It’s time for our monthly dividend income update. For those of you that are new, we plan to live off dividends when we are financially independent. While it would be amazing to receive $360k in dividend a year like Reader B, we’d be happy with around $60k in annual dividend income.

We are doing these monthly dividend income updates to keep ourselves accountable and to demonstrate that it is possible to build up a sizable dividend portfolio over time. For now, we are aiming to reach our $60k dividend income goal by 2025. I will admit, it is a massive task!

As a leader for a local Beavers colony, I have been helping and teaching the kids aged five to seven various Scouting skills. The pandemic meant we had to do a lot of meeting virtually since the past September. We met outside once the weather was nice again. Thankfully, everyone stayed healthy throughout the year and we all had a lot of fun. At our year-end wrap-up meeting, it was great to hand out many badges to the kids.

It shouldn’t come as a surprise that our backyard garden kept us really busy throughout June as a lot of the veggies were ready for harvest. Since we could only eat so much, we had to preserve some veggies by blanching them first then freezing or pickling them. We also made a ton of Chinese dumplings with home-grown vegetables then freeze them for consumption later.

Dividend Income – June 2021

Too many pictures? Let’s resume to dividend income update, shall we?

In June 2021, we received dividends from the following companies:

- BlackRock (BLK)

- Brookfield Renewable (BEP & BEPC)

- Canadian National Railway (CNR.TO)

- Canadian Tire (CTC.A)

- Canadian Utilities (CU.TO)

- Dream Office REIT (D.UN)

- Dream Industrial REIT (DIR.UN)

- Enbridge (ENB.TO)

- European Residential REIT (ERE.UN)

- Fortis (FTS.TO)

- Granite REIT (GRT.UN)

- H&R REIT (HR.UN)

- Hydro One (H.TO)

- Intact Financial (IFC.TO)

- Intel (INTC)

- Johnson & Johnson (JNJ)

- McDonald’s (MCD)

- Manulife Financial (MFC.TO)

- Magna International (MG.TO)

- Metro (MRU.TO)

- PepsiCo (PEP)

- Qualcomm (QCOM)

- RioCan REIT (REI.UN)

- Saputo (SAP.TO)

- SmartCentres REIT (SRU.UN)

- Suncor (SU.TO)

- Target (TGT)

- Unilever plc (UL)

- Visa (V)

- Waste Management (WM)

- Wal-Mart (WMT)

- iShares Ex Canada International index ETF (XAW.TO)

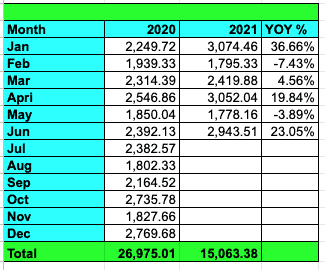

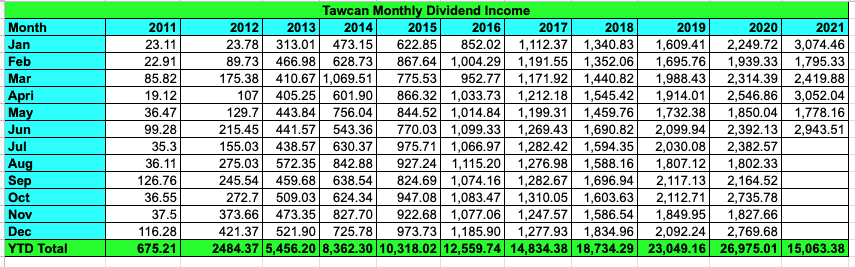

The 32 dividend paycheques added up to $2,943.51 After a low dividend income in May, it was nice to see a monthly dividend income that’s closer to $3,000.

Out of the $2,943.51 received, $456.01 was in USD and $2,487.5 was in CAD or about a 15-85 split. Please note, we do not convert USD to CAD when reporting our monthly dividend income. I have been using this approach to avoid fluctuations in our monthly dividend income because of changes in the exchange rate.

The top five dividend payouts for June were iShares Ex-Canada International Index ETF, Enbridge, Fortis, Manulife, and Brookfield Renewable (not in order). The dividends from the top five payers for June added up to $1,986.32 or 67.5% of our June dividend income. June’s dividend income was highly concentrated with these top five dividend payers. Ideally, for income diversification purposes, we want the top five payers to account for about 50% of the monthly dividend income.

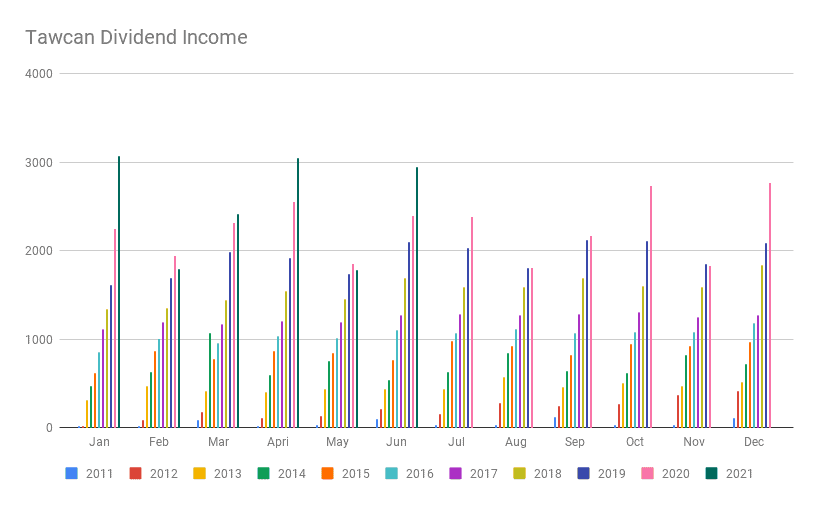

Dividend Growth

After a month where we saw negative YoY dividend growth, it was comforting to see 23.05% YoY dividend growth when compared with June 2020. We have made many purchases throughout the first half of 2021 and we are finally receiving dividends from these purchases.

If we look at the overall YoY growth for 2021, we are sitting at an average YoY growth rate of 13.3%. We would like to see this number to be 15% or more. Therefore, we will need to continue to add new cash and buy more dividend paying stocks, including some of the best Canadian dividend stocks.

Dividend Transactions

Like the previous five months, we kept ourselves busy on the dividend stock purchase front. We made two purchases in June.

- 180 shares of AQN.TO

- 23 shares of BNS.TO

AQN’s price has traded sideways the last year. Since I see AQN as one of the core long-term holdings in our dividend portfolio, it makes sense to continue to build up our position and wait for the stock price to recover later. We’ve done the same approach with the likes of Bank of Nova Scotia and Enbridge in the past and it has worked out well.

Although we already hold a sizeable amount of Bank of Nova Scotia shares, I purchased more because I believe BNS has more room for further price growth. The Canadian banks are posed to hike their dividends or pay out special dividends in the fall, so I wanted to take advantage of this eventuality by owning a good chunk of Canadian bank shares.

These two purchases added $205.63 toward our annual dividend income.

For July we plan to continue to add more dividend paying stocks. Telus, BCE, Apple, Canadian National Railway, TD, and Royal Bank are some stocks we’re monitoring.

Dividend Increases

In June, only one company we own announced dividend payout increase. But the increase was HUGE!

Target increased its dividend payout by 32.4%, its dividends went from $0.68 per share to $0.90 per share. Although we don’t own that many Target shares, I was thrilled to hear about the +30% dividend increase.

It would be very nice to see more companies raising their payouts by more than 30%! Who knows, maybe the Canadian banks will announce 20-30% dividend payout increases in the fall?

Summary

After six months, we have received $15,063.38 in dividends. Looking at our dividend income history, we have already crossed the annual dividend income of 2017. I continue to feel very grateful and blessed for how much progress we have made on our dividend income. Living off dividends tax free will eventually be a reality, as Reader B has assured me when he first contacted me.

To put things in perspective, our dividend portfolio generated $3.47 per hour during the first six months of 2021. At an hourly working wage, the portfolio generated $14.48 per hour, assuming 26 working weeks and eight hours each week.

Dear readers, how was your June dividend income?

Hi Bob,

Thanks for the article it’s always so inspiring and here I couldn’t help it but to see that you do hold Canadian utilities CU.to in your portfolio , I recently added it to my utility trio FTS EMA and AQN but looking at their income growth it doesn’t seem so good as it looks like a roller coaster , so i’m just wondering if you’re planning on keeping it and also what other utility would you suggest , I was looking about Hydro one as well.

Thanks

Hi James,

CU makes a small percentage of our portfolio. We’ve been slowly adding the likes the AQN and BEPC as we like renewable.

Congrats. My strong months are the second month in each quarter now as that’s when most of my US stocks pay.

Do you plan to have “cash on hand” for 6 months, or 1 year or 2 years or just rely on the income (uneven at times) from month to month.

Thank you Dividend Earner.

Do you mean when we’re living off dividends in the future? If so, we probably will keep some cash on hand, probably at least 1 year worth of expenses.

Great stuff Bob. Huge payout but man those pics are sweet. Your garden looks fantastic. Very cool about being a beavers leader. My son had his first year in beavers and loved it (although it was all virtual) here’s hoping next year will all be in person.

keep it up Bob

great stuff!

Thanks Rob. Really hoping to in person Scouting next year.

Nearly $3,000! Congrats Tawcan! That’s a solid month, and very good dividend growth!

We had an excellent month as well. I love collecting those dividends when I’m on vacation!

Thanks Mr. Tako. You had a MONSTER month. 🙂

Yum, I didn’t know zucchini flowers with mozzarella was a thing! I just picked off my first zucchini from our plant. I’ll have to look up that recipe sounds very kid friendly, zucchini flowers are so pretty.

Amazing growth and almost $3000! I just received an average amount in June, but July is going to be a bit fatty month with my VXC payment.

Why let these flowers go to waste right? 🙂

Hey Bob,

Plenty of great dividend content, though I think my favourite part is your involvement with youth at the Beavers! Didn’t know that about you—it’s a wonderful way to have a huge impact in the lives of kids, many of whom don’t have great role models elsewise.

Take care,

Ryan

Thanks Ryan, I went through Scouting myself as a kid and really appreciated what the leaders did. I’m also involved because my oldest is in Beavers.

Loving the food and garden photos, especially the broccoli and cauliflower!

I am also adding to my bank holdings in anticipation of the release of dividend restrictions!

Thank you! Adding more bank holdings seemed like a good idea.

Aren’t March, June, September, and December months just so wonderfully magical? That’s when I feel like we are truly getting paid for our efforts to build our portfolio up with the reward of dividends, haha.

Great gardening! One day, I want to grow my own food sources with my own cows, chickens, vegetables, etc. Will it happen? 99% it won’t, but there’s always that 1%!

Indeed, March, June, Sep, and Dec are stronger months usually. 🙂

My goodness…single income and the ability to purchase the following in one month??

“We made two purchases in June.

180 shares of AQN.TO

23 shares of BNS.TO”

Needless to say, well done. Pedal down!

Mark

We’ve been busy saving money Mark. 🙂

You were so close to $3K! That is awesome! Congrats on a strong month. I also loved the TGT dividend increase and hope there are more increases like that. Keep it up! 🙂

Thank you, I definitely would love to see more dividend increases like TGT.

This is another strong month of dividend income, Bob. Nicely done. 🙂 The 23% growth from last June is a huge increase.

It was a typical dividend month for me, about $1500 in June. I’m hoping to reach $20K in annual dividends by the end of 2021. I can probably get there with some more emerging market ETFs.

You mentioned ideally you would like your top 5 dividend payers to account for no more than half of your dividend income. Are you considering a rebalance or just buying more of other stocks/ETFs over time?

We might need to look into options to increase our passive income somehow.

We probably will just buy more of other stocks/ETFs over time.

Oops! I meant to say that I’m also hoping for $60,000/year in 2026…

Never too many food pictures! 🙂 So far, I’ve earned $14,000 in dividends this year from my dividend portfolio. I’m hoping to hit $30,000/year in 2026 so I’m eager learn from you & Mrs. Tawcan as you get closer and closer to your goal of $60,000/year by 2025.

That’s fantastic Blue Lobster.

Hi Bob

Your dividend income updates are always very strong, here again such a solid organic growth. Many great companies having sent cash dividends.

Keep it up and all the best.

Cheers

Thank you SavyFox.

Great update Bob! Boy, I wish I could invite myself over for some dumplings!!!

Our June dividend income was $3,098. One thing I’ve noticed more this month is with the adjustment to the timing of the POW dividend payment our monthly income is a lot more “lumpy” (although POW looks like it will pay at the very end a month, so it’s more “paper” lumpiness).

I’m still waiting to open our position in TD – our single income situation is still limiting our ability to expand our holdings, but hopefully the opportunity will arise for the inevitable announcement regarding buybacks and dividend increases!

The dumplings are pretty tasty I got to say.

Amazing June dividend income for you James!

Thanks for the artcile. Would love to see the whole portfolio. Just a question. Is selling shares vs receiving a dividend less tax efficient? I own stocks and just thought when the time comes to retire i will sell stocks for income. I guess it’s better to reach your financial goal from a dividend perspective?

Hi Jonathan,

We share what we own here- https://www.tawcan.com/dividends/. We don’t disclose our portfolio value for privacy reasons.

Selling vs. dividends tax efficiency is a complicated question since there are many different variables.