Later this year I’ll turn 40. I have never considered being 40 as old or the start of a midlife crisis. For me, 40 is just another number, the important thing is that I still feel young at heart.

It’s also hard to believe that I have been in the corporate world for almost 16 years. When I graduated from university back in 2006 and entered the workforce that year, I felt that I was starting a new chapter of my life.

Looking back to this important time of my life today, there are many things I wish I could have done differently. If I had, I would be so much better off financially today. Having said that, there are also many things I’ve done quite well that set me up well financially to where I am today.

If I could go back in time, here are 10 lessons I would give to my 23-year-old self.

1. Stop Buying DVDs

I watched a lot of movies in my 20s. Whenever I watched a great movie, I found myself having a huge desire to own the DVD so I could watch the movie again. It became a fascination to have a great DVD collection. I’d often go to Future Shop or other stores to buy the latest movie DVDs, or DVDs that were on sale. Due to this “addiction”, I’ve spent quite a bit of money on DVDs.

Looking back, it was very silly to have spent all that money on DVDs, especially considering I don’t even have a device that can play DVDs. We don’t own a TV at home, let alone a DVD player. Furthermore, DVDs aren’t even the “thing” anymore, since online streaming services like Netflix and Disney+ have taken over.

Today I still have a box full of DVDs sitting in one of the closets at home. So much for my awesome DVD library…

2. Quit listening to hot tips

When I first started investing in stocks, I would listen to hot tips and try to make a quick buck or two.

I sure got burned by these hot tips!

Thanks to these hot tips, I purchased my fair shares of penny stocks, I also did a number of day trades (and short-term trades). More often than not, I would end up on the losing end of the spectrum.

For example, one time I decided to day-trade Ballard (BLP.TO) based on a hot tip. The stock had been going up for a couple of days straight. Based on momentum charts, things looked good. Everything indicated that the stock would continue to climb.

The stock was hot due to some new contracts that the company had just won and there were more contracts to be won in the pipeline. So I pulled the buy trigger for a couple of thousand dollars in my RRSP account.

As luck would have it, as soon as I purchased the stock, the share price started dropping like a stone. The stock price went from bright green (up) to bright red (down) in a matter of minutes. Frustrated and a bit nervous, I decided to set a stop limit to avoid the stock gaping down and ending up with a big loss. The stop limit was triggered about 10 minutes after my share purchase and I lost about 15%.

Yes, I have won big a few times with hot tips. But most of the time I lost money on hot tips…

3. Avoid high fee mutual funds

Although I started investing early in my early 20s, I was buying mutual funds that bank financial advisers were recommending. I knew that minimizing Management Expense Ratio (MER) was a good idea but I’d often get persuaded by these “financial advisers” to go with actively managed funds. Simply because these funds had better historical returns. Unfortunately, the actively managed funds also happened to have much higher MERs than mutual funds that tracked the different indexes.

For some odd reason, I kept repeating this mistake again and again, even after reading books like A Random Walk Down Wall Street. I was not willing to do my homework and take charge of my own finance.

Instead, I wanted someone to look after my money and manage it for me so I didn’t have to. Simply put, I was lazy. Not taking any responsibility meant I was paying extra fees on these actively managed funds.

What I should have done instead, is to invest my money in dividend growth stocks or simply invest in index ETFs. If I had purchased dividend stocks like Royal Bank, Disney, TD, and Johnson & Johnson over 15 years ago, I’d be sitting at a very comfortable yield on cost for these stocks, collecting great dividend payouts every quarter. Likewise, index ETFs have much lower MER than most mutual funds. Even a small 0.5% difference in fee can make a HUGE difference in the long term.

If I were 23 years old today, I’d forget about mutual funds and simply invest my money in one of the all equity ETFs.

4. Take advantage of the economic downturn

When I entered the workforce after graduating from university in 2006, life was good. I was making more money than I ever had before. Since I had money left over each month, I decided to start investing money in the stock market by purchasing mutual funds.

Then the financial crisis hit. As a result of the financial crisis, the stock market stumbled too. Since I had some spare cash lying around, I thought I’d take advantage of the down market by buying some top Canadian dividend stocks. One of the stocks I purchased was Royal Bank (RY.TO).

I purchased Royal Bank at a heavily discounted price. My original plan was that I’d wait for the market to recover.

In case you’re wondering, I bought 100 shares of Royal Bank at $26.92 on Feb 26, 2009. I thought I purchased at an all-time low.

The stock recovered a bit in early March but then the market started dropping again. Panicked, I decided to sell all 100 shares on March 3 at $29.05 to take in a small profit. I thought I was a genius.

Little did I know that the stock price would continue to climb after my sale.

Today, Royal Bank’s share price had increased more than five times if I had kept these 100 shares. I would have also received a nice amount of dividends since 2009. At the current dividend payout of $1.20 per share, that means my cost on yield would have been a jaw-dropping 17.8%!

Oops, talk about losing a golden opportunity!

Looking back, I definitely wish that I had held onto Royal Bank and used all the cash I had available to buy all the big 5 Canadian bank stocks during the financial crisis, instead of holding cash in GIC and fearing what was happening in the stock market.

What I failed to realize is that the likes of Royal Bank, The Bank of Montreal, CIBC, The Bank of Nova Scotia and TD all have been paying uninterrupted dividends since the late 1800s! If I had done some research and looked at the big picture, it was easy to the financial crisis was a golden opportunity to load up on solid dividend stocks!

Fortunately, I learned from this mistake and decided to take full advantage of the COVID-caused-market-melt-down in 2020.

5. Be patient

As I showed above with my Royal Bank trade, if I had been patient, I would be doing very well today. But I was young and impatient. I was looking for the quick buck and the excitement of big stock gains in a very short period of time. Thanks to my impatience, I had gotten out of many trades way too early, losing either huge gains, or huge amount of dividends.

Here’s another example. A long time ago, I used to watch Business News Network (BNN) regularly. I’d base my purchase on picks of the day (see lesson #2 above). One of the stocks that caught my attention was WI-LAN Inc.

The stock picker suggested that the stock was undervalued. After some quick analysis, I decided to purchase some shares at $1.70. After less than a month, the stock price was bouncing all over the place. My patient ran short so I sold all my shares at $1.98.

If I had waited for a year, the price would have doubled. If I had simply waited for 2 years before selling the stock, I would have made a 6 bagger on this stock.

Be patient, my 23-year-old self.

6. Listen to my intuition

I recalled using Google in the 90s and thought the search engine was a million times better than Yahoo and other search engines around. I thought to myself, if Google were to go public one day, I should purchase some shares and hold forever. I thought Google had some excellent potential.

Similarly, when Apple first announced the original iPhone, I thought the phone was very cool but didn’t think too much about it. About a month after the launch, a co-worker showed me his iPhone. After playing around for a little bit, I thought the phone was revolutionary. I even talked to my co-worker about purchasing some Apple stocks because the iPhone would totally take over the smartphone market.

Instead of listening to my intuition and purchasing shares of Google and Apple, I didn’t go through with it. I did eventually purchase Google and Apple stocks but it wasn’t until many years later. Talk about missed opportunities.

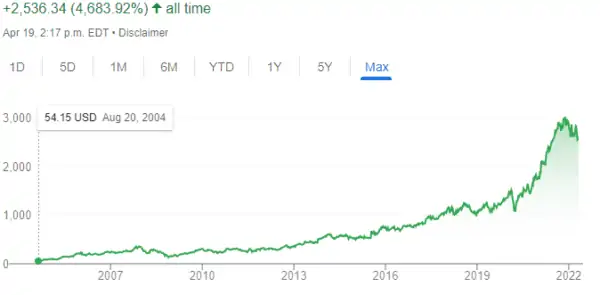

Just for fun, let’s look at the historical chart for Google.

And here’s what the Apple historical stock chart looked like.

7. Say yes to free money

If work has RRSP matching, take advantage of it. It’s essentially free money from your employer. It amazes me how many people don’t take advantage of this great benefit.

Likewise, if work has an employee stock purchasing plan and is matching cash contribution to a certain percentage, get on top of it!

Always say yes to free money!

8. Maximize RRSP and TFSA

One thing that I’m very glad that I’ve done since started working is to always maximize my RRSP and TFSA contribution room every single year. Tax-sheltered & tax free accounts are efficient ways to reduce your income tax. Best of all, your investments can compound tax-deferred or tax-free for many years.

It is also important to stop using TFSA as a savings account, and use it for retirement instead!

Whatever you do, do not “invest” in GICs or term deposits in your RRSP or TFSA. Why? Well, the interest rates nowadays are terrible. So terrible you’re essentially losing purchasing power by putting money in GICs/term deposits because inflation rates will diminish your actual purchase power.

9. Maximize savings rate

When you’re single and young, it’s a lot easier to save money every month. So when you just enter the corporate world and start earning money full time, aim to maximize your savings rate each month. Aiming for a 50% savings rate is good but 80% or higher is even better. It sure is a lot more challenging to have a savings rate in the above 80% range when you have a family and have dependents.

When I started working, I kept an excel sheet to track my income and expenses. Although I wasn’t specifically tracking my savings rate, I was trying to keep an eye on my expenses.

I recently went through this excel sheet and calculated my savings rate. Below is a 3-year snapshot of my savings rate after started working. A bit of explaining first, for about 1.5 years I moved back with my parents paying no rent. When I finally moved out again to live with a flatmate, my expenses increased.

Back then all I was doing was tracking my income vs. expenses. I didn’t know anything about maximizing my savings rate. I was still living like a poor student. As you can see, my savings rate was pretty decent without me even trying.

I could probably have paid more attention to maximizing my savings rate in my 20s. This could be done by simply partying less and investing my money in index ETFs or dividend stocks.

10. Stop caring about what others think of you – be yourself

This is probably the most important lesson. Stop caring about what others think of you.

Stop feeling that you need to impress people by wearing brand-name clothes, having expensive jewelry, driving expensive cars, or having the latest electronic gadgets. If people are friends with you because you have these expensive, latest toys, they shouldn’t really be considered friends.

You want to be friends with people that care about who you are and your values. Stop second-guessing what people think about you behind your back. You can’t control how others feel about you, so the only thing you can do is to do things that will result in happiness for yourself and yourself alone.

Be yourself and be comfortable about the decisions you make in your life. You’ll make some good decisions, you’ll make some bad decisions. That is life. Don’t base your important life decisions on what other people might think or say about you.

Take charge of your own life. Don’t make decisions based on what others would think about you.

Dear readers, do you have any lessons you’d give to your 23-year-old self?

Hi! I am new here. I am a 29 year old in vancouver. I have been saving money like crazy since I got my first “real” salary job in 2019 when I had no financial obligations. I never invested at the time. I am now working on dividend investing since March 2022 and I am already seeing dividends as high as 60 dollars in a month. I currently auto deposit 200$ biweekly which is all I can really handle as single female with a mortgage.

When I look at your yearly dividend income throughout the years and do a rough calculation of how much money you have invested year to year it looks like you are depositing money way more than I could ever imagine. Like 50k a year? Is my math wrong or how do you do it? I think it made me feel discouraged that I will never see growth like you.

Hi Crystal,

I think finding the right balance between saving and enjoy life now is important. Congrats on having $60 a month! When we started, we were not depositing as much money as we are now. It took us a while to build up our dividend portfolio. Everyone’s path is different, no need to compare. 🙂

Love this post Bob! The Stop Buying DVDs made me laugh out loud. I used to have a CD addiction in the early 2000s. Buying them and burning mix ones. I’d definitely go back in time and tell myself to chill out in that regard.

Haha yea we all made silly mistakes in the past haven’t we?

All wonderful advice! I can’t wait to pass down this advice to my young son and teach him these lessons as he grows older!

Thank you. 🙂

Most are the same for me, but look how many people still focus on the home runs. We all look back on the items we should have bought, but what is wrong with steady earnings? The banks have been a cash cow forever and I don’t see any need for risk. If we would have started with blue chip stocks right from the start it is more than we can spend later. Steady investing in secure investments over time is all you need. The surprise to me is that I was so focused on a number I needed to retire, that I didn’t realize that most of the money I saved will continue to grow. “ONCE CHEAP ALWAYS CHEAP”. I don’t even come close to spending what it is growing now.

Slow and steady wins the same. 🙂

Lessons:

Dont concentrate on one section.

Dont concentrate on one stock.

That’s a good summary. 🙂

Super good ideas in this post. One of the reasons I blog is to leave my future kids w some pointers I hope serve as a head start. Of course, all the better if we can have those conversations ourselves, but some kind of almanac is nice to pass down. I hit my 20’s with a bunch of good habits, but by the time I was in my later 20’s, living in a capital city and studying full time, a lot of those good habits diminished (not to mention the not so good ones blossoming)…having a high savings rate and investing early are two important ones I let go! Good to be getting back on track 🙂 I would probably also tell my 20 year old self to travel more and for a few months at a time (working holidays etc).

Glad to have got the information when am 21, am hopping to implement all these strategies onwards so that when I will be 31, I will be smiling my way off!

Thanks for the great advice !

You’ll be smiling for sure. 🙂

Some of the things you mention in this post are very recognizable for me. I nearly bought around 5000EUR worth of Google stock in 2005 but at the last moment I didn’t pull the trigger as I was scared as they had already gone up so much since the IPO. Those shares would now be worth over 40,000EUR. Same thing with NVIDIA, I owned a block of 655 NVIDIA shares in 2008/2009 but eventually I sold them at a small loss. Those shares would be worth at least 5x as much today.

Wish we both would have more guts back then. 🙂

I am turning 35 myself later this year and I would love just 10 mins with my 23 year old self. I would tell him to start caring about his finances earlier. There is no reason why I didn’t have investments back them (even if I had made bad choices with them at least I would have been in the game).

I’m not sure that one can tell a 23 year old person much they would listen to. All your points are great and thinking back to when I was 23, saving and investing wasn’t something I cared about or even felt a need to consider.

What we decided was to set aside savings for out grand kids by purchasing one DRIP stock and periodically add funds to buy more. Over the years the stock raised it’s dividend and the reinvestments have grown the value of their holdings. Every now and them we showed them the quarterly statements with a chart of how their dividends have grown.

Now that one of them is 18, she will take over the DRIP and she wants to continue to add her own money. If she does and increases the amount as she gets older I think some of your points will come into play without anyone telling her.

That’s true, most 23 year olds will probably not listen to these advice but a few might.

The DRIPing part is exactly what we’re doing with Baby T1.0’s dividend portfolio.

She has seen DG work through the Financial Crisis and how DG drives price growth. We are trying to teach her that DG, not ETF Indexing works through good and bad times, which I doubt Indexing will do.

By getting Baby T involved, or when she/he is able to understand, I’m sure it will have the same impact as our grand daughter experienced.

I would tell 23-year-old me to stop buying so many clothes and to bump up my savings rate! I paid very little rent at the time yet was spending my money on shopping and travel. I don’t regret the travel but I also could have saved that money too. Great tips!

Good point on buying less clothes.

Hey Tawcan,

Great list buddy. Really resonates with me since I’ll be turning 23 at the end of this year. Fortunately, I follow most of these tips. Really crazy to see how low you purchased shares in RY and IFC before and sold early compared to now. Those price jumps is what makes me hope that the markets can achieve the same thing going forward.

That’s awesome that you follow most of these tips already. 🙂

Oh Tawcan. I learned a lot from this post! I am a 25-year-old guy and would like to be successful at money like you. 😀

Glad to have helped.

Hi tawcan,

Great list and many youngsters should take a look at it.

Kisses,

Mrs Moneypenny

Thanks Mrs. Moneypenny.

Great list. I can identify with several of these as well. I might add: do your own taxes and figure out how different things are taxed. When I think of all the money I spent on tax prep while blindly playing around with different investments-completely oblivious of IRAs- I want to wack my young self over the head.

Hi Lena,

That’s a great one. I’ve done my own taxes since started working and have learned quite a few things on how to be more tax efficient. 🙂

Great tips Tawcam, as a 24 year old, I really appreciate them 🙂

Patience is definitely a huge thing for investors. I think Buffett said along the lines that the stock market is a great way of transferring wealth from the impatient to the patient. That is the key, after you’ve chosen a decent business of course.

Tristan

Be patient is a big one regardless what your age is. 🙂

Terrific list. The one thing I would have told my 23-year-old (or any age before 32 really) self would be to educate myself to the greatest extend possible about personal finance. While I am absolutely on a great path now, I often give a little thought to how much I’d really be crushing it if I had started my journey to financial freedom 5 – 9 years earlier.

If we had all started the financial journey earlier, we’d all be in a much better place. 🙂

Yup I can relate to hot stock tips when I put money into GBSN.. Great post, I loved it. I’ll be a subscriber of yours for life!

Thanks Makesshifthappen2020.

Can my 23-year-old join the class?

Myalmost-40-year-old would be in a very different situation now.

I hop to take all these lesson’s and pass them on to my kids by te time they are 18. What if they have a nice DIG portfolio at that age… Just imagine…

That’s why we created a DIG portfolio for Baby T1.0. 😀

Fantastic list! I can relate to all of these — especially #1! My collection was CDs, not DVDs, but the same lesson applies. I just donated a huge box of hundreds of albums I had collected. I don’t even want to think about how much money I spent on them.

Hi Matt,

I had my shares of CDs as well. Amazing how much useless stuff we collect over time. 🙂

hey 🙂

Thats a very good post! I am now 23, I turn 24 in two weeks. Your post reminds me to be patient.

I am pushing myself to higher heights everyday.

Your post lets me hope that I will be very wealthy in my thirties.

Thanks for sharing!

best regards from Austria

Being patient is very important. Takes time to build up your net worth. 🙂

Funny I just turned 36 recently and I cringed that I was closer to my late 30s than mid 30s! haha Fortunately, I do have those youthful Asian genes as well though I do have graying hair. I definitely would have told myself to stop jumping on the hot stock tips…they rarely turned out well. And I absolutely would have increased my savings rate. I thought that I was doing a good job contributing to the match with my employer (compared to many co-workers who didn’t contribute at all). I was pretty frugal but I probably had too much money sitting in “high interest” savings accounts earning like 2% at the time.

It’s easy to listen to the hot stock tips and just pull the buy trigger. It’s all about being able to ignore all the noises. 🙂

I definitely have a drawer full of DVDs that have not been used in about 2-3 years (some never).

Have a few “hot tips” mucking up my account – will unload them at a loss one day

I think I have a few unopened DVDs, which are a total waste when you think about it.

Apple and Google. We all saw it happening right before our eyes. I didn’t invest in either. I’m still not sure why. I love the first piece of advice, don’t buy DVDs. I wonder how many people have libraries of those useless babies taking up space in their homes.

At least you can use these DVDs as Frisbee. 😀

These are great lessons. I wish I contributed more to my 401k and IRA instead of trading stocks in a brokerage account. I also wish I didn’t finance a used car purchase when I was 22.

Oh the mistakes we made in our early 20’s. 🙁

Live and learn.

My situation is I only started in late 2012. when I was 30. I started not as a dividend investor but focusing on profit by trading frequently. In the beginning it all went good . I made some money. In mid 2014 I lost all the money i made as a profit and also lost huge amount of my principal that was invested. Ohh.. all that U.S dollar I wasted in trading chinese stocks. During the same time I also hold some of the dividend stocks like TD and BNS which I didn’t sell and realized the dividend coming every quarter that interested me. I started reading dividend blog like this and made me more motivated.

Today I would only like to focus on solid companies and focus on dividend growth/ Although I have been doing my best the problem is I started it quite late i.e after I got married now I am going to be a dad soon and since i m the only working member its very hard for me to save and invest. I am doing my best and would like to stay focus.

It’s amazing that so many of us were looking for the big bucks early on and end up losing big thanks to these moves.

Stay focused on solid companies is a great idea.

I am glad that I read this before I hit 23 (Kind of a point you made on your comment on my blog :p) I really like how you about taking advantage of economic downturn as well as listen to your intuition. Before I started blogging and understanding investing I never would have thought about leaving some cash in the portfolio specifically for a pull back or downturn. The amount of money to be made could set somebody for life… if they are patient (something I really need to work on). I am always on the lookout for what people are talking about these days and the new trend as it will usually reflect in the company’s next quarter. Depending on the trend it would be worth a long term holding such as Google or Apple. Hopefully I can spot the next hottest stock before it blows up big.

One thing I would add is always look for supplemental income. In your case it is dividend income. Having an additional source is great whenever there is uncertainty.

Hi Stefan,

Great to hear that you read the article before you hit 23. Hopefully these lessons will help you a lot in the future.

In April 2003, everyone in my college Investment Analysis class had to give a presentation on one of the stocks we had each picked at the beginning of the semester and recommend to buy it or not. My stock was Apple, and I have a whole presentation recommending to buy it, despite their terrible financial ratios. I got a D on the assignment. This was literally the day before the iTunes Store opened. Too bad I was a poor college student and couldn’t spare a few dollars to invest. I got the bad grade AND no Apple stock!

Boy if you had purchased some Apple stocks then you’d have done pretty well. Too bad.

my 25 yo self would have like that tip. I finished grad school in 2006. Stock was going wild at first. After seeing stock decline so much, I got scared a little bit. But then again, back then I had a huge mortgage and very little savings, I had to think differently, manage my risk differently. LOL 🙂 I did manage to sock away 6%, 8%, 10%, 15% then maxed out my 401K at $18K though since 2010. That’s not too bad LOL:)

That’s pretty good that you managed to sock away so much money in your 401k. That certainly have done wonders for you. 🙂

I feel like many of us could provide incredible lists of DO NOT DO THIS to our younger selves – even just a year or two ago. It is very good to remember the lessons we’ve learned and pass it on to the next generation or even just keep them as road signs for the future to not make the same mistakes. Thanks for sharing. As always, very much enjoyed your post.

-Dividend Reaper

Thanks Dividend Reaper. Too bad quite often our younger selves are simply not ready to listen to these lessons. 🙁

It is impressive to me that you maximized your RRSP and TFSA contribution room every single year, especially RRSP. I do personally max out my TFSA every year, but I found it difficult for RRSP since it’s contribution room is huge (18% income) and most importantly, it is not very liquid.

I do understand RRSP is a great deductible on the income tax, however, I couldn’t gasp the concept of not being able to allocate my own asset without taking penalty on early withdraws. I believe by putting a majority of my savings into RRSP could lead to the loss of many potential opportunities, such other alternative investments including real estate, or better yet, capitals to start a business.

Hi Jack,

Yes there are penalties for RRSP early withdraws but I think there are definitely ways around that to minimize the penalties. If alternative investments have better returns than investing in your RRSP, definitely go with these investments instead.

Unfortunately, we are no longer eligible for the HBP, and I do actually plan to withdraw some of my RRSPs to pay for the grad school in the near future. Taking income tax deductible into consideration, it is tough to find any alternative investments can beat RRSP investments.

To be honest, I don’t think HBP is a good idea. You’re taking a huge growth hit in your RRSP to buy a home. I’d argue taking money out of RRSP for education is not a good idea in general but that may different based on each individual.

It depends on how much you withdraw, how quickly you can put the money back and how your investments are performing. I withdrew a modest amount when I bought my first home, as a “top-up” to my down payment. I was able to put the amount back in a reasonable time. The hit wasn’t too big or too bad.

That’s true, if you can put the money back very quickly you might be OK in the long run.

Well Stephanie (above) added some great tips. Only thing I would add is:

Hustle, just because you have a decent paying job doesn’t mean you can’t earn more as a mystery shopper or starting a blog. Plus whatever you make, put that away in investments like #3. It’s always better to have your money working for you rather than you working for it.

Side hustle is a great idea if you can find the time to do it. 🙂

These are some good ones! The old “if I knew then what I know now” adage… kind of depressing in a way.

While you were the big movie watcher, I was the big music lover. I owned around 650 CDs at one point. Still love my music, but even with the music clubs, that was still a big investment that might have been better off being put into something else that might have made me some money instead.

— Jim

Hi Jim,

Wow that’s a lot of CDs. I owned a few CDs in my younger days but certainly not as many as you. Funny how CDs all went away when digital music became popular.

For me, I would also add:

– don’t be afraid of negotiating your salary/asking for a raise

– don’t wait to be in debt to track your income/expenses and make a budget

– bring your lunch to work instead of spending a fortune in restaurants/take-out

Hi Stephanie,

Great points. Negotiating salary/asking for a raise will do wonder in the long term. Bringing your lunch to work is always a good idea in my book.

All great advice. I especially agree with saving more. I did get this advice when I was starting out, but I didn’t really want to hear it.

I have also succumbed to the same problem with mutual funds. Don’t let the brokers talk you into it. Many of them have no money themselves, so why would we listen to their advice?

It’s always great to be able to save more when you can. Really wished someone could have told my younger self about that when I first started working.

This is a really good list — I especially like the last one. Along those lines, I’d tell my 23 year old self to stop comparing myself to all my friends. It doesn’t matter who is moving up the corporate ladder the fastest, who bought their house first, or who is driving the newest car. Instead, focus on paying off debt and accumulate savings. Compounding is your best friend 🙂

Thanks Kate. The last one is probably the most important IMO. If you’re trying to please others, you’ll never make the right decisions in life. Compounding is indeed your best friend.

Very good lessons to learn that many others have experienced as well. I particularly relate to #3, #5, and who couldn’t do a better with #9 in their young adult years! But we can learn from it and move on, trying to do better in the future.

I think everyone could try to do better with their savings rate when they’re single and young. Being more patient would have done some wonders for me. Oh well, you live and learn.

Between the two of us, we can relate to a lot of these! Mr. ONL never got into day trading, but he definitely bought some stocks based on hot tips that we actually still have — and after 10 years they still haven’t recovered their value! (Actually, you’re making me think this might be a good year to take a capital loss, while we’re in a high bracket — thanks!) 😉 And I definitely wish I’d gotten into the saving habit earlier, and stopped spending on stupid stuff that I thought I needed around the house. If I could go back and tell my 23 or 24 year old self, “All this crap you’re buying is going to get KonMari’d to Goodwill in the 2010s,” I would! 🙂

Agreed about Goodwill! I have 5 more boxes that I’m bringing over this weekend. So tired of making trips there. I try not to buy much outside of consumables anymore since everything ends up at Goodwill.

As long as Mr. ONL doesn’t day trade anymore. 🙂

It’s amazing how much better off we could have been if we made some smarter choices in our early 20’s.

“Live and learn” as they say, right? Looking back I think I’d tell my 23yo self to pay off my student loan ASAP and then vow to never go into debt again. I totally had the means to pay that thing off in 2-3 years, but chose not to because I had better things to do with my money like lease a car, pay for an upscale apartment, and buy a VCR 🙂 Ugh.

Hi Ernie,

Paying off student loan ASAP would have been a great idea. 🙂

A great list. I hope that some of your younger readers can learn from your own mistakes so they don’t have to go through them on their own. Unfortunately I have to say I missed out big on Apple too. I wanted to purchase some shares right when Steve Jobs announced his first leave of absence but just never got around to it. That would have been for a pre split price of <$100. Oops!

Hi JC,

That’s the whole point of this post, hopefully some readers will learn from my mistakes.