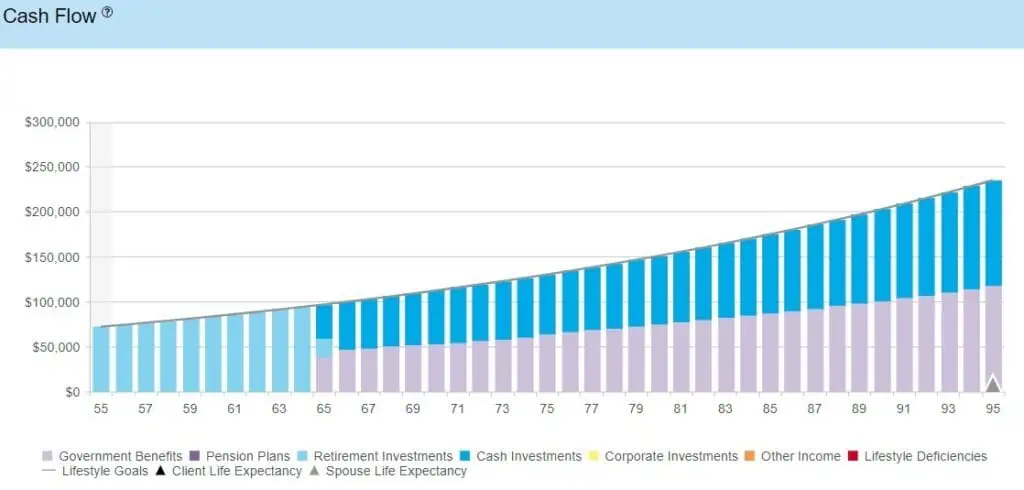

The cashflow results:

The punchline: any couple, at age 55, would have done very, very well to have such assets to consider retirement with. Also to highlight, RRSP/RRIF assets would be drawn down first in this scenario/example and their max spend with that draw down approach would be $72,000 to start with, but spending can rise 3% every year throughout retirement after that. Spending can essentially double at age 78 or so to keep up with any cost of living.

Summary – How much do you need to retire early at age 40, 45, 50 or 55?

I hope readers have found all four scenarios useful. In particular, the portfolio value in the respective scenario should give readers some ideas on how much you need to achieve early retirement at the different ages, including some future reliance on government benefits.

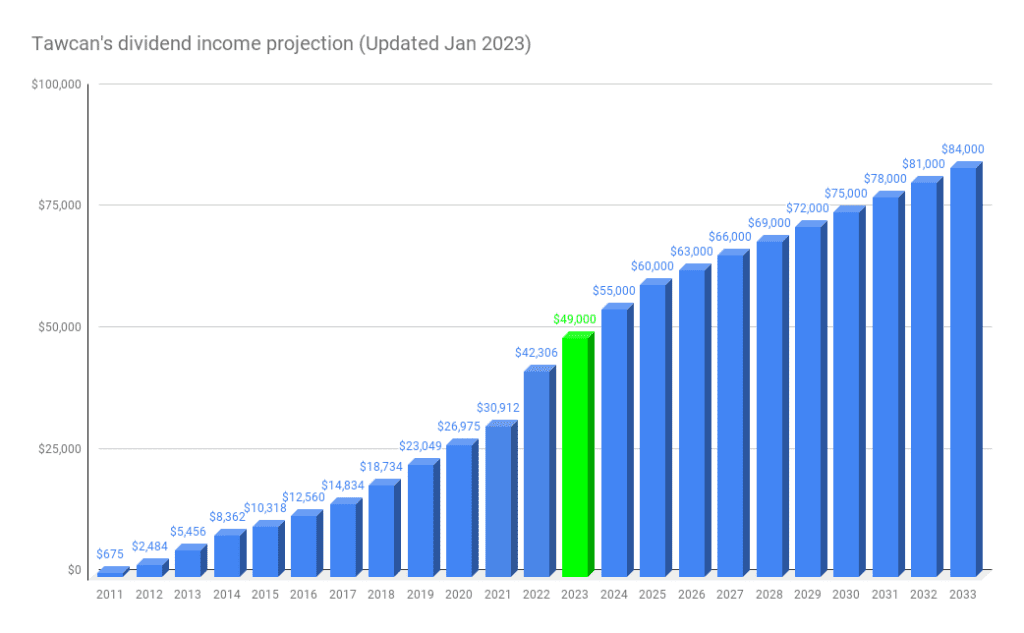

For us, we are aiming to live off dividends sometime in 2025 (both of us are in our early 40s). We estimate that our dividend income will need to generate about $60k for us to achieve that. At a 4% dividend yield, that means our portfolio will be $1.5M by 2025.

Since we don’t plan to stop working completely, most likely we will continue working part time and generate income somehow. We estimate that we’d bring in about $20,000 in part time/side hustle income a year. Without considering tax implications, this equals $80,000 in annual income for us – more than enough to enjoy life after-tax. These projections align with our assumptions as well.

Tax efficiency will be very important when we are not working full time anymore. But most of our dividend income is generated inside of our TFSAs and registered accounts, which should be quite tax efficient. For dividend income from RRSPs, we will need to develop tax efficient early RRSP withdrawal strategies.

With income splitting planned (for our dividend income), we should hopefully be in the lowest tax bracket when we are not working full time anymore.

Of course, this is just the plan right now. Plans can change and we will have to re-evaluate regularly and adjust our plan accordingly.

To summarize, there are a few important themes in this post:

- You need modest assets to retire/semi-retire at age 40 and 45 to begin with – without question. Unless you are ruthless with cutting costs and sustaining frugal ways for decades, you’re going to require a high savings rate and need to divert lots of cash from high-paying jobs to FIRE. So, although I believe in the principles of FIRE, don’t let all the FIRE marketing fool you! I would anticipate most couples in their 40s who FIRE, still work, they just have side-hustles.

- You can retire and have a very comfortable retirement starting in your 50s if you max out contributions to your TFSA(s), annually, and you make sizable, annual RRSP contributions for decades on end, ideally maxing out your RRSPs as well. Therefore, it’s important to try to max out TFSA and RRSP each year to take advantage of these retirement saving vehicles that the Canadian government created. Focusing on these accounts, even without non-registered investing, will deliver financial wonders.

- Although some investors are very suspicious about Canada Pension Plan (CPP) longevity, don’t be. CPP is sustainable for at least 75 more years. As such, if you are in your 40s and 50s and planning for semi-retirement or retirement like I am, make sure you consider how much and when to take your CPP benefit since it has a huge impact on your retirement spending plan, longevity risk, and more.

- Similar to CPP, count on OAS income in your 60s if you have lived and worked in Canada for many decades. Although deciding when to take OAS may not be as important as CPP, due to the fact that delaying CPP vs.OAS offers a higher inflation-protected income boost, receiving some OAS income is an additional retirement income stream that must be accounted for including taxation considerations and when to drawdown your personal assets. And don’t put too much time worrying about OAS clawback. If you have to figure out how to reduce your income in retirement to avoid OAS clawback, that means you’ve done very well financially. You should congratulate yourself.

- These projections have some linear thinking involved, purposely, to simplify this post and mini-case studies. As such, they might suggest you need more money than you really do. Again, personal finance is personal. A good example of that is inflation sustained to 3% over time. All examples above do not account for passive retirement years or slower-go years in your 70s or 80s and beyond. As such you might not need nearly this much saved up if you anticipate your spending will decline more as you age, and it very well could. Most studies suggest they do. That decline in spending is highly variable and personal. This is a very important consideration when you do your own financial projections and estimates, and speaks to the point why you want to do projections every year or so to see if you can spend more over time to avoid a large estate value.

- Like Mark and Joe, I think you should be optimistic about your financial future but at the same time, be a bit pessimistic on the assumptions-side. What we mean by this is to target modest rates of return for your portfolio (we used 6% annualized for a 100% equity portfolio over time) and be suspicious about inflation rates, so a bit higher is better (we used 3% sustained inflation). You could earn more than 6% returns over the coming decades and inflation could eventually settle down a bit and normalize but it is critical you make some reasonable assumptions about the future and revisit them periodically to keep testing them over time.

- You’ll notice we took a total return approach, not a “live off dividends” approach or otherwise. If you live off dividends, in perpetuity throughout retirement, you could be leaving lots of portfolio value and spending on the table. Even more so than what these charts show. Die with zero concept is something more and more people are considering.

- These projections are to age 95, for both individuals. That’s fine for longevity risk but many Canadians won’t live that long, statistically. Something to consider, in that this couple could likely spend much more during retirement than the above. We don’t live life in a spreadsheet or PDF report.

- Lack of homeownership may or may not be in the cards for you. Each couple in our scenarios decided to rent over their lifespan, so a decent portion of their retirement income will need to fund rent. If you decide to own a home, and retire at some point, then being debt-free is likely the way to go for early retirement anyhow. Otherwise, servicing debt long-term is making other people wealthy.

- On that note above, being debt-free is quite liberating. When you don’t have any mortgage debt, you can save quite a bit of money without that obligation. It is definitely beneficial to be mortgage free when you retire. If you can be mortgage free before retirement, kudos to you. This can be an important key to your financial journey and boost savings rate and portfolio value over time.

I want to thank Mark and Joe from Cashflows & Portfolios for their work with me and I encourage you to check out their low-cost services on their site here:

In addition to the retirement projections service, Mark and Joe are writing about and providing more free content on their site about asset preservation and portfolio decumulation, since these subjects are not discussed nearly enough, even for the FIRE community.

I really believe that Mark and Joe provide a lot of benefits with their retirement projections. The retirement projections that they did for us a few years ago were quite eye-opening to Mrs. T and me. To be able to see all the charts visually and the different withdrawal strategies and their implication for the portfolio value was really awesome. Such visuals and financial projections might be hard to model when you’re only relying on spreadsheets.

Therefore, I remain very happy that Mark and Joe are offering these great services to Canadians at low-cost rates for folks at any income level.

Unfortunately, many people gravitate to safe withdrawal rates (like the 4% rule) and other generalizations when it comes to retirement planning, and because of that, they don’t take the necessary time to look at all the combinations of what is possible for any retirement drawdown plan. Mark and Joe are here to help to do just that.

If you ever want to see your personal drawdown strategy, or what your net worth, estate value or taxation might be in a key retirement scenario – subscribe to the Cashflows & Portfolios free newsletter and contact Mark and Joe about their low-cost projections services. They post regular content on their site and if you become a member they even have a forum to interact with other clients.

When it comes to my plan, I’ve been thinking more about semi-retirement since five or so years ago. I have come to the realization that full retirement just isn’t for me. I want to keep myself busy and engaged in different activities. It’s important to be able to choose and pick what I want to do in early retirement.

For now, we still aspire to reach financial independence in 2025. That’s two years from now, so we have done a lot of planning and simulations to make sure we’re on track. Per my latest dividend income projection, I think we can reach $60,000 in dividend income in 2025, but it will require a lot of savings in the next couple of years.

Even if we don’t reach the $60k dividend income goal by 2025, that’s totally OK. We have no set plan to “retire” in 2025 anyway. After all, I still enjoy what I do at work, I am learning new things on a daily basis, and I really enjoy the challenges working in high tech. So it is still “fun” for me to show up to work every day.

Now, if this fun factor ever disappears, then I may have to re-examine my full time work plan…

One minor thing I need to figure out is if I do move from working full time in high tech to working part time, what kind of part time job I would want to do. Luckily I have lots of time to figure that out.

Writing and thinking about FIRE on a regular basis has made me realize one crucial thing – life is fluid and things can change. We need to remain flexible with our FIRE plans and different backup plans.

Finally, a very important thing I want to mention!

Mark and Joe are kind enough to offer all Tawcan.com readers a 10% discount on their Cashflows & Portfolios Done-For-You Retirement Projections services.

To get the discount, mention TAWCAN10 in your email correspondence with them or add TAWCAN10 in the “How Did You Hear About Us” part of the form.

Mark and Joe have also just launched a new DIY Projections Solution as well, so feel free to pick their brain on that. You can become your own retirement income planner!

In the coming weeks, I have a new dividend income update to share with you so I can try to semi-retire myself and I have more great blog ideas to post as well.

Thanks for reading.

Dear readers, what is your path to semi-retirement or retirement? Do you intend to FIRE or not? What income do you intend to spend for your retirement?

I recall my financial advisor showing me a similar graph of how our fortunes would play out over time, and what I took from that exercise was that the RRSP/RIF assumptions were stacked at the end, rather than withdrawing early in order to minimize the taxes. So upon retirement, absent the work income, my tax bracket was the lowest it was going to be…if you are planning to grow your stock investments over time. That seemed to be the best time to reduce RRSP which is fully taxed when you withdraw it. My circumstances are different due to having a pension (and thus not a lot of RRSP room), but taxes are like a current against you when sailing to your destination.

Agree with you, early RRSP withdrawals can make a lot of sense.

Hi Bob..this is an interesting exercise. However I just want to point out that all ongoing income amounts, other than the age 40 amount, seem to have been discounted from x years after age 40. You can see the age 40 graph starts at $63k, and stated ongoing spend is $63k, they match. However, at age 50, the stated maximum ongoing spend is $89.7k/year, however the graph clearly shows income starting at over $100k. Discounting it makes the sustained income seem lower than it actually would be, if you are 50 today, with the assumptions stated. To compare apples to apples, they should all be stated assuming you are age x today, with portfolio and assumptions as specified.

Thanks for your comment, Mike. Chiming in here a bit in that Bob was seeking age 40 as a starting point, and then some assumptions were made with hobby income (age 45) and then sustained, very aggressive savings until ages 50 and 55 respectively to see what this would bring, for this couple. As you are well aware, just a set of assumptions about the future…

As you have pointed out, it could have been more clear between MAX Spend vs. what is actually happening with inflation since it requires some interpretation to your point: “…however the graph clearly shows income starting at over $100k.” In fact, you can see for all ages, the spending level is incredibly high for the age 55 couple. I mean, they are spending something like more than $300,000 per year, at age 82!!

What would be easier to understand in future case studies is essentially ignoring some MAX spend but rather starting retirement, now/today, not discounting anything – to better demonstrate both the income needed to start retirement today and the sustained income anyone needs, to fight inflation over time. That is much more clear but we appreciate the feedback and were also working with some inputs from Bob as well – but fully appreciate where you and likely a few other readers are coming from.

In some respects, part of the theme for this post as well to be honest from our perspective when we got Bob’s ideas, is that many folks who have a very high, sustained, savings rate, could be over-saving to be honest. Unless you have very high spending needs, we don’t know of any couples let alone individuals that would even need anything remotely close to the age 55 couple for retirement. My goodness 🙂

CAP

Thanks for reply. To fix this and make it clear what was actually done and what the numbers actually represent, I’d suggest the wording should be changed to:

– “How much to retire today at age 40”, and then “Maximum sustained spend starting today in today’s dollars: $63k/year”

– “How much to retire in 5 years at age 45”, and then “Maximum sustained spend starting in 5 years in today’s dollars: $71.6k/year”

– “How much to retire in 10 years at age 50”, and then “Maximum sustained spend starting in 10 years in today’s dollars: $89.7k/year”

– “How much to retire in 15 years at age 55”, and then “Maximum sustained spend starting in 15 years in today’s dollars: $117.6k/year”

Either that, or treat each as if you are that age today and retiring today, and state each maximum spend as it was done for age 40 (ie. without discounting the max spend), so it’s apples to apples which was my point. Also likely that would be more useful and understandable for most people.

Thanks

I think we should be aware it’s very hard to aggressively save money for most people between 25-35. In that age range, your savings mostly will go to down payment and then you spend a lot on kids. I would say real savings start at somewhere between 35-40 years old

Tawcan, thanks for a great read as always. You mentioned a lot of important points in your preamble. Thanks for that. In response to CAP above, I agree…a discounted model is tough to grasp. Perhaps an inverse way of doing this is to take a few fixed amounts – $1m, $1.5m and say $2M and then outline what each portfolio could spend at each of retirement at 40/45/50/55. and then what would a variable bump in returns could generate, or a drawdown could impact. It’s a little more complex, but gives people a better idea than to strive towards a portfolio growth goal. hope that helps.

It would be more helpful if you can create a few lifestyle categories such as frugal, moderate, comfortable…and then going backwards to see how much people need to live in those lifestyle when retiring at different age. We can’t just assume people have 3,4,5 millions when they retire. Most people probably won’t even have 1.5 million when retiring at 65

That’s a fair comment but please understand that it’d turn the already a very long post into even longer. Something to consider for a future update perhaps.

Totally agree, William.

To clarify, Bob was looking for a few examples of 40, 45, etc. and if they sustained their savings rate what the outcomes could be. Certainly, Bob would agree there is no way sustained savings like that is really required let alone should be done by most. So, you could consider age 50 and 55 examples in this post, of continued savings, both very aggressive and certainly not required by 99% of Canadians to meet their retirement dreams.

Happy to consider more lower savings rates and more modest retirement income spending. A very valid and worthy comment.

Thanks

Just to clarify that my comment wasn’t a criticism but just a suggestion.

Because how much you need to retire is mainly based on how much you plan to spend. If one plans to spend 2500 a month vs 5000 per month, they would retire at different age even if they have same savings

Thanks again

Do these max spend numbers include “spending” on income taxes, meaning they are before-tax numbers.

Just FYI, I have used the services at Cashflows and Portfolios and highly recommend them.

Hi Dawn,

The numbers are after tax numbers. Glad you recommend Cashflows & Portfolios’ services.

I feel something is off regarding these calculations. In looking at the simplest case of the 55 year old where cash to live on is only from investment and government programs, if I have $3.877M in assets, most Monte Carlo calulators say you are safe (e.g. around 95% confidence) withdrawing 3.2% of your portfolio every year. So (3.2% * $3.877M) / 12 = $10,338 / mo. (without government programs). This is much more than the $9.8k / mo cited which includes government programs.

We did not run Monte Carlo but totally agree, Phillip – certainly most Canadians will never need what the 55 year-old couple wants. Maybe half of that. Thanks very much.

Hi Phillip,

Most likely they won’t need that much money. 🙂

Like any projections, take things with a grain of salt and use them as a baseline and adjust to your situation accordingly.

Interesting projections Bob. A five digit income can provide a comfortable lifestyle long term. Looking at our own situation back thru life, our family was raised during the difficult inflation years when mortgages were ranging between 12% and 18% with CMHC. I was a stay at home mom which meant my degree in chemistry wasn’t worth much because I hadn’t practiced the skill for 10 years so went back to university for a masters in computer science along with two kids that also were in university — bottom line, there wasn’t much left over! We lived comfortably but frugally and happily. Getting out of debt was the challenge — burning the mortgage, completing car payments and university payments by the beginning of the 90’s was an achievement. We retired mid 90’s with a total joint pension income of five digits. Investing in an electric car in 2013, and solar in 2015, and then a Model X Tesla in 2017 and no mortgage or debts has certainly reduced expenses. Investing in stock has become my pastime and hobby for the last two years. I’m now 78, and dividends have doubled my income. Great fun! Thanks for the coaching Bob! It’s been very helpful.

Awesome, Dianne and kudos to you. This post was just for illustrative purposes only and not meant at all to demonstrate what some folks could or should need, rather, Bob was looking for some examples of what the projections might look like to assure a high, max, sustained spend over many, many decades. Most Canadians will not likely ever need this much and that’s part of the messaging in the post. Getting out of debt and largely staying out of debt for most Canadians is an amazing start.

Congrats on your success Dianne.

Another great article.

Every renter just got a super duper gift 2 weeks ago with the new FHSA program.

The 55 year old couple who “rent and do not own a home” can open up a FHSA put the $40,000 in over 5 years, get a tax credit then at retirement transfer it all to their RRSP even if the RRSP is maxed out. They don’t even have to buy a house!

Now they have more investments to compound and in 10-15 years get an extra $150K for retirement.

As an aside I don’t think the authorities have thought the FHSA through and have essentially stoked the already overinflated Canadian housing market with more demand.

The FHSA is an outstanding account for younger Canadians, they should absolutely look into it and take advantage of it if that works for them.

Agreed that the FHSA is another great savings vehicle for Canadians.

I would also suggest if you plan to winter south or somewhere warm it might be smart to pick an opportunity to get some money into the USA market. Nothing bothers me more than to worry about the exchange rates when enjoying the sun. I pull from US investments that I purchased long ago at favourable exvchange rates.

That seems very smart, Paul. Exchange rates are an annoyance but that means you have some money to spend/exchange – a good “problem” to have!

It’s always a good idea to consider picking up foreign currencies if you’re planning to spend extended time outside of Canada.

In order for these projections to be applicable to single people such as myself, would we simply cut the net worth amounts in half? Or should single people use a proportional amount like 60% or 70% of these net worth amounts?

Great point. Bob had requested a few examples for couples and we were happy to oblige but much more case studies need to account for singles or single-income planning – we intend to and need to publish more of them. It all depends on your spending of course but maxed out TFSAs or RRSPs or both for singles, is a great start coupled with CPP and OAS benefits.

That’s a very good point. I guess another set of case studies focused on single individual would be beneficial. As CAP indicated below, I had requested for examples for couples…. certainly not trying to exclude single folks. 🙂