A while ago, I wrote a VEQT review where I performed a thorough and deep analysis of the Vanguard All-Equity ETF. While I really like VEQT, we ended up buying XEQT for our kids’ RESPs due to a few key reasons. The beauty of a one-fund solution ETF such as the iShares All-Equity ETF (XEQT) means there’s no need to re-balance regularly. This makes it a very straightforward and simple investment approach. More importantly, the all-in-one ETFs provide instant asset class diversification and geographical diversification, all for a very low management fee.

Vanguard and iShares are two of the most well established and most trusted ETF companies in the world. Both companies offer similar all-equity ETFs – VEQT and XEQT, respectively. Lately, when I’m coaching clients new to investing, I’d typically recommend XEQT to them because of the lower MER fee compared to VEQT.

Although XEQT is great for beginner investors, this all-equity ETF is just as good for experienced investors. This ETF definitely has a place in most investors’ portfolios.

Having written a VEQT review, I figured I needed to write a similar review for XEQT so readers can compare the two side-by-side.

The iShares All-Equity ETF Portfolio, XEQT, holds 100% in equity. This means that the ETF holds no bonds. iShares have several all-in-one ETFs and XEQT falls in the more volatile, riskier spectrum of all the all-in-one ETFs because XEQT holds 100% in stocks.

XEQT seeks to provide long-term capital growth by investing primarily in one or more exchange-traded funds managed by BlackRock Canada, or an affiliate that provides exposure to equity securities. Just like its counterpart all-in-one ETFs, iShare All-Equity ETF trades on the Toronto Stock Exchange under the ticker name “XEQT” and is traded in Canadian dollars.

XEQT is a relatively new ETF. It was created in Aug 2019. Some key facts of XEQT:

- Inception Date: Aug 7, 2019

- Eligibility: RRSP, RRIF, RESP, TFSA, DPSP, RDSP, taxable

- Dividend Schedule: Quarterly

- Management Fee: 0.18%

- MER: 0.20%

- Listing Currency: CAD

- Exchange: Toronto Stock Exchange

- Net Asset: $595.48M

- Number of holdings: 4

- The number of stocks: 9,444

XEQT Fees

XEQT has a management expense ratio (MER) of 0.20%, which is 0.05% lower than VEQT. While 0.05% may not seem a lot, if your portfolio value is $250,000, it means $125 in fees each year. While it’s not an enormous amount of money when your portfolio is that big, it adds up eventually.

One thing to note is that the all-in-one and all-equity ETFs that Vanguard, iShares, and other ETF companies all have very low management fees. These management fees are typically much, much lower than the MER on the typical mutual funds available to Canadians. The low MER is one of the key reasons why index ETFs are excellent investment options for Canadians.

If you use a discount broker like Questrade, you can buy ETFs commission free. This would reduce your overall transaction cost significantly. If you use Wealthsimple, you can also buy ETFs commission free.

Check out my Questrade vs. Wealthsimple Trade review to see which discount broker is best for you.

XEQT Underlying Holdings

Like other iShares all-in-one ETFs, XEQT holds four iShares ETFs which means that XEQT holds 9,033 stocks. The underlying holdings are:

- iShares Core S&P Total US Stock (ITOT) – 48.02%

- iShares MSCI EAFE IMI Index (XEF) – 24.39%

- iShares S&P/TSX Capped Composite (XIC) – 22.71%

- iShares Core MSCI Emerging Markets (IMEG) – 4.64%

The rest of the portfolio holds USD and CAD cash and/or derivatives.

XEQT Top 10 Market Allocation

Here is XEQT’s top 10 market allocation.

- US: 47.13%

- Canada: 23.79%

- Japan: 5.37%

- UK: 3.08%

- Switzerland: 2.25%

- France: 2.23%

- Germany: 1.92%

- Australia: 1.84%

- China: 1.74%

- Netherlands: 1.27%

The exposure to each country will vary month over month but the variations are typically in the fractions of a percentage. XEQT has a much higher exposure to the US market compared to VEQT. While XEQT has 8.89% exposure to other markets, iShares did not provide such information on the website.

Having a large exposure to the US market makes sense given that so many international companies are based in the US. One certainly wouldn’t want to miss out on the next Apple, Tesla, or Facebook.

Given the size of the Chinese economy, I was a little bit surprised that XEQT only has slightly over 2% exposure to the Chinese market. It is possible that as the Chinese market grows, the overall exposure will increase.

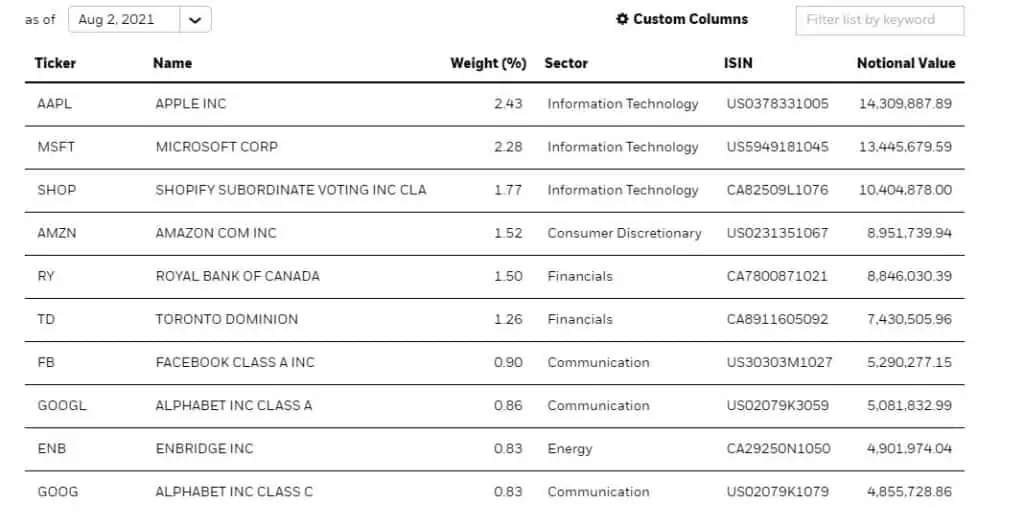

XEQT Top 10 Holdings

XEQT’s top 10 holdings are composed of a mix of US and Canadian companies.

- Apple: 2.43%

- Microsoft: 2.28%

- Shopify: 1.77%

- Amazon: 1.52%

- Royal Bank: 1.50%

- TD: 1.26%

- Facebook: 0.90%

- Alphabet Inc Class A: 0.90%

- Enbridge: 0.83%

- Alphabet Inc Class C: 0.83%

XEQT Sector Exposure

XEQT has a similar sector exposure as VEQT, which is expected. Please note, since iShares does not disclose XEQT sector exposure information, I had to find this information from Morningstar.

- Financial Services: 18.59%

- Technology: 17.88%

- Industrials: 11.21%

- Healthcare: 9.83%

- Consumer Cyclical: 10.03%

- Communication Services: 8.06%

- Consumer Defensive: 6.27%

- Basic Materials: 6.20%

- Energy: 5.16%

- Real Estate: 3.64%

- Utilities: 3.12%

XEQT Returns

Because XEQT is a relatively new ETF, the historical return data is a bit lacking. As of July 31, 2021, XEQT has a 1 year return of +26.98% and a +17.35% return since its inception. In comparison, VEQT has a 1 year return of +26.63%.

XEQT Distributions

XEQT pays distribution quarterly. The actual dividend amount varies each quarter. In 2020, XEQT paid out $0.39765 per share. At the current stock price that’s equivalent to around 1.49% yield.

If you’re looking for yield, XEQT probably isn’t the right ETF for you. Instead, you might want to take a look at one of the best Canadian dividend ETFs instead.

Foreign Withholding Tax with XEQT

Since XEQT has a large exposure to the US market, one thing to keep in mind is the 15% withholding taxes that the US government charges on any dividends paid to Canadians. Fortunately, XEQT would take care of the withholding taxes when it pays dividends every quarter. If you hold XEQT in TFSA, RRSP, or RESP, you won’t be able to recover any withholding taxes paid, unfortunately. If you hold XEQT in a taxable account, you can recover a portion of the withholding taxes in the form of foreign tax credits.

Thanks to the Canadian Portfolio Manager blog’s excellent Foreign Withholding Tax Calculator, we can determine what XEQT’s expected foreign withholding tax is in the different accounts.

According to the calculator, XEQT has the following tax drag in the different accounts:

- TFSA: 0.22%

- RRSP: 0.22%

- RESP: 0.22%

- Taxable: 0.01%

Combined with the MER fee of 0.20% that means the overall tax drag for the different accounts are:

- TFSA: 0.42%

- RRSP: 0.42%

- RESP: 0.42%

- Taxable: 0.21%

This makes XEQT much cheaper to hold compared to VEQT. By holding XEQT you’d be saving yourself anywhere from 0.05 to 0.06% in terms of fees per year.

While it may be cheaper to hold XEQT in a taxable account for the quarterly distributions, you need to consider capital gains when you eventually sell XEQT. Therefore, always consult a tax specialist for tax planning and investment efficiency.

XEQT Review – Pros and Cons of XEQT

A review wouldn’t be complete without a pros and cons list. Like every investment, there are pros and cons. Therefore, I believe it is always important to go over them before making any investment decisions.

Pros of XEQT

There are lots to like about XEQT:

- 100% in stocks targeting long term growth

- Instant diversification by holding over 9,000 international stocks

- Instant geographical diversification

- Instant asset class diversification

- Low Management fees, much lower than the Vanguard equivalent (VEQT)

- Possible higher returns than VEQT due to higher exposure to the US market

- No need to re-balance regularly

- Hands-free portfolio management

- Commission-free purchase when a broker like Questrade

Cons of XEQT

I have to admit, it was really hard to come up with cons of XEQT.

- More volatility and higher risk because of 100% in stocks

- Slightly more fees in the long run compared to the multi-ETFs approach. For example, holding VCN and XAW.

XEQT vs. VEQT

As mentioned already, XEQT is very similar to VEQT as both hold 100% in stocks. After my thorough analysis of the all-equity ETFs, I decided to hold XEQT for our kids’ RESP. Why did I do that? My key reasons were:

- XEQT has a lower overall fees than VEQT

- XEQT has a higher exposure to the US market than VEQT

With so many iShares ETFs available, some readers might wonder, how does XEQT compare to the other iShares ETF funds?

XEQT vs. XGRO

XGRO holds around 80% in stocks and 20% in bonds, while XEQT holds 100% in stocks. For people that aren’t as risk tolerated, XGRO might be a better ETF to hold. You can check out my All-in-One ETF in Canada comparison for more information.

XEQT vs. XIC

XIC, the iShares Core S&P/TSX Capped Composite Index ETF, only tracks the Canadian market. So if you hold XIC, you definitely want to find another index ETF that tracks the global market. XEQT has a good exposure to the global market.

XEQT vs. ITOT

XEQT holds over 47% of ITOT, the iShares Core S&P Total US Stock Market ETF. While ITOT has a manage expense ratio of 0.03%, it only covers the US market. XEQT is a good fund to hold if you want international exposure.

XEQT vs. XAW

XAW, the iShares Core MSCI All Country World ex Canada Index ETF, tracks all markets outside of Canada, as the name suggests. Like XEQT, XAW also holds the likes of XEF and IMEG. XAW is an excellent choice if you go with a multi-ETF approach (i.e. holding XIC and XAW) and are OK with the regular re-balancing. The multi-ETF approach will result in a slightly lower fee. If you want a straightforward approach, XEQT is a superb choice.

Who should buy XEQT?

So, XEQT seems like a good ETF to hold, but who should consider buying XEQT? If you check off some of these items below, XEQT may be a good fit for you.

- An all-in-one portfolio that invests 100% in equity

- Exposure to all the major global markets

- No desire to tinker and re-balance your portfolio regularly

- OK with higher risk and volatility due to the 100% equity exposure

XEQT is a great index ETF for most Canadian investors, whether novice investors or experienced investors. The one fund approach that covers everything can make investing a very simple and pleasant experience.

Summary – XEQT Review

XEQT is a relatively new ETF but the fund has performed well. This one fund with 100% exposure to global stocks can be a great all-equity ETF to hold for both novice and experienced investors. Per my VEQT vs. XEQT vs. HGRO showdown, XEQT came out on top of all three all-equity ETFs compared. As mentioned, XEQT is the ETF we are using for our kids’ RESPs.

Why do I hold XEQT? Because of its simplicity and straightforward approach. I no longer need to worry about re-balancing. Whenever we add new contributions, we just need to purchase more shares of XEQT. Whenever there’s a distribution, we’d purchase more XEQT shares via DRIP. Best of all, XEQT provides asset class and geographical diversification by holding over 9,000 different international stocks for a low MER of 0.20% per year.

What’s not to like about XEQT? Therefore, my review of XEQT is overwhelmingly positive.

XEQT trades in Canadian dollars. But some of the equities it holds are in some foreign currency. So it is unprotected from currency fluctuations each time it is priced. Does this mean it is considered “unhedged”?? Currency exchange rates will affect its returns. There can be no unhedged version of XEQT. Thanks for answering!

Yes XEQT is unhedged.

Hi Bob, thank you for the detailed review on XEQT, especially the information about USA index having a lot of international companies. I haven’t considered that before.

If XEQT is ones main investing holding should there be worry about the 43% holding of USA stocks? Considering the rest of global market, does that feel too heavy?

That exposure might be too heavy for some but IMO it seems quite reasonable, given many international companies are based in the US.

Hi,

I am a bit confused how fees work in an ETF. You mentioned Management fee and MER. Does that mean that both are taken out of your funds or is the management fee part of the MER?

Thanks in advance for your reply.

Jyoti

MER is the total fee so that includes the management fee.

Thank you! That makes sense.

I would like your opinion about investing in XEQT few years from retirement. Enough years for good returns?

I’d say that if you’re a few years from retirement you may want to reconsider about having 100% in stocks. But again this depends on your risk tolerance. Furthermore, we don’t know what future returns will be.

Bob,

I have a question about weighed percentages that show up as 0% on their aggregated underlying holdings that make up XEQT of 9662 companies invested. Does that mean its not invested in those companies or is the percentage weighing of its share so insignificant that it rounds it to 0%?

(https://www.blackrock.com/ca/investors/en/products/309480/ishares-core-equity-etf-portfoliowebsite)

A good question, it usually means it’s a very small percentage of the overall holding.

If you put $6000 into a TFSA in 2021 and add $500 each month to XEQT for the next 30 years and assume a 7% nominal annual return, the fund will grow to $612,438

https://www.investor.gov/financial-tools-calculators/calculators/compound-interest-calculator

Curious why you show RRSP withholding tax drag of 0.22. I thought RRSP’s are exempt from withholding taxes due to international tax treaties?

With these ETFs that have international holdings, the withholding tax is already taken out when you get the distribution. You do get a foreign tax credit when it’s held in non-registered accounts. Unfortunately, it’s not recoverable within RRSP and TFSA.

Ah, I think my confusion was because XEQT is Canadian domiciled therefore subject to WT. Something like AOA or AOR may not be?

Thanks for the reply. Does compound interest really come into play monthly with growth etf’s , considering that they don’t pay an interest amount monthly per se

If your ETFs are growing at 8% return rate then yes, the returns are being compounded each year.

Hi Bob.

I am 33 years old, married and have a 2 year old and a 3 week old. Currently first child’s resp is valued at $4800 with BMO, Manulife and just invested 500 dollars in xeqt. Also plan on opening another resp for newborn and continue investing in xeqt for 12 years, then switch to xgro and then a conservative etf closer to college.

I have about $25k in my tfsa based on various Canadian and usa stock buys. I plan on keeping them in there now untouched for 30 years.

I just invested $1000 in XEQT and plan to continue investing in xeqt regularly, my wife and I have about $100000 in combined tfsa room available.

I always get confused by etf calculators online. Can I ask you for a scenario? With $1000 as an initial investment in xeqt and assuming $750 monthly contribution for 20 years and then another 5 years switching to something like xbal and eventually xcns for 5 years for a total of 30 years, while continuing the 750 dollar investment per month.

What do you think a good estimate of total etf investment value will be at the end of these 30 years.

Completely understand that inflation will impact and returns are not guaranteed.

Thanks a ton in advance!

Hi Sam,

It really depends on the estimated return. You can do some simulations using online compound interest calculators.

Hi Bob

I hold XEQT in my RRSP account which is with RBC Direct Investing. I noticed during the last distribution payout, it didn’t drip the shares. Are you able to DRIP?

Yes I was able to drip just fine.

My RBC direct investing account won’t drip XEQT but will drip VEQT. Does that change the long term outcome for me? Would VEQT be better?

That’s odd it won’t drip XEQT. In that case maybe consider holding VEQT if you can enrolling in drip.

Hi Bob

Thanks for putting this together! Have a quick question about whether there are any negatives about holding something like XEQT during the decumulation phase (i.e. retirement), I assume you have less flexibility about what you would sell (compared to holding all the underlying ETFs and selling off based on performance).

Thanks!

I don’t think there are any negative holding XEQT during the decumulation phase. You’d just sell the number of shares to cover the money you need.

Hi Bob

great write up.

I no you hold xaw as a core holding, any thoughts on VGG (do they overlap eachother with xaw)

thanks

Sandro

While I didn’t cover VGG in the two articles below, my general feelings about these dividend ETFs are the same.

https://www.tawcan.com/top-canadian-dividend-etfs-dont/

https://www.tawcan.com/top-us-dividend-etfs-why-i-dont-buy-dividend-etfs/

Like the write up and I am strongly looking at this one. Looks like a great total ETF to have for 10 + year timeline.

I’m a big supporter of the RESP. When I attended University, my parents never helped me at all and I worked numerous part-time jobs working my butt off to pay for expenses. Even with this, I finished school with 40 k in debt. I promised myself I never let my kids start in the hole as it’s so hard to do anything with owing a car payment (and not having a car lol).

I started my kids RESP 8 years ago for my daughter and son around 5 years ago (family RESP). I maxed it every year by using family birthday/Christmas money, baby bonus from governments and recent money from governments for COVID. In total we have contributed around 20 % of what accumulated over that time. I had the RBC RESP 20 year fund originally which I think netted us 6% – we contributed to it around 5+ years before switching to direct investing and I began managing it. Best decision I have ever made.

I followed the Canadian Couch Potato indexing method for around 1 year. I decided to switch to stock portfolio as it wasn’t getting the returns I wanted so I decided to sell it all and by stocks.

I originally purchased 2 stocks: BCE and mostly AQN (yes I know boring but safe until I got use to running the portfolio). Ran this for a while and branched out to BIP.UN. Did fairly well with AQN and sold a bunch as I needed diversity in the portfolio. I bought NVDA and SHOP and let them run for a while. I sold Shop as I felt the stock was overvalued and wouldn’t return the money I expected (retrospect probably should have kept some but I don’t regret it for the reason above).

I bought VFV for the RESP. I did it mainly to get exposure the SP500 without buying the individual companies. I bought this in September last with profits made from other companies and up pretty decent. It now accounts for 8% of the portfolio.

I hold the remainder stocks in the portfolio. They include:

1) TD (bought in March 2020)

2) CIBC

3) AQN

4) NVDA (this is by far my best purchase and doing very well)

5) BIP.UN

6) Kirkland Gold (my only red but I bought as a hedge against inflation but I may rethink it. At least it’s a company that has done well and is well run)

7) CMMC (bet on EV and electrification with small position around 1-2 %)

8) LIF (Labrador royalties and bet on the reopening with a great dividend)

9) MFC (bought last year around the huge drop)

10) ATVI (just added based on the recent turbulence and double digit stock declines). I believe this a future trend going forward so why wouldn’t want to invest with the biggest gaming company in the world with a 77% gross margin and increases its dividend every year. Plus I myself have played many of their games and enjoyed them quite a bit.

I have done fairly well with the portfolio returning almost 20 % in 2.5 years (last year has me around 21% returns). I expected the account to be around 80 k at the end of the year but as of right now sitting at 76k so it’ll likely be higher. I am hoping by the time they go to school (hopefully at our local U or college) that the account will be 200 – 300 k. This should adequately cover any of their expenses — of course I have rules on how it will be dispersed and things expected of them also (they need to appreciate what we did to get the $). Maybe another time I’ll get to that subject lol .

Sorry I thought I write out my journey for the RESP fund and why I did it.

Another great read — thanks for the insight.

DB

You’re welcome Dean. Looks like you’ve gotten some solid returns over the last 2.5 years. Congrats.

I know laziness and boring investments are beneficial when it comes to investing but reading all these ETF analysis posts are making me think that it’s time to kick it into gear and actually put in the work to learn about different investments!!

I’ve just been putting things in the S&P 500. I have never touched my investments in the past five years and I really don’t even know how to start getting around to it and lifting a finger to tend to my investments haha.

Great review and interesting ETF to look at.

Question: The Management Fee and MER for XEQT look quite low/nominal. Does the fund also pay fee for the investment in underlying funds so that needs to be factored too? Is this correct or am I missing something please clarify. I believe MER would be added on for underlying funds. Im not too sure how it works please enlighten me.

Hi Sridhar,

The MER listed under XEQT is the total MER. The fees for the underlying funds are already factored in.

Thanks Bob for clarifying.

Great review Bob. I also like XEQT a lot. I would recommend it over VEQT to most investors because of the lower fees. As time goes on maybe the MER could drop even lower. The yield isn’t very high, but it’s the total return that counts I believe. 🙂

Thanks Liquid. You can’t really go wrong with either VEQT or XEQT IMO.