It’s the beginning of the month and that means it’s my favourite time of the month – it’s time for the monthly dividend income and financial independence journey update! For those of you who are new here, we are focusing on achieving financial independence by 2025 or earlier. Our definition of financially independent is a little different than many FIRE seekers. Our definition of financial independence means that our annual expenses can be completely covered by our passive income sources, and our dividend income makes up the majority of our passive income sources. How much money do we need? We estimated anywhere from $40,0000 to $60,000 in dividend income to cover our expenses.

How did we come up with $40,000 to $60,000? You’re probably thinking that is a HUGE range. Well, the $20,000 range is there to give us some flexibility. Our current annual recurring necessities expenses are in the $34-$30k range. This amount does not include expenses like travels, charity donations, dining out, entertainment, education, and other big item purchases. We padded an extra $10-20k for these expenses and some buffer. Therefore, when our dividend income reaches $40,000 to $60,000 range, we can call ourselves financially independent. When this happens, whether we decide to retire early or not is completely up to us. We can decide to retire early from the typical full-time work and focus our energy on our side businesses (i.e. my photography, our cookbook business, Mrs. T’s holistic healing practices, her self-help book), our interests, and volunteering opportunities.

In March, we continued saving and investing money. This repetitive process is becoming second nature to us. Since March was unusually warm, we spent a lot of time outside. My in-laws were visiting from Denmark and we got to spend a whole week with them. It was great to see the kids spending time with my in-laws and building on the grandparents-grandchildren relationship.

Dividend Income

In March, we received dividend payments from the following companies:

- Brookfield Renewable (BEP.UN)

- Canadian National Railway (CNR.TO)

- Canadian Tire (CTC.A)

- Canadian Utilities (CU.TO)

- Chevron (CVX)

- Dream Office REIT (D.UN)

- Dream Industrial REIT (DIR.UN)

- Dream Global REIT (DRG.UN)

- Enbridge (ENB.TO)

- Evertz Technologies (ET.TO)

- Fortis (FTS.TO)

- Hydro One (H.TO)

- High Liner Foods (HLF.TO)

- H&R REIT (HR.UN)

- Intact Financial (IFC.TO)

- Intel (INTC)

- Inter Pipeline (IPL.TO)

- Johnson & Johnson (JNJ)

- KEG Income Trust (KEG.UN)

- Magellan Aerospace (MAL.TO)

- McDonald’s (MCD)

- Manulife Financial (MFC.TO)

- MCAN Mortgage Corp (MKP.TO)

- Magna International (MG.TO)

- Metro (MRU.TO)

- Prairiesky Royalty (PSK.TO)

- Qualcomm (QCOM)

- RioCan (REI.UN)

- Saputo (SAP.TO)

- SmartCentres REIT (SRU.UN)

- Suncor (SU.TO)

- Target (TGT)

- Unilever plc (UL)

- Visa (V)

- WestJet (WJA.TO)

- Waste Management (WM)

- Exco Technologies (XTC.TO)

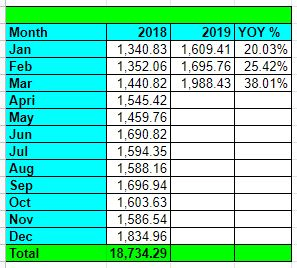

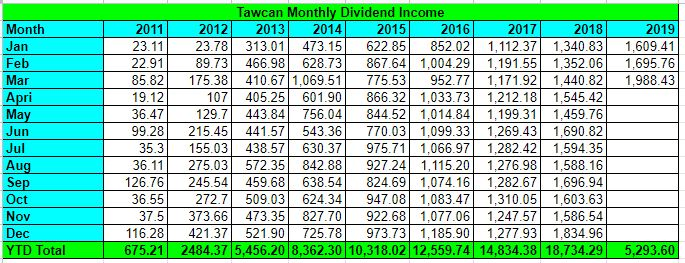

In total, we received 37 pay cheques that added up to $1,988.43 – a new monthly dividend income record! We have crossed the $1,900 milestone! Woohoo! And what was even more amazing was that we were only $11.67 away from the $2,000 milestone. I feel truly blessed to receive this kind of money for doing absolutely nothing at all. That’s the power of having your money work hard for you, so you don’t have to!

Of the $1,988.43 received, $325.95 was in USD and $1,662.48 was in CAD or about a 15/85 split. Please note, we use a 1 to 1 currency rate approach. We do not convert dividends received in USD to CAD. We are ignoring the exchange rate to keep the math simple. This is our way to avoid fluctuations in dividend income over time due to changes in the exchange rate.

The top 5 dividend payouts in March 2019 came from Canadian Utilities, Manulife, Enbridge, Suncor, and Inter Pipeline (not in order). Dividend payout from these 5 companies accounted for $916.58, or 47.1% of our March dividend income total.

Dividend Breakdown

We try to be as tax efficient as possible when it comes to dividend income. To do this, we maximize our TFSA and RRSP contribution rooms each year. When we max out both of these accounts, we then contribute to our taxable accounts.

We only purchase US listed dividend paying stocks in our RRSPs; REITs and income trusts in our TFSAs and RRSPs; and Canadian dividend stocks that pay eligible dividends in our taxable accounts. The plan is to pay as close to $0 in income tax when we are financially independent and living off our dividend income.

For March 2019, here’s the breakdown of the different accounts:

- TFSA: $623.29 or 31.4%

- RRSP: $776.34 or 39%

- Taxable: $588.80 or 29.6%

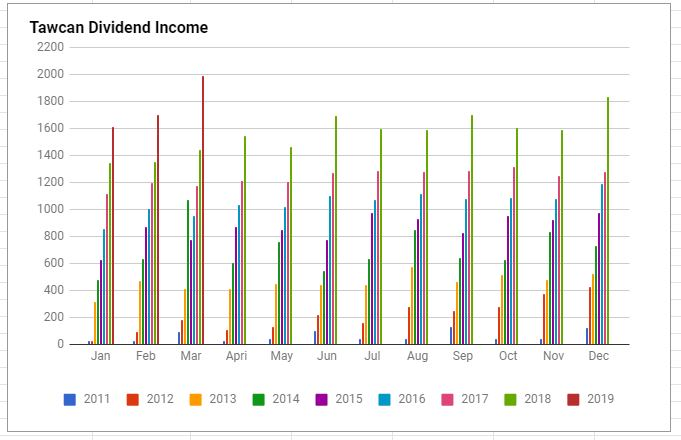

Dividend Growth

Compared to March 2018, we saw an extremely impressive 38.01% YoY growth! Holy moly! This is absolutely mind-blowing, especially considering we are starting to experience the law of large numbers. However, unless we continue to add large amounts of fresh capital and purchase more dividend-paying stocks throughout the year, I don’t expect this kind of 30%+ YoY growth to continue. Considering we received over $1,600 in the latter half of 2018, 30% YoY growth would put us close to $2,100 of monthly dividend income. This may not be sustainable.

Dividend Increases

We saw a lot of companies announcing dividend increases in Feb which increased our annual dividend income by $363.04. The dividend increases slowed down dramatically in March with only one dividend increase:

- Canadian Natural Resources raised its dividend by 11.9% to $0.375 per share.

This added almost $25 toward our annual dividend income. The dollar amount from organic dividend growth in March certainly wasn’t as impressive as what we had in February, but a small increase was better than none at all!

In case you’re wondering, in Q1, our annual dividend income has increased by over $460 simply thanks to organic dividend growth. At 4% dividend yield, this is like buying $11,500 worth of dividend-paying stocks.

Dividend Stock Transactions

In March, we kept ourselves busy on the dividend stock purchase front.

- First, after going through the VXC vs. XAW analysis, we decided to sell all of our VXC shares and purchased XAW shares instead. This was done over multiple accounts.

- Purchased 69 shares of TD (TD.TO)

- Purchased 71 shares of Bank of Nova Scotia (BNS.TO)

- Purchased 20 shares of AbbVie (ABBV)

- Purchased 26 shares of Canadian Imperial Bank of Commerce (CM.TO)

For the most part, we purchased the 5 stocks that I considered for our RRSP in 2019. We decided to purchase more TD and CIBC shares to take advantage of the lower prices as we continue to like Canadian banks. We purchased AbbVie shares rather than Qualcomm and Discover Financial Services because I wanted to increase our exposure in the health care sector.

Excluding the exchange between VXC and XAW, the four other purchases added $682.52 toward our annual dividend income.

In Q1 2019, we increased our dividend income by $1,622.94 by purchasing more dividend-paying stocks. If we use a 4% dividend yield, that’s equivalent of adding over $40,500 into our dividend portfolio. We plan to continue buying more dividend-paying stocks throughout the year to help to boost our overall dividend income. In terms, this will help us become financially independent earlier.

Financial Independence Journey Progress

The $1,988.43 dividend income received in March was able to cover 64.5% of our necessities spending. I was very pleased to see that our dividend income was able to cover a significant amount of our necessities spending. When it comes to total spending for the month, our March dividend income was able to cover 40.7% of the total spending. Non-necessity expenses were higher than usual this month due to a few planned big item expenses.

We are not quite at the 50% goal that I am targeting for this year, but we are close. Rather than only focusing on growing our dividend income, we can focus on reducing our expenses. Growing dividend income and reducing expenses definitely go hand in hand when it comes to reaching financial independence.

Summary

With Q1 2019 wrapping up, we have received a total of $5,293.60 in dividend income. In comparison, we received a total of $4,133.71 in dividend income in Q1 2018. It’s crazy to think that we have increased our quarterly dividend income by over $1,000, or over 25%, in less than a year. We feel extremely blessed to earn this kind of passive income and to know that our money is working hard for us, so we don’t have to.

Dear readers, how was your March dividend income?

Great progress. The has motivated me as well.

Mind if you share following –

1) How much money you invested YoY to get these results since 2011?

2) How do you track dividend amount as it must be paid directly in your bank?

Hi Viv,

1. I don’t share the specific amounts but you can get an idea with this post:

https://www.tawcan.com/reviewing-1h-2018-dividend-stock-etf-purchases/

2. We use this dividend template that I created to track our dividend portfolio and dividend amount. Dividend income is entered when it’s paid in our accounts.

https://www.tawcan.com/step-step-guide-make-google-spreadsheet-dividend-portfolio-template/

I’m I the same boat you were in with VXC. I own a lot of shares. How painful were the fees to sell everything and buy XAW? Did you sell and then buy immediately? Sounds like you made the switch in every account. I own VXC in 4 accounts so it will be a few trades.

We sold everything and bought XAW. Had to make a number of trades all together but the short term pain was worth it.

Wow! Your monthly dividend income is so steady. Nice job structuring it like that! You’re so close to hitting $2000/month. Keep it up!

Scott

Wow, nearly $2,000 a month. That’s some impressive growth. You’ve come a long ways. Keep up the good work!

Thanks Brent. Very happy with our progress.

Hey, that is awesome growth in dividend income.

Have you put any target to 2019 year end dividend income?

The target for this year is $23k, a very ambitious goal.

Congratulations! Question, does the income/dividend gains include DRIP…

Thank you. No the income/dividend gains do not include DRIP.

Now that’s some serious passive income. Many people don’t make $2K actively working so that’s a great achievement. Nice double digit year over year growth too. What’s not to like?

Thanks DivHut. Very happy with the double digit YoY growth. 🙂

Hi Bob, I honestly just found this article by accident. But congrats on the milestone. Becoming at least partially financially independent from dividends really interests me. But I saw your analysis on the changes you made to your stocks this month and I was curious how much time and analysis does it take to make effective decisions with your stocks?

Hi Andrew,

You can see my my analysis of VXC vs. XAW here – https://www.tawcan.com/vxc-vs-xaw-the-battle-of-ex-canada-international-index-etfs/

Bob –

WOW. Man oh MAN. There we go! You are going after it, with one goal in mind. You are relentless and I love it. Also – always have to enjoy the top Canadian banks, they are dividend power houses. Further, that income growth over time, from your table, is awesome to see and I have something similar on my spreadsheet, dating back to 2011.

You are working hard, and you are seeing the benefits of doing so. Congratulations Tawcan.

-Lanny

Thanks Lanny, working hard on building our dividend empire. 🙂

Wow, no doubt some fantastic YoY growth! Do you think you’ll be able to hit $25K in annual dividends this year? With the growth you’ve experienced in Q1 so far, that may not be too far of a stretch. Best of luck!

Hmm $25k would be quite challenging as that’s a very high YoY growth compared to 2018. Would be nice if we can hit that number though.

pffft wow Bob

absolutely killer month! 2k next quarter for sure.

congrats on the new record and huge progress. The amount of capital you put to work last month is insane.

Just a huge report man, keep it up!

Thanks man. Very happy with the results in March.

Hi Bob!

Congratulations on the $1900 milestone. Based on last year performance you’ll reach the $2000 soon. I really like the way you track your income since 2011.

Here we also had the best month so far with ~€ 1400, making our monthly avg cross the €1k for the first time.

Success and all the best.

Cheers!

Thank you Odysseus. I’m pretty convinced that we’ll hit $2,000 pretty soon. Congrats on an awesome month you had, 1400 euro is pretty impressive!!!

Amazing progress Bob! You guys are doing great! It happens fast, doesn’t it?

For my family, Q1 dividend income was 13,883. The vast majority of that ($11,161) was paid out in March.

My results are a little bit lumpier, just because of how the dividends are paid out, but I don’t try to smooth it out. Lumpy payouts are fine by me!

Thanks Mr. Tako. For some reason our monthly dividend income are not lumpy at all. Not sure how that happened exactly. Lumpy dividend income is totally fine, as long as the income covers your expenses, right?