It’s May and the weather in Vancouver is getting warmer and sunnier every day. I have been walking around in a T-shirt, without a jacket. It feels that summer is just around the corner.

Nicer weather also means that Mrs. T and I are spending more time in the garden. Mrs. T had spent some time in March planting seeds. As you can see from the pictures, we have a number of things growing in our kitchen garden already.

Lots of rain in April and lots of suns the last few weeks means our lawn has been growing really fast. We have been cutting it every week or so. The best part of mowing the lawn? Getting some exercise as we have a push lawn mower.

April Dividend Income

In April we received dividends from the following companies:

- Pure Industrial REIT (AAR.UN)

- BCE (BCE.TO)

- Bank of Nova Scotia (BNS.TO)

- CIBC (CM.TO)

- Canadian Natural Resources (CNQ.TO)

- Dream Office REIT (D.UN)

- Dream Global REIT (DRG.UN)

- Dream Industrial REIT (DIR.UN)

- Enbridge Income Trust (ENF.TO)

- H&R REIT (HR.UN)

- Inter Pipeline (IPL.TO)

- KEG Income Trust (KEG.UN)

- Coca-Cola (KO)

- Nutrien Ltd (NTR.TO)

- Prairiesky Royalty (PSK.TO)

- Rogers (RCI.B)

- RioCan (REI.UN)

- SmartCentres REIT (SRU.UN)

- Telus (T.TO)

- TD (TD.TO)

- TransCanada Corp (TRP.TO)

- Domtar Corp (UFS.TO)

- Vanguard Canada All Cap (VCN)

- Vanguard All-World Ex Canada (VXC)

- Ventas (VTR)

- Wal-Mart (WMT)

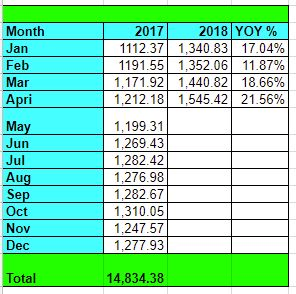

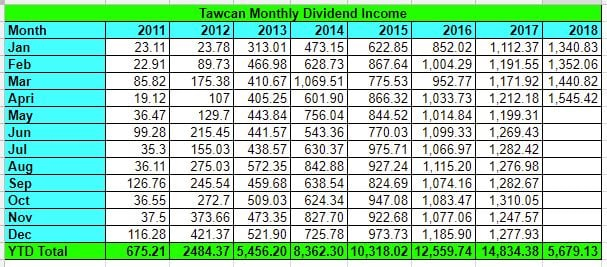

In total, we received $1,545.42 from 26 companies in April 2018. It’s yet another all-time record! This marked the 4th straight month that we broke the all-time monthly dividend income record!

Woohoo!

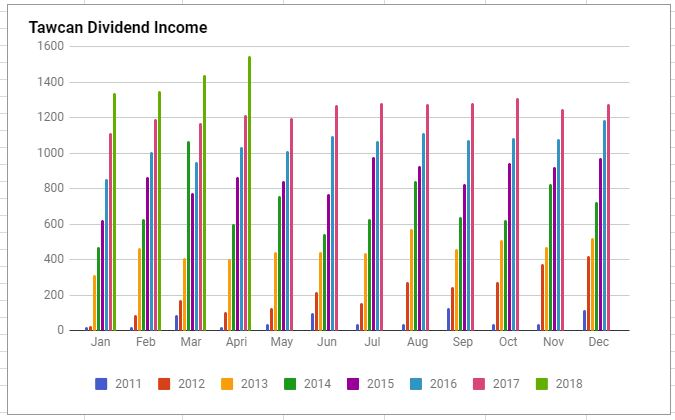

The green bars in the above chart just keep going higher and higher each month. Love it!

At $25 per hour wage ($52,000 annual salary), this means we have saved ourselves close to 62 hours of work in April. That corresponds to almost 8 days worth of work, or almost 2 weeks. Crossed the $1,500 milestone felt really good. So far in 2018, we have managed to cross the $1,300, the $1,400, and the $1,500 milestones. This has been quite encouraging, considering not too long ago, back in 2015, we couldn’t even cross the allusive four-digit $1,000 milestone.

Out of the $1,545.42 dividend received, $110.27 was in USD and $1,435.15 was in CAD. April was a month that was heavy in Canadian currency.

Please note, we use a 1 to 1 currency rate approach. Therefore, we do not convert dividends received in USD to CAD. We are ignoring exchange rate to keep the math simple. This is our way to avoid fluctuations in dividend income over time due to changes in the exchange rate.

The top 5 dividend payouts in April 2018 were BCE, Bank of Nova Scotia, CIBC, Telus, and TD (not in order). Dividend payouts from these 5 companies accounted for 55.7% of our April dividend income, or $860.96.

Dividend Income Breakdown

We hold our dividend stocks in taxable accounts, RRSPs, and TFSAs. Every year, we maximize tax-advantaged accounts first before investing in taxable accounts.

For Apr 2018 dividend income, here’s the breakdown of the different accounts:

- Taxable: $423.09 or 27.4%

- RRSPs: $409.49 or 26.5%

- TFSAs: $712.84 or 46.1%

Effectively, only 27.4% of our April dividend income was taxable. We constructed our taxable accounts so we only receive from stocks that pay out eligible dividend income. Since we plan to live off dividend income when we are financially independent, we want to construct our portfolio to be as tax efficient as possible. This way, we can minimize income tax during financial independence.

Dividend Growth

Compared to April 2017, we saw a respectable YOY growth of 21.56%. Wow! This is the first time in 2018 we saw an above than 20% YOY growth! Given we had yet another record month, this shouldn’t come as a surprise. Our target is to continue having the YOY growth matrix to be above 10% for the rest of the year.

Dividend Increases

After a less than stellar month in March where we only saw 1 dividend increase announcement, we hoped we would get more dividend increase news in April. Fortunately, this was the case. In April we saw 4 dividend payout increase announcements.

- Procter & Gamble raised its dividend by 4% or $0.7172 per share.

- Costco raised its dividend by 14% to $0.57 per share.

- Johnson & Johnson raised its dividend by 7.14% to $0.90 per share.

- Unilever NV raised its dividend 8.01% to €0.3585 per share. (We own the ADR listed Unilever shares)

These announcements increased our annual dividend by roughly $40 (had to estimate the amount from UL due to currency conversion).

Dividend Stock Transactions

In April, many Canadian stocks continued to be volatile. Enbridge stock price took a big tumble after the Line 3 approval announcement. Having cash in hand, we decided to take the opportunity to add to some of our existing holdings.

- Purchased 100 shares of Enbridge (ENB.TO)

- Purchased 50 shares of Emera (EMA.TO)

- Purchased 100 shares of Enbridge Income Fund (ENF.TO)

The 3 purchases increased our annual dividend by $338.96.

Since the beginning of 2018, we have managed to increase a total of $2,134.91 in our annual dividend income simply by adding new capital to buy additional dividend stocks. This amount does not include any dividend increases from organic dividend growth and growth from DRIPing additional shares.

Conclusion

With 4 months in the book for 2018, we have received a total of $5,679.13 in dividend income. This amount is already over our 2013 annual dividend income and more than half of the 2014 dividend income. It’s really cool to track our progress over the last 7 years.

Dear readers, how was your April dividend income? Have you been busy shopping for dividend growth stocks like us?

Congrats on a very good dividend month with great YOY growth!

We had a successful month as well and were quite busy adding some new shares to our portfolio (British American Tobacco and Legal & General).

Keep it up and all the best.

Thank you Financial Shaper. That’s great you had a successful month as well. Here’s to a great May!

I like the garden photos 🙂 Over here lot of folks do that from their ground floor apartments and no one says much about it .. a lot of roses too 🙂 … I appreciate the dividends report … it is good to compare what others do … or try …. it seems to help get around low bond yields etc Michael CPO

Thank you, Michael. I think it’s interesting to post garden photos and show the progression of the garden over the next few months. 🙂

Some great progress this month Bob! It’s also neat to get a glimpse of the veggie garden – how it’s coming along each season is awesome. Plant anything tasty recently? (I couldn’t spot the strawberries!)

Thank you wealth from thirty. Very happy with our progress in April. I’m sure I’ll post more of the veggie garden later to show the progress of the garden. Strawberries were planted back in the fall. Should start getting some fresh tasty strawberries later this month/early next month. 😀

I love the garden! I’m impressed that you’re putting together such a great garden with two kids, I feel like I’m struggling to get stuff done with just the one kid. 🙂

Most of our investments are still in our retirement accounts, I buy our dividend stocks in a separate brokerage, but that may be backwards. I bought a couple more dividend stocks this year but the payouts have been slow, so I’m just keeping my eye on saving more cash to buy with.

Thank you! I think Mrs. T spends more time in the garden than me. She somehow manages to juggle between 2 kids and tending the garden. 🙂

Buying dividend stocks in non-retirement accounts might not be too bad if they are all eligible dividends and you are investing index ETFs in retirement accounts.

That’s a really strong year-on-year growth. I’m looking forward to being able to reach that $1.5k mark too!

Thank you Income Master. Continue building your dividend portfolio and you’ll reach the $1.5k mark soon enough.

Tawcan –

Just love seeing this. The $1.5K mark is fricken awesome, let alone doing it in April. The growth is amazing and you are just killing it. Massive purchases you are making, by the way.

Also – love that you are tending the garden. Any tips for things to plant in may with mild weather i.e. 65-70 degrees?

-Lanny

Thank Lanny. It’s awesome that we crossed the $1.5k mark. 🙂

Because of the mild weather, that’s why we purchased the greenhouse last year so we can grow things like tomatoes and cucumbers in the greenhouse. The plants in the kitchen garden area that we planted (like kale, garlic, onions, etc) can handle mild weather better.

Awesome progress! I’m not a dividend investor – I invest entirely in index funds. I still track the dividends by quarter each year and it’s really fun to watch them grow, mostly because they are growing from me buying more shares, not necessarily from the share price going up. With one quarter down in 2018, I already have more dividends than I did in all of 2012. My Q1 this year was almost double last year’s Q1!

That makes sense that you are tracking dividends quarterly. With index funds it is harder to estimate the dividend distribution amount since it varies quarter to quarter. Having said that, it’s pretty awesome that you have already gotten more dividends than what you got in all of 2012. Congrats on this amazing progress!

This is awesome to see! You are making some amazing progress. I also hit a personal record for the month of April. Thanks for sharing the pics of the garden, I’ve been doing a bit of landscaping on the east coast with the nicer weather too!

Than you Wally. That’s really awesome that you hit a personal record for the month of April. Keep it up and let that dividend income grow! 🙂

That’s nice the east coast is finally getting some good weather and no more snow.

Amazing progress! You are getting to FI in a faster and faster pace.

I also admired you courage to buy stocks at low. It’s kind of difficult for me to be greedy when everybody is fearful, although in theory I know that’s what I should do. I still have quite some cash to deploy this year. Hopefully I can conquer my fear and begin to buy more stocks.

Hi May,

Thank you. Buying when everyone else is fearful is definitely tough. And you win some, you lose some. This is why you should only invest money that you don’t need in the next 5 years at least. If you don’t feel comfortable investing a large sum of money, add a small amount first and cost average over time.

Congrats on building the perpetual passive cash inflow!! Question for you regarding the REIT DRIPs. What’s your take on companies deciding not to offer discounted DRIPs anymore, and strictly paying out cash. (ie REI-UN, AX-UN, HR-UN) as examples? Do you end up manually reinvesting in these companies?

Hi,

We are DRIPing through Questrade and TD Waterhouse (synthetic DRIP), so we typically don’t get discounted DRIPs in the first place anyway. Discounted DRIP is just an added benefit.

Are synthetic DRIPs never discounted? I ask because like you, I also use Questrade and I am aware that they only do synthetic, but does that mean certain companies don’t offer discounts on DRIPs when enrolled?

Most discount brokers only offer synthetic DRIP rather than full DRIP. Shareowner is the only discount broker that I’m aware of that offers full DRIP.

For Questrade they don’t provide discounted DRIP. For TD Waterhouse, if the stock offers discounted DRIP, TD will set that up for you with the respective company. It really depends on the discount broker you use.

You might want to try to calculate that going backwards. I’m at Credential Direct (soon to be Qtrade, yah!), but on my statements, i see # of shares received, and the cash where you don’t get partial shares. Knowing the # of shares and the $ per share on the divy, less the cash received, you can calculate the cost of shares purchased. In the cases where the prices were going up, i noticed that the cost was less than market price at any time during the month.

But back to my original question, most of these REITS have taken away the discounts, and some now no longer even allowing (synthetic) DRIPs. Just wondering if it’s another sign that they are trying to cope with the rising interest rates world.

Synthetic DRIPs is something offered by the individual discount brokers. If discount brokers honor the DRIP discount, you’ll get it when you DRIP a share. Otherwise, I believe discount brokers just purchase the DRIP share at market price. I’m not exactly sure how Credential Direct works. I’m speaking from our experience with Questrade and TD Waterhouse.

Congrats on an incredible month! It’s always nice to have another record breaking month. Nice YOY growth too. Keep up the great work! 🙂

Thank you My Dividend Dynasty. Very happy with the YOY growth for month of April. It’s been great seeing our dividend income grow each month. Higher and higher we go!

Daaammmmmm, green eggs n haaammmm!!!!

Spitting fire…. that is sweet Bob. Huge income and threw down some stacks! Crazy how much forward income you have created since the start of 2018.

Keep it up

Cheers

Haha, spitting fire lol! Thank you!

We have been very surprised how much dividend income we’ve been able to generate so far. We’ll continue adding more cash into the portfolio and grow forward looking dividend income.

Congrats! That is really an awesome month!

And your garden looks nice

What will it look like in 3till 4 months ? Your harvest will be great

Thank you Pollie. In 3 to 4 months, we’ll have lots of green stuff in the garden, that’s for sure. We are looking forward to the harvest later this year. 🙂

We had an awesome month indeed, very happy about that.

Very rewarding to achieve over 20% div growth!

I was very surprised with such high YOY growth. Like I said in the article, we were expecting about 10% YOY growth for 2018. We’ll take more growth of course. 🙂

hello

can you do an updated blog post on how to get started today with just $1000, $5000, $10000, etc. i really enjoyed that post of yours but it was from years ago and would like to know your input for 2018-2019 . thanks

Hi Judy,

There shouldn’t be much difference in terms of starting today with just $1,000, $5,000, and $10,000. The technical theory and stock selection process stay the same.

Nice looking Garden and nice looking dividends Tawcan!

For the year so far, we’ve collected $13,905 in dividends. I think we’re doing pretty good!

The garden is just getting started. More and more things are popping up each day. 🙂

I think you guys are doing really well. We have a long way to go before we catch up to you guys.

Amazing progress! Here is to another record month in May!

Thank you R. Stay tune for May. Maybe we’ll have another record month, that’ll be totally awesome to have 5 straight months of record breaking.

That’s pretty impressive gains this year. I bet you’ll start to see the compounding more and more noticeable now.

Hi Jeannie,

Yup, the compounding is getting more and more noticeable. We can easily purchase more stocks each month with the dividend income that we received.

Those are awesome numbers! You’ve already surpassed all of 2013 🙂 And that is one good sized greenhouse. I’ll have one set up one of these years.

Thank you Angela. The greenouse took a whole day to install last year and we’ve produced lots tomatoes last year. It’s a great way to get fresh home-grown produce.

Congrats! That is really awesome! Will be interesting to see May as it looks like it is historically less than April. The site also looks great, I like the changes.

Thank you Wealthy Content. I’m not sure if we’ll get another all-time record for May. Hopefully that’ll be the case.

Great that you are liking the changes to the site.

Unreal! Those numbers are getting quite large very quickly! Congrats and the progress. I just planted all of our vegetables this past weekend. Looking to get a good yield of crops this year as I have planted more than I ever have before.

Keep up the great work!

Thank you American Dividend Dream. We’ve been adding new capital and buying dividend stocks very aggressively so far this year and this has translated into higher dividend income.

We have already harvested some salad last week. Looking forward to getting more stuff from our garden and save a few dollars or two for grocery expenses.

Hi Bob –

Great recap and progress – congratulations.

That is an impressive list of names paying out in the first month of the quarter. We’re also finally starting to diversify across our taxable accounts into individual securities (nearly 94% of our net worth is in retirement accounts via index or other funds).

Thanks for sharing. -Mike

Thank you Mike, I appreciate it. 94% of your net worth is in retirement accounts is totally awesome. That means you are able to take advantage of tax-free or tax-deferred. Make sure you do have a tax-efficient withdrawal strategy for tax-deferred accounts though. 🙂

“Make sure you do have a tax-efficient withdrawal strategy for tax-deferred accounts though.”

Can you elaborate or provide a link to a previous post you may have written about this strategy? Thanks and great month!

Here are a few posts related to your question.

https://www.tawcan.com/our-financial-independence-assumptions-what-about-taxes/

https://www.tawcan.com/canadian-income-tax-financial-independence-retire-early/