October was a crazy travel month for me. I spent 2 weeks in Asia for work, then two weeks in Texas for personal vacation. Part of the two weeks in Texas was spent at FinCon17 (I’ll write a recap later). It was neat to be on the road for so long, seeing different cities, eating different types of food, and meeting new friends. But I am looking forward to sleep on my own bed and getting back to the regular routines at home. I am also looking forward to taking life a bit slower and enjoying the finer things in life.

October Dividend Income

In October 2017 we received dividend income from 24 companies:

- Pure Industrial REIT (AAR.UN)

- Agrium (AGU.TO)

- BCE (BCE.TO)

- Bank of Nova Scotia (BNS.TO)

- Corus Entertainment (CJR.B)

- CIBC (CM.TO)

- Canadian Natural Resources (CNQ.TO)

- Dream Office REIT (D.UN)

- Dream Global REIT (DRG.UN)

- Dream Industrial REIT (DIR.UN)

- Enbridge Income Trust (ENF.TO)

- General Electric (GE)

- H&R REIT (HR.UN)

- Inter Pipeline (IPL.TO)

- KEG Income Trust (KEG.UN)

- Coca Cola (KO)

- Prairiesky Royalty (PSK.TO)

- Rogers (RCI.B)

- RioCan REIT (REI.UN)

- Smart REIT (SRU.UN)

- Telus (T.TO)

- TD (TD.TO)

- TransCanada Corp (TRP.TO)

- Domtar Corp (UFS.TO)

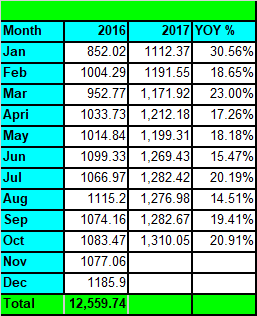

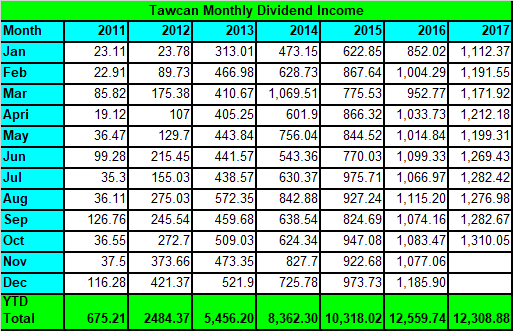

In total we received $1,310.05 in dividend income for October 2017. Yes, we FINALLY crossed the $1,300 milestone! Woohoo! It’s quite amazing that we have accomplished so much already in 2017. We crossed both the $1,200 milestone and the $1,300 milestone in the same year. That’s really cool stuff!

Out of the $1,310.05 dividend income that we received in October, $158.20 was in USD and $1,151.85 was in CAD. October was a month that we received most of our dividend income in Canadian currency. Nothing wrong with this but having a bit more currency diversity would have been nice.

Please note, we use a 1 to 1 currency rate approach. Therefore, we do not convert dividends received in USD to CAD. We are ignoring exchange rate to keep the math simple. This is our way to avoid fluctuations in dividend income over time due to changes in the exchange rate.

The top 5 dividend payouts in October 2017 were BCE, Bank of Nova Scotia, CIBC, Telus, and TD. The top 5 payouts accounted for 55.20% of our October dividend income.

Dividend Income Breakdown

We hold our dividend stocks in taxable accounts, RRSPs, and TFSAs. Every year, we maximize tax-advantage accounts first before investing in taxable accounts.

We do this so we can be as tax efficient as possible. Why pay extra taxes when we can avoid them by utilizing these tax-advantage accounts? It seems like a no brainer to me. This is why I am always shocked to hear people who are investing using taxable accounts when they have tons of RRSP and/or TFSA contribution rooms left.

For October dividend income, the breakdown across the different accounts are:

- Taxable: $297.20 or 22.69%

- RRSPs: $387.86 or 29.61%

- TFSAs: $624.99 or 47.70%

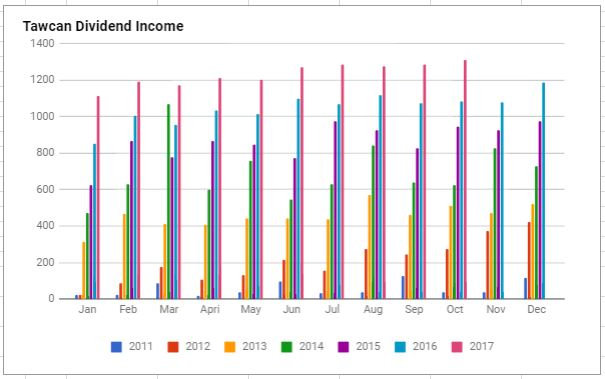

Dividend Growth

Compared to October 2016, we saw a YOY growth of 20.91%!!! With 10 months behind us, we are sitting at slightly lower than 20% YOY growth. Hopefully we will end 2017 with a YOY growth rate that is higher than 20%.

Dividend Increases

In October a number of stocks that we own in our portfolio announced dividend increase:

- Fortis raised its dividend by 6.25% to $0.425 per share

- Omega Healthcare raised its dividend by 1.56% to $0.65 per share

- Visa raised its dividend by 18.18% to $0.195 per share

- AbbVie raised its dividend by 10.94% to to $0.71 per share

With these announcements, our annual dividend income has increased by $26.14. The increase may seem pretty insignificant but I will take organic dividend growth any day, regardless of what the amount is.

Why?

Because the $26.14 increase does not require us to invest additional capital. At 3% dividend yield, we would have needed to invest over $871 of fresh capital to get the same dollar amount. Instead having to invest $871, we can use invest that cash to get another $26.14 in dividend income.

Dividend Stock Transaction

Just like September, we didn’t make any dividend stock transaction. I was paying close attention to the GE development. I thought about liquidating the entire GE position but didn’t pull the sell trigger because I was on the road. Now the share price has dropped quite a bit, I figure I might as well keep GE and wait and see if the share price will recover or not. If GE decides to cut or suspend dividend, I may liquidate the entire holding.

Summary

Can you believe we FINALLY crossed the $1,300 dividend milestone? And it feels so good! It’s amazing to finally crossed this major milestone after so many tries in 2017.

So far in 2017 we have received a total of $12,308.88 in dividend income, with majority of it being tax-free and tax-deferred. With two more months left before we wrap up 2017, it is very definitely possible for us to reach the highly challenge $15,000 dividend income goal that we set at beginning of 2017. If we can achieve that, it will be absolutely amazing!

We have received $12,308.88 in 2017 for doing absolutely nothing at all. It is amazing to have our money working hard for us to so we don’t have to. To put this into perspective, at $40 per hour ($83,200 annual), this means we have saved ourselves over 307 working hours, 38.5 days, or over 7.5 week. In case you are wondering, 7.5 weeks accounts for 14.4% of the year.

Dear readers, how was your October dividend income?

I just came across this blog and I love hearing about other Canadian personal finance bloggers dividend progress! I just have a question…how much capital do you have invested ? $1300 /month is a LOT of income so I’m thinking it has to be at least several hundred thousand invested?

Hi Danielle,

If you calculate using 3% dividend yield, you can estimate how much our dividend portfolio is.

Congrats at cracking the $1300 milestone! $15K for the your should definitely be possible.

Thanks, would be awesome to hit $15k.

What more is there to say than amazing Tawcan. Great results and an impressive growth rate all around. These results are motivating as heck and have me excited to continue investing and finding ways to keep pumping up my portfolio. Hopefully we will see you at FinCon 18!

Bert

Hi Bert,

Thanks. You guys are going to FinCon18? I haven’t decided whether to go or not at this time.

Congrats on reaching the $1300 milestone! No wonder you’re stoked. I still remember your tweet when you were heading home from FinCon…must have been a very good and busy time!

Good luck with the your Nov/Dec dividends, you are so close to $15k!

Thank you wealth from thirty. Oct was one crazy time for me, it’ll be nice to have a hopefully non-travel November.

Great job on hitting $1300! I like how you posted your previous year’s dividend income- makes it seem much more achievable. Hopefully in 3 years I’ll be at $1300 too!

I also like how you share the percentage of the year that were covered by dividend pay- fantastic! Really motivates me to try and increase my dividends.

Thanks GYM. Our dividend income is really starting to snowball. Love this. 🙂

Very nice, Tawcan. Stories like yours strengthen my belief in DIV investing.

Oct I finished with 390.89$.

Woohoo $390.89 is pretty solid. Congrats.

Great to see the consistent growth month after month. I think this is helpful for folks to see how a solid plan, executed consistently, can lead to significant gains.

Thank you Freedom40Plan. Consistent growth each month is definitely very nice. It’s encouraging to see that. 🙂

Truly amazing performance, Bob! You might as well reach another milestone in December! Good luck!

That’d be nice if we reach yet another milestone in Dec. Thank you.

Great job Tawcan. I especially liked the Abbvie dividend increase announcement. It exceeded my expectations and hopefully yours too. Tom

Thanks Tom. Yup love the Abbvie dividend increase for sure.

Congrats on breaking the $1300 milestone! That is impressive. If things go well, maybe next year I’ll finally break the four-digit mark in dividend income for a quarter ending month. I love your YOY growth rate as well. Keep up the awesome work! 😀

Thank you My Dividend Dynasty. It wasn’t long ago that it would take us 6 months to break the four-digit mark. It just takes time to build your dividend portfolio. Keep it up!

Congrats on the new milestone! Amazing!

I have a question, I’m hoping you or other readers can help answer for me. Let’s take an RRSP account for example. If investing in individual stocks, let’s say US companies, to avoid the 15% tax lag, that is obviously tax efficient and I know its what you (and other sites) preach doing and I understand why. However, on the topic of taxes, even if you were to sell an entire position(s) within the RRSP account, you’re not taxed on any capital gains (assuming there are gains) until you withdraw the proceeds from the RRSP account. How does the commissions come into play for taxes. So, if for example, you sold your entire position of Apple stock and made a capital gain, you paid commissions when buying multiple times and selling as well, but if you do NOT withdraw the proceeds out of the RRSP, how do you take into account the commissions paid for taxes? Do you have to wait until you withdraw the proceeds from the RRSP before you can claim the commission fees or do you claim them anyway at tax time even if you didn’t withdraw the cash.

Sorry if this seems like a silly question, but after reading your blog, it occurred to me and has left me wondering. Or if you can provide a link to any site, I would love to read over an explanation.

Cheers! and congrats again!

Hi moneyhelp,

The thing with investing in RRSP is that the commission fee and capital gain aren’t calculated the same as taxable accounts. Basically when you withdraw from the RRSP, everything is taxes as regular income at your marginal tax rate. This is why we plan to withdraw from RRSP early on when we live off from dividend income. I wrote some explanations here:

https://www.tawcan.com/our-financial-independence-assumptions-what-about-taxes/

Hope this helps.

Hurray! Was hoping when I clicked this link that you’d have broken that $1300 mark 🙂 Congrats!

Hurray indeed. Next milestone, $1,400 a month!

Congrats!!!

Thank you Charlotte.

Congrats on another solid month. Hope to get to 4 figures soon.

Thank you, you’ll get to 4 figures soon, just keep adding more money in your portfolio. 🙂

Congrats on hitting yet another milestone for your dividend income. I’m still waiting to hit my first ever four digit month but I know I’ll get there. As usual a nice long list of solid dividend payers throwing cash your way. Your chart is really painting an amazing growth picture. Keep up the good work.

Thanks DivHut, I’m sure you’ll get a four digit month soon. It’s pretty cool for sure to look at the chart and see our progress over the years.

Nice dividends Tawcan, and congrats on passing that $1300 milestone!

October isn’t a big dividend month for us, but despite that we pulled in $3500. Our dividend income this year should reach $52k this year — only slightly behind my 10% growth goal.

Thanks Mr. Tako.

Your dividend income is a whole different level compared to ours. Hopefully we’ll get to your level in the near future. $52k dividend income per year we’d be financially independent.

Good job. No dividend increase is insignificant. Right now I only got about $141 in dividend increase for this year looking forward to see what it is next year. You might hit 1600 at the end of next year with dividend increases and additions. That snowball is really moving now. Keep it up.

$141 in dividend increase for this year is pretty solid. It’s like a snowball getting bigger and bigger.

wow – that’s great – even motivational. Congrats.

Thanks gofi. 🙂

Congrats on hitting $1,300 dividend income for the month!

Next goal: $1,400. When do you foresee reaching this?

Thank you!

Hopefully next year to reach $1,400? We’ll have to wait and see. 🙂