After a very busy October, November was relatively quiet. Our seven-day Disneyland trip in October was a distant memory. With the temperatures getting colder, we spent more time inside working on various projects.

Since I like to plan ahead, I have been writing and planning a blog post schedule for 2024. It’s hard to believe this blog has been around for over nine years already. By July next year, this blog will be in existence for 10 years. It’s a pleasant surprise that I have been writing for so long and have kept up the every Monday publication schedule since 2021.

I still have many great and interesting topics to cover. I just need to find the time to write and edit them. Even if I have no shortage of ideas for future blog posts, If you have any ideas, I’d love to hear from you.

Mrs. T spent a lot of time each week on her pottery creations. She also attended a local Christmas market to sell some of her creations.

I suspect I might get some potteries as Christmas presents from Mrs. T.

In November, Mrs. T and I celebrated our copper wedding anniversary (12.5 years), the first landmark wedding anniversary for Danes (25 years is silver and 50 years is gold). In Denmark, for the silver wedding anniversary, the couple’s friends, neighbours, and family typically would build an arch over the couple’s front door and have a celebration. For the copper wedding anniversary, half an arch would be built.

Because this isn’t a Canadian tradition, we (well Mrs. T mostly) had to build the half arch ourselves.

Here’s to more years to come for the two of us. Both sets of Mrs. T’s grandparents celebrated their golden wedding anniversary, so hopefully one day we’ll celebrate our golden wedding anniversary too.

Dividend Income – November 2023

In November we received dividend income from the following companies:

- Apple (AAPL)

- AbbVie (ABBV)

- Bank of Montreal (BMO.TO)

- Costco (COST)

- Emera (EMA.TO)

- Granite REIT (GRT.UN)

- Metro (MRU.TO)

- National Bank (NA.TO)

- Power Corp (POW.TO)

- Procter & Gamble (PG)

- Royal Bank (RY.TO)

- Starbucks (SBUX)

- SmartCentres REIT (SRU.UN)

- Waste Connections (WCN.TO)

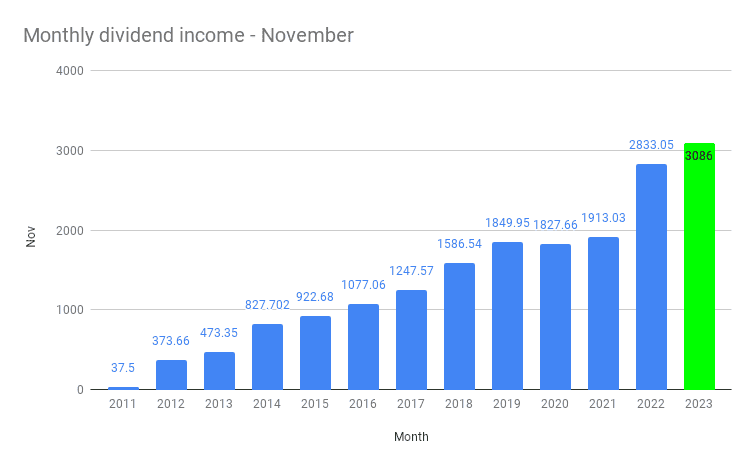

The 14 dividend pay cheques added up to $3,086.00. After a record-setting month in October, we are back down to ~$3,000 in dividend income for November.

Last quarter (i.e. August), we “only” received $2,982.13 in dividends. So it was nice to see our November dividend income starting with a three. Furthermore, considering November is one of the low dividend income months, we are pretty happy with the result.

Out of the $3,086.00 received, $347.49 was in USD and 2,738.51 was in CAD. Please remember, we do not convert USD to CAD when reporting our dividend income. The main reason is to avoid fluctuations in our monthly dividend income reports due to sudden changes in the exchange rate.

I have considered converting USD to CAD starting next year by using the average monthly exchange rate from the Bank of Canada. But there are a few things to consider:

- The exchange rate will vary month to month, making the overall math a bit more complicated

- Our 2024 dividend income would arbitrarily grow by about 30% because of the exchange rate (if we use the exchange rate of 1 USD to 1.30 CAD)

- Most importantly, our US dividend income is all in our RRSPs. When we make withdrawals in the future, we will be paying taxes at our marginal tax rate (RRSP withdrawals are counted as working income). While I don’t believe the tax rate will be high, it is difficult to accurately estimate the overall tax impact. In other words, not all of our RRSP dividends will be money in our pocket, it makes sense to have some level of buffers in the form of a 1:1 exchange rate.

Therefore, I plan to continue using the 1:1 exchange rate and maybe not report the details in the USD and CAD dividend amounts.

Dividend Hikes

We saw many companies announcing dividend hikes throughout November.

- Canadian Natural Resources (CNQ.TO) raised its dividend payout by 11% to $1.00 per share.

- Telus (T.TO) raised its dividend payout by 3.4% to $0.3761 per share

- Granite REIT (GRT.UN) raised its dividend payout by 3.125% to $0.2750 per share

- Canadian Tire (CTC.A) raised its dividend payout by 1.4% to $1.750 per share

- Suncor (SU.TO) raised its dividend payout by 5% to $0.545 per share

- Alimentation Couche-Tard (ATD.TO) raised its dividend payout by 25% to $0.175 per share

- Enbridge (ENB.TO) raised its dividend payout by 3.1% to $0.915 per share

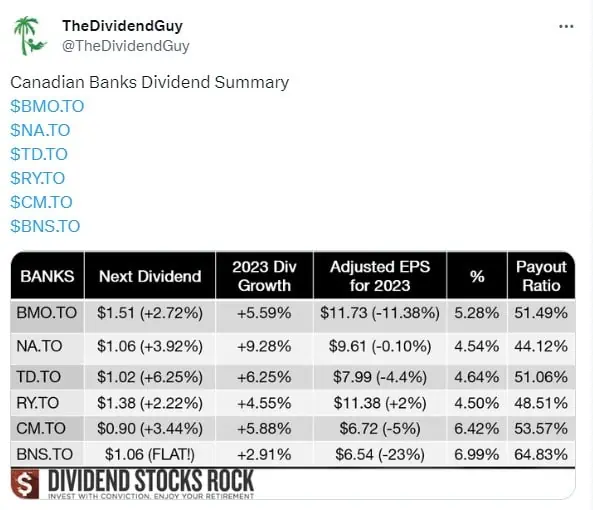

- CIBC (CM.TO) raised its dividend payout by 3.4% to $0.90 per share

- Royal Bank (RY.TO) raised its dividend payout by 2% to $1.38 per share

- TD (TD.TO) raised its dividend payout by 6.2% to $1.02 per share

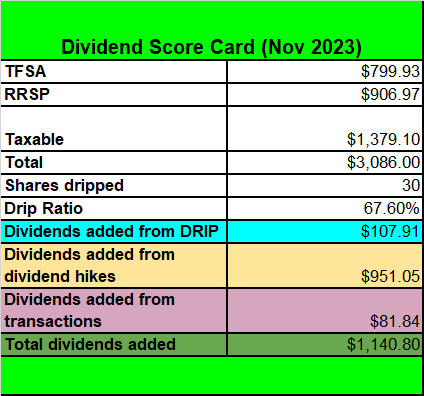

All these dividend hikes increased our forward annual dividend income by $951.05. What a fantastic month in terms of dividend hikes! At a 4% dividend yield, that’s equivalent to investing $23,776! Boom!

Overall I am very pleased to see so many dividend hikes in November. In fact, a total of ten companies raised their dividends in that thirty-day period! It was fantastic to see ATD raising dividends by 25%. Furthermore, it was nice to see Enbridge, CIBC, Royal Bank and TD raising dividends.

As we face the law of the big numbers, dividend hikes, or organic dividend growth will increasingly become more important as we get closer to our goal of living off dividends.

Dividend Reinvestment Plans

Over the years, we have invested a lot of new cash into our dividend portfolio. In addition to new capital, we also rely on organic dividend growth (previous section) and dividend reinvestment plans (DRIP) to grow our dividends.

One of our goals, whenever we own a dividend stock, is to eventually have enough shares so we can enroll in synthetic DRIP. This would allow discount brokers to DRIP a full share using dividends that we receive. For example, if we received $150 dividends from Royal Bank and Royal Bank is at $123 per share, we would DRIP 1 share and $27 would get deposited in our account.

Side note: It’d be fantastic if more online discount brokers could offer full DRIP where you can drip fractional shares.

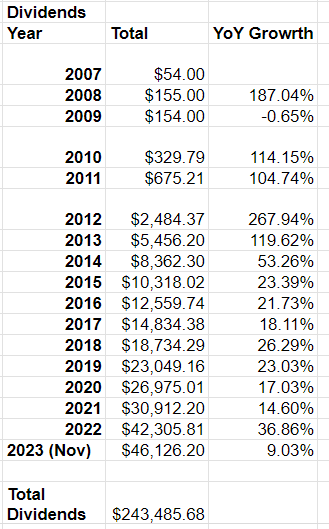

Since we started tracking dividend income in 2007, we have received close to $250,000 in dividends.

That’s a lot of money!!! And we definitely wouldn’t be where we are today without enrolling in DRIP.

In November we dripped the following shares automatically:

- 4 shares of BMO.TO

- 3 shares of EMA.TO

- 6 shares of NA.TO

- 6 shares of POW.TO

- 5 shares of RY.TO

- 6 shares of SRU.UN

Thanks to DRIP we added 30 more shares in November. More importantly, we added $107.91 toward our forward annual dividend income.

Dividend Transactions

Over the last few months, we have been waiting for dividends to pile up in my TFSA. In November the amount sitting in our TFSA was over $1,000. So with that money, we decided to add 22 shares of TC Energy Corp (TRP.TO).

This added $81.84 toward our forward annual dividend income.

TC Energy Corp’s share price has had a bit of a beating over the last six months, mostly caused by the news that the company plans to split into two entities next year as well as the massive cost overruns on the Coastal Link project.

In November TC Energy raised its earnings expectations for 2023 and 2024 as it prepares to launch its liquids pipeline business spinoff. I believe the current share price is quite attractive and getting in now will allow us to get shares of both TC Energy and the new spin-off company in 2024.

Random Thoughts on Canadian Banks

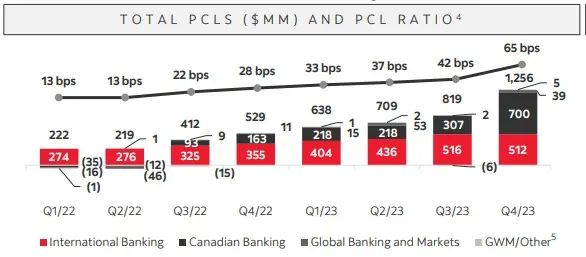

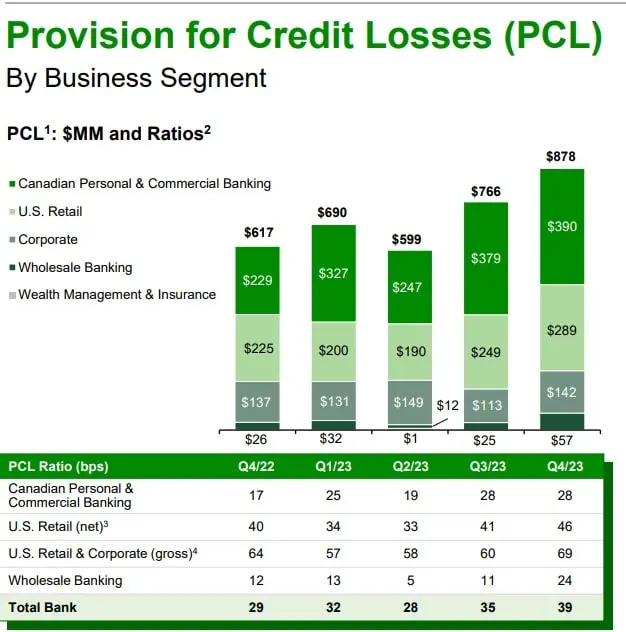

Canadian banks reported quarterly earnings in the week of November 27. The Bank of Nova Scotia started the earnings season with terrible news. It missed earnings estimates significantly by 41 cents a share ($1.26 reported vs. $1.67 expected).

The bank also reported $1.26 billion in provision of credit losses (PCL, an estimate of potential losses that a company might experience due to credit risk. The provision for credit losses is treated as an expense on the company’s financial statements) vs. the expectations of $870M. Furthermore, the bank also forecasted marginal profit growth in 2024.

The market reacted to this terrible news with a sell-off. At one point, BNS had a dividend yield north of 7%. Given the state of BNS, I suspect there’s a high chance we won’t see a dividend raise next year.

Royal Bank, TD, and CIBC announced their earnings a couple of days after BNS.

Royal Bank reported higher profits that beat analysts’ estimates thanks to a surge in capital market earnings and lower taxes. It also raised dividends by 2%. It is concerning that RY had a surge in PCL of $720 million in the fourth quarter, an increase from $381 million the previous year.

CIBC also beat profit expectations thanks to smaller-than-expected loan provisions and raised its dividends by 3.4%.

Like BNS, TD saw a profit miss and an increase in PCL. TD also announced that it was cutting 3,000 jobs and also set aside a higher than expected amount for PCL. The one good piece of news from TD’s earnings report was a dividend hike of 6.2%.

Bank Montreal raised dividends on December 1st but missed analysts’ earnings estimates. The bank also had millions of provisions for credit losses but slightly less than analysts had forecasted ($457.7 million vs. $446 million).

National Bank followed suit with the dividend raise. Despite having profits up from a year ago, the PCL was up from $115 million compared to $87 million a year ago.

What do I think of all these bank earnings reports? Well, I think 2024 will be a rough year for all the Canadian banks. Banks are setting aside millions for loan provisioning in case Canadians start defaulting on their loans due to higher rates. The nice thing is that all Big Fives have been paying uninterrupted dividends since the late 1800s. That’s through several recessions and even two world wars. Furthermore, the consensus is that interest rates will come down in the middle of 2024. Therefore, I’m confident that the Canadian banks will weather the storm.

Will the Canadian banks get back to their former glories? I think so but we’re looking at a longer term recovery. Since all of them are paying dividends, investors can continue to collect dividends and wait. This is exactly what we plan to do.

Dividend Scorecard – November 2023

Here’s our dividend scorecard for November:

We had a very solid month, especially on the total dividends added front.

Dividend Income – November 2023 Summary

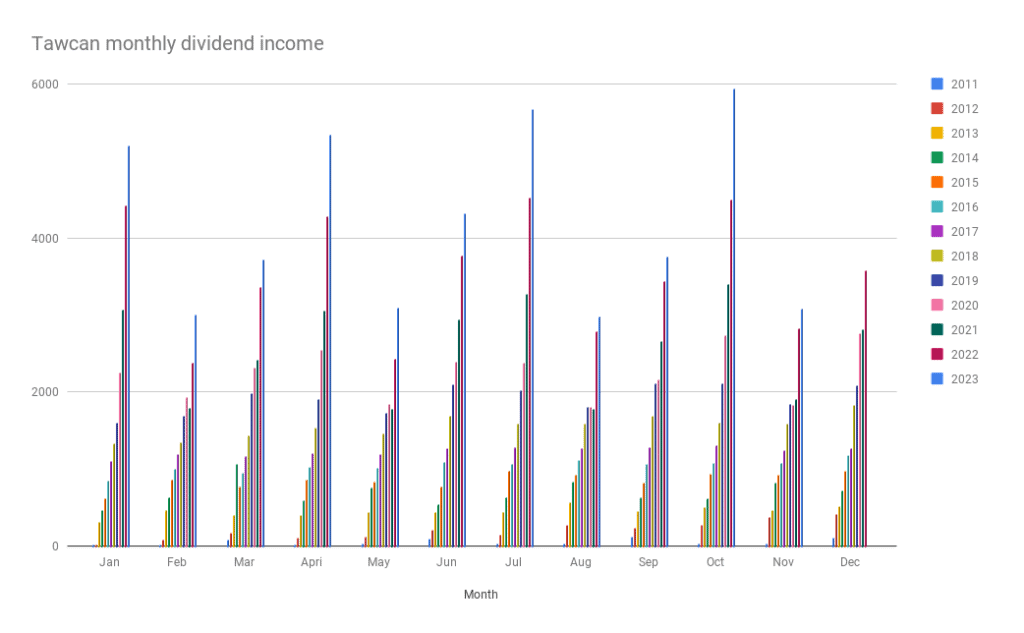

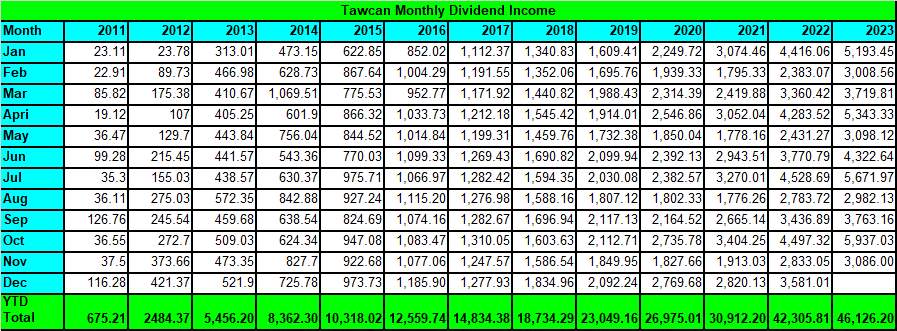

With only one month to go this year, we have received a total of $46,126.20 in dividend income.

If we were to receive the same dividend amount as December 2022, we’d end the year with over $49,000 in dividends. At this point, I’m 99.9% sure that we not only will exceed our goal of receiving over $49k in dividends but we will end up with over $50,000 by the end of the year.

It’s pretty amazing how far we have come since we started focusing on dividend growth investing. The snowball is getting bigger and bigger at a faster pace. This is the power of compounding!

To put things in perspective, $46,126.20 is equivalent of:

- $138.10 per day or $5.75 per hour

- $960.96 per week or $24.02 per hour after 48 working weeks

It’s lovely to see that our boring investing strategy is working hard for us so we don’t have to.

How was your November dividend income?

Congrats on the milestone anniversary!

Thank you!

Always enjoy your updates, Bob.

I finally decided to take my loss on AQN, and took the cash from that to buy TC Energy; a new

holding for me.

BTW I’m a big fan of your personal updates. It’s fun to follow your financial life and your home life!

Thank you Alan. It was tough to take the loss on AQN for us but it was time to move on…

Thanks for the update, I really enjoy these 🙂

You’re welcome.

Happy Anniversary 🙂

Thanks Chris.

Happy Anniversary and congratulations on your dividend success. Thanks for another great newsletter.

Jeff

You’re very welcome, Jeff.

Yes, I am benefiting from the WS fractional dripping as well. I like how you can set it so they do the dripping for you, or you can select the option to do it yourself. Right now it’s ‘one or the other’. Hopefully soon they’ll allow us which stocks we’d like to have automatically dripped, and which stocks we’d like to allocate ourselves, perhaps to different stocks in the portfolio.

That’s an impressive amount of passive income! I hope to be in the same spot in a few years time. Great work.

Thank you! Glad to hear that you’ve been benefiting from the WS fractional dripping.

What about that special dividend from COST?

What’s going on with that stock ? It’s going hyperbolic ! Going up 4% daily .

It doesn’t make any sense and has a PE of over 46! That’s totally in the speculative era when interest rates were 0%.

By comparison GOOG has a PE of 25.

Would you ever buy a stock with a PE of 46?

I buy WCN regularly, and they have a PE of 45.

The special dividend was announced in December so didn’t include it in the November update.

Yea, Costco stock has been on steroids lately. I would love to add more Costco but seems there are better deals out there.

If you have a 40 years of investing horizon, as Charlie Munger would “Just buy the damn stock, it’s a wonderful company”.

I am enjoying the DRIP/fractional shares with WealthSimple, which might be worth looking into. Although it is all or none per account, you cant choose which stocks you DRIP

Yea it’s great that WS supports fractional drip, definitely wish other discount brokers will support this nice feature one of these days.