October 2020 was unusually dry here in Vancouver with less than 90 mm of precipitation. For the past number of years, we usually got more than 100 mm of precipitation, even over 200 mm in some years. Therefore, we took advantage of the unusually dry weather by spending as much time outside as possible. Mrs. T and I spent a bit of time working on our backyard garden to get it ready for next spring. We also planted garlic so they would be ready for harvest in about ten months.

Baby T1.0 had borrowed a crabbing trap from a school friend of his. Thanks to the dry weather, we spent a few weekends crabbing at a nearby local beach. We got many different types of crabs but unfortunately, they were all too small to keep. So no crab dinner for us…yet.

Both kids have been back to school for over two months. For three days each week, the house would be dead quiet for about five hours. On those days, Mrs. T and I could get some quiet time and have extended hygge without any interruptions. Both kids are enjoying school and we are glad we decided to send them back to school rather than doing distance learning. Although COVID cases have been picking up lately in BC, we remain optimistic that in-person learning will continue. We are trying to do our part of flattening the curve by staying home as much as possible and limit our interactions with other people. Part of me feels that it is going to be a long winter but at the same time, perhaps this provides a good opportunity to spend more family time together. When will we get out of the woods? I have no idea, maybe next spring? Maybe next summer? Maybe longer? We’ll have to wait and see. For now, I think we need to do our shares to make sure the medical system doesn’t get overwhelmed.

Dividend Income

In October 2020, we received dividend income from the following companies:

- Algonquin Power & Utilities (AQN.TO)

- BCE Inc (BCE.TO)

- Bank of Nova Scotia (BNS.TO)

- CIBC (CM.TO)

- Canadian Natural Resources (CNQ.TO)

- Dream Office REIT (D.UN)

- Dream Industrial REIT (DIR.UN)

- European Residential REIT (ERE.UN)

- Granite REIT (GRT.UN)

- H&R REIT (HR.UN)

- Inter Pipeline (IPL.TO)

- KEG Income Trust (KEG.UN)

- Coca-Cola (KO)

- Nutrien (NTR.TO)

- Rogers (RCI.B)

- RioCan REIT (REI.UN)

- Saputo (SAP.TO)

- SmartCentre REIT (SRU.UN)

- Telus (T.TO)

- TD (TD.TO)

- TC Energy Corp (TRP.TO)

- Vanguard Canada All Cap ETF (VCN.TO)

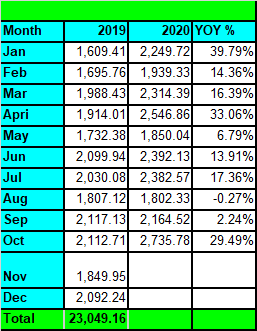

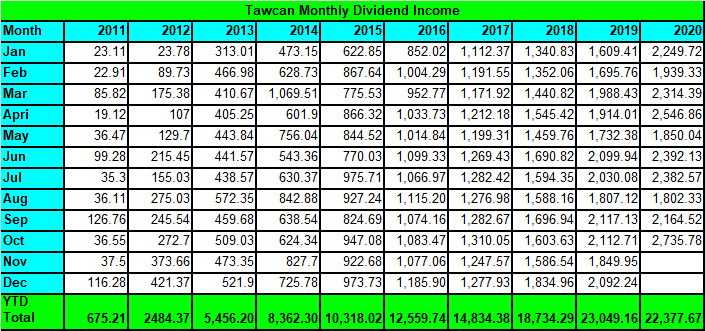

The 22 paycheques from these companies added up to $2,735.78. Yes, you read that right, we set an all-time record! Not only that, we also broke the $2,400, $2,500, $2,600, and $2,700 monthly dividend income milestones! Needless to say, October was a fantastic month in terms of dividend income.

If I had to nitpick, I’d say that we need to pay more attention on getting dividends in USD. This may be one of the goals for us next year – to increase our holdings in US dividend paying stocks.

The top five dividend payout came from BCE, Bank of Nova Scotia, TD, Telus, and CIBC (not in order). The top five dividend payers accounted for $1,912.83 or 69.9% of the October dividend income.

Dividend Income Breakdown

While dividend income is very tax efficient, we are always trying to maximize the tax efficiency by investing in tax-deferred and tax-advantaged accounts like RRSP and TFSA. Each year we aim to maximize our RRSP and TFSA contribution rooms before we add invest in our taxable accounts. We only hold US dividend paying stocks in our RRSPs to avoid the 15% withholding tax on dividends. We only hold REITs and income trust funds in our TFSAs and RRSPs to avoid the complicated income tax calculations.

In October 2020, our dividend income breakdown across the different accounts are:

- Taxable: $978.61

- RRSPs: $751.00

- TFSAs: $1,006.17

So only 35.8% of our October dividend income was taxable. Since both Mrs. T and I have taxable accounts, the $978.61 dividend income received is further split up between us two. In other words, we are paying a small amount of taxes on our dividend income.

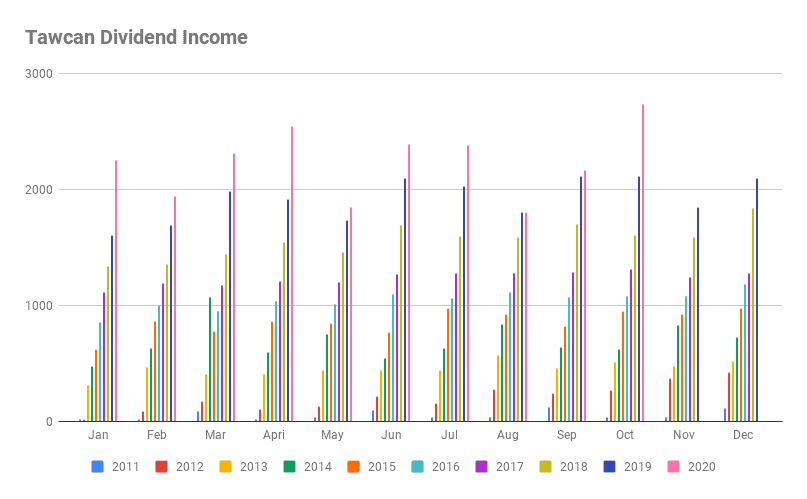

Dividend Growth

We saw very poor dividend growth performance in August and September, so it was very pleasant to see a YoY dividend growth of 29.49% in October. This is the third-highest dividend growth so far in 2020 and it feels fantastic to see a number above 25%.

After ten months in 2020, we are averaging a dividend growth rate of 17.1%. It would be nice to see this number end up above 20% by the end of the year but I’m not sure if it’s possible or not.

Dividend Transactions

Since the market was volatile in October, we decided to take advantage of that and deployed some of our cash sitting on the sideline. We purchased the following stocks throughout October:

- 200 shares of Enbridge (ENB.TO)

- 101 shares of TD Bank (TD.TO)

- 50 shares of National Bank (NA.TO)

- 507 shares of iShares All World Ex-Canada ETF (XAW.TO)

- 10 shares of Vanguard Canada All Cap Index (VCN.TO)

Although I have said that we want to divert from the oil & gas sector, I decided to add more Enbridge. The key reason is that I think Enbridge has a wide moat and is not exactly a pure oil & gas play. Since Enbridge transports oil & gas using its pipelines, in many ways, one can almost see Enbridge as a utility company. Canadians will continue to need natural gas to heat their homes, so Enbridge isn’t going away anytime soon.

Given that XAW has over 55% exposure to the US market, over 7% exposure to the Japanese market, and over 5% exposure to the Chinese market, we decided to add a significant amount of XAW to further diversify geographically. It is our goal to have XAW as our number one holding in our portfolio in the near future.

All these purchases increased our forward annual dividend income by approximately $1,380 (approximately because it’s difficult to predict XAW and VCN distributions).

Dividend Reinvestment Plan (DRIP)

To keep our investment strategy as simple as possible, we enroll in dividend reinvestment plan (DRIP) whenever we are eligible. Dripping allows us to re-invest the dividend payments right away. Adding more shares also allows us to dollar cost average over time: when the stock price is suppressed, we can buy more shares; when the stock price is too high, we’d get the dividend amount deposited and we can invest the cash elsewhere.

In October, by enrolling in DRIP, we added 51 more shares to our dividend portfolio.

- 3 shares of AQN.TO

- 2 shares of BCE.TO

- 8 shares of BNS.TO

- 1 share of BPY

- 3 shares of CM.TO

- 3 shares of CNQ.TO

- 1 share of D.UN

- 1 share of DIR.UN

- 1 share of ERE.UN

- 3 shares of IPL.TO

- 1 share of KO

- 1 share of RCI.B

- 4 shares of REI.UN

- 2 shares of SRU.UN

- 3 shares of SU.TI

- 5 shares of T.TO

- 7 shares of TD.TO

- 1 share of TRP.TO

- 1 share of VCN.TO

Through DRIP, we were able to immediately re-invest $1,903.20 or 69.6% of our October dividend income. As a result, we also added approximately $110 toward our annual dividend income. This is the equivalent of a 5.78% dividend yield.

Sharp-eyed readers will notice that most of the dripped shares are in Canadian dividend paying stocks. It would be great to be able to drip more shares in US dividend paying stocks and this is something we need to work on moving forward. Ideally it would be nice to be able to DRIP additional shares for the likes of Johnson & Johnson, Procter & Gamble, McDonald’s, Pepsi, etc.

Dividend Increases

Although the global pandemic is still raging on, companies have now started to announce dividend payout increases, which is an encouraging sign for us dividend growth investors. In October, the following companies announced dividend payout increases:

- AbbVie (ABBV) increased its dividend payout by 10.17% to $1.30 per share.

- McDonald’s (MCD) increased its dividend payout by 3.2% to $1.29 per share.

- Visa (V) increased its dividend payout by 6.67% to $0.32 per share.

- KEG Income Trust (KEG.UN) increased its dividend payout by 42.85% to $0.05 per share.

Given that KEG slashed its dividends earlier this year, it was a pleasant surprise to see the company increasing its dividends. Hopefully we will see the KEG reinstate its dividend payout to the previous amount of $0.0946 per share.

These four dividend payout increases added $53.72 toward our forward annual dividend income. It’s not a big raise but I will take a raise over no raise any day.

Summary

After ten months we have received a total of $22,377.67 in dividend income. While it doesn’t look like we will be close to the $30,000 dividend income goal that we originally set out at the beginning of the year, I am still quite happy with how much we have accomplished already.

Since I like to put our dividend income in perspective…

- We’re getting paid at an equivalent of $2.93 per hour. We are getting paid when we sleep too! So when we wake up each morning, after an 8-hour sleep, we would have $23.52 in our pocket, enough money to buy Mrs. T and I breakfast at Tim Horton’s.

- At $40 per hour salary ($83,200 annual), it means we have saved almost 14 weeks’ worth of work. That’s like not working until April 6, 2020! This is pretty cool!

As usual, we are extremely grateful that we have created a passive income stream so we can focus our energy and time elsewhere. The COVID-19 global pandemic isn’t going away any time soon. More than ever, it is important to provide a helping hand to those in need whenever possible.

On the other hand, the pandemic has also reminded me the importance of long term investing. Don’t try to jump between strategies or time the market. Consistency will pay off in the long run.

Dear readers, how was your October dividend income?

Very nice stuff as well. Congrats.

I am beginner investor.

I have a question have you done any articles on how do you file your taxes on income that your receive through the taxable account? I would love to see that article.

My Second question is are your suppose to pay taxes in taxable account if you haven’t sold that stock and still holding it?

Thanks

No I don’t have any articles on how to file taxes on income receive through taxable account. You should get a T5 slip from your broker and you simply include the slip as part of your tax filing.

We pay taxes on dividends received in taxable account but we also get dividend tax credits. Since we aren’t selling holdings in taxable account, we don’t pay for capital gain taxes.

Hope this helps.

Great thanks for the reply. Do you only buy /hold Canadian Div stocks under Taxable account for better tax efficiency?

Please see here – https://www.tawcan.com/dividend-faq/

By the way, Enbridge IS a gas utility company in Ontario 🙂 It has customers just like Fortis does in BC.

Hehe I know but most ppl categorize Enbridge in the O&G sector. 🙂

Shut the front door Bob. This is fantastic stuff Bob! I cannot believe that you set a personal record in the month of October. I was expecting December. Heck, you may set it in December once again.

Continue pushing and spreading the word of financial freedom. You continue to inspire us.

Keep up the great work.

Bert

Thank you Bert, very happy and grateful to receive such a huge amount of dividend income.

I bet that Tim Horton’s breakfast tastes even better knowing you didn’t have to lift a finger to pay for it! Great update!

Haha definitely!

What an October. I know 2020 may have been a tough year for everyone, but it’s been a great year for your dividends! I think the best part of dividends is that you’re basically making a salary ($2.93 per hour) AND getting paid when you sleep. Fantastic work, Bob!

Thank you FreshLifeAdvice.

Hello Bob,

Great results as always. Also thoroughly enjoy your photos. Not to be a downer, but it seems that you have mis-reported your YTD dividends in your Summary (high by $1,000). Also means you have not yet exceeded 2019 dividend income. But it WILL happen!

Best wishes!

Haha oops, a good catch. Will edit that. 🙂

Hi just found your site for the first time I am an old guy fooling with the mkt my problem is I have been buying hi and selling low not good can you give me an idea if the size of investment for your kind of returns I like dividend stocks however not good at mkt but surviving Thanks Al J.

Hi,

You might want to take a look here – https://www.tawcan.com/dividend-portfolio-beating-the-tsx/

A very solid dividend income Bob! Congrats! That’s some excellent dividend income growth YoY!

I’m guessing you’ll easily break $25k this year. Nice! Won’t be long now and you’ll be wondering what to do with it all! 🙂

Thank you Mr. Tako. Yup we should be able to easily break $25k this year. I do wonder what we’ll end up with. 🙂

Congratulations Bob, good progress on your dividend journey. I didn’t get a chance to sift through your prior updates, but what did you do to get such a nice bump in October? Since dividends are typically paid quarterly, October 2020 seems incongruous with Jan/April/July 2020. Sorry if I missed any information that you posted such as pumping additional capital into your portfolio during the year.

Hi Kam,

Thank you. We purchased quite a bit of TD since July.

Steady, consistent and unwavering…..well done on your execution of the plan Bob. A bit of FOMO with your accumulation phase still ongoing while I watch from the sidelines in the preserve phase. I wonder if Enbridge will see a drop with Michigan announcing they are shutting down Line5 this past week after the AB premier said some very stupid things. I as well keep reinvesting into XAW, very curious to see what the dividend is in January as I did a major restructure across my TFSA & RRSP for XAW in July this year.

Thanks Chris. It will be interesting to see what kind of distribution XAW will provide in Jan. It might be a bit lower than expected due to a bunch companies reducing/cutting dividends. We’ll have to wait and see.

Awesome total for October. Congrats on the new record. These updates always fuel my passion for DGI. I’m with you about back to school. Each day at home Mrs. DivHut and I also enjoy several hours of quiet. Be well!!!

Thank you DivHut. Yes school has been a bit of a breather for us parents.

Congratulations Bob, smashing through all those milestones is one shot! Finishing the year with 25k+ in passive income has to be a good feeling 🙂

Thank you.

Great stuff Bob.

Congrats on setting a new record, a solid growth rate and putting a tonne of new capital to work for you.

I’d like to get those us companies to drip as well. Slowly but sure growing that jnj position over here.

Keep it up Bob, fantastic stuff

cheers

Thanks Rob. Adding more JNJ shares would be fantastic. That’s certainly one of our goals.

Awesome breaking 4 milestones at once! Congrats on a record month. A nearly 30% YOY growth is an incredible achievement. Nicely done! 🙂

Thank you My Dividend Dynasty. Feeling very grateful to hit a major milestone during a global pandemic.

Hi Bob,

I follow your blogs and find it very informative. I started investing through Wealthtrade around 2 months ago and make it a point to buy a few stocks every month.

I am all for Dividend Income and as such prefer investing in REITS.

Thanks for your guidance!

Fred

Thank you, Frederick. Happy investing. 🙂