First of all, I want to apologize for posting the monthly dividend income update later than usual. Life has been a bit hectic in December and the last couple of weeks was filled with a lot of sadness in our family (more on that next week).

As many of you know, it rains a lot here in Vancouver, hence the term “Raincouver”. However, November was abnormally wetter than usual. We have had a number of atmospheric rivers in southwest BC which meant A LOT of rain over a short period of time. We have had so much rain, many places were flooded and travel and gas restrictions have been put in place. My heart goes out to all the people that have been affected.

Just how devastating the damages have been? Take a look.

Many thanks to everyone working around the clock to build roads, dams, and other important infrastructures to restore highways and prevent further rain damages and floods. I am optimistic that we will get through this rough time and come out stronger than before.

If you can, please join me and donate money to Red Cross Canada to help those affected by the floods. Please also consider donating money and food to the local food banks in BC if you can. People in need will very much appreciate all the help they can receive.

When it wasn’t raining sideways, we’ve been busy working in the yard, trimming various trees and bushes and getting ready for the winter.

To prepare for Christmas, Mrs. T and the kids made a Christmas advent wreath with candles. It sure is hyggelige here at home. Since I’m taking two weeks off at the end of the year, we are very much looking forward to Christmas and having a slow & quiet December.

This year has been tough mentally for many of us. One of the things Mrs. T and I do is have daily hygge after lunch and enjoy some dark chocolate together while drinking coffee. We have been keeping a good amount of chocolates in our pantry. What can I say, Mrs. T and I love having chocolate while we have our daily coffee hygge.

Remember, FIRE doesn’t mean you have to save every single penny and penny-pinch. It is important to spend money on things that you enjoy and cherish those special moments.

On the blogging front, I’d like to thank everyone that filled out the reader survey and shared with me their thoughts. Congratulations to the three winners, they have been contacted by email.

It’s very interesting to see what some readers would like to see more in depth stock analysis, Facebook Live/Instagram Live/Zoom calls, private support, etc.

This makes me wonder if there are any interests for a membership support group (i.e. Patreon or something similar) that offer things like:

- Monthly zoom calls

- Analysis of what I’m monitoring

- Investment analysis, more looking forward type of analysis

- Instant update on what we’re buying and selling

- A private support community

The membership support group will certainly take up quite a bit of my time so I’m not 100% sure if that’s a good idea or not at this point. Please help me out by filling out the poll below so I can gauge the interest. Based on your input, I can determine whether this membership support group idea makes sense or not.

Thank you!

Don’t worry, I am not planning to stop posting free contents on here.

Dividend Income – November 2021

Back to dividend income shall we? In November we received dividends from the following companies:

- Apple (APPL)

- AbbVie (ABBV)

- Bank of Montreal (BMO.TO)

- Costco (COST)

- Dream Industrial REIT (DIR.UN)

- Emera (EMA.TO)

- European Residential REIT (ERE.UN)

- Granite REIT (GRT.UN)

- Metro (MRU.TO)

- National Bank (NA.TO)

- Omega Healthcare (OHI)

- Power Corp (POW.TO)

- Procter & Gamble (PG)

- RioCan REIT (REI.UN)

- Royal Bank (RY.TO)

- Starbucks (SBUX)

- SmartCentres REIT (SRU.UN)

- Verizon (VZ)

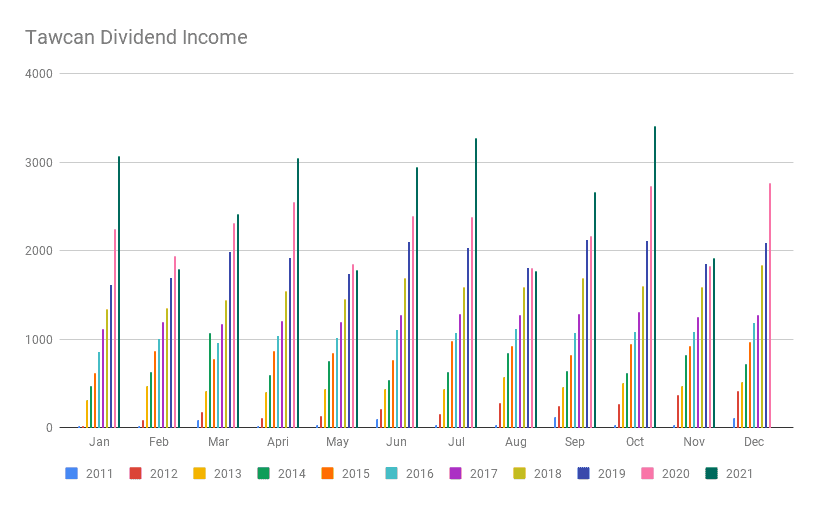

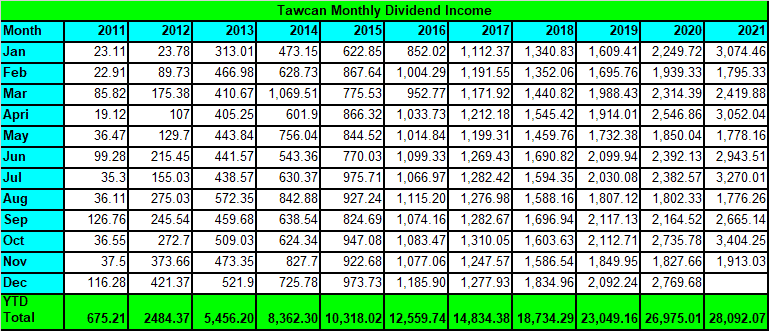

The 18 dividend paycheques added up to $1,913.03. After last month’s fantastic $3,404.25 dividend income, I am not going to complain about a small dividend payout. It is important to note that November is one of our lower dividend months, so it was normal to see a monthly dividend income of below $2,000.

Compared to other weaker months like February, May, and August where we were receiving a bit shy of $1,800, it was nice to see that we finally crossed the $1,900 mark. This was because we finally received dividends from the Power Corp purchase we made a few months ago.

If we look at our dividend history, $1,913.03 of monthly dividend income would have been the highest monthly dividend income for 2018. We have come a long way in the last few years! I am grateful that we have been able to save and invest money regularly.

Out of the $1,913.03 dividend income received, $421.90 was in USD and $1,491.13 was in CAD. This was roughly a 25-75 split. Please keep in mind that we do not convert USD to CAD when reporting our monthly dividend income. This is to keep the math easy and avoid fluctuations in our monthly dividend income caused by changes in the exchange rate.

The top five dividend payers for November were Royal Bank, Omega Healthcare, Bank of Montreal, National Bank, and Emera (not in order). Dividends from these five companies added up to $1,293.37 or 67.6% of our November dividend income.

Am I concerned that the top five dividend payers made up over 65% of our monthly dividend income? I feel very comfortable receiving a large sum of dividends from the likes of Royal Bank, Bank of Montreal, National Bank, and Emera. All of these companies are stable dividend payers. In fact, Royal Bank and Bank of Montreal have been paying uninterrupted dividends since the late 1800s!

Omega Healthcare, on the other hand, is a bit concerning. The dividend yield is over 9.5%. Although Omega Healthcare is a REIT, such a high dividend yield may not be sustainable. Furthermore, Omega Healthcare has faced a lot of challenges during the global pandemic, especially when for skilled nursing facilities. In October 2021, excluding collateral, Omega Healthcare saw an 88% rent collection rate for its skilled nursing facilities. Therefore, it is possible that a dividend cut may be coming for Omega Healthcare.

Omega Healthcare makes up a very small percentage of our dividend portfolio. For now, we plan to continue monitoring OHI and not closing out this position. Hopefully, the OHI management can turn the ship around soon.

Dividend Growth

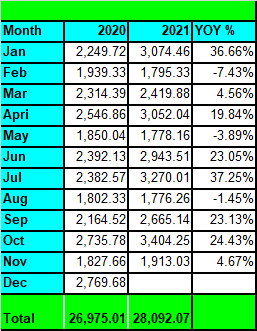

Compared to November 2020, we saw YoY growth of 4.67%. This is the first time that we saw a positive growth rate in the weaker dividend income months. So this is definitely a step in the right direction!

November’s low YoY growth rate meant the 11-month running YoY growth rate decreased from 16.99% to 16.06%. Considering we had a very strong December in 2020 thanks to Costco’s special dividend, I am hoping that we can end the year above 15% growth rate.

Dividend Transactions

At the beginning of November, we added 22 shares of National Bank (NA.TO). This was my way to play the anticipated dividend raise from the Big Six banks. And National Bank awarded us with a 23% dividend increase!

Then on Black Friday, thanks to COVID-19’s new omicron variant, the market went on sale. Seeing how we had some US cash in my RRSP, I decided to average down our VICI cost basis and purchased 40 shares of VICI.

These two purchases added $163.20 toward our annual dividend income. This amount includes the recent National Bank dividend increase.

Since we are busy saving money for the 2022 TFSA contribution limits of $6,000 per person ($12k in total for Mrs. T and me), December might be a quiet month on dividend transactions. However, we do plan to keep our eyes open and take advantage of any market volatilities.

For the 2022 TFSA, we will be buying only Canadian dividend paying stocks. We don’t buy US dividend paying stocks in TFSA to avoid paying the additional 15% withholding tax. Some of the names we’re considering for our TFSA include Algonquin Power & Utilities, Brookfield Renewable Corp, Telus, Power Corp of Canada, and Granite REIT. We may also consider starting a position in Brookfield Asset Management.

Dividend Increases

I always jump in joy whenever companies announce dividend increases because this is like getting a pay raise without doing anything at all. In November, there was a flurry of dividend payout increases.

- Granite REIT (GRT.UN) increased its dividend payout by 3.3% to $0.2583 per share.

- Canadian Natural Resources (CNQ.TO) increased its dividend payout by 25% to $0.5875 per share.

- Telus (T.TO) increased its dividend payout by 3.5% to $0.3274 per share.

- Manulife Financial (MFC.TO) increased its dividend payout by 18% to $0.33 per share.

- Intact Financial (IFC.TO) increased its dividend payout by 10% to $0.91 per share.

- Power Corp (POW.TO) increased its dividend payout by 10.6% to $0.495 per share.

As you can see, A LOT of raises in November and many of them are quite sizable. Hopefully, this means that we are finally over the COVID-19 pandemic squeeze and we will start seeing more and more sizable dividend increases moving forward.

These six announcements added $331.23 toward our annual dividend income. At a 4% yield that’s equivalent to adding $8,280.71 of new cash to our portfolio! BANG! This is the perfect example of the power of organic dividend growth.

While I’m writing this dividend update, the Big Six banks have announced significant and impressive dividend increases. These increases are like the best Christmas presents for dividend investors like me. I’ll write more about these increases in next month’s dividend income report.

DRIP

Organic dividend growth can be very powerful, as you saw in the previous section. But we can’t control whether companies will raise dividend payout or not. So one way to increase our dividends is by enrolling in dividend reinvestment plans (DRIP) and adding new shares whenever there’s a dividend payment.

We dripped the following shares in November:

- 1 share of BMO.TO

- 1 share of EMA.TO

- 1 share of ERE.UN

- 1 share of NA.TO

- 3 shares of OHI

- 1 share of REI.UN

- 2 shares of RY.TO

- 3 shares of SRU.UN

A total of $771.57 out of the $1,913.03 was reinvested or a drip ratio of 40.3%. The 13 dripped shares added $35.72 toward our annual dividend income. At a 4% yield, that’s equivalent to adding $893 of new cash to our dividend portfolio.

Summary

It is absolutely amazing that we have received $28,092.07 in dividend income so far this year and we already exceeded our 2020 annual dividend income by $1,117.06. With one more month to go before the year wraps up, we should be on track to end the year with over $30,000 in dividend income. It is extremely unlikely that we’d meet our $32,000 dividend income goal for 2021 though.

In case you’re wondering…

- Our dividend portfolio has generated us $3.50 per hour after 334 days.

- After 49 work weeks, our dividend portfolio generated $14.33 per hour. We are only $0.87 per hour away from BC’s minimum wage.

By the end of 2022, we should be earning a higher “dividend hourly wage” than BC’s minimum wage of $15.20.

It has taken us many years to build up our dividend portfolio and it is absolutely amazing to see how much progress we have made over the last 10 years. For those dividend investors that are just starting out, do not get discouraged. Not too long ago we were receiving less than $20 dividend income per month. Persistence and patient will pay off in the long run!

Dear readers, how was your November dividend income?

Happy holidays everyone!

Hi Bob. Fantastic month and thanks for sharing your journey. It’s also been a tug of war with me in the high yield, low growth vs low yield, high growth. I look forward to your article on that! I wonder about the importance of your age when you start your investing journey with regards to this. For me, when I started I was in “catch up” mode and wanted the dividends to grow faster. As many will know, a few wrong choices can easily be made when chasing high yield – a few hard lessons were learned along the way. Good luck in 2022, but I was sad to read of your family pet passing. I hope your family recovers soon.

Hi Kyle,

Your starting age and your “retirement” timeline are definitely important factors to decide whether to go for higher growth vs. higher yield.

Bob – Excellent month. What more can I say here. Almost $2k in your lowest paying month is fantastic.

Those pictures you posted were insane. Its easy to get caught in our bubble and push towards FIRE. Its always humbling to see what is going on elsewhere and realize that there are so many other things going on out there that are causing pain and issues for so many.

Cheers to a great 2022 and I’m excited to see what you come up with.

Bert

Thanks Bert. Looking forward to wrapping this year up and having a great 2022.

Great job continuing to grow the dividend income flow.

I want to avoid my mine vs yours but please know your approach motivated me to more closely watch the dividends across many accounts. It’s fun to summarize them and think about making a decent hourly ‘wage’ by letting the savings do the work.

Thank you Bruce. We need to avoid comparing dividend income and focus on supporting each other along the journey. 🙂

Wow, in your survey I did not ask for anything more. I wrote that your current content is more than enough, as writing these blogs and post take a lot of time (topic idea, the research, the write up etc). I can’t believe that individuals asked for so much more (zoom calls, IG live etc) I will assume that these Individuals are expecting paid services. You should NOT provide anymore for free. I selected no in the quick survey here. Keep up the great work as is.

Carol

Thank you for the feedback Carol.

You are doing good. Those Canadian banks ought to add quit a bit to your income. Merry Christmas.

Thank you Doug.

Looks good, I’m also thinking about adding GRT and DIR into my TFSA this year. Also CAR as it has been a laggard this past year.

House prices rising 25% yoy should be a boom for reits. As prices rise, so should rents. (If they forced evictions then the rents would really sky rocket, kinda awful though )

So reits into my TFSA, they don’t seem to grow their dividend nearly as much as Telus or other companies though. What are your thoughts on holding them?

REITs typically have higher yields than other dividend stocks and therefore don’t offer much dividend growth. It’s a constant debate of low yield high growth vs high yield low growth. Stay tuned for an article on that topic. 🙂

An impressive year for your to be sure, you should be proud!

Just wondering about your weaker months, surprised to see them in negative growth, especially how good the other months were.

What’s the story there? Dividend cuts?

Thank you Pete.

Some negative growth months this year because we changed some investments throughout last year. And yes one of the reasons was dividend cuts (and we sold most of those stocks that cut dividends). See here for more info – https://www.tawcan.com/re-examine-our-115k-dividend-stock-transactions-2020/

wow that’s a lot of chocolate.

The bc dmg Is devastating to say the least. The weather is crazy will be 5 degrees here on Monday……

great income, solid drips

keep it up Bob

Merry Christmas!

It is a lot of chocolate. Mrs. T made more too. 🙂

I didn’t say yes to ay of those harder things on the blog because your time is valuable. Absolutely only do those for patreon members, so much work and you should be rewarded for it.

Happy Holidays to you and the family.

Happy holidays to you too Chris.