As many of you know, we deploy a hybrid investing strategy where we invest in both dividend paying stocks and index ETFs. This strategy provides us with a predictable monthly dividend income as well as asset and geographical diversification. Lately I have come to appreciate the all-in-one ETFs – so much that I have been recommending new investors to start off with these all-in-one ETFs rather than buying individual dividend paying stocks.

I typically suggest building up an investment portfolio that consists of a solid selection of ETFs before venturing to the world of individual dividend stocks. What I really like about these ETFs is that they are simple. Since they are all-in-one ETFs, there’s no need to re-balance regularly. Furthermore, these ETFs provide investors with a complete global indexed portfolio, so you get both asset and geographical diversification.

Although we don’t use these all-in-one ETFs like VGRO, VBAL, XGRO, XBAL, ZGRO, ZBAL, etc. in our dividend portfolio, we have been looking to simplify our kids’ RESPs. We started to wonder, which all-in-one ETF is the best for our kids? VGRO vs. XGRO vs. ZGRO, which one would come out ahead? And VBAL vs. XBAL vs. ZBAL, which one would come out ahead?

Our Old RESP Portfolios

When Baby T1.0 was born, the Canadian Couch Potato’s model portfolios used a five ETF fund approach for constructing a balanced investing portfolio. Back then, there were no ex-Canada ETFs trading in the Canadian stock exchange available. This meant we had to utilize ETFs traded in the US stock exchange, like VTI and VXUS.

When Baby T2.0 was born, ex-Canada ETFs like VXC and XAW were available. We originally went with VXC because I liked Vanguard but after comparing VXC vs. XAW in detail, we switched from VXC to XAW.

Baby T1.0’s RESP

- Vanguard FTSE Canada Index ETF (VCE.TO) – 30%

- Vanguard Total Stock Market ETF (VTI) – 25%

- Vanguard Total International Stock Market ETF (VXUS) – 30%

- BMO Equal Weight REIT Index ETF (ZRE.TO) – 10%

- Vanguard Canadian Short-Term Bond Index ETF (VSB.TO) – 5%

Baby T2.0’s RESP

- Vanguard Canada All Cap ETF (VCN.TO) – 35%

- iShares All Country ex-Canada ETF (XAW.TO) – 60%

- Vanguard Canada Bond Index (VAB.TO) – 5%

For both of these RESPs, the idea is to have a high international exposure. Since both kids are still young, I have decided to hold a small percentage in bonds.

Problems with the old RESP Portfolios

While I liked the multiple-ETF approach, we started to encounter a few problems, mostly with Baby T1.0’s RESP. Because VTI and VXUS are traded in USD, when we purchase these stocks, we have to exchange between CAD and USD. To avoid the 2% Questrade exchange rate, we would utilize Norbert’s Gambit. However, this became quite tedious, especially whenever we wanted to rebalance the portfolio.

Furthermore, since the two portfolios are still small in dollar amount, whenever we receive distributions from the ETFs, it is not possible to DRIP additional shares. In other words, the only time we can dollar cost average is whenever we make a deposit to the RESPs, or when we receive the government grants, like the BC Training and Educational Savings Grant.

RESP Asset Allocation – Original Plan

Given that kids typically start their postsecondary education when they are 18 or 19 years old, this means RESPs have a much shorter investing time frame compared to retirement savings. So as our kids get close to the postsecondary age, it makes sense to allocate a higher percentage of the RESP portfolio toward fixed income.

Given the interest rates are so low, my original plan was to be aggressive for the first 10 years (90% equities, 5% bonds) for each child. We would increase the fixed income allocation as they get closer to postsecondary education age.

Below is our original RESP asset allocation strategy:

| Index | 0-10 Yrs | 10-15 Yrs | 15-18+ Yrs |

| Canadian Equity | 30% | 25% | 20% |

| US Equity | 25% | 20% | 15% |

| International Equity | 30% | 30% | 20% |

| REITs | 10% | 5% | 5% |

| Canadian Bonds | 5% | 20% | 40% |

I decided not to allocate 60% in bonds for the last column because I believe that interest rates will continue to stay very low for many years. In order for the portfolio to continue growing, it makes sense to have a balanced approach and hold 60% equities and 40% bonds. Since this is a plan, nothing is set in stone. We are always open to adjust the percentages as we see fit.

And as you can see from the intent of this post, we have decided to change our RESP strategy by considering the transition to the all-in-one ETFs.

Vanguard All-in-One ETFs – VGRO, VBAL, VCNS

Below are the three Vanguard all-in-one ETFs that we are considering for reconstructing our RESPs. All of these Vanguard all-in-one ETFs have the same MER of 0.25%.

| Vanguard All-In-One ETFs | Ticker | Asset Allocation | Distribution Yield |

| Vanguard Growth ETF Portfolio | VGRO | 80% Equities / 20% Fixed Income | 2.33% |

| Vanguard Balanced ETF Portfolio | VBAL | 60% Equities / 40% Fixed Income | 2.18% |

| Vanguard Conservative ETF Portfolio | VCNS | 40% Equities / 60% Fixed Income | 2.14% |

Vanguard Growth ETF Portfolio (VGRO)

Vanguard Growth ETF Portfolio seeks to provide long-term capital growth by investing in equity and fixed income securities. The fund will maintain a long-term strategy asset allocation of equity (approximately 80%) and fixed income (approximately 20%) securities.

VGRO holds the following underlying Vanguard funds:

- 32.8% Vanguard US Total Market Index ETF

- 24.2% Vanguard FTSE Canada All Cap Index ETF

- 16.9% Vanguard FTSE Developed All Cap ex North American Index ETF

- 11.7% Vanguard Canadian Aggregate Bond Index ETF

- 6.2% Vanguard FTSE Emerging Market All Cap Index ETF

- 4.5% Vanguard Global ex-US Aggregate Bond Index ETF CAD-hedged

- 3.7% Vanguard US Aggregate Bond Index ETF CAD-hedged

Vanguard Balanced ETF Portfolio (VBAL)

Vanguard Balanced ETF Portfolio seeks to provide long-term capital growth with a moderate level of income by investing in equity and fixed income securities. The fund will maintain a long-term strategic asset allocation of equity (approximately 60%) and fixed income (approximately 40$) securities.

VBAL holds the following underlying Vanguard funds:

- 24.7% Vanguard US Total Market Index ETF

- 23.7% Vanguard Canadian Aggregate Bond Index ETF

- 18.4% Vanguard FTSE Canada All CAp Index ETF

- 12.6% Vanguard FTSE Developed All Cap ex North America Index ETF

- 8.5% Vanguard Global ex-US Aggregate Bond Index ETF CAD-hedged

- 7.3% Vanguard US Aggregate Bond Index ETF CAD-hedged

- 4.8% Vanguard FTSE Emerging MArket All Cap Index ETF

Vanguard Conservative ETF Portfolio (VCNS)

Vanguard Conservative ETF Portfolio seeks to provide a combination of income and moderate long-term capital growth by investing in equity and fixed income securities. The fund will maintain a long-term strategy asset allocation of equity (approximately 40%) and fixed income (approximately 60%) securities.

VCNS holds the following underlying Vanguard funds:

- 35.3% Vanguard Canada Aggregate Bond Index ETF

- 16.3% Vanguard US Total Market Index ETF

- 13.5% Vanguard Global ex-US Aggregate Bond Index ETF CAD-hedged

- 12.4% Vanguard FTSE Canada All Cap Index ETF

- 11.3% Vanguard US Aggregate Bond Index ETF CAD-hedged

- 8.0% Vanguard FTSE Developed All Cap ex North America Index ETF

- 3.2% Vanguard FTSE Emerging Market All Cap Index ETF

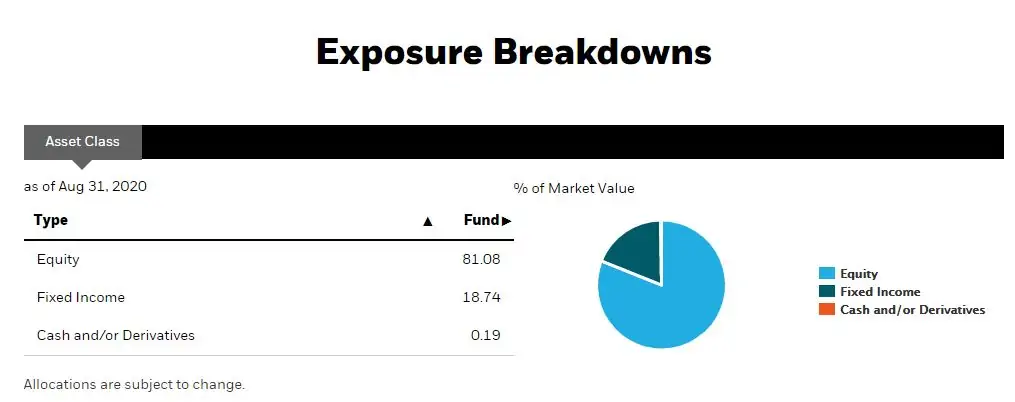

iShares, being another financial institution that offers index ETFs, has similar all-in-one or multi-asset ETFs. Interestingly, these ETFs have very similar ticker symbols as the Vanguard ones. The nice thing about these iShares All-In-One ETFs is that the management fee of 0.20% is a little cheaper than the Vanguard ETFs.

| iShares All-In-One ETFs | Ticker | Asset Allocation | Distribution Yield |

| iShares Core Growth ETF Portfolio | XGRO | 81.08% Equities / 18.874% Fixed Income / 0.19% Cash | 2.43% |

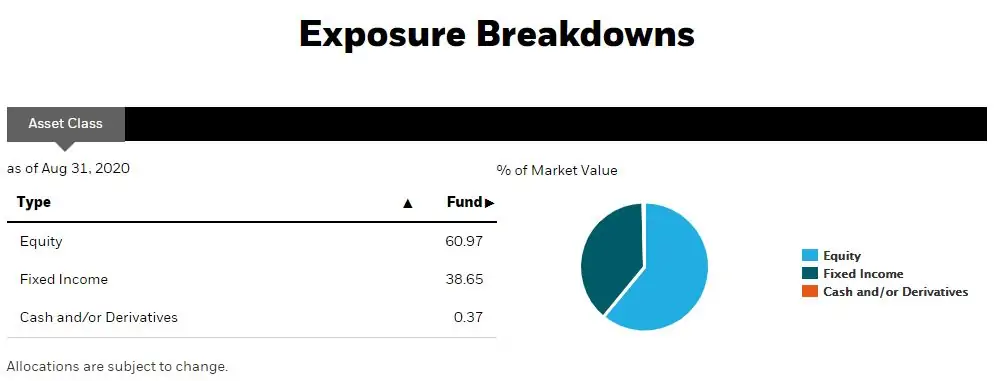

| iShares Core Balanced ETF Portfolio | XBAL | 60.97% Equities / 38.65% Fixed Income / 0.37% Cash | 2.49% |

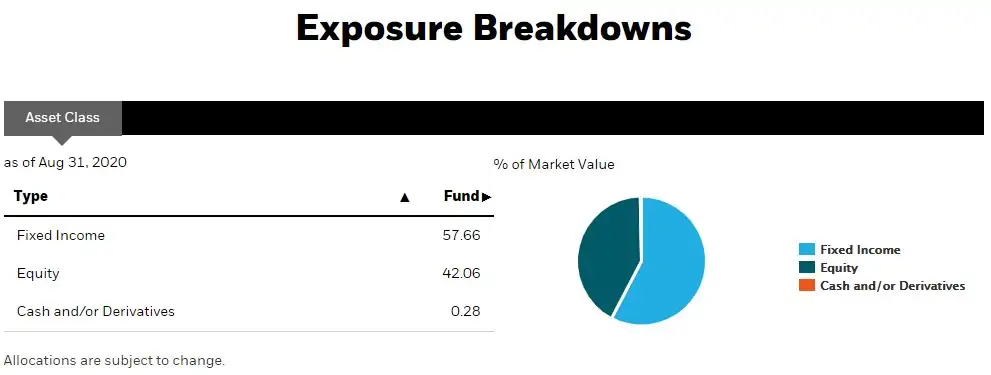

| iShare Core Conservative Balanced ETF Portfolio | XCNS | 42.06% Equities / 57.66% Fixed Income / 0.28% Cash | 2.00% |

iShares Core Growth ETF Portfolio consists of the following underlying iShares funds:

- 38.43% iShares Core S&P Total US Stock

- 19.47% iShares S&P/TSX Capped Composite

- 19.28% iShares MSCI EAFE IMI Index

- 11.99% iShares Core CAD Universe Bond Index ETF

- 3.89% iShares Core MSCI Emerging Markets Index ETF

- 3.05% iShares Core CAD Short Term Corporate Bond Index ETF

- 1.85% iShares Broad USD Investment Grade Corporate Bond ETF

- 1.85% iShares US Treasury Bond ETF

- 0.10% CAD Cash

- 0.10% USD Cash

iShares Core Balanced ETF Portfolio consists of the following underlying iShares funds:

- 28.75% iShares Core S&P Total US Stock

- 24.72% iShares Core CAD Universe Bond Index ETF

- 14.74% iShares S&P/TSX Capped Composite

- 14.23% iShares MSCI EAFE IMI Index

- 6.42% iShares Core CAD Short Term Corporate Bond Index ETF

- 3.80% iShares Broad USD Investment Grade Corporate Bond ETF

- 3.71% iShares US Treasury Bond ETF

- 3.15% iShares Core MSCI Emerging Markets

- 0.20% USD Cash

- 0.13% CAD Cash

iShares Core Conservative Balanced ETF Portfolio consists of the following underlying iShares funds:

- 37.07% iShares Core CAD Universe Bond Index ETF

- 19.52% iShares Core S&P Total US Stock

- 10.45% iShares S&P/TSX Capped Composite

- 10.16% iShares MSCI EAFE IMI Index

- 9.16 iShares Core CAD Short Term Corporate Bond Index ETF

- 5.76% iShares US Treasury Bond ETF

- 5.68% iShares Broad USD Investment Grade Corporate Bond ETF

- 1.93% iShares Core MSCI Emerging Markets

- 0.28% CAD Cash

- 0.18% USD Cash

BMO All-In-One ETFs – ZGRO, ZBAL, ZCON

Being one of the financial institutions in Canada that offer ETFs, it wasn’t a surprise to see BMO offering similar all-in-one/multi-asset ETFs. Again, the tickers are all very similar to the Vanguard and iShare equivalent. The BMO all-in-one ETFs have the same low MER of 0.20% as the iShare all-in-one ETFs.

| BMO All-In-One ETFs | Ticker | Asset Allocation | Distribution Yield |

| BMO Growth ETF | ZGRO | 81.04% Equities / 18.91% Fixed Income / 0.05% Cash | 2.63% |

| BMO Balanced ETF | ZBAL | 61.51% Equities / 38.26% Fixed Income / 0.23% Cash | 2.64% |

| BMO Conservative ETF | ZCON | 41.54% Equities / 58.19% Fixed Income / 0.27% Cash | 2.65% |

BMO Growth ETF (ZGRO)

BMO Growth ETF holds the following underlying BMO ETFs:

- 37.05% BMO S&P 500 Index ETF

- 20.26% BMO S&P/TSX Capped Composite Index ETF

- 16.21% BMO MSCI EAFE Index ETF

- 13.22% BMO Aggregate Bond Index ETF

- 7.52% BMO MSCI Emerging Market Index ETF

- 3.77% BMO Government Bond Index ETF

- 1.92% BMO Mid-Term US IG Corporate Bond Hedged to CAD Index ETF

- 0.05% Cash

BMO Balanced ETF (ZBAL)

BMO Balanced ETF holds the following underlying BMO ETFs:

- 28.11% BMO S&P 500 Index ETF

- 26.76% BMO Aggregate Bond Index ETF

- 15.38% BMO S&P/TSX Capped Composite Index ETF

- 12.30% BMO MSCI EAFE Index ETF

- 7.63% BMO Government Bond Index ETF

- 5.71% BMO MSCI Emerging Markets Index ETF

- 3.88% BMO Mid-Term US IG Corporate Bond Hedged To CAD Index ETF

- 0.23% Cash

BMO Conservative ETF (ZCON)

BMO Conservative ETF holds the following underlying BMO ETFs:

- 40.71% BMO Aggregate Bond Index ETF

- 19.01% BMO S&P 500 Index ETF

- 11.60% BMO Government Bond Index ETF

- 10.33% BMO S&P/TSX Capped Composite Index ETF

- 8.34% BMO MSCI EAFE Index ETF

- 5.89% BMO Mid-Term US IG Corporate Bond Hedged to CAD Index ETF

- 3.86 BMO MSCI Emerging MArkets Index ETF

- 0.27% Cash

All-In-One ETF Comparisons

Let’s compare all of these all-in-one ETFs and see which ones come out ahead. Just so we are comparing apples to apples, I will compare all the growth ETFs, all the balanced ETFs, and all the conservative ETFs side-by-side.

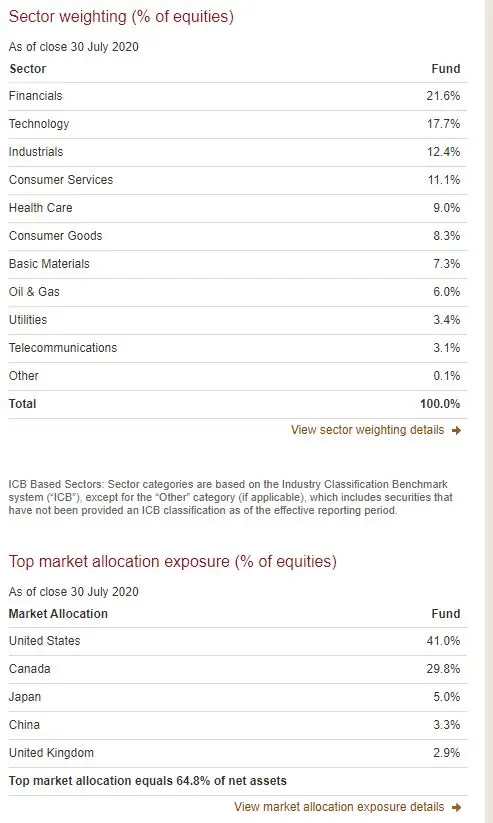

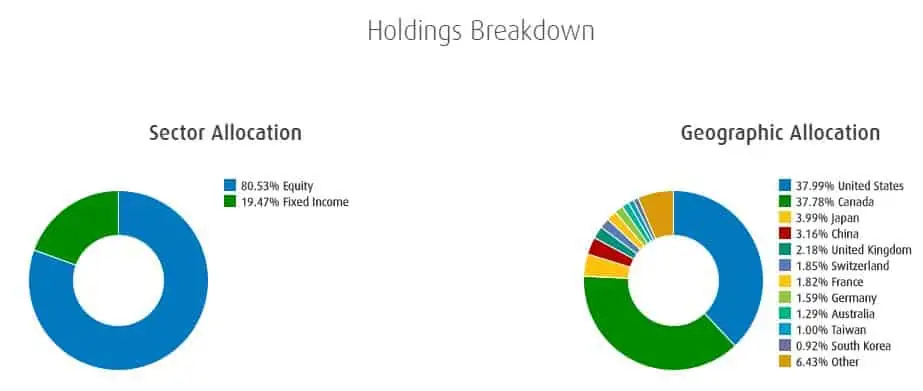

Growth ETFs – VGRO vs. XGRO vs. ZGRO

While all three of these growth all-in-one ETFs have similar strategies and approaches, there are some small differences in exposures and holdings. When it comes to Canadian exposure, XGRO has the lowest exposure at 19.63% while VGRO has the highest at 24.2%. XGRO has the highest US exposure while ZGRO has the highest international exposure. If we look at ex-Canada exposure by grouping US and international exposures together, XGRO is the highest at 61.2%, ZGRO at 60.44% and VGRO in third at 55.9%.

For fixed income, VGRO provides a better global exposure to bonds while both XGRO and ZGRO have a higher exposure to Canadian bonds. Interestingly, both XGRO and ZGRO have exposures to corporate bonds while VGRO doesn’t. However, since bonds only constitute less than 20% of the overall ETF, the difference is minuscule.

Because of the different exposures and holdings, these growth all-in-one ETFs have different distributions. ZGRO came out ahead at 2.63% with XGRO in the middle at 2.43% and VGRO in third at 2.33%.

| Allocation | VGRO | XGRO | ZGRO |

| Canada | 24.2% | 19.47% | 20.26% |

| US | 32.8% | 38.43% | 37.05% |

| International | 23.1% | 23.17% | 23.73% |

| Canadian Bonds | 11.7% | 15.04% | 16.99% |

| US/International Bonds | 8.2% | 3.70% | 1.92% |

| Yields | 2.33% | 2.43% | 2.63% |

Considering XGRO and ZGRO have the lowest MER fee at 0.20%, I think I’d pick one of them over VGRO.

Therefore, if I had to pick one to use for our kids’ RESPs, I’d definitely pick XGRO because of the higher US and international equity exposure.

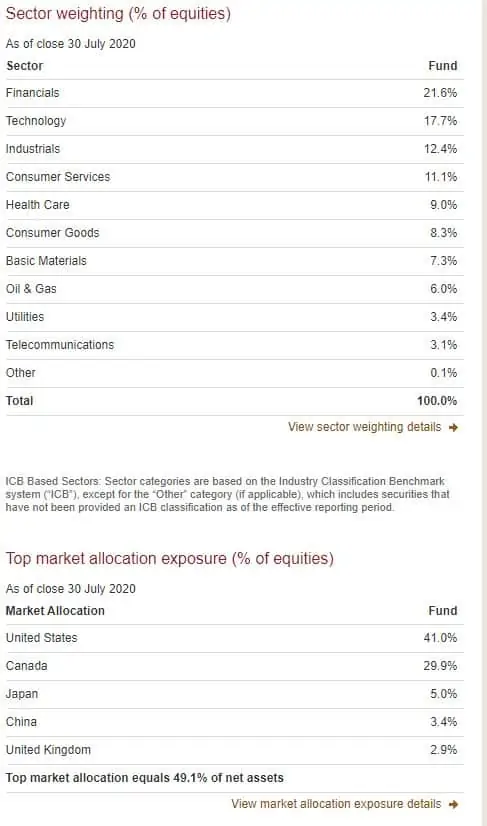

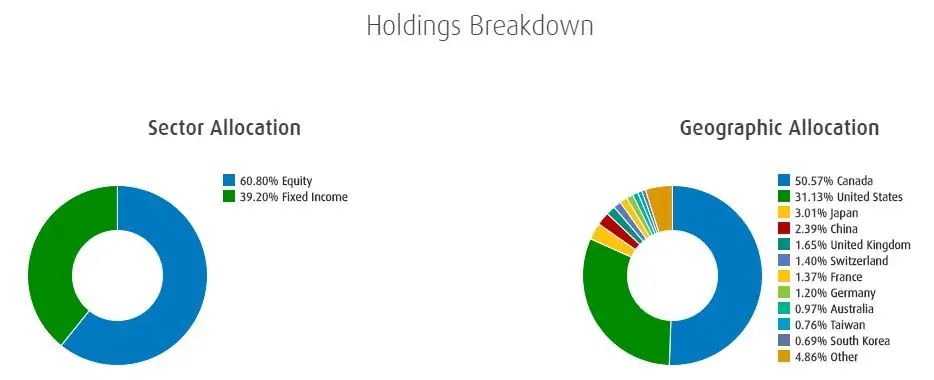

Balanced ETFs – VBAL vs. XBAL vs. ZBAL

Once again, these three balanced all-in-one ETFs have slightly different exposures and holdings. Similar to the growth all-in-one ETFs, the iShare ETF, XBAL came out ahead for US exposure. XBAL also has the highest overall exposure to ex-Canada equities at 45.85% with ZBAL trailing slightly behind at 45.79%. VBAL has the highest Canadian exposure while XBAL has the lowest.

For fixed income, I was a little surprised that ZBAL has such a high exposure to Canadian bonds and very little exposure to US & international bonds. Given that the balanced all-in-one ETFs have around 40% allocation to bonds, I believe having a high exposure to Canadian bonds and a very low exposure to US & international bonds isn’t a good idea.

When it comes to distributions, ZBAL was the highest at 2.64%, XBAL in the middle at 2.49%, and VBAL in the third at 2.33%.

| Allocation | VBAL | XBAL | ZBAL |

| Canada | 18.4% | 14.84% | 15.38% |

| US | 24.7% | 28.75% | 28.11% |

| International | 17.4% | 17.38% | 18.01% |

| Canadian Bonds | 23.7% | 24.72% | 34.39% |

| US/International Bonds | 15.8% | 13.93% | 3.88% |

| Yield | 2.33% | 2.49% | 2.64% |

Both XBAL and ZBAL have the lowest MER at 0.20% while VBAL has a slightly higher MER of 0.25%. If you have a $500,000 portfolio, the 0.005% MER difference would mean an extra MER fee of $250 every year. In other words, although there’s a bit of difference in MER, the actual dollar difference should be quite small considering the portfolio value.

If I had to pick one to use for our kids’ RESPs, I would pick XBAL because of the higher exposure to international equities and a decent amount of exposure to US & international bonds.

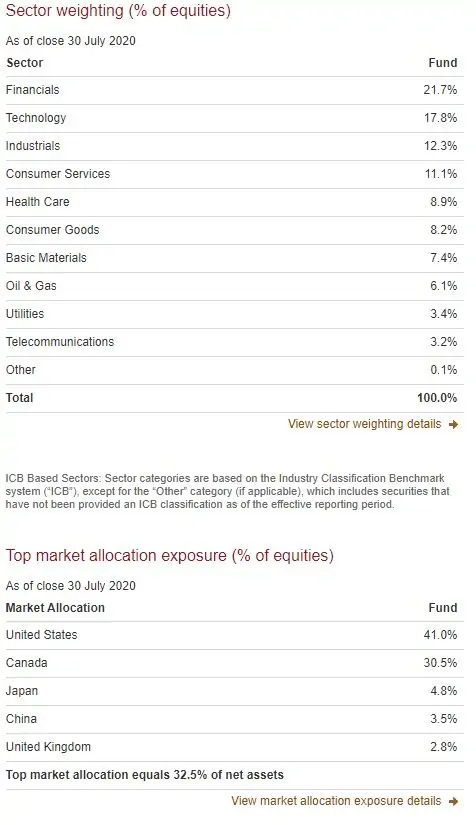

Conservative ETFs – VCNS vs. XCNS vs. ZCON

Just like their counterparts, these conservative all-in-one ETFs have slightly different exposures and holdings. XCNS provides the highest exposure to US and international equities while VCNS provides the highest exposure to Canadian equities. ZCON has the highest exposure to Canadian bonds and a very low exposure to US & international bonds. Meanwhile VCNS has the highest exposure to US & international bonds and XCNS has the highest exposure to Canadian bonds.

Since not all bonds are created equal, it is interesting to note that XCNS hold both Canadian and US corporate bonds. Meanwhile, ZCON holds US corporate bonds and government bonds.

Holding a higher percentage of bonds means the ETFs should have lower volatility while providing regular income (i.e. distribution). VCNS has a one-year-return of 7.07% and a 2.14% distribution yield; ZCON has a one-year-return of 8.48% with a 2.65% distribution yield. At the time of the writing, XCNS does not provide a one-year-return rate but has a distribution yield of 2.00%, which is the lowest of all three conservative ETFs. Since XCNS holds more equities, I’d expect XCNS to have a slightly higher one-year-return than ZCON. In other words, when the market is performing well, XCNS should outperform the other two ETFs.

| Allocation | VCNS | XCNS | ZCON |

| Canada | 12.4% | 10.45% | 10.33% |

| US | 16.3% | 19.52% | 19.01% |

| International | 11.2% | 12.09% | 12.20% |

| Canadian Bonds | 35.3% | 46.22% | 52.31% |

| US/International Bonds | 24.8% | 11.44% | 5.89% |

| Yield | 2.14% | 2.00% | 2.65% |

For me, it was a little bit harder to pick which conservative all-in-one ETF to hold for our kids’ RESPs. I like the idea of holding some corporate bonds for higher yield, but corporate bonds typically mean higher risk than government bonds. After a bit of reviewing and comparison, I think the best conservative all-in-one ETF to hold is VCNS because of the higher exposure to US & international bonds.

RESP Asset Allocation – New Plan

It was interesting to see that the iShare all-in-one ETFs came out ahead for two out of the three types of ETFs compared. Even for the conservative all-in-one ETF, some people may prefer XCNS because of the higher exposure to equities.

After a bit of discussion and research, we have decided to switch from the multi-ETFs approach a one fund ETF approach. This will allow us to leave the RESPs completely passive, other than when we contribute new cash or when we get government grants and need to buy more shares. Holding one single ETF should also allow us to enroll in DRIP and buy additional share(s) whenever there’s a distribution.

With this new approach, we need to change our RESP asset allocation and figure out which all-in-one ETF to hold when the kids are at different stages of their RESP investment timeline.

Again, given the interest rates are so low, I personally don’t think it makes sense to hold a conservative all-in-one ETF when the kids are 15 or older. However, things may change in the future so I won’t shut that door just yet.

Below is our new RESP strategy:

| Index | 0-10 Yrs | 10-15 Yrs | 15-18+ Yrs |

| XGRO | 100% | 70% | 0% |

| XBAL | 0% | 30% | 100% |

With this new RESP all-in-one ETF holding strategy, from 0-10 years, we’d hold around 80% in equities and 20% in bonds. I decided to do a mix of XGRO and XBAL so we’d hold around 26% in bonds when the kids are between 10 and 15 years old. Then when they are older than 15, we’d hold XBAL only and have about 40% exposure to bonds. This age tiered approach should help stabilize the portfolio value by reducing exposures to market volatility.

Update: We ended up changing our strategy again and decided to go 100% stocks for both RESPs. Find out more here with my all equity ETF comparison.

There are many different all equity ETFs available for Canadians. I wrote a VEQT review where I performed a comprehensive analysis for this popular all equity ETF. While VEQT is a great all equity ETF, you may want to take a look at XEQT as well. Check out my XEQT review.

Summary

While it can be very difficult to choose and compare between these all-in-one ETFs, I think the iShare all-in-one ETFs have come out ahead for investors seeking growth and balanced approach. For conservative investors, I think VCNS is a good all-in-one ETF to hold. Since the ETF companies have a tendency to adjust these ETFs slightly or create new ETFs, the winning ETF may be different in the future.

After a bit of review and discussion, Mrs. T and I have decided to transition both of our kids’ RESPs over to use these all-in-one ETFs. We plan to start off with XGRO for both kids, then do a mix of XGRO and XBAL once they are teens, then transition completely to XBAL as they get closer to university age.

If you’re new to investing, I think the iShares all-in-one ETFs are great for building up your investment portfolio. The iShares growth and balanced all-in-one ETFs have lower MERs and seem to have a higher exposure to international equities. However, if you decide to pick another ETF, you should still see a performance that mimics the market performance. Best of all, by investing in these ETFs, you can take advantage of the commission free ETF trading some discount brokers are offering.

I personally think these all-in-one ETFs are a good way to get started with investing. Once you have a sizable portfolio, you can then venture into the world of individual dividend stocks if you choose to.

Dear readers, what’s your thoughts on these all-in-one ETFs? Do you hold any? Which one do you like better? Vanguard, iShares, or BMO?

Would you consider doing an analysis/ comparison of the TD one click funds with Vanguard and iShares all in one funds?

I’ve been a long time client at TD investing in both stocks and ETF’s.and was thinking to switch to Questrade or Wealthsimple. However If the TD ETF’s are worth considering I wouldn’t make the switch, since the EasyTrade app allows for 50 commission free stock trades/year plus unlimited free trades for TD ETF’S

Good idea, will consider this as a future post topic.

Hello Tawcan,

Thank you for your article. We need more like you to educate us. I have a quick question: Would you do any changes to your strategy now that interest rates were increased and will most likely be increased even more to fight inflation?

No I wouldn’t change anything. Still holding XEQT for both our kids’ RESP.

We are grandparents and looking at establishing a RESP for a (currently) 8 month old grandchild. We have narrowed it down to either ZEB or XEQT. I know you like/have XEQT. Any words of wisdom in deciding between the two?

ZEB and XEQT are two completely different ETFs. Between the two I’d go with XEQT for diversification reasons. I’ve written about ZEB here – https://www.tawcan.com/canadian-bank-etfs/

ETF’s seem like an amazing option for those of us who don’t have time to manage individual stocks.

Having said that I do own some individual stocks and my return and dividends have been great.

My question is …with ETF ‘s the dividend payouts are not as frequent (I have XGRO) and return is much lower than what I get on my stocks.

Cost of ETF (XGRO) is much lower than buying ind. blue chip stocks but I don’t see much growth over time either. How is a good return made by investing in ETF’s?

If these total market ETF’s are based on S&P returns over time, the returns should be just as good or better than with ind. stocks but i don’t see that. What am I missing here?

Not sure if it’s a fair comparison to say that ETFs have lower return than individual stocks because it totally depends on what stocks you own. Don’t forget, most of these index ETFs track specific index so the return would be the return of index minus expenses.

These all-in-one’s aren’t just track S&P, they track other markets too.

Glad i have came across this blog post,

I have no idea about FIRE movement until 2017 and since then i built my retirement portfolio with 5 fund old CCP strategy until now at QT. But after reading this post i am kind of inclined towards your all in one suggestion.

Appreciate your take on the below.

Target Retirement year 2022 to 2023 (50yrs).. one or two years left

Current portfolio 80:20 (VAB/VUN/VCN/XEC/XEF) OF $650K + $350K in HISA,

Target portfolio 1M – 40:60(VCNS) or 60:40 (XBAL/ZBAL) ??

Should i sell every thing and convert to all in one or keep the existing 5 fund as is and new funds of $350k into all in one ??

For my kid(16yrs now), who is currently 1 year away from university..is it still recommended with XBAL ??

Currently the RESP is with CIBC and having CIBC Income Plus mutul fund

Invested so far $33,500+Ontario Govt grants ($8650)=$42150, The current value is $56,679.

Should i sell everything and open a new RESP account at Questrade and buy the XBAL at this time or leave it as is with CIBC.

Once again thank you in advance for you suggestion/feedback for my situation.

Hi Mak,

If you’re OK with re-balancing your 5 fund portfolio then don’t see any need to switch over to XBAL/ZBAL. Re-balancing yourself will be slightly cheaper than relying on XBAL/ZBAL but obviously, more time on your part is required.

If your kid is 1 year away from university I’d be careful about switching the investment product. But it really depends what the CIBC income plus mutual fund holds. Feel free to drop me an email if you need to discuss this more.

Thank you for the quick response Tawcan,

Time is not a constrain for me as i am planning to retire anyways but i am getting confused every time buying the same 5 funds in every account whether they are tax efficient or not.

ex: i gather info that ideally i am suppose to buy the following

TFSA – Foreign Equity/Emerging Markets (VUN/XEC/XEF)

RRSP – Fixed Income/Foreign Dividend Investments (VAB/VUN)

Taxable Account – Canadian Equity (VCN)

Now that my equities are grown up, any new money is ending up buying only VAB(bonds) in every account which seems to be a drag on the portfolio.

Btw..how much savings i am looking at by holding 5 fund portfolio vs the XGRO/XBAL. just wanted to make sure is it worth it or not.

Hi Bob,

I am 42 years old and have 12k initial. Planning to put 500 a month.Which all in one etf would you recommend?

Thanks,

Hi Naomi,

Sorry without knowing your personal situation it’s nearly impossible to provide any suggestions. Furthermore, you need to make the buying decision on your own. If you need further one-on-one assistance, I’d suggest taking at look at my coaching service

https://www.tawcan.com/coaching/

As a 25 year old able to put an initial 8K and 300$/month, do you suggest I pick XGRO or XEQT?

* 300$/ pay therefore 600$/month

Depends on your risk tolerance. At 25 years old, I think going with 100% stocks may make sense given the longer timeline. But it’s your personal choice.

I started an resp and tfsa account using td eseries before and 4 etfs for my non registered account.

would it still make sense to do an all in 1 etf now?

rrsp- i only started recently and thats in black rock all in 1 etf

Hi Catherine,

The nice thing about TD e-Series is that it’s free to purchase and you can easily set up automatic purchase plan.

If you’re using TD, buying these all-in-one ETFs will cost you $9.99 per trade so the commission cost can add up pretty quickly if you purchase regularly. If you trade with Questrade that has ETF free purchase, then it makes sense to go with these all-in-one ETFs.

Bob – thanks for this great analysis. Last month, I’ve moved all my daughter’s RESP account from TD to TDDI, it took a long time for the branch representative to do the move – due to the lack of knowledge like you mentioned in your other post. I was just wondering what I should buy for the lump sum in kind amount – and your post just came in to my rescue. I will buy all XGRO since she is under 10 yo. And I am going to contribute monthly for the next 10 years, and planning to either buy TD e-series, or one of the MAW fund. Thank again!

You’re welcome. 🙂

Interesting. I actually decided to switch my kids RESPs to VGRO and increase the bond portion with ZAG as they get closer to college age.

Looking at the same or similar with my retirement funds to be honest

Hi Bob!

I like your blog and your posts are easy to read and understand.

I am investing XEQT for my 2-year-old son’s RESP and I plan to do the same for my newborn baby girl. For the first 10 years of my kids’ RESP, I think it is okay to go a bit more aggressive with 100% equities funds like XEQT/VEQT. While I investing my principal money into XEQT, I am thinking to use the grant from government to pick and choose a higher risk stock to test my luck.

Thank you. Sounds like we have the similar approach. I like the idea of using XEQT for younger kids.

Do you have separate RESP account for each child or do you use a family RESP?

For the ones mentioned in this post, separate RESP account for each child.

For this one mentioned here (to apply for the BC Education and Training Grant), it’s a family RESP – https://www.tawcan.com/bctesg-sages-resp-grants/

Hi Tawcan,

Congrats on your speaking role at the Canadian Financial Summit this year. I’m excited to tune in and hear what you have to say!

I like your strategy of making your RESPs more and more conservative as your children grow older. It’s almost like what a target retirement fund would do. I wonder if there’s a market for “target university” (ha) funds or something similar.

Cheers,

Loonie

Thank you.

That’s the current strategy, if the interest rate stays this low in the next 10-15 years we may have to re-evaluate this strategy. 🙂

I’m also a hybrid investor. Individual securities for income growth and ETF’s to keep up with the market. The two ETF’s I mainly use are VUN.TO (VTI) and VFV.TO (VOO). Both track the US markets.

My 2 kids RESP are currently all US individual stocks, that is because I am trying to move some US securities from my non-registered account to registered accounts, so I have done in-kind transfers for the past 2 years.

That’s interesting that your 2 kids’ RESPs are all US individual stocks. Does the RESP trade in USD?

Actually no. The transfer in-kind gets done on the backend and exchange rate is calculated by the brokerage firm automatically. I am only doing this because I don’t want to sell any stock even though I have to register it as a sale on the tax returns, but I am trying to close up a USD non-registered account without actually buying and selling.

My wife and I are retired and have been invested in ZBAL in the TFSA’s and RRSP/RRIF since near the beginning of 2020. Couldn’t be happier with it. One year and YTD returns it’s outperformed both VBAL and XBAL plus it’s all Canadian owned so the profits stay right here in Canada and we’re also shareholders in BMO common along with the other large banks.

Thirty individual all Canadian dividend growth equities in the taxable account. Since the start of the pandemic I’ve focused on twenty of these Canadian companies. Capital gains are secondary to growing our income which always comes first. Been investing for well over thirty five years and I’ve learned to keep investing simple and don’t spend any more time on our individual stocks than I do on our balanced all-in-one ETF.

Very interesting. I didn’t go into the details and compare how the different ETFs compare to each other in terms of performance. It’s interesting to hear that ZBAL has outperformed boht VBAL and XBAL.

congrats on being one of the speaker at Canadian financial summit

Thank you Dipu.

Bob – Great post. We moved to VGRO for our daughter’s RESP for the reasons you stated. The current plan is to just move the entire portfolio from VGRO to VBAL for 10-15 years and to VCNS for 15-18+ years.

Looks like we think alike. 🙂

What are your thoughts on the all in one Horizon ETF’s?

The Horizon ETFs are pretty decent too. TD also started their own as well.

Thanks for the analysis and review – with these all in one ETFS are you not paying the MER twice – once on the original ETF and then on the combined all in one portfolio? I had my kids set up with Wealthsimple and moved away from them because of the this and the low returns.

Hi Rick,

Nope, you’re not paying the MER twice. Everything’s calculated already.