Lately, many readers who are at the beginning of their investment journey have asked me about my choice of discount broker. To be more specific: Questrade vs. Wealthsimple Trade, which one is the better choice? Mrs. T and I use both discount brokers and think both are fantastic for DIY investing. But do we prefer one over the other? Given that we use both Questrade and Wealthsimple Trade, I figure I’d write a real user review to compare the two. Here’s my honest and a real user review of Questrade vs. Wealthsimple Trade.

In case you’re wondering, we use Questrade for our RRSPs, TFSAs, RESPs, and taxable accounts. We opened accounts with Questrade back in 2011 when we had our financial epiphany. Back then, Questrade was the leader in online discount brokers.

I was very curious about Wealthsimple Trade when launched in March 2019, but never considered opening an account with them. About half a year ago, our kids wanted to invest their birthday money and other various gift money, so we opened a Wealthsimple Trade account. Since the kids aren’t eligible to open a taxable account, the account is under Mrs. T’s name.

Unlike other Questrade vs. Wealthsimple Trade reviews, my aim for this article is to provide some real life usage analysis and determine which discount broker is the best for DIY investing.

About Questrade

Questrade has been one of the leading discount brokers in Canada since 1999. Headquartered in Toronto, Questrade allows Canadians to manage their own investment portfolio by providing low-cost trading and commission free ETF purchasing. In over two decades, Questrade has grown to manage over $9 billion in assets.

For trading, Questrade offers two different options: self-directed investing and active traders. The commission cost structure is different for each option. For this review, I am going to examine Questrade’s self-directed investing only.

About Wealthsimple

Founded in 2014, Wealthsimple started off as an online wealth management service, or robo-advisor. The company also operates in the US, and UK.

Wealthsimple Trade was introduced in March 2019 when the company decided to expand beyond the robo-advisor service, allowing Canadians to buy and sell stocks and ETFs on major Canadian and US exchanges without having to pay any commissions.

Needless to say, the $0 commission stock trading was a game changer and Wealthsimple Trade quickly became one of the leading trading platforms in Canada.

Just recently, Wealthsimple Trade introduced fractional shares, making them the only Canadian trading platform to offer fractional shares of US and Canadian companies. Although not every single stock is available for fractional share, this is another game changer for Canadian DIY investors.

With services like Wealthsimple Cash, Wealthsimple Crypto, and the purchases of the likes of ShareOwner and SimpleTax, Wealthsimple has been expanding its services. One interesting fact about Wealthsimple is that Power Corporation of Canada owns 70.1% of Wealthsimple. So if you’re an investor that believes in Wealthsimple products and want to invest in the parent company, take a look at POW.TO.

Questrade vs. Wealthsimple Trade – Features

Let’s look at some key features that I like about each discount broker and some features that I do not like.

Key Features I like about Questrade

After using Questrade for almost ten years, there are a lot of features I like about Questrade:

- You can open many different account types with Questrade, including RRSPs, TFSAs, taxable (i.e. margin), RESPs, LIRAs, RIFs, LIFs, corporate accounts, investment club accounts, informal trusts, etc.

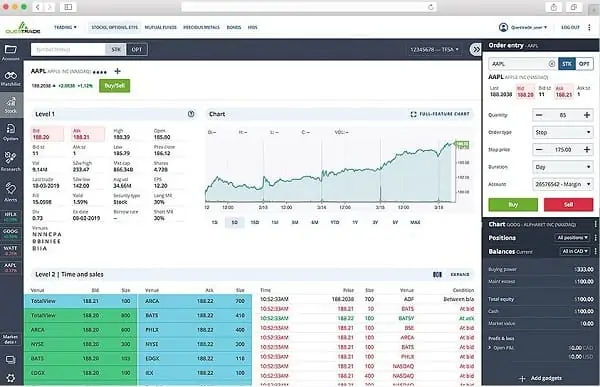

- Questrade offers different trading platforms – Questrade Trading, Questrade app, Questrade IQ Edge, and Questrade Global. I usually use Questrade Trading and have only used the Questrade app a few times. I haven’t used Questrade IQ Edge and Questrade Global. I do like the simple, intuitive designs that Questrade Trading and Questrade app offer to allow me to easily buy and sell stocks and ETFs.

- With Questrade, you can buy and sell stocks, ETFs, options, and international equities. You can also participate in IPOs. (Note, I have not traded options, international equities, or IPOs). So if you’re looking for a one stop discount online broker, Questrade can do that.

- I really like that you can purchase ETFs for free. This allows me to buy a few shares of ETFs whenever we have some cash lying around.

- The biggest advantage Questrade has is that you can hold both USD and CAD inside registered accounts like TFSAs and RRSPs. This means you can trade in USD and leave dividends and proceeds in USD rather than converting everything back to CAD and paying the conversion fee each time. You can also perform Norbert’s Gambit to effectively convert CAD to USD and leave the USD cash in your account for future transactions.

- Questrade Trading and Questrade app show one click real time market data. If you need Questrade’s streaming real-time data, you can pay $19.95 to $89.95 per month for access. For most investors, the free one click real time data that Questrade provides is more than sufficient.

- As of October 1, 2020, Questrade removed the quarterly inactivity fee. There’s no longer inactivity fees to any Questrade account type.

- No annual RRSP or TFSA account fees. The brokers through Canadian banks typically charge a quarterly account maintenance fee.

- Funding a Questrade account is super easy. To fund a Questrade account, we simply “make a payment” to the account via our bank’s online banking system.

- Funds show up pretty quickly. It usually takes one business day for funds to show up in our Questrade accounts.

- You can enroll in a dividend reinvestment plan (DRIP) by filling out the DRIP form with Questrade. One thing to note is that Questrade only supports synthetic DRIP, so dividends must be enough to purchase full shares. Another thing to note is that Questrade does not honour DRIP discounts. DRIP shares are purchased at the market price on the day of the DRIP.

- Questrade will reimburse transfer fees up to $150 per account.

What I don’t like about Questrade

As much as I like Questrade, there are a few things I don’t particularly like:

- Trading cost used to be $4.95 flat but now it’s minimum $4.95 to max $9.95.

- Need to pay exchange fees like ECNs (Electronic Communication Networks) and ATSs (Alternative Trading Systems). The ECNs apply to US listed securities while ATSs apply to Canadian securities. There are ways to avoid paying these exchange fees (by not removing liquidity) but they’re just plain annoying!

- While there’s no minimum to open an account, you need a minimum of $1,000 in your account to start trading.

- Although you can hold money in USD and CAD, Questrade charges 1.5% to 2.0% in currency conversion fees if you buy US listed stocks with your CAD. This can be quite costly.

Key Features I like about Wealthsimple Trade

After using Wealthsimple Trade for our kids’ investment account, there are a few features I really like about Wealthsimple Trade:

- $0 commission trading. This means you can buy and sell stocks and ETFs for free. This is the biggest advantage to Wealthsimple Trade.

- Fractional shares. You’re able to trade fractional shares for the likes of SHOP, RY, TD, and CNR in Canada and AMZN, GOOGL, APPL, MSFT, FB, NFLX, TSLA, ABNB, COIN, NVDA in the US.

- Everything is done via the mobile app. Opening an account is super simple and straightforward. You just download the Wealthsimple Trade app on your phone and get started that way.

- Unlike Questrade, there’s no account minimum. You can start trading with $1.

- You can open RRSPs, TFSAs, and taxable accounts with Wealthsimple Trade.

- The Wealthsimple Trade app is very very well designed and very minimalistic. You can do everything from funding, opening another account, and checking transaction history from the app.

- When you look up a stock or ETF, the app gives you a brief summary of what the company or ETF is about.

- Wealthsimple Trade will reimburse fees on transfers of more than $5,000.

- Fractional DRIP is supported

- Instead deposit up to $5,000 (up to $50,000 if you sign up for the USD accounts subscription)

What I don’t like about Wealthsimple Trade

Wealthsimple Trade is quite good but there are several things that can improve to make Wealthsimple Trade the “perfect” online discount broker in Canada:

- Only limited to stocks and ETFs that are traded on Canadian and US stock exchanges. You cannot trade options and preferred shares, for example. For the most part, this limitation is fine for most DIY investors.

- The book value isn’t shown (i.e. adjusted cost basis). Instead, only total price is shown. This shouldn’t be an issue for most people since you should be using a spreadsheet to track your portfolio.

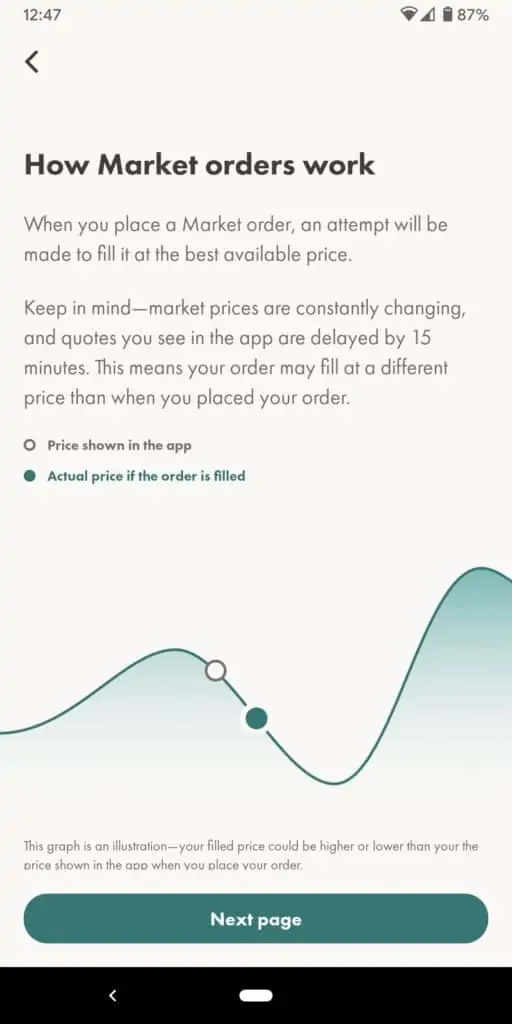

- Stock and ETF quotes have a 15 minute delay (i.e. not real time). This can be problematic if you’re trying to place market orders.

- A bunch of add-ons for additional features. For example, if you have $100k in assets you unlock the premium features and $500k you unlock the generation features.

- To cut down exchange fees you’d have to subscribe to the USD package for $10 per month.

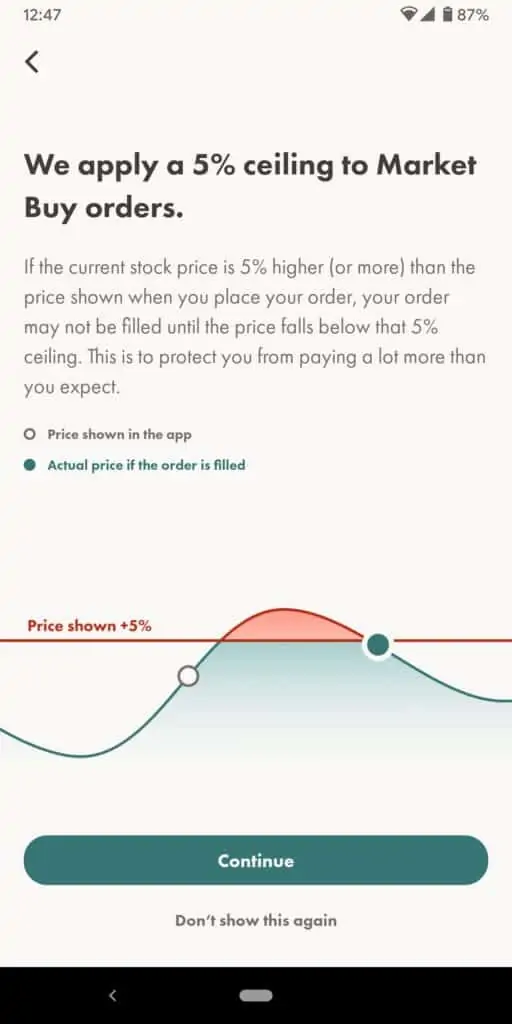

- When you place a market order, Wealthsimple Trade app gives you a warning about applying a 5% ceiling to market buy orders (i.e. Wealthsimple provides a 5% collateral to protect you against sudden last-minute price changes)

- Wealthsimple Trade does not support RESP.

Features I’d really like to see at Questrade and Wealthsimple Trade

As you can see, there are pros and cons for Questrade and Wealthsimple Trade. If these two discount brokers can somehow merge together and provide the best of the both features, that’d be a major win for Canadian DIY investors. Some features that I would absolutely love to see:

- Truly $0 commission at Questrade – This is a total dream though, since Questrade needs to make money somehow.

- No account minimum to start trading at Questrade – This would allow investors with a small investment portfolio to get started.

- A Wealthsimple desktop app for all account management – Although I’m a millennial, I prefer doing things on a desktop rather than on my phone.

Questrade vs. Wealthsimple Trade – Summary Comparison

Here is a quick head-to-head comparison between Questrade and Wealthsimple Trade.

| Questrade | Wealthsimple Trade | |

| Fees | $4.95 to $9.99.ETF purchases are free.ECNs/ATSs are applicable. | $0 to buy and sell stocks and ETFs. |

| Accounts Available | TFSA, RRSP, taxable accounts, RESP, LIRA, RIF, LIF, corporate accounts, trusts, etc. | TFSA, RRSP, taxable accounts |

| Minimum investment to trade | $1,000 | $1 |

| Transfer fees reimbursement | Up to $150 | For transfers over $5,000 |

| Hold USD & CAD cash | Available in registered accounts | Not available |

| Norbert’s Gambit | Supported | Not supported |

| Account fees | None | None |

| Trading platform | Web, iOS, and Android | iOS and AndroidLimited functions for web |

| Stock exchanges supported | TSX, TSXV, NYSE, NASDAQ, MX, PINK, BATS, CNSX, etc | TSX, TSXV, NYSE, NASDAQ |

| Market data | Real time | 15 minute delay |

| DRIP | Available, synthetic DRIP (no DRIP discounts). | Not available |

| Fractional Shares | Not supported | Supported |

| Currency Conversion fee | 1.5%-2% | 1.5% |

| Promotions | Get up to a $250 cash bonus, depending on the amount deposited. | Get a $10 credit bonus when depositing at least $100. |

| Funding time | Typical 1 business day | Instant for<=$5,000, more if you have $100k assets |

Questrade vs. Wealthsimple Trade – Fees Winner

When we only use trading fees as the only parameter to evaluate these two online discount brokers, it is easy to declare Wealthsimple Trade as the winner. Wealthsimple Trade is the best discount online broker for selling and buying US and Canadian listed stocks and ETFs. You simply can’t beat $0 commission trading for stocks and ETFs.

There’s no doubt that Wealthsimple Trade take the win here. The ability to buy fractional shares offers Canadian DIY investors opportunity to own a fraction of some stocks that are trading a very high prices. Since the purchased of ShareOwner and phasing out ShareOwner, I am extremely pleased that Wealthsimple Trade is finally introducing fractional share purchases. While the list of stocks available for fractional shares is limited, it is definitely a good start.

Questrade vs. Wealthsimple Trade – Features Winner

Although Questrade and Wealthsimple Trade both offer outstanding and unique features, if I evaluate the overall features, one stands out over the other. Trading fees aside, Questrade offers far more features that provide benefits to DIY investors.

If you make sure that the commission fee is less than 1% of the overall commission cost whenever you make a trade, I think Questrade is the better broker for Canadian DIY investors.

Who should use Questrade

Questrade is well suited for most DIY investors. If you are looking for more features like real-time data, opening accounts like LIRA and corporate accounts, the ability to trade stocks not listed on TSX, TSXV, NYSE, and NASDAQ, enroll in dividend reinvestment plans, and the ability to hold USD and CAD in registered accounts, Questrade is the choice for you.

Having used Questrade since 2011, I am pretty happy with Questrade. Whenever I need help from Questrade, I can contact them via email or online chat. Depending on the number of users, the online chat can take some time before you reach a representative.

You can open an account with Questrade using my referral code and get up to $250 bonus cash.

Who should use Wealthsimple Trade

Wealthsimple Trade is perfect for investors looking for a no frill discount online broker that offers zero dollar commission trades. This is especially true if you only invest in RRSPs, TFSAs, and/or taxable accounts.

I think Wealthsimple Trade is perfect for investors who are starting out and want to invest their contributions of a few hundred dollars every other week. In other words, if you are only buying a few shares of a stock each time, Wealthsimple Trade is perfect because you don’t have to pay any trading commissions. Furthermore, Wealthsimple Trade also allows you to purchase fractional shares on certain stocks, allowing Canadian DIY investors to slowly build up their portfolio over time.

Also, if you’re comfortable trading on your smartphone and don’t need features like real-time data and enroll in DRIP, then I’d highly recommend Wealthsimple Trade.

Wealthsimple Trade has a very comprehensive Help Centre if you have questions. If you need to talk to a person, you have to either email them or phone them. I haven’t needed to contact Wealthsimple Trade representatives, so I am not sure how responsive they are.

You can open an account with Wealthsimple Trade using Mrs. T’s referral code and get a $10 credit bonus.

Questrade vs. Wealthsimple Trade – Which broker is best?

Questrade and Wealthsimple Trade are both very solid online discount brokers. You can’t really go wrong with either of them. But which broker is the best if I had to pick?

Well, overall I think Questrade is the best discount broker to use. Questrade offers a lot of features that can be valuable for novice and experienced investors, like the ability to hold both USD and CAD cash in my accounts, to be able to trade on the desktop, and the quick one business day funding. Questrade removed the inactivity fees so you aren’t forced to make trades regularly.

- You may also want to consider National Bank Direct Brokerage if you’re looking for commission free trading.

Yes, I have to pay trading commissions and the exchange fees, but Questrade’s trading commissions are still far cheaper than how much Canadian banks charge when trading with their direct investing accounts.

Questrade has also partnered up with Passiv to allow you to put your portfolio on autopilot for free. With the help of Passiv, you can build your own personalized index, invest, and rebalance all through a click of a button. Passiv can even calculate and execute the trades needed to keep your portfolio balanced. Essentially, Passiv makes investing super simple! A community user account is free to sign up. The elite member account is $99 per year, but it’s free for Questrade clients! Make sure to check out Passiv.

While Questrade is overall the best discount broker to use, Canadian investors shouldn’t ignore Wealthsimple Trade. If you are just starting out with a small investment portfolio comprising RRSP and/or TFSA, and want to invest with small and frequent contributions, Wealthsimple Trade is the online broker for you. The truly zero cost commission trading is a key benefit when you are starting out and want to put your regular contributions to work.

You can only make trades on the Wealthsimple Trade mobile app, but soon, it may be possible to trade on the desktop. If Wealthsimple Trade can add two features – setting up recurring deposits and enroll in dividend reinvestment plans, it would make the platform even better.

Once you’ve got an online broker set up, it’s time to spend some time reading about investments. You may find the following articles helpful:

Your article is dated May 2023 but this is WAY OUTDATED. Wealthsimple has DRIP and fractional and many many features you have not listed. This article should not have an updated tike stamp as its very misleading to readers.

The article has been updated to reflect the changes.

Wealthsimple now has up to $5,000 instant deposit (within seconds), DRIP with fractional shares, and a paid plan for $US accounts or free US accounts if you hold $100k or more in deposits across Wealthsimple. 🙂

This is outdated now. Wealthsimple has pulled ahead imo addressing most of your concerns !

Will need to update the article. 🙂

Hello,

I was wondering if this review is still current, or have there been changes at Wealthsimple Trade or Questrade since this was posted? Also, is your referral link still valid?

Yes everything mentioned is still accurate and the referral links are still valid.

Not anymore.

You can DRIP in WealthSimple. I think you can do more with the web interface too. But not as much as in the app, which I find really annoying; who prefers to… “commit” $$$$ using a limited screen rather than a big screen with keyboard and mouse.

There are also more problems with WealthSimple.

For example you can only DRIP the stocks offered in fractional shares, but you can’t find a list of them. In app you can get to a screen with them that can’t be exported and can’t even be sorted by name. Also the screen seems to contain much more stocks (thousands!) than the number they say they currently offer fractional shares on (500). So what’s one to think?

Right, you can now drip in WS.

Wealthsimple Premium is $10/month not $3 as listed above.

With Moomoo starting to accept Canadians, hopefully they will make it worthwhile to check them out as another alternative

Thanks, need to update this article one of these days.

I recently turned 27. I pay approx 9.4% of my gross income to the public service pension plan that I can receive beginning age 60. I’m new to investing, hoping to build wealth and possibly retire before 60 etc. I hold approx $5500 of VBAL ETF with QuestradeI am wanting to start investing more and I’m interested in your dividend strategy. I see dividend ETFs aren’t necessarily worth it as opposed to buying individual stocks. As someone with a lower amount of money to deposit, is Wealthsimple worth using simply for the commission free share purchases? Should I transfer my ETFs with Questrade to be held in a Wealthsimple account alongside my future investments/purchases?

I should add the ETF is held within my TFSA with Questrade.

Hi Chelsea,

A couple of things you might want to consider:

1. Given you’re only 27, VBAL’s 60-40 approach might be too conservative. I’d consider VGRO or even VEQT. See my comparisons below:

https://www.tawcan.com/all-in-one-etfs-canada/

https://www.tawcan.com/all-equity-etfs-veqt-xeqt-hgro/

2. If you’re just buying ETFs, I think either Questrade or Wealthsimple Trade will do just fine. If you plan to enroll in dividend reinvestment plan (i.e. reinvest your distributions), Questrade supports it but Wealthsimple Trade currently doesn’t.

Hope this helps.

Thank you! Are you aware of anyway to change from VBAL to another higher equity option other than selling and re-purchasing the new one?

And sorry, to clarify, when I asked about Wealthsimple vs Questrade for someone beginning to do stocks instead of ETFs.

No you need to sell VBAL.

You should profile National Bank Direct Brokerage (NBDB) vs Questrade and WealthSimple, since National Bank removed all commissions on trading fees for stocks and ETFs. It seems like NBDB is the best of both worlds.

Yes would love to profile NBDB but that’d require me to open an account with them. I don’t want to do a phantom review without actually using the broker. 🙂

NBDB definitely looks interesting.

Hey thanks for your article. I think u made a mistake copy pasting the info in ur chart. You put RESP and Lira are possible in wealthsimple. Maybe u can edit it 😉

My bad, I must have mixed it up. Thanks for pointing it out.

Bob: Very informative article. Wealthsimple Trade offers an added advantage for the beginner, or anyone who does trade often: If they invest for Income and hold just a quality dividend growth stocks, then most likely the dividends they receive will not buy a full share in some cases. That means they’ll always have cash remaining in their account, until they accumulate enough money to buy a full share, or enough so that the commission is a reasonable percentage of their purchase. With a zero buy commission, they will be able to invest in stocks they own, or a new stock, where they can buy a full share, and the remaining funds can be invested in one of the three stocks which currently qualify for fractional share purchase. That means every time they have money to invest, every cent will be go towards growing their income.

I think having all of their money working, to grow their income is important, for beginners or those with small investments.

If they upgrade their services, as you suggested, they’ll become more attractive to the average investor, but I think they’ve unintentionally became a great choice for those with little funds to invest or those who can only invest small amounts periodically, provided they stick with a buy quality and hold strategy.

For most DYI the simple answer is hold your Canadian assets with WealthSimple and buy and sell Cdn stocks/ETFs for free. Then for U.S. assets go with Questrade. Athough now that Interactive Brokers has eliminated their account minimums/inactivity fees, a strong argument can be made for using IB to hold U.S. assets, given their CAD to USD cost of ~$2 regardless of how much and their trading cost of $1 to buy/sell stocks/ETFs.

Another great article Bob. I’m in the process of deciding which broker to use to set up a TFSA for my child who will be turning 18 soon. Moneysense has a useful comparison tool for online brokers: https://www.moneysense.ca/canadas-best-online-brokers-comparison/ as well as an article comparing and ranking them based on usage: https://www.moneysense.ca/save/investing/best-online-brokers-in-canada/

Questrade has come out on top overall. I have narrowed my top 3 to Questrade, QTrade, and Wealthsimple. I am leaning towards Questrade because Wealthsimple doesn’t have DRIPS and Qtrade has a high minimum balance or a requirement to contribute $50 monthly. Qtrade does have commission-free ETFs but is limited to a list of about 100.

BTW, I have heard the Questrade IQ Edge is a fantastic platform for stock analysis.

My perennial beef with all firms and platforms I have used so far is how well they hide the possibility to see at one glance (juxtapose!) book value, inception date and current market value for a given position… this is what a not-so-sophisticated investor like me wants to see. I have to keep my own speadsheet to have this info handy.

IMO you shouldn’t rely on these brokers to provide this information. Keeping your own spreadsheet is vital for DIY investors.

One omission in the wealthsimple trade app – you can’t see the book value of your investment. You can see total value and average price. But not book value. You can calculate book value by multiplying numberShares x averagePrice, but I’d prefer to see book value as a stated value instead of performing a calculation.

Perhaps this isn’t a large issue because adjusted cost basis calculations in WST should be simple, given the lack of commissions?

Good point, the total value shown in the app isn’t your book price. I’ll add this point.

Hi, very useful info, just what I was looking for. I plan to part with my advisor (I hate the Manulife clumsy platform!) and move my RRSP to either TD broker or WS/Questrade. Since I can do research on TD and really want simplicity, WS may be better for me.

I believe in the table there is a mistake on the attribution of account types, and a typo (FSA). Correct me if I’m wrong!

I would add ease of use and technical reliability of the platform as criteria.

Would you know whether multiple accounts of the same type can be open, e.g. two margin accounts to follow two different strategies.

Regards,

Thanks for pointing out, I have fixed the typo.

Yes you can open multiple accounts with Questrade and Wealthsimple Trade.

Hi. How do I find out if a stock or ETF I want to buy/sell is a US security or a Canadian security?

I’ve opened up a Questrade account and I want to find QQQ ETF, which I was told was a good ETF to invest in. The trouble is that when I went to “symbol lookup” I got 8 different results and I don’t know which–if any–are Canadian :S

You’d check where they’re trading. For example, QQQ is trading on NASDAQ so that’s a US listed security, traded in USD.

QQC.F, ZQQ, and XQQ are listed on the TSX and are traded in CAD.

Hi, Bob.

I’m new to investing and trying to learn the jargon (so much!).

I’m interested in opening a Questrade account. You’d said, “If you make sure that the commission fee is less than 1% of the overall commission cost whenever you make a trade, I think Questrade is the better broker for Canadian DIY investors.” If commission fee is not the same as commission cost, just what is commission cost?

Thank you!

Hi,

Commission fee is the trading cost. So for Questrade it’s $4.95 per trade. Wealthsimple Trade has no trading cost so that’s free.

Commission cost is the overall transaction cost. So say you have $1,000 to invest in an ETF or stock, then $4.95 is about 0.5% of the overall transaction cost.

Hope this helps.

Great article! I’m wondering if you could expand on how you set up your kids under your wife. Do they have one account between them or one each? Do they put the same amount in, if one account? I would love to learn the pros and cons of what you’ve discovered about your set up so far.

Thank you in advance

Mike

Thank you.

The account is under my wife’s name. We just designated the account for the kids on our side (i.e. nothing official). It’s one account and they put the same amount in each time. So far it has worked pretty well.

Doesnt Wealthsimple charge a % fee based on the account balance? If Im correct, a new investor with perhaps $20K would pay $100 per year ($20K X .5%). With a smaller balance, it’s unlikely (or wise) there are a lot of trades happening. Would it be worth using one of the bank-based brokers to get their lower trading fees and advanced tools? (Might have to watch out for annual fees at the discount brokers too).

Food for thought.

Good work on the articles

Hi Bruce,

You have it mixed up. Wealthsimple is a robo-advisor and charges % fee based on the portfolio size. Wealthsimple Trade is a trading platform.

It’s great that there are alternative trading platforms out there and not just Robinhood, which we hear so much about in the media and through family and friends.

Alternatives are much needed.

Robinhood is a US trading platform and not supported here in Canada. 🙂

Nice comparison Bob. If I were to start over with investing I would probably go with the Wealthsimple Trade platform because it sounds great for someone making small, but regular investments. 🙂

As you know I’m using IB right now. It doesn’t have commission free trading, but the margin rates are low. I wonder if Wealthsimple Trade allows clients to trade on margin trading.

Thanks Liquid. I’d agree with you and Wealthsimple Trade would be a great broker for someone starting out and possibly have a smaller portfolio to work with.

I don’t believe Wealthsimple Trade allows for margin trading.

Thanks for a great article comparing these two platforms. I recently signed up for a WealthSimple account and have been satisfied with the experience for trading ETFs so far. The platform is definitely basic, but for making simple ETF purchased to buy and hold it seems to suit my needs. Your article has me interested in also opening up a Questrade account to give it a spin and compare with WS.

One thing I notice that you didn’t include in the “negatives” section of your article regarding Questrade is that, if I’m not mistaken, there is a fee for selling ETFs. WealthSimple offers ETF purchases and sales for free. Am I correct with this? If so, Questrade might not be as good a choice for people that plan on selling their ETFs on a regular basis (such as retirees who sell on a regular basis to fund their retirement). Would you agree, or am I missing something?

I didn’t list fees for selling ETFs as a negative because that’s just standard trading commission which I mentioned as part of this review. Wealthsimple Trade is completely commission free, meaning buy and sell can be done no commission, stocks and ETFs. For Questrade you can only buy ETFs commission free.

If you’re retired, I hope you’re not selling your stuff on a regular basis. You probably should be making once a year withdraw, maybe twice a year at most. So that trading cost should be pretty low overall.

Having to wait 3 days for deposits over $250 to clear, seriously? No can do.

I also didnt’ know market orders were delayed 15 mins in WS, very interesting. I’m a buy and hold investor so looks like WS biggest advantage (no fees) is not going to do much more for me than Questrade does. Plus, you could always call up Questrade and try to get free trades/fee rebates, that’s worked for me in the past whenever I had reason to call. This was a good one, thanks Bob.

Yea it’s a bit slow. If you pay the $3 per month premium subscription you can deposit $1,000 immediately. IMO it’s not enough to justify paying the $3 per month fee but your miles may vary.

New dividend investor started last year, first full year on pace for 2k dividends I have been using WS and enjoying it my thoughts were If you’re a long term investor 3 days and 15 min quote delay shouldn’t matter 🙂 great articles

Great post Bob and very enlightening!

You mention by using your referral code, we can get up to a $250 bonus cash.

Could elaborate on this?

Hi Shannon,

You can sign up using this referral code – https://www.questrade.com/?refid=335712213387087

Great detailed post, I don’t have Wealthsimple Trade because I worry about the ease of buying shares without commissions. I wonder how it works when you sell and I guess there are no ACB costs to calculate?

I wasn’t aware of a $250 cash bonus with Questrade, do you mean that a person signs up and has to refer other people to get $25 and then every 3rd you get $50?

“It pays to tell your friends about Questrade. And the more you share, the more your portfolio earns! Get $25 for every friend who opens an account. Get $50 bonus for every third referral.”

Yea I’m not sure how it works when you sell with Wealthsimple Trade. I assume they’d provide you with some paperwork?

The $250 cash bonus depends on how much money you deposit in the account I think.

Questrade is asking for a referral code. When I click on the link discount doesn’t get automatically applied. Would you please send the code?

I have sent you the quote separately.

Hi Bob. Thanks for this article.

My two (adult) kids opened TFSA’s recently and, given the hassles with TD’s webbroker, one opted for Questrade and one opted for Wealthsimple, which were both easy to set up for them. Since I use TD and Scotia personally, I wondered if they had something to teach me. So I opened demo accounts at a bunch of discount brokers. I found them all lacking. Little or no research, stodgy interfaces (questrade), no US accounts (WS). And the old saying: There is no such thing as a free lunch. I did a deep dive into all of them. I am sticking with webbroker with great research available under one roof and one of the best interfaces. There are a few problems but compared with the limitations of the discount brokers, TD Webbroker is the best of the bunch- even at 10 bucks a trade. Note that I don’t trade frequently-more buy and hold style. Itrade is second and also very good. I know there is lots of free legitimate research out there, like StockRover, that I also use, but combined with the flexibility and polish and the very good phone app, my pick is still Webbroker. If I had to pick a discount, it would be “Interactive” as the obvious winner although the commission structure looks intimidating, it is cheap for the beginner and expert alike.

One of the criteria you deem so important is the low threshold for trading at WS. I would argue that if you have only $1000, you should probably accumulate more first, or just open a practice account. With only $1000, you’ll make maximum perhaps $40/year in dividends. You might triple your money if you bought zoom in March ’20, or lose 2/3 if you bought other risky stocks.

I also don’t like the idea of being forced to trade on a phone (WS). It is not a game or an app. It is investing and requires time and energy to do responsibly – which is not really possible, imho, on a 5″ screen while commuting or lying in bed.

My two cents – so to speak!

Thank you for your articles and web site. I do read every newsletter with interest and I think your stock and etf analysis is very good. I felt the need to weigh in on this particular article.

Best to all fellow investors,

– Lawrence

Hi Lawrence,

I use TD as well and I find Questrade and TD just as comparable. Mind you, I don’t use TD’s analytic tools for research.

If you don’t trade often and have a large portfolio, TD’s $10 per trade is manageable. If you’re just building up your portfolio, utilizing Questrade or Wealthsimple Trade might be a great way to get started.

Hey Bob,

As an FYI, you can now trade on Wealthsimple Trade’s desktop application. I can report having done so for all of my trades since opening an account in April.

Cheers,

John

Hi John,

Thanks for that info. I haven’t tried it myself yet, will have to try it out.

Second on this – I only use desktop for WS.

There are a few limitations (like transferring funds from another account, seeing your account statements) but I actually have yet to use my phone app as I prefer desktop as well.

Thanks. Great comparison. I use both but I honestly believe nothing beats a free platform. I use Questrade Platform for analysis and watchlist. But as soon as I know what I want to purchase, I go to Wealthsimple and make my orders for free. Wealthsimple opened a whole new world. I had fun starting positions in new companies with only 1 share without paying any fee. I think that is awesome.

One other thing is the foreign transaction fee. Wealthsimple charges 1.5% while Questrade charges 2.5%. That is where Wealthsimple makes money from FX only. The other cool and new feature by Wealthsimple is their premium as you mentioned. For $3 you can get market live price.

I think investors who are more advanced and like trading Options or more complicated order types, should have a mix of both. Use Questrade for advanced and Wealthsimple for simple orders.

Regarding DRIP, I like the freedom of choosing what to buy with my dividends specially when I don’t have enough shares of a company to get DRIPs. That’s when the power of free commission solution shines.

Good points Mr. Dreamer. I think both brokers have their advantages and disadvantages as I pointed out in this review. As an investor you need to figure out which broker works best for you.

It’s good there are cheaper/free solutions for Canadian investors.