Wow, it’s hard to believe 2023 is already behind us.

When I looked back, 2023 felt like an eternity. A lot of things have happened, both on the home front and especially on the work front. When some of my coworkers and I had our Christmas lunch in mid-December, we commented that the past year felt like a decade and we weren’t joking. Getting acquired by a company and going through the integration process was an eye-opener for me and many of my coworkers.

2023 was the fifth year that I created goals and resolutions at the beginning of the year and published them on this blog. For me, sharing my goals publicly and updating my progress every quarter was a great way to keep me motivated and inspired throughout the year.

For 2023, I set 13 goals in total. Six of them were yearly goals that I had to work on throughout the year; the other seven goals had different timelines on when I was planning to accomplish them.

Let’s find out how I did.

2023 Goals and Resolutions

Being financially successful doesn’t mean a thing if you can’t stay healthy. So my main focus for 2023 was personal well-being.

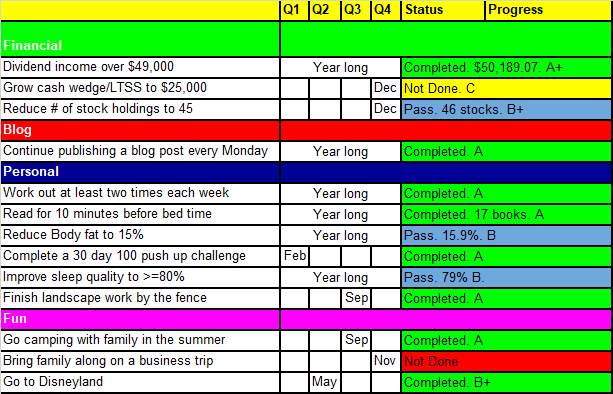

I tracked my goals and resolutions via a self-made spreadsheet to make it easier to follow.

Here’s what my spreadsheet looked like at the end of 2023:

Financial Goals

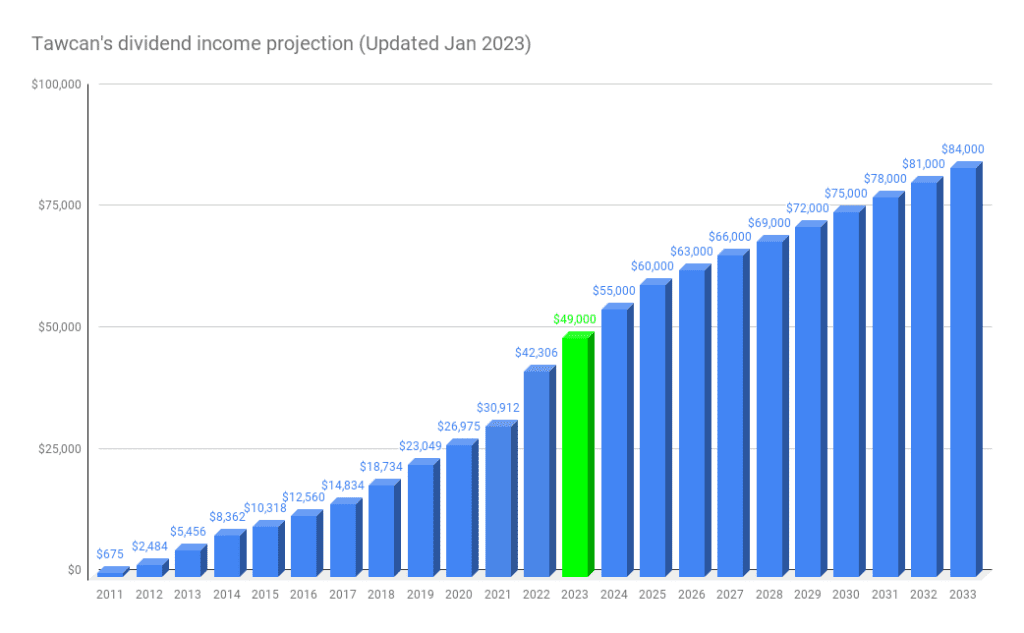

Dividend Income over $49,000: Completed. $50,189.07. A+

Well, we did it. We not only received $49,000 in dividend income in 2023, we exceeded that amount by $1,189.07, or +2.4%. It felt really good to be ahead of the projection below:

Most of the dividend income increase was a result of new capital contributions. We continued to add a lot of cash throughout 2023 and took advantage of market volatility. We are very thankful for our relatively high savings rate which allowed us to save and invest a large sum of money in 2023.

We also increased our dividend income via organic dividend growth and dividend reinvestment plans. Thanks to these two pillars, we added $4,596.13 toward our forward annual dividend income in 2023. At a 4% dividend yield, this would be like adding $115,000 in new capital capital into our dividend portfolio.

Grow cash wedge/LTSS to $25,000: Not done. C.

To have as much margin of safety as possible, it makes sense to have a large cash edge in the first few years of becoming financially independent. If our dividend income couldn’t cover our living expenses, having a cash wedge would prevent us from having to touch our principle in the first few years

Throughout the year, we had large expenses like staying in Whistler for six nights, a 12-day Alaska cruise, replacing the dishwasher, a weekend trip to Calgary, a 7-day trip to Disneyland, fixing the fireplace, booking airfare to go back to Denmark, etc.

As a result, our cash wedge/Long Term Savings for Spending was not anywhere close to $25,000 at the end of the year.

We’ll continue to save and grow the cash wedge throughout 2024.

Reduce # of stock holdings to 45: Pass. 46 stocks. Stocks, B+.

We started the year with 49 individual dividend stocks and 1 index ETF in our dividend portfolio. Although the goal was to trim the number of holdings down to 45 by the end of the year, I didn’t want to be irrational about it.

In the end, we decided to close out five positions:

- Verizon (VZ) – a total yield trap, our money was better invested somewhere else.

- Omega Healthcare (OHI) – another yield trap, our money was better invested somewhere else

- Dream Industrial REIT (DIR.UN) – didn’t do much in terms of stock price appreciation over the last few years and there has been no dividend payout growth since March 2013.

- RioCan REIT (REI.UN) – the stock price hasn’t done much in recent years and its distributions were not back to the pre-pandemic level yet. It was better to invest our money elsewhere.

- Algonquin Power & Utilities Corp (AQN.TO) – unfortunately AQN was a complete disaster the last number of years with the price down by over 35% in the last five years. AQN not only cut dividends by 50% but, the company also made multiple guidance adjustments. Again, our money was better invested somewhere else.

Despite wanting to trim the number of positions, we did start a new position in Alimentation Couche-Tard Inc (ATD.TO) back in July, mostly because of ATD’s amazing price appreciation and impressive dividend growth history.

Although we didn’t end the year with 45 holdings or less, I was pretty happy with our overall progress. We closed out weaker positions and focused on dividend stocks that should continue to do well in the long run.

Blog Goals

Continue publishing blog posts every Monday: Completed. A.

For the third year straight, I published blog posts every single Monday. For me, this was a significant accomplishment. It helped to plan and write ahead. I continue to enjoy interacting with readers and receiving blog post suggestions.

Personal Goals

Work out at least two times each week: Completed. A.

Some readers may recall that my back was bugging me in Q3. Although my back was feeling better in Q4, I didn’t want to re-injure myself with kettlebell workouts. Instead, I did bodyweight workouts, swimming, yoga, and rode stationary bikes.

Overall, I felt pretty good about my physical well-being. It’d be nice to get back to feeling 100% with my back so I can do kettlebell workouts again

Read for 10 minutes before bedtime: Completed. 17 books in total. A.

I only finished 2 books in Q4 but both were quite long.

- Harry Potter and the Order of the Phoenix by JK Rowling – 896 pages. It was an enjoyable book and I could see why it was so popular. Unsurprisingly, the book had so many more details than the movie. I have two books left in the Harry Potter series which I plan to read in 2024.

- World Without End by Ken Follett – 1056 pages. The book was so thick when I read it in bed, Mrs. T would often joke that I was getting a workout and that I needed to make sure not to fall asleep and drop the book on my head. World Without End is the second book in the Kingsbridge series (The Evening and the Morning is a prequel to The Pillars of the Earth so it counts as book 0). I quite enjoyed reading World Without End and loved the character development. As usual, I got really mad and frustrated by the “bad” characters in the book.

In total, I read 17 books in 2023 and I was happy with the result.

Reduce body fat to 15%: Pass. 15.9%. B+.

I started the year at 17.5% body fat. At the end of the year, I was down to 15.9%, or a drop of 1.6%. Visually I’m fitter and have a better body tone.

At some point in Q4, I was down to 15.6% body weight but eating a bit more than usual during the holidays increased my body fat percentage slightly (I blame it on chips and chocolate!).

Although I didn’t get to my target of reducing body fat to 15% or below, I made solid progress throughout the year so I was happy with my result.

Complete a 30-day 100 push-up challenge: Completed. A.

I finished this challenge in January. It was a hard challenge as my arms and shoulders got pretty sore toward the end of the challenge.

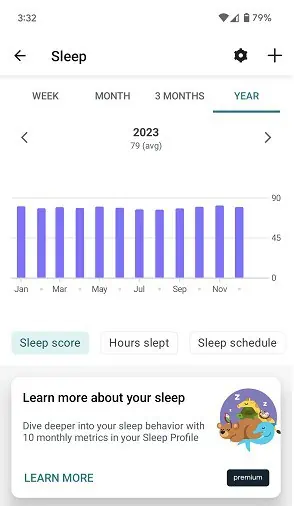

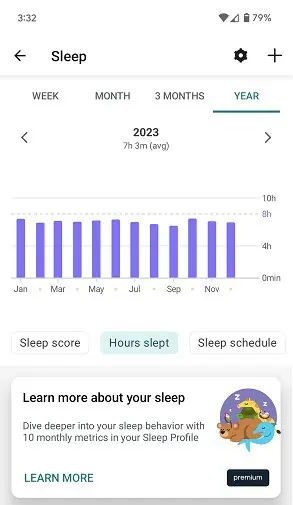

Improve sleep quality to >=80%: Pass. 79%. B+.

Compared to 2022, I improved my sleep quality significantly in 2023. I went from an average score of 76 in 2022 to an average score of 79 in 2023. Having better sleep quality meant I woke up feeling well rested and I felt more alert throughout the day.

Finish landscape work by the fence: Done. A.

I finished the landscape work earlier this year. It took a lot of muscle power to dig to a depth of about half of a metre, install the bamboo barrier membranes along the fence, and fill it up with soil. I was glad this little project was finally done.

Fun Goals

Here are three fun goals I wanted to accomplish for 2023.

Go camping with family in the summer: Done

We went camping for 5 days at Goldstream Provincial Park on Vancouver Island in July and had a lot of fun. Both kids spent hours at the playground and bike track which gave Mrs. T and I time to chill. We may go back to Goldstream again this summer.

Bring the family along on a business trip: Not done.

I failed to accomplish this goal but I knew this would have been a stretch for this year. Oh well.

Go to Disneyland: Completed. B+

We went to Disneyland in the fall as a surprise trip for Kid 1.0’s 10th birthday. We spent a week in Anaheim and went to Universal Studio Hollywood for one day, Disneyland for 2 days, and California Adventure for 1 day. We had a blast!

I originally set the timeline to accomplish this goal by May. I ended up finishing the goal in October, a few months behind. Therefore, I gave myself a B+ letter grade.

Summary – 2023 Goals and Resolutions – Q4 Update & Wrap up

Here are the overall stats on my 2023 goals and resolutions:

- Completed 8 goals

- Passed 3 goals (i.e. didn’t hit the target but came pretty darn close)

- Failed on 2 goals

All things considered, I had a very successful year and accomplished a lot.

I plan to continue setting goals and resolutions this year. Stay tuned for my 2024 goals and resolutions.

Do you think that BCE is a value trap? The dividend is very good, but I suspect there isn’t much growth, at least in the near term.

Telecoms probably wouldn’t have as much growth compared to tech stocks. Having said that, I expect Canadian telecoms to continue to grow, especially considering how many new immigrants Canada plans to accept each year.

Hi Bob,

As a fellow Canadian and someone actively working towards early retirement, I just wanted to share how much I enjoy your blog. What I really liked about this particular post was how you illustrated the different ways you proactively balance the important pillars of your life: health, financial well being, and quality time with family. I’m not sure if people realize how much these things are intertwined. Looking forward to reading future posts!

Thank you MJ for following along. 🙂

Admirable discipline, and congratulations on surpassing your goals! Adding Disney in relation to your kids…oy vey. While it’s clear you’re doing great in many aspects, I personally have reservations about supporting Disney due to concerns about its impact. I believe in the importance of educational content for children, and while Disney is undoubtedly entertaining, I question its contribution to making the world a better place. Of course, this is just my perspective. What are your thoughts on the matter?

Fair point Jon. We went to Disneyland not to support Disney but have a memorable family trip. Didn’t think too much about the political side of things.

Very cool to see your dividend income that high, definitely motivating for someone like me who is still way behind to keep grinding and eventually hit those goals too.

Thank you Fil.

Hello Bob,

Long time reader, first time commenter. Concerning your body fat % goal, and if I recall correctly from previous blog post, I think you are using a home scale, something like Renpho. Have you also considered measuring your body fat % with a more sophisticated machine, such as one in commercial gyms or even a DEXA scan?

If not, I would encourage you to do so from time to time. I did myself and I found 2% difference, at home I was 20%, at the commercial gym, 18%. In your cas, you might have reach your goal already without knowing it.

Another aspect, if you’ve already reach your goal, is you might be overtraining and restricting calories for too long, which will bring health issues. It did so for me, still trying to heal my knees after overdoing it on the cardio.

Thank you for your blog. Warm regards,

Jean-François

Hi Jean-Francois,

Thanks for commenting for the first time. Haven’t considered measuring body fat percentage with a more sophisticated machine, I’ll have to consider that.

I don’t think I’m restricting calories all that much, basically watching what I eat.