Mrs. T and I are working toward financial independence by investing in dividend stocks and index ETFs. Our plan is to live off dividends by having between $60,000 to $70,000 in dividend income. We may also do some part time work to supplement our dividend income. Because of that, we are always on the lookout for great dividend stocks to invest in. What are some of the best Canadian dividend stocks?

When it comes to picking dividend stocks, it is important to not just look at the dividend yield alone. Many dividend investors fall into the dividend yield trap by only looking at stocks with high dividend yields. We certainly fell into the trap in the past. It is always important to consider the dividend payout ratio to determine whether the dividend payout is safe or not.

Other factors like dividend growth rate, earning history, company revenue growth, return on equities, and cash flow are also important to monitor.

Total return matters. I’d rather have a dividend portfolio yielding 3% and have my principal growing consistently each year than a dividend portfolio yielding 8% but my principal shrinking each year.

- Check out the Best Canadian Dividend Stocks from the DGI community and see which stocks my fellow dividend bloggers picked out.

- Looking for monthly dividends? I listed all the best Canadian monthly paying dividend stocks.

- Looking for US dividend stocks? Check out the best US dividend stocks.

Per our dividend portfolio, we own quite a number of Canadian dividend stocks. We own more Canadian dividend stocks not because of home bias, it’s mostly due to the added cost of exchanging CAD to USD.

Which stocks made my best Canadian dividend stocks list?

Top 13 Canadian Dividend Stocks

Here are my best 13 Canadian dividend stocks for 2024. These picks are based on total return- a combination of dividend growth and stock price appreciation.

1. Alimentation Couche-Tard (ATD)

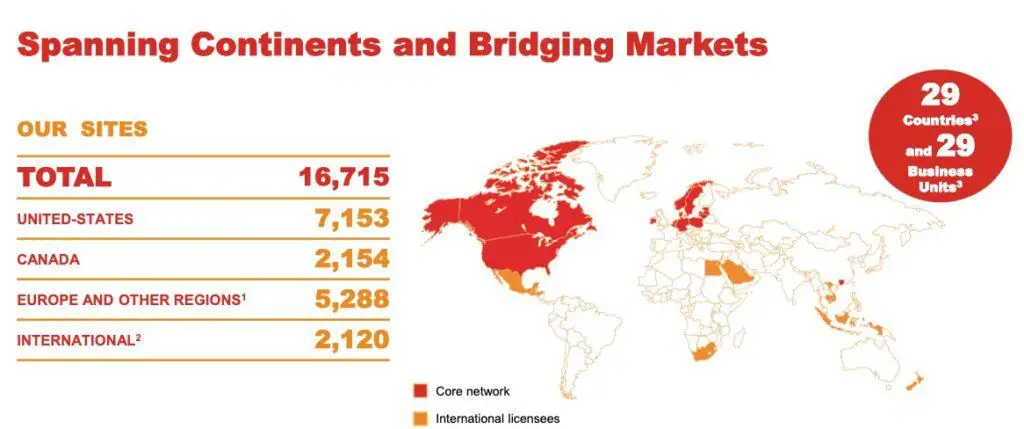

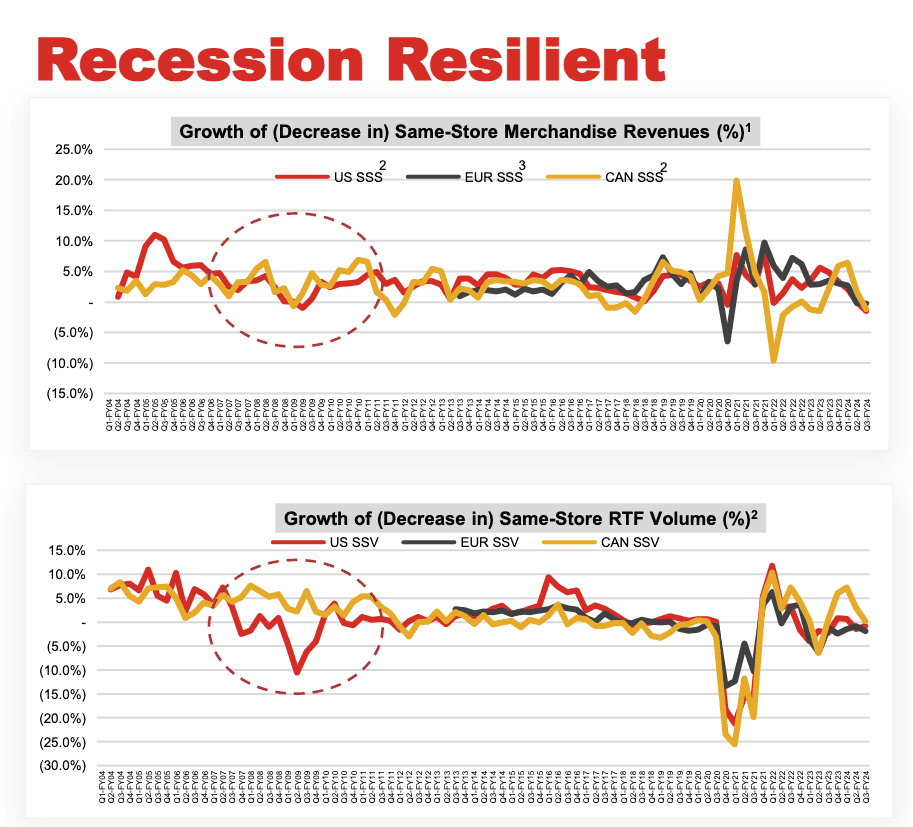

Alimentation Couche-Tard doesn’t have the highest dividend yield but its dividend growth rate over the last ten years has been fantastic. ATD also has had some fantastic revenue growth and strong cash flow. The strong growth is attributed to the 14,000 convenience stores across the globe.

- Sector: Consumer Defensive

- Dividend Yield: 0.93%

- Dividend Payout: 13%

- PE Ratio: 18.44

- 5 Year Dividend Growth Rate: 21.2%

- Dividend Increase Streak: 13 years

Despite the low dividend yield, ATD has been growing its dividends at an impressive rate. For those investors with long time line, ATD is a great pick for total return and compounding dividends. Furthermore, the defensive nature of the business makes ATD a great pick if you’re worried about recessions.

ATD is one of those stocks that the share price just keeps climbing over the last five years. Again, I think it’s an excellent choice for total return.

2. Equitable Group (EQB)

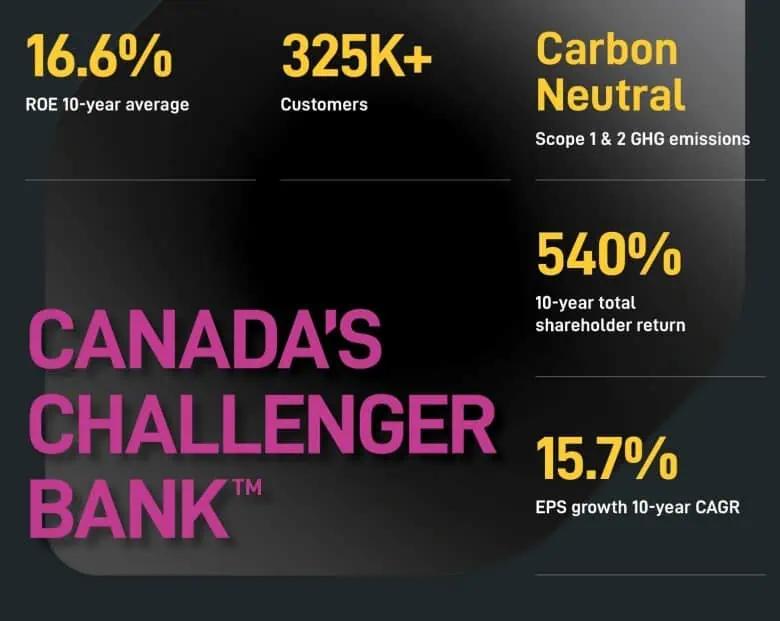

Equitable Group serves a growing number of Canadians through Equitable Bank. Equitable Bank has grown over the years to become the seventh largest independent Schedule I bank by assets in Canada.

EQB offers Canadians the chance to earn high interest rates with their money and not pay fees for everyday banking. Positioning themselves differently than traditional banks, EQB has more than 290,000 customer base in Canada and growing.

- Sector: Financial Services

- Dividend Yield: 2.05%

- Dividend Payout Ratio: 16%

- PE Ratio: 8.76

- 5 Year Dividend Growth Rate: 20.6%

- Dividend Increase Streak: 1 year

In recent years, EQB has announced some pretty hefty dividend increases. If you’re looking for a high dividend growth Canadian stock, EQB would be the one to consider.

3. National Bank (NA.TO)

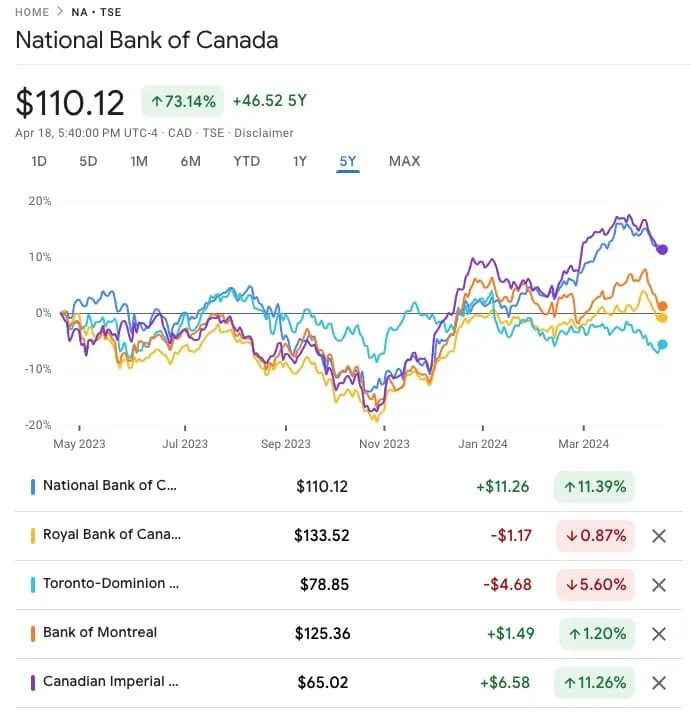

National Bank is the sixth-largest bank in Canada with Quebec contributing 62% of its revenues. While the majority of National Bank’s revenue comes from Quebec, the bank is expanding quickly in the rest of Canada.

National Bank has raised dividends for 13 straight years and has had solid total returns compared to its peers.

- Sector: Financial Services

- Dividend Yield: 3.84%

- Dividend Payout Ratio: 44%

- PE Ratio: 11.66

- 5 Year Dividend Growth Rate: 9.7%

- Dividend Increase Streak: 13 years

The share price has dropped quite a bit in 2023 mostly because investors are concerned that businesses and homeowners may not be able to pay their loans and mortgages. However, with the inflation rate stabilizing and the Bank of Canada looking to hold interest rates steady and potentially lowering the rates, I believe this is a great time to buy more National Bank shares.

4. Brookfield Asset Management (BAM.TO)

Brookfield Asset Management is a leading global alternative asset manager with over $850 billion of assets under management across real estate, infrastructure, renewable power, private equity and credit.

- Sector: Financial Services

- Dividend Yield: 3.38%

- Dividend Payout Ratio: 21%

- PE Ratio: 8.69

- 5 Year Dividend Growth Rate: n/a

- Dividend Increase Streak: n/a

Please note, since BAM is a newly formed entity, some of the financial parameters are not yet available.

Brookfield Asset Management had declared that it plans to pay 90% of its profits and grow the dividend payout every year. This makes BAM very attractive for dividend investors.

I picked Brookfield Asset Management over Brookfield Corporation because of the higher dividend yield. BAM is more suitable for dividend investors looking for income.

Now, if you are looking for higher total returns, you may want to consider Brookfield Corporation (BN).

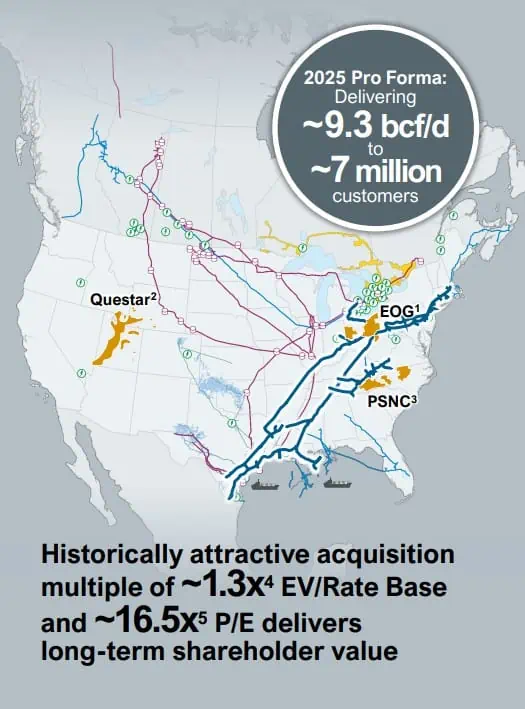

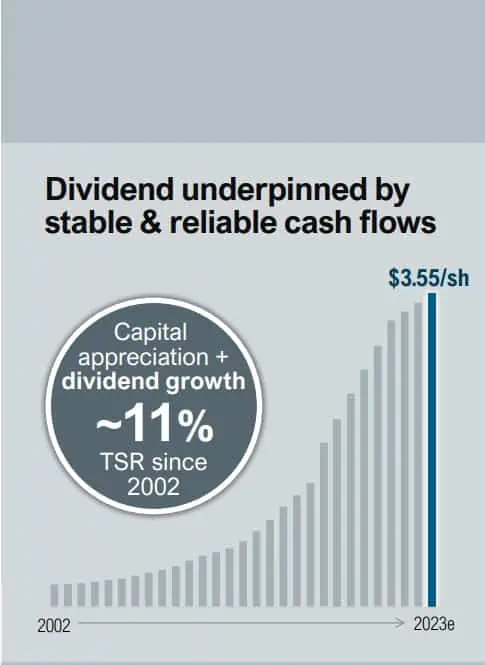

5. Enbridge (ENB.TO)

Enbridge is one of the leading North American infrastructure companies with a vast network of pipelines. In fact, Enbridge owns an extensive network of about 192,000 miles of natural gas and NGL pipelines across North America and the Gulf of Mexico.

Since our reliance on natural gas and crude oil isn’t going away anytime soon, we will need to continue to rely on Enbridge’s pipelines to transport these valuable assets across North America. Environmental concerns and the inability to build new pipelines mean Enbridge’s existing pipeline network is even more valuable than before.

- Sector: Energy

- Dividend Yield: 7.67%

- Dividend Payout Ratio: 190%

- PE Ratio: 18.8

- 5 Year Dividend Growth Rate: 7.3%

- Dividend Increase Streak: 27 years

The Enbridge management expects a 5-7% dividend growth rate moving forward. Given the high initial yield, this is a very solid dividend growth.

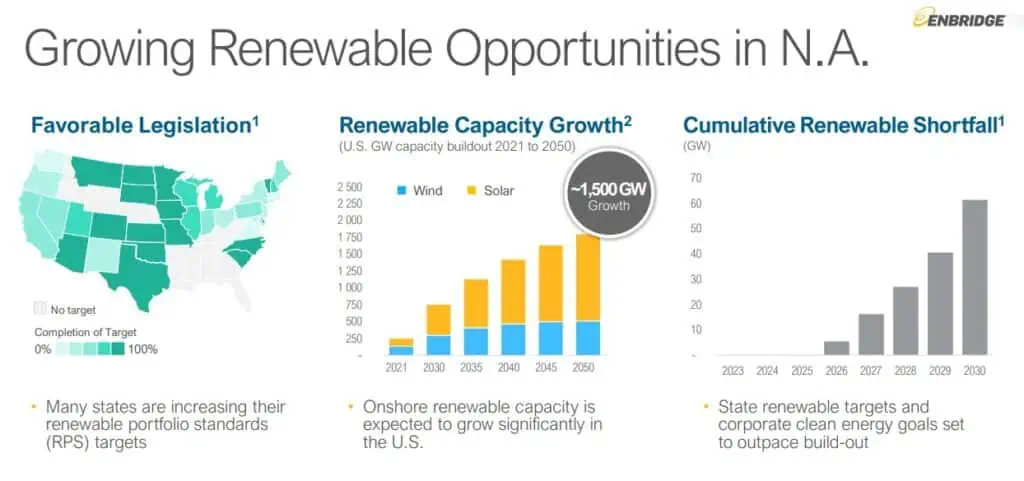

Despite being known as a pipeline company, transporting natural gas and oil across North America, Enbridge is working to increase its renewable footprint.

Enbridge announced it plans to acquire a trio of US companies to create North America’s largest natural gas utility franchise. While the market didn’t like this announcement, as a shareholder, I like Enbridge’s plan to be more like a utility company. Given TC Energy’s recent announcement on splitting the company into two, I suspect Enbridge will plan to do something similar in the near future.

For investors looking for income, Enbridge is a great choice. It definitely falls under the high yield low dividend growth category.

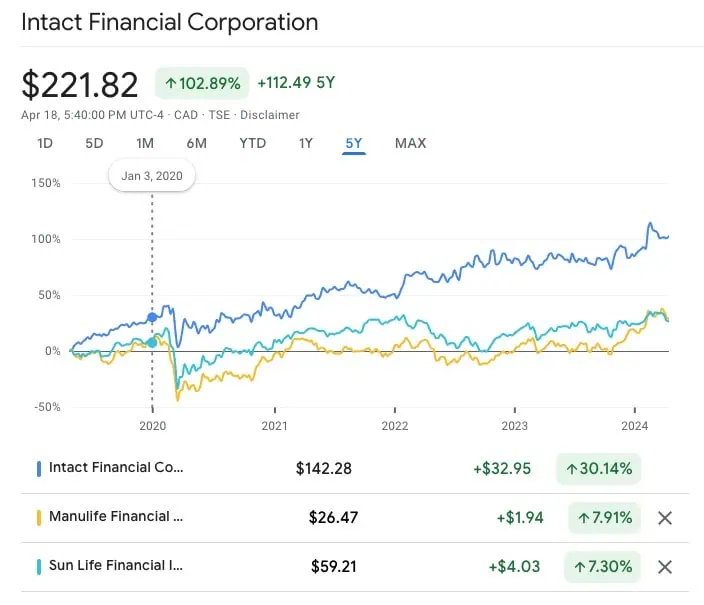

6. Intact Financial (IFC.TO)

Intact Financial is Cana’s largest provider of property and casualty insurance. The company has over 16,000 employees and insures more than five million individuals and businesses through its insurance subsidiaries.

- Sector: Financial

- Dividend Yield: 2.21%

- Dividend Payout: 58%

- PE Ratio: 26.23

- 5 Year Dividend Growth Rate: 9.3%

- Dividend Increase Streak: 18 years

Intact Financial was one of the first dividend paying stocks that we purchased and it has done very well over the years compared to Manulife and Sun Life.

Its stellar return is probably the number one reason why the PE ratio is so much higher compared to Manulife and Sun Life.

7. TD Bank (TD.TO)

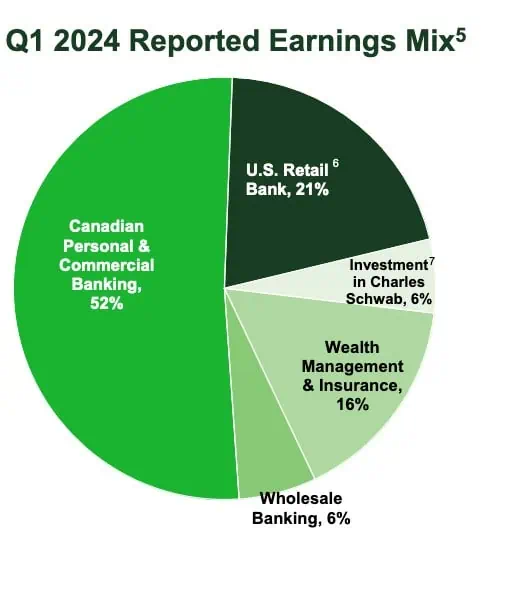

Toronto-Dominion Bank is a Canada-based bank, which operates in North America. TD is one of the largest banks in Canada and the 5th largest bank in North America. It is an online financial services firm, with over 14 million online and mobile customers. Its segments include Canadian Retail, U.S. Retail, Wholesale Banking and Corporate.

- Sector: Financial Services

- Dividend Yield: 5.06%

- Dividend Payout Ratio: 50%

- PE Ratio: 12.38

- 5 Year Dividend Growth Rate: 8.7%

- Dividend Increase Streak: 12 years

TD doesn’t just generate its income from the Canadian market. In fact, TD gets more than 30% of its net income from the US division which has 1,160 retail locations in the US. Overall, TD has a very large retail presence in North America with more than 2,200 retail locations across the continent.

Do you know people who switch banks regularly? Probably not too many.

Because people don’t change banks regularly, TD should continue to benefit from its large client base. Many young adults are TD clients because their parents bank with TD. Once these young adults have kids, it’s very likely they will set their kids up with TD for financial service. Who doesn’t like a perpetual client base?

Given that TD has an initial yield of around 5% right now, I believe at current share price level, TD is very attractive as a long term holding.

8. Canadian Natural Resources (CNQ.TO)

Canadian Natural Resources is a natural gas and heavy crude oil producer that operates primarily in Western Canada.

- Sector: Energy

- Dividend Yield: 3.98%

- Payout Ratio: 53%

- PE Ratio: 14.21

- 5 Year Dividend Growth Rate: 23%

- Dividend Increase Streak: 22 years

CNQ has shown consistently that it can weather the storm. It managed to keep the same dividend payout throughout the pandemic instead of cutting dividends like many Canadian energy companies. Recently CNQ announced an impressive 11% dividend payout increase to reward its shareholders.

CNQ’s management also told investors that it expects to hit $10B in net debt in Q1 2024, which means special dividends are on the table for 2024.

9. Canadian National Railway (CNR.TO)

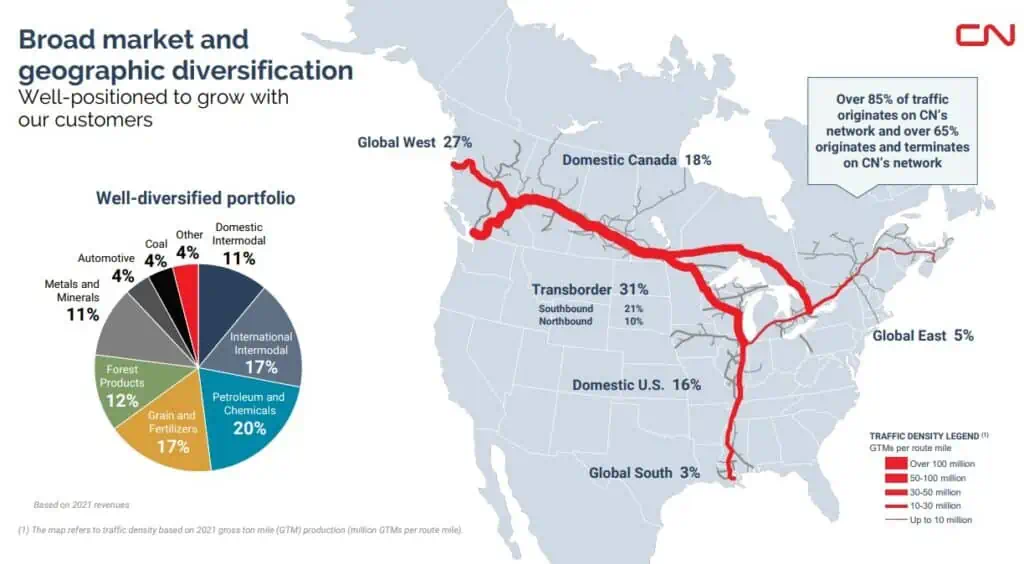

Canadian National Railway Company has a network of approximately 20,000 route miles of track that spans Canada and mid-America, connecting approximately three coasts, including the Atlantic, the Pacific and the Gulf of Mexico and serving the cities and ports of Vancouver, Prince Rupert (British Columbia), Montreal, Halifax, New Orleans, and Mobile (Alabama), and the metropolitan areas of Toronto, Edmonton, Winnipeg, Calgary, Chicago, Memphis, Detroit, Duluth (Minnesota)/Superior (Wisconsin), and Jackson (Mississippi), with connections to all points in North America.

- Sector: Industrials

- Dividend Yield: 2.08%

- Dividend Payout Ratio: 43%

- PE Ratio: 20.31

- 5 Year Dividend Growth Rate: 12.2%

- Dividend Increase Streak: 27 years

CNR is a very diversified company. No one particular product line accounted for more than 25% of the total revenues. And the company has one of the lowest operation ratios of all American railway companies that are publicly traded.

Canadian National Railway has a pretty low dividend yield, but the key here is its high dividend growth rate over the years. The company currently has a 20 year dividend growth rate of 16.3%. Needless to say, CNR shareholders get rewarded when holding the stock for the long term.

Although rail is not frequently used for passenger travels here in North America, rail is still one of the most cost-efficient ways of transporting goods. Canadian National Railway’s large rail network will allow the company to provide transportation services in North America and bring profits to shareholders.

10. Fortis (FTS.TO)

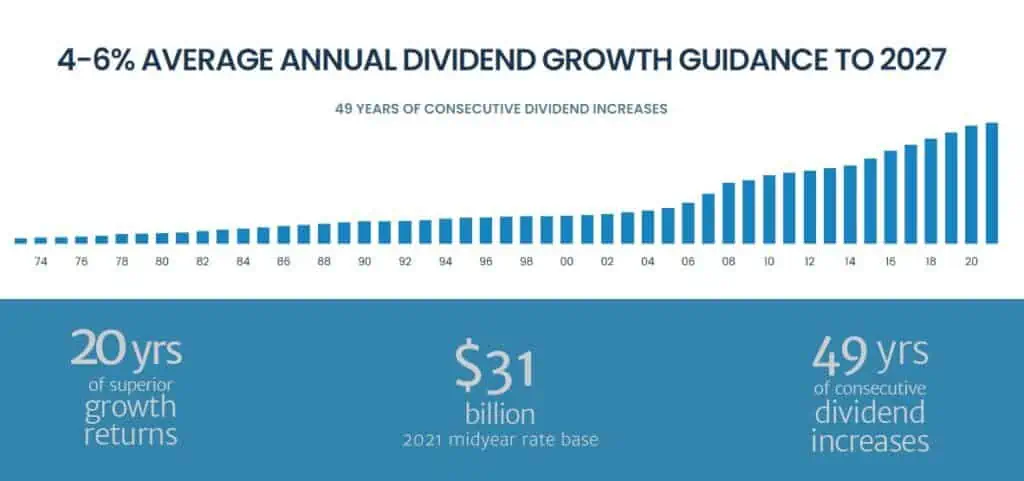

Fortis is a Canada-based electric and gas utility holding company. The Company’s segments include Regulated Utilities and Non-Regulated Utilities. Fortis serves many different regions, including Arizona, BC, Alberta, New York, Newfoundland, Ontario, PEI, and the Caribbean.

- Sector: Utilities

- Dividend Yield: 4.55%

- Dividend Payout Ratio: 83.7%

- PE ratio: 16.74

- 5 Year Dividend Growth Rate: 6%

- Dividend Increase Streak: 50 years

Who doesn’t like the 49 years of dividend increase streak?

Fortis is one of the few Canadian dividend paying stocks that can be called the Canadian dividend aristocrats. With a dividend yield of over 4% and a solid dividend growth history, it’s nearly impossible not to create a dividend portfolio without Fortis in it.

11. Royal Bank (RY.TO)

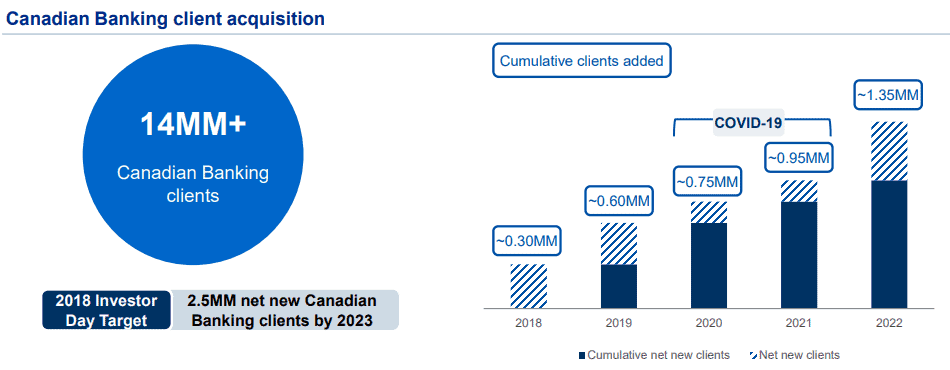

Royal Bank is the largest bank in Canada. If we look at Royal Bank’s earnings, 45% came from personal & commercial banking, 24% came from capital markets, 19% came from wealth management, 7% came from insurance, and 5% came from investor & treasury services.

RY serves personal, business, public sector and institutional clients in Canada, the United States and approximately 40 other countries.

Despite being the largest bank in Canada, Royal Bank set out a plan in 2018 to attract new Canadian banking clients. So far they’re on track to meet this target.

- Sector: Financial Services

- Dividend Yield: 4.14%

- Dividend Payout Ratio: 47.7%

- PE Ratio: 12.45

- 5 Year Dividend Growth Rate: 7.3%

- Dividend Increase Streak: 12 years

Royal Bank has been paying dividends since 1870 and has never missed a dividend payment since. Let that sink in! The 150 year of dividend payment streak is pretty darn impressive if you ask me.

Royal Bank’s share price has been depressed the last year so it may be a good time to load up and wait for the stock price to recover.

12. Telus (T.TO)

Telus is one of the big three Canadian telecommunication companies based in Vancouver BC. The Company provides a range of telecommunications services and products, including wireless and wireline voice and data. Telus has around 11 million subscribers and they have increased its dividend nearly every year since 2002.

- Sector: Communication Services

- Dividend Yield: 6.94%

- Dividend Payout Ratio: 176%

- PE Ratio: 37.54

- 5 Year Dividend Growth Rate: 6.6%

- Dividend Increase Streak: 19 years

Since the launch of smartphones and data plans, more and more Canadians are addicted to these smart devices. This addiction has helped Telus to continue making a massive amount of profit. Telus’ board is very shareholder friendly and has declared that they have a goal to continue increasing dividends by 7 to 10% in future years. Telus usually raises dividend payout twice a year and recently announced a 3.56% dividend payout increase.

Like many telecoms, Telus’ share price has taken a beating lately due to concerns with telecoms’ debt level. While concerning, let’s not forget that telecoms require a lot of investments to improve their infrastructures so it’s normal to see high level of debt. Yes, if the interest rates don’t come down, the the debt and interests will drag the telecoms down. However, I believe interest rates will slowly creep down and the telecoms should recover in the medium term.

13. Granite REIT (GRT.UN)

Granite REIT is a Canadian-based real estate investment trust engaged in the acquisition, development, ownership management of logistics, warehouse and industrial properties in North America and Europe.

- Sector: Industrial REIT

- Dividend Yield: 4.71%

- PE Ratio: 7.52

- 5 Year Dividend Growth Rate: 3.5%

- Dividend Increase Streak: 12 years

GRT.UN’s portfolio consists of 137 investment properties representing almost 62.9 million square feet of leasable area with an occupancy rate of 96.3%. These numbers are very impressive for REITs. I have come to really like Granite REIT for its global footprint with a focus on institutional-quality assets in key distribution and e-commerce markets.

As online shopping gets more popular, online retailers like Amazon and Wayfair need to have warehouses in major cities to store merchandise. GRT.UN should benefit from this shopping trend.

13 Best Canadian Dividend Stocks – Final Thoughts

Here you have it, my picks for the best Canadian Dividend Stocks. I picked these stocks from different sectors to help build a diversified dividend portfolio. For the most part, investing in Canadian banks, Canadian utilities, and Canadian telecoms is a very easy and straight forward way of DIY investing and receiving juicy dividends.

Want to learn to construct your own dividend investing portfolio and start investing in dividend paying stocks? I went through several methods on how I shortlist and screen dividend paying stocks. You may also want to take a look at this Canadian Dividend Calendar to see when the Canadian dividend all stars pay out dividends.

Some of you might wonder if preferred shares have a place in your portfolio. This is a very personal question and totally depends on whether your aim is total return or dividend income. Personally, I think there are too many preferred shares available and it can be very confusing looking at preferred shares from the same company and understanding all the different jargon. Therefore, if you’re considering holding preferred shares in your portfolio, it might be a good idea to utilize one of the best preferred share ETFs in Canada and let the professionals manage it for you.

If you’re reading this post, you are probably managing your own portfolio and may not want to use an ETF and pay the management fee, is there a way to do that? Fortunately, some smart folks created Passiv to do that for you automatically. With Passiv, the tool can put your portfolio on autopilot. You can build your own personalized index, invest, and rebalance all through a click of a button. Passiv can even calculate and execute the trades needed to keep your portfolio balanced. Essentially, Passive makes investing super simple! A community user account is free to sign up for. The elite member account is $99 per year…but it’s free for Questrade clients! Make sure to check out Passiv.

In case you’re curious, for diversification outside of Canada, we hold a handful of US dividend paying stocks. In addition, we utilize one of the low cost ex-Canada ETFs like XAW to diversify our portfolio internationally.

Do you already own dividend stocks and want to create a spreadsheet to track your portfolio? Take a look at my Google Spreadsheet Dividend Portfolio Template.

The dividend-growth lovers over at Million Dollar Journey have their own list of Canada’s best dividend stocks, which focuses heavily on earnings-per-share, and forward earnings-per-share as their main dividend stock valuation metrics. This again, makes intuitive sense from a dividend-growth perspective, as companies that have a lot of free cash flow – plus a history of raising their dividends – should be ideally positioned to keep those dividends growing far into the future.

Is it better to purchase one of these top Canadian dividend stocks, or purchase lesser known Canadian dividend stocks with lower yield and higher dividend growth? This is a personal decision you need to make yourself. Personally, I believe a mix of both.

Note: This blog post represents my opinion and not an advice/recommendation to purchase these stocks. Before you buy any stocks, please consult with a qualified financial planner.

Love the list. Had a question for you. Would you rather top up a stock that you own so you can now get a share drip or buy a new stock entirely

Thanks

I usually try to get enough shares so we can enroll in DRIP. Having said that, it depends on how many holdings you have in your portfolio.

Enbridge and Telus have been money looser for more than two years

I am very happy that I sold them three years ago

May be good for new investor now trying to gamble the upside side

It’s probably the same for Canadian banks though. 🙂

I currently have SJ.TO (Stella Jones), it’s amazing how nobody ever notices them, yet they are a Canadian dividend Aristocrat (18 years in a row of growing their dividends), they have a 5 year dividend growth rate of 13.62%, in the last 10 years, they grew their dividends in the double digit % for 9 years out of 10….In the last 20 years, if you invested 500$ in SJ, you would’ve crushed SP500 with a total return (dividends included) of 46 829$ vs SP500 SPY at 2430$.

They are up 78% in 1 year and 67% YTD.

Their payout ratio is 15%!!!!! It baffles me that for a Canadian stocks, not many Canadians put them on their top 10 list with those insane numbers. This is not a brand new company, it became publicly traded in 1994.

I suspect it has to do with the fact that it’s a materials company, so it gets burried in people’s radar. Also, for a materials company, the reason I had bought them in the past is because their Earnings grow upwards at a much more consistent pace than your typical materials company. Lumber is a small part of their segment, but they do more than that, for example they build utility poles which will always demands and even more in the future as we saw this year with forest fires. They do railway ties too….it’s a nice diversified buisness.

Sorry for my long post, I felt I needed for people to know about this company that I feel should be as far as I’m concerned a top 5 Canadian company. This is not to criticize your ranking btw, but I felt people should know more about this company that not many ever mention. Only this year, I’ve seen a few Youtubers mention them, but before that, it was all crickets. As I said, most likely the fact that they are in a non popular sector, people tend to just skip over them, but their numbers speaks for themselves.

FYI, your list is solid too btw.

Stella Jones has done quite well the last year or so. The initial yield is a bit low for some but yes, he dividend growth rate has been quite solid. Reason for not including it on my list is that materials tend to be quite cyclical. Agree that the company has been expanding into other segments so that’s promising to see. Definitely something to put no my radar in the future. Thanks for the mention.

I have read this post number of times and every time it gives you a different perspective. Looks like you have a real great list of Canadian Stocks.

Couple of questions for you

1. Do you have a similar list for US stocks?

2. What do you think of CN and/or CP Rail?

3. What are your thoughts of CSU.TO at the current price?

Thanks

See best US ones here but it hasn’t been updated for a while – https://www.tawcan.com/best-us-dividend-stocks/

I like CN better but between CN and CP it’s a coin flip IMO. CSU price seems to just keep climbing. Dividends might be on the low side for serious dividend investors to consider.

I’m surprised you didn’t have BNS on the list.

BNS has quite high yield now but the total return aspect has been poor. You’re better off wit NA, RY, and TD at this point.

Hi,

What do you think about:

IFC.TO

EMA.TO

Thanks.

Two totally different companies. IFC I like, but under 170/ share – it will happen soon. Very solid earner ! Wait then buy . EMA is also good, I like it . Pays a good Div and has a good amount in “regulated’ utilities. Buy at 40.50 or lower – it will happen. Also look at GEI -TO . Anything less than 19.50 . Great buy for GEI at this price. Also look at ZWK and ZWB ( USA and Canada Banks) . Good bets at anything less than 15.80 for ZWK and ZWB at less than 15.25 . both will cycle down there mid winter or sooner . Hope that helps ! I dont know what your looking at investing in or what type of investor you are . Risks are similar , but of coarse GEI and EMA are tied to energy and regulated business .

James (from Aruba right now ….but normally on Vanc Island 🙂

Leo check out CAT too at anything less than 155.00 USD is a great deal . on a downturn in the markets you may be able to snag it !

We own both and believe both are solid long term holds.

These are some profitable stocks, thank you for sharing this information. Will you keep me updated if there is any change?

Yes that’s the plan. 🙂

Bob,

Do you know of a resource that lists all the CDN companies that have increased their dividend lately?

This thread is pretty good – https://forums.redflagdeals.com/2023-canadian-dividend-increases-2593087/

Wonderful list Bob! Thanks! I’m wondering what are your thoughts of investing in BCE going into 2023? Would appreciate your thoughts.

Both BCE and Telus are solid dividend paying stocks. We bought quite a bit of BCE in 2022 so plan to focus more on Telus for 2023.

Thank you Bob for this post, I have 9 out of those 13 companies BAM is something I was thinking of adding but I already have BIP and BEP in our portfolio so maybe for the future I’ll add EQB.

I wanted to hear your thoughts about AQN , I’m sure you’ve heard the new about the slash of dividends and other cuts in order to clean house I guess , so yeah just wanted to know if you’re still holding or you’ve already sold and moved on.

If you already have BIP and BEP, BAM might be a bit of an overlap.

Yes, saw AQN’s dividend cut. For now we plan to hold and see what happens in the next few months before making a decision.

Hi Bob, love the picks and explanations as always! Just wondering about your thoughts on IFC.TO these days? I remember learning about this ticker and doing more research of my own after seeing it on one of your previous Top 13 Canadian Dividend Stocks lists (I forget which year). I never pulled the trigger on it but always had it in my watchlist.

Don’t see it here in your top 13…. is it still in your top 20 at least or has it completely fallen off your radar for some reason? Curious to hear your thoughts!

Some solid picks. I have 6 of these 13 (TD,RY,EQB,T,FTS,ENB). I worry about ATD medium term+ w/ EVs. And MFC – I just can’t do it given the history of missteps, perhaps SLF safer and smoother track record? For your consideration: WCN,EIF,EFN,GSY,EMA,L. And one flyer: HPS-A.

Thanks. I think ATD will be fine with EVs. It’s a toss up between MFC and SLF IMO. 🙂

Will you continue to add aqn at this level? The stock dropped nearly 40% in three trading days. RBC analyst, Nelson Ng

, forecast 38% dividend cut in 2023 while TD Bank analyst forecasting zero dividend increase for few years. Aqn is excessively leveraged with debt and 23% of its debt is floating as if the variable rate that we pay with our mortgage. Will it change your view on Aqn as one of the top dividend stocks.

I will update this post soon and plan to have a post on AQN analysis. Haven’t been able to get to it due to our entire household sick with the flu.

Hope all things well with the family and a speedy recovery! Will love to hear your in depth analysis on Aqn. Cheers!

Hi. I’m just starting to learn and want to invest. What is the best way to buy stocks through a bank or broker?

You need to buy it through a broker. All the Canadian banks have a broker division. Alternatively you can use the discount brokers like Questrade or Wealthsimple.

See here – https://www.tawcan.com/questrade-vs-wealthsimple-trade/

Do you have an opinion on Nutrien (NTR) tsx?

I have them in my dividend portfolio and have been very happy so far.

We used to own them too. Given the growing global population and demands for food I think NTR may make sense.

Hi Bob

I have a question for you about ENB.TO – as far as I know Enbridge has suspended the DRIP program from 2018 and they pay quarterly dividends (no complaints there). Do you manually purchase additional shares end of every quarter?

TIA

We are dripping through our discount brokers.

Are you dripping on your taxable accounts as well?

Yes we are.

Hi,

What are your thoughts on BCE and BNS.

Are there any specific reasoning why they are not past of your top dividend list?

Thanks for all your great work!

David

They’re solid companies, we own them in our dividend portfolio. Since I only picked 13 stocks, I wanted to ensure a wide selection of stocks in different sectors.

Love BCE and BNS ( …or even TD , and BMO) . The telcos in Canada operate as a monopoly, and so do the banks under the “charter bank act”. These are considered “tolls-type entities” , much like solid infrastructure plays. BCE and BNS I own … solid companies I think. Have a great one !

During the early days of the pandemic, I gobbled up ENB, KEY, PPL, BNS and a couple of retail REITS like a hungry man at a buffet table.

I was eyeballing Cdn.Natural Resources as well but never got around to it.

If I look at the chart now, CNQ is just too high for my liking – it looks like it could crash down at any moment, especially if middle eastern countries start blasting up the oil supply.

They have fantastic dividend growth rates no doubt, but I would be too nervous buying into it at these levels.

I’m also more comfortable holding midstream oil&gas companies, rather than a front-liner susceptible to wild fluctuations.

Having said that, I’m sure CNQ can repurpose when the time comes, just like ENB.

As much as we’d all like to hug windmills and solar panels – the infrastructure just isn’t there to service all of us, like oil&gas still can.

So I’m pretty confident these companies will be necessary for a couple decades to come.

Thanks for your insights, I like all your choices – except for AQN.

Their debt load just seems insane to maintain long-term dividend rates.

I know it’s incredibly popular though and they certainly aren’t going to disappear anytime soon.

Good moves! We added a lot throughout 2020 as well – https://www.tawcan.com/dividend-stock-transactions-2020/

Oil & gas will be around for a while, despite renewables getting more and more prominent. Like you said, the instrastructure will take a few more years to service all of us.

I’m quite disappointed in Telus International – they are growing , huge cash reserve and Earnings …but zero dividend !?. NOT the best. I would call this division – NOT shareholder friendly.

Hello,

I don’t own or follow TIXT but have owned T for many years and am happy with it. I believe TIXT was spun off by T to be a growth vehicle, not a dividend stock. It may have been priced to high to begin with, hence the decline since late October. The company is focused on retaining their earnings for growth. If dividends are your focus I wouldn’t suggest holding TIXT. There are better opportunity income opportunities elsewhere.

I think there was quite a bit of hype with TIXT so the stock price was probably higher than it should have been. I don’t follow TIXT too closely though.

It’s a solid company, and a great diversification play for Telus . But in the end it’s shareholders money, if there not willing to provide a Div in great times … well I’m not interested. . I like to see a blend of growth and sharing profits. Thanks

I’m surprised fortis is not here. Any reason why it was not included on this list?

Fortis is a solid company but simply didn’t make it to the list.

Hi,

What do you think of the sustainability of the dividend for Telus? The payout ratio is rather high so I checked their website and it stated that they are using free cash flow instead of net income and targeting 60 to 75 percent. Not sure if I used the correct FCF number from their recent quarterly report, but I came up with a number even higher than the payout ratio that uses dividends paid/net income.

I like your list and have positions in 7 of them with a few others that I’m looking to add. EQ bank looks interesting, but Wealthsimple does not let me buy it yet…guess volume is too low.

Based on free cash flow analysis I think Telus’ dividend is safe. Telus management seems to be very shareholder friendly as they’ve been raising dividends quite consistently.

That’s odd you aren’t able to buy EQB with Wealthsimple.

Healthy list ! I feel markets are over heated …too much stimulus, combined with near zero interest rates. There will be a pull back at some point . What the catalyst will be I don’t know, however if you look at history it tends to predict the future.

Great list of bluechip dividend stocks.

I find the coverage on Savaria Corp interesting and also shows there are good stocks outside the bank/utility/energy/resource space. A small suggestion – if you could cover mid or small cap dividend stocks as a separate article it would be great and provide more idea or sectors to explore beyond the typical Canadian index heavyweight sectors. Thank you.

Thanks for the suggestion.

So at least at BMO InvestorLine for ENB they do not offer Drip which might be per ENB policy, do any other discount brokers offer DRIP for ENB?

Now have been taking the dividends from ENB to purchase no fee purchase of ETF XDV.

I have shares of ENB, FTS, T which are in XDV already so may look into moving XDV to some individual stocks eventually.

I guess I have some research to do as about 38% of the portfolio is XDV. ENB 21%, FTS 12%, T 22%, then rest is small amount of CRYP 2.73% & ETHY.B 2.53%.

I have no problem dripping ENB with TD and Questrade. There’s no drip discount with ENB though. Weird that BMO doesn’t offer drip for ENB.

Great list Bob.

I have really been getting a lot out of your blog over the last 15 months or so. This post reaffirms for me that I am on the right track. I hold 12 of the 13 with a heavy weight to Financials and Utilities. Love the dividends I am seeing as my wife and I head into retirement…..Looking at $32,000 this years across all our accounts with a goal of $36,000 in 2022.

Funny that the only one I am missing on your list is National Bank….your number 1. I will certainly be giving NA close look in the new year and adding to several others in 2022.

All the best to you and your family over the holiday season.

You too, Rod, have a great holiday season.