To many people’s surprise, the US inflation rate in October slowed down to 3.2%, lower than anticipated, causing people to believe that the Federal Reserve’s interest rate hikes are working and cooling the inflation rate.

Here in Canada, we saw similar behaviour – the inflation rate decelerated to 3.8% in September.

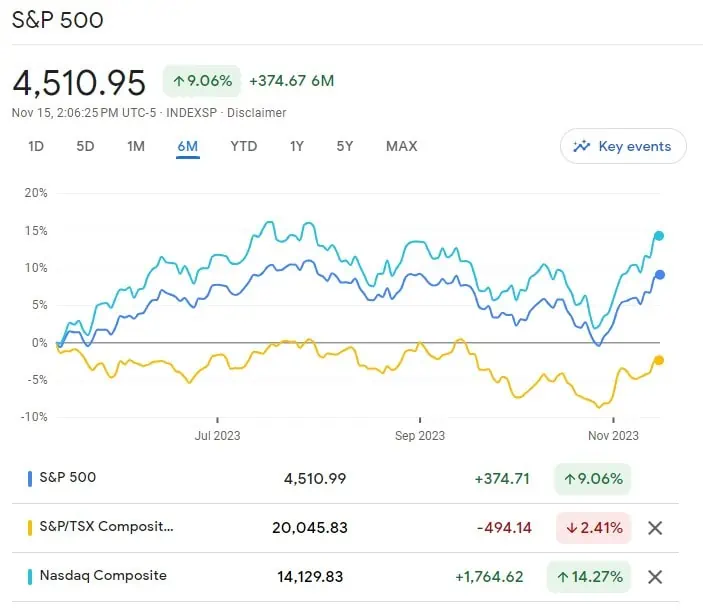

The lower inflation rates are fueling people’s optimism and we have seen the North American stock indices going higher and higher in the last couple of months.

Will this lead to a nice Santa Claus Rally?

Will the inflation rate deceleration continue and eventually lead to lower interest rates?

My best guess? The higher interest rates are indeed taming the inflation rate. I would guess that interest rates will remain at the current level for the next few quarters and the central banks will start lowering the rates toward the end of 2024, assuming the inflation rate continues to drop.

That leads to the next question that’s on the mind of many dividend investors – will Canadian banks raise their dividends before the end of the year?

Per the Globe and Mail, John Heinzl believes likely some modest dividend increases.

In fact, Desjardins Securities predicts the Big Six banks will raise their dividends by about 3 per cent, on average, when they report fourth-quarter results in late November and early December. Specifically, it expects that Toronto-Dominion Bank (TD) will hike its dividend by 5 per cent, with Bank of Montreal (BMO), Canadian Imperial Bank of Commerce (CM), National Bank (NA) and Royal Bank (RY) each raising their payouts by about 3 per cent. The only big bank not expected to raise its dividend is Bank of Nova Scotia, which typically reviews its dividend when it posts second-quarter results in May.

If this turns out to be true, it’d be fantastic!!!

I guess we’ll find out next week when the banks start reporting their quarterly results…

Looking ahead though, given that we’re still in the accumulation phase, I’m really hoping there won’t be a Santa Claus rally so we can utilize the new 2024 TFSA contribution limit to purchase discounted dividend paying stocks.

Good reads from the PF community

Here are some personal finance/investing related articles that I enjoyed reading.

Mark from My Own Advisor explained The upside of inflation – “The good news is in my view, it’s not all doom-and-gloom for this cohort either. For one, like I mentioned above, stocks offer an inflation hedge. Historically, because companies have been able to pass forward some rising prices back to the consumer, I would simply keep more stocks than bonds and/or cash as you enter retirement and remain in retirement. Two, make sure you consider specific inflation-hedgers and fighters in your portfolio. Historically speaking, whether you are investing in real estate directly via your home or rental units – owning real estate can at times be a decent hedge for higher inflation. Why? People have to live somewhere…“

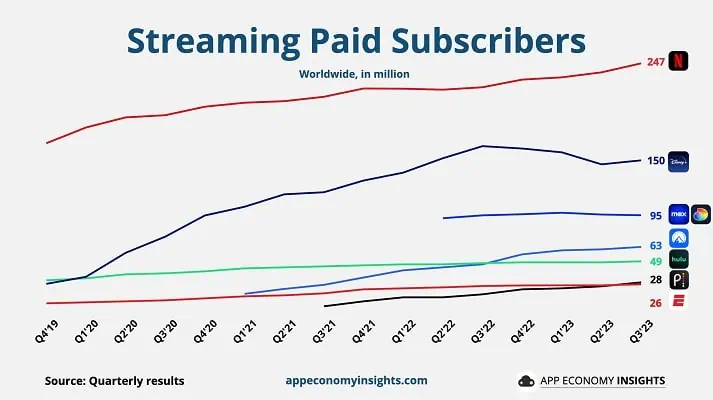

Which streaming service has the most paid subscribers? App Economy Insights provided a great breakdown of the streaming subscribers. Looks like Netflix continues to lead. It’s interesting to note that Disney+ lost some subscribers.

Two things you can accelerate your FIRE journey – reduce expenses and increase income. While reducing expenses is typically the first thing people do when they start their FIRE journey, there’s only so much you can cut before you deprive yourself.

Therefore, it is far more impactful to increase your salary. Kitty at Bitches at Riches wrote an excellent guide on How to grow your salary – “Negotiating is a learned skill. It’s difficult to practice and easy to mess up. I’ve learned some tricks over the years. The best general advice I can give is that this process is like poker. Even if it feels like the hiring manager can see your cards, they can’t. They can only see what you show them. Now is your time to quiet your inner imposter and focus on winning the game. You can go back to being a hot mess once it’s done.“

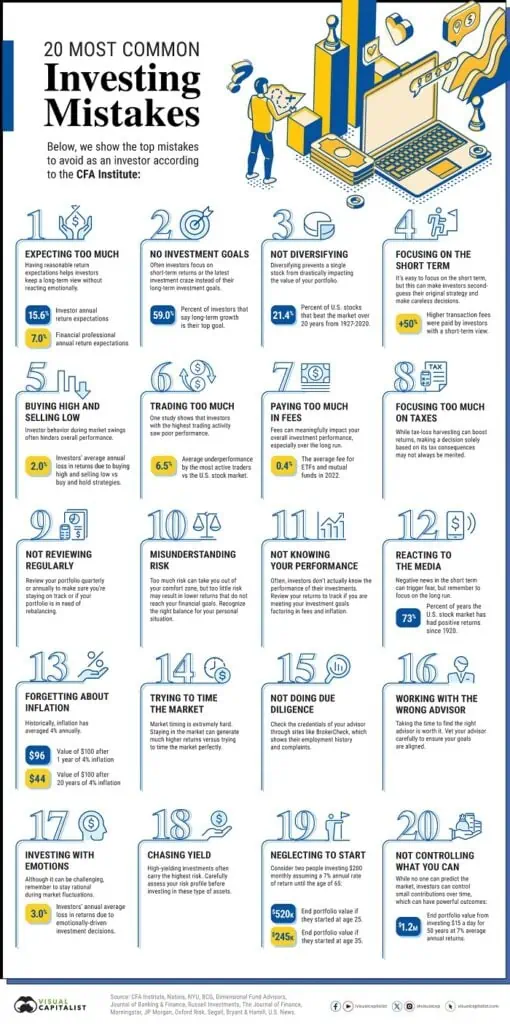

I’ve made many investment mistakes. Trying to be a better investor, whenever I make a mistake, I try to learn from it. Visual Capitalist shared the 20 most common investing mistakes people make.

Joseph Carlson is one of my favourite investment content creators on Youtube because he shares similar long term investing philosophies as me. He shared why he keeps buying quality stocks.

Ever get confused about how informal trusts work? Chrissy from Eat Sleep Breathe FI created The ultimate guide to informal trusts (for Canadians) – “To raise (or help raise) financially-responsible kids, I suggest that you focus on developing a trusting and healthy bond with the child and teach them how to care for, grow and respect their money. Here’s how and why: Develop and maintain a strong bond If the child looks to you as someone who genuinely cares for them and has their best interests at heart, they’ll very likely want to follow your advice and guidance. This bond will also serve as a sort of insurance against irresponsible behaviour once they can access the money. They won’t want to disappoint you and will want to do their best with the money you helped them grow.“

Can you believe this guy lost $204M on a trip to Las Vegas? Holy molly!

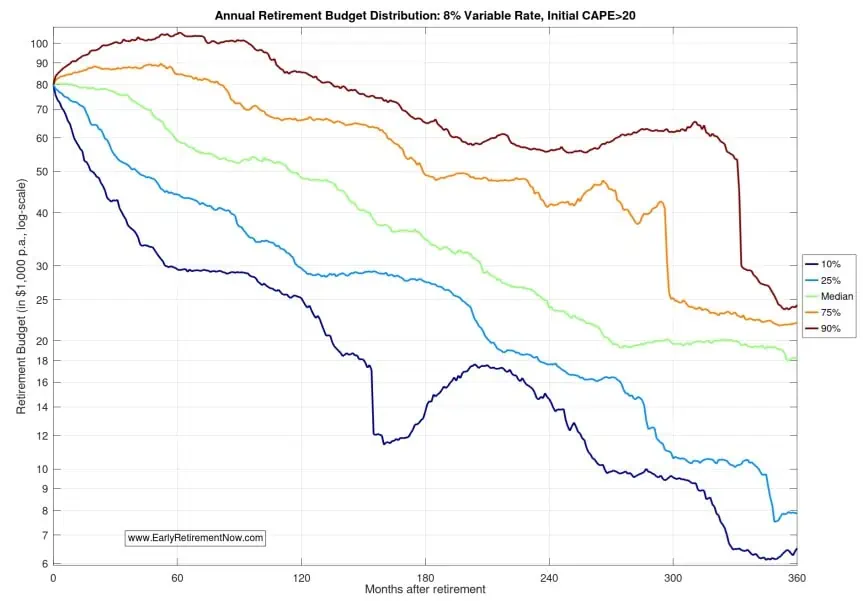

Dave Ramsey caused a HUGE stir in the FIRE community recently on two of his claims:

- Annual return of 12% on mutual funds

- An 8% withdrawal rate is absolutely safe

Be careful when it comes to investment and retirement recommendations! Always ask yourself, does the recommendation/suggestion/tip/advice make sense? It totally fair that you take what I write on this blog with a grain of salt.

Have a great weekend everyone!

Thanks again for sharing my post!

Re: Dave Ramsey, I totally agree that his advice is irresponsible. How many people will be irreparably harmed with this “advice”? Just awful.