It’s hard to believe that Q3 2023 is already behind us and it’s time to do a Q3 goals and resolutions update.

For those readers who are new since 2019, I have been setting goals and resolutions at the beginning of the year. I then post quarterly updates to keep myself accountable. Having goals and resolutions written down and tracking them regularly has helped me tremendously – you won’t see me giving up on my goals early in the new year.

For 2023, I set 13 goals with different timelines for accomplishing them. Six of these goals are yearly goals that I have to work on throughout the year.

Let’s find out how I did in Q3, shall we?

2023 Goals and Resolutions

My focus for 2023 was personal well-being so many of my goals were set based on this personal focus.

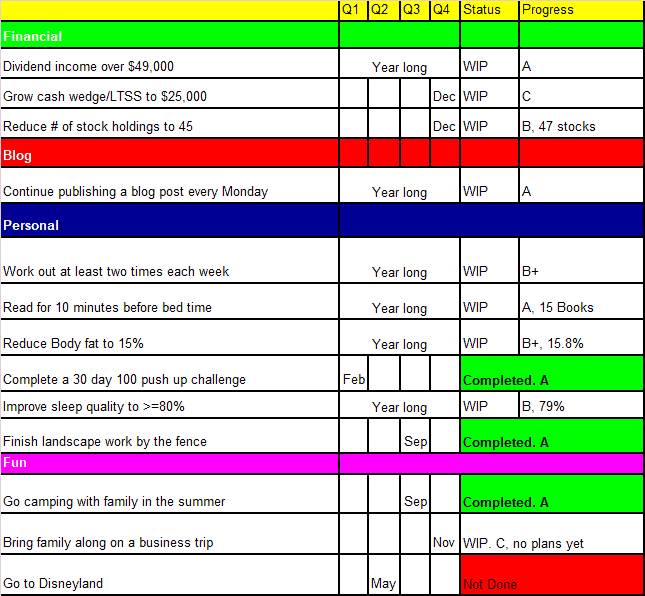

To make my life easier, I track my goals and resolutions via a self-made spreadsheet. Thanks to Joe at Retire by 40 for giving me this idea many years ago.

Here’s how my spreadsheet looked like at the end of Q3 2023:

Financial Goals

I have made some excellent progress toward my financial goals.

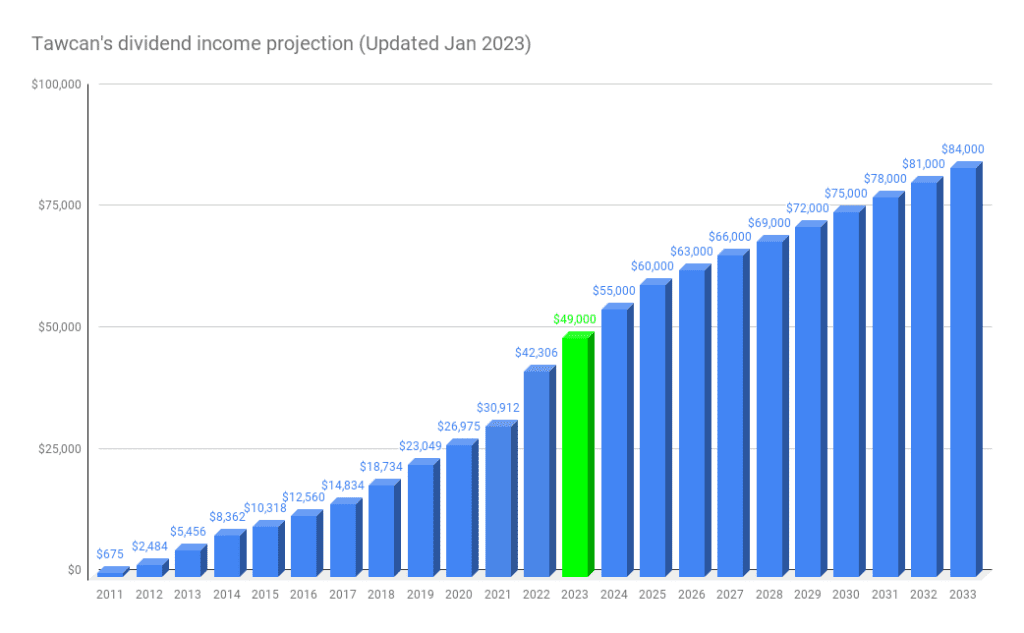

Dividend Income over $49,000: A, $37,103.17

With only three months left for the year, we have received $37,103.17 year to date. In other words, we are slightly ahead of schedule on this goal. Who knows, maybe there’s a small chance that we can hit $50,000 in dividend income for this year.

I can dream, right?

Grow cash wedge/LTSS to $25,000: Work in Progress (WIP). C

This goal is to have some cash reserve available to us as we move closer to being financially independent and living off dividends. Why? While living off dividends and not touching the principal in the early years of FI is a great idea, there’s no guarantee that we won’t see dividend cuts (or some other unforeseen financial crisis.)

Therefore, it is a good idea to build a cash wedge to increase the margin of safety and avoid a withdrawal from the principal.

Throughout Q3, we had some big expenses (Alaska cruise, replacing an old dishwasher, paying for another planned vacation, etc.) which caused us to be not anywhere close to the $25,000 target. At this point, it’s probably unlikely for us to accomplish this goal by the end of the year.

Reduce # of stock holdings to 45: WIP, 47 stocks, B

At the time of writing, we hold 47 individual dividend stocks and 1 index ETF. Since the last update, we have closed out RioCan REIT (REI.UN) and Dream Industrial REIT (DIR.UN). We then re-invested the money and purchased Alimentation Couche-Tard (ATD.TO). Alimentation Couche-Tard doesn’t pay nearly as much a dividend as RioCan and Dream Industrial but it has been raising its dividends at a fantastic rate. ATD has also had an amazing share price appreciation over the years.

For now, there’s no plan to close out any more positions just for the sake of accomplishing this goal. It’s silly to consider closing any position when the stock market has been quite volatile.

Blog Goals

Continue publishing blog posts every Monday: WIP. A.

I have been planning and writing ahead to keep up the Monday publication schedule. It’s hard to imagine that this blog has been around for over 9 years. So many blogs that started around the same time as me have disappeared. It certainly makes me feel like a grandpa blogger in that sense.

I plan to continue writing ahead on various topics. If you have any interesting topics that you’d like me to cover, feel free to let me know.

Personal Goals

These goals were created for me to focus on personal fitness and overall well-being.

Work out at least twice each week: WIP. B+

My lower back has been bugging me throughout Q3. As a result, I haven’t been doing my usual kettlebell workouts all that much. I have been doing bodyweight workouts, swimming, and a lot of yoga instead.

I lowered the letter grade from A to B+ because I had only been working out twice a week.

Read for 10 minutes before bedtime: WIP. 7 books read in Q3. A

After a C+ performance on this goal for Q2, I picked it up and was more consistent with my bedtime reading. In Q3 I managed to finish seven books.

These are the books I read in Q3:

- Then She Vanishes by Claire Douglas – Mrs. T and I continued to read books from Claire Douglas. Then She Vanishes was full of twists and a very cleverly written crime thriller. I really enjoyed reading it.

- Teach Your Own by John Holt – We were doing some research on homeschooling, so reading this book was mostly for research purposes. It was an eye-opener for me to read this book and reconsider the possibility of homeschooling.

- The Couple at Number 9 by Claire Douglas – another book by Claire Douglas. This was probably one of my favourites by this author. Like all of her other books, a very intriguing plot that kept me guessing until the end.

- The Pillars of the Earth by Ken Follett – last year I finished reading The Evening and the Morning, the prequel to The Pillars of the Earth. After putting a hold at the library, I finally got my hands on this must-read classic. At 806 pages long, The Pillars of the Earth was a long book with excellent character development. I was definitely sad when Tom the Builder died halfway through the book. I’ll have to continue with the rest of the Kingsbridge series – World Without End, Column of Fire, and the recently published Armour of Light.

- Just Like the Other Girls by Claire Douglas – OK, you see the trend here, right? I ended up reading books from Claire Douglas once Mrs. T finished reading one. Just Like the Other Girls, this was another thrilling book with lots of plot twists that kept me guessing until the end.

- Chip War by Chris Miller – this book was recommended by my work’s EVP when we had a work dinner in June. The topic sounded interesting, especially knowing the chip sanctions on China and that Taiwan produces over 60% of the world’s semiconductors and over 90% of the most advanced ones. I found Chip War extremely interesting as the author went through the history of semiconductors.

- Changing Our Minds by Dr. Naomi Fisher – Another book on how homeschooling and how children can take control of their own learning. It was interesting to re-examine the school education system and understand how schooling can be structured differently.

So far this year, I have read 15 books in total. It would be nice to finish the year by reading at least 20 books.

Reduce body fat to 15%: WIP. 15.8%. B+

I reduced my body fat percentage from 16.6% at the end of Q2 to 15.8% at the end of Q3. This was a surprise to me given that I ate like a king throughout the Alaska cruise and had way too many nice work meals on my recent trip to Taiwan and Hong Kong.

I suppose that keeping up with intermittent fasting and watching what I eat throughout the day helped.

I suppose that keeping up with intermittent fasting and watching what I eat throughout the day helped.

Complete a 30-day 100 push-up challenge: Completed. A.

I finished this challenge in January. It was a hard challenge as my arms and shoulders got pretty sore toward the end of the challenge.

Improve sleep quality to >-80%: WIP. 79% so far in 2023. B.

After 9 months, I have an average sleep quality score of 79%, according to the Fitbit app. All things considered, I think this is a huge accomplishment for me considering I have been getting up around 6 AM to go swimming once or twice a week quite consistently.

Finish landscape work by the fence: Done. A.

I finished the landscape work earlier this year. It took a lot of muscle power to dig to a depth of about half of a metre, install the bamboo barrier membranes along the fence, and fill it up with soil. I was glad this little project was finally done.

Fun Goals

Here are three fun goals I wanted to accomplish for 2023.

Go camping with family in the summer: Done

We went camping for 5 days at Goldstream Provincial Park on Vancouver Island in July and had a lot of fun. Both kids spent hours at the playground and bike track which gave Mrs. T and me time to chill.

Bring the family along on a business trip: WIP. C, no plan yet

It’s looking quite unlikely that I’ll be able to accomplish this goal for this year… oh well.

Go to Disneyland: Not Done.

I originally set this goal to be accomplished by May, thinking we could plan a trip during spring break. The trip didn’t happen.

Summary – 2023 Goals and Resolutions Q3 Update

In Q3 I finished one of my goals (camping with family in the summer) and continued making good progress toward all my annual goals.

Overall, I’m happy with my progress. For Q4, the plan is to wrap up these annual goals so the spreadsheet has more green highlights by the end of the year.

Would love to see an update to your post “Living off Dividends”. By far the best, most informative posting.

Not sure if I can convince Reader B to do an updated Q&A. Will see what I can do.

I am also confused by the BN conversion

Should I do it or not?

Have decided to not as I don’t understand their reasoning

Enjoy your blogs

Great job!!

Bev

I’m keeping BN.

Hello Bob,

Thanks very much for your weekly blog. Very informative. I like that you focus both on your investment objectives and your personal goals. It sounds like you and your family have a very balanced life!

A question about one of your goals, specifically “cash wedge/LTSS”. What is the definition of “cash wedge” and “LTSS”? How are these measurements calculated?

Thanks, Dan

Thank you for the kind words.

Cash wedge just means some cash reserve for future spending. LTSS stands for long term savings for spending.

Hello Bob,

Thanks for clarifying the definition of “Cash wedge” and LTSS. However, your goal is “Grow cash wedge/LTSS to $25,000”. The way it is presented, your goal is a ratio, and not an absolute number. How do you come up with $25,000 when a ratio should be the goal?

Thanks, Dan

Sorry, what I meant is cash wedge or LTSS to $25,000. I suppose it’s a little bit confusing as I see the two as the same thing. 🙂

Got it Bob. Now I understand. LTSS and Cash wedge are the same thing, and the goal is an absolute number. Thanks for the explanation. Dan

You’re welcome. Sorry for causing any confusion.

I’m with you Bob. Disneyland trip is out for a while . I’ve read and heard so many sticker shock stories and long line horrors of people going to Disneyland and dropping thousands$. It just would not be satisfying and restful for anyone. I’ll keep my daughter happy knowing she has DIS in her RESP.

Any thoughts on the Brookfield latest conversion. I own a lot of BAM but always find them confusing.

BN conversion to BNRE. I’m keeping my BN as any spinoff/conversion has always confused me.

Great bargains out there but all my new powder is going money market ETF and GIC’s.

Yea Disneyland can get expensive but there are ways to travel hack the trip.

On BN and BNRE, my preference would be sticking with BN.

Such good acheivement of goals! I love reading your blog and all your progress in acheiving your goals. Thank you for sharing!

Looking forward to when you hit $50,000 in your dividends, for the year!

Thank you very much.

Thanks! Your goals are an inspiration. Long time reader and admirer, appreciate the long lived blog!

Thank you Bri.