I have been posting our annual financial review since 2016. Originally, I wasn’t going to write about our 2022 financial review, but I was pleasantly surprised when a few readers reached out and asked why I haven’t posted anything.

- 2016 Financial Review: $47,566.96 Spent & Net Worth +34.4%

- 2017 Financial Review: $51,144.77 Spent & Net Worth + 8.65%

- 2018 Financial Review: $57,231.99 Spent & Net Worth +2.83%

- 2019 Financial Review: $54,906.02 Spent & Net Worth +6.94%

- 2020 Financial Review: $48,908.74 CAD Spent & Net Worth +5.28%

- 2021 Financial Review: $71,852.02 CAD Spent & Net Worth +34.4%

Some readers may recall that in 2021 our annual spending was higher than usual because we had unplanned expenses of around $16,500 (vet bills and fixing our gutters).

Since I share a lot of numbers on this blog and friends and coworkers read this blog, I decided to do things a little bit differently for the 2022 financial review and moving forward. Instead of sharing the total expenses for 2022, we will only share our core expenses.

Privacy is one reason, the other reason is that non-essential spending can be a bit sporadic. The total annual spending can be higher than usual if we had unplanned expenses like last year, if we go on more vacations than usual, or if we donated more money to charities than usual.

Our Budget System

Before we get into all the juicy details, let’s go over our budget system. We have been using our current budget system since mid-2011. Each month we break down our after-tax income into 6 different accounts and allocate a certain percentage for each account.

Here’s the default suggested percentage breakdown for each account:

- Necessities/Core Expenses (55%)

- Education (10%)

- Play (10%)

- Financial Freedom Account (10%)

- Long Term Savings for Spending (10%)

- Give (5%)

We have adjusted these percentages accordingly each year after reviewing our spending trends. We have been allocating less than 50% for the necessities account.

The percentages listed above are the default suggested values. Over the years we have adjusted all of these numbers to suit our needs. Our necessities percentage is much lower than 55%.

By tracking everything with our budget spreadsheet, we are able to easily see our historical spending trends and quickly analyze what we need to improve on. Since started tracking in 2011, we have consistently spent less than we earn and saved a significant amount of our income toward investing. In terms, this has allowed our net worth to increase significantly.

2022 Necessities Spending: $40,563.19 CAD / $30,105.39 USD

In 2022, we spent $40,563.19 in necessities (i.e. core spending). At an exchange rate of 1 CAD to 0.74 USD, this corresponds to $30,105.39 USD.

Please note, necessities only include core expenses like groceries, household items, house insurance, life insurance, property taxes, mortgage, health-related expenses, utilities, car gas, internet, cell phone, etc.

Necessities do not include things like eating out, massages, charitable donations, vacations, educational courses, etc.

Here’s our necessities spending since 2012:

| Total Necessities | Necessities per month | |

| 2012 | $26,210.52 | $2,184.21 |

| 2013 | $26,343.00 | $2,195.25 |

| 2014 | $29,058.96 | $2,421.58 |

| 2015 | $31,256.88 | $2,604.74 |

| 2016 | $29,831.40 | $2,485.95 |

| 2017 | $33,887.68 | $2,823.97 |

| 2018 | $31,840.75 | $2,653.40 |

| 2019 | $33,199.98 | $2,766.66 |

| 2020 | $35,511.60 | $2,792.33 |

| 2021 | $38,950.66 | $3,245.89 |

| 2022 | $40,563.19 | $3,380.27 |

Compared to 2021, we spent $1,612.53 more in 2022, or about 4.13% more.

If we calculate the necessities spending on a per person basis, it means the four of us spent $10,140.80 per person or $845.07 per month. Compared to 2021, we had a per person average of $9,737.67 per person or $811.47 per month.

It’s a bit concerning that we spent more money in 2022 than in 2021, but let’s not forget that we saw significant inflation in 2022. In fact, the consumer price index in Canada rose 6.8% on an annual average basis in 2022, compared to 3.4% in 2021 and 0.7% in 2020. The increase in 2022 was the highest in 40 years.

It’s also important to remember that we have two young & growing kids that are eating more and need new clothes regularly because they’re growing so fast.

So while our necessities spending habits stayed more or less the same compared to 2021, it shouldn’t come as a surprise that our core spending increased slightly in 2022.

Deep Dive into the 2022 Numbers

Let’s take a closer at the 2022 numbers.

- We spent $1,125.77 per month on groceries. We continued to change our eating habits throughout 2022. In addition to stopping drinking milk completely and drinking oat milk and other plant-based milk alternatives, we stopped having dairy products for about 6 months. We ate plant-based cheeses and other plant-based dairy alternatives. As one would expect, this increased our grocery bills as a result. We also ate less meat and add more plant-based proteins like tofu and beans. The shift is mostly due to being more health-conscious but also being more mindful as consumers.

- At $1,125.77 per month on groceries, that corresponds to $3.08 per meal per person. In 2021, we spent on average $3.23 per meal per person, so this is a decrease of $0.15 per meal per person.

- We spent $411.04 per month eating out, an increase of $80.14 per month compared to 2021. Occasionally, after a long and exhausting day, Mrs. T and I just didn’t have the mental capacity to make new meals. So we would order takeouts instead. We also dined out more in 2022 compared to 2021.

- Adding groceries and dining out together, we spent $4.21 per meal per person in 2022. This was an increase of $0.08 per meal per person compared to 2021. I was not surprised to see the per meal per person cost being higher since we had more takeouts and dined out more in 2022.

- We spent $127.49 per month on car gas, or $29.16 per month more compared to 2021. I worked from home all throughout 2022 but Mrs. T drove a bit more due to her doula services and we spent quite a bit on gas for our summer vacation in the Maritime provinces.

- We spent $210.20 per month on clothes and shoes. We spent a lot more on this category in 2022 compared to all other years. This was mostly caused by two growing kids (seemed that they needed new clothes and shoes every other month) and Mrs. T and I had to replace our hiking boots, runners, and rain jackets. My expectation is that we should see a lower spending total for clothes and shoes in 2023.

| Necessities | Groceries | Car Gas | Clothes & Shoes | Dining out | |

| 2016 | $2,485.95 | $662.61 | $115.33 | $108.51 | $392.17 |

| 2017 | $2,823.97 | $784.07 | $123.57 | $86.27 | $370.13 |

| 2018 | $2,653.40 | $714.98 | $140.85 | $105.39 | $432.80 |

| 2019 | $2,766.66 | $747.94 | $148.20 | $99.98 | $455.95 |

| 2020 | $2,792.33 | $870.17 | $93.31 | $62.14 | $178.88 |

| 2021 | $3,245.89 | $1,178.14 | $98.33 | $102.38 | $330.91 |

| 2022 | $3,380.27 | $1,125.77 | $127.49 | $210.20 | $411.05 |

- Property tax and house insurance increased by $44.96 per month or $539.52 in total in 2022 compared to 2021. We expect these two expenses to increase again this year.

- We spent $186.07 per month on utilities (hydro, water, and natural gas). This was $3.85 more than in 2021 and $46.22 more than in 2020.

- We spent $82.55 on cell phones and the internet. Miraculously this was the same amount as in 2021.

- We spent $249.21 on household items in 2022. Household items include things like toilet paper, cleaning supplies, appliances, tools, frying pans, etc.

- We donated about 25% more to charities than in 2021. Mrs. T and I believe in giving back to our communities and providing a helping hand to those in need. Since we are doing quite well financially, we believe it’s very important to donate money to charities regularly.

Despite a slight increase in necessities spending, I think we believe we did quite well managing our core expenses. When groceries are getting more expensive due to inflation, we managed to reduce our food spending. We have to say thanks to our awesome backyard garden.

2022 Net Worth: +9.14%

Because my name is associated with this blog, for privacy reasons, I don’t publish our actual net worth numbers. Therefore, I only share net worth changes in percentages.

In 2022 our net worth grew by 9.14%. The net worth increase came from a combination of our dividend portfolio and housing assessment value.

Please note that we don’t include depreciation assets like the family car and photography gear in the net worth calculation. Essentially, our net worth consists of our cash in our chequing and savings accounts, investments in taxable accounts, RRSPs, TFSAs, and RESPs, and our house then minus any debt we have. We use the annual BC Assessment value for our house value.

Growing our net worth

When it comes to growing our net worth, we follow a simple strategy:

- We maximize our RRSPs every year.

- We maximize our TFSAs every year.

- We maximize kids’ RESPs every year.

- We try to invest as much money as possible in taxable accounts once we maximize tax-advantaged accounts.

- We DRIP our dividend income whenever we can.

- We re-invest 100% of our dividend income.

- We try to ruthlessly cut expenses on things that we don’t enjoy spending money on.

- We spend money on things that we enjoy. Like food and travel.

- Most importantly, we invest for the long term by ignoring the short-term noises. We hold onto our investments unless the fundamentals of the company have changed.

- We remind ourselves that time in the market is far more important than timing the market.

Rinse and repeat for years and let the power of compound interest take over.

Random 2022 Numbers

Here are some random (and fun) numbers from 2022.

Travels

- Total business trip: 1 (Taiwan, had to quarantine for 4 days)

- Number of flights: 6

- Countries visited: 2 (Taiwan & Denmark)

- Number of Canadian provinces visited: 3 (Nova Scotia, New Brunswick, PEI)

After two years, we finally stepped on a plane in 2022! At first, it felt really weird to be jammed into a plane and sitting next to strangers. But we quickly got used to that.

Personal

- Total number of times I worked out: 184

- Total books read: 27

- Number of steps: 3,303,776 (9,051 steps per day… need to improve that!)

- Total distance walked: 2,454.37 km

Blog

- Top visiting country: Canada eh (75.92%)

- Top 10 visiting countries: Canada, USA, Germany, Turkey, UK, South Korea, Netherlands, India, Czech Republic, and Spain

- Did not get visitors from: North Korea, French Guiana, Guyana, Western Sahara, Chad, South Sudan, Central African Republic, Republic of Congo, Equatorial Guinea, Gabon, Namibia, Vatican City, and Yemen.

- My favourite posts from 2022:

- Should I invest in high-yield dividend stocks? A case study of dividend yield & growth

- Be an owner

- Learning from my own investment mistakes

- Die with zero – Does it make sense?

- Dividend tax drags – foreign withholding taxes for dividend stocks & equity ETFs

- Evermore Retirement ETFs – Q&A with the Evermore Executive Team

- 10 lessons I’ve learned along the FIRE journey

- Re-examine our financial independence plans

- Do we have enough to retire in 2023?

- 40 lessons I’ve learned after 40 years

- A letter to young investors

I really appreciate all the kind words and support from all of you. This blog wouldn’t have been possible without your support.

Thank you!

Passive Income

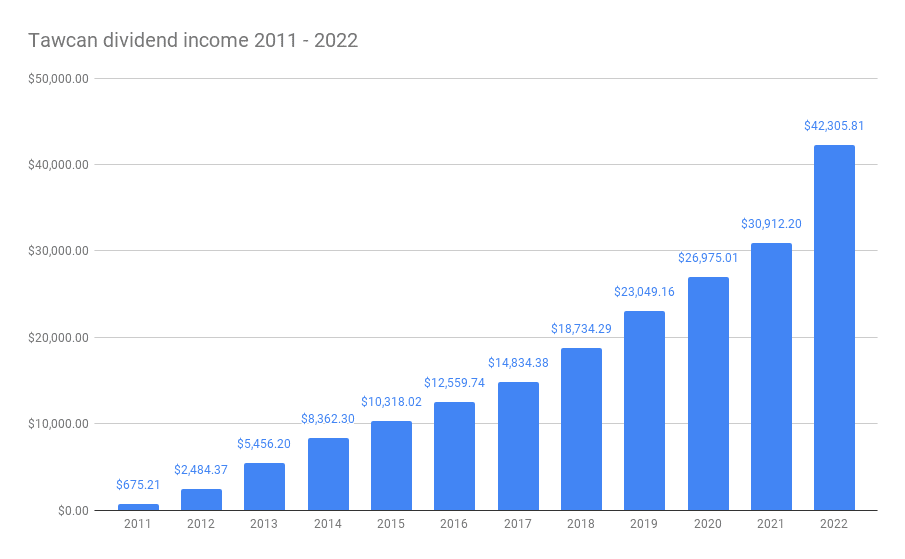

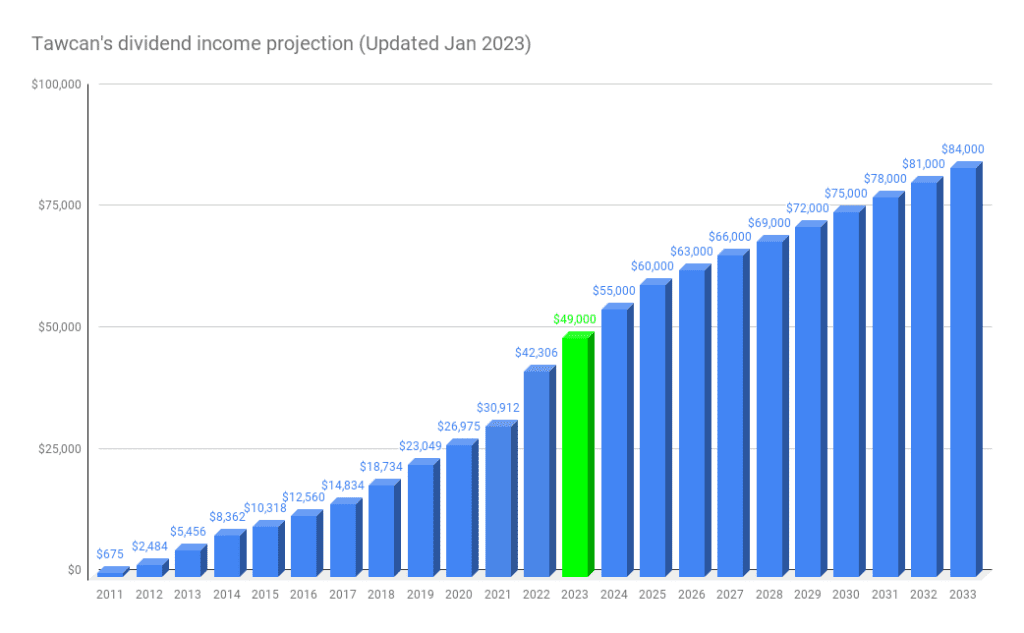

In 2022 we received $42,305.81 in dividend income. This amount covered 104.3% of our necessities spending! It is very exciting and assuring to see that it is indeed possible to live off dividends one day.

We have always estimated that we need between $50,000 to $60,000 to be financially independent. We are getting closer and closer to reaching that target.

Are we able to achieve our goal of receiving $49,000 in dividend income for 2023? It’s quite an ambitious goal but I’m up for a challenge!

At this point in our financial independence journey, there’s no doubt in our mind that will become financially independent in the next 10 years. The question is when. Fortunately, we are not in a rush to get to the finish line – we want to enjoy our journey!

In addition to our dividend income, we are earning travel and hotel reward points via travel hacking. In 2022 we earned the following points by applying for various credit cards:

- 225,000 in Marriott Bonvoy points. At $0.009 per point, that’s equivalent to $2,025 – you can earn 55,000 Marriott Bonvoy points by applying for the American Express Bonvoy Card.

- $300 worth of WestJet points via RBC Avion Visa

We also earned travel points through our HSBC World Elite MasterCard and interests for having cash in high savings accounts. I didn’t track these too closely though.

Compared to other years, we didn’t apply for nearly as many credit cards. We plan to apply for more credit cards this year.

2022 Financial Review Summary

As mentioned, we changed how we reported our spending for this year’s financial review. Overall we have managed our expenses relatively well and are doing well financially. For that, we’re really thankful. Many expenses increased as a result of inflation and are therefore outside of our control. We need to stay focused on expenses that we can control.

Most importantly our net worth increased despite a challenging year in the stock market. After many years of tracking our expenses and net worth, we know our strategy is working. We will stick to our strategy of earning money, saving money, investing money, and ignoring all the white noise.

Here’s to a fantastic 2023!

Dear readers, how was your 2022? How much did you spend in 2022?

Great job on keeping your spending low (and keeping your increase from 2021 below the average inflation rate). It’s not easy and takes effort to do that, especially when raising two young kids!

Thank you Chrissy.

Congrats on all of your success!

Can you share your methods of tracking daily expenses? Do you use an app or excel?

Thanks in advance!

Thank you, we track everything using a spreadsheet.

That’s definitely an achievement when you start covering your expenses! And with all that happened in the markets last year, it’s a testament to strategic investing and closely monitored budgeting that your net worth increased – how has 2023 (especially this past month) treated you? I always breathe easier knowing that my portfolio value comes a distant second to the dividends rolling in each month!

Hi Kyle,

2023 is looking good, we are on track to receive $49k in dividend income, that should cover necessities and more.

I would love to know how you spend so little on cell phones and internet. I assume you need a robust connection in order to work from home.

The trick is to call the internet provider after your contract is up and get a better deal. Do that on a yearly basis.

For cellphone, my work pays for my cellphone and Mrs. T uses Public Mobile which is super low cost – We’re already covering necessities with dividend income.

Hi Bob!

Great recap, thanks for sharing.

“In 2022 we received $42,305.81 in dividend income. This amount covered 104.3% of our necessities spending! It is very exciting and assuring to see that it is indeed possible to live off dividends one day.”

Just curious (and apologies if this is noted somewhere else on your site) – do you have a target percentage for dividend income vs. necessities spending?

We’re already covering necessities with dividend income. Our goal is to have dividend income covering all expenses.

Why are you applying for more credit cards and how do you use them? A friend of mine has many to get points for different hotels but I don’t understand if you actually have to use the card. Do you eventually cancel the cards you don’t use?

We are currently attempting to cancel a dozen cards for my husband’s parents who both have dementia. It’s a complicated business – you have to submit your power of attorney to each credit card company. This has made me leery of having extra cards.

Hi Karen,

It’s called travel hacking, applying for more credit cards to get welcome points, then canceling the cards after 1st year. We do keep some cards depending on usage.

Hi Bob.

Very detailed report. You are quickly reaching your FI crossover point! Well done

How the heck are you paying only $182 for utilities and $83 for cell and internet??? Do share please!

Thanks

Chuck

That’s per month, not total. 🙂

My cellphone is covered by work, Mrs. T uses Public Mobile – https://activate.publicmobile.ca/?raf=KYJLNL

For internet, we call our provider each year to negotiate rates.

Don’t think our utitilies cost is that low.

Netherlands….hold my beer.

Thank you for your visits.

Yes for 2022 expenses are significantly increasing especially utilities due to dramatic increases in “carbon taxes”, inflation. We also had to replace a hot water tank heater now 15 years old, cost $1800. Was thinking of replacing with instant hot water device (low carbon ) but that would be $6-7000 due to gas line needing to be adjusted!

Costs dramatically increasing and can’t help thinking all self inflicted due to poor government policies whether it’s pumping trillions $ into economy or confiscating wealth with ‘carbon tax’ . I’m dreading what new taxes will be imposed in canada tomorrow for budget day

We have an instant hot water device so don’t have to worry about replacing hot water tank. 🙂

Inflation is definitely causing increases for all expenses.

Unfortunately for us, the vast majority of our dividend income is in our RRSP, so accessing the dividends for daily expenses means the govt takes their healthy cut first. Will you have the same issue?

In some way, yes will have similar issues so need to work on RRSP early withdrawal strategies.

See these:

https://www.tawcan.com/revisit-our-financial-independence-assumptions/

https://www.tawcan.com/early-withdrawal-strategies-readers-discussion/

Hi Tawcan, does your net worth being up in 2022 actually mean that it’s not large enough yet?

Almost all retirees and wealthy people I know had flat or a decline in net worth in 2022 due to the decline in stocks and real estate.

For people with smaller net worths and smaller investments, their net worths were up because their day job income was the main reason for their net worth gain.

Does this maybe concern you that either one or both of you will still have to work a long time, given you write about financial independence?

Thanks

Hi Derek,

Not sure why you have the impression that a net worth increase in 2022 = not a large enough net worth.

We were surprised our net worth went up in 2022 given our sizable dividend portfolio already.