In 2009, when Personal Capital first came out, I decided to give it a try but quickly found out it was designed for Americans only. Personal Capital couldn’t access Canadian financial institutions so it was pretty much useless for us Canadians. Fortunately, some smart Canadians decided to solve this issue by building Wealthica, a net worth and portfolio tracking app that is like the Canadian version of Personal Capital. When I first stumbled upon Wealthica, I was very intrigued. I was very curious whether Wealthica would work better than the good old Excel spreadsheet. The different free Wealthica add-ons also looked like they could be useful analysis tools. After using Wealthica for some time, I really enjoyed using Wealthica and here’s my unbiased Wealthica review.

Although I don’t share our net worth here on this blog, I have been tracking my net worth since 2006. When Mrs. T and I started living together and eventually got married, we combined our finances and started tracking our net worth together. Being an Excel nerd, I built a net worth spreadsheet that we use for tracking our net worth quarterly. I have personally found that Wealthica is a great tool to use for monitoring our net worth and tracking our investment portfolio.

What is Wealthica

Wealthica was co-founded by Simon Boule, Martin Leclair, and Eric Chouinard in April 2015. The three co-founders had a problem statement: How can they easily track their complete investment portfolio from multiple Canadian financial institutions? And like that, Wealthica, the investment tracking web and mobile app was born.

To me, Wealthica is the Canadian equivalent of Personal Capital, except Wealthica is founded by Canadians and built specifically for Canadians!

Since many Canadians use multiple financial institutions, it can get very time consuming and tedious whenever you update your net worth or want to track your investments. For example, we use TD, Coast Capital, Questrade, ShareOwners, and Solium Shareworks. When we update our net worth every quarter, we’d have to log into every account, and enter the numbers in our spreadsheet. It is time consuming to pull all these data and it is difficult to get a quick look at the real-time value of our investment portfolio on one single page and track the historical performance closely.

The beauty of Wealthica is that you can do all that! You can see all of your investments in one single place. After connecting your accounts with Wealthica, Wealthica then pulls data from your financial institutions, synchronizes your account balances automatically, and aggregates the results on one single page. The different add-ons then provide further analysis on your investments.

As of this writing (July 2020), Wealthica tracks over $6.1 billion in assets and supports over 100 Canadian institutions. If there’s a financial institution that Wealthica doesn’t support, you can enter the information manually. Weathica is also actively working on expanding the number of financial institutions it can support.

Is Wealthica Free?

Yes Wealthica is free! You can create a Wealthica account and use it for free. As a personal finance blogger, I like when things are free!

How can something so good be free? You’re probably wondering.

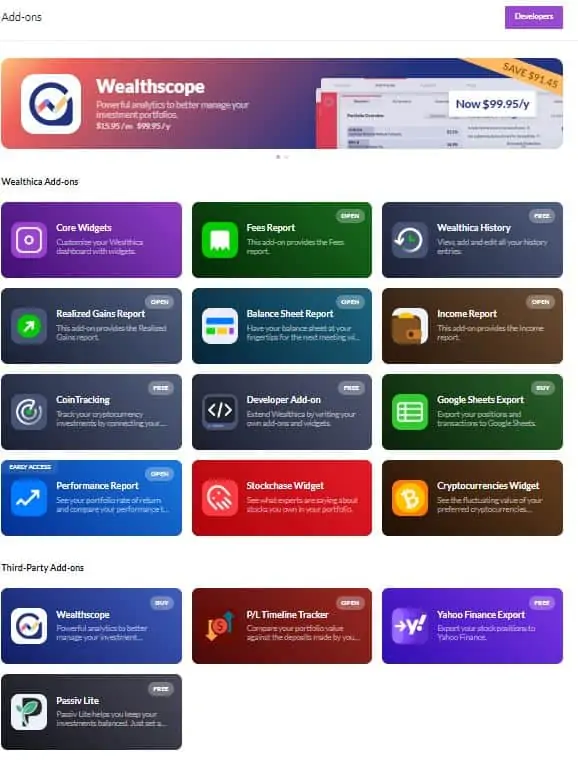

Well, Wealthica has some add-ons like the Wealthica Google Sheet Add-On and Wealthscope Add-On that you have to pay monthly or annually to gain access.

How Wealthica works to track your net worth & portfolios

As mentioned, Wealthica allows you to easily see all your investments in one place. After connecting Wealthica to your financial institutions, Wealthica then pulls data from your financial institutions and aggregates the results on the investment dashboard. Every day, Wealthica automatically synchronizes and updates your account balances. If there’s a synchronization error, Wealthica sends a notification email so you can log in and address the issue.

I’ve found Wealthica extremely useful if you have accounts with multiple Canadian financial institutions and being able to see everything on one single page. For example, I have my taxable account and TFSA with TD, RRSP with Questrade and SunLife, Mrs. T has her taxable, TFSA and RRSP accounts with Questrade, and we have two kids’ RESPs with TD and Questrade, and their dividend portfolio with ShareOwner. With Wealthica, we can take a look at the Wealthica Dashboard and get a good sense where our net worth is going.

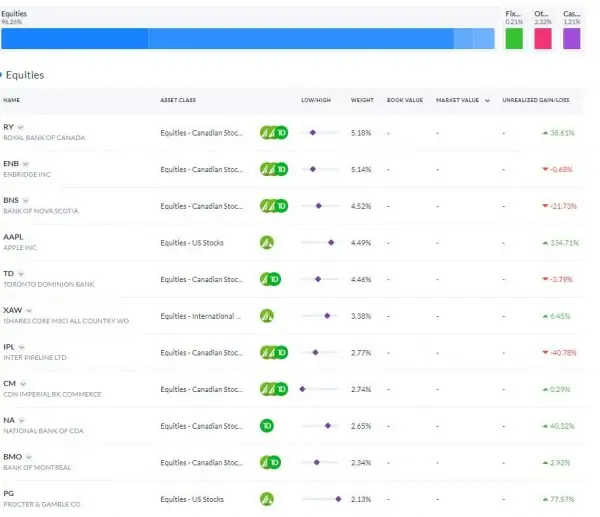

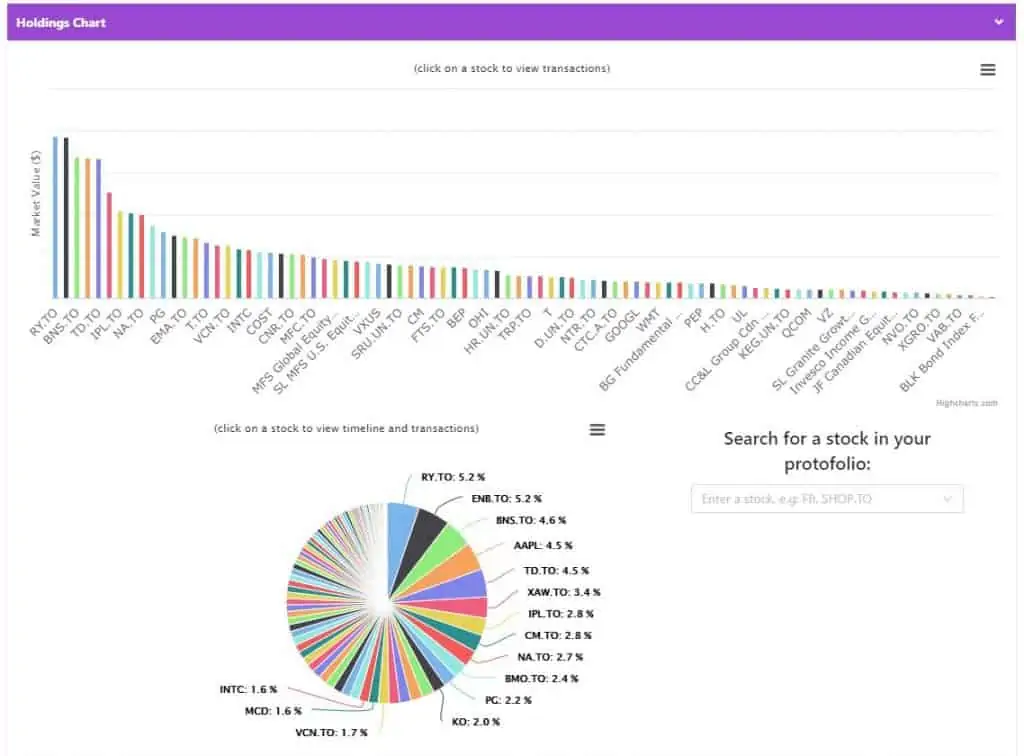

Wealthica can also collect data from the different financial institutions and consolidate them. For example, we own Bank of Nova Scotia (BNS.TO) in TSFA, RRSP, and taxable accounts with TD and Questrade. When BNS.TO is displayed in the Wealthica Holdings Dashboard, Wealthica consolidates all BNS.TO shares into one listing with weighting, book value and unrealized gain/loss info all calculated. Although the same thing can be done in a spreadsheet as well, Wealthica’s Holdings Dashboard is more elegant and is done all automatically.

Wealthica’s Holding Dashboard is where I can quickly take a look at our top 10 holdings in real-time and allow me to take a closer look at our investment portfolio.

Wealthica has made everything so much easier! It is a time saver!

How does Wealthica make money?

If Wealthica is free, how do they make money and stay in business? Well, Wealthica makes money by selling add-ons like Google Sheet Export and Wealthscope to users. These add-ons provide more advanced reports and analysis.

It is also highly possible that Wealthica will one day offer investment services like Personal Capital and Wealthsimple to generate additional revenues.

Is Wealthica Safe & Secure?

One of my biggest worries when it comes to online financial tracking tools like Wealthica, Personal Capital, and Mint, is security. If I provide Wealthica my account login credentials, does this mean other people can gain access to my login credentials and move my money?

After looking at Wealthica’s security page, my worries were eased. Wealthica uses the latest bank-level security and encryption technology to ensure all financial information is protected and encrypted. Furthermore, Wealthica only has read access to your financial institutions. In other words, Wealthica can only read and save all brokerage data to build a visual dashboard of your investments. Wealthica does not have the ability to trade, transfer money, or withdraw funds. In addition, you can set up two-factor authentication in your Wealthica account for enhanced security. When this is set up, a security PIN is sent to your smartphone to authorize login from a new device.

Wealthica uses cloud services provided by Amazon Web Services (AWS) which is used by millions of businesses and is extremely secure. For some financial institutions like Questarde, Wealthsimple Wealthbar, and Interactive Brokers that utilize Application Program Interface (API) access, Wealthica can access accounts with these financial institutions with API without needing to share credentials.

No wonder Canadians have trusted Wealthica to track over $6.1 billion in investment assets!

Wealthica Investment Dashboard & Wealthica Add-ons

Wealthica Investment Dashboard is a great place to take a quick look at your net worth and your investment performance over the last 7 days, 30 days, 90 days, 6 months, or 12 months. Wealthica also provides some awesome free and paid add-ons that provide additional reporting or analysis.

Balance Sheet (Free):

The Balance Sheet add-on provides a snapshot of your overall net worth. The add-on consolidates all of your assets and debts per asset type. I also really like how it breaks things up into non-registered and registered investments. You can also compare your balance sheet between two different dates.

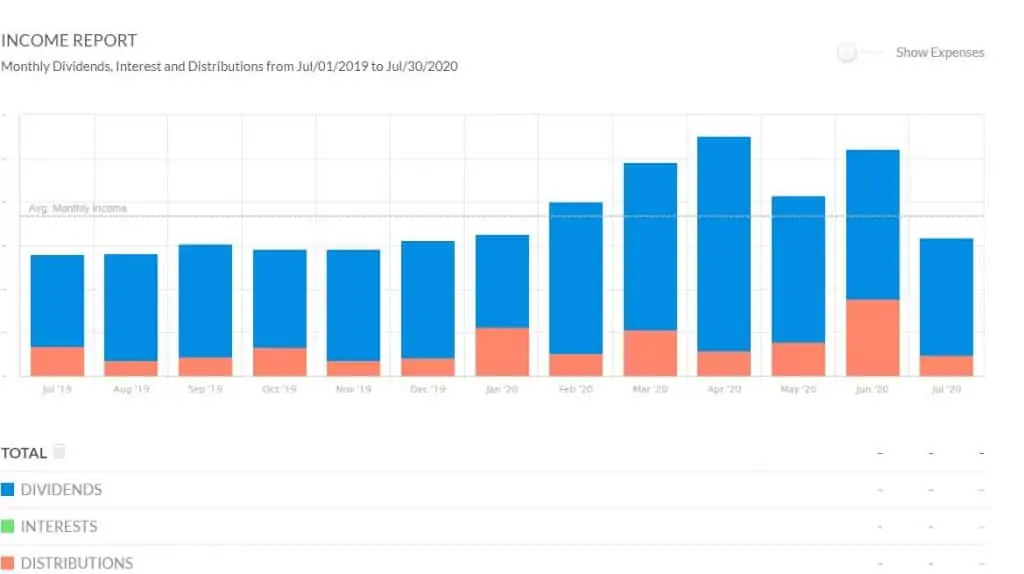

Income Report (Free):

This add-on is a perfect add-on for income investors like us. It adds up any investment income each month, including dividends, interests, and distributions. Everything is converted into CAD with a very accurate exchange rate. Since we use a 1:1 USD to CAD exchange rate in our monthly dividend income reports, it is very interesting for me to see our consolidated monthly income in CAD.

Fees Report (Free):

The Fees Report tallies how much fees you are paying over time and across the different financial institutions. The add-on also provides an analysis of how much in percentage you’re paying each year in fees. The real eye-opener is the Fees Report can estimate how much money you’d spend on fees over 30 years.

I feel that the Fees Report is a very excellent free add-on and everyone should enable it within their Wealthica account.

Realized Gains Report (Free):

This add-on provides a report on gains and losses you have realized over time. You can see whether you come out ahead on these trades or not.

Performance Report (Free):

The Performance Report add-on allows you to see the rate of return of your portfolio and compare your performance to major North American indices like the S&P/TSX Composite Index, NASDAQ Composite, and Dow Jones Industrial Average. It’s a great tool especially if you are buying individual stocks like us and want to track your performance over time.

CoinTracking (Free):

If you are trading cryptocurrency like Bitcoin, CoinTracking is a great Add-on to allow you to track your cryptocurrency investments alongside with other investments. In case you’re wondering, CoinTracking supports over 5,000 cryptocurrencies and imports your data automatically from most popular exchanges like Binance, Bitfinex, Coinbase, Cryptopia, and Kraken.

Developer Add-on (Free):

If you’re a developer, the Developer Add-on allows you to write your own add-ons and widgets. By using this add-on, you can also install add-ons and widgets from untrusted third party sources to your Wealthica Dashboard. This is an advanced setting and is not recommended for the average Wealthica users.

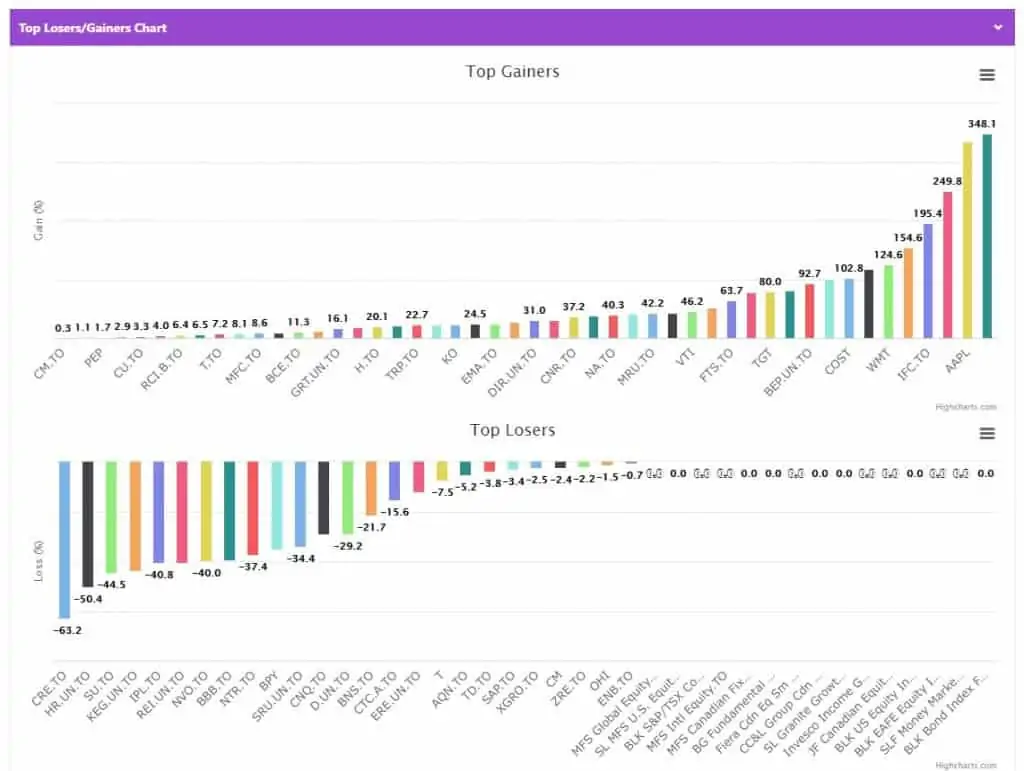

P/L Timeline Tracker (Free):

P/L Timeline Tracker is a neat add-on that I really like. It compares your portfolio value against the deposit made by you over time. You can easily get visual representations of your profit and loss over time and how well your portfolio has performed.

This add-on also displays the top gainers and losers in your portfolio, which I think is great to be able to see everything visually.

Passiv Lite (Free):

Passiv Lite is a tool that can help you rebalance your portfolio. You simply set a target and follow the trades. This is a useful tool for keeping a balanced ETF portfolio. If you trade individual stocks like us, you can also set a target percentage for each stock and Passiv Lite will compare your target to the actual holdings.

Google Sheets Export (Paid):

For $5.99 per month, Google Sheets Export does exactly as its name suggests—it exports your positions and transactions to Google Sheets. You can then do your own analysis with these sheets.

Wealthscope (Paid):

Wealthscope costs $15.95 per month or $99.95 per year. This paid tool by PW Portfolio Analytics Inc provides powerful analytics to better manage your investment portfolios. For example, Portfolio Scorecards reviews your portfolio score and provides an in-depth analysis; Portfolio Comparisons allows you to analyze how your Portfolio Score may change before you buy or sell an investment asset. The extra analysis may be worth the extra fee for some Canadians. For us, we didn’t pay for Wealthscope and decided to stick with the free add-ons.

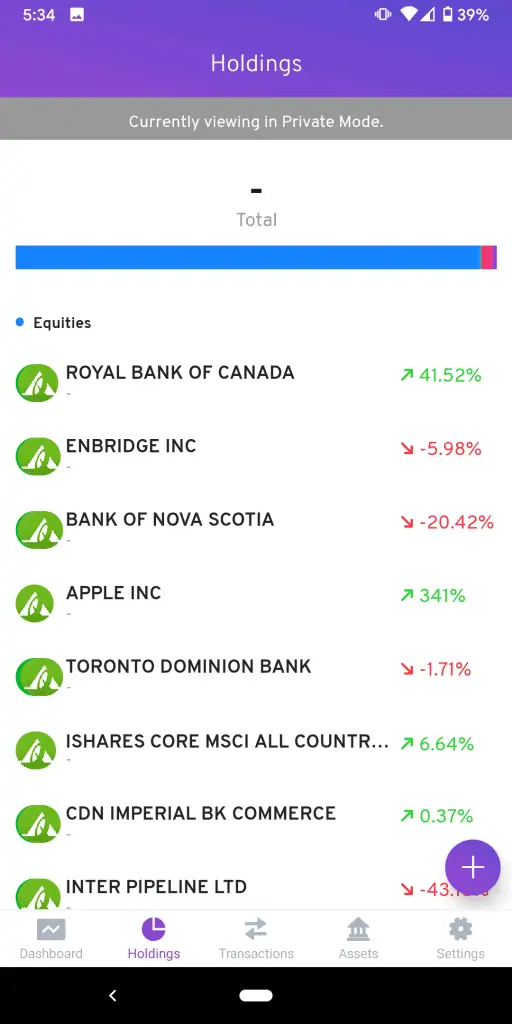

Wealthica Mobile App

For the most part, I have been using Wealthica on the desktop and haven’t played too much with the Wealthica Mobile App. From my limited experience, the Wealthica Mobile App has limited capabilities and does not support the powerful Wealthica desktop add-ons.

Basically, the Wealthica Mobile App allows you to see your overall net worth, the number of holdings you have, the transactions you have made, and the different assets and liabilities you have.

For me, I prefer using the desktop version of Wealthica as it provides far more useful information than the mobile version.

Wealthica Review – Pros and Cons of Wealthica

After using Wealthica, there are definitely some things I really like and some things that I wish can be improved. My review of Wealthica and these pros and cons of Wealthica are purely my personal opinions, you may have different opinions than me.

Wealthica Pros

- It’s free! If you want to have a place to track your net worth and your portfolio value, Wealthica is perfect for you. If you’re looking for a Personal Capital alternative for us Canadians, Wealthica is the perfect app.

- Consolidated reports. I really like that you can look at your net worth and portfolio value in real time. You can also track these numbers over time. You don’t need to log into all your financial accounts and tally all the numbers in an Excel spreadsheet. Everything is done for you, automatically.

- Secure fully encrypted. API access. Wealthica uses the latest and highest level of security and everything is encrypted. By using API access, Wealthica can access your accounts without sharing any credentials.

- Email notifications. If there are any changes to your accounts or any sync errors, Wealthica emails you a notification. You can change your email preference under user preferences to determine when and how often you get email notifications.

- Income report. I’ve really come to like the Wealthica Income Report where it automatically adds up our monthly dividends, interests, and distributions. Best of all, Wealthica automatically converts everything into CAD. Since we’ve been reporting our monthly dividend income by ignoring the exchange rate (i.e. 1:1 for USD to CAD), it is nice to see what our monthly income is like in CAD.

- Fees report. Wealthica adds up all the fees you’ve paid over time including commission fees, foreign tax withholding fees, ADR agency processing fee, etc. You can also see the average transaction fee of each account and the fees as a percentage of each of your accounts. The best part of the fee report is the 30-year projection and how much fees you’d pay in 30 years.

- Family Office option. This is one of the options that Wealthica offers so you can share the same dashboard with other family members. In other words, you can track your net worth by family members and provide a one-page financial picture for each family member. This can be quite useful when you want to get your kids involved in family finances.

- Share with your Advisor. If you use a financial advisor, you can share with them restricted access to your Wealthica dashboard, so they can gain a better understanding of your finances.

- Private mode. In both Desktop and Mobile apps, you can “enable” private mode so the no values show up. This is quite useful if you’re checking Wealthica in less private settings or want to share your net worth or investment portfolio performance with friends without displaying real values.

- Share aggregation. This is probably one of my favourite features of Wealthica. Once you connect Wealthica with your financial institution, it goes in and pulls data from the different accounts. It then aggregates all the data into one. For example, say we have 100 shares of Bank of Nova Scotia (BNS.TO) in my TFSA at $30 per share, 250 shares of BNS.TO in my taxable at $32.50 per share, 50 shares of BNS.TO in Mrs. T’s RRSP at $40 per share, Wealthica automatically adds up all the shares, calculates the book values, and displays it in the Holding Report as 400 shares of BNS.TO with a book value of $13,125. It also shows the weighting of BNS.TO, the market value, and the unrealized gain/loss.

- Performance comparison. With the Performance Add-On, you can compare your portfolio performance with other major North American stock indices. This is where we can easily determine whether we are beating the TSX or not.

- Easily Compare between two dates. If you are curious about how your net worth looks over time, the Compare Mode in the Balance Sheet Add-On allows you to compare two dates. The add-on then displays the percentage and dollar amount increase or decrease between the two dates.

- Easy P&L Analysis. I’ve found the P/L Timeline Add-on to be an extremely useful tool. I can see deposits vs. portfolio value timeline and the P/L ratio timeline. I can also quickly see the top loser and gainers in our portfolio.

- Additional useful add-on’s. I didn’t pay for the Wealthscope and Google Sheet Export add-on’s but I can definitely see how both can be quite useful. In addition, some of the free add-ons like Passiv Lite and P/L Timeline Tracker are really powerful tools. As more and more people use Wealthica, I believe more free and paid add-ons will get developed.

All unbiased reviews must include some downsides. Therefore, in this Wealthica review I’ll share with you some things in Wealthica that I didn’t like so much. Hopefully Wealthica can fix these in the near future.

Wealthica Cons

- Sync errors with beta financial institutions. Some financial institutions are in beta stage and may not sync properly. For example, Coast Capital Savings is in beta stage. For the longest time, whenever I’ve tried to connect Wealthica with Coast Capital Savings, the connection would time out so Wealthica couldn’t pull any financial data from our Coast Capital Savings accounts. Eventually I was able to get Wealthica to connect to Coast Capital Savings properly. However, Wealthica only displays our chequing account and does not display the different savings accounts we have with Coast Capital Savings.

- Non supported financial institutions. ShareOwner isn’t supported by Wealthica so we can’t connect the two kids’ dividend portfolio with Wealthica. Although Wealthica supports more than 100 Canadian financial institutions, some Canadians may find that Wealthica doesn’t support some smaller Canadian financial institutions.

- Only works with Canadian financial institutions. If you have non-Canadian accounts, you can’t track them with Wealthica. For example, Mrs. T has a Danish bank account, so we can’t track the account balance with Wealthica.

- Some data must be entered manually. The value of real estate properties must be entered manually on Wealthica. Some liabilities like mortgages must also be entered manually. For data entered manually, Wealthica doesn’t synchronize the balances automatically so you must update them manually. If you own multiple properties and have multiple mortgages, this can be a tedious process to manually update these accounts regularly. It would be great if Wealthica can one day pull real estate values from government assessment pages and mortgage balance from your mortgage provider.

- No technical support. When it comes to technical support, there’s no such thing yet. You can’t contact the Wealthica team via online chats or phone. There, however, is a Reddit support forum and an email you can raise questions with.

- It can be too much information for some. While I really like how Wealthica displays everything on one page and found the additional add-ons are super useful, information overload may happen very quickly. To avoid that, I’d suggest not enable every single add-on and limit the amount of analysis you do within your Wealthica account.

- Huge fluctuations. If you don’t add all your assets and liabilities at the same time and add some at a later date, this will create huge fluctuations in the Dashboard. One time Wealthica had some syncing error with Questrade. I resolved the issue by removing our Questrade accounts and reconnecting them again. However, I forgot to remove all historical data and that caused a huge fluctuation in our net worth. The same thing can also happen when you add your mortgage balance, for example.

Summary – Wealthica Review

Overall my review of Wealthica is positive. While I still use my trusty spreadsheets to track our dividend portfolio, dividend income, and net worth, I found myself using Wealthica more and more. Wealthica is a really great tool where you can see all your finances on one page. It’s also great for tracking your investment portfolio and monthly investment income. The graphical displays and the ability to enable private mode is really useful as well. My favourite part of Wealthica is its ability to aggregate all my shares and show me the overall weighting and the unrealized gain/loss. Rather than tracking everything in a spreadsheet and entering the different formulas, it is extremely easy to track the Adjusted Cost Basis (ACB) in Wealthica. If you’re using Questrade, I think Wealthica is the perfect tool to track your investments.

While there are a few downsides to Wealthica, I am optimistic that they will get resolved by the Wealthica team and developers in the near future.

For the longest time, us Canadians are being ignored by Personal Capital and it is great to finally see a tool made by Canadians, built for Canadians. Wealthica is a great tool for Canadians to track their investments and net worth effortlessly.

Best of all, Wealthica is free which makes it very accessible to all Canadians. Needless to say, my review of Wealthica is overwhelmingly positive, and I am sure it will be the same for you as well.

Dear readers, have you tried using Wealthica? What’s your experience so far with Wealthica?

I just stumbled onto Wealthica a couple of weeks ago. I am also leery of security concerns. I’ve read the security promises on Wealthica’s website as well as your review of the security. However, aren’t these just promises? The part about Wealthica’s access being “read-only”. What ultimately prevents a bad actor working at Wealthica from doing something bad once they have your log-in information?

I guess I am just wondering if there is any technical reasons that prevents a user giving up their “keys to the castle” and for Wealthica to do something bad with it? Is it ultimately “trust”? It just seems a major leap of faith to give up one’s keys to all financial accounts.

Best analogy is if I’ve done everything to secure my house by putting triple deadbolts on all the doors in my house but I give my keys to a 3rd party. That 3rd party might have all sorts of guarantee regarding how secure they will keep my keys. But I’m ultimately trusting them that they don’t have a rogue employee using the keys to break into my house. That’s a bit scary.

Thoughts?

Hi Ken,

Some valid points. One thing you can prevent that is to enable two-factor authentication, both on Wealthica and also your financial institutions. When two-factor authentication is enabled, whenever you try to log in with the username and password, one have to authenticate (either through an authenticator app or authentication code via email or text) before one can log in. So if someone can access these “read data” and use it to access your accounts, two-factor authentication should prevent this.

Hello, I really liked your review.

And I love the idea of a tool that tracks all my investments.

But I still don’t like the idea to give out my credentials, username and password.

What if they use them to withdraw my money?

I mean… this is really a big concern!

It’s Wealthica 100% safe and secure?

Hi Kristian,

Wealthica only has read access to your financial institutions. They utilize APIs to access your account information so it’s not possible for someone to use Wealthica to withdraw your money. Hope this helps.

Thanks for the honest and thorough review, the only thing that I’m hesitant about is the security issue but after reading your review I think I’ll give it a try

You’re welcome. You can always enable 2-step verification if you want an extra layer of security.

I love using Wealthica, I probably log into it now almost every day, haha!

It’s a great tool. I definitely do not check that regularly. 🙂

Great review Bob, I didn’t realize there was a Canadian web platform like this out there. I use MINT the most to track my monthly budgets which in reality I don’t need to do but really like keeping an eye on things. As a dedicated index investor I don’t think I would need this platform but for someone like you who does dividends I look at almost like a must do. Solid review, well done.

Thanks Chris.

Personally the fewer bits of info divulged to third parties the better. Everything is secure and ok until it isn’t.

One would have to question if your accounts require this sort of aggregation, that maybe your accounts are out of control and require simplification?

Something like Wealthica is of zero interest to me as I cannot see the benefits – I prefer KISS methodology.

That’s a fair comment. It’s nice to have a dashboard for a quick overview, although a spreadsheet may still be the best option if you don’t want to use a 3rd party tool.

With accounts in both the US and Canada, thus far Mint appears to be the only viable solution, although there are still some fringe institutions in Canada that Mint doesn’t recognize. Too bad Mint sucks at portfolio tracking and doesn’t do real-time currency conversion.

Regardless, as a Personal Capital user this appears to be worthy add-on to try out. Thanks!

(egads, 3 financial tracking tools now…)

It’s a bit troublesome when you have accounts in both US and Canada. Mint isn’t very good with portfolio tracking though.

Martin from Wealthica, thanks for the review. We do support a few US financial institutions in BETA (Schwab, Fidelity US, etc.) and our plan is to bundle support for hundred of US institutions with our new Premium subscription that we should launch early 2021.

That’s great to hear! 🙂