It’s hard to believe it’s already April. I don’t know about you, but the last two years have been a bit of a blur to me. I still remember getting a work email on March 13, 2020, stating that we’d be working from home effective immediately without an end date. Two years later, I’m still working from home and there’s no timeline on when we’d be back in the office.

However, the global pandemic situation seems to be getting better. The global vaccination rate is increasing every day. Fewer people are developing severe symptoms. More importantly, there are better and more effective treatments available. I don’t think COVID will disappear completely. Rather, it will become a part of our lives and we will need to adapt and learn to live with it. Hopefully, this global pandemic will soon become an endemic…

One thing I am forward to is getting on a plane for work travels. Once travel restrictions in Asian countries are lifted, I’ll be on a plane heading over there.

On the home front, Mrs. T has been doing a lot of pottery drop-ins at the local recreational centre. I’m really impressed with what she has made. Our house is quickly being filled up with a lot of pottery products.

Baby T2.0 enjoyed her silly hair day at school in mid-March. It took Mrs. T quite a bit of time to prepare Baby T2.0’s hair that morning.

Now that the weather is getting drier and warmer, we are doing more activities outside with both Beavers and Cubs. It’s a nice change from having meetings in someone’s garage. Kids are enjoying time outside, exploring the great outdoors. When we’re hiking around outisde, it almost feels like we’re back to pre-COVID.

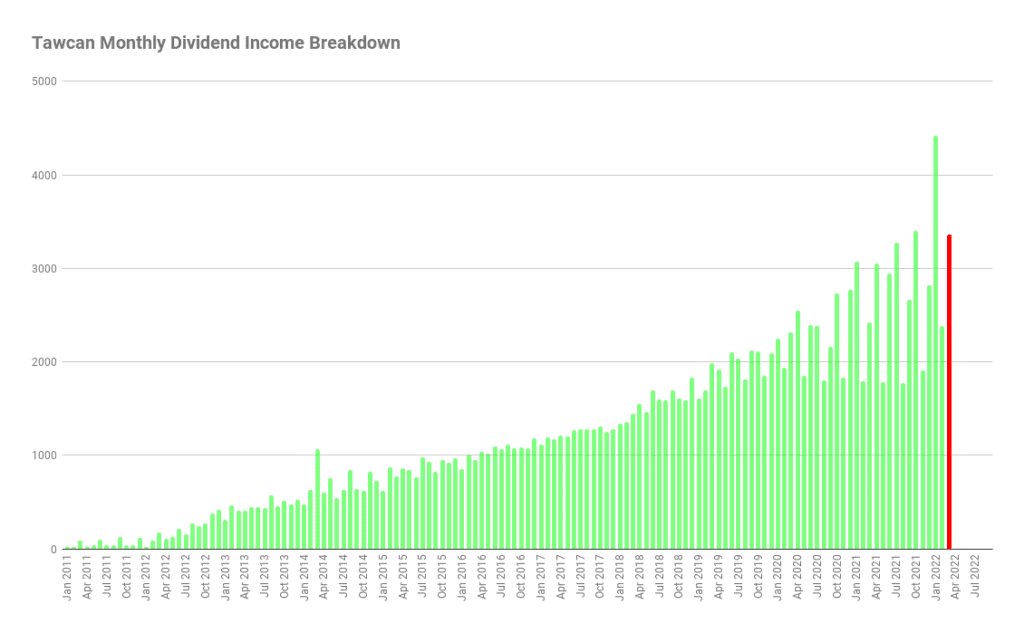

Dividend Income – March 2022

Back to dividend income. In March we received dividend paycheques from the following companies:

- Brookfield Asset Management (BAM.A)

- BlackRock (BLK)

- Brookfield Renewable (BEPC/BEP)

- Canadian National Railway (CNR.TO)

- Canadian Tire (CTC.A)

- Canadian Utilities (CU.TO)

- Dream Industrial REIT (DIR.UN)

- Enbridge (ENB.TO)

- European Residential REIT (ERE.UN)

- Fortis (FTS.TO)

- Granite REIT (GRT.UN)

- Hydro One (H.TO)

- Intact Financial (IFC.TO)

- Intel (INTC)

- Johnson & Johnson (JNJ)

- McDonald’s (MCD)

- Manulife Financial (MFC.TO)

- Magna International (MG.TO)

- Metro (MRU.TO)

- PepsiCo (PEP)

- Qualcomm (QCOM)

- RioCan REIT (REI.UN)

- SmartCentres REIT (SRU.UN)

- Suncor (SU.TO)

- Target (TGT)

- Visa (V)

- Waste Connections (WCN.TO)

- Waste Management (WM)

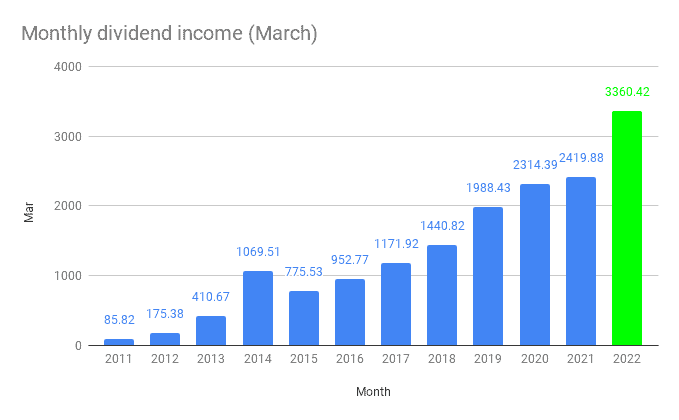

The 28 paycheques added up to $3,360.42. Needless to say, March was a solid month for us.

If we compare this month’s dividend income to last March’s dividend income, we saw an incredible 38.87% increase! It’s absolutely crazy to think that we went from a little over $2,400 last year to over $3,300 this year. Saving money and investing money each month has certainly paid off for us.

Out of the $3,360.42 received, $494.53 was in USD and $2,865.89 was in CAD. Long time readers will recall that we do not convert USD to CAD when reporting our monthly dividend income. This is to keep the math easy and avoid fluctuations in our monthly dividend income caused by changes in the exchange rate.

The top five dividend payers for March were Enbridge, Fortis, SmatCentres REIT, Brookfield Renewable, and Manulife (not in order). These top five payers contributed 70.4% of this month’s dividend income, or $2,365.32.

For the last few months, the top five payers have been contributing more than 65% of the monthly dividend income. Ideally, we want to rely less on the top five payers so our dividend income is more diversified. This would require investing more money in lower weighted dividend paying stocks in our dividend portfolio.

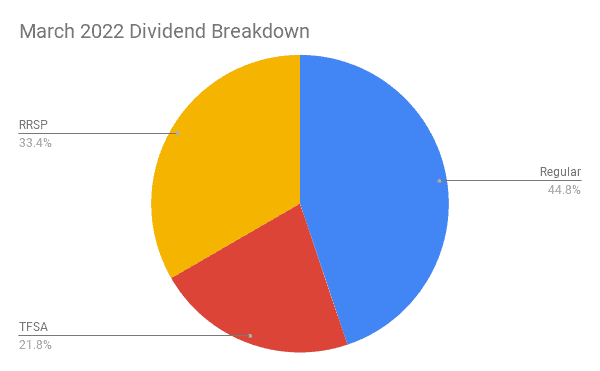

Dividend Income Breakdown

Whenever we invest, we always keep tax efficiency in mind. Therefore, we always try to max out our TFSAs early in the year and then max out RRSPs throughout the year. Once both these tax-advantaged accounts are maxed out for both me and Mrs. T, we then contribute to our taxable accounts.

We only hold REITs and income trusts like SmartCentre REIT and RioCan REIT in either our TFSAs or RRSPs. To avoid the 15% withholding tax on foreign dividends, we only hold US dividend stocks in our RRSPs.

For taxable accounts, we only own Canadian dividend stocks to take advantage of the dividend tax credits, as Reader B highlighted previously. The only exception is that we hold XAW in my taxable account.

Here’s our March dividend income breakdown per the different accounts:

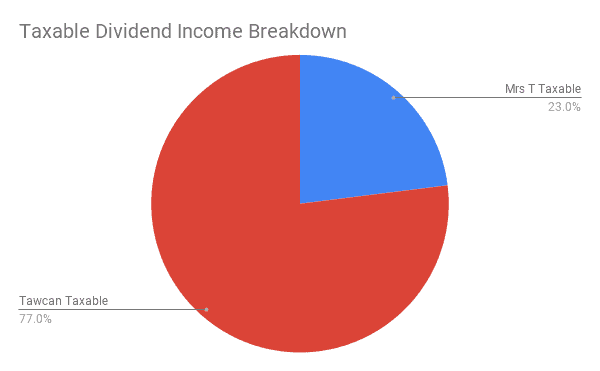

As you can see 55.2% of our dividend income is either tax-free or tax-deferred. Out of the 44.8% taxable dividend income ($1,505.47), it is broken down between Mrs. T and me for further tax efficiency.

The breakdown isn’t quite 50-50 because I currently have a higher income than Mrs. T. Due to the income difference between us, I have been contributing to Mrs. T’s TFSA and the spousal RRSP so she can contribute to her taxable investment account with earnings from her holistic doula business. It is our goal to get as close as possible to a 50-50 split when we’re living off dividends, but I’m not sure this is achievable given the income variance.

March 2022 Dividend Transactions

As mentioned in our January dividend income update, I’ve been toying with the idea of closing out our position in Canadian Utilities due to the lacklustre 1% dividend growth rate over the last few years. A few days after receiving dividends from CU, I decided to pull the sell trigger and reinvest the money in companies with higher dividend growth rates. Investing in a high dividend growth company is generally a good idea if you have decades of investment timeline. I have demonstrated this idea in the case study of dividend yield & growth post.

With the money from the CU sale and additional cash, we decided to add the following shares:

- 58 shares of BCE.TO

- 157 shares of POW.TO

- 61 shares of BMO.TO

- 7 shares of APPL

- 10 shares of SBUX

The selling of CU shares and the addition of the above purchases added a total of $397.22 toward our annual dividend income from these purchases.

In case you’re wondering why we added more shares of these companies, you may want to take a look at my reasoning in last month’s dividend update.

The April we plan to continue to monitor the following stocks and look for opportunities to add more shares:

- Apple – I continue to like Apple’s ecosystem.

- BCE – we’d like to increase our telecommunication sector exposure slightly and BCE has continued to grow its dividends at a good rate.

- BlackRock – BlackRock has taken a beating in the last two months. People will continue to invest in iShares ETFs so it makes sense to take advantage of the discounted price.

- Canadian National Railway – I picked CNR as one of my best Canadian stocks and I believe in CNR’s long term profitability. CNR is definitely a long term hold for us so we plan to build up our position over time.

- Magna International – Magna has a lot of growth in the EV revolution. The stock has taken a big hit due to the war between Ukraine and Russia. I might take advantage of the short term downturn and add a few more shares.

Dividend Increases

Last month there were 11 dividend increases and increased our forward dividend income by $261.19. Unfortunately, March was a very quiet month in terms of dividend increases. Only two companies in our dividend portfolio announced a dividend payout increase.

- Canadian Natural Resources (CNQ.TO) increased its dividend payout by 27.7% to $0.75 per share.

- Qualcomm (QCOM) increased its dividend payout by 10% to $0.75 per share.

These two increases added $104.60 toward our annual dividend. It’s not as impressive as last month but I’ll take a raise over no raise at all.

Summary

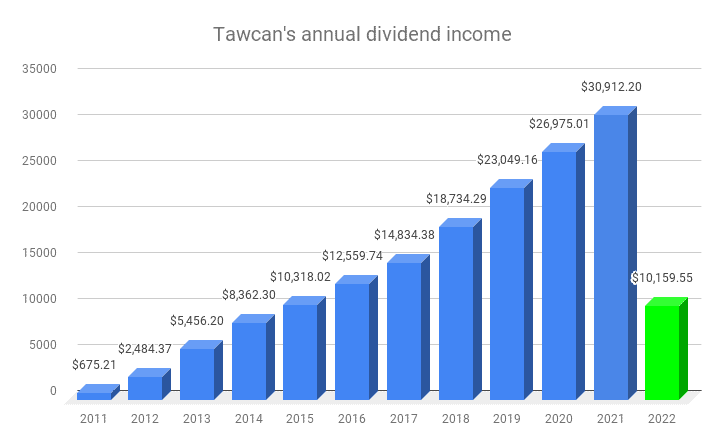

With Q1 2022 in the books, our investment portfolio has generated $10,159.55 in passive income. This is purely passive income as we don’t need to do anything other than monitoring our portfolio regularly. If we continue this monthly average of around $3,300, we will be able to beat our goal of $36,000 in dividend income. That itself would be a fantastic achievement.

Looking at the chart, it’s fascinating to me that our dividend income from Q1 2022 is almost as much as the 2015 total annual dividend income. The dividend snowball is definitely getting bigger and bigger. Compounding is indeed very very magical!

To put things in perspective…

- We are earning $112.88 per day or $4.70 per hour.

- We’re getting a working hourly wage of $18.14 per hour assuming 14 working weeks and 40 hours a week.

Given what’s going on in Ukraine and lots of people are suffering as a result of the unnecessary war, we have donated a portion of our March dividend income to charities. I’d encourage readers to donate to charities like Canadian Red Cross, Unicef, Save the Children. You can also check out more charities here.

Dear readers, how was your March dividend income?

Congratulations on strong March dividend earnings. Do you have goals for the future – 1, 3, 5 year range?

Thank you. See here – https://www.tawcan.com/dividends/ and here https://www.tawcan.com/2022-goals-and-resolutions/

well done! what and how many did you drip.?

I forgot to include drip info on this update. Will make sure to share that in the next update.

Nicely done yet again.

Good luck for the rest of the year.

Thank you!

Kub Kars are awesome and so is your update!

It’s fun seeing all the different Kub Kar designs that’s for sure. Best part was doing the race with a lot of excited youths running around.

Thank you for your kind words.

Very kind of you to give to others in need.

March is a “medium” dividend month for me (February being low and January high). Great job on continuing to grow your dividends. I’ve reached “my enough” so I’m finding ways to try and spend some of my “extra” money (since I don’t need the dividend income). Even though, I’m still saving, giving and investing. Some habits are hard to break.

I’ve had WCN.to on my watch list for five years now. Too bad I didn’t buy back then when the analysts were saying that the share price was over valued or “high”. Can you share your thoughts on the company and/or why you bought/own it? People aren’t making any less garbage and even if they do, I have faith that the company will find ways to make money off of having less garbage.

Regards, Sarah

Thank you Sarah.

We got into Waste Management a long time ago because I thought the garbage business is an easy to understand one. I wish we had got into WCN years ago as well but given WCN And WM have similar business models, I figured WCN is a good company to invest in. 🙂

Very nice year over year growth Bob. And $10K in quarterly passive income is terrific. I picked up some Apple shares as well this year. Great company. Will you give your kids iPhones when they’re older? 🙂

Thanks Liquid. Working hard to increase our passive income. 🙂

Despite loving Apple, Mrs. T and I have Android phones. We do not plan to give kids cellphones until they’re much older. Sometime in high school? We’ll have to wait and see.

Bob:

TD says that CU is paying 4.55%

What gives?

The price has gone up since I wrote about CU.

Wow, your dividend income is amazing. It keeps growing. Nice job.

I just got back from spending 3 months in Thailand with my elderly parents.

It’s great to see them and enjoy real Thai food.

Most Asian countries are starting to ease their Covid restrictions. This summer would be a good time to go, before Cold War 2 gets serious. I wrote about that on my blog today…

Thanks Joe. Would love to check out Thailand one of these days.

Congratulations, I always enjoy your newsletters. Wondering whether you have any updates on Canadian Monthly Dividend stocks, which I like to focus on in my holdings. Thanks kindly again.

Thank you. Haven’t updated the monthly dividend stock post, will plan for that.