It’s hard to believe that July is over and August is already upon us. Time sure passes by when you are having fun!

For the first half of July, Mrs. T, the kids, and I were busy tending our backyard garden. It felt really good that all the hard work we did in the spring was paying off as we were harvesting lots of fresh veggies and produce. Growing our own veggies has been a very worthwhile and humbling experience.

In the latter half of July, we hopped on a plane to go visit family and friends in Denmark. We’ll be spending over a month in Denmark. Having been to Denmark many times (7th time for me), it is now feeling like a second home. It’s also nice to have some authentic Danish food that we typically don’t get in Canada.

Unfortunately, that meant we couldn’t enjoy all the veggies from our garden. Hopefully, when we get back at the end of August, there will be a ton of veggies waiting for us still.

I’m starting to understanding a bit more Danish but there’s a long way before I can be considered as fluent in Danish. It’s funny because Baby T1.0 is completely fluent in Danish and Baby T2.0 can understand Danish (and speak a little bit) just fine. I need to step it up!

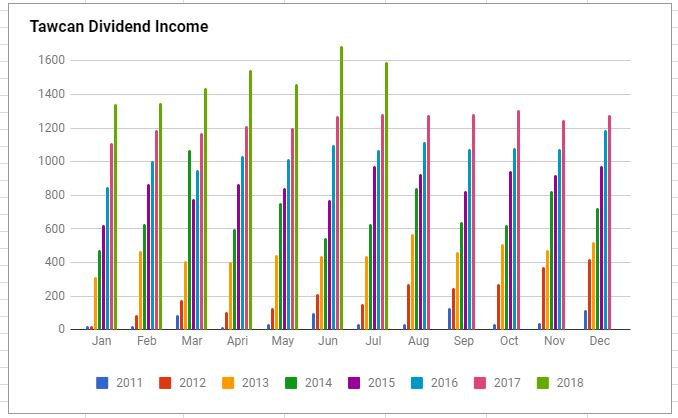

July Dividend Income

In July we received dividends from the following companies:

- BCE (BCE.TO)

- Bank of Nova Scotia (BNS.TO)

- CIBC (CM.TO)

- Canadian Natural Resources (CNQ.TO)

- Dream Office REIT (D.UN)

- Dream Global REIT (DRG.UN)

- Dream Industrial REIT (DIR.UN)

- Enbridge Income Trust (ENF.TO)

- Evertz Technology (ET.TO)

- H&R REIT (HR.UN)

- Inter Pipeline (IPL.TO)

- KEG Income Trust (KEG.UN)

- Coca-Cola (KO)

- Nutrien (NTR.TO)

- Prairiesky Royalty (PSK.TO)

- Rogers (RCI.B)

- RioCan (REI.UN)

- SmartCentres REIT (SRU.UN)

- Telus (T.TO)

- TD (TD.TO)

- TransCanada Corp (TRP.TO)

- Domatar Corp (UFS.TO)

- Vanguard Canada All Cap (VCN)

- Ventas (VTR)

- Vanguard All-World Ex Canada (VXC)

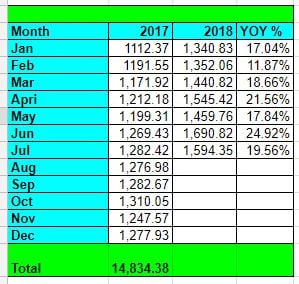

In total, we received $1,594.35 from 25 companies in July 2018. Although we didn’t break any monthly dividend income record in July, like what we did for 5 out of 6 months prior, $1,594.35 was the second highest amount received ever! That by itself was very encouraging to see.

Compared to the previous quarter (April), $1,594.35 was only a small increase. The increase was mostly contributed by organic dividend increase and DRIP.

Out of the $1,594.35 received, $141.78 were in USD and $1,452.57 were in CAD. Or about a 10-90 split. If you are a long time reader to our monthly dividend income reports, you know that we use a 1 to 1 currency rate approach. We do not convert dividends received in USD to CAD. We are ignoring the exchange rate to keep the math simple. This is our way to avoid fluctuations in dividend income over time due to changes in the exchange rate.

The top 5 dividend payouts in July 2018 were Bank of Nova Scotia, Coca-Cola, TD, Telus, and CIBC (not in order). Dividend payouts from these 5 companies accounted for 47.9% of our July dividend income, or $764.32. In order words, the top 5 payers contributed significant amount of July dividend income. While we like to diversify our dividend income source, sometimes it’s unavoidable to have a high concentration from certain companies.

Dividend Income Breakdown

We hold our dividend stocks in taxable accounts, RRSPs, and TFSAs. Every year, we maximize tax-advantaged accounts first before investing in taxable accounts.

For July 2018 dividend income, here’s the breakdown of the different accounts:

- Taxable: $437.31 or 27.4%

- RRSPs: $427.11 or 26.8%

- TFSAs: $729.93 or 45.8%

Having 73.2% of dividend income in TFSAs and taxable accounts meant we could easily assess the money if we had to start utilizing our dividend income to cover everyday expenses.

As a reminder, we only hold US dividend paying stocks in our RRSPs to avoid the 15% withholding tax. If we were to hold US dividend paying stocks in taxable accounts, we would lose $0.15 for every dividend dollar received, however, we do get the foreign tax credit. If we were to hold US dividend paying stock in TFSA’s, not only we would lose $0.15 for every dollar of dividend received, we would not get the foreign tax credit.

Dividend Growth

Compared to July 2017, we saw a respectable YOY growth of 19.56%.

An almost a 20% YOY growth! I’m very pleased to see such great performance. I suppose the high YOY growth has to do with investing over $50,000 so far in 2018.

Dividend Increases

Although most of our dividend income growth is contributed by investing new capital in our dividend portfolio, lately we have been putting more focus on organic dividend growth. Why? Because once we stop investing a large sum of new capital (i.e. we’ve stopped working), we will be relying on organic dividend growth to keep up with inflation.

In July only one company that we hold announced dividend payout increases.

- Coca-Cola raised its dividend by 5.41% to $0.39 per share.

Coca-Cola keeps its dividend increase streak alive. A 5.41% raise is a bit low, but a raise is a raise.

Dividend Stock Transactions

In July we made a few dividend stock transactions. First, we purchased 62 shares of Laurentian Bank (LB.TO). This is the third time this year that we purchased LB. We have been slowly building up our LB position because the stock price has been suppressed all year. The dividend yield is above 5% while the payout ratio is below 50%. We may continue to buy more LB if the price stays flat the next few months.

In addition to the LB.TO purchase, we decided to close out our BP and ConocoPhillips positions. I have outlined some of the reason in an earlier post. With the extra US cash, we may decide to purchase more US dividend paying stocks, or we may take advantage of the recent FAANG (Facebook, Apple, Amazon, Netflix, Google) price drop and add some shares (FYI, I don’t discuss our non-dividend-paying stock transactions on this blog).

Ironically after closing out our BP position, BP announced a 2.5% dividend increase, first one since 2014. Oh well.

Conclusion

So far in 2018, we have received a total of $10,424.06 in dividend income. It’s really nice to see that we’ve already broken the $10k mark with 5 more months to go in the year. We didn’t break the $10k mark until September of 2017. Furthermore, we have already exceeded the total dividend amount for the entire year of 2015.

It’s nice to see our awesome progress!!!

If we look at our dividend income from a quantitative perspective, at $40/hr ($83,200 annual salary), we have saved ourselves over 260 hours or 6.5 working weeks. This is a perfect example of how our money is working hard for us so we don’t have to.

With 5 more months to go, if we average $1,500 a month, we would be on track to receive close to $17,500 in dividend income for the entire year. We do plan to purchase more dividend paying stocks for the rest of 2018, so hopefully we can end the year at above $18,000 in annual dividend income.

Dear readers, how was your July dividend income? Did you break any personal record?

That’s a wonderful dividend income chart, Bob. It details all the effort and persistence you’ve put into investing over the years. Continued success to you!

I like the thought you are putting into making sure some of the money is accessible, in preparation for the day you’ll use the dividend income for expenses. Always have to be thinking ahead!

That’s quite the garlic harvest… my wife loves garlic on all sorts of food. Are you able to store/preserve any of that?

We usually have sufficient garlic to last us almost 1 year. Once harvested, you need to dry them first. Once dried, keep them in a cool place.

Oh my god, you are all so lucky. I’m from Portugal and when we get the dividends we are taxed at 43% imediatly. But i still hoppe to get my early retirement.

Tawcan, i would like to ask you a question…..

Someone that doesn’t understand anything about fundamental analysis is it a good idea to invest in a “dividend growth portfolio” like yours????

It’s always possible to reduce the list of companies to the dividend aristocrats (currently 53) and start from there but wich ones to choose?!

My recommendation is to start with index ETFs and learn from about stock analysis before you venture into DGI.

Hi Bob, how did you build that greenhouse? Did you have someone install it or build it yourself?

Hi Tim,

We bought it from Costco (online) and installed it ourselves.

Bob – Unbelievable. It is that plain and simple. 20% YOY growth and you crossed the $10k in dividends received mark after July. I love reading your updates, looking at the pictures and fun month you are having, and the chart showing how much progress you have made over the years. Keep up the great work and keep on inspiring!

Bert

Thank you Bert, very happy with the 20% YOY growth. Was a bit surprised to see that number actually.

The chart is very inspiring to see for me every month. 🙂

You have a lovely garden! Thanks for sharing those pics! As portfolio goes, what an amazing progress! Keep it up! I must have missed your LB purchased. I bought LB a few days ago as well. Hopefully we’ll make good return from it.

Cheers!

Thank you Dividend Income Stocks. Very happy with our portfolio but can probably do some tweaking here and there over time.

sweet! nice work bob… My gardens is busting out with the tomatos and green beans. The peppers, cucumbers and watermelons really havent done much this year. seem to always have that problem with peppers.

Anyways solid dividend income man, keep it up and have a great trip.

cheers

Thanks man. That’s awesome your garden is busting out with tomatoes and green beans. Have to say, home grown tomatoes are so much better than ones you can buy from grocery stores. We had trouble growing peppers last year too so we didn’t try again this year.

WOW! Nearly $1,600 in dividend income and a 20% YOY! Congrats! Keep it up! 😀

Thank you My Dividend Dynasty. Loving the dividend income for sure.

I remember trying pickled herring when I was in Sweden, and couldn’t keep it down. But your pic makes it look good, maybe time to give it another shot.

I quite like it. Ironically Mrs. T doesn’t like it lol.

I hope you weren’t trying surströmming. :S

I feel like I should like it, I like fish, I like pickled things. Was a long time ago, so I don’t remember exactly what it was I tried.

Great update, and I like the similarity behind growing your garden and planting the seeds of new capital that are reaping a dividend harvest of their own. Your month to month results are quite consistent, and great to see you eclipsing prior year results with 5 months still to go!

Hehe yup seed and fresh capital comparable when it comes to growing your own garden and growing your dividend income. 🙂

Nice pictures of the Garden. I got into that a little bit last year and found it really enjoyable to be out in nature growing something. And of course the yummy veggies on the table were nice too. Good to see your dividend strategy is continuing to pay off and that cash continues to grow and build your money making machine!

It’s really nice to spend some time in the garden for sure. And knowing you will end up with nice yummy veggies is a bonus too.

20% growth with your portfolio is awesome! I really like your actual harvest. It’s somewhat of a family dream to be able to do something like that.

Thank you Mr. Robot. If you start planting a few things in pots, you’ll be amazed what you can end up with.

Nice. Thanks for publishing your monthly dividend income. I was waiting for yours to make the compilation.

BTW: I married in Copenhagen 🙂

That’s very cool that you got married in Copenhagen. We had a wedding reception in Denmark as well but in a small Danish town.

Nothing warms my soul more than a Monday with a dividend update from Tawcan. Mrs. G and I don’t have any dividend stocks per se. We’re investing in a total stock market index fund and a total bond market index fund. For July, our total bond market fund kicked out $1,422. Not bad considering interest rates are so low. Can’t wait till we return to the days when interest rates were in the 4-5% range. Thanks for the update, sir.

Thank you Mr. Groovy, that’s very nice to hear from you. Total stock market index fund and total bond market index fund are a great way to go, we invest in index ETF’s as well. $1,422 for bond is pretty awesome! Gotta love that!

Nice dividends Tawcan! Our dividends in July were $1671, but this is a rather small amount compared to June, which broke $10k.

Congrats on the great dividend growth!

Thanks Mr. Tako. Your dividend income is pretty impressive, that $10k amount last month was crazily awesome. This month at $1671 is pretty awesome too.

WOW….. not sure what I’m more impressed with, the garden or the dividends.

Well done on the careful cultivation of both crops Bob

Haha the garden is mostly done by Mrs. T. She enjoys doing stuff in the garden (me too).

20% Growth is Awesome! Next year you should be pushing the $2000 per month mark with that type of growth! Our garden fizzled out this summer. The deer really did a number to the plants and I felt discouraged so I have not taken good care of it since. Our green beans were doing incredible – 6 large plants with tons of pods ready to be picked – came out the next morning and everything was gone. The deer knocked over the tomatoes during their time in the garden snapping a few off at the base. Squirrels/deer also took out about half the corn crop right before they were going to be picked. it was a rough morning that day but there is always next year!! We still have canteloupe and watermelon coming in so all is not lost.

Nice work again on the dividends!

ADD

Hi American Dividend Dream,

Thanks, it would be very awesome if we can get $2,000 per month next year. Gotta invest more fresh capital for sure.

That’s too bad to hear that your garden fizzled out this summer. Fortunately, we don’t have any wild animals roaming around to eat all the different veggies. That’s crazy the deer can do that much damage. 🙁

Wow, 20% YOY growth. That’s beyond awesome. Great job.

Your vegetables are great too. That’s a lot of fresh vegetables. Our community garden is also doing very well this year. I need to go take some pictures.

Thank you Joe. It’s amazing how much vegetables we managed to get out of such a small garden. Very happy with the results so far.

Garden & harvest look great!

Another great month as well…nice work!

Hope you have a good trip and safe return home!

Thank you Jordan. Too bad we aren’t home to enjoy all the home-grown vegetables. Hopefully there will be some left still when we come back.

Impressive harvest so far! And there will be so much more coming, also a nice form of dividend (albeit not entirely passive)

It’s also fun to see the dividends move like clockwork!

Thanks Team CF. Our dividend income is indeed like clockwork, I like that a lot.

Congrats, really impressive! That reinvestment of over $ 50K is giving the snowbal a huge push and will pay dividends in the future (pun intended). PS Well done on the tomatoes, of everything in my garden it seems like the one I just can’t nail.

Thanks Wealthy Content. The $50k was a really nice snowball for sure. 🙂