How would you define the word freedom? By definition, freedom is the power or right to act, speak, or think as one wants without hindrance or restraint; it is the state of not being imprisoned or enslaved. Throughout human history, people have fought for their freedom and many have lost their lives fighting for it. William Wallace fought the English for Scottish independence with the goal that the Scots would decide what they want to do in their own country. While many reasons have caused the War of 1812, the simplified reason was the colonists wanted to have the freedom to govern themselves, instead of having to listen to the British government. If you look at a more recent event like the Tiananmen Square protects of 1989, the young Chinese students were protesting to gain their freedom of the press and freedom of speech. Hundreds to thousands of these young students were killed and many more were wounded during this protest.

Freedom of speech and freedom to decide are very important rights. So important that many were willing to die for these rights.

Financial freedom is perhaps just as important as freedom of speech and freedom to decide. Without financial freedom, you’re limiting yourself in many things in life.

How many have fought for financial freedom/independence?

Retiring at age of 65 or more is a generally accepted idea today. We are taught to follow a standard life path – study hard when we’re in school, graduate with good grades, get a good and stable job, don’t question the authorities, work for 30-40 years, retire at the golden age of 65 or more, and finally enjoy the fruits of our labour. If we make it till then.

Because this life path seems to be the universally accepted norm, we follow this path and just try to get to the next milestone. When we are young we go to school to get a good education so we can graduate and find a good job. Once we’re in our adult years, we wake up everyday knowing exactly what we must do. Every week for 5 days straight we wake up, get dressed, eat, commute to work, work for 8 hours or more, commute back home, eat dinner, spend some quality time with our close ones (some don’t do that and mindlessly watch TV instead 🙂 ), go to bed, wake up the next day and repeat the process. Then on the two special days of the week called the weekend, we finally have the freedom to break away from our daily work routine. On these two special days, we get to decide for ourselves what we want to do with our own time. Shockingly, many of us just follow a weekend routing by watching TV for hours, playing video games for hours, wondering mindlessly in shopping malls for hours, or trying to triumph or impress their neighbours by purchasing unnecessary things.

Does it make sense to go through 40 years of your life working 9-5 and doing the same daily routine?

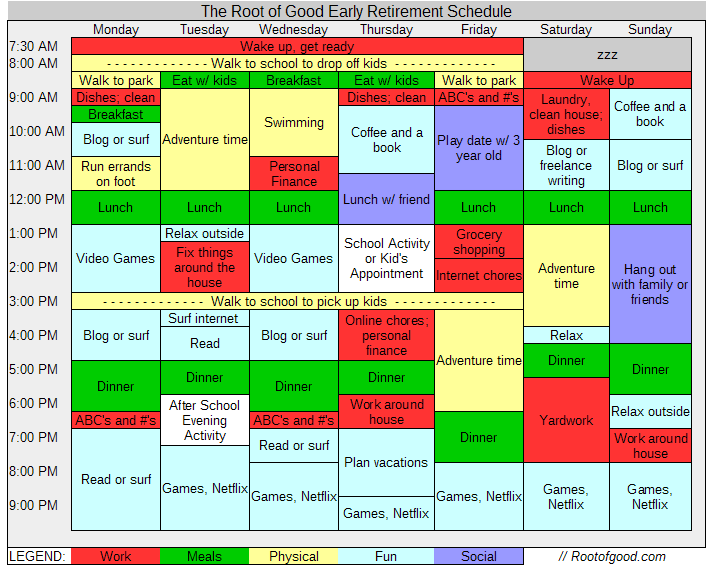

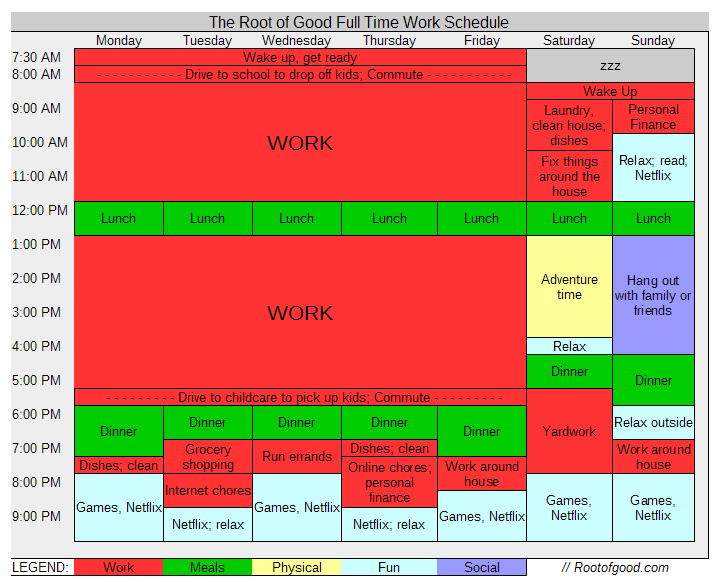

Justin at Root of Good recently shared his version of the early retiree’s weekly schedule. He summarized that on a weekly basis he’s spending 33.5 hours on fun, 7.5 hours on social, 18 hours on physical activity, and only 13 hours on “work.” His definition of work in his early retirement schedule was very loosely defined. 🙂

Sounds like a pretty awesome weekly schedule to me!

http://rootofgood.com/early-retirement-schedule

http://rootofgood.com/early-retirement-schedule

When Justin was working full time, he spent a lot more hours “working” and not so many hours on fun and social. Although he only worked for 8 hours each day, he actually spent more hours in the “work” category. It was such eye opener for me to see the schedule breakdown between the two different scenarios.

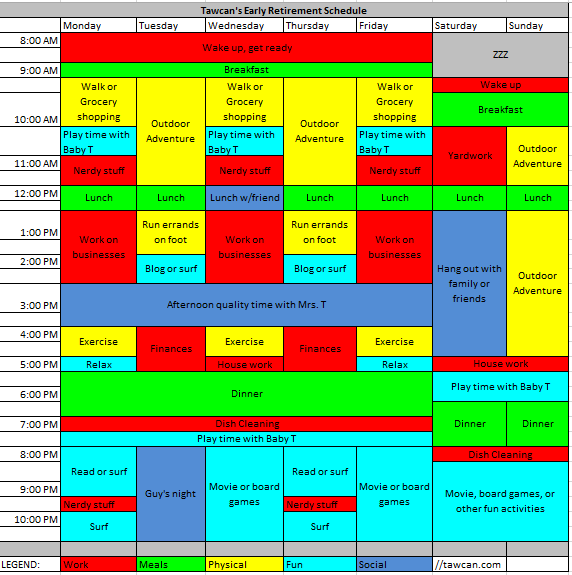

If I had to construct my version of early retiree’s schedule today, it would probably look something like this:

This is just what I have in mind right now and it probably needs to be optimized some what if I were to become an early retiree today. The theme here is that the amount of hours spent on work will be greatly reduced. Please note, the term work is very loosely defined here. Another thing to note is that the amount of time spend on physical activities is greatly increased. This will definitely allow me to optimize my overall health even more.

Someone I know from work recently retired. This person is in her late 50’s and the retirement announcement came as a surprise to everyone. I thought it was fabulous that she could retire early. It was unfortunate that I couldn’t discuss with her what her retirement plans are. I was also wondering if she is one of those secret frugal people who have socked up a nice investment portfolio. As expected, there were many water cooler and lunch conversations about this person’s retirement. Interestingly, some of my co-workers made comments that they’d get bored if they were to retire early. Some commented they would just sit on the couch all day watching TV, some even commented that they probably wouldn’t have enough money if they retire that early…

Many people have the word “retirement” propped up on a pedestal. Retirement is the ultimate dream, it means freedom of not working, freedom from the daily routines, freedom from the norm. They feel that they would never achieve happiness until they reach retirement. So they suck it up, continue the daily grind, and hope to make it to the that magical day when they can retire.

When they finally do retire, they cannot free themselves from their 40 years of working identity. They find out that they have not found the happiness they were imagining while in their working years. Retirement turns out to be something completely different than what they had in mind. They are unable to free themselves. Without the normal daily routine that they have gotten so used to for the past 40 years, they are completely lost. They don’t know what to do and what to think. Slowly these people go into a downward spiral. Their health starts to deteriorate, their mental state starts to degrade, and they begin to loose any ambitions they have in life.

No wonder a number of people kick the can a few years after retiring from their jobs!

This is far off to my idea of retirement financial freedom.

(Note: I don’t like using the word retirement, I like the term “financial freedom” better.)

To me, financial freedom means having choices and options. It means I have multiple options on what I want to do for the day and what I want to do with my life. I have the option to determine whether I want to continue the 9-5 job. Because I’m financially independent, I am no longer relying on the job for the sole purpose of income. I have choices of when and where I want to travel and how long I want to travel for. I no longer have to request vacation time and wait to get an approval. I am free. Financial freedom means Mr. T and I can pack up our suitcases, go to the airport, jump on a plane to an unknown destination, and just let everything unfold. I guess we need to arrange a cat sitter for T Cat and we should probably bring Baby T with us too.

Look around, how many people are doing something about their financial freedom/independence? Only less than 30% of Canadians are contributing to their RRSP. Although the participation rate for TFSA is much higher, many people only hold GIC or cash in their TFSA’s, effectively losing purchasing power as time goes by. These people also think that they can rely on Old Age Security (OAS) and Canadian Pension Plan (CPP) as major contributor to their post retirement income. So they continue their daily routines, and punch in and out of their 9-5 jobs. Can they truly reach financial freedom when they retire at 65 by relying heavily on social benefits?

I believe these people are not fighting for their financial freedom. They are only fighting to continue the norm. Maybe because they don’t know any better. When they hear something outside of the norm like someone “retiring early” or someone having a strategy to reach financial independence, these people feel uncomfortable. They begin asking a lot of questions, maybe even feeling left out.

How do you fight for financial freedom?

First, stop thinking like the majority of people in our society. Start thinking differently and approach your life differently.

Second, pay yourself first. Allocate a certain percentage of income towards investing. 10% is a good start but the higher the better.

If you have any debt, draw up a plan on how to eliminate them. Consumer debt and student debt should be the first ones to go. Although mortgage debt are generally considered a good debt, you want to eliminate this debt as quickly as you can. It makes no sense to start investing your money when you’re paying high interest rates on your credit card debt. By reducing your credit card debt at 19.9% interest rate, you’re effectively getting a 19.9% investment return. It’s tough finding that kind of consistent return in the equity markets.

Learn about the different investing strategies, whether it’s passive investing through index EFT’s, dividend growth investing, or something else. Then start investing and stick with this strategy. Don’t jump around different strategies because you will get nowhere. A big piece of fighting for financial freedom lies on learning how to invest and how to become tax efficient. Maximizing tax efficiency means learning to maximize all tax-sheltered and tax-deferred accounts like TFSA and RRSP first before investing in regular taxable accounts. We all should pay taxes, but we should also find a way to be tax efficient and optimize our income tax.

Being frugal comes into place next. Optimizing your expenses is an absolute step in fighting for financial freedom. Cutting down unnecessary spending or even eliminating expenses like cable subscription.

Learn about the different insurances and enroll in ones that you need. Term-life insurance is a good policy to have when you’re starting a family and you’re just starting on the financial independence journey. Once you accumulate enough assets later in life, you may not need life insurance anymore.

Explore different possible income streams and start diversifying your income streams. Having multiple income streams will allow you to eventually step away from the 9-5 work and focus on your own life.

Write up a will if you have a family. If you don’t have one, you’re letting the laws in the province or state you live in, make decisions for you when you’re gone. If you have specific wishes, you need to specify them in your will.

Start tracking your savings rate, investment portfolio value, and net worth. All these numbers all become a performance matrix on how well you’re doing on your financial independence journey.

Finally learn to stop caring about what others think about you. You can never please other people, so why waste your time worrying about how to please other people? Focus on yourself. Learn how to be happy and be content with your life. Once you stop caring what others think about you, you’re freeing yourself from judgement of others. You’re freeing yourself from self judgement. It is then you’re winning the fight on financial freedom.

Are you fighting for your financial freedom?

The updated schedule looks great. I hope you an reach it soon!

As you mentioned, in order to achieve unconventional success, you gotta have unconventional thinking. This includes aggressive saving and really being particular about the types of investments you need in order to achieve desired lifestyle.

Good luck in your investing journey

Dividend Growth Investor

Hi Dividend Growth Investor,

Good luck in your investing journey too. 🙂

Really liked the article, makes you think about what you are fighting for in freedom. Also completely agree with the word retirement used as playing shuffleboard and golfing or the worse version sitting on your couch getting old, watching TV. I use the term Early Retirement but you are right it’s a fight for financial freedom, not retirement.

We’re fighting. Alas, life likes to fight back. Right now, the fight is to save up the $25k for my husband’s oral surgery. We’ve pushed it back to next year to help.

Things like that (and his being on disability/my being on disability in my 20s) mean that I’ll consider us successful if we’re ever able to retire at all. But at least we’re fighting the good fight.

Hi Abigail,

Sorry to hear about your situation. Even in your situation if you make some efforts (which looks like you are), you’re still fighting for your financial freedom.

Great post Tawcan and thanks for including Root of Good’s timetables. The Early Retirement Timetable is awesome and one that I am really looking forward to following!

The Full Time Work Schedule is pretty close to my own current schedule, except that since I’m a night owl, I can add an extra 3 hours of ‘fun’ time every evening after 9pm!

I’ve joined the fight to financial freedom later than you youngsters but I don’t plan on trudging on in work mindlessly and leaving my financial fate to the generosity of our government via state handouts.

By the way, I’m likely to watch more tv when I’m no longer working – got a lot of box-sets to catch up on!

Hi weenie,

Nothing wrong with join the FF fight later, the important thing is that you’re fighting for it.

Hey Tawcan,

A good article that describes what financial freedom is about.

The best part is where you say it is not early retirement: it is not about watching TV all day long. The goal is to have financial freedom and options to do what you want.

I just started the journey, and a reminder on the key steps and end goal is a great boost.

Hi ambertree,

Totally. We definitely spend way too much time in front of TV… that’s something we should all try to cut back on.

As my semi-passive income is approaching to my take home income. I’m going to have to pitch for a retirement job – I want to teach 1 class, or do 4 hours of research in the lab per day :). Unless we have a baby, I don’t see myself hang out daily just to have “fun”. Although I would love to take a couple months off to just read.

Seeing someone who has already made is incredibly inspiring. Thanks for sharing. I think you guys are not too far.

Hi Vivianne,

That sounds like a great working schedule and allows you to be more flexible. 🙂

Love the FI schedule. I saw that over at Root of Good and comparing the FI schedule and the work schedule (which is eerily similarly to mine) was depressing and inspiring as well. So yes, I am fighting for financial freedom. It is something that I think about often now. It’s great to have so many like-minded people on the same journey.

Hi Andrew,

It’s great that there’s a big PF community where we support each other toward financial freedom. 🙂

Nice post! For us, the biggest game changer was starting to ask ourselves, “Do we NEED this, or do we WANT this?” This alone cut out a LOT of mindless consumerism. So much that we started tracking our overall spending even more to see where else we could optimize/frugalize/reduce waste.

That was the catalyst that got us pushed towards looking into FIRE. I still resisted strongly for a few years after that, but not to the reduced spending/frugalization of our household, more to the fact that FIRE was a comfortable possibility. Turns out, I was wrong and it is possible to be comfortable AND achieve FIRE. Thank goodness!

Hi Mr. SSC,

Asking if you need an item vs. wanting an item is the first step. When you start asking yourself this important question, you stop buying as many things.

Great article, makes you think, I like that.

I enjoyed Justin’s original article and have experienced that with a kid a schedule is quite useful (and almost necessary). However, once we reach financial freedom, I would love to get rid of any type of schedule (this probably won’t happen as our kid will still be going to school once we do, so we will still have a schedule of some sort), that would feel like real freedom to me.

I do get that the schedules you and Justin drafted up are very flexible, but just thinking about a schedule during financial freedom still makes uncomfortable. For each his own i guess.

Hi Mr. FSF,

My schedule was drafted up around Baby T’s daily routines. You’re right though, when one achieves financial freedom, one can just do whatever he/she wants to do. There’s no need to follow a set schedule.

Great article Tawcan. I believe that financial freedom is more important than ever given the tough job market and high debt levels that people carry. For me it’s all about peace of mind and the freedom of choice that financial freedom brings.

Hi My Road to Wealth and Freedom,

Financial freedom is definitely important. Having the peace of mind and the freedom of choice are something we all thrive for.

Thanks for sharing and taking the time to write this article Tawcan. I enjoyed it. Let’s continue this awesome journey together and glad to be a part of this community with you my friend. Have a nice weekend and enjoy that baby aight! Cheers bud.

Hi Dividend Hustler,

Thanks for the comment, glad that you enjoyed reading the article. 🙂

Hey Tawcan,

Great article dude! I really enjoyed reading this one, and I loved the schedule difference Root of God illustrated from a 9 – 5 working man and his early retirement. Definitely looks much more fun and exciting.

I too prefer the term financial independence to retirement, being able to choose and do as you please because you have the means to just sounds beautiful.

Keep it up T!

DB

Hi Dividend Beginner,

Thanks! Glad that you enjoyed reading this article. The retiree schedule definitely look more enticing and exciting!

Wow, what a bleak landscape Tawcan! On a serious note that’s a great discussion. I have also noticed, at various times when I wasn’t “working” in a traditional office, how much more productive my working time was.

It’s great to see all that talk about surfing in your proposed schedule, and Jason’s……even if it’s the wrong kind 🙂

-Bryan

Hi Bryan,

I’m not trying to be negative but rather trying to make people think. 🙂

Tawcan,

Good stuff!

You know that I couldn’t agree more. I’m now basically living much as I would if my dividend income were already fully covering my expenses. My routine is custom designed for me, allowing me to wake up, work, eat, exercise, and be free when and however I want. It’s truly one of the best perks of all.

It’s a shame that so many people identify themselves so much with work that they can’t cope with life after work. I think that might be somewhat due to just plain being used up after existing in the grind for four decades, which is why I recently wrote that post about not all years being equal to one another.

Let’s keep fighting!

Best regards.

Hi Dividend Mantra,

You’re definitely living as if you’re financially free right now. You’re not tied to a 9-5 job so you get to control your own schedule. That is awesome!

Routine is a funny thing, once people develop a routine, it becomes tough to get out of this routine. Working 9-5 is a routine that quite many people have a hard time getting out.

Your early retirement schedule looks awesome too! I love seeing the huge patches of non-work with a couple blocks of work tossed in. I’m pretty sure that’s how life is supposed to be lived. 🙂

Hi Justin,

Thanks, agree that is how life is supposed to be lived. We should have control on our time, not getting controlled by our work.

Financial independence certainly is a fight for freedom – fighting against the norm, fighting against your own desires for comfort now and going out and working hard to earn and invest your money. If it was easy, everyone would be financially free, right?

I love seeing the early retirement schedules, its very inspiring, and just seems like such a better, balanced way to live. It’s still some way off for me, but definitely worth fighting for!

Cheers,

Jason

Hi Jason,

Fighting for financial freedom certainly isn’t easy. If it was easy we’d see way more early retirees and we probably won’t be hearing about all the consumer debt warnings.

Nice post, T.

Also some great weekly schedules posted both from your dream and Root of Good. Now you have me dreaming of what my retirement schedule will look like 🙂

I think Jason from DivMantra put it well in one of his posts a while ago that resonated with me – that we have to buy our own freedom. As hard as it is to swallow that pill, its true. Most of us are engaged in simply working for The Man and we have to change and deviate from the path set out by society and whats accepted as the norm. Less consumption. More saving (and investing). Thats the path to financial freedom.

Thanks for sharing your thoughts. Great post.

Its good to follow and share this journey with you.

cheers

R2R

Hi R2R,

I guess I could have updated the retirement schedule so my “weekend” falls during the week. Totally agree that we have to buy our own freedom, that’s something all of us in the PF community is working on.