Lately, I have been getting many emails from readers that have a similar tone…

“Bob, what are you guys doing with your investments? Are you considering selling some positions and holding more cash? If you’re not selling positions, are you increasing your cash position in anticipation of a recession?”

“Aren’t you concerned that the Canadian banks, given the higher interest rates, could potentially lead to commercial and residential mortgage failures, causing Canadian banks to fail?”

“Why are you investing in dividend stocks when you can get safe GICs with a guaranteed rate of more than 5%?”

These are all very good questions and given how volatile the TSX has been in 2023, readers definitely have valid reasons to be concerned. These questions also showed me that there’s a lot of fear with the Canadian economy and where it might potentially be heading.

With that, here are my random thoughts on the market and my attempt to answer some of the above questions.

What are we doing with our investment portfolio? Holding more cash vs. investing

Given the stock market volatility, what are we doing with our investment portfolio? Are we holding more cash?

Nope, we are not doing anything differently. Also, we aren’t holding more cash just because the market is more volatile. We continue to save every month and invest regularly to take advantage of dollar cost average whenever we can.

Since I receive regular employment income every two weeks from my full-time job and Mrs. T is bringing in income with her doula services (although more sporadic), a set amount of money gets deposited in our bank account. We then allocate a certain percentage of our income per our budgeting system for investing. (Note: I don’t disclose the percentage saved for privacy reasons).

Usually, the saved money from the previous month is systematically deployed and invested at the beginning of every month.

Do I believe in holding a large sum of cash and waiting for a stock market crash? Not really. I believe that you incur an opportunity cost whenever you hold a large sum of cash. Cash sitting on the sideline means it’s not working hard for you. For example, having $10,000 in a high savings account earning 2% interest doesn’t make sense to me when I can invest in a stable dividend stock such as Fortis yielding 4% with a good chance to grow the $10,000 to something much larger. Therefore, I like to put our money to work whenever we can.

Remember, I believe in time in the market rather than timing the market. But at the same time, it’s important to deploy cash strategically whenever there’s an attractive opportunity, like buying when the market has a sudden drop of 10% or more (i.e. buy the dip).

In 2023, we have deployed a large sum of money in the first half of the year already, around $95,000 (not all new capital, as this includes reinvesting dividends and cash from selling stocks), so we have shifted to saving mode for next year.

What do I mean partially? Well, instead of deploying all the cash each month, we are saving for next year’s TFSA and RRSP contributions. At the same time, we’re also looking at strategic ways to invest some cash whenever there’s an opportunity. If fundamentally sound companies, such as Apple, TD, and Royal Bank were suddenly to drop by 10 or 15%, we’d deploy the saved money.

On many occasions, we have deployed the TFSA/RRSP savings to buy dividend stocks in non-registered accounts in the second half of the year when there’s a buying opportunity too good to ignore. We would then transfer the stocks in-kind to our TFSA/RRSP in the new year. This is one of the ways to avoid any opportunity cost.

So no, we aren’t holding more cash just because the market seems to be more volatile, or people believing there’s a pending recession. For us, it’s steady as it goes – continue executing our long term investing strategy.

Should I be worried about the Canadian banks?

Unless you’ve been living under a rock, you probably have heard that interest rates have been going up. The Bank of Canada’s overnight interest rate went from a low of 0.25% in 2020 to 4.75% in June 2023.

The rising interest rates mean more and more Canadians are seeing an increase in their mortgage payments. Just how much is the impact?

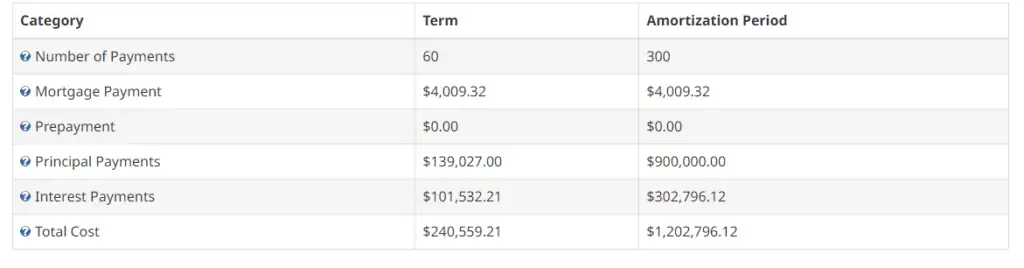

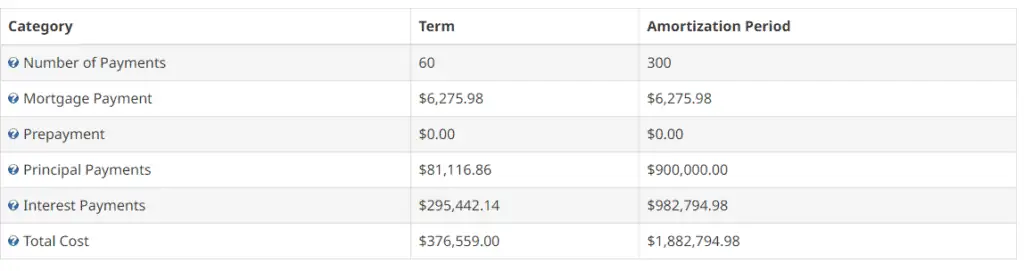

I ran a quick mortgage calculator using a $900k mortgage with mortgage rates of 2.45% and 6.95% with 25 years of amortization period and monthly payment frequency. I used a high mortgage number given that many detached houses are going for over $1.5M.

A difference of $2,266.63 per month! That’s $27,199.56 after 12 months! Whichever way you look at it, that’s a lot of money!

Now, with a smaller mortgage amount of $450k, there’s still a difference of $1,133.33 per month or $13,599.96 for the year – still a big increase!

It also doesn’t help that the average house price in Metro Vancouver is $1.188 million and in Toronto is $1,164,400. Furthermore, Canadian housing prices are on an upward march again, after a brief cooling-off period.

Are we going to see a point where many Canadians are not able to pay for their mortgages, resulting in loan defaults?

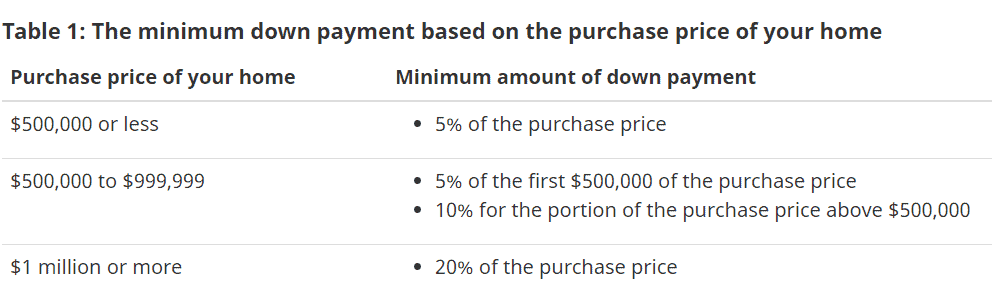

It’s possible, but let’s not forget in Canada, there’s a minimum down payment requirement depending on the purchase price of your home.

Mortgage loan insurance, in many ways, protects the Canadian banks, holders of the bulk of residential (and commercial) mortgages. Furthermore, according to Statistics Canada, fully about 30% of Canadian homeowners are mortgage free. So it is possible that any potential housing/mortgage crisis may not be as severe as expected.

Knowing the potential risks, all the big six Canadian banks have been increasing their loan loss provisions over the last few quarters in case they start seeing more loan defaults.

In other words, Canadian banks are already putting aside money to protect themselves. They did exactly the same thing in the early days of the COVID-19 global pandemic, when there were a lot of uncertainties about the economy.

Let’s also not forget that Royal Bank, TD, Bank of Nova Scotia, Bank of Montreal, and CIBC have been paying uninterrupted dividends since the late 1800s, almost a century and a half. This uninterrupted dividend streak is an extremely impressive feature of investing in any of the major Canadian banks. It shows that all the Canadian banks have gone through a lot of economic turmoil, yet continue to be very shareholder friendly.

At the current price level, I would say all the major Canadian banks are at very attractive valuations, some being obviously more attractive than others.

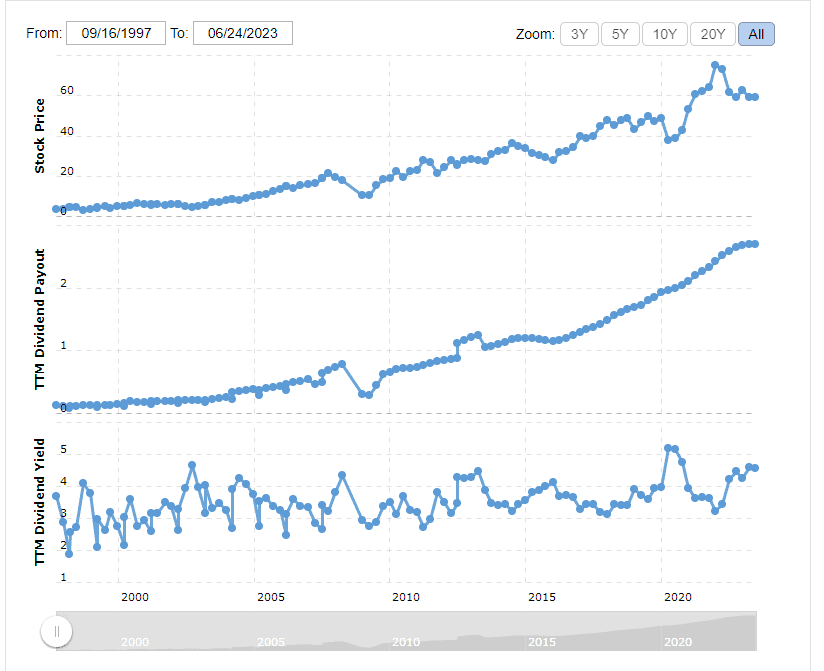

Take TD for example. It’s close to its 52-week low and it has almost $14 billion on hand after pulling out of the First Horizon deal. The TD Board recently approved a buyback of 30 million shares, something that is exceedingly shareholder friendly as it reduces the total number of stocks outstanding. Add to the major share buyback program TD’s historical dividend yield and dividend growth investors should be salivating.

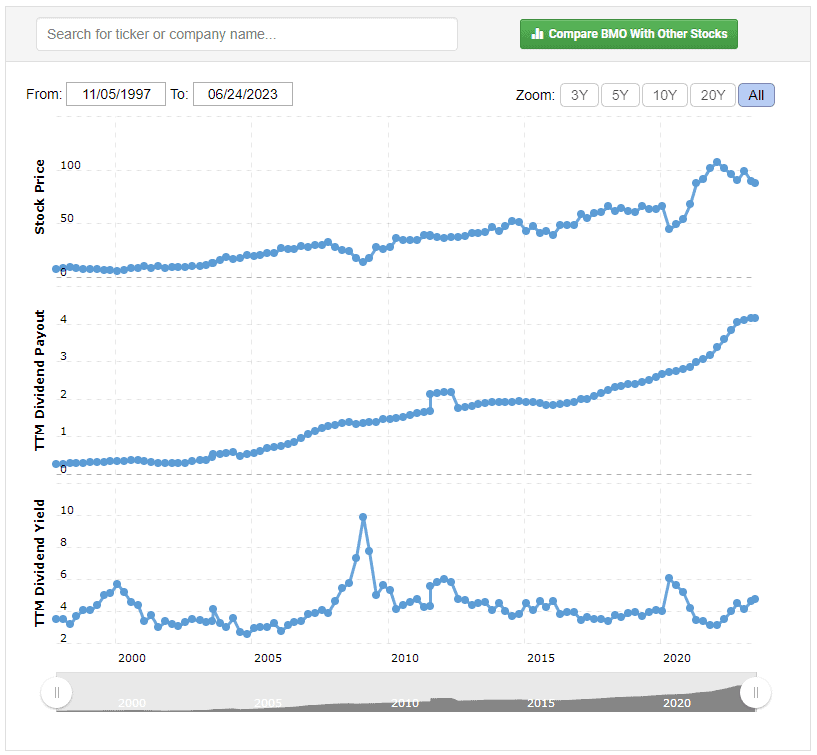

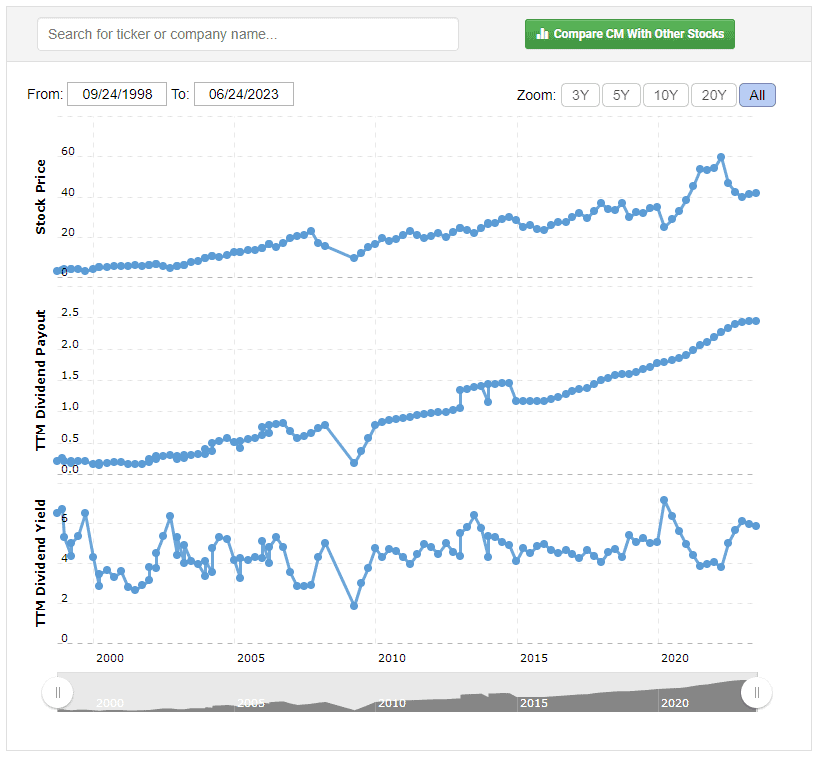

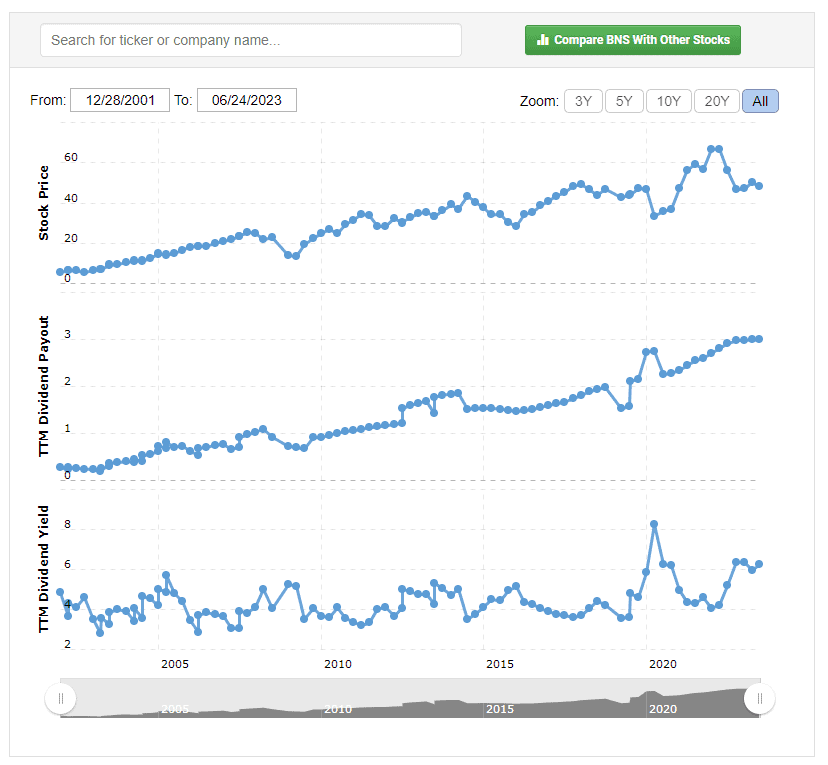

Source: Macrotrends.net

Outside of the abnormality caused by the pandemic in 2020, TD’s current dividend yield is close to a historical high.

For comparison purposes, here are the historical dividend yields for Royal Bank, Bank of Montreal, Bank of Nova Scotia, and CIBC:

Based on these historical dividend charts alone, I’d conclude that TD, Royal Bank, and Bank of Nova Scotia are quite attractive from a historical dividend yield point of view. Of course, further research is needed before you start loading up on shares

Overall, the concerns with Canadian banks are valid but perhaps a bit exaggerated. Since Canadian banks have taken measures to protect themselves just as they have done in the past, coupled with their historically low PE’s and very attractive dividend yields, I think long term the Canadian banks will do just fine.

The banking business is something that’s quite simple at its core – hold money for people and lend out that money to make money. The banking business is also quite lucrative in the sense that the banks can control the spread in their favour (i.e. they charge a higher interest rate than the interest they pay. Canadian banks also have a lot of levers they can adjust to make sure they can continue to make billions of revenues each quarter.

Therefore, I continue to believe that investors need to ignore the short term noises and focus on the long term. Looking back, I’m pleased that in the midst of the global pandemic uncertainties, we were able to purchase 320 shares of TD at an average price of $63.11.

Finally, let’s not forget that a lot of pensions are tied directly to Canadian banks. If the Big Five were to fail like the US banks during the financial crisis, Canada will be in A LOT of trouble. The government will have to step in order to prevent that from happening. Canadian banks, largely because of government regulation and oversight, have a sterling international reputation. There’s a level of security blanket with the major Canadian banks.

Are we investing in GICs instead of dividend stocks?

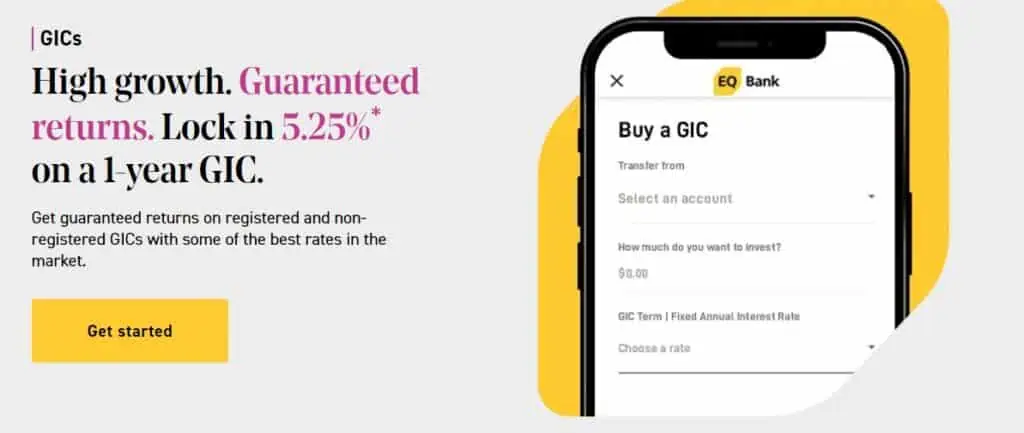

With the high interest rates, GICs are increasingly becoming more and more attractive. For example, EQ Bank offers 1-year GICs at 5.25%.

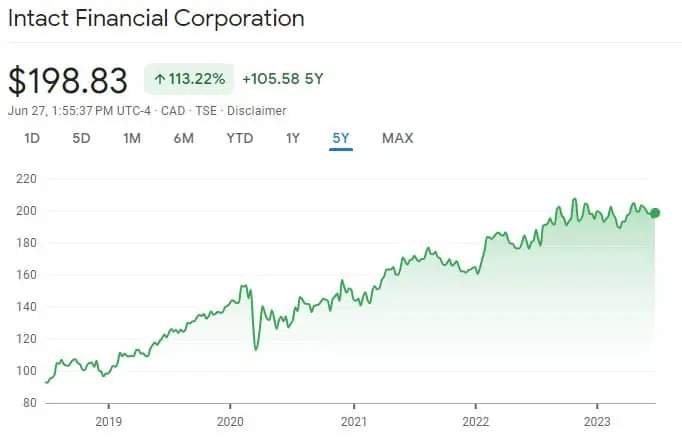

It begs the question, why invest in a dividend stock like Intact Financial that has a measly 2.2% dividend yield when you can invest in a GIC and get a guaranteed return of 5.25%?

Logically it makes sense to invest in a financial product that returns a guaranteed 5.25% plus all your principal. It doesn’t make much sense to invest in a financial product that returns 2.2% knowing that your principal may diminish in the short term.

If we were to invest $20,000 in a 5.25% GIC, we’d get $1,050 at the end of the year with $20,000 back; if we were to invest $20,000 in IFC, we’d only get $440 at the end of the year, plus it’s not a guarantee that we’d get our $20,000 back. There’s a reasonable chance that we may see a lower amount at the end of the year.

But we can’t just look at the dollar amount, we need to take income tax into consideration. GIC interest is taxed at your marginal tax rate, whereas eligible dividends have a favourable tax treatment.

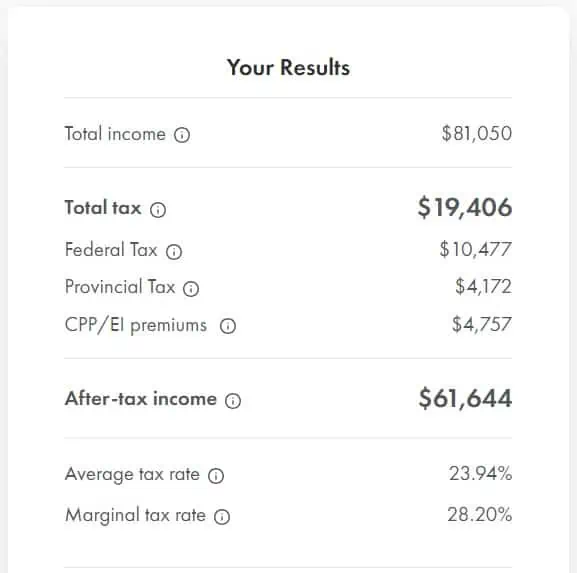

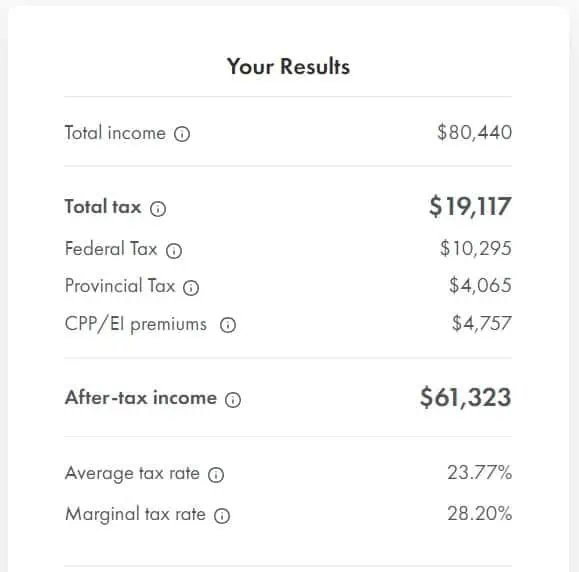

Using Wealthsimple’s tax calculator, assuming that we earn $80,000 in employment income plus $1,050 in GIC interest, we’d need to pay $14,649 in provincial and federal taxes. We’d get an after-tax income of $61,644.

On the other hand, $80k in employment income plus $440 in eligible dividends, we’d need to pay $14,360 in provincial and federal taxes, resulting in an after-tax income of $61,323.

That’s a difference of $321 in after-tax income. As expected, the pre-tax difference of $610 ($1,050 minus $440) becomes a lot smaller after-tax.

The bigger question is what happens to the principal. For GICs, the principal is guaranteed so you get 100% of your initial investment back at the end of the GIC term; for dividend-paying stocks, the principal isn’t guaranteed. However, the stock market has a long term return of 8%. So if you hold dividend-paying stocks for five years or more, you should expect to see your principal grow. Since capital gains are taxed at 50% of your marginal tax rate, they’re more tax efficient than GICs.

So are we selling investments or parking cash in GICs instead of the stock market?

Nope, we are not.

Since we are investing for the long term, we plan to continue executing our investment strategy – regularly investing in dividend paying stocks over time with savings.

Having said that, if you need the money for the short term such as within the next two or three years, investing in GICs is a good idea so you don’t lose your principal. If that’s the case for you, spreading your money out and create a GIC ladder is a good idea.

Speaking of dividend stocks, many investors will notice that there have been pullbacks on many of them. Perhaps one of the reasons is that some people are pulling money out of dividend stocks and investing in GICs.

But let’s not forget that people have been investing in dividend stocks for a long time, even in the 70s and 80s when interest rates were super high.

The important lesson here? Think long term. Always think long term. Be patient and abide by the great stock market truism – ‘it’s time IN the market, not timing the market.”

Hi Bob

As you pointed out, mortgage rates are scary these days. What is your take on the dilemma between keeping stock investment and put down more mortgage that is locked at a much lower rate for the remaining 2.5 years or so.

Always appreciate your insights!

Hi Yon,

I think that depends on your mortgage amount and whether you can accelerate your payments. Overall I think reducing mortgage amount and getting rid of debt as fast as you can is a good idea.

Are you still holding on to AQN?

Yes, continue holding and dripping away.

Hi Bob

You stated:On many occasions, we have deployed the TFSA/RRSP savings to buy dividend stocks in non-registered accounts in the second half of the year when there’s a buying opportunity too good to ignore. We would then transfer the stocks in-kind to our TFSA/RRSP in the new year. This is one of the ways to avoid any opportunity cost.

Would you explain “transfer the stocks in-kind to our TFSA”, please. Does that mean I can move stocks out of my TFSA account in 2023, and then move say an interest stock like TD into my TFSA in 2024 of equivalent value without charge? There are several stocks I would like to swap between accounts. Does TD Web Broker permit this? I would appreciate learning the mechanics of this process. Always learning from your weekly! Thanks Bob!

Hi Mary, what Bob meant to say is he see opportunity in stock selling at very attractive price so he decide to purchase it now instead of waiting to Jan 1 next year. Let’s use your example of TD shares. As of now, TD is trading at $81 a share and Bob has $6500 cash on hand and he decided to purcahse about 80 shares of TD with his $6500 cash. Come Jan 1 next year(2024), hypothetically TD bank stock rise to $100 a share and contribution limit for TFSA remain the same ($6500)as last year , Bob can do in kind transfer of 65 shares of TD stock from his non-registered account into registered accounts namely TFSA and RRSP. From tax point of view, he need to declare a capital gain of $19 a share ($100-81) x 65 shares on his tax return as capital gain for the last taxation year (2023). Same can be said to capital loss situation if TD bank fall below $81 a share at the time of in-kind transfer from non-registered accounts to registered accounts. By acquiring TD at bargaining price of $81 a share now, he would avoid opportunity cost if share price of TD rise to much higher price at the end of year. If price fall below the $81 at the year end, he can also apply the tax loss stragtey by declaring capital loss on his tax return. Capital loss can only be write off against capital gain but not your active and passive income.

Hi Dianne,

Dan explained it quite well for me already. 🙂

Scary times for people with big mortgages. Luckily we now ‘own the bank’ and don’t ‘work for the bank’ anymore.

Good ideas.

I agree that the market has the tax advantages compared to interest income.

They say people should have 60/40 stock/fixed income-bonds.

Just from a psychological point of view I’m about 80/20. Finally after decade of no interest rates, the 5-5.25% that can be gotten is wonderful.

I’m about 15 years from retirement so about 20% in GIC, brokerage GIC and fixed income lets me sleep at night, knowing I have cash in case the world implodes.

I don’t think more than 20% fixed income is really necessary.

Agreed that it’s scary times for people with big mortgages.

Given the interest rates are still relatively low historically speaking, I don’t think it makes sense to do the bond = age % exposure though. Probably should still stay high exposure to stocks.

Thanks for validating my approach because I sometimes have moments of doubt. 🙂

I keep buying into the market, probably overweighted a bit in Canada at this point but so much is at a discount while the US is at a premium. Even if it takes a while to recover and I need to extract funds (retire early), the dividend is as good as a GIC in many cases. For eg, TD is down ~25% from it’s peak and ~13% since Feb 2023. That’s bargain basement prices!

You’re very welcome Sandra.

The US market is definitely at a premium compared to the Canadian market right now.

What banks are the best at the moment you recommend? Only the big boys?

Hi Rick,

I believe I stated my opinions in the article. 🙂

Hi Bob, it was well written and is all I can say. I agree with you 100% on everything you said. As I always said to others that we should stay invested and purchase more shares on the dips unless tomorrow is the end of the world. If tomorrow is the end of the world, what is the point of having money today? If you miss 10 best trading days in 10 years, you would lose half of your return. It is never anyone’s job to time the market and it is the time in the market that matters. As Warren Buffet often said that we should never bet against the US economy. Over the long run, the Canadian market tend to follow our next door neighbour and I have so much faith in our Canadian banking system.

Thanks Stan. Stay invested!