Although we have been investing in dividend paying stocks for over 10 years, we didn’t get serious into dividend growth investing until 2011. Since 2011 we have managed to grow our annual dividend income of $675.21 to close to $15,000 in 2017. This year we are hoping to hit the $18,000 mark. As you may know, while we invest in dividend growth stocks, we also invest in index ETF’s (hybrid investing strategy). This is because it takes more time to evaluate dividend stocks and making sure dividend payments are safe. For investors starting out, it might be better to get your feet wet with index ETF’s.

If you’re a dividend investor, I have asked my friend Mr. Tako from Mr. Tako Escapes to talk about the problem with dividend investing and why you should create your own dividend scorecard to keep monitoring your dividend holdings.

Take it away Mr. Tako!

Hi folks! If you’re a reader of Tawcan or MrTakoEscapes, there’s a very good chance you’re the kind of investor that loves dividends. Specifically, a growing stream of dividend income. This form of investing is sometimes it’s called “Dividend Growth Investing” or DGI for short.

I’ve been writing about my dividend growth strategy for three years now, but I’ve been a dividend growth investor for over 15 years! More importantly, my dividend stream has grown from an initial $10 to $20 per month, to a gushing river of dividend income that now pays for our lifestyle – a nice home, two kids, delicious food, and a couple vacations every year.

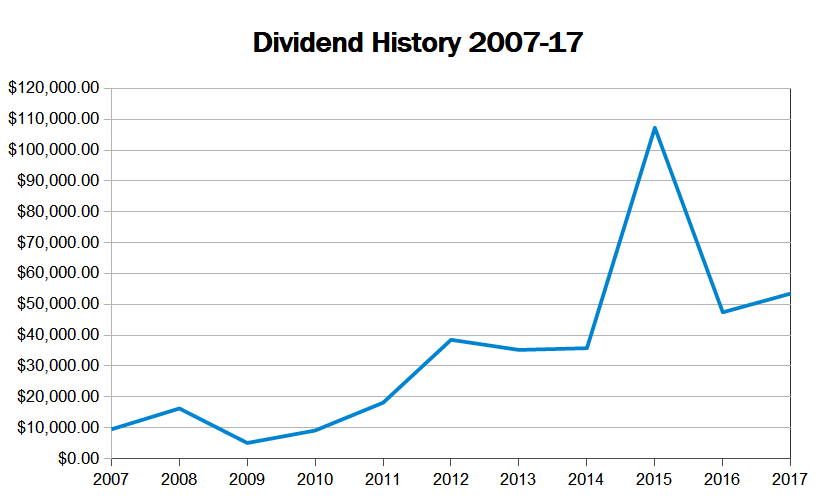

It’s a system of investing that actually works. Last year we collect dividends over $53k per year, and I’ve even had a year where annual dividends exceeded $100k.

MyMy last 10 years of dividend income. The general trend is upward.

Not only does this cashflow provide for a very fun life, but it decouples our portfolio from the vagaries of market returns – In other words, when the markets are down I’m not forced sell my stocks at low prices. Instead, I can calmly collect my dividends and ignore the swings of the market. It’s a pretty good life.

But dividend growth investing isn’t without its problems…

The Problem With Dividend Investing

As much as I love investing in dividend paying stocks, it’s not the perfect investment. Like any stock problems can arise. For instance, dividends are always changing — up or down, rising at rates slower or faster than inflation. Sometimes dividends get cut when recessions happen or cash flow problems arise.

Dividend cuts or raises can have a huge effect on stock price, most noticeably when the dividend gets cut — the stock price can absolutely tank in a single day.

Savvy dividend growth investors have to be careful. It’s not enough to just buy a dividend paying stock, but that stock must also be watched for signs of business health, good dividend growth rates, reasonable payout ratios, and so forth.

Why is this so important?

If your dividends aren’t growing, over time inflation is going to erode away your wealth. What might have looked like a fun retirement initially becomes a penny-pinching festival a decade or two later when dividend growth doesn’t keep up with inflation.

Most investors fail to watch their stocks well — perhaps they research a stock up-front when they initially buy, but fail to follow the business closely after several years of capital appreciation and dividend growth. I would argue that it’s the following of the business over time that’s more important than the initial research.

Time changes everything. Time can erode even the best business. What may have once been a healthy growing company with nice growing dividend could eventually turn into an over-leveraged and stagnant dump of a company.

This is a normal part of the business lifecycle. Depending upon where a company is in its lifecycle you may or may not want to invest (e.g. the BCG Matrix – is the company a Cash Cow, Rising Star, Dog, or Question mark?). Obviously, we want to hold the Cash Cows and Rising starts and dump the dogs.

Dividend health can deteriorate significantly over time too. If payout ratios rise too fast or debt levels grow too quickly, the company could be at risk of cutting its dividend… and you don’t want to hold a dividend cutter.

As dividend growth investors we need to track these metrics and make sound decisions about whether to buy, sell, or even invest more. Unless we re-evaluate our dividend investments regularly we run the risk of holding onto troubled dividend stocks that could cut dividends.

This is where many investors run into trouble – Tracking investments is hard. It requires diligence and a temperament free of nostalgia, emotion, or other mental bias.

This is why I recommend most investors create a system called a dividend scorecard to make the process of dividend-stock tracking a mechanical process.

The Solution: A Dividend Growth Scorecard

The first thing to realize about creating a dividend growth scorecard is that it’s really just a checklist, and checklists are a powerful tool (hey, don’t laugh!). If you’ve ever read the Checklist Manifesto, you’ll have a good idea of how people in supercritical jobs make sound life or death decisions. From the surgeon who cuts you open, to the pilot who flies you home from that business trip; they all utilize checklists.

A dividend growth scorecard is the checklist I use before I make critical investment decisions. This ensures I make my decisions with facts and without emotion or market sentiment biasing my decisions.

It’s a lot like the ‘fly’ or ‘don’t fly’ checklist a pilot might use – When first starting up a plane, if one engine isn’t working the pilot surely isn’t going to fly. The same goes for when the plane is in the air. If the engine or some other critical piece of equipment fails, the pilot is going to land the plane as quickly as possible. You don’t keep flying a broken plan.

Similarly, a dividend growth investor shouldn’t keep a stock that’s at risk of falling out of the sky. Just like the pilot, I run my scorecard over all new investments. If it doesn’t get a passing score, I don’t invest (or I divest if I’m already a shareholder). Furthermore, I regularly re-check my existing investments on a regular basis to see if they pass.

I do this every year, but I use longer evaluation periods to avoid short-term blips.

Here’s an example scorecard question with a longer timeline: Over the last three years, has the stock grown dividends faster than 5%?

Why 3 years? Well, at times the stock market can be almost random – prices can rise and fall by 50% in any given year. Business results can also be very uneven at times. If we’re looking for dividend growth, sometimes even the greatest dividend aristocrats put up pathetic dividend raises at times only to resume them in a couple years.

So I feel like 3 years is a good window of time – not so long that we miss important changes before it’s too late, and not so short that we overreact to small market blips.

My Scorecard

Since not everyone thinks in lists and scorecards, I thought it might be helpful to share a shortened version of my own dividend scorecard. I’m not including all the items I keep in my own scorecard here, but here are a few scorecard questions that I think are extremely important for maintaining a dividend growth engine:

- Is the company growing dividends faster than inflation (roughly 3%), over the last three years? I personally look for dividend growth that’s at least twice the rate of inflation.

- Has the payout ratio risen, stayed the same, or fallen over the last three years? I like investments with a flat or declining payout ratio. If the payout ratio is rising, the dividend growth rate should be discounted appropriately.

- Is the three-year average payout ratio less than 60%? High payout ratios can often lead to poor growth or an over-leveraged business. I generally look for payout ratios less than 60%. Any payout ratio higher than 60% would be at risk of being cut if there was any kind of business disruption.

- Has the company maintained a debt to equity ratio under 1.5? Companies that are funded with too much debt (instead of equity) have a tendency to cut dividends when the going gets rough. I look for stocks with lower debt levels.

- Has the company been able to consistently maintain Net Margins over 7%? High net margins that can be maintained are a good indicator of pricing power. A company that can maintain high net margins usually has some form of moat or niche business with little competition. Pricing power is important for maintaining a strong and growing dividend.

- Does the company maintain a ROIC level that exceeds 20%? Since our investment isn’t paying out 100% of profits as a dividend, some of that capital is retained and reinvested. The company should be able to invest that capital in places that have good rates of return.

- Is the diluted share count falling or rising? Companies that can buy back shares faster than they issue them build value for investors by “shrinking the pie”. Conversely, companies that issue shares faster than they buy them back should be avoided.

After I’ve run an investment through my scorecard, I tally up the points. A ‘yes’ answer gets one point and a ‘no’ answer gets zero points. In the case of items that can have more than a yes/no answer (such as item #2) I’ll apply an appropriate number of points depending upon the answer.

Every year I run all of my current investments through my dividend scorecard (usually multiple times a year) and the weakest scoring investments I consider selling. The highest scoring investments I usually hold or consider buying more if market prices are appropriate.

Now obviously, everyone’s scorecard is going to look a little different. I chose these items because I believe they’re a reflection of a healthy dividend growth company. If you’d like to read more about my dividend growth philosophies, you can read more on my blog – Mr. Tako Escapes.

It’s also worth noting that there are some variations to the classic dividend scorecard – Some people might value certain metrics more than others and choose to have a weighted scorecard. But be careful what metrics you use if you decide to weight your scorecard, it can have a powerful effect on the outcome.

Final Thoughts

As investors, it’s important that we remain unemotional and unbiased about our investments. The dividend scorecard is just one tool I use to maintain my own objectivity when investing. You won’t find me holding onto an investment I’ve got a crush on, because it will fail my dividend scorecard.

However, there are times when investments go from ‘top of the class’ to somewhere in the middle. Deciding whether to hold those investments requires a judgement about where you think the future lies. Making decisions like this can be tricky. All I can say is “trust your scorecard” — the dividend scorecard can signal a negative trend before most investors realize a dividend cut is even imminent.

Think of it like giving a classroom full of students a test every year. Some of the kids are fantastic students and regularly get top marks. Some always score poorly. Rarely do good students turn into bad students and bad students into good students. But it does happen, and it will begin to show up in test scores.

As investors, we simply want to own the best and the brightest students or those showing the greatest improvement. So test regularly and test often!

Good luck everybody!

Hi Bob,

Thanks a lot for your insight and helpful remarks.

My wife just opened her TFSA Account with contribution room of $12000. She intends to buy a mixture of one etf (either VCN or XAW or XBAL) and one or 2 Canadian banks shares (BNS, RY, or BMO or CIBC…)

What kind of combination you recommend for us?

We are open also one or two ETF’s or for 2 Canadian bank stocks.

Your recommendation is highly appreciated.

Truly

Al B.

Hi Al,

I don’t like to do a blind recommendation without knowing more details. Furthermore, I’m not a financial advisor so ultimately you need to make up the decision on your own.

If you want to keep it simple, I’d do XBAL since it has a mix of bonds and stocks. VCN and XAW means you’re 100% in stocks.

In terms of Canadian banks, you can’t really go wrong with any of the big six IMO.

Thank for your insight Bob.

Al

Is there a comprehensive list of good dividend stocks available online? Thank u

I’d take a look at the dividend faq here – https://www.tawcan.com/dividend-faq/

To track true performance you must also look at the IRR of your investments. How do your factor dividend income in an IRR calculation? Should it be treated differently if you are reinvesting the dividend?

Great post and helpful list as another sanity check for individual dividend stocks.

Keep up great work!

Thank you ddivadius, glad the post was helpful.

Interesting article about your Dividend Scorecard strategy. How much time, each year (or multiple times a year), do you spend on vetting your dividend stocks?

Not sure about Mr. Tako but I do every half year at a minimum.

Bob & Mr. Tako,

Great article. I guess I should start my Dividend Scorecard to track my stocks purchase. Great work both of you. Mr. Tako, I just stumble upon your site at work few weeks ago and have been an avid reader since. Bob, Keep inspire all of us.

Thank you Dividend Pursuit. 🙂

I like the scorecard approach and I think with some tweaks this could be a very effective tool for stock investing in general, not just dividend stocks.

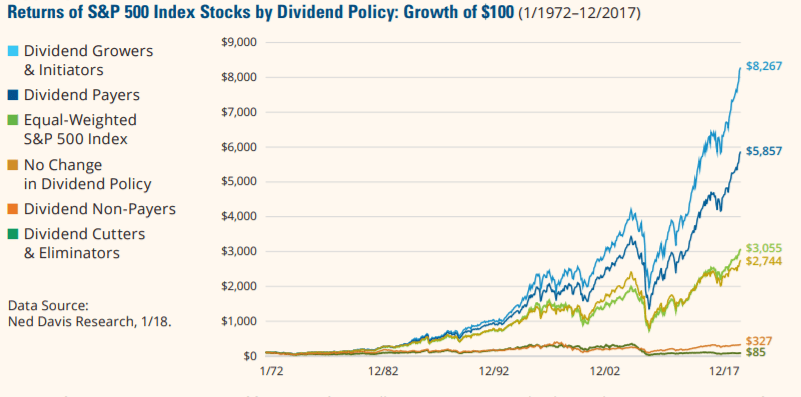

Clearly both Tawcan and M. Tako are doing well with dividends, but have either of you ever run an alternatives analysis of your high dividend portfolios to say the S&P 500? I’m just curious if the growth stocks there might outstrip the dividend portfolio. Could be interesting to see.

Thanks for sharing your approach.

I don’t actually have a high dividend portfolio. I have a low-ish dividend portfolio that sometimes matches the yield of the S&P 500 most years (it depends upon valuations of course).

Not the last couple of years though. Valuations have spiked.

My portfolio probably yields (on average) 2 to 2.5%. Just to give you an idea.

Our portfolio yields around 3.5%, higher than S&P 500 I suppose, but many of the Canadian dividend stocks have higher yields compared to their US counterparts.

Thanks for sharing your approach Mr. TAKO and for Tawcan to publish it.

I am a big fan of these approach to filter down stocks. Investors have to find the metrics that are important to them and the reasons and off you go. The next challenge is to get access to the data for a lot of stocks. It’s not always easy. Canadian reporting is not as streamlined as the US reporting either.

Don’t forget to monitor your performance – while dividend are meant to replace an income, your total returns should still matter during accumulation years. I share all the steps to create a spreadsheet under Dividend Portfolio Tracker.

You should plan a score card for when you are accumulating wealth through savings and then when you are relying on your portfolio income. The score cards will be different unless you can generate all you need from a growth portfolio rather than an income portfolio. For example, I have Visa (V) and Costco (COST) which are killing it on the performance front but with a relatively low yield. In my income years, I could switch to AT&T for higher income as an example.

Cheers and good luck.

Total returns are important for sure. Just because you’re receiving dividends, it doesn’t mean the stock price shouldn’t go higher as well.

We had great returns for V, COST, and Canadian Tire. 🙂

nice post Tako and Bob.

This sounds like a great things to do and 1 I havent really done.

I hold a couple loser stocks (that i feel will rebound in price and will sell then) Corus / Highliner

I also hold 2 retirement home stocks that should do well with the trend of retirement but lack in dividend growth.

The longer I invest the more I learn to stick to the blue chip dividend stocks.

C.a.n.i (Continous and nonstop improvements)

Thanks for yet another learning lesson.

Cheers

Highliner is something that we own as well. At current price I figure we might as well continue holding and see if the price recovers. *fingers crossed*

wonderful read – thanks, and the Checklist Manifesto came up in this week’s Hidden Brain as well 🙂

Thank you goofy.

Thanks for publishing this post Bob! I sure had fun writing it!

Thank you for writing this awesome article. 🙂

we look at similar features for dividend stocks in our portfolio. share price matters and a dip can be either a buying opportunity or a sign that something is changing (like slowing dividend growth, competitors stealing share of sales, etc.). i like the mention of debt, which is often overlooked. i also agree you gotta be willing to sell if the story changes, and that where i come back to share price. it’s good that with growth the price usually comes along for the ride.

Yup, debt is something that’s often overlooked. That’s why it becomes concerning when a company starts having too much long term and short term debts yet continues to increase its dividend payout.

Tawcan & Mr Tako –

Couldn’t agree more. Dividend stocks need to be evaluated, continuously, in the early and forever stages. You need to make sure it’s a good investment today, tomorrow and in 5, 10, 25+ years. The scorecard is a great cut check to an investment you are about to make and takes some of the emotion out of it. Great add.

-Lanny

Exactly. It’s a great idea to monitor the stocks that you own so you know whether there are better investments out there.

Nice tips, I haven’t done any scorecard yet but I guess I should. I need to get in the habit of checking up in my dividend stocks every year.

This is something that we do as well, although we use slightly different parameters.

To me the problem with dividend investing is that you have to pick stocks. Something I was never good at. Not only does that bring in risk, but it requires time. Many see great success and that’s awesome, but it’s not for me.

That’s why we do hybrid investing – we own index ETF’s and dividend paying stocks too.