Mrs. T and I are working toward financial independence by investing in dividend stocks and index ETFs. Our plan is to live off dividends by having between $60,000 to $70,000 in dividend income. We may also do some part time work to supplement our dividend income. Because of that, we are always on the lookout for great dividend stocks to invest in. What are some of the best Canadian dividend stocks?

When it comes to picking dividend stocks, it is important to not just look at the dividend yield alone. Many dividend investors fall into the dividend yield trap by only looking at stocks with high dividend yields. We certainly fell into the trap in the past. It is always important to consider the dividend payout ratio to determine whether the dividend payout is safe or not.

Other factors like dividend growth rate, earning history, company revenue growth, return on equities, and cash flow are also important to monitor.

Total return matters. I’d rather have a dividend portfolio yielding 3% and have my principal growing consistently each year than a dividend portfolio yielding 8% but my principal shrinking each year.

- Check out the Best Canadian Dividend Stocks from the DGI community and see which stocks my fellow dividend bloggers picked out.

- Looking for monthly dividends? I listed all the best Canadian monthly paying dividend stocks.

- Looking for US dividend stocks? Check out the best US dividend stocks.

Per our dividend portfolio, we own quite a number of Canadian dividend stocks. We own more Canadian dividend stocks not because of home bias, it’s mostly due to the added cost of exchanging CAD to USD.

Which stocks made my best Canadian dividend stocks list?

Top 13 Canadian Dividend Stocks

Here are my best 13 Canadian dividend stocks for 2024. These picks are based on total return- a combination of dividend growth and stock price appreciation.

1. Alimentation Couche-Tard (ATD)

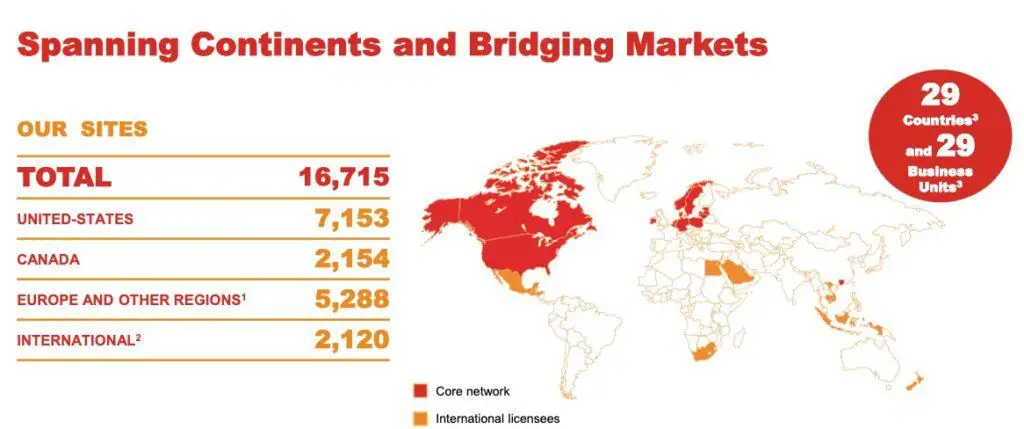

Alimentation Couche-Tard doesn’t have the highest dividend yield but its dividend growth rate over the last ten years has been fantastic. ATD also has had some fantastic revenue growth and strong cash flow. The strong growth is attributed to the 14,000 convenience stores across the globe.

- Sector: Consumer Defensive

- Dividend Yield: 0.93%

- Dividend Payout: 13%

- PE Ratio: 18.44

- 5 Year Dividend Growth Rate: 21.2%

- Dividend Increase Streak: 13 years

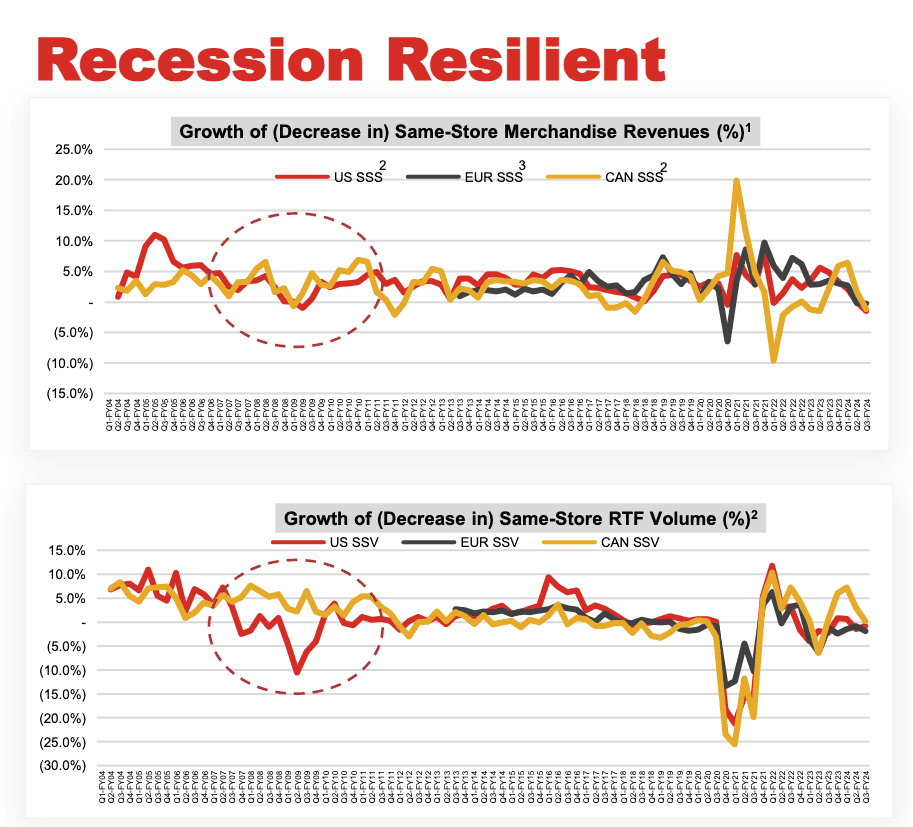

Despite the low dividend yield, ATD has been growing its dividends at an impressive rate. For those investors with long time line, ATD is a great pick for total return and compounding dividends. Furthermore, the defensive nature of the business makes ATD a great pick if you’re worried about recessions.

ATD is one of those stocks that the share price just keeps climbing over the last five years. Again, I think it’s an excellent choice for total return.

2. Equitable Group (EQB)

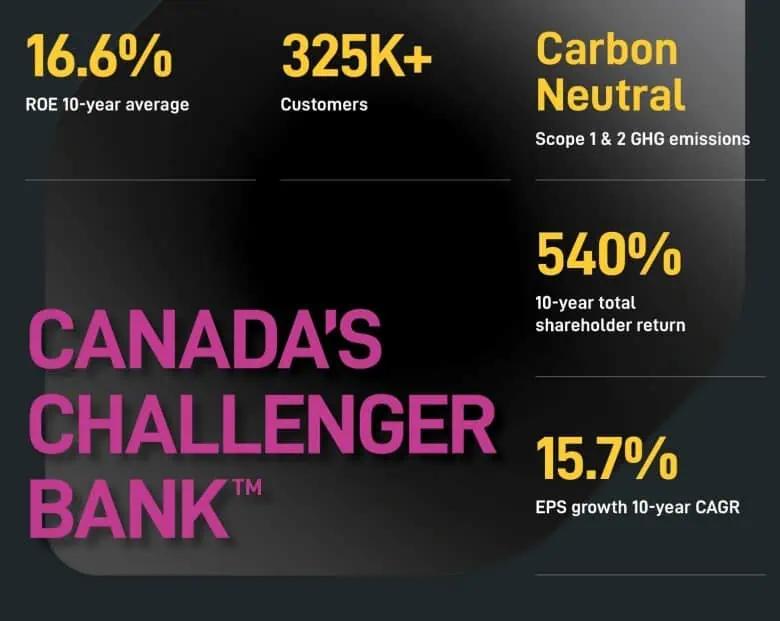

Equitable Group serves a growing number of Canadians through Equitable Bank. Equitable Bank has grown over the years to become the seventh largest independent Schedule I bank by assets in Canada.

EQB offers Canadians the chance to earn high interest rates with their money and not pay fees for everyday banking. Positioning themselves differently than traditional banks, EQB has more than 290,000 customer base in Canada and growing.

- Sector: Financial Services

- Dividend Yield: 2.05%

- Dividend Payout Ratio: 16%

- PE Ratio: 8.76

- 5 Year Dividend Growth Rate: 20.6%

- Dividend Increase Streak: 1 year

In recent years, EQB has announced some pretty hefty dividend increases. If you’re looking for a high dividend growth Canadian stock, EQB would be the one to consider.

3. National Bank (NA.TO)

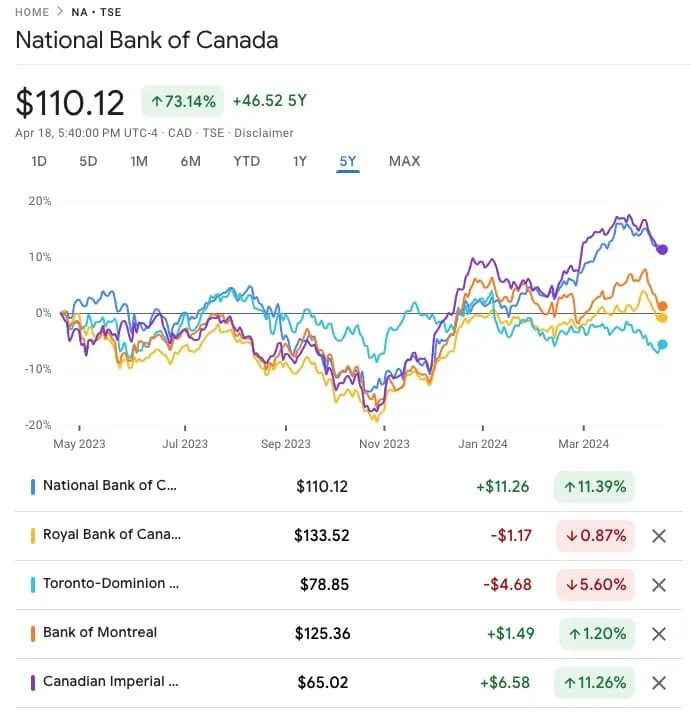

National Bank is the sixth-largest bank in Canada with Quebec contributing 62% of its revenues. While the majority of National Bank’s revenue comes from Quebec, the bank is expanding quickly in the rest of Canada.

National Bank has raised dividends for 13 straight years and has had solid total returns compared to its peers.

- Sector: Financial Services

- Dividend Yield: 3.84%

- Dividend Payout Ratio: 44%

- PE Ratio: 11.66

- 5 Year Dividend Growth Rate: 9.7%

- Dividend Increase Streak: 13 years

The share price has dropped quite a bit in 2023 mostly because investors are concerned that businesses and homeowners may not be able to pay their loans and mortgages. However, with the inflation rate stabilizing and the Bank of Canada looking to hold interest rates steady and potentially lowering the rates, I believe this is a great time to buy more National Bank shares.

4. Brookfield Asset Management (BAM.TO)

Brookfield Asset Management is a leading global alternative asset manager with over $850 billion of assets under management across real estate, infrastructure, renewable power, private equity and credit.

- Sector: Financial Services

- Dividend Yield: 3.38%

- Dividend Payout Ratio: 21%

- PE Ratio: 8.69

- 5 Year Dividend Growth Rate: n/a

- Dividend Increase Streak: n/a

Please note, since BAM is a newly formed entity, some of the financial parameters are not yet available.

Brookfield Asset Management had declared that it plans to pay 90% of its profits and grow the dividend payout every year. This makes BAM very attractive for dividend investors.

I picked Brookfield Asset Management over Brookfield Corporation because of the higher dividend yield. BAM is more suitable for dividend investors looking for income.

Now, if you are looking for higher total returns, you may want to consider Brookfield Corporation (BN).

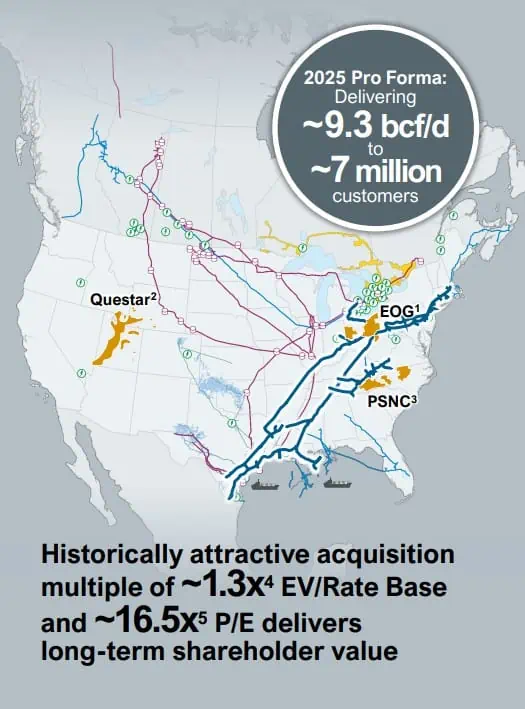

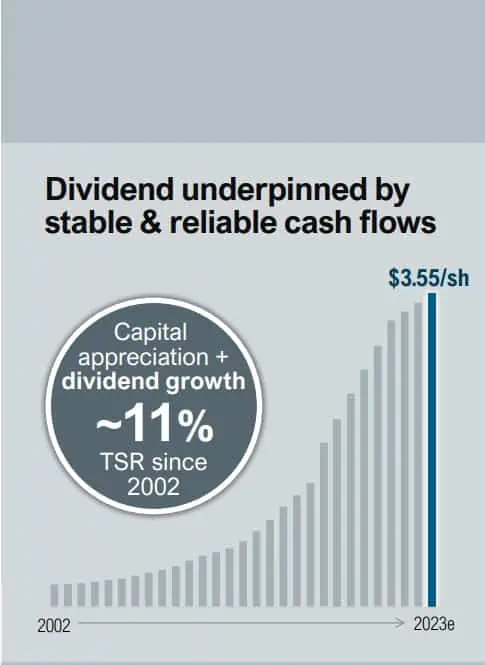

5. Enbridge (ENB.TO)

Enbridge is one of the leading North American infrastructure companies with a vast network of pipelines. In fact, Enbridge owns an extensive network of about 192,000 miles of natural gas and NGL pipelines across North America and the Gulf of Mexico.

Since our reliance on natural gas and crude oil isn’t going away anytime soon, we will need to continue to rely on Enbridge’s pipelines to transport these valuable assets across North America. Environmental concerns and the inability to build new pipelines mean Enbridge’s existing pipeline network is even more valuable than before.

- Sector: Energy

- Dividend Yield: 7.67%

- Dividend Payout Ratio: 190%

- PE Ratio: 18.8

- 5 Year Dividend Growth Rate: 7.3%

- Dividend Increase Streak: 27 years

The Enbridge management expects a 5-7% dividend growth rate moving forward. Given the high initial yield, this is a very solid dividend growth.

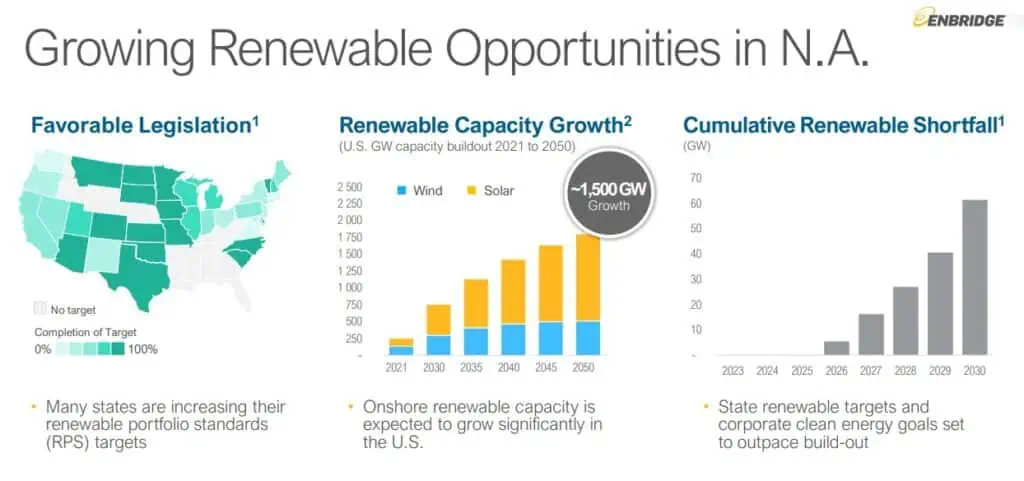

Despite being known as a pipeline company, transporting natural gas and oil across North America, Enbridge is working to increase its renewable footprint.

Enbridge announced it plans to acquire a trio of US companies to create North America’s largest natural gas utility franchise. While the market didn’t like this announcement, as a shareholder, I like Enbridge’s plan to be more like a utility company. Given TC Energy’s recent announcement on splitting the company into two, I suspect Enbridge will plan to do something similar in the near future.

For investors looking for income, Enbridge is a great choice. It definitely falls under the high yield low dividend growth category.

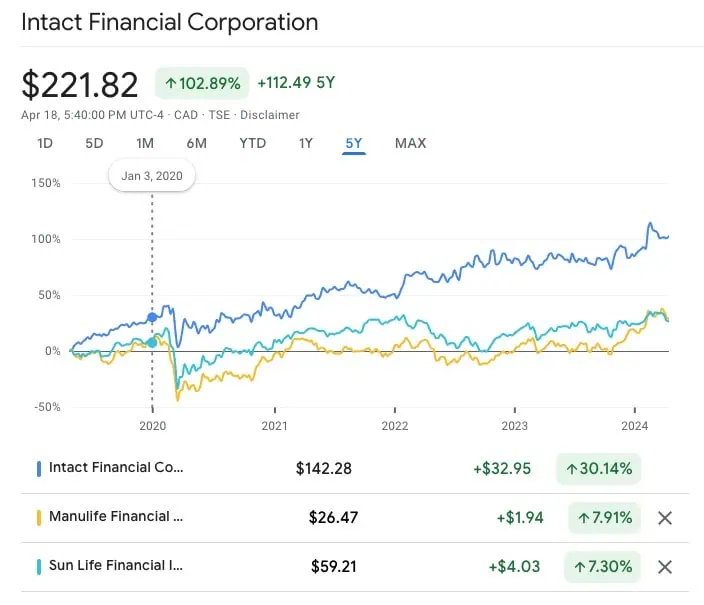

6. Intact Financial (IFC.TO)

Intact Financial is Cana’s largest provider of property and casualty insurance. The company has over 16,000 employees and insures more than five million individuals and businesses through its insurance subsidiaries.

- Sector: Financial

- Dividend Yield: 2.21%

- Dividend Payout: 58%

- PE Ratio: 26.23

- 5 Year Dividend Growth Rate: 9.3%

- Dividend Increase Streak: 18 years

Intact Financial was one of the first dividend paying stocks that we purchased and it has done very well over the years compared to Manulife and Sun Life.

Its stellar return is probably the number one reason why the PE ratio is so much higher compared to Manulife and Sun Life.

7. TD Bank (TD.TO)

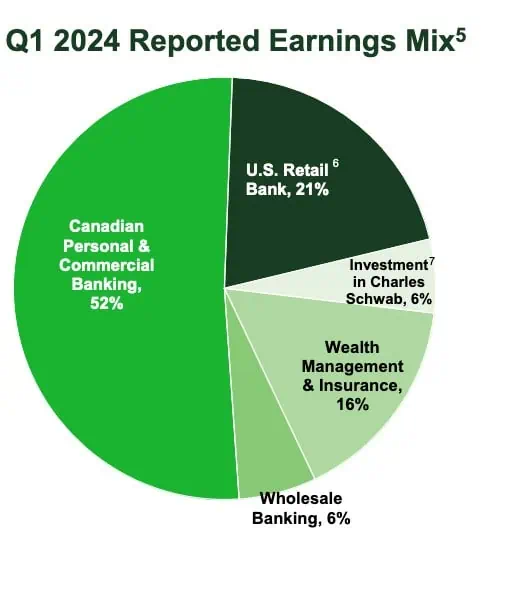

Toronto-Dominion Bank is a Canada-based bank, which operates in North America. TD is one of the largest banks in Canada and the 5th largest bank in North America. It is an online financial services firm, with over 14 million online and mobile customers. Its segments include Canadian Retail, U.S. Retail, Wholesale Banking and Corporate.

- Sector: Financial Services

- Dividend Yield: 5.06%

- Dividend Payout Ratio: 50%

- PE Ratio: 12.38

- 5 Year Dividend Growth Rate: 8.7%

- Dividend Increase Streak: 12 years

TD doesn’t just generate its income from the Canadian market. In fact, TD gets more than 30% of its net income from the US division which has 1,160 retail locations in the US. Overall, TD has a very large retail presence in North America with more than 2,200 retail locations across the continent.

Do you know people who switch banks regularly? Probably not too many.

Because people don’t change banks regularly, TD should continue to benefit from its large client base. Many young adults are TD clients because their parents bank with TD. Once these young adults have kids, it’s very likely they will set their kids up with TD for financial service. Who doesn’t like a perpetual client base?

Given that TD has an initial yield of around 5% right now, I believe at current share price level, TD is very attractive as a long term holding.

8. Canadian Natural Resources (CNQ.TO)

Canadian Natural Resources is a natural gas and heavy crude oil producer that operates primarily in Western Canada.

- Sector: Energy

- Dividend Yield: 3.98%

- Payout Ratio: 53%

- PE Ratio: 14.21

- 5 Year Dividend Growth Rate: 23%

- Dividend Increase Streak: 22 years

CNQ has shown consistently that it can weather the storm. It managed to keep the same dividend payout throughout the pandemic instead of cutting dividends like many Canadian energy companies. Recently CNQ announced an impressive 11% dividend payout increase to reward its shareholders.

CNQ’s management also told investors that it expects to hit $10B in net debt in Q1 2024, which means special dividends are on the table for 2024.

9. Canadian National Railway (CNR.TO)

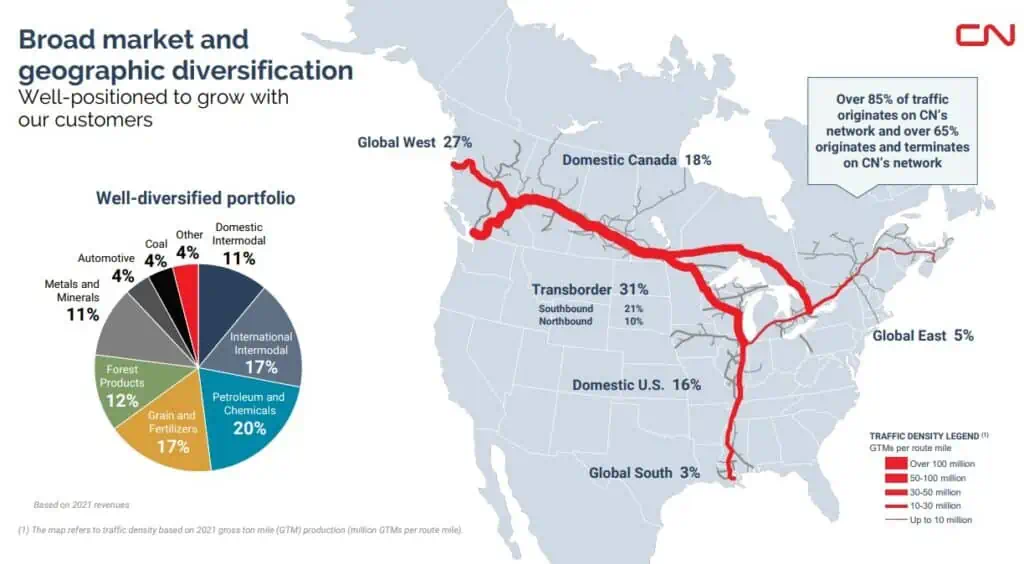

Canadian National Railway Company has a network of approximately 20,000 route miles of track that spans Canada and mid-America, connecting approximately three coasts, including the Atlantic, the Pacific and the Gulf of Mexico and serving the cities and ports of Vancouver, Prince Rupert (British Columbia), Montreal, Halifax, New Orleans, and Mobile (Alabama), and the metropolitan areas of Toronto, Edmonton, Winnipeg, Calgary, Chicago, Memphis, Detroit, Duluth (Minnesota)/Superior (Wisconsin), and Jackson (Mississippi), with connections to all points in North America.

- Sector: Industrials

- Dividend Yield: 2.08%

- Dividend Payout Ratio: 43%

- PE Ratio: 20.31

- 5 Year Dividend Growth Rate: 12.2%

- Dividend Increase Streak: 27 years

CNR is a very diversified company. No one particular product line accounted for more than 25% of the total revenues. And the company has one of the lowest operation ratios of all American railway companies that are publicly traded.

Canadian National Railway has a pretty low dividend yield, but the key here is its high dividend growth rate over the years. The company currently has a 20 year dividend growth rate of 16.3%. Needless to say, CNR shareholders get rewarded when holding the stock for the long term.

Although rail is not frequently used for passenger travels here in North America, rail is still one of the most cost-efficient ways of transporting goods. Canadian National Railway’s large rail network will allow the company to provide transportation services in North America and bring profits to shareholders.

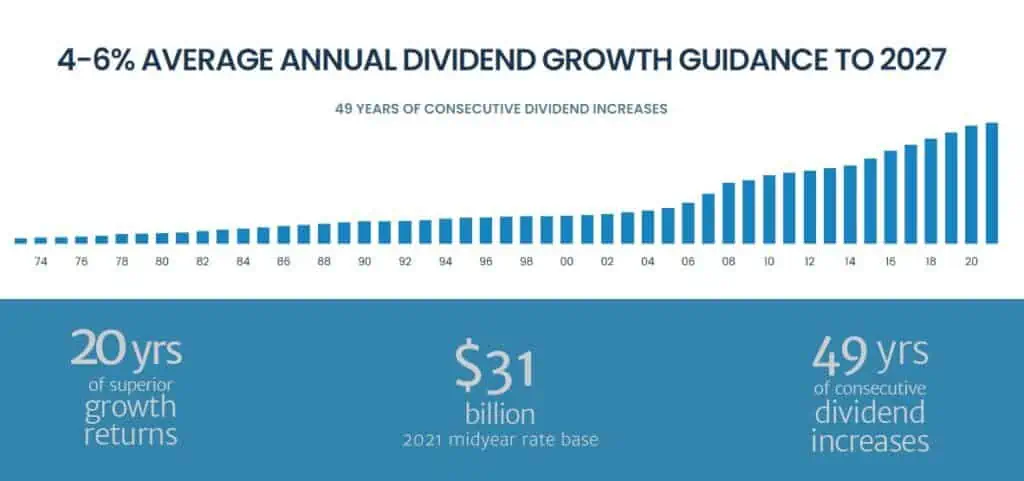

10. Fortis (FTS.TO)

Fortis is a Canada-based electric and gas utility holding company. The Company’s segments include Regulated Utilities and Non-Regulated Utilities. Fortis serves many different regions, including Arizona, BC, Alberta, New York, Newfoundland, Ontario, PEI, and the Caribbean.

- Sector: Utilities

- Dividend Yield: 4.55%

- Dividend Payout Ratio: 83.7%

- PE ratio: 16.74

- 5 Year Dividend Growth Rate: 6%

- Dividend Increase Streak: 50 years

Who doesn’t like the 49 years of dividend increase streak?

Fortis is one of the few Canadian dividend paying stocks that can be called the Canadian dividend aristocrats. With a dividend yield of over 4% and a solid dividend growth history, it’s nearly impossible not to create a dividend portfolio without Fortis in it.

11. Royal Bank (RY.TO)

Royal Bank is the largest bank in Canada. If we look at Royal Bank’s earnings, 45% came from personal & commercial banking, 24% came from capital markets, 19% came from wealth management, 7% came from insurance, and 5% came from investor & treasury services.

RY serves personal, business, public sector and institutional clients in Canada, the United States and approximately 40 other countries.

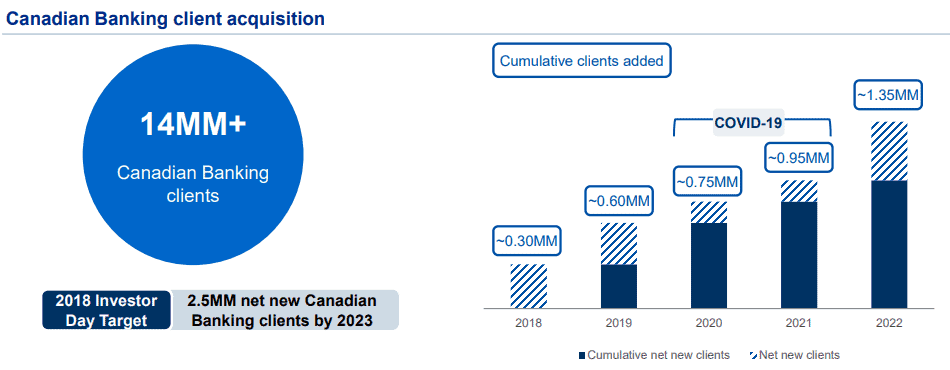

Despite being the largest bank in Canada, Royal Bank set out a plan in 2018 to attract new Canadian banking clients. So far they’re on track to meet this target.

- Sector: Financial Services

- Dividend Yield: 4.14%

- Dividend Payout Ratio: 47.7%

- PE Ratio: 12.45

- 5 Year Dividend Growth Rate: 7.3%

- Dividend Increase Streak: 12 years

Royal Bank has been paying dividends since 1870 and has never missed a dividend payment since. Let that sink in! The 150 year of dividend payment streak is pretty darn impressive if you ask me.

Royal Bank’s share price has been depressed the last year so it may be a good time to load up and wait for the stock price to recover.

12. Telus (T.TO)

Telus is one of the big three Canadian telecommunication companies based in Vancouver BC. The Company provides a range of telecommunications services and products, including wireless and wireline voice and data. Telus has around 11 million subscribers and they have increased its dividend nearly every year since 2002.

- Sector: Communication Services

- Dividend Yield: 6.94%

- Dividend Payout Ratio: 176%

- PE Ratio: 37.54

- 5 Year Dividend Growth Rate: 6.6%

- Dividend Increase Streak: 19 years

Since the launch of smartphones and data plans, more and more Canadians are addicted to these smart devices. This addiction has helped Telus to continue making a massive amount of profit. Telus’ board is very shareholder friendly and has declared that they have a goal to continue increasing dividends by 7 to 10% in future years. Telus usually raises dividend payout twice a year and recently announced a 3.56% dividend payout increase.

Like many telecoms, Telus’ share price has taken a beating lately due to concerns with telecoms’ debt level. While concerning, let’s not forget that telecoms require a lot of investments to improve their infrastructures so it’s normal to see high level of debt. Yes, if the interest rates don’t come down, the the debt and interests will drag the telecoms down. However, I believe interest rates will slowly creep down and the telecoms should recover in the medium term.

13. Granite REIT (GRT.UN)

Granite REIT is a Canadian-based real estate investment trust engaged in the acquisition, development, ownership management of logistics, warehouse and industrial properties in North America and Europe.

- Sector: Industrial REIT

- Dividend Yield: 4.71%

- PE Ratio: 7.52

- 5 Year Dividend Growth Rate: 3.5%

- Dividend Increase Streak: 12 years

GRT.UN’s portfolio consists of 137 investment properties representing almost 62.9 million square feet of leasable area with an occupancy rate of 96.3%. These numbers are very impressive for REITs. I have come to really like Granite REIT for its global footprint with a focus on institutional-quality assets in key distribution and e-commerce markets.

As online shopping gets more popular, online retailers like Amazon and Wayfair need to have warehouses in major cities to store merchandise. GRT.UN should benefit from this shopping trend.

13 Best Canadian Dividend Stocks – Final Thoughts

Here you have it, my picks for the best Canadian Dividend Stocks. I picked these stocks from different sectors to help build a diversified dividend portfolio. For the most part, investing in Canadian banks, Canadian utilities, and Canadian telecoms is a very easy and straight forward way of DIY investing and receiving juicy dividends.

Want to learn to construct your own dividend investing portfolio and start investing in dividend paying stocks? I went through several methods on how I shortlist and screen dividend paying stocks. You may also want to take a look at this Canadian Dividend Calendar to see when the Canadian dividend all stars pay out dividends.

Some of you might wonder if preferred shares have a place in your portfolio. This is a very personal question and totally depends on whether your aim is total return or dividend income. Personally, I think there are too many preferred shares available and it can be very confusing looking at preferred shares from the same company and understanding all the different jargon. Therefore, if you’re considering holding preferred shares in your portfolio, it might be a good idea to utilize one of the best preferred share ETFs in Canada and let the professionals manage it for you.

If you’re reading this post, you are probably managing your own portfolio and may not want to use an ETF and pay the management fee, is there a way to do that? Fortunately, some smart folks created Passiv to do that for you automatically. With Passiv, the tool can put your portfolio on autopilot. You can build your own personalized index, invest, and rebalance all through a click of a button. Passiv can even calculate and execute the trades needed to keep your portfolio balanced. Essentially, Passive makes investing super simple! A community user account is free to sign up for. The elite member account is $99 per year…but it’s free for Questrade clients! Make sure to check out Passiv.

In case you’re curious, for diversification outside of Canada, we hold a handful of US dividend paying stocks. In addition, we utilize one of the low cost ex-Canada ETFs like XAW to diversify our portfolio internationally.

Do you already own dividend stocks and want to create a spreadsheet to track your portfolio? Take a look at my Google Spreadsheet Dividend Portfolio Template.

The dividend-growth lovers over at Million Dollar Journey have their own list of Canada’s best dividend stocks, which focuses heavily on earnings-per-share, and forward earnings-per-share as their main dividend stock valuation metrics. This again, makes intuitive sense from a dividend-growth perspective, as companies that have a lot of free cash flow – plus a history of raising their dividends – should be ideally positioned to keep those dividends growing far into the future.

Is it better to purchase one of these top Canadian dividend stocks, or purchase lesser known Canadian dividend stocks with lower yield and higher dividend growth? This is a personal decision you need to make yourself. Personally, I believe a mix of both.

Note: This blog post represents my opinion and not an advice/recommendation to purchase these stocks. Before you buy any stocks, please consult with a qualified financial planner.

Hi Bob,

This particular article is a great reference point for me to return regularly to check your reiterative updates 🙂

I have a few of these in my portfolio, partly to diversity sectors , to protect myself from exchange rate fluctuation, and partly to be able to allocate my funds in large Canadian company dividend stocks.

Frankly though, if I bought only these stocks, my annual rate of return would have been much smaller. For any MILLENIALS who are new to stock investment and have smaller seed money and longer investment timeframe, I think we are able to take more risk for higher capital gains and lower dividend yield elsewhere. Still, your list is a good reference for safety stocks and also a good future goal to aim for ONCE we have sizable portfolio like you 😀

Thanks Sarah. What I’m trying to do is keep this article updated each month so it stays relevant.

For younger investors it might be a good idea to have a higher percentage of your portfolio in all equity index funds like XEQT or VEQT. 🙂

what are your thoughts on CP rail vs CNR? I own both however i have more CP? would love to hear your thoughts?

I think both are solid companies. CNR seems to yield a little bit higher than CP.

AQN:

Looks like great dividend yield & dividend growth rate.

Yet – full stop!

Look at their debt loads and their ability to actually pay off said debt. That stopped me considering them within my portfolio.

If I’m to go with utilities, I’d rather Fortis, or Emera.

I just don’t understand why ATD.B is considered a top contender with its low dividend payout. Everything else on your list I agree with. What am I missing?

It’s not just about dividend payout, ATD.B is attractive because its high dividend and price growth.

I do not invest on ATD.B. Do not like that business model.

Everytime that I enter in the store and I see the prices always said to me: how people can pay those very high prices for goods that you can get everywhere for less than 50%?

I own Costco instead

Convenience store prices have always been higher.

You pay a premium for the ‘convenience’ of a store that could be within walking distance to you.

You are not their target customer. Nor am I. I only buy lottery tickets at convenience stores.

They are one of the most successful retail store operator/owner’s worldwide and arguable one of the most successful Consumer Defensive stocks in Canada.

—

To each their own – I am a Costco member as well.

It’s a love/hate relationship though – I cannot stand how busy it is all the time. It’s extremely difficult to even push around a cart.

But this is about stocks…

I own Costco and buy them on their mild dips , their growth is Asia is next ….huge profits there for them. I dont tend to buy duel listing companies . Too many things can go wrong. The only one I own is RDS.A – bought at 35.20 USD about a year ago. Good growth as it pivots into renewables . They just took their office out out the Netherlands and EU , and placed it in the UK- much better tax treatment and growth prospects . Due your own DD of course . Good luck to all ! No more “Royal” in Royal Dutch Shell ! Holland will sure miss the taxes they provided !

Bob

A couple thought.

ATB.B

You never mentioned the dual class share structure. That has been in the news with the Rogers battle.

I’m not saying ATB.B is not a bad pick, look at a 20 year chart. This is an example of a family controlled business run well. Just that I think it should be mentioned.

The other thing is Telus. Specifically Telus International. Telus did not ‘spin off’ TIXT. They ‘carved out’ TIXT. Check investopedia, it is different. Why? Because Telus still owns a controlling interest in TIXT (over 60%) and Darren Entwistle is the CEO of TIXT. All they did was to take it public to get a higher valuation than they got when it was still part of Telus.

Besides that I enjoyed the list. I probably own half of them already.

Hi Rick,

A very good point on ATB’s share structure. News with the Rogers battle has highlighted the ugliness of the dual class share structure.

Right, Telus did not spin off TIXT in the traditional sense, but they take this section of the company public to get more valuation. I’ll get this fixed.

Great Article Bob! My list is very close to yours. MFC is paying 5.28% now for new buys , as they just increased their share price.Conservative P/O ratio of 33% SLF is at 35% and GWL at 50%( last time I looked) . I like their Asian exposure ( I’m Bias though – as I grew up there as a kid), but MAN Life insurance and Asia is tough to make money at with their format! Always shocking to see “MANULIFE” Asia …and one other point, the company’s SP never moves up it seems . The cheapest type insurer of its kind in Canada by a P/E ratio from my knowledge . Total return of only 11% over 5 years – stings a bit though ! . Im thinking its a “Div Trap” at this point , however a fine business and well managed I think. Their Asian market exposure has been good – but their combined ratio has been high too leaving them ‘off the mark’ with their Asian expectations . Insurers are deeply effected by low bank rates- factor 1 COVID will likely keep them down for some time Factor 2 , their Life insurance business is so-so and the area is ultra competitive with fickle pricing dynamics Factor 3 ,Fee pressure will dampen their profits on their asset management side of their business, Factor 4 . Insurers such as Manulife dont know their pricing until a decade down the road – nature of the business ,so if underwriting is not sharp they can underperform a lot, as their product is essentially a commodity with ‘exact’ unknown costs . They had a miss last quarter of .03 cents per share. Surprising given the markets having been bouncing off the tops for a year now! They have had ample money from Ottawa too. Solid company, yes.Growth ? …there may be better choices for me in the future . Just my idle thoughts. Good luck to all !

We will have to wait and see whether MFC can continue to grow in the future. 🙂

There is no future with ENB. Too risky for new investors now, better wait for a drop.

AQN is droping fast. I am down -22% from peak. Good chance for new investor to made some money but I think that still will go lower

Hi Bob

Good group of strong Canadian companies. I have a strong focus on Europe and US, might diversify a bit geographically. Enbridge and Algonquin Power & Utilities caught my eyes.

Cheers

Agree with all of them except Enbridge. A money looser depending of when you bought it.

See charts of the last five years.

Do not risk your money now that is near to highest value

You can try after the next -20% drop.

Enbridge may not have much price appreciation the last five years but you’d gotten pretty juicy dividends. But yes, it depends when you purchased the stock. I do think Enbridge has a bit more room for price appreciation even at ~$51 price.

Great list, Bob. I’m long several of these.

I do struggle with finding diversity in the Canadian dividend space. Very easy to get sucked into Financials and O&G if you’re after decent yields to live off of. Glad to see your list has a bit more diversity!

Losing money with ENB for the last two years. Bought at peak January 2th 2019

I do not see a future with it

Near to recover initial investment. Will sell at that moment

Sorry to hear about your experience with ENB.

CNR (and CP) will be around ..a long time. Covid has highlighted severely how much we depend on our freight rail lines and their network/partnerships with trucking lines for export and imports. Lest I sound too nationalistic as an investor, 1 pick of these rail lines is a good thing for porfolio….and for Canadian economy as a whole. Just to give an fragment example: there is worldwide shortage of new bikes and some parts. Just go into any bike shop. Of course, alot of manufacturing in Asia…and to get them to North America to meet consumer demands. Figure out the transport of bikes from across the ocean.

Great list. I’m surprised Manulife (MFC) is not on here especially given their low PE and relatively high dividend yield compared to some of the names here. Would love to hear your thoughts on why you left it out. Cheers!

If this article is Top 15, MFC probably would be on the list. I just thought there are better Canadian dividend paying stocks than MFC.

KAI , you concern MFC is a Div Trap or Value trap ? Its growth has been , well …. lacklustre and anemic !

I have added to all of them this year. I was adding AQN since around 21. Hopefully it’s bottomed out now. Just added some CNR this morning. Curious about your thought between CNR and CP? Why do you think CNR is better than CP? For past few years, CP outperformed a lot than CNR. Regret to death that I have sold CP at $300 which I purchased around $200. I thought it was a very nice run and want to lock the profit. Turned out I left lots of money on the table.

Feel I have enough Canadian Dividend Growth stocks for now. I am focusing on adding more US stocks, but they are all very expensive. Was tempted to add MSFT and AAPL the past week, but didn’t pull the trigger, now they are all back up………..

We plan to buy more AQN. It was a toss up between CNR and CP and I picked CNR as I’ve been monitoring CNR longer. 🙂

Hey Bob,

Great post as always. I own a lot of the top 10 of yours however I have been accumulating PKI since around 2003 – I remember backing up the truck in 2008 after the crash for $5 per share. Why ATD.B and not taking a look at PKI… Have you looked at PKI?

Have a great day!

Charles

Thanks Charles. Nicely done on backing up the truck and buying at $5 per share, you’ve done well.

I didn’t consider PKI because the 5 year dividend growth has been low (<5%) and it cut its dividends in 2011.

Thanks Bob, I get it…. Keep well, thanks for the reply!

Charles

5 year dividend growth mean CAGR?

Annualized growth rate, not compounded.

Thanks for your blog site. It is very informative and inspiring. What’s your review for Capital Power (CPX)? Why not included in your top 10 list?

I think Capital Power is a good stock to hold. We don’t have it in our portfolio because we think there are better companies out there.

Love your blog, it’s got so many useful information and helps me a lot.

Would it be still a good decision to buy some of those Canadian banks’ stocks since the prices look pretty high thesedays. For those starting to build their dividend portfolio for the first time, would it be better to wait for the adjustment or just go get started? Thanks Bob!

Thank you Bryan, I appreciate your kind words.

Yes some Canadian banks are at all time high price, but you need to compare them to the historical PE rather than just look at the price alone. I do think Canadian banks are solid investments and we plan to continue buying more shares via DRIP.

Thank you for the reply Bob and also thanks for reminding me with PE.

I am trying to build a solid portfolio with annual dividend yield of 4% plus some more and it is pretty sad to miss the perfect time to invest in canadian banks last year with great bargain. Thanks again Bob!

You’re welcome Bryan. 🙂

Great blogs! can you talk more or have a good reference on the tax advantages or disadvantages of investing in dividend stocks vs buying stocks for capital gain?

Thank you Vince. It’s a bit more complicated than a few points though. Dividends are generally pretty tax efficient. Capital gains too. It really depends on your income level/tax bracket and your overall investment strategy. Sorry I couldn’t provide a more direct answer.

Im surprised BMO is not in the list.

Oh, I just seems to have found the answers to my questions! 😀

“So if a Canadian like you, Peter, owns U.S. investments that have been subject to withholding tax of 15% (dividends) or 10% (interest), that income still needs to be declared on your Canadian tax return. However, you do get to claim the foreign tax already withheld. CRA allows you to claim a foreign tax credit for foreign tax paid in order to avoid double taxation of the income.

(…)

Of note is that Canadian dividends qualify for a reduced tax rate due to something called the dividend tax credit. U.S. dividends are taxed at a higher rate (unless you own Canadian companies that are listed on a U.S. stock exchange – many companies are inter-listed).”

(Source: https://www.moneysense.ca/save/taxes/filing-taxes-u-s-investments-canada/)

According tot he above, it seems indeed I can deduct the interests from taxes, recover the 15% withheld tax on dividends, and the dividends would benefit of the CRA tax credit 🙂

😀

I would love to have your comments/confirmation on this topic, anyway.

Cheers!

I forgot:… would the ENB dividends qualify for the Canadian dividend tax credit if I buy the stock in the NYSE? Thanks!

Yes.

Thanks! (just saw your answer after I sent my last message confirming the positive answers).

Hope you’re having a great weekend in BC! (I LOVE this province 🙂 )

Hello Bob!

I’m glad to have found your website. I enjoyed some of your articles and even learned a couple of things. Thanks for making it!

I stumbled upon it by researching some specific info online that I still havent found. I was wondering if you knew the answer:

I want to invest in ENB using my margin account. For some weird reason, my USD account gives me much more margin than my CAD account. So, I want to purchase the stock in the NYSE.

I need to know if I can still deduct the loan interests from my taxes. It’s still a Canadian corporation, but I’ll be purchasing it in the US stock market.

Do you know if this is possible? Can’t find anything online with information about this specific case.

Also, I believe the 15% tax withheld in the US can be recouped via foreign taxes declaration in my CRA return. Do you know if this is correct?

Thanks so much for your insights!

AL

I think it’s possible. The 15% withholding tax is only applicable to US companies so you should be OK with ENB. But better to double check with your broker first.

Hi Tawcan: I own Merck Stock, but hate the withholding tax ($100 in 2020). Can’t move it into an RRSP because I am 75. Should I sell Merck and buy some of your recommendations to hold in my TFSA, e.g., Alimentaire Couche-Tard, or IFC? I am looking for a high dividend because I need them to live on at my age. I hold all the Can. banks in my TFSA so am not looking for a bank stock. Love your blog. Lula in Toronto

Are you holding Merck in your taxable account? If so you’d be getting foreign tax credit at least.

what about QSR?

Check out this portfolio by John Heinzl : https://www.theglobeandmail.com/investing/investment-ideas/article-john-heinzls-model-dividend-growth-portfolio-as-of-jan-31-2021/

Hi,

I have considered QSR but figured there are better investments available.

What are your thoughts on preferred shares? I have some CPD which pays about 5% divided.

Preferred shares have a place in the portfolio. We generally prefer standard shares though.

Awesome!!! Couche-Tard is on the list

🙂

Great list. What are your thoughts on some REITs, especially those growing their dividends like CAR or AP? Also thoughts about JWEL, MG and ARE?

REITs are good to hold but you need to personally determine the portfolio composition. My latest list doesn’t include any REITs because I think there are better dividend stocks to hold than REITs right now.

Hi Bob, thanks for giving us your thoughts.

How would you adjust this Top 10 list in an inflationary environment? i.e. buy, hold or sell?

Hi,

Since we’re in accumulation phase, we’re buying more shares and not selling.

Hello Tawcan,

How do you decide on the % allocation to each company?

Hi Sam,

That’s entirely up to you. Typically we try to keep each stock less than 5% of our overall portfolio.

I wanted to start a portfolio with dividends

do you like zeb or the bank stocks

ZEB is a good start if you want to hold a selection of the big six and more or less equally weighted.

Greetings from Europe (Denmark)

Thanks for a great page, and your Canadian top 10 dividend stocks

There was certainly some interesting Canadian dividend stocks that I didn’t have in my portfolio.

keep up the great work 🙂

Welcome J.W. Hope you’re staying safe & healthy in Denmark. My wife is from Denmark and we go back to Denmark quite regularly. 🙂

Thanks for telling me about your thoughts that you think what the best top 10 stocks of your dividend investing in canada. I am South Korean. I was looking for someone who I can learn. I was doing dividends investing in South Korea like you. I am happy to find you from google internet.

Your article made so much sense! It’s easy to understand. Thank you for helping others.

You’re very welcome.

XUT looks like a decent high-dividend utility ETF. It misses out on Banks, Oil, Telecomm, and CNR but I invest in those stocks individually (e.g., ENB, CP, CNR, Telus, BNS).

XUT charges a 0.62% MER to hold only ten stocks. Three stocks make up 45% of the ETF. I have always used this ETF as the example of the situation where the fund company offers no value to the investor. My opinion would be different if the MER were 0.10%.

What the ETF does offer is a tidy list of Canadian utility stocks from which to start one’s research. That’s a plus!

Fair enough, those are good points. As you suggest, it provides a good list (as does ZUT) and convenient for the lazy investor.

My preferred Canadian pick for the next decade is still Enbridge.

Combination of the high sustainable dividend and mid-single digit DCF growth is an interesting opportunity.

Also, if the stock returns to its historical valuation that further boosts total returns.

Wish you successful investing!

I’ve always been a little scared of Brookfield Renewable because of their 64% reliance on hydroelectric. I don’t fully understand the impact of climate change on the supply of fresh water to hydroelectric dams. The renewable space also feels a little too popular these days, which is making it expensive. We do hold a couple hundred of their Series E preferred shares though, which currently yield 5.6%.

You’re definitely right, the popularity of renewable is pushing Brookfield Renewable to the expensive side.

Between BEPC and BEP, I will just buy BEP if I invest in RRSP as the dividend is the same but BEPC is more expensive. I sold my BEPC in my RRSP, obviously too early. LOL.

Even BEP at this moment is overvalued I think. I might buy AQN instead if I need to invest in green energy at this moment.

Great list, Canadian banks are great. I am waiting to pick up more TD when/if it goes back down.

Thanks GYM.

Thanks, tawcan. Great list. I would like a little more diversification. I think MRU is a pretty good dividend growth stock. Personally I would prefer MRU over SAP. SAP was a disappointment to me, especially when comparing to SYY in the US.

Looks like you don’t like pipelines any more. ENB at $40 is pretty tempting to me.

ENB is pretty tempting but trying to avoid O&G sector right now. 🙂

For canadian stocks, I also really like CU, MRU, couche tard .

Thanks for the list and the exact data I look at: P/E, Ratio, Yield, Increase rate, and length of rises. Since the downturn this spring, I added debt/Capital ratio to what I look at.

I put Royal Bank on my watch list now. I already own TD, Bank of Nova Scotia, Bank of Montreal, and Canadian Imperial.

cheers!

John

I am already very overweight BNS and TD , especially since March of this year. I’ve been adding to both especially BNS because of the high yield. But I’ll be adding to existing utility positions going forward the next few months.

Canadian preferred shares today have an average yield of 5.8600%.

With rates on the 5 year around 0.37% preferreds should be considered for any portfolio looking for stable dividends. BNS Common stock pays more than its preferreds so you need to do some homework.

Here is a list of all Canadian preferreds and their yields/dividend. https://canadianpreferredshares.ca/rank-5-year-reset-preferred-shares-by-yield/

The list is for common shares only. I don’t typically consider preferred shares.

Please explain how are these different and are their ticker symbols different?

From Investopedia:

Preference shares, more commonly referred to as preferred stock, are shares of a company’s stock with dividends that are paid out to shareholders before common stock dividends are issued. If the company enters bankruptcy, preferred stockholders are entitled to be paid from company assets before common stockholders. Most preference shares have a fixed dividend, while common stocks generally do not. Preferred stock shareholders also typically do not hold any voting rights, but common shareholders usually do.

More info here: https://www.investopedia.com/terms/p/preference-shares.asp#:~:text=Preference%20shares%2C%20more%20commonly%20referred,company%20assets%20before%20common%20stockholders.

You may also want to check out these – https://www.tawcan.com/best-preferred-share-etfs-in-canada/

Makes a lot of sense. 🙂

Great list Bob, I own six. I currently don’t hold National, TD, Intact or Saputo.

Keep up the great work!

Thanks Matthew.

Hi Bob,

Great selection of Canadian top 10 dividend stocks. I’ve only got Bank of Nova Scotia (BNS) on your selection. I’ve owned some of these lists in the past (TD, CNR, FTS and SAP) but sold and restructured my dividend portfolio to monthly dividend income. I have also narrowed down my lists to 6 for now from around 13-14 stocks and who knows may add again some dividend growth stocks in the future.

Is Enbridge (ENB) in your radar and if not do we know why? Thanks.

We own Enbridge, I just didn’t list it as one of my top 10.

Hello Tawcan,

First of all congratulations for your blog, I follow you from Spain!

I was struck by the fact that you do not have the “Brookfield Infrastructure Partners” in your portfolio. I have read that it is considered a great share, and I would like to know your opinion if it is possible and why you do not have it in your portfolio.

THANKS AND GREETINGS!

Hi Rafael,

We have looked at Brookfield Infrastructure Partners but for some reason just never pulled the trigger. 🙂

I own a few of these and plan on holding them for a while too! Thanks for sharing with us!

Just discovered your blog. Really enjoying the content thus far. Well done! Do you think utilities (FTS, EMA, etc) and REITs will be impacted in this rising rate environment? Would you still acquire new shared in those interest sensitive sectors at this time?

Thanks

Stephan

These dividend stocks will be negatively impacted by the rising interest rate, but we also need to remember all of these companies have survived the higher interest rate environment. I think in the long run they’ll come out just fine.

I have been studying stock market since 2 months and to me all the share price are inflated. I have been thinking of buying Fortis and some banks’ shares but not sure if I should do it now or wait it out a bit till january, 2018.

https://theirrelevantinvestor.com/2020/12/23/3-reasons-why-you-shouldnt-wait-for-the-stock-market-to-crash/

I have 5 of your 10 in my top ten. Then instead of RY, I went LB and Suncor I exchanged for ENB. Now that Saputo made that new acquisition in Australia it’s on my watch list, too. Just waiting for a good entry.

LB and ENB are both pretty solid dividend stocks too. Don’t own LB as we already own 6 Canadian banks.

Thanks for the list Bob. Hey where do you get your payout ratios (and other values)? I seem to get different values from different websites.

Plus, how do you know what a good PE is for various stocks? For financials, it seems that a low PE of 10-15 is the norm. But for other stocks, we seem to accept higher PE’s.

I wrote the post over a span of a week so some of the numbers may have changed slightly.

In terms of PE, obviously the lower the better but it also depends on the sector. Some sectors will have lower PE’s than other sectors.

Canadian stock yields are awesome. But, they do seem concentrated in finance sector. I own TD. I have been thinking about buying iShares MSCI Canada ETF … I also have exposure to Canada through my VXUS (6.7%).

Nice blog! Adding you to my blogroll

Thank you!

Yup the Canadian market is very financial and energy focused. That’s why when it comes to diversification, we are slightly limited.

The Reserve Bank (like the US Fed) sets the cash rate and it’s currently at 1.5%. That’s a pretty standard interest rate on a transaction acc and on an online savings account you can get 2.8-3%. We also have an investment culture geared heavily toward dividends, partly because of franking credits (tax credits for what tax was paid at the company tax rate) and partly just tradition. So banks pay a high dividend and are held by people who expect a high dividend. The share price often get bid up and down based on the yield. Results season for a few of our banks this coming few weeks so it’ll be interesting reading.

That’s an interesting fact to know. Interestingly enough, Canadian banks seem to pay higher dividend yields than US counter parts. I’m not exactly sure why this is the case.

wealth from thirty,

Are you referring to Australian banks by chance? I’ve only heard the term “franking” when it was in reference to Australian stocks.

Tawcan, I’m with you on the exchange rate issue. Being from the US, I invest mostly in US based stocks. Being a dividend investor, I like to know how much I’m going to get paid and not have to worry about exchange rates influencing my payments. We also have to deal with the 15% tax on Canadian company dividends here in the US. For better or worse, those issues keep me mostly invested domestically, buy your list is a nice representation of good Canadian companies. Tom

Hi Tom,

We need to deal with the 15% withholding tax for US dividend stocks too. But don’t need to worry about that if we invest US dividend stocks in RRSP. I think it’s the same if you invest Canadian dividend stocks in 401(k) too.

Does this top 10 come in an ETF 😛

Interesting that Canadian banks seem to have a lower payout ratio compared to Australian banks at ~80% payout. Our top 4 bank stocks in Oz have slightly higher dividend yield due to this (around 5.0-5.5% yield) and higher PE ratio, around 14. I’m still waiting for them to reduce in price a little.

Well not top 10 for ETFs but I did write this:

https://www.tawcan.com/top-canadian-dividend-etfs-dont/

Wow that’s pretty high dividend yield for Oz banks. If I’m correct, Oz also has higher interest rate than Canada?

A list of solid companies indeed, we own 5 our out of 10. Some of the other are on the horizon too, but currently don’t have funds to start a new position (and considering we cannot contribute anymore, we have to wait until we have sufficient cash form existing dividend income streams).

Thanks for the good write up Bob.

That’s my problem too… cannot contribute anymore. Well we can, just have to contribute in taxable accounts.

Always great to see these lists Tawcan. I’m pretty excited that I own the number 1 stock on the list. Love having a stake in Canadian Imperial. Quite frankly, all the major Canadian Banks that I have researched are strong performers. I am a little interested to see that only one of the stocks is considered a Dividend Aristocrat. I thought there would be more companies with consecutive increase streaks greater than 25.

Thanks for taking the time to prepare this!

Bert

It’s interesting that most of the Canadian dividend stocks aren’t considered as dividend aristocrats. I guess continuing paying dividends is better than suspending dividend.

I am concerned about enbridge as it has high debt and the stock price is at 54 weeks low. That said, the company seems to be well managed. Suncor to me is a better bet with EPS able to meet dividend payout.

I have 7 out of your top 10 list. The outstanding 3 are definitely in my list to buy namely IFC, Saputo and Suncor.

Cheers!

Enbridge has high debt because it keeps borrowing to build more pipelines and such. IFC and Saputo are both solid dividend stocks IMO.

Can you tell us wby you recommend Enbridge in the previous article?

I think Enbridge is still a solid pick. High yield and a solid company. I just think there are better companies out there right now.

Canada does offer many solid long term investing opportunities. I’m happy to own TD, BNS and RY in my retirement account and have CM on my watch list. Thanks for giving us your top 10!

Glad that we own the same Canadian banks.

Good list bob. Personally I would switch the suncor pick with enbridge. higher dividend and longer dividend increase streak. (Although i never realised suncors dividend growth rate was that high) The oil sands scare me as a investment because of how much it costs and the environmental impacts. Just my 5 cents…. haha either way great list. Cheers

Thanks man. I was debating between Enbridge and Suncor. Picked Suncor because it has slightly less debt compared to Enbridge. Both stocks are solid though.

Did you consider Canadian Natural Resources (CNQ)? Dividend growth was 13.07% CAGR over last 5 years.

I did but want to limit exposure to the Canadian O&G sector right now. CNQ is a solid company, we own shares in our portfolio.

Suncor has been great disappointed during pandemic, they cut down the div ( a big big alarm for any Dividend investor and a real put off and a wake up call.) KEY.TO any thoughts on that I think they didn’t cut any dividend during the pandemic with a better Yield.

I haven’t followed KEY.TO all that much. Generally I think there are better investments out there than the O&G sector.

I follow Key -Keyera Corp. operates an integrated Canadian-based midstream business. The Company is organized into two business units: Gathering and Processing Business Unit and Liquids Business Unit. The Gathering and Processing Business Unit owns and operates raw gas gathering pipelines and processing plants, which collect and process raw natural gas, remove waste products and separate the economic components, primarily natural gas liquids (NGLs). The Liquids Business Unit consists of Liquids Infrastructure and Marketing segments. The Liquids Infrastructure segment owns and operates a network of facilities for processing, fractionation, storage and transportation of the by-products of natural gas processing, including NGLs. The Marketing segment markets a range of products associated with its infrastructure business lines, primarily propane, butane, condensate and iso-octanes, and also engaged in crude oil midstream activities. It has a great track record of making money , even when Oil/Nat Gas is Low , AS THEY ARE MORE OF A TOLL type company than producer per se .Interesting times in mid stream and infrastructure area in Canada Now. The space is in general positive. Inter Pipeline was acquired by Brookfield recently , leaving ‘Key’. Keyera will be one of the few remaining smaller players profitable Gems in the sector left. It could be a consolidation target down the road. Their core business is doing well. Natural gas prices are rising and will continue given the Biden government of raising energy costs for Americans. A company to watch in the next 6-12 months, for sure. I have a full position in them . I would call them a Hold at anything above 31.00 , and a weak buy at 29-31 . Great buy at less than 27, IMHO . Its not as cheap as before trading at 2.5 times it Book Value, right now. Divs have increased over time to what is now~6.2%. Solidly managed thats for sure . Unique assets when you delve into them. Main issue is the negativity facing core energy markets in general ,except for green energy. Everyone like to keep warm, but has no understanding of energy grids, how they work . the need for Nat Gas and problems inherent with Green energy. We can’t get pipelines built anymore until ‘sense comes back into fashion’ . Energy prices have come roaring back in the USA/Canada for obvious reasons. Energy boom of the last few months will continue as will rising engird costs – all good for KEY as a Transporter , more or less . Just my opinion , do your own DD on it . Solid company at the right price, IMHO . Buying anything at the top of the market ( and a long top at that , with inflation at 6% and rising quick) needs extensive research . In Economic history, a 6% pop in inflation would have killed a normal market….but this is far from normal times with “stimulus/tax spending” . Best of luck.

What a well thought out analysis James. I’m glad I nabbed some Keyera late Oct.2020 at less than $19/share.

KEY and ENB make up the lion’s share of the energy portion of my portfolio. I feel pretty secure in their futures, knowing they will be able to adapt to ‘greener’ sources, when the time comes.

These environmentalists just don’t get it. They want every country to change – effective immediately! They don’t care, or understand the time, or investments necessary to build the infrastructure to meet the current & future needs of a given population.