Last year, I asked whether we have enough to retire in 2023. After running some projections and analysis, it was clear that we can’t retire and rely on dividend income alone to sustain our current lifestyle. I concluded that we probably could “retire” this year if we really wanted to, provided that we rely on $35,000 combined self-employment income between Mrs. T and me.

I used quotes around the word retire because in my view, retire doesn’t mean stop working completely and relax every day for the next 40, 50 years, or longer. For us, we have always strived for so-called semi-retirement – work part time and have the power to decide what we want to do, not working because we needed the money.

There were quite a number of assumptions in that analysis. For example, we used a projected dividend income of $40,015.43 for 2023. In reality, our 2022 dividend income was higher than that projection and we received over $42,000 dividend income. This year we’re aiming to receive over $49,000 this year. So the calculations I did last year weren’t exactly accurate. Turns out we have increased our dividend income quite a bit already.

Although I very much enjoy my job and what I do at work, the planning side of me is always wondering if we have enough for me to walk away from it. Since there have been a lot of layoffs in the high tech sector lately, it really makes me wonder if we have enough to live off dividends and not have to rely on my full-time job.

With this question in mind, I decided to do another analysis. This time around, rather than using projected dividend income, I’m going to do things a little bit differently. I am going to use the actual numbers from 2022 to see if we had enough to live off dividends while working part-time and earning a $35,000 combined income between Mrs. T and me.

Some background info

In 2022 we received $42,305.81 in dividend income. Long-time readers will recall that we do not convert USD to CAD to keep the math simple. But since I wanted accurate numbers to allow for an accurate case study analysis, the USD and CAD breakdown is as below.

| Dividends in CAD | $37,193.14 |

| Dividends in USD | $5,112.67 |

| Total CAD (1.301 exchange rate) | $43,844.72 |

I used 1.301 as the USD to CAD exchange rate since that was the average exchange rate in 2022.

So, with a 1.301 USD to CAD exchange rate, our 2022 dividend income was $43,844.72.

Some of you may look at the dividends in USD and think we are heavily exposed to the Canadian market. Well, that’s not exactly true.

First of all, many of the US dividend stocks that we invest in like Apple, Costco, and Visa all have a less than 1% dividend yield. Although other US dividend stocks like BlackRock, Coca-Cola, Starbucks, Pepsi, and Johnson & Johnson have a bit higher yield in comparison, the yields are significantly lower compared to the Canadian stocks that we own in our dividend portfolio.

Despite owning a decent number of US dividend stocks in terms of dollar value, we don’t get nearly as much dividends from these stocks compared to the Canadian dividends stocks that we own.

Another reason for the low US dividends is because we are diversifying geographically by using the iShares ex-Canada index ETF (XAW), which pays dividends in CAD, not USD.

Below is the total CAD dividend breakdown across the different accounts:

| Accounts | Dividend Amount in CAD |

| Mrs. T Taxable | $6,557.41 |

| Tawcan Taxable | $11,196.81 |

| Mrs. T TFSA | $5,262.80 |

| Tawcan TFSA | $6,026.62 |

| Tawcan RRSP | $9,915.00 |

| Mr. T RRSP | $4,886.08 |

| Total | $43,844.72 |

Now we’ve covered how much dividends we received in 2022 in Canadian dollars, let’s look at the other side of the coin – expenses.

In 2022 we spent $40,563.19 in core expenses. Core expenses only include expenses like groceries, household items, house insurance, life insurance, property taxes, mortgage, health-related expenses, utilities, car insurance, car maintenance, gas, internet, cell phone, etc.

Below are our annual core spendings since 2012:

| Year | Annual core spending |

| 2012 | $26,210.52 |

| 2014 | $26,343.00 |

| 2015 | $29,058.96 |

| 2016 | $31,256.88 |

| 2017 | $29,831.40 |

| 2018 | $31,840.75 |

| 2019 | $33,199.90 |

| 2020 | $35,511.60 |

| 2021 | $38,950.66 |

| 2022 | $40,563.19 |

It’s nice to know that in 2022 our dividend income was able to cover our core expenses while giving us over $3,000 leftover

I started posting core expenses only on this blog because non-core expenses can fluctuate each year, especially if we go on multiple oversea vacations or if we have planned large expenses.

Please note that core expenses do not include things like eating out, massages, charitable donations, vacations, educational courses, and contributions to registered accounts (TFSA, RRSP, RESP). So we estimate that we need between $60,000 to $70,000 to sustain our current lifestyle without depriving ourselves.

For this particular case study, I will use $45,000 as our annual core expenses and $70,000 as our total annual expenses. These numbers should give us some margin of safety.

One quick note about registered account contributions. When we are living off dividends, we most likely will stop contributing to our RRSPs while continuing to contribute to our TFSAs and RESPs (no RRSP contribution rooms if we aren’t earning active income). To be as tax-efficient as possible, we may consider transferring shares from taxable accounts to our TFSAs rather than contributing new cash (we’d contribute if there’s free cash available).

As mentioned, since we don’t plan to stop working completely and drink pina coladas all day, I will assume that Mrs. T and I will work part time when living off dividends. We will either find some sort of semi-relaxed part-time jobs, or spend more time on our side businesses to grow our business incomes.

Looking at our side hustle income history over the last few years and knowing that we can spend more time on our side businesses to increase income, it’s safe to estimate that we can generate $35,000 in part-time income while living off dividends; $10,000 would come from Mrs. T and $25,000 would come from me.

To put things in perspective… $10,000 at $40 an hour is 250 hours of work, or 6.25 weeks of work. $25,000 at $40 an hour is 625 hours of work or just under 16 weeks of 40 weeks of work (assuming a 40 hour work week). These numbers really are part-time numbers, not full- time work.

Tax Considerations

In the past, I used Wealthsimple’s Tax Calculator to determine the tax implications. It’s simple and easy to use but it doesn’t take deductions like spouse/common-law amounts, health expenses, and charitable donations into consideration. I have found that the Tax Calculator from TaxTips.ca is a more comprehensive tax calculator to use.

I will use the following parameters to calculate the tax implications and obtain the net income:

- RRSP withdrawals on dividends only. At $9,915.00 and $4,886.08 respectively, we’d have to pay $1983 and $489 in withholding taxes.

- $25,000 in self-employment income for me and $10,000 in self-employment income for Mrs. T.

- No capital gains, meaning we do not sell stocks to supplement our income

- All dividends from our taxable accounts are eligible dividends

- No T4 employment income

- No RRSP deductions

- $1,000 in charitable donation

- $2,500 in medical expenses (assuming we won’t have extended health coverage)

We will use the 2022 tax year for the calculations.

Can we live off dividends?

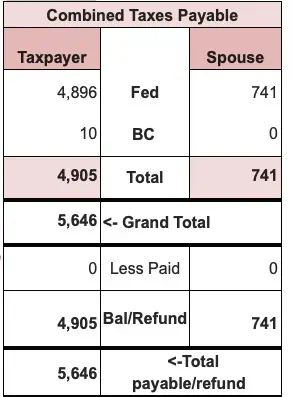

I input all the parameters into TaxTip.ca’s calculator and got a total payable tax amount of $5,646.

In other words, our income statement would look something like this:

| Tawcan | Mrs. T | |

| Taxable | $11,196.81 | $6,557.41 |

| RRSP | $9,915.00 | $4,886.08 |

| TFSA | $6,026.62 | $5,262.80 |

| Self-employment | $25,000 | $10,000 |

| Taxes Payable | ($4,905) | ($741) |

| Total | $47,233.43 | $25,965.29 |

We would have a combined after-tax family income of $73,198.72. This amount covers our estimated annual spending of $70,000 and gives us over $3,000 of a buffer.

Like my fellow blogger Mark Seed from My Own Advisor, the more I think about our semi-retirement drawdown plan, the more I’m leaning toward not touching our TFSAs and allowing all the money to compound for as long as possible.

Why? Because it would give us more flexibility in later years. Slowly withdrawing from RRSP and reducing the RRSP amount is a good idea to avoid hefty mandatory RRIF withdrawals and potential OAS clawbacks in the future.

That means if we only rely on dividend income from taxable accounts and RRSPs (i.e. ignore the TFSA income of $11,289.42), we’d end up with $30,083.30 (only considering RRSP withholding tax). This is not enough to cover our core expenses.

However, if we then supplement with our self-employment income, we would end up with a combined after-tax family income of $61,909.3.

At $61,903.30, that’s a little less than $8,000 short of our $70,000 annual spending target, but it is more than enough to cover our core expenses of $45,000.

So what does that mean?

This is telling me that if we only rely on income from taxable accounts, RRSP, and self-employment income, we would need to be more mindful of our expenses, or increase self-employment earnings.

The optimistic side of me is telling me that we will be fine and that over $62,000 is more than sufficient for us; the pessimistic side of me is telling me that we will need to generate more income to increase our margin of safety. Or do rely on a portion of the TFSA income to be safe?

One thing to note is that we’re using our 2022 dividend income for this calculation, so as we invest more money into our dividend portfolio – both automatically through ‘dripping’ as well as new stock buys – we are generating more dividend income across the different accounts.

What about making more money through self-employment or part time work?

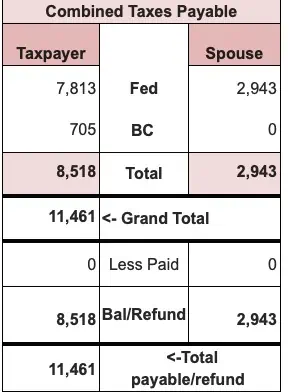

What if we make more money through either self-employment or part time work? What if I could bring in $35,000 and Mrs. T could bring in $20,000 for a combined self-employment/part time income of $55,000? This is under the assumption that we can take on some part time work in addition to self-employment.

Again, to put things in perspective… $20,000 at $40 an hour is equivalent to 12.5 weeks of work; $35,000 at $40 an hour is equivalent to just under 22 weeks of work (assuming a 40 hour work week).

The TaxTips.ca calculator estimates a total payable tax of $11,461.

Our income statement would look like below:

| Tawcan | Mrs. T | |

| Taxable | $11,196.81 | $6,557.41 |

| RRSP | $9,915.00 | $4,886.08 |

| TFSA | $6,026.62 | $5,262.80 |

| Self employment | $35,000 | $20,000 |

| Taxes Payable | ($8,518) | ($2,943) |

| Total | $53,620.43 | $33,763.29 |

This would result in a combined after-tax family income of $87,383.72. If we take out TFSA dividend income, it would be a combined after tax family income of $76,094.30.

Both of these numbers would be more than sufficient to cover our $70,000 annual spending estimate.

Additional thoughts

While relying on self-employment income isn’t the ideal situation, the reality is, we have always planned to work part-time when we’re financially independent anyway. There has never been a plan to stop working completely, for either one of us.

Some additional thoughts on the two analyses above:

- The only tax deductions I used were charitable donations and medical expenses. There might be additional deductibles that we didn’t consider. If so, we’d be able to reduce our taxes.

- It is likely that we’d be spending more than $2,500 on medical expenses, allowing more deductions.

- For self-employment, we should be able to deduct business expenses and business home usage expenses, so the actual net income would be lower, again reducing the overall tax amount.

- I only considered relying on dividend income and self-employment income. If necessary, selling stocks in our RRSPs and taxable accounts should be considered for supplementary income, since the most optimized withdrawal order is taxable first, RRSP second, then finally, TFSA.

- I used our 2022 dividend income for analysis. As we get closer to $60,000 in annual dividend income, the less we would have to rely on self-employment/part time income. This would provide more flexibility and buffer for us.

- I didn’t include expenses like raining day funds, and other unplanned expenses in my calculator and analysis. We plan to cover those with a cash reserve fund. This is why one of my goals this year is to save up $25,000 in our LTSS account.

- We also didn’t include kids’ post-secondary expenses in these calculations. In addition to RESPs, we’re also saving up for post-secondary expenses outside of RESPs.

Summary – Do we have enough to live off dividends?

It is comforting to know that we are at a point where we can rely on a combination of dividend income and part-time income to sustain our current lifestyle. This is giving me a sense of calmness given how quickly things can change in the high tech world.

When Reader B, who received $360k divided income a year, reached out a few years ago via email he wrote the following:

“So I’ve been following the exact same dividend investing path as you are on for some 36 years now – and I just wanted to tell you (as living proof) that our dividend investing approach definitely does work and I solidly stand behind it. You’re on the right path, Bob. And at the rate you’re making progress (as I see on your web site) by the time you reach my age you will certainly have achieved my levels and beyond. So I wanted to encourage you (not that you really need any, ha) to continue along the course you have set – it certainly does work. Again, carry on.”

Nowadays,I totally understand what Reader B meant when he said we’re on the right path!

We will be able to live off dividends, whether with or without part time income, in the not so distant future.

We just need to be patient.

There’s no rush to get to the dividend income crossover point. Both Mrs. T and I have come to realize that it is more important and crucial to know what we are retiring to. We need to put more time into thinking about our FI/semi-retirement/retirement plans.

This is a great breakdown. I played a game with myself a few years ago where I set out to buy at least one share of each of the Dividend Aristocrats. It forced me to look at each one before I bought it to make sure I understood what they do and why they are valuable. It’s a fun exercise if you have the time!

That’s an interesting idea!

One thing to be mindful of in planning is cpp contribution rates for self employed income – you’ll be paying employee and employer portion so there will likely be more deductions than just income tax.

Thanks Scott, we’re fully aware of the CPP contribution rates for self employed income. 🙂

Outstanding progress and love the taxtips calculator.

I doubt very much that OAS recovery tax will be an future issue and if it is, that’s a great problem to have. Currently 2023 clawback begins at almost 87K PER PERSON or 174K per couple and that number will continue to rise.

Strategically winding down RRSP/RRIF is a solid idea. You have created lots of options for the future.

We regret the risks we don’t take.

Thank you, glad to hear someone validating our idea of winding down RRSP/RRIF.

I love this analysis. We haven’t built up the same dividend investments, but we have a lot of money invested in the market. My theory is that we could “flip the switch” and go from growth to a dividend investing strategy when the time comes. Most of the money is in retirement accounts anyway, so we’d have to do some withdrawal strategy planning anyway.

Would you see any difficulties with the approach we’re taking vs. buying the holding the specific dividend stocks that you do now.

Thanks. I don’t see any difficulties with your approach at all, just require some planning when you’re ready to flip the switch.

You have also forgotten that or intentionally left out the income you will get for the kids because of the CCB payments. For each child:

under 6 years of age: $6,997 per year ($583.08 per month)

6 to 17 years of age: $5,903 per year ($491.91 per month)

Try to keep income below $71,000 annually where the big clawback occurs.

There is a BC top up monthly for the kids as well, if your adjusted family net income is between $27,354 and $87,533, the BCFB is not less than:

$64.58 per month for the first child;

$62.50 per month for the second child; and

$60.41 per month for each additional child.

Plus because your income will drop so much you will get the GST rebate and Climate rebates in BC. GST max calculated would be ■ $467 if you are single ■ $612 if you are married or have a common-law partner ■ $161 for each child under 19 years of age.

BCCATC provides a credit of up to $447 for an individual, $223.50 for a spouse or common-law partner and $111.50 per child.

Lastly add the new 2023 Family Grocery rebate (inflation help) in as well ( 2 parents and 2 kids is $467 extra)

Also thanks to the current term of federal govt we have dental care for kids and soon pharmacare if the bill passes.

Important things to consider and also support within Canada for long term financial planning, Court at ModernFImily does a good job calculating these in as you are entitled to them and add a huge supplement to income. You are WAY closer to FIWOOT (thx Mark) than you think.

Hi Chris,

That’s a very good point. We see CCB as extra gravy (just like CPP and OAS) so not counting those. 🙂

Government social benefits are great. Gotta love them when you do qualify them.

Wow quite the analysis! Thank you for sharing. You’re obviously well prepared for a shift in lifestyle.

I have a question though – I didn’t see any mention of inflation and how you would compensate for that?

Thank you. We believe $70k gives us enough buffer to cover inflation.

Hi Tawcan – good article! Have you ever looked at living off dividends in retirement vs. selling units of growth type stocks and the “sequence of returns” issues? Maybe I am missing something, but it seems like (unless there were big dividend cuts) by living off dividends in retirement and keeping your stocks mostly intact, you could avoid some/most of the consequences of an unfortunate sequence of returns?

Hi Jerri,

A good point and something I’ve considered. The idea is to live off dividends in the initial few years then eventually selling stocks.

$40/hr is a very juicy part-time wage! I’m guessing its well above Walmart Greeter pay.

That’s true but definitely not looking to go from high tech to a McDonald’s cashier type of part time job. 🙂

Do not quit too soon.

Definitely, John. 🙂

Great read! We’ve been retired for 17 years now – Wow! how time flies. No debt was part of our ‘must do’ plan. Get rid of your mortgage; it’s a relief. Take that payment and add it to your investments. Plus consider that life can take left turns. What if you couldn’t work du to health issues? These things happen. Run your numbers under doom & gloom scenario. Be aware and be prepared.

Thanks Cat for the feedback. Definitely planning to have no debt when living off dividends. 🙂

It would be interesting to compare your projections to a work pension. Ours are technically indexed but the criteria for increases cut back long term relative to reality.

One concern I would have is a decline in actual value of investments by removing the growth due to consuming the dividends rather than reinvesting.

Also you mentioned mortgages and possibly other debts that include interest. One criteria I have maintained in our finances is no debt in retirement. With increasing interest rates this could be a heavy burden when retired or semi-retired.

Lastly with your young family you will likely find they become progressively more expensive. Have you taken that into consideration?

Thank you for your insights to investing. I look forward to your Monday reports.

Hi Dianne,

That’s an interesting suggestion. For the most part I’ve ignored work pension due to the fact that I don’t have one, plus work pension is become a rarity for many people.

Decline in the investment value when consuming dividends is a valid point but the idea is to hold a mix of high dividend/capital growth stocks and high dividend income/lower dividend growth stocks.

Yup, expenses getting progressively more expensive as kids growing up is definitely something we need to watch out for.

Nice Summary, Bob. Curious do you have a work pension/DCPP or considered other income streams you can incorporate into this analysis? i.e. HISA. Another opportunity maybe getting into real estate investing as it offers another layer of diversification. Timing to enter maybe key with interest rates, but the push for immigration without a strong infrastructure plan continues to create a disproportion of housing supply vs. demand which in the long run is beneficial to investors.

Our drawdown approach is a bit different in order to reduce our up front tax hit, instead we will seek to leverage TFSA dividend income to help with core expenses during FI and then plug back up the new contribution room created in future years via savings etc.

Josh

Thanks Josh. I don’t have a work pension so need to rely on our own savings. Having other income streams is highly desirable, I kinda grouped that in the part time/self employment income. 🙂