Nothing can be said to be certain, except death and taxes.

Benjamin Franklin 1789.

When I wrote about our financial independence assumptions back in July, many readers asked if we were taking taxes into consideration. As the great Benjamin Franklin pointed out many years ago, taxes is definitely something that we must plan for in life. How much taxes do we need to pay on our divided income? Let’s take a closer look at our financial independence assumptions.

Disclaimer: I’m not a tax specialist. This post is simply my interpretation of the Canadian income tax system. Please consult a tax specialist regarding your income tax.

Our Financial Independence Assumptions

As you may recall, we broke down our core expense per month estimate.

House property taxes $350

House maintenance $50

House insurance $100

Utilities $100

Internet & cellphones $100

Groceries $800

Healthcare $150

Household supplies $100

Clothing $100

Car insurance for 1 vehicle $120

Gas for 1 vehicle $50

Car maintenance $50

Buffer $200

Total: $2,270.

Since our core expenses do not include things like eating out, charity donations, entertainment, vacation, and education savings, we will add $950 per month to cover these non-core expenses.

This results in $3,220 per month in expenses, or $38,640 per year. For simple calculation, we will round this number up to $40,000.

So, to be financial independent, we need our dividend portfolio to produce $40,000 per year. While we do plan to continue some part time work when we are financial independent, dividend income will be the primary source of income.

Don’t you have to pay taxes on the $40,000 dividend income?

Yes but that’s the beauty of our dividend portfolio – we do not hold all of the dividend paying stocks in taxable accounts. We hold many of these stocks in tax advantage accounts like RRSP and TFSA.

RRSP (Registered Retirement Savings Plan) is a tax deferred account that is similar to the 401(k) in the US.

TFSA (Tax Free Savings Account) is a tax free account that is similar to the Roth IRA in the US. But there’s no age restriction on withdraws. We can withdraw money at anytime.

To make sure we are tax efficient, we hold all Canadian REITs and income trusts in TFSA. All US stocks and ADRs are held in RRSPs. We maximize our RRSP And TFSA before making any investments in taxable accounts.

Our Dividend Income Breakdown

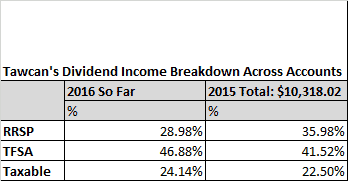

Table below shows the dividend income breakdown of our dividend income in 2015 and so far in 2016.

How come over 45% of our dividend income comes from TFSAs?

Because our TFSA consist a number of high yield stocks like REITs and income trusts. We also hold Canadian dividend stocks in our TFSA. These Canadian dividend stocks tend to have higher yield rates compared to their US counterparts.

Due to RRSP withdrawal rules, it does not make sense to receive a large amount of dividend income from our RRSP (I’ll explain this later). So, we will need to start focusing on adding dividend stocks in TFSA and taxable accounts rather than RRSP. When we are financial independent, our ideal dividend income breakdown is 20% RRSP, 50% TFSA, and 30% taxable.

Taxes in Financial Independence – Scenario 1

What happens to income tax when we are financially independent and we are receiving $40,000 in dividend income per year? Using the 20% RRSP, 50% TFSA, and 30% taxable breakdown from above, our income breakdown would be:

- RRSP: $8,000 (taxed)

- TFSA: $20,000 (tax free!!!)

- Taxable: $12,000 (taxed)

Note: We will assume the taxable dividend income is split 40-60 between Mrs. T and I.

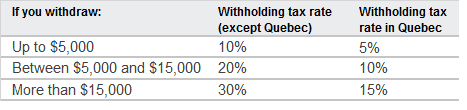

There are tax consequences when withdrawing money from RRSP. Therefore, we need to come up with a withdrawal strategy. Our RRSP withdrawal strategy is to split the withdrawal amount between the two of us. Below are the RRSP withholding tax rates:

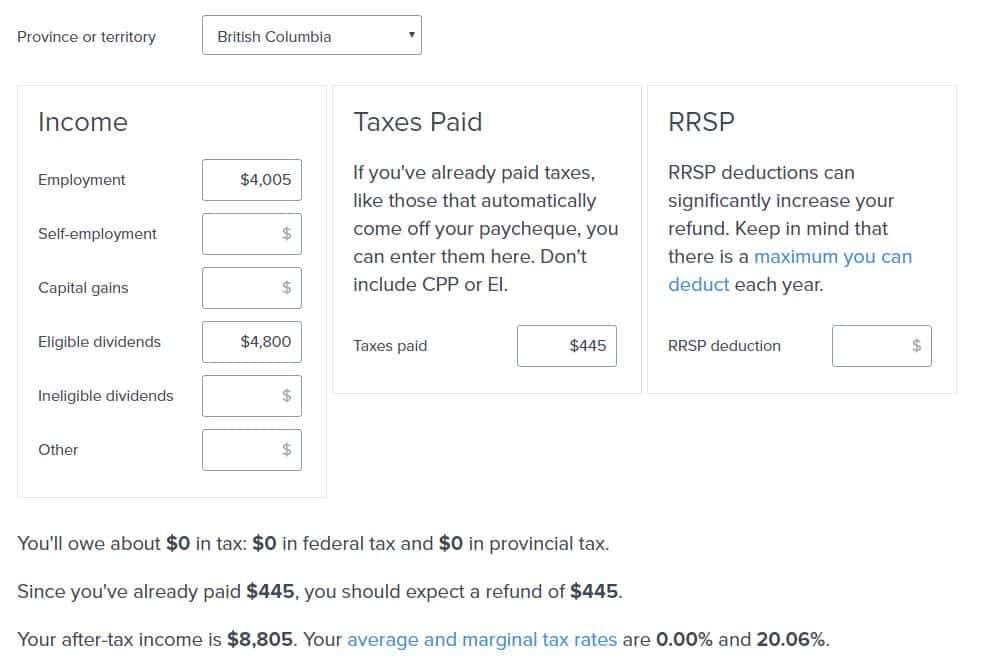

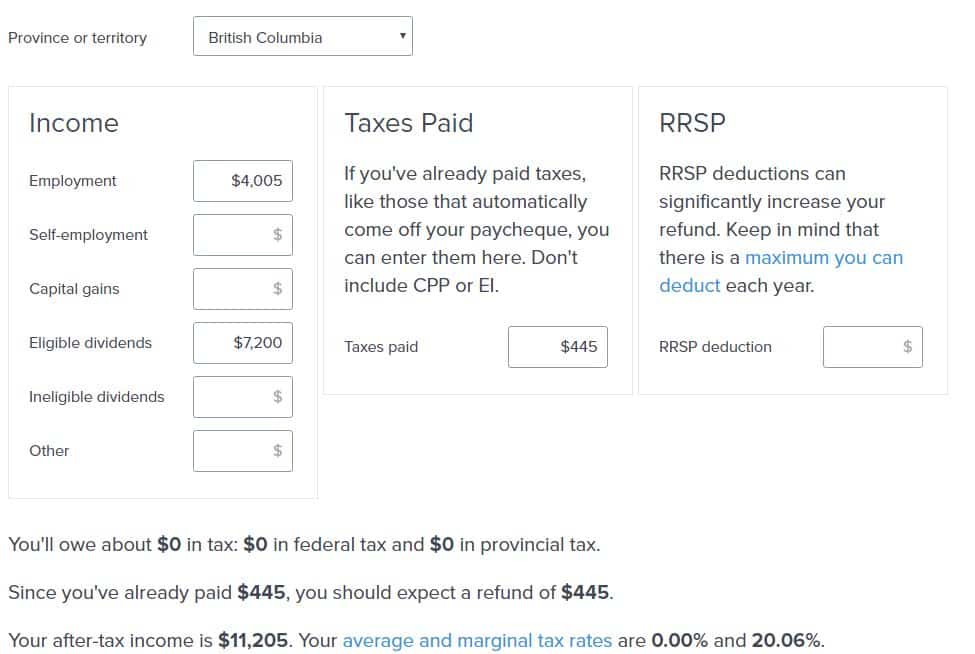

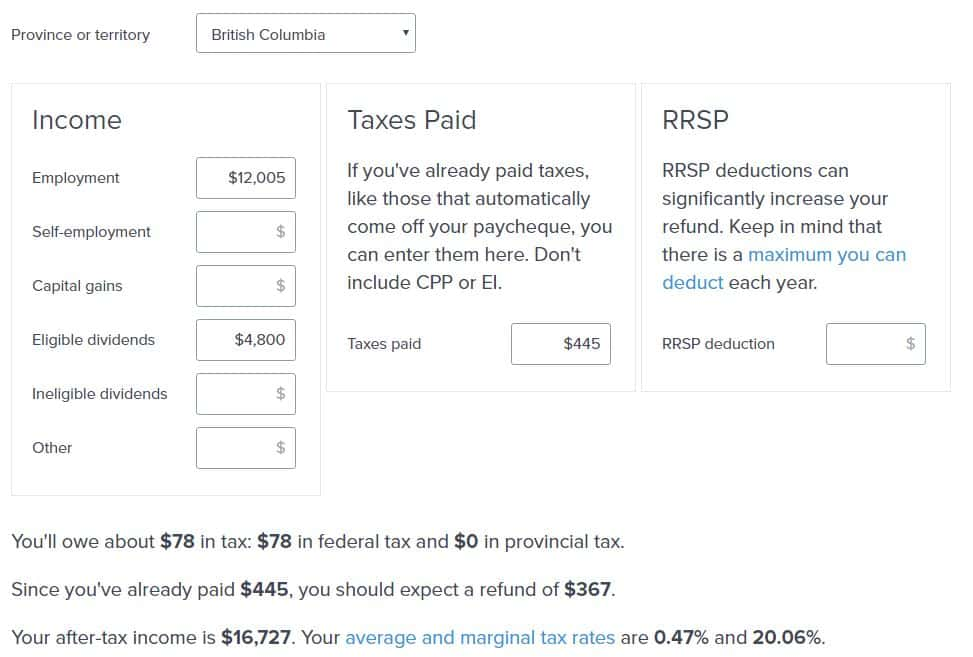

Since we are splitting our RRSP withdraws, we can withdraw $4,450 each and still receive $4,005 after paying 10% ($445) of withholding tax. The amount withdrawn is then considered as employment income.

When we file our income tax, our annual taxable income would look like below:

- Mrs. T: $4,005 employment income from RRSP + $4,800 eligible dividend income

- Tawcan: $4,005 employment income from RRSP + $7,200 eligible dividend income

Because we do not know future federal and provincial tax rates, we will use the 2016 income tax calculator by SimpleTax for estimate purposes.

That’s right! We pay $0 in taxes if we rely 100% on our dividend income. We will be getting the entire $890 RRSP withholding tax back. How cool is that?

Taxes in Financial Independence – Scenario 2

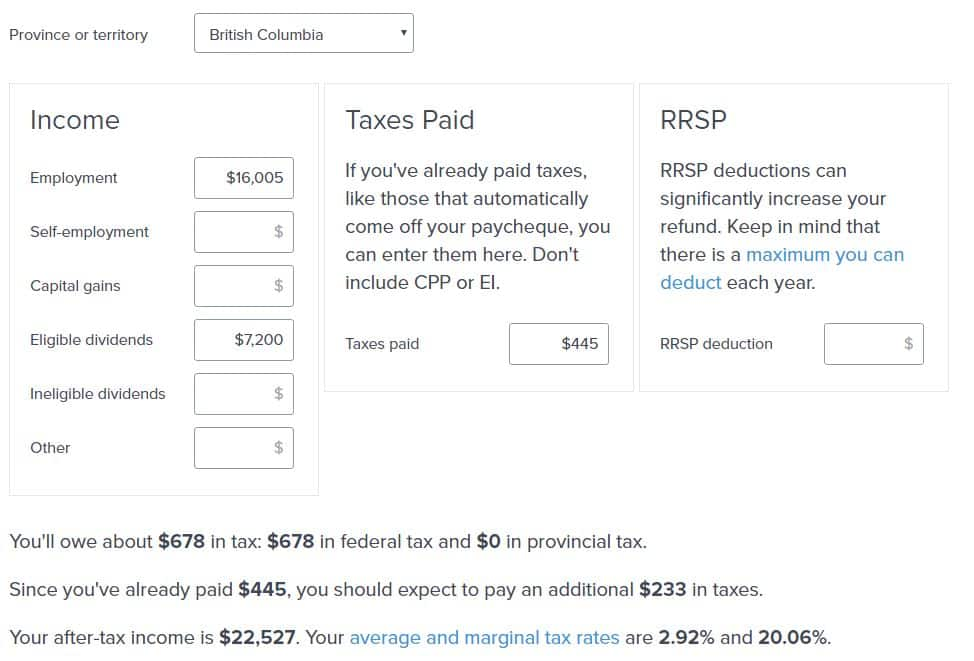

What if we decide to work part time once we are financially independent? Let’s assume that we are making $20,000 part time at a 40-60 mix. Our total income breakdown would be:

- Mrs. T: $12,005 employment income ($8,000 employment income + $4,005 RRSP income) + $4,800 eligible dividend income

- Tawcan: $16,005 employment income ($12,000 employment income + $4,005 RRSP income) + $7,200 eligible dividend income

The two of us will pay $756 in taxes for a combined taxable income of $40,010. An average tax rate 1.89%! Because our marginal tax rates are so low, we would be getting part of the RRSP withholding taxes back . If the part time income is from our side businesses, we can most likely write off eligible expenses too, meaning we will be paying even less taxes.

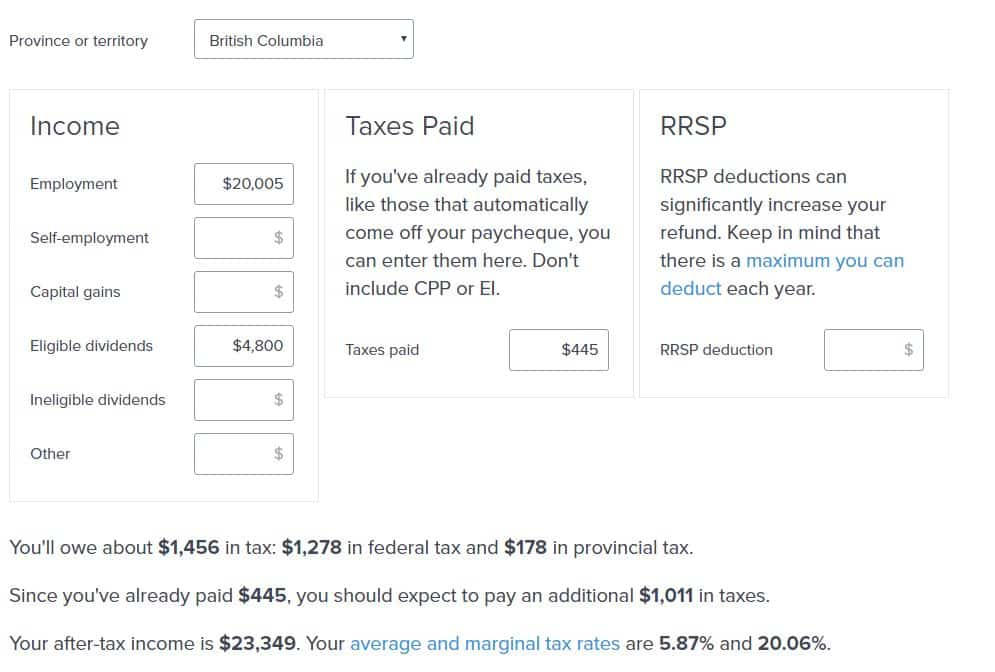

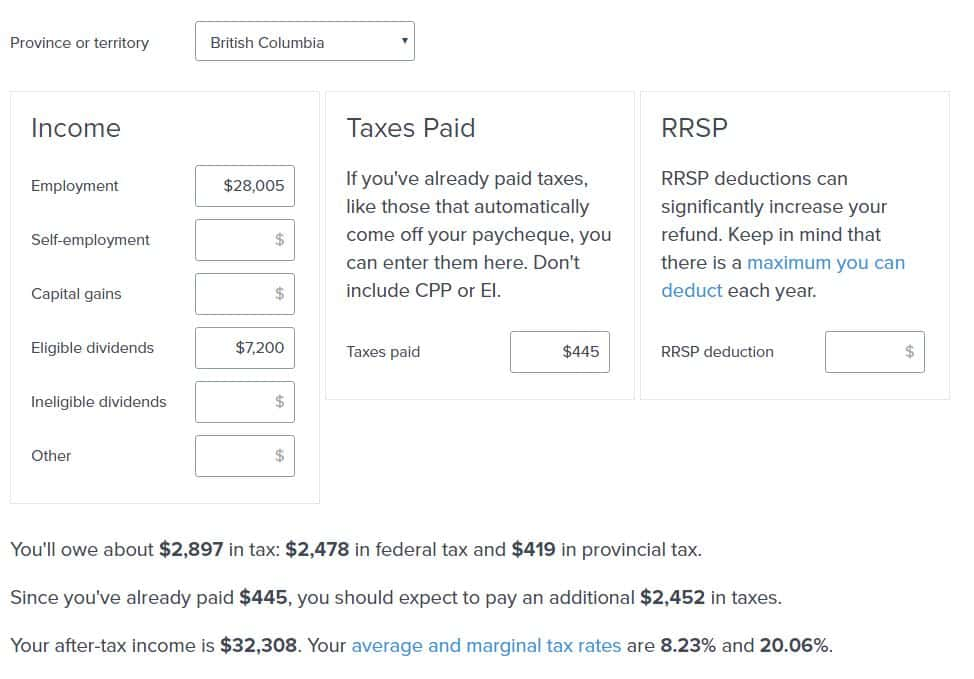

Taxes in Financial Independence – Scenario 3

What if we make $40,000 in part time income plus $40,000 in dividend income?

- Mrs. T: $20,005 employment income ($16,000 employment income + $4,005 RRSP income) + $4,800 eligible dividend income

- Tawcan: $28,005 employment income ($24,000 employment income + $4,005 RRSP income) + $7,200 eligible dividend income

In this $80,010 per year income scenario, we would be paying a total of $4,353 in federal and provincial taxes on a $60,010 taxable income. This is an average tax rate of 7.25%. To put into perspective, if Mrs. T and I were to make $32,005 and $48,005 in active income ($80,010 total), we would be paying a total of $12,001 in taxes, or about 15% average tax rate.

As a Canadian, I think it’s important to pay whatever amount taxes that we owe to make sure Canada stays great. Social services like health care, schools, public transportation rely on taxes. Therefore I have no problem paying a small amount on our taxable income.

Final Thoughts

The three scenarios above showed taxes on dividend income can be very minimum if we construct our dividend portfolio properly. It is indeed possible to rely on dividend income alone when we are financially independent. We need to maximize all of our TFSA contribution rooms to take advantage of the tax free dividend income. Since withdraws from RRSP are considered as employement income and taxed at our marginal tax rates, it is more efficient to receive dividend income from taxable accounts.

Moving forward, it is crucial that we construct our dividend portfolio and any working income so they are split roughly equally between the two of us.

Dear readers, what do you think about my assumptions? If you see any holes in my tax calculations and assumptions, I would very much love to hear from you.

Fee points & a few questions on this post.

In the above post & assumptions – are you currently renting, living with family, own your own property, are you mortgage free, or will you be mortgage free when you retire in your 40’s.

When you do retire sometime in your 40’s will you continue to contribute to RRSP’s (you need employment income to do this) as well as continue to pay into CPP (either self employed, working or within a business ownership)?

On RRSP withdrawals, if you do this in your 40’s, how long will the RRSP’s last before they’re melted down to zero?

Retiring in your 40’s will you be empty nesters, will you be paying for your childrens university education in part?

What do you see your lifestyle will be retiring in your 40’s, do you or will you have to work at anything for income or at that point will you have enough in ALL investments to keep your expenses covered?

We currently own our property. It’s not fully decided if we’ll stop working or not once we reach FI. We may stop working full time and do some part time work. We most likely won’t be contributing to RRSPs and have no plan to pay into CPP. We plan to pay for our kids’ university education but that depends if they decide to stay in Canada for university, or if they decide to go to Denmark (it’s free there). Our lifestyle will probably be similar as today. 🙂

This is a question about expenses that I don’t see above. Is the current property that you live in that you own mortgage free, and/or with zero liens on the property?

Is anyone other than your wife & children occupying/living in the residence that you live in that might be sharing or contributing to the expenses, operating or running cost of the property?

Hi Tawcan,

Here;s a great article on tax free dividend income in some provinces provided no other income is present.

https://www.google.ca/search?q=dividend+income+tax+free&ie=utf-8&oe=utf-8&gws_rd=cr&ei=IFcQWbW5CYL4jwT4sKi4Bg

David

Thanks I have read these articles before. Very useful info.

Great to see a fellow Vancouverite blogging about FI! It’s helpful to have more Canadian voices out there. I just have one question: how is it that you’ll be able to claim RRSP withdrawals as employment income? I find that fascinating as we’re also planning on early FI and trying to plan our withdrawal strategy. Thanks in advance for your time!

RRSP withdrawals before age 71 are counted as regular income.

Interesting… I never much cared about taxes in great detail as we’re still about 17 years or so away from achieving FI, but this post has opened up another avenue for us to consider.

Great post, T! Keep ’em coming.

Definitely a good idea to plan for taxes.

This is probably the most underrated topic in FIRE, but so critical to get it right.

Nice post Tawcan!

Thanks Team CF.

This is all provided that you stay in Canada, or at least that CRA still considers you as a resident of Canada. If you decide to move somewhere else you will probably be in a totally different (tax) situation.

That is very true. While we do plan to travel around the world and stay for extended period of time, we will most likely still call Canada home. 🙂

I did a similar exercise a while ago and got similar results for my situation. One thing you may want to consider is making a larger RSP withdrawal and contributing that to your TFSA. So in your situation #1, you could withdraw $10k from your RSP, spend $4500 and put $5500 into your TFSA. Your income would be low enough that there would be little to no net tax paid on this extra withdrawal, and you’d be reducing a potential future tax liability.

Also in your examples, your income tax is calculated on the amount withdrawn from the RSP before withholding tax, so the ’employment’ income should be $4450, but this won’t make much difference to your results.

Agreed. This should definitely be part of the plan. You should max out your TFSAs in retirement as long as your tax rate is still low.

Definitely. We probably will end up withdrawing RRSP to both fund our expenses and the annual TFSA contribution limits. That way we can continue increasing our TFSAs and the amount of dividend income coming from TFSA.

Hi jd,

That’s an option we are considering as well. Withdraw a large amount from RRSP and putting the money into our TFSA for that year’s contribution limit.

Good point on the income tax calculation, that’s good to know for future estimates.

That’s great seeing you ran some estimation on your taxes. That will give you a good idea and be somewhat prepared. Taxes make me frustrated, seem to complicated. I just give it to my CPA lol, and have them figure all the numbers out. I should try to learn a bit more maybe later on.

Hi Jay,

Yes it is a good idea to run some estimate on taxes. If our tax situation gets more complicated we may just use a CPA too.

I think a tax professional told me that if we have 0 income the year before I withdraw from my 401k (at 59.5), then I pay zero income taxes on it. It’s hard for me to believe that which is why I’ll double check when the time comes but man taxes are so hard to understand but it’s something that everyone has to pay.

Hi Finance Solver,

I’m not too sure about US taxes but you might want to double check on that. 🙂

Looks like you have a great plan and strategy in place to minimize taxes. Great work and great analysis.

Right now we are focused on maximizing our contributions to tax sheltered accounts. Still too early for us to put our formal withdrawal plans in place.

Thanks The Green Swan. Makes sense to focus on maximizing contributions to tax sheltered accounts.

Taxes and healthcare expenses, since I live in the US, are the biggest question marks with financial independence. With government spending rising every year and I have less and less faith that the current tax system will stay in place. There’s likely to be changes namely higher taxes which could really screw things up for those in FI if they don’t have an adequate margin of safety. But it’s great to run through the numbers to play out different scenarios and have a plan in place beforehand.

I’m so glad that we live in Canada where healthcare is easier to estimate. We have to pay for healthcare but the cost is very low. Furthermore, if one makes less than a certain amount, then healthcare is free.

The tax problem that I now have to live with is that I have accumulated too much money in RRSP’s which is taxed as regular employment income when withdrawn. The whole premise of RRSP’s was that when you withdraw funds you would be in a lower tax bracket but in some cases you might find yourself in a higher tax bracket especially so if you continue to earn active income.t. So much for the Canadian tax system. They need to increase the TFSA limits further and give us a break.

That’s a problem we need to watch out for sure – having too much money in the RRSP. Definitely want to limit amount of money that we have to withdraw from RRSP to reduce amount of taxes that we need to pay.

I’m all for increasing the TFSA limits further. I was very sad that the Liberals government reduced the limits from $10k to $5.5k. At least the new limit is inflation indexed.

I’m wondering roughly how much a nest egg would be required to yield $40k in dividends?

Hi skube,

I have a bit more detail in our previous post here – https://www.tawcan.com/financial-independence-assumptions/

Ok so that I’m understanding correctly, basically a $1M portfolio with an expected 4% overall yield to produce $40k/yr.

The ideal is to have 50% of dividend income coming from high-yield stocks within the TFSA. The rest coming from taxable and RRSP accounts.

Isn’t there a large risk to high-yield anything? Isn’t it possible for companies to reduce dividends or suspend them completely in tough times? Isn’t it hard to achieve $20k yield from a TFSA account which only has a max contribution to date of $46.5k?

(sorry for the questions, I’m just trying to understand)

Hi skube,

These numbers are assumptions when we reach financial independence, which is about 10 years or so away. So the TFSA account would have way higher than $46.5 contribution to date. Assuming $5,500 for 10 more years with no inflation indexed, that would be $101,500 max contribution limit. I think that amount will be much higher when taking inflation into consideration. Also the $20k/50% mix is in the ideal situation, whether we get to that mix or not we’ll have to see.

Yes there’s a larger risk to high-yield stocks… but REITs typically have a higher yield in the first place as they distribute 80-90% of their profits to shareholders. We don’t just buy REITs and income trusts in our TFSA, we also own other Canadian dividend stocks for diversification purposes.

Ok so there’s a few assumptions although I can’t see inflation affecting TFSA that much over the next 10 years. I’ve read the TFSA contribution limit isn’t expected to increase or be indexed to inflation until 2019.

Assuming that remains unchanged and a generous average 3% inflation rate, would mean an increase of the max. cumulative contribution limit to around $120k by 2026 (not really that much larger than your initial number).

Of course, this doesn’t factor in any compound growth, which if we assume an average return of say 5.5% would result in around $160k*

So overall and rounding up, you would be extremely fortunate to have, say $200k in your TFSA in 10 years time yielding a consistent 10% to give you $20k/yr income.

(Again, this is all to understand better myself)

*http://www.theglobeandmail.com/globe-investor/retirement/retire-taxes-and-portfolios/tfsa-calculator/article29642271/

Hi skube,

Good points. Again as I mentioned before, these are just estimates. Who knows maybe our TFSA dividend income contribution is more like 40% when we are financial independent. Whether it’s 50% or 40% or something lower, what I’m showing in this post is that it’s indeed possible to live on dividend income and pay only a very small amount of income tax (if anyat all).

Given your calculation of $160k in 10 years. That’d be a total of $320k for the two of us. At $20k of dividend income per year, that’s roughly 6.25%. Given dividend growth in 10 years, I think that’s quite possible. 🙂

Good tax post Tawcan! Like you, our portfolio has a large number of dividend payers. In the U.S. as long as we stay under $74k (approx) income, our qualified dividends are not taxed!

I think that’s fantastic!

Hi Mr. Tako,

Canadian tax system is very similar, there’s a threshold where qualified dividends are not taxed. The trick is to make sure our RRSP withdrawal amounts are smaller as they’re taxed as employment income.

First of all, its great to see the same thought process that we went though in our retirement budget and tax planning.

For the tax planning, this seems correct to me and mirrors what I found. Still to be determined are what surprises are in store for us with stocks that don’t issue “eligible dividends” like some REIT income. It seems hard to tell some times.

Our budget comes out to around 5k per month but it looks like we have more travel planned.

Our own retirement budget goes into more detail and is based on our own historical spending which we have tracked for 2 years or so. Some items you may want to think about:

– utilities seem low at $100 – does this include electricity, heat, sewage and water?

– from our experience your auto maintenance and house maintenance seem low. We have $100 per month for both of these.

– no pets, I assume?

– travel insurance? When you are not covered through work anymore, this is an issue.

– I would suggest breaking down your non-core expenses further. There’s a risk that you aren’t accounting enough there for travel, gifts, entertainment and other purchases. We do a detailed travel budget as well and average this over the year based on the estimated number and type of trip.

Keep the great posts coming!

Hi Matt,

Thanks. I think the key is to keep ineligible dividends in either TFSA or RRSP and eligible dividends in taxable accounts. This way you can take advantage of the dividend tax credits.

Maybe my estimate is a bit on the conservative side. Our historical spending was outlined in the earlier post. We have been tracking our expenses for almost 5 years now and we’re spending about $50k per year. At $40k spending per year it might be a bit low but if we are traveling around in cheaper countries, I think these numbers are doable.

Utilities – yes include electricity, heat, sewage and water. We are averaging about $30 on hydro, $50 on natural gas, and about $10 on water & sewage per month right now.

House & Auto – our house and car are relatively new so expect the maintenance cost to be low.

Pet – We have a cat, that cost is in the buffer section

Travel insurance – good point. I think either that can be covered in the buffer or the non-core expenses section.

Agree that we can probably freak down our non-core expenses. Again this is just a rough estimate. Since we include side business related expenses in non-core expenses and they kind of go up and down over time, it’s hard to do an accurate estimate.

Given this is just an estimate, I realized things can change over time. The post simply highlights the fact that it is indeed possible to live off dividend income and paying very little taxes. 🙂

This is a great read. This is something that I haven’t done too much research on, but we do want financial independence eventually. Taxes are always such a headache to me!

Thanks Michelle. Given you’re making so much off your blog, I’m assuming you’re using a tax consultant? Maybe the tax consultant could give you a tip or two. 🙂