Should I invest in high-yield dividend stocks? This is usually one of the first questions from someone who has just started their dividend investing journey. What’s the point of investing in dividend stocks which yield less than 1% when you can invest in high-yield dividend stocks and get paid right away?

I get it, it is easy to salivate over that juicy +5% dividend yield and take the immediate gratification. These high-yield dividend stocks are especially attractive given the current environment of low interest rates.

Does that mean one should simply ignore the low-yield dividend stocks?

If you look at our dividend portfolio, you’ll see that we own a mix of low-yield and high-yield dividend stocks. For example, we own the likes of Enbridge, SmartCentre REIT, and TC Energy which all have relatively high dividend yields at above 5%. We also own the likes of Apple, Costco, and Visa which have low yields of less than 1%.

Why do we do that?

It all comes down to the dividend growth rate.

The law of the big numbers

If you have been following this blog for a while or reading Mr. Tako’s excellent blog, you probably have seen us babbling on about the law of the big numbers from time to time. What exactly does the law of the big numbers mean?

Imagine that you received $200 in dividend income last year. To double your dividend income from $200 to $400 this year, or a 100% year-over-year (YoY) growth, at a 4% dividend yield, that means you have to invest at least $5,000. For many people, saving and investing $5,000 a year or $416.67 a month is a doable task.

Imagine that you received $2,000 in dividend income last year. Doubling your dividend income this year, at a 4% dividend yield, means you have to invest at least $50,000 in a year. This is a large sum of money and may not be possible for some people.

Now imagine that you received $30,000 in dividend income last year. To double your dividend income this year, at a 4% dividend yield means you need to invest at least $750,000 this year ($30k divided by 4%). Unless you make millions of dollars each year, this is not possible for the majority of the population. Even if you aim to increase the dividend income by 10% YoY (an increase of $3,000), it would require saving and investing of at least $75,000. Again, not an easy feat.

Therefore, as your dividend income gets larger and larger, it becomes increasingly difficult to increase your dividends simply by investing new cash. While the same amount of new cash invested provides the same amount of dividend income (assuming the same dividend yield), the overall percentage of dividend income increases diminish over time.

You are faced with a big obstacle – the law of the big numbers.

In other words, once your dividend income gets to a sizable level, growing dividend income by investing new capital alone isn’t sufficient enough. You must start to rely more and more on the organic dividend growth of your portfolio.

This is where a low-yield dividend stock with high dividend growth comes in place.

A case study of dividend yield & growth

Would you prefer to have $1 million cash right now or a penny that doubles every day for 30 days? If you choose the penny, congratulations, you made the right choice!

The penny would be worth two cents on the second day. It would be worth four cents on the third day. By the 15th day, it would be worth $163.84. The magic of compound interest really starts to shine later on as by the 27th day it would be worth $671,088.64. Then by the 30th day, it would be worth $5,368,709.12!

The same compound power can be seen with a low-yield dividend stock with high dividend growth. Can a low-yield dividend stock with high dividend growth produce more dividend income than a high yield with low dividend growth after a number of years?

Let’s take a look.

Scenario 1

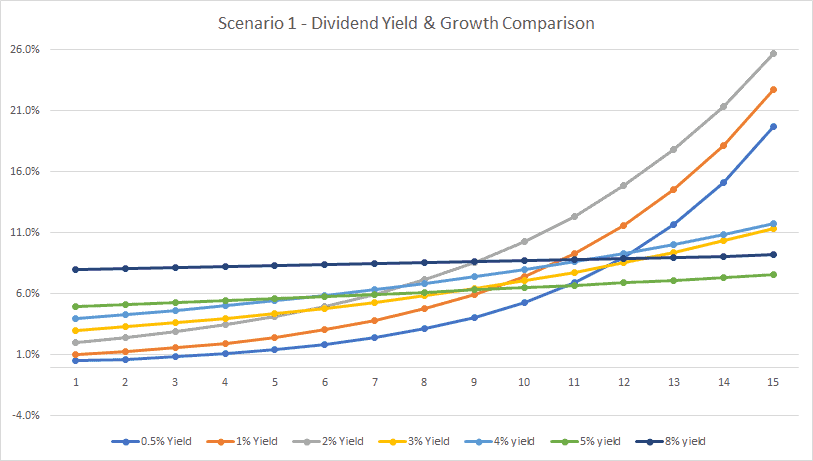

I’ll start Scenario 1 with seven different dividend yields, ranging from 0.5% to 8%. Each yield will have a different annual dividend growth rate, ranging from 1% to 30%. This is a very simplistic approach because the dividend growth rate stays constant throughout the 15 years of simulation.

Here are the numbers:

| Year | 0.5% Yield | Growth | 1% Yield | Growth | 2% Yield | Growth | 3% Yield | Growth | 4% yield | Growth | 5% yield | Growth | 8% yield | Growth |

| 0 | 0.50% | 30% | 1% | 25% | 2% | 20% | 3% | 10% | 4% | 8% | 5% | 3% | 8% | 1% |

| 1 | 0.65% | 30% | 1.25% | 25% | 2.40% | 20% | 3.30% | 10% | 4.32% | 8% | 5.15% | 3% | 8.08% | 1% |

| 2 | 0.85% | 30% | 1.56% | 25% | 2.88% | 20% | 3.63% | 10% | 4.67% | 8% | 5.30% | 3% | 8.16% | 1% |

| 3 | 1.10% | 30% | 1.95% | 25% | 3.46% | 20% | 3.99% | 10% | 5.04% | 8% | 5.46% | 3% | 8.24% | 1% |

| 4 | 1.43% | 30% | 2.44% | 25% | 4.15% | 20% | 4.39% | 10% | 5.44% | 8% | 5.63% | 3% | 8.32% | 1% |

| 5 | 1.86% | 30% | 3.05% | 25% | 4.98% | 20% | 4.83% | 10% | 5.88% | 8% | 5.80% | 3% | 8.41% | 1% |

| 6 | 2.41% | 30% | 3.81% | 25% | 5.97% | 20% | 5.31% | 10% | 6.35% | 8% | 5.97% | 3% | 8.49% | 1% |

| 7 | 3.14% | 30% | 4.77% | 25% | 7.17% | 20% | 5.85% | 10% | 6.86% | 8% | 6.15% | 3% | 8.58% | 1% |

| 8 | 4.08% | 30% | 5.96% | 25% | 8.60% | 20% | 6.43% | 10% | 7.40% | 8% | 6.33% | 3% | 8.66% | 1% |

| 9 | 5.30% | 30% | 7.45% | 25% | 10.32% | 20% | 7.07% | 10% | 8.00% | 8% | 6.52% | 3% | 8.75% | 1% |

| 10 | 6.89% | 30% | 9.31% | 25% | 12.38% | 20% | 7.78% | 10% | 8.64% | 8% | 6.72% | 3% | 8.84% | 1% |

| 11 | 8.96% | 30% | 11.64% | 25% | 14.86% | 20% | 8.56% | 10% | 9.33% | 8% | 6.92% | 3% | 8.93% | 1% |

| 12 | 11.65% | 30% | 14.55% | 25% | 17.83% | 20% | 9.42% | 10% | 10.07% | 8% | 7.13% | 3% | 9.01% | 1% |

| 13 | 15.14% | 30% | 18.19% | 25% | 21.40% | 20% | 10.36% | 10% | 10.88% | 8% | 7.34% | 3% | 9.10% | 1% |

| 14 | 19.69% | 30% | 22.74% | 25% | 25.68% | 20% | 11.39% | 10% | 11.75% | 8% | 7.56% | 3% | 9.20% | 1% |

| 15 | 25.59% | 30% | 28.42% | 25% | 30.81% | 20% | 12.53% | 10% | 12.69% | 8% | 7.79% | 3% | 9.29% | 1% |

Some thoughts:

- Given the high annual dividend growth rates, the 0.5%, 1.0%, 2%, 3%, and 4% yield curves all eventually surpass the 5% and 8% yield curves. This shouldn’t come as a surprise.

- The 2% yield curve passes the 3% yield curve between the 5th and 6th year. It then passes the 5% yield curve after the 7th year.

- Despite the 30% dividend growth rate, the 0.5% curve yield rate grows very slowly in the first 5 years. It eventually passes the 5% yield curve in year 11 and the 8% yield curve in year 12.

- I am surprised that the 2% yield, 1%, and 0.5% yield curves are way ahead of the 3% and 4% yield curves after year 12.

- The 3% and 4% yield curves have modest annual dividend growth and still manage to surpass the 5% curves after 8 years. Both the 3% and 4% curves then pass the 8% yield curve after 12 years.

- All the “low” yield curves eventually surpass all the “high” yield curves. This scenario demonstrates the power of organic dividend growth.

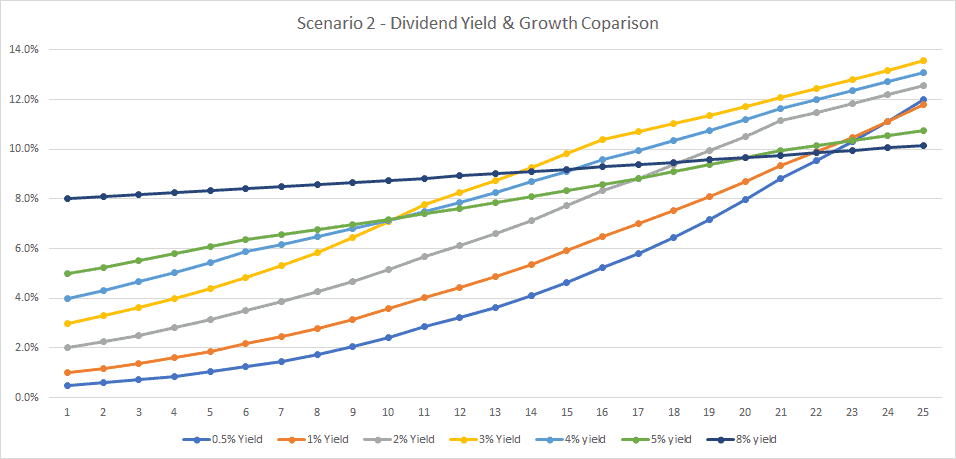

Scenario 2

Scenario 1 showed the power of organic dividend growth, but the growth rate perhaps isn’t realistic. It is difficult for a company to maintain a 30% dividend growth rate for over 15 years, regardless of how much the company is growing its revenues. To create a more realistic model, I took a look at the Canadian Dividend All Star list maintained by DGI&R. Going through the list, I determined the following:

- Out of 101 Canadian dividend all stars, only one company has a 20-year dividend growth rate of over 20%.

- Six companies out of 101 have a 15-year dividend growth rate of over 20%.

- Eleven companies out of 101 have a 5-year dividend growth rate of over 20%.

- Dividend aristocrats like Canadian Utilities and Fortis have a 15-year dividend growth rate of 8.0% and 8.3% respectively.

- The average annual dividend growth rates for all 101 Canadian dividend all stars are

- 1-year DGR: 9.06%

- 3-year DGR: 11.1%

- 5-year DGR: 11.42%

- 10-year DGR: 10.51%

- 15-year DGR: 9.18%

- 20-year DGR: 9.7%

So, companies may be able to raise dividend payout at a very high rate for a few years but eventually the dividend growth rate will slow down. As a result, I used variable dividend growth rates for Scenario 2. Below is the data:

| 0.5% Yield | Growth | 0.5% Yield 2 | Growth | 1% Yield | Growth | 2% Yield | Growth | 3% Yield | Growth | 4% yield | Growth | 5% yield | Growth | 8% yield | Growth | |

| 0 | 0.50% | 25% | 0.50% | 25% | 1% | 20% | 2% | 15% | 3% | 10% | 4% | 8% | 5% | 3% | 8% | 1% |

| 1 | 0.63% | 25% | 0.63% | 25% | 1.20% | 20% | 2.30% | 15% | 3.30% | 10% | 4.32% | 8% | 5.15% | 3% | 8.08% | 1% |

| 2 | 0.78% | 25% | 0.78% | 25% | 1.44% | 20% | 2.65% | 15% | 3.63% | 10% | 4.67% | 8% | 5.30% | 3% | 8.16% | 1% |

| 3 | 0.98% | 25% | 0.98% | 25% | 1.73% | 20% | 3.04% | 15% | 3.99% | 10% | 5.04% | 8% | 5.46% | 3% | 8.24% | 1% |

| 4 | 1.22% | 25% | 1.22% | 25% | 2.07% | 20% | 3.50% | 15% | 4.39% | 10% | 5.44% | 8% | 5.63% | 3% | 8.32% | 1% |

| 5 | 1.53% | 25% | 1.53% | 20% | 2.49% | 15% | 4.02% | 10% | 4.83% | 10% | 5.88% | 8% | 5.80% | 3% | 8.41% | 1% |

| 6 | 1.91% | 25% | 1.83% | 20% | 2.86% | 15% | 4.42% | 10% | 5.31% | 10% | 6.35% | 8% | 5.97% | 3% | 8.49% | 1% |

| 7 | 2.38% | 25% | 2.20% | 20% | 3.29% | 15% | 4.87% | 10% | 5.85% | 8% | 6.86% | 8% | 6.15% | 3% | 8.58% | 1% |

| 8 | 2.98% | 25% | 2.64% | 20% | 3.78% | 15% | 5.35% | 10% | 6.31% | 8% | 7.40% | 8% | 6.33% | 3% | 8.66% | 1% |

| 9 | 3.73% | 25% | 3.16% | 20% | 4.35% | 15% | 5.89% | 10% | 6.82% | 8% | 8.00% | 8% | 6.52% | 3% | 8.75% | 1% |

| 10 | 4.66% | 10% | 3.80% | 15% | 5.00% | 10% | 6.48% | 8% | 7.36% | 8% | 8.64% | 5% | 6.72% | 3% | 8.84% | 1% |

| 11 | 5.12% | 10% | 4.37% | 15% | 5.51% | 10% | 7.00% | 8% | 7.95% | 8% | 9.07% | 5% | 6.92% | 3% | 8.93% | 1% |

| 12 | 5.63% | 10% | 5.02% | 15% | 6.06% | 10% | 7.56% | 8% | 8.59% | 8% | 9.52% | 5% | 7.13% | 3% | 9.01% | 1% |

| 13 | 6.20% | 10% | 5.77% | 15% | 6.66% | 10% | 8.16% | 8% | 9.28% | 8% | 10.00% | 5% | 7.34% | 3% | 9.10% | 1% |

| 14 | 6.82% | 10% | 6.64% | 15% | 7.33% | 10% | 8.81% | 8% | 10.02% | 8% | 10.50% | 5% | 7.56% | 3% | 9.20% | 1% |

| 15 | 7.50% | 10% | 7.64% | 10% | 8.06% | 10% | 9.52% | 8% | 10.82% | 8% | 11.02% | 5% | 7.79% | 3% | 9.29% | 1% |

| 16 | 8.25% | 10% | 8.40% | 10% | 8.87% | 10% | 10.28% | 8% | 11.69% | 8% | 11.57% | 5% | 8.02% | 3% | 9.38% | 1% |

| 17 | 9.07% | 10% | 9.24% | 10% | 9.75% | 10% | 11.10% | 8% | 12.62% | 5% | 12.15% | 5% | 8.26% | 3% | 9.47% | 1% |

| 18 | 9.98% | 10% | 10.16% | 10% | 10.73% | 10% | 11.99% | 8% | 13.25% | 5% | 12.76% | 5% | 8.51% | 3% | 9.57% | 1% |

| 19 | 10.98% | 10% | 11.18% | 10% | 11.80% | 10% | 12.95% | 5% | 13.92% | 5% | 13.40% | 5% | 8.77% | 3% | 9.66% | 1% |

| 20 | 12.08% | 8% | 12.30% | 8% | 12.98% | 8% | 13.60% | 5% | 14.61% | 5% | 14.07% | 5% | 9.03% | 3% | 9.76% | 1% |

| 21 | 13.04% | 8% | 13.28% | 8% | 14.02% | 8% | 14.28% | 5% | 15.34% | 5% | 14.77% | 5% | 9.30% | 3% | 9.86% | 1% |

| 22 | 14.09% | 8% | 14.35% | 8% | 15.14% | 8% | 14.99% | 5% | 16.11% | 5% | 15.51% | 5% | 9.58% | 3% | 9.96% | 1% |

| 23 | 15.21% | 8% | 15.49% | 8% | 16.35% | 8% | 15.74% | 5% | 16.91% | 5% | 16.28% | 5% | 9.87% | 3% | 10.06% | 1% |

| 24 | 16.43% | 8% | 16.73% | 8% | 17.66% | 8% | 16.53% | 5% | 17.76% | 5% | 17.10% | 5% | 10.16% | 3% | 10.16% | 1% |

| 25 | 17.75% | 8% | 18.07% | 8% | 19.07% | 8% | 17.36% | 5% | 18.65% | 5% | 17.95% | 5% | 10.47% | 3% | 10.26% | 1% |

Some thoughts:

- Unlike scenario 1, the 0.5% and 1% yield curves do not surpass the 8% yield curve until much later, in years 22 & 23.

- The 3% and 4% yield curves show tremendous dividend growth after 15 years.

- Despite the low 1% dividend annual growth rate, the 8% yield curve stays above all other yield curves until year 14.

- The exponential growth (i.e. compound magic) doesn’t show up until after 15 years or so.

Additional analysis & final thoughts

The two scenarios above provide some interesting results. If a company can grow its dividend payouts over 15% per year, then investors should consider overlooking the initial dividend yield. But not every single company can keep pace with such a high dividend growth rate for one and half decades.

Looking at the graph from Scenario 2, readers may conclude that one should simply ignore dividend stocks with less than 1% yield, regardless of the dividend growth rates. While it is important to consider dividend income and dividend growth, I truly believe that it is vital to consider total return. Dividend income growth and overall stock price growth should both be considered when investing in a dividend paying stock. Take low-yield stocks like Apple, Costco, and Visa, for example—although they don’t provide very high yields, they have provided significant share price growth over the last 10 years.

Some dividend growth investors only consider dividend income. The logic is that as long as the dividend income is stable, uninterrupted, and can continue to grow, they don’t care about their portfolio value, even if the portfolio value has gone down by 50%.

I do not agree with this view.

I believe it is far better to have both a stable growing dividend income and a portfolio with a decent growth at the same time. Would you rather have $50,000 in annual dividend each year, an annual dividend growth rate of 5%, a portfolio principal value of $1.25 million, and a portfolio market value of $500,000? Or would you rather have $50,000 in annual dividend each year with an annual dividend growth rate of 3%, a portfolio market value of $5 million, and the actual portfolio principal is only $750k?

But it is not as simplistic as I describe. This is not a one size fits all solution.

The mix of low yield high growth and high yield low growth dividend stocks in your portfolio will also depend on your age and your investment timeline. If you are older and are counting on living off dividend income in the immediate future, it makes sense to invest in a higher mix of high yield, low growth dividend stocks. On the other hand, if you are younger and have time on your side, it makes sense to invest in a higher mix of low yield, high growth dividend stocks.

Remember, when it comes to dividend investing and DIY investing in general, it is very important to determine what your goals are and develop your investment strategy accordingly.

Please don’t blindly follow someone else’s advice, my advice included!

Interesting article and very relevant for me at this time….thanks Bob. I have a question(s) about keeping growth stocks in my portfolio during the retirement phase of my life.

I subscribe to the BTSX method of investing and purchase the top 10 high yield dividend stocks from TSX 60 as described by Matt at Dividend Strategy. I have added another bank stock and utility as well, and 2 US ETFs with a focus on Nasdaq 100 and US dividend Appreciation for diversification.

To complement the high yield stocks with BTSX, I have added some dividend growth stocks (reduced yield) such as Canadian Tire, Metro, Nutrien, Magna, CNR and Alimentation CT. All solid performers with good dividend increases and growth. The growth stocks help out with capital appreciation and staying ahead of inflation – that’s my thought anyway. I almost feel that I have too many growth stocks! It was my goal to carry most of these growth stocks with me during retirement.

I am getting close to 60 and will be retiring in the next 2-4 years. Unfortunately, my health is failing which has limited my life span to perhaps another 10 – 15 years.

Given the results described in Scenario #2 above, and with my limited life span (hopefully with medical advancement I can extend it), is it worthwhile to continue to hold these growth stocks? My priority is high yield and income, with “juicy” dividends, but I want something for inflation and appreciation. However, it seems that I will need to hold these growth stocks for at least 10 – 12 years for that to happen. Perhaps I made a mistake in buying the growth stocks?

I would appreciate any suggestions from this group regarding the growth stocks that I presently have. Should I carry them into my retirement with the knowledge that I will receive a lower dividend yield and possibly wait 7-10 years before some acceptable appreciation? Which ones would you suggest holding on to? Or should I just focus on high yield stocks?

I wish I had another 20 years to invest….I would have my answer and would not be asking these questions.

If you haven’t guessed yet, I am a newbie with stocks (formerly mutual fund investor) who is still getting a grasp on the metrics. Bear with me. A learning process.

Hi John,

If you’re close to retirement and need the income to live off, then going a little bit more in high yield does make sense, but I think having some amount of dividend growth stocks will help fighting inflation. Matt has a great selection method with BTSX so there’s nothing wrong following that strategy either.

Ultimately I think the right mix is a very personal question and also depends if you invest in bonds or not. Sorry, without knowing your full personal situation it is very difficult to provide a suggestion.

Bob, thanks for the response. Ok full disclosure.

My current nest egg is about $900,000. I don’t invest in bonds, and if I have to, I will use laddered GIC’s. $900,000 is not a large sum, but it is my intent to start using it as income in the next 2-3 years, for 10 – 15 year period depending on my life expectancy.

I would like the dividend income to pay me about $42000 – $45,000 per year. Except for CPP and an emergency fund, which not included in my stock portfolio, I have no company pension.

So based on your suggestion, I think a good portion of my portfolio (say 80 – 85%) should be invested in high yield dividend paying stocks such as BCE or Telus or Emera, which I presently have. (Bluechip safe havens such as Utilities, Energy, Telecom, Financials) as outline in BTSX.

I still think there is sweet spot somewhere in this equation for growth stocks, which can be included in my retirement portfolio, perhaps 10 – 15% of my stock portfolio for inflation and appreciation. This would be a lot easier if my portfolio had 1.5 million, but it does not.

If there were 2 -3 growth stocks that you were to suggest to hold in a retirement portfolio, which ones stick out for you that I currently have : CNR, Metro, Nutrien, ATD, Magna? I also looked hard at SJ and Waste Connections, but don’t currently own them.

Or maybe you would suggest just sticking with income producing dividend stocks and just forget about growth stocks.

I’m running out of time and panicking, combined with my lack of experience with stocks. I have no one to blame except myself. But I think this situation is redeemable and improving (knowledge increasing) every day.

PS – Blog members can perhaps use my experience and situation to learn from my mistakes.

Hi John,

If you’re aiming for $45k per year at 4% yield you’d need $1.125M. To get that kind of income with a smaller portfolio value will require investing in higher yield dividend paying stocks. High yield stocks outlined in BTSX are generally safe but it doesn’t mean they won’t cut their dividends during bad times, so that’s something to keep in mind. Higher yield = higher risk. You simply can’t get high yields without taking on additional risks. Having a specific income target and a shorter timeline can mean you’re more attracted to higher yield stocks, which could potentially cause some headaches down the road.

Say you hold 20 dividend stocks, one thing you can do is to hold two or three higher yield stocks but make sure all the stocks are roughly 5% of your portfolio.

Again, since I do not know your full financial history I can’t provide specific suggestions over comments. If you’re looking for more one-on-one guidance you may want to take a look at my coaching service – https://www.tawcan.com/coaching/

Bob, thanks for the insight…. a much needed perspective to help me focus. It was the “slap in the face” that I needed. As a newbie, I was being consumed with “analysis paralysis” from reading too much.

Given my personal health circumstances, budget needs, portfolio size and timeline, I need to focus on using more high yield dividends with stable long term companies supporting Energy, Utilities, Financials, and Telecom. A couple of REITS as well. I own many of these now in my portfolio but will be reducing the list (ie. having 2 rather than 3 utilities.)

I was in a “plan vanilla” balanced and global equity fund (MAWER) and cash for too long and now I am paying the price for lost growth opportunities and capital appreciation. I still think I may keep 2 or 3 dividend growth funds (Canadian Tire, Magna and ?) that have decent 5 – 7 year dividend growth histories as well as QQC.F (Nasdaq 100) to help with capital appreciation and inflation. I will sell the rest as I don’t have the 10 years to wait to reap the rewards. However, my comfort level is now buying high yield dividends (and yes, I hear your caveat about yields that are too high = risky, red flag about earnings and probably not sustainable)

Your offer for professional assistance is appreciated and I will consider.

If I may, a shout out to dividendearner.com for his positive suggestions / blog as well.

Regards

Thank you for doing this analysis, Tawcan! I’ll share it with my better half. She’s VERY interested in going all-in on high dividend stocks since she loves seeing that income come in. Your perspective here will hopefully be eye opening for her. Cheers!

You’re welcome AL. Would be interesting to hear what your wife thinks.

Hi,

thanks for sharing and all the work you put into this article. In general I agree with your points that it’s often best to have a balanced portfolio. And most of all it depends on the individual investing goals, time horizons, preferences and capabilities.

I’m a DGI investor since 2015/2016 and I focus on building a portfolio (value on Jan 2022 at 312.000 USD) which is balanced and has a solid risk/reward ratio.

I think that reliable HighYield stocks / Funds deserve a place in an income portfolio. Income is flexibility and freedom and I don’t think it is always best to wait 15 or more years for a decent yield on cost. Don’t get me wrong, to look only at the yield of a security is foolish. But I think it is important not to overlook the factor of compounding when re-investing the dividend income. There was a good article on SeekingAlpha recently

https://seekingalpha.com/article/4477890-3-brutal-income-investing-truths concerning this topic.

My International Income Portfolio consists of about 40 stocks/funds an has a projected dividend income in 2022 of 11.500 USD after! taxes (25% in Germany).

My top holdings include: AbbVie, Realty Income, Deutsche Post, W.P. Carey, Medical Properties Trust, Ares Capital, IBM, Allianz, Deutsche Telekom etc…

If you have the time you can check it out here:

https://dividende-um-dividende.com/portfolio-dividenden/

All the best for 2022!!

Greets from Germany…

Again, I think it really depends on your investment timeline. If your investment timeline is long then getting in the low yield high growth dividend paying stocks might be beenfitial, especially from a tax point of view. 😉

Excellent article Bob !

You addressed my curiosity on this….thank you.

You’re welcome.

Very well done Bob and very detailed.

As Matt and you both know, yield and growth are two sides of the same coin – I say. Meaning, you can’t have lots of both, you want both, but it’s not realistic.

As such, a strong, well constructed portfolio will likely have a mix of modest yield and ideally, high growth whether that growth comes from YoY dividend growth or capital gains, either will do.

My portfolio is purposely constructed with some growth stocks and some income stocks. Always will be.

All the best for 2022 to you and family!

Mark

Great point Mark and how you construct your portfolio may be different than how I construct mine. That’s the beauty of personal finnance. 🙂

Great post Bob.

This is something I have highlighted that I need to improve on. Being a long term investor we need to focus on growth and dividend growth. I plan to mix some high yields with low yields to achieve an avg 3% yield. No question though those high yields are always tempting. haha

keep it up

cheers

Yes high yields are tempting but you need to find the right mix between high yield low growth and low yield high growth.

My portfolio had an average of 18% yield. I had 15% to 19% yields. It’s the monthly payout. I looked at it differently. 19% yield is a 19% return. I couldn’t care less about growth or total returns.

Higher the yield = higher the risk.

I’d argue that 19% yield is not sustainable long term. 🙂

My portfolio holds Funds and ETFs and they hold Big Caps such as 6 banks and Insurance companies. Diversification is the key to mitigating risk. To get $1,000 per month for a TD Stock at a price of $99, you’ll need a 375k while I’m getting 1k a month for only a 68k portfolio.

Are you calculating yield on cost? Never heard of funds yielding over 17%! Or please share the fund!

Yield. But I won’t share this information. The more people buy it, the yield gets smaller. The usual MER on these Funds and ETFs are .50% to .70%.

This might be interesting to you – https://www.tawcan.com/should-i-invest-in-high-yield-covered-call-etfs/

You really should consider total returns a little bit more and also security. You are not likely to keep an 18% dividend payout over any length of time, especially without missing months of payouts when the market hits rough patches.

Of course, Total Returns are considered which I’m averaging at 25%. The yield varies, if the price goes down, the yield goes up and if the price goes up the yield goes down. I don’t have missing months payouts on all my funds and etfs. If they ever missed one month, I will sell it right away. I looked at your portfolio. For a $345k portfolio having 1k dividend monthly payout is a pretty low performance for me. I had 65k of the portfolio having a 1k monthly dividend. If I have 345k portfolio, I will have 5k of monthly payout.

A solid analysis Bob! Thanks for the mention in the post too! I’ve run into the law of large numbers myself, so it’s great to see you doing a writeup on it!

I wish I’d thought of the topic! 🙂

Thanks Mr. Tako. You certainly have run into the law of large number. 🙂

Nice article. I read too often that dividend income is the goal. While income is good, total return should be a significant consideration.

Total return is important IMO. Having some capital appreciation gives you the option to make withdrawals if necessary. having more options for retirement is always a good thing IMO.

Hi,

As a dividend investor, I thought a lot about this topic. I came to more or less the same conclusion as you do.

I think, it depends on how much time you’ve left until you reach your dividend/expense cross-over point: if it’s 10+ years to go, i would take 2-3% yield and 10%+ growth stocks. If it’s less than 5 years to go, i would go for reliable (!) high-yield stocks and reinvest in “sure” 2-3% yields.

Reliable high yield stocks are difficult to find, but i think BATS, MO are two examples.

Finally, i decided to look at the dividend amount a stock delivers. If it’s above a certain percentage of the sum of all dividends (annually), then i don’t add any more of these stocks. That leads automatically to a limitation of high-yield stocks (portfolio value and dividend amount).

It’s very important to consider your investment timeline and when you plan to rely on using your dividend ncome. 🙂

Excellent explanation, as usual. You’ve answered a question I had been asking myself about your portfolio (why own stock X that yielding 1%/year in dividends?). You also reiterate the need to consider one’s age/timeline when investing for dividends: thank you for that.

I was thinking of you last night while watching ‘Seaside Hotel’, a Danish series on PBS.

Thanks Pierre. There are a lot of stuff to consider, that’s for sure.

Haven’t heard about Seaside Hotel, will have to check it out.

Very nice study thanks for this really appreciate would love to see such studies in future also.

Thank you and you’re welcome.

I have been somewhat mindlessly collecting large cap company stocks without putting too much thought into their dividend growth rate. This is an area I should learn more 🙂

Where can I look and compare dividend growth rates over the years? I am sure that you have mentioned it in previous post somewhere but I can’t seem to find it… Should I go into individual companies investor info website?

Take a look here – https://www.tawcan.com/dividend-faq/

Thank you and happy new year!

Excellent read, fascinating really. Wish I had started the dividend journey 20 years ago!

Thanks for a great blog Bob. It is all starting to make sense.

Happy to hear that it all starts to make sense. 🙂

This is an excellent explanation of a topic that trips up a lot of investors. Yield without growth won’t be a good long-term investment. But historical growth rates cannot necessarily be counted on to continue. Fortunately, we don’t have to choose. There are plenty of good stocks that provide both yield and growth – banks, telecoms, and utilities come to mind.

All the best in 2022, Bob!

Thanks Matt, hope all is well with you. 🙂