I love receiving reader emails. If you have any questions feel free to contact inie. 🙂

A few days ago, a reader asked:

I’m just wondering if you have any comments on Questrade vs. National Bank Discount Brokerage for commission free ETFs. Do you think one is better than another?

As some of you may have heard, National Bank Discount Brokerage recently announced that they are elimination ETF transaction fees.

What does this mean? Upon a closer look I discovered the following key points:

- Commission free ETF trading is only for Canadian listed ETFs

- Minimum of 100 shares per trade is required

- No restrictions are placed with respect to account size or number of transactions

- For US listed ETFs, commission fee is $9.95 per trade

Meanwhile, Questrade has been offering free commission when buying ETFs for a few years. A bit on Questrade’s commission free ETF trading:

- Commission free when buying ETFs

- $4.95 commission when selling ETFs

- Electronic communication networks (ECNs) fees may apply

National Bank Discount Brokerage vs. Questrade

If you’re a casual investor like myself, which brokerage account is better?

A bit of background first. While we invest primarily in individual dividend paying stocks, we do hold index ETFs in our dividend portfolio and RESPs. For RESP we are utilizing Canadian Couch Potato’s Vanguard model portfolio.

For our dividend portfolio, we usually buy a few shares of ETFs each time using the left over cash from DRIPs. For RESP, we contribute $2,500 per year for each kid and use the cash to re-balance their index portfolios (3 and 5 ETF funds respectively). In both scenarios, we rarely buy more than 100 shares per trade. Furthermore, for Baby T1.0’s RESP, we are trading US listed ETFs like VTI and VXUS.

If we were using National Bank Discount Brokerage, our ETF buying habits mean we won’t qualify for commission free ETF trading. We would be paying $9.95 per trade.

On the other hand, if we were using Questrade, we can purchase both US and Canadian ETFs commission free. There’s no restriction on how many shares we need to purchase each time. We can buy as few as one share and build up the portfolio over time.

In our case, Questrade is the better discount broker to use.

However, if you buy and sell ETFs in 100 shares or more regularly, National Bank Discount Brokerage might be the right choice for you.

What is ECN fee?

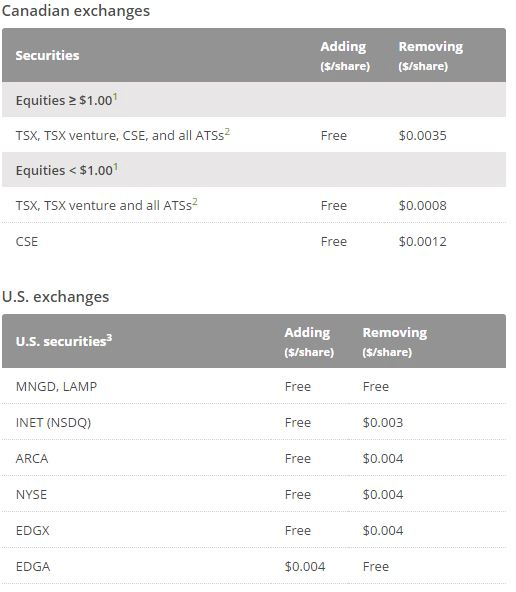

It can be a bit confusion when purchasing ETFs with Questrade, because you may be subject to ECN fees. As you can see below, ECN fees are applied on per share basis. Since ETFs are typically greater than $1, the ECN fee is $0.0035 per share on Canadian listed ETFs and $0.004 per share on US listed ETFs.

It’s a very small amount if you think about it. If you were to purchase 100 shares, that’s $0.35 for Canadian listed ETFs and $0.04 for US listed ETFs

How to avoid ECN fees with Questrade?

As you can see from the table above, ECN fees do not apply on every trade. They are only charged when a buy or sell order removes liquidity.

Huh? What the heck does removing liquidity mean?

If your order is filled immediately after you place it, you’re removing liquidity. So if you place a market order, you will be charged ECN fee. This also includes any limit orders where you set a price that is either above the ask (when buying) or below the bid (when selling) price. Just like a market order, these limit orders will usually be filled right away, so Questrade will charge you ECN fees.

So how do you avoid ECN fees when using Questrade?

Simple. When buying, place a limit order with a price that is lower than the ask; when selling, place a limit order with a price that is higher than the bid. Since these orders are not likely to be filled immediately, they are considered as adding liquidity to the market. So when these orders are filled, Questrade won’t charge you ECN fees.

Confused? Please allow me to give a quantitative example.

Imagine we’re trading VCN, Vanguard Canada All Cap Index ETF. The quote looks like this on Questrade:

- Last: $28.95

- Bid: $28.97

- Ask: $29.00

- Vol: 17.80k

- Bid Size: 159

- Ask Size: 120

In this example, the ETF is currently trading at a price of $28.95 with $28.97 bid and $29.00 ask.

If we are looking to add VCN in our portfolio and want to pay $0 commission and $0 in ECN fees with Questrade, we would place a limit order below the ask price. For example, we would place a limit order at $28.96. Since our order will not be filled right away (assuming the bid & ask do not change quickly), and we are adding liquidity to the market, we won’t incur ECN fees.

Unfortunately, if we are placing an order in odd lots (i.e. not in blocks of 100 shares), we can incur ECN fees.

Why? Because an odd lot can remove liquidity from the market even if we place a limit order with price below the ask price (when buying) or above the bid price (when selling).

So in our case where we often purchase less than 100 shares of ETFs, we will incur ECN fees regardless.

Is this a big deal? I do not think so, given that the ECN fees are such small fractions of the entire purchase. If we buy 10 shares of VCN at $28.96, we would be paying $0.035 in ECN fees, or roughly 0.01% in fees. This is certainly less than if we were to pay $9.95 per trade (~3% in fees) when using National Bank Discount Brokerage.

Final Words

Considering our ETF trading habits and we’re still in the accumulating phase of our financial independence journey (i.e. buying only, not selling ETFs), Questrade’s commission free ETFs is a way better option for us than National Bank Discount Brokerage’s commission free ETFs offering.

We do like using Questrade for buying international ETFs like the iShares ex-Canada ETF XAW and also the new all-in-one ETFs.

Dear readers, what do you think about my assessment? Do you plan to use National Bank Discount Brokerage given the latest announcement?

PS: Looking to open a Questrade account and wanting to get up to $250 of rewards? Please contact me for referral code. Alternatively you can use my QPass Key 335712213387087 when signing up. You can receive from $25 to $250 of cash reward depending on your account size.

Two non-financially literate adult children in their 20’s are starting their investment path. Questrade and an all-in-one equity ETF seems like the way to go for them (simple one stop shop, long investment horizon, auto-rebalancing, low fees …). My question is, do you have any recommendations for a simple way for them to monitor their investments.

You might want to take a look at this spreadsheet – https://www.tawcan.com/using-google-spreadsheet-for-etf-investing/

Wealthica is always good for tracking – https://www.tawcan.com/wealthica-review/

Commission-free trades both ways on all Canadian AND American ETFs at NBDB.

Bob,

I’m actually in the process of moving my RESP from RBC DI to NBDB. At the moment, NBDB is the ONLY brokerage that supports the $1200 BC government grant that is given to kids who turn 6 (https://forums.redflagdeals.com/bctesg-resp-self-directed-investment-accounts-2072699/). Your kids are still young, but unless Questrade starts supporting the grant, I think that the differences in ETF commissions are minor at this point.

Thanks, very interesting info, will have to take a look on this.

Also, looks like you can’t apply until kids turn 6. That’s in 3 years time for Baby T1.0 and 5 years time for Baby T2.0. In 3 years, who knows, maybe Questrade will support the application.

That is correct. I have an 8 year-old, and a 5 year-old, so I need it now. I hope that in 3 years all brokerages will support it!

I’ll let you know how things to with NBDB. I’m excited about the free ETFs. I’ve been tempted by Questrade, but I heard from a couple of people a while ago that Questrade made mistakes in transactions that they had to manually fix. That made me hesitant to go with a smaller brokerage. Things might have changes since then. NBDB offers a good compromise. It comes from the 6th largest bank in Canada, and has free ETFs when transactions are larger than 100 shares. BTW, in your article you state “Minimum of 0000 shares per trade is required”. I think you mean “Minimum of 100 shares per trade is required”.

Just a couple points.

1) My brokerage is Questrade and I have not been able to find a straight for-sure answer to my question, which was do other brokerages charge an ECN fees? From what most of the articles I’ve scoured online show, Questrade is the only one, but after contacting Questrade, they insist they don’t charge this fee, rather the market charges it, its just they are transparent about it. So after inquiring with a prominent PF expert in the TO area, they also are not sure, but agree with my suspicion that perhaps ECN fees are being charged at other brokerages, they just simply hide it in the commission cost. Not sure, but a straight answer would be nice if I finally find one. 🙂

2) There is a great article by Dan over at CCP (http://canadiancouchpotato.com/2014/12/18/understanding-ecn-fees/) that talk about ECN fees and trying to avoid them can be foolish because of the potential opportunity cost and I tend to agree with him, its just a reasonable trade off

Thanks for the insightful comment. I agree, many other brokers probably just hide the ECN fees inside the commission cost.

just read the article very carefully, and noticed that 100 shares x $0.0035 = $0.35, not $0.035.

Thanks for pointing this out. Fixed.

Hi Bob!

I found your blog through Google when I was trying to find out why I was charged fee while buying ETF at Questrade (I saw it at the order screen). Once I read this article I went to my account right away and changed quanity multiple to 100 (the price was lower already). TA-DA! Fee became ZERO! You saved me around 10 bucks (I’m in process of transferring funds from TD and setting up my portfolio at Questrade). Interesting enough I would be charged ECN fee for WHOLE amount of units!

Now I know ECN little dirty secret thanks to you! Thank you very much for your blog and info you are sharing!!!! Nobody else told me that 🙁

Also congratulations for making it to the MoneySense magazine! 🙂 All the best to you and your family! Please keep this great work!

With best regards

Great to have helped you save some money Aleks. 🙂

Good points Tawcan,

I use Questrade for all my ETFs and small stock purchases because of their ultra low commission fees. I don’t bother about ECN as it is very low compare with commissions charge by other brokerages.

Cheers,

I typically don’t bother with ECN as well but if I can avoid paying extra fees I try to do that.

Interesting Tawcan, shame I don’t know hardly anything about these 2 and it’s sad these options aren’t available in Australia. Free brokerage is a really option, though – very jealous!

Tristan

Sounds like there needs to be a trading revolution in Australia. 🙂

Thanks for the review.

I have been considering doing a review of the two brokers I’ve used (RBC DI & Questrade) to compare the two.

And I’m glad you mentioned the ECN fee’s because I was unaware of those when I switched to Questrade at first. I had to learn the hard way. I had been placing trades on HOU/HOD and was getting charged as high as nearly $28 on the buy/sell with the ECN. But if you trade USD ETF’s then you avoid that cost. I began trading UWTI/DWTI instead and never paid more than $10.00 for the buy and sell. When trading higher volume ETF’s like these, they fluctuate so much that you still get dinged with ECN fees. But the method you mentioned to avoid them would be perfect for less volatile equities.

RBC DI is ok for long term investing, but it’s still overpriced. I’m much happier with he platform available on Questrade too.

I’ve never looked into National Bank, but like you, I think Questrade fits my current investing habits best. Thanks again!

ECN fees can be confusing. It might be hard to avoid it on higher volume ETFs.

Not sure if this only applies to US investors, but I use Charles Schwab and they don’t charge any commissions to buy or sell ETFs. I did notice when I recently sold some there was a very small fee and I think it was probably what is described as the ECN above.

That’s great that Charles Schwab offers no commission ETF trading too.

I believe in the US, the equivalent to the ECN fee are called SEC fees which is $0.00002180 x value of the trade.

I’ve used Etrade/Scotia I trade, TD waterhouse RBC discount and now Quest Trade.

I switched to RBC due to not having to wash my money like I had to at Itrade. Now all major brokerages let you trade in US dollars without paying the currency fees like they used to (was about 1% per exchange which adds up)

I find Quest Trade to be the Best platform at the moment for the reasons you list. But saying that I’m also in the process of opening an Interactive Brokerage account to try trading small amounts of covered calls.

Steve

I have no used Etrade or RBC discount. Have only used TD Waterhouse and Questrade so far. Liking Questrade a lot.