It’s a new month and that means it’s time for another monthly dividend income update. For those of you who are new, I am doing these monthly updates to keep us motivated and accountable. I also want to demonstrate that it is possible to live off our dividend income once we are financially independent.

Based on our historical annual spending for the past number of years, we estimate we need somewhere between $50,000 to $60,000 in dividend income to cover our living expenses. Why the wide range? Simple – margin of safety. At a 4% yield, that means a dividend portfolio valued between $1M and $1.5M. Needless to say, it will take us a few more years to accumulate that much money in our dividend portfolio.

For the most part, we build our dividend portfolio by looking at products that we use daily or regularly. We then purchase companies that produce these products. For example, we use toothpaste, cellphones, and natural gas every day, so we invest in the likes of Procter & Gamble, Telus, and Fortis.

To diversify, we then utilize low-cost ETFs like VCN and XAW.

To be as tax-efficient as possible, we hold income trusts and REITs in our TFSAs and RRSPs. We only hold US-listed dividend-paying stocks in our RRSPs to avoid the 15% withholding tax on dividends. We only hold Canadian companies that pay eligible dividends in our taxable accounts. To minimize taxes, we strive to have roughly 50-50 dividend income split between Mrs. T and I once we are living off dividend. But it may not be 100% possible because we are a single income family. So a 40 (Mrs. T) – 60 (me) split may be more achievable.

For us, April was an interesting month. Due to COVID-19, we stayed home and practised social distance the entire month. That meant we didn’t get out of our house for the entire month, other than the couple of times that I went out to get groceries (and dropping groceries off at my parents). It was definitely a lot of work when both kids were around 24/7. Fortunately, the weather was quite good throughout April, so we were able to get some fresh air in the backyard and work on our garden. Both kids were also able to ride their bikes up and down the sidewalk to burn off some energy. We were also busy baking and making home-made meals the entire month.

April Dividend Income

In April 2020 we received dividend payments from the following companies:

- BCE (BCE.TO)

- Bank of Nova Scotia (BNS.TO)

- CIBC (CM.TO)

- Canadian Natural Resources (CNQ.TO)

- Dream Office REIT (D.UN)

- Dream Industrial REIT (DIR.UN)

- European Residential REIT (ERE.UN)

- H&R REIT (HR.UN)

- Inter Pipeline (IPL.TO)

- KEG Income Trust (KEG.UN)

- Coca-Cola (KO)

- Nutrien (NTR)

- PepsiCo (PEP)

- Rogers (RCI.B)

- RioCan REIT (REI.UN)

- SmartCentres REIT (SMR.UN)

- Telus (T.TO)

- TD (TD.TO)

- TC Energy Corp (TRP.TO)

- Domatar Corp (UFS.TO)

- Vanguard Canada All Cap ETF (VCN.TO)

- Ventas (VTR)

- Wal-Mart (WMT)

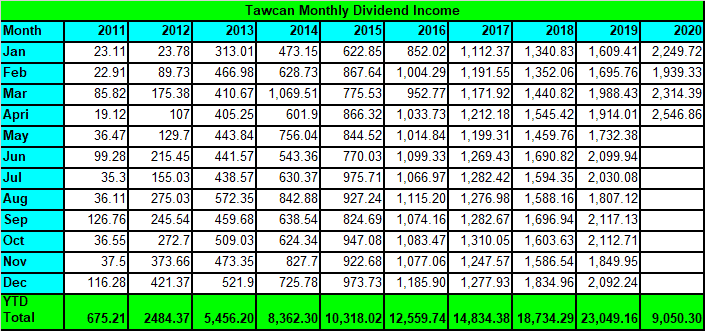

The 23 paycheques added up to $2,546.86, another all-time high! We have crossed the $2,400 and $2,500 per month dividend income milestones. Woohoo! However, this all-time record was bittersweet because Inter Pipeline continued to pay the pre-cut dividend rate in April. So starting in May we will see a drop in dividend income from Inter Pipeline. This will reduce our monthly dividend income by around $100. Furthermore, KEG.UN had cut its dividends by 63% and this reduction was reflected in our April dividend income.

It sucks to see all these dividend cuts recently but we remain grateful knowing that our dividend income is diversified and that our money is working hard for us so we don’t have to.

Out of the $2,546.86 received, $197.79 was in USD and $2,349.07 was in CAD or about a 10-90 split. April was a CAD currency heavy month. Please note, we do not convert the USD to CAD when reporting our dividend income. Instead, we use a 1 to 1 currency rate approach. Why do we do that? Because we want to avoid fluctuations in dividend income over time due to changes in the exchange rate.

The top five dividend payers for April 2020 were BCE, TD, IPL, BNS, and CM (not in order). The payout from these five companies added up to $1,666.31 or 65.4% of our April dividend income. It’s interesting to note that the three banks accounted for $1,256.51 or almost 50% of the April dividend income. Given that the Canadian big five banks have been paying uninterrupted dividends since the late 1800’s, I am not worried that TD, BNS, and CM accounted for the majority of our April dividend income.

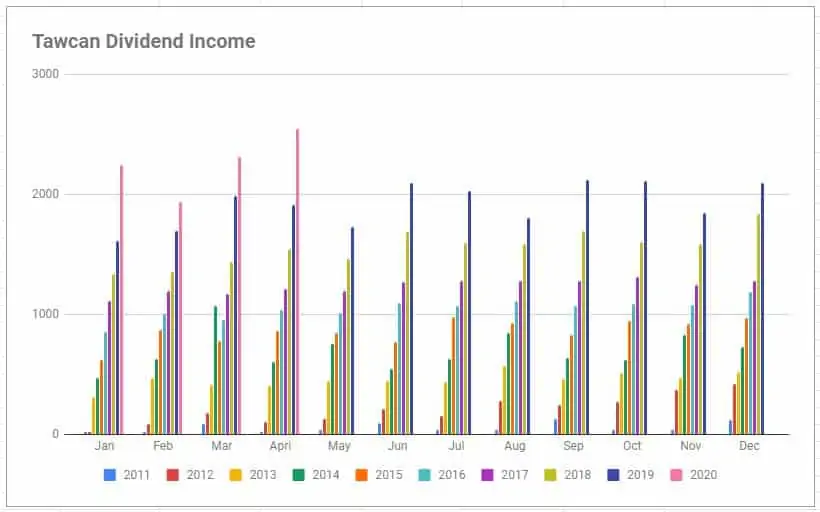

Dividend Growth

Compared to April 2019 we saw a YoY growth of 33.06%! After two months of sub 20% YoY growth, it was nice to see a big number again. I’m quite pleased to see such big YoY growth in April.

Dividend Increases

Even though the market was volatile in April, some companies continued to increase dividend payouts. It was extremely pleasant to see these announcements.

- Johnson & Johnson increased its dividend payout by 6.3% to $1.01 per share.

- Procter & Gamble increased its dividend payout by 6% to $0.7907 per share.

- Costco increased its dividend payout by 7.7% to $0.70 per share.

- Apple increased its dividend payout by 6.5% to $0.82 per share.

These raises have increased our forward annual dividend by $48.07. It’s not a lot of money but given the current market condition, I will take any increase over no increase at all.

Dividend Cuts

Unfortunately, we went through April with the news of yet another dividend cut. The KEG Royalties Income Fund declared a reduction of dividends from $0.0946 per share to $0.035 per share, or a 63% reduction. This has reduced our forward dividend income by $175.94. Ouch!

The dividend cut by The KEG was expected though, given that the restaurants have been closed due to the COVID-19 pandemic. It is actually a good idea for The KEG to reduce its dividend payouts during this tough time. I was a bit surprised that The KEG did not suspend the dividend payouts completely and declared that they plan to roll back to the $0.0946 per share payout in six months.

In April, we also saw a few major oil companies like Exxon and Shell either cut or suspend their dividend payouts. The low crude price is definitely hurting these oil producers. I am hopeful that Suncor will continue to pay dividends at the current distribution level but it wouldn’t surprise me if Suncor decides to suspend or cut its dividends. I guess we will have to wait and see.

Dividend Stock Transactions

Like the previous three months, we kept ourselves busy on the dividend stock transaction front. We continued to save money so we can invest. It also helped that we got received a tax refund when we filed our 2019 taxes. Rather than trying to time the market, we tend to invest money whenever we have some cash (keep a little in the reserve of course). We also tend to buy dividend-paying stocks on the days the market is red (i.e. down). With that in mind, we purchased the following stocks in April:

- 37 shares of TD @ 59.30 per share

- 43 shares of BMO @ $70.16 per share

- 75 shares of ENB @40 per share

- 26 shares of RY @ $84.60 per share

- 40 shares of XAW @ $25.37 per share

We added a little shy of $11,500 in fresh capital in April. These transactions added roughly $676 towards our annual dividend income.

In addition to the April dividend stock transactions listed above, we have added the following dividend stocks since January 1, 2020.

- 12 shares of CNR.TO @ $117.71 per share

- 450 shares of ERE.UN @ $4.67 per share

- 260 shares of BPY @ $18.22 per share

- 52 shares of BPY.UN @ 12.14 per share

- 100 shares of BEP @ $45.85 per share

- 20 shares of PEP @ $135.94 per share

- 57 shares of BMO.TO @ $77.62 per share

- 105 shares of TD.TO @ $67.84 per share

- 450 shares of IPL.TO @ $22.51 per share

- 94 shares of CM.TO @ $78.11 per share

- 36 shares of T.TO @ 52.15 per share

- 118 shares of SU.TO @ 30.63 per share

All these dividend stock transactions so far in 2020 meant we have deployed almost $57,500 in cash and added close to $2,800 towards our annual dividend income. Please note, I’m using a 1:1 exchange rate for USD and CAD, so the actual CAD amount is higher.

Looking back, the amount of money invested was roughly in line with how much money we added in 1H 2018.

One thing to keep in mind is that not all the $57,000 deployed was new cash. As some of you may remember, we closed out a number of positions in January (103 shares of ET.TO, 63 shares of CVX, and 44 shares of GIS) which resulted in $11,800. So we have added over $44,200 in new capital in 2020 so far. Needless to say, we have been very busy saving and investing.

Now some of you may look at the $44,200 and think, wow Tawcan and Mrs. T must make a lot of money to save $44,200 in four months! I can’t relate to them at all!

Well, remember, we are a single income family. My job pays well, but not THAT well. In reality, a portion of the money was saved in 2019 (i.e. we saved $12,000 in 2019 for the 2020 TFSA contributions and saved some money for the 2020 RRSP contributions). We also have quite a high savings rate each month.

If you compare the per share price listed above and compare the current price, you’ll notice that we are in the red for many of the transactions. That is because we purchased many of these stocks back in January and February. For the most part, I am not too worried about the stock price. I believe over the long term, the stock price will go appreciate above the pre-COVID-19 level.

Financial Independence Journey Update

One of the positives of staying home due to COVID-19 is that we spent less money in April. We spent less than usual on expenses like gas, eating out, and travels. Because of pre-school closure, we also saved around $300 in pre-school tuition for Baby T2.0l. We did, however, spend more money on groceries in April.

For the month of April, our dividend income of $2,546.86 was able to cover 86.5% of our monthly expenses, not including business expenses. It’s really neat to see our dividend income covering a pretty significant amount of our April expenses. But we also need to remind ourselves that April wasn’t a normal expenditure month. We basically stayed home for the entire month. Unless the stay-home-social-distancing order were to continue in May, we probably won’t see such a low monthly expense number again.

Summary

So far in 2020, we have received $9,050.30 in dividend income. If we were to simply extrapolate the number by simply multiplying the amount by three, we would end up with $27,150.90 for the entire year. But this is a simplistic view as we aren’t taking account of potential dividend increases, dividend cuts, and any additional purchases.

What’s pretty cool is that we already exceeded the annual amount we received in 2014 and only about $1,200 short of the 2015 annual dividend amount. We certainly have come a long way in the last few years.

To put our 2020 dividend income so far into a quantitative perspective it means the following:

- $9,050.30 earned in 121 days corresponds to an hourly rate of roughly $3.12 per hour. So our portfolio is making us money even when we are sleeping.

- $9,050.30 earned after 18 working weeks corresponds to an hourly rate of roughly $12.57 per hour. Our dividend portfolio is generating an hourly rate that is only $2 less than BC’s minimum wage of $14.60.

- If we were earning $40 per hour, this means $9,050.30 in dividend income has saved us over 226 hours or almost 6 weeks of work (i.e. Jan 1 to Feb 7).

It’s pretty neat to see all these hourly numbers.

Dear readers, how was April for you? Did you stay at home all month? How was your April dividend income?

Bob….just incredible my man. Holy cow! The food pictures look amazing. You’re one of my favorite accounts to follow on Instagram for that reason 🙂 It is great to see how involved your kids are in everything and I can’t wait to start doing that stuff with my daughter. Right now, she is too busy walking into everything haha

In terms of dividend income, what more is there to say, other than….HOLY FREAKING COW. Every month I come here, read your summary, and leave amazed. This is just great stuff Bob. Keep on inspiring all of us.

Bert

Thank you Bert, I appreciate it. You will have a lot of fun once your daughter is a bit older. 🙂

Talk about inspiring. That’s just awesome Bob. I love the pictures too of your family. I started cooking too to help save on costs.

It’s just crazy that you’ve already earned enough in dividends than you did in all of 2014. So, let’s see, you started in 2011 and it’s now 2020, so that’s about 9 years. I just started over from scratch, so I hope to be somewhat where you are in 2029! Haha.

Thank you Dividend Portfolio. It takes time to build up your dividend portfolio/dividend income. You’ll get to where we are soon too.

Very impressive month, Bob. Over $2,500 on the back of 33% YoY growth… Wow!

Your diligent saving and investing is inspiring. You are well on your way to $50K-$60K of dividend income in the future.

Those breads look delicious… they probably smell wonderful, too. Hard to beat fresh, homemade breads.

Wanted to mention that I was in Vancouver once (way back in 2000). Stayed a day there before catching a cruise to Alaska. I had a good time there, despite the rain that day. I got a chance to spend some time in Stanley Park… very pretty.

Thank you, $50-60k will happen in the near future, we’re sure of it. 🙂

Glad to hear that you had a good time in Vancouver. Should come back in the summer when the weather is better.

Good job, I enjoy your updates. You have definitely come a long way. Keep up the good work!

Thank you Compounding Norseman.

Hello Tawcan,

I’m a german so my english is not the best …. this is one of the first comments on a website outside from Germany ….. I am also a Dividend investor and wish you all the best … great blog … I come back …

Thanks a lot for the inspiration

Yours sincerelly

Uwe

Thank you Uwe.

HI Bob, Great article. Just a question about Investing in US Dividend Stocks in RRSP, Do you recommend buying US Stocks with CAD ( let’s say in Questrade). If yes, will the dividends be always in US Dollars? I would appreciate any strategy you have buying US stocks with CAD currency for first time in RRSP.

Hi Mark,

With Questrade you can trade in USD. You just need to find a way to convert CAD to USD efficiency. To do that, I’d suggest looking into Norbert’s Gambit.

Really enjoy your monthly updates. This will be a good test of your resolve as a dividend investor. IPL cut hurt but only a bit. Working on our small garden as well. Gave blood this week and was inspired your history of donating. Keep well.

Thanks Gruff403. Good for you on donating blood. 🙂

Sorry to hear about the dividend cuts Bob. If you recall from my guest post on the dividend scorecard (https://www.tawcan.com/the-problem-with-dividend-investing-creating-a-dividend-scorecard/) cutting dividends is a big no-no, and a indicator that business isn’t very strong.

Granted, Covid-19 is a special case… but any company that must cut dividends and recapitalize during this crisis, will probably dilute shareholders and destroy future returns.

Is it worth holding stocks like this? Depends upon the individual stock’s math.

Yup good reminder on keeping a close eye on the dividend scorecard. COVID-19 is definitely a special case that many companies got hammered because of the sudden economic changes. Still, we need to evaluate whether it makes sense to continue holding stocks that cut or suspend dividends on an individual basis.

First of all, kudos on those baking skills (you and wife). Those breads, especially sourdough, look really good! Congrats on another solid monthly showing. Yes, those dividend cuts can be painful but we all go through them as dividend growth investors. The key, as you know, is to stay diversified and keep investing to mitigate any future cuts. I can say that it is comforting seeing those dividends continue to roll in passively while active work is cut.

Thank you DivHut, the breads tasted amazing.

The key is definitely to stay diversified and keep investing. 🙂

Hey Bob,

Not sure if the +30% YOY growth and +$2,500 single-month record are more impressive, or if it’s the baking! Delicious on all counts.

As far as the portfolio, there’s a ton of overlap between our portfolios, and BCE is one of my top payers as well. I also aggressively added to my TD position (150% increase from 80 to 200 shares).

The dividend cuts/suspensions over the past while have been creeping in, but the stalwarts in the portfolio have been holding their own. All the more reason to stick to quality (and generally avoid cyclicals) in the portfolio rather than reaching for yield.

Take care,

Ryan

Thank you Ryan. I think more cuts/suspensions are coming but in the meantime will keep buying and increase some of the safer positions.

Great Going very impressive all time high dividend Congrats!! Any reason why you bought BPY in USD?

Thank you. Bought BPY in USD because we had money in USD.

Sorry to say this but I think you are going to have a couple more dividend cuts from your portfolio.

Given the current economic condition, that is definitely possible.

It is a given. Some of your holdings will not be able to maintain the current distribution. Not saying you should sell them here, but you should understand that and be ready.

Love the pictures of sourdough bread,wanted to make my own,started reading ,maybe soon will experiment.

Very good Payment for April ,we have common in BNS,PEP,KO,VTR,WMT.

Even i added BMO,RY right before the ex dividend date last month.

Thanks, the sourdough bread has been amazing. Mrs. T has been following this book – https://amzn.to/2LlsQZI

Hi bob, thanks for posting your dividend summary. It’s very helpful for new dividend investors. Question, would it be possible to add the total amount invested annually to generate the returns you have? That would be helpful for newbies like me to understand how much money we need to invest to get the amount of income you have. Thanks!

Hi Shyla,

I don’t specify the portfolio amount for privacy reasons. To answer your questions you can take a look here:

https://www.tawcan.com/your-dividend-and-index-etf-questions-answered/

https://www.tawcan.com/dividend-portfolio-beating-the-tsx/

Will be interesting to see what Q2 financial updates from all the corporations looks like and what affect that will have on the stock market in July. Very impressed by the steady climb your dividend work has yielded.

Yes it will be very interesting. Our dividend income moving forward will be impacted due to all the different cuts and suspensions. 🙁

Another fantastic month Bob

We have been baking up a storm over here as well. An absolute monster total and month overall. How cool is that seeing your income covers 84% of your expenses last month?

Like you our expenses are way down, but with all the free time I had we put a lot of $ into house projects.

That is a tonne of income just from those banks… =) I always debate if my banks are overweight, kinda reassuring seeing your positions. lol

Anyways keep it up, the amount of cash you have put to work in 2020 already is fantastic and the totals will continue to increase.

cheers man!

Congrats on a record April! Nice earning over $2,500 and 33% YOY growth! Sucks to see dividend cuts (I got my first one last week), but the snowball will continue to grow on. Anyways, keep up the impressive work! 🙂

Thank you My Dividend Dynasty. Yea it sucks to see dividend cuts or suspensions. Will continue to add cash and buy more dividend paying stocks.