With 2022 coming up to a wrap, I am amazed at how much progress we’ve made in the last 11 years. While we can’t retire and live off our dividend income in 2023 quite yet, we are getting pretty close to our dream of living off dividends and working part-time (if we choose to).

What’s even more amazing is that I have been blogging on this site for over 8 years. Man, time does pass by quickly when you’re having fun!

It’s also crazy that both our kids aren’t little babies anymore. Hence I’ve stopped referring to them as Baby T1.0 and Baby T2.0 and use Kid 1 and Kid 2 monikers instead. As a dad, I feel extremely proud to see both kids blossoming and becoming more independent.

Earlier this year, I wrote a post outlining 6 stocks I plan to buy more of in 2022. I kept true to my words and purchased more shares of each one of those 6 stocks. A few months ago, I also reviewed all the transactions we made between 2020 and 2022.

Long time readers will also remember that I typically go through our dividend transactions in our monthly dividend reports.

Inspired by Mark at My Own Advisor’s recent post called 5 stocks I bought in 2022, I thought I’d do the same and make it an investing learning exercise on what went well and what didn’t go well.

At the time of writing, we own 49 dividend paying stocks and 1 index ETF. The 49 dividend stocks are a mix of US and Canadian stocks.

- 19 US dividend stocks including big international brands like Visa, Procter & Gamble, Apple, McDonald’s, and Coca-Cola, to name a few. All of these are held inside our RRSPs to avoid the 15% withholding tax on dividends

- 30 Canadian dividend stocks including well known names like TD, Royal Bank, Manulife, Enbridge, and BCE. We hold them in TFSAs, non-registered accounts, and RRSPs.

Like Mark, we hold dividend paying stocks that offer a mix of high dividend yield and high dividend growth. We also invest in one index ETF – XAW, for geographical diversification purposes.

Ideally, it would be nice to trim down the number of dividend paying stocks in our portfolio to between 30 and 35, but it’s hard to close out positions.

For the most part, we keep our investment portfolio as simple as possible – we strive to buy enough shares to allow us to enroll in a DRIP. Once we’ve enrolled in the DRIP, we “drip” additional share(s) in each dividend payout and let the compounding do its work.

5 stocks we bought in 2022

So what are 5 stocks we bought more of in 2022? And what are some changes we have made to our portfolio? Let’s find out.

1. Apple (AAPL)

Well, it shouldn’t come as a surprise that I like Apple; a lot. Apple makes billions each quarter and has a boatload of cash available for deployment. As much as people see Apple as a hardware company, it has slowly turned itself into a services company over the last number of years. Furthermore, Apple has a ridiculously strong ecosystem which is the main stickiness for customers to stay with Apple products.

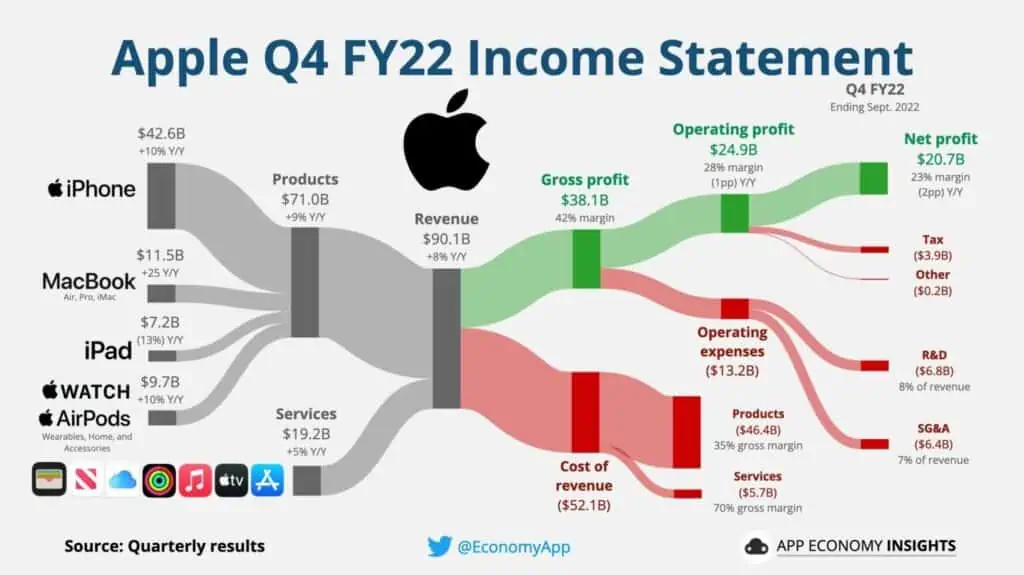

Below is a very good graphical breakdown of Apple’s Q4 FY22 income statement

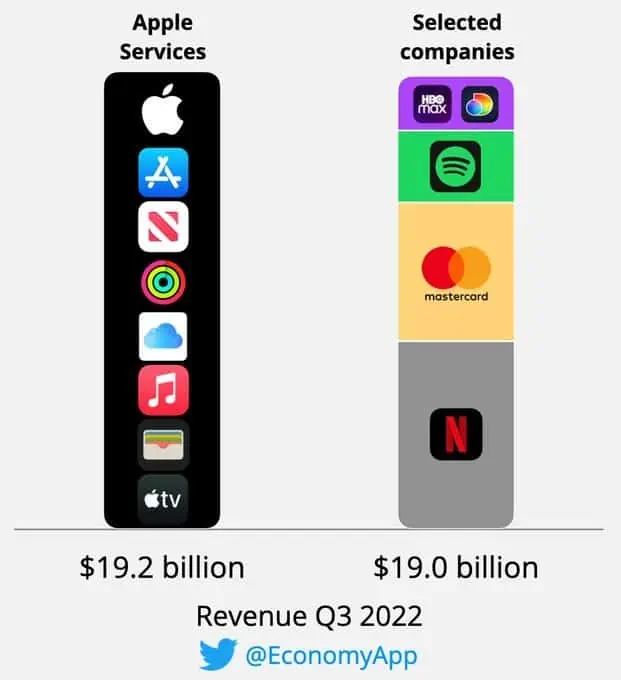

And Apple’s revenue from all the different services is quite mind boggling:

Let’s also not forget how much money Apple managed to generate from a single accessory called AirPods back in 2020 ($31.5 billion!). As we saw from the graphic income statement above, Apple Watch and AirPods brought in $9.7 billion US in Q4 FY22 alone.

Despite Apple products usually being so much more expensive than its competition, people continue to buy Apple products.

Apple has a 10-year dividend increase streak with a 5 year dividend growth rate of 8.76%. Although the dividend yield is super low, the overall total return has been quite impressive.

2022 hasn’t been the best year for Apple in terms of total return. The tech sector is being hammered due to concerns over the ever-increasing interest rates. As an investor, I’m not concerned though as I believe Apple will continue to generate billions of revenue every single quarter like clockwork.

2. BCE (BCE.TO)

We have been adding more BCE shares more or less every other month throughout 2022. Why do we like telecommunication companies so much? First of all, Canadians are paying some of the highest cell phone bills in the world. So I think it makes sense to be a shareholder and take in the rewards.

Don’t believe me that we Canadians are paying some of the highest cell phone bills in the world? During my trip to Taiwan in September, I bought a 7-day unlimited data prepaid SIM card for $17 CAD. The same would probably cost at least double, if not more, here in Canada.

BCE has a 13 year dividend increase streak with a 10 year dividend growth rate of 5.5%. Such a growth rate is pretty decent considering its high initial yield.

We started adding a lot more BCE after closing out our position in Rogers. I used to think that owning all 3 Canadian telecom companies is the best approach but after the recent Rogers fiasco, I decided to focus on Telus and BCE instead.

3. Algonquin Power & Utilities (AQN)

Yea, this one backfired. Big time!

Oops!

In case you haven’t read my recent analysis on AQN and whether the dividend is safe or not, you might want to take a look here – Is AQN’s dividend safe?

AQN share price tanked after its Q3 earnings. Despite the lowered ESP guidance from AQN, I think the price drop was a market overreaction. AQN certainly is facing a lot of headwinds but I am confident that its management will figure out a way to get out of this mess.

As much as a dividend cut will be negative for shareholders, in my opinion, this should be the one thing AQN must do to steer the ship out of the storm. I believe a dividend cut in early 2023 is the responsible thing to do and will allow AQN to be in better financial shape and have a stronger balance sheet.

If a dividend cut does happen, and maybe it would be as much as 50%, I think the stock price will eventually recover, especially after the successful integration of the Kentucky Power acquisition.

We bought a lot of AQN shares throughout 2022, all the way in the high teens to low teens share price, so we are seeing beetroot red with our AQN holding. However, AQN is about 2% of our overall portfolio value, so it’s a relatively small position compared to the top 15 holdings in our dividend portfolio.

For now, we plan to continue to hold AQN and get more clarity after AQN’s investor day in early 2023.

4. Manulife Financial (MFC)

Manulife Financial was one of the first stocks I’ve ever purchased. I made the initial purchase before the financial crisis and held on to my shares despite a dividend cut and a hefty price drop. Yup, I’ve lived through the storm with MFC and come out just fine.

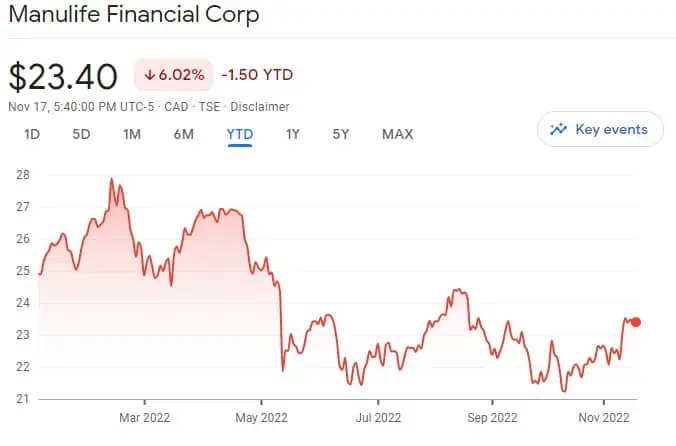

Manulife stock price took a beating throughout this year. At some point, the stock had a dividend yield of over 6%. When that happened, it was simply too hard not to buy more shares.

As you can see from the chart below, the one unfortunate thing about Manulife is that the share price hasn’t really moved all that much over the last 20 years. But I suppose that’s what happens with a high dividend yield stock.

In other words, Manulife is very much an income play for us. But since it only makes a very small percentage of our portfolio value, I think it’s OK to have a few income-centric dividend stocks in our dividend portfolio.

5. Bank of Montreal (BMO.TO)

We have been adding more BMO shares throughout 2022 because BMO was a bit underweight compared to the five Canadian banking stocks we hold. Although BMO has been paying dividends since the late 1800s, it didn’t raise dividends in 2021 and lost its 9-year dividend streak.

Am I concerned or losing sleep over this?

Not really. BMO still has an initial dividend yield of over 4% and the overall total return has been pretty solid. Furthermore, BMO has raised its dividend payout twice so far in 2022.

Looking ahead

Over the last 20 years, BMO has provided solid dividends and share price returns. There’s no plan to sell our BMO shares any time soon. Rather, we plan to continue to add more BMO shares.

Stocks that we wished we added

The market has been quite volatile so far in 2022. A lot of stocks saw significant price pullback at some point in 2022. Here are two stocks in our portfolio that I wished we had added more shares.

1. BlackRock (BLK)

BlackRock is the parent company for iShares. iShares is a very well known name in the ETF world. For example, we hold XEQT, iShares all-equity ETF, and XAW, iShares ex-Canada all-cap index ETF. We own BlackRock because we figured if people are holding iShares ETFs, why not be an owner and hold its parent company stock and get rewarded?

For an extended period, BlackRock was below $600 USD per share. I wish we had more USD in our RRSP to allow us to add more BlackRock shares back then, but we didn’t. It simply wasn’t worth it to convert Canadian dollars to American dollars in order to buy it.

Oh well, we plan to continue to buy more BLK shares as we have USD from US dividend paying stocks, most likely in 2023.

2 Waste Connections Inc (WCN)

We started buying WCN back late last year. Years ago we purchased Waste Management and that position has done quite well. Overall, I think the waste management sector is easy to understand – people will produce garbage and waste and companies like Waste Connections and Waste Management collect these wastes, transfer them, and dispose of them.

I’d call the waste management sector a recession-proof sector because we will make garbage regardless of whether we’re in an economic boom or a recession.

WCN’s share price went below $150 per share in 2022. Unfortunately, I didn’t take advantage of it. Instead, we purchased higher yield stocks like AQN.

Oops. Should have focused more on low yield high dividend growth stocks like WCN. If we had, we’d have seen a better return.

Oh well, that’s the thing with picking individual stocks – you win some and you lose some.

Summary – 5 stocks we bought in 2022

So here you have it, five stocks we bought in 2022 and two stocks that we wished we had bought more. I plan to write a post in early 2023 on five stocks we plan to buy and share some of my thoughts with readers.

Mark and I share a similar investment philosophy – we invest in both individual dividend stocks and index ETFs (hybrid investors). Furthermore, both of us try to keep any individual stock to less than 5% of the overall portfolio value. Now that’s just a general thumb-of-rule We certainly have a number of stocks that are more than 5% of the overall portfolio value (nothing higher than 7% though).

For index ETFs like XAW, we don’t have a hard percentage requirement as we have for individual dividend stocks, because index ETFs provide far greater geographical and asset diversification.

Dear readers, which stocks did you buy in 2022?

Rohny : It was mentioned i believe in your top 13 for 2023 that one should establish a core of stocks first. In that regard:

What minimum should one have to invest in each stock as obviously some may only start with 20k to say 50k in total, and therefor could only afford 2 or 3 stocks? and should they all be in different sectors?

Do U repeat stocks across the 3 types of accounts tfsa, NR, and Registered and do u do it purposefully?

Do U put more risky cos in a TFSA for higher growth potential ie do u have somewhat of a different strategy for each of the 3 types of accounts? thks

If you’re starting today I’d recommend starting with one of the all in one ETFs and building up an ETF portfolio. Once you have a sizable portfolio, say $20k or so, you can start individual dividend stocks. How much per each stock will depend on how much money you have. Say you pick 20 stocks to get started, I’d try to invest at least $1k per stock. So if you’re adding $1k each time, then you can buy one stock and rotate until you finish buying all 20.

It seems Bob(i hope ur correct name as just found ur site) u r saying that one should even if they have only 20k invest in at least 10 – 20 stocks rather than just 2 or 3. My 49 yr old son is starting out with 42kcad today but will have new traunches to invest over time with earliest next spring and i was thinking only 3 stocks to start(say 2 banks and one other sector ) to make dividend reinvesting meaningful (he will be using wealthsimple so trading is free and fractionals available)- but u seem to be saying NO but instead spread out his funds over 10-20 stocks and keep repeating them when new money comes in? thks

This requires a longer discussion than just a few sentences in the comment section. Everyone’s situation is different so it’s difficult just to provide a generic solution. 3 stocks to start means you’re not very diversified at all.

As a senior senior investor Ive been over diversified myself in the past with up to 55 stocks in a non-registered account and could not watch all properly (missed some key exit points on some stocks) but above that the bookkeeping was overwhelming. So from now on i do not want to be too overdiversified myself and have recently sold off huge numbers of stocks, but for my son i agree that maybe he can go to say 5 now and then add later as in one year he will be mortgage free and can buy a fair few more companies. thks Ps do u have any insight on my other questions including but not limited to the core? thks

Thanks for another great read! Just remember as far as AQN.TO is concerned, you did not actually get burned unless you sold.

Throughout the year – but mostly in the second half of it – I focused on buying dividend stocks that tend to do fine through recession or recession-like fears; namely railroads (CNR.TO, CSX, UNP), necessity goods (KMB, PG) and supermarkets (MRU.TO, KR). Some staples as well such as PEP and NKE.

Now, I’m getting ready to break out the popcorn for the first quarter of 2023 and letting my dividends pile up waiting for a major drop in the market to pounce on discounted stocks. If that does not happen, I will resume my previous careful investing strategy in Q2.

That’s true about AQN, it’s just paper loss until you pull the sell trigger. 🙂

Solid buys on these recession proof stocks.

Great post, I too am an Apple holder, but I recently sold off some of my ‘profit’ shares. I got a little nervous because of their exposure in China, and the civil unrest. I think it has great upside of course, just thought it was a good time to take a little profit off the table.

Thanks, taking some profit from time to time makes sense. 🙂

For my regular trading account, I’m doing no dividend stock hxt. It does the tsx 60 drip for you. I should be buying google/alphabet now. At some point dividend investing doesn’t make sense when the market is giving you great deals.

Thanks for another insiteful article. Always learn from your approach. Quick question….when you mention the percent of stock is that of your entire portfolio or just the stock portion (excluding EFT)? As a hybrid investor I also look to keep any individual stock at less than 5% of total portfolio, but have had a couple slip up to close to 6.5% and am comforatable with that. I do the rebalancing through new money to other holdings to bring down the percent on the winners…..not sure if that is the best approach but I am comfortable with it.

Thanks again for another great article.

Thanks Rod. Percent of stock of our entire portfolio does include ETF as well. Hope this helps.

Yes preserving cash. In last 6 months we only bought CM Canadian side and GOOG on US side.

Preserving US cash with short term BIL and added TLT recently as I’m thinking interest rate hikes are near target .

C $ cash in safe short term CMR and 1 year brokerage GIC at 5%. Will add more cash this week after BOC raises tomorrow.

Interesting that you’re in cash preservation mode. 🙂

Consensus from the news and celebrity CEO’s is that recession coming and data from this quarter and next several quarters of 2023 will be bad and on the downswing. Keeping lots of cash around safely earning high interest to have available to buy bargains. Will also hold off on buying any stocks (other than GIC’s) in RRSP/TFSA for several months

Good picks although I’m not sure about AQN — I prefer FTS over them. If they turn around this will be a good pick. I personally am not a fan all the shares being issued and how they finance their debt. I think the dividend will be cut but we’ll see in January.

I bought the following positions within our portfolio

TFII. BAM. TOU. CNQ. EIF.

These are spread through our accounts and my kids TFSA.

On the radar are ATD, CNR/CP, BRK.B, AP.UN, GRT.UN, GSY

Going forward for the next number of years I think energy, commodities, industrials, financials are going to be the big movers. Tech and real estate are going to lag but should be good for pickups.

Just my 2 cents

Hi Dean,

Like I said, AQN backfired on us. Would have done better if we picked FTS for sure.

Energy, commodities, industrials, and financials for the next number of years sound like a great plan to me.

Big congrats on your progress – I always learn something new from you, thanks.

QQ – how do you access the dividends that are in your retirement accounts and can’t access before retirement age?

Thank you gofi.

You can do early withdrawal with RRSP, just that you have to pay withholding taxes. With some proper tax planning, you can do it and minimize taxes.

ya, I’m in the states, and unsure about just that. Also, I have VYM, but may be VIG would’ve been be better. I read your high yield vs. dividend growth post.

But then VIG looks just the same at VTI – so a little perplexed at the moment.

Ah, sorry I’m not as familiar with the American registered accounts. Best to check and do your research to see if early withdrawals are allowed. 🙂