November is upon us which typically means A LOT of rain here in Vancouver Canada. We have had a few rainfall warnings already (like +80 mm per day) and looks like there are a lot more raining days ahead. I do love raining days though because it means snow up in the mountains! Hopefully Mrs. T and I will be able to head to the slopes for a few times this skiing season! Who wants to babysit and look after Baby T1.0 and T2.0 for us?

Dividend Income

In October we received dividend income from the following companies:

Pure Industrial REIT (AAR.UN)

Agrium (AGU.TO)

BCE (BCE.TO)

Bank of Nova Scotia (BNS.TO)

Corus Entertainment (CJR.B)

CIBC (CM.TO)

Canadian Natuaral Resources (CNQ.TO)

Dream Office REIT (D.UN)

Dream Global REIT (DRG.UN)

Dream Industrial REIT (DIR.UN)

General Electric (GE)

H&R REIT (HR.UN)

Inter Pipeline (IPL.TO)

KEG Income Trust (KEG.UN)

Coca-Cola (KO)

Prairiesky Royalty (PSK.TO)

Rogers (RCI.B)

RioCan REIT (REI.UN)

Telus (T.TO)

TD (TD.TO)

TranCanada Corp (TRP.TO)

Domtar Corp (UFS.TO)

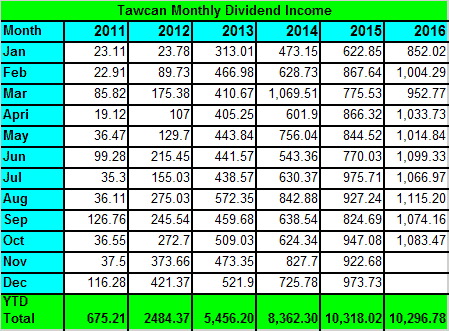

In total we received $1,083.47 in dividend income in October 2016 from 22 different companies. We received a total of $93.65 in US currency and the rest, $989.82, was in CAN currency. I was slightly surprised that we received less than $100 in US dividend income this month. It was a Canadian-dividend-heavy-kind-of month. Not as much currency diversification as I wished for but still solid dividend income nonetheless. Please note, we use a 1 to 1 currency rate approach, so we do not convert the dividends received in US dollar into Canadian currency. Reason for doing this is to keep the math simple and avoid fluctuations in dividend income over time due to changes in the exchange rate.

The top 5 payouts came from Bank of Nova Scotia, Coca-Cola, TD, Telus, and CIBC. The top 5 payouts correspond to about 53% of our October dividend income. This is definitely different from the very well diversified top 5 payout exposure that we saw in September.

Dividend Growth

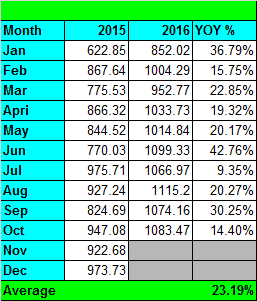

Compared to October 2015, we saw a 14.4% YOY increase. Certainly not one of the best YOY performance months but still quite respectable growth considering we received almost $950 in dividend income last October.

Here’s a very important thing to keep in mind… As we start getting more and more dividend income each month, it becomes harder and harder to see a significant YOY increase. Why? Imagine receiving only $20 per month in dividend income, or $240 for the year. A 100% YOY increase means the annual dividend income will increase to $480, or $40 per month. At 3% dividend yield, only $8,000 additional capital is needed to see 100% YOY increase.

Now imagine a monthly dividend income of $1,000, or $12,000 for the year.

A 5% YOY increase means an additional $20,000 is needed at 3% dividend yield.

A 10% YOY increase means an additional $40,000 is needed at 3% dividend yield.

A 20% YOY increase means an additional $80,000 is needed at 3% dividend yield.

A 50% YOY increase means an additional $200,000 is needed at 3% dividend yield.

As you can see, it takes significant large sum of fresh capital to sustain a high dividend growth rate. Unless you are making millions at your job, it is challenging to save $200,000 each year.

Our YOY average dropped from 24.17% last month to 23.19% this month. A drop of almost 1%. It will be interesting to see whether we can hold the YOY average at 23% with two more months to go for 2016.

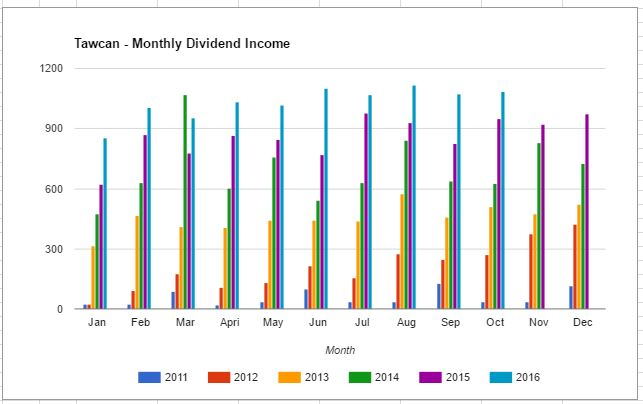

I think it’s pretty cool to take a closer look at the graph below and see how much progress we have made since 2011. There has been significant amount of dividend growth over the years. It’s really neat to see the bars getting longer and longer each year. Again as per my statement above, we probably will start seeing these bars growing at a slower pace starting next year.

Dividend Increases

In October a number of companies that we own in our dividend portfolio announced dividend increases:

- Omega Healthcare increased dividend by 1.67% to $0.61 per share.

- Visa increased dividend by 17.86% to $0.165 per share.

- AT&T increased dividend by 2.08% to $0.49 per share.

- Chevron increased dividend by 0.93% to $1.08 per share.

- Telus increased dividend by 4% to $0.48 per share.

- McDonald’s increased dividend by 5.6% to $0.94 per share

- Canadian Natural Resources increased dividend by 9% to $0.25 per share

- Inter Pipeline increased dividend by 3.8% to $0.135 per share.

In total our forward dividend increased by $63.50. While it might sound like a small amount, if we use a 3% dividend yield, that means we didn’t have to invest $2,116.67!

It was great seeing all these dividend increases but I was slightly concerned seeing dividend increase from CVX, CNQ, and IPL. Why? Because all these companies have seen their revenues drop due to the lower crude oil price. We will have to keep a close eye on the respective payout ratio to make sure the dividend payouts are sustainable.

Conclusion & Moving Forward

So far in 2016 we have received $10,296.78 in dividend income. I am extremely happy to see that we have crossed the $10,000 milestone! I can’t wait to see how much dividend income we end up with by end of 2016. Life is good!

Dear readers, how was your October dividend income?

Having over $10,000 a year in dividend income is FANTASTIC! Well done!

Dividends should only increase given rates have increased. Much easier to accumulate an income generating portfolio now!

I’m building a muni-bond portfolio for double tax free income.

Thanks Sam. Muni-bond portfolio sounds pretty good to me!

Hey,

looks like are you are doing very good in dividend investing. 1000 dollar every month is awesome.

congratulations on your 10k milestone!

best regards from Austria

Chri

Thanks Chri. I’ll take the $1000 every month. 🙂

Big congratulations here, that’s an awesome amount of income! Onwards and upwards 🙂

Thanks misterslm. Onward and upward!

wow! 5-digit dividend income is fabulous. It’s the dream of many dividend growth investors!

Cheers!

Thanks Vivianne, now working to get this 5 digit dividend income to a bigger amount.

Wow, you are making quite a streak of $1000+ months. Good point by the way on the expected YOY decrease when one’s portfolio starts growing, due to limitations on contributions as a result of salaries not going up in the same pace.

Hi Team CF,

If salaries can go up at the same pace that’d be totally rad. 😀

Wow looks like you are earning about $1k a month in dividends which is awesome!!! Congrats on the awesome numbers and it looks like you are positioning yourself well for the foreseeable future.

Hi MustardSeedMoney,

Thanks. Getting paid for doing nothing is pretty awesome for sure.

Great numbers! Really shows the results of compounding over time. And although the relative growth might be getting lower, it’s still some solid growth.

Hi Divnomics,

I’m not too worried about the relative growth getting lower, it’s a nature progression IMO as your income gets bigger.

I love seeing those dividend totals that y’all are putting up. $1k+ per month for just about every month this year is awesome. It’s always so motivating to see the progress of others, although admittedly I’m a bit jealous. I can’t wait to see how y’all end up at the end of the year.

$1k per month is pretty awesome, need to work toward $2k.

Wow, nice job Tawcan. I love how your graph shows how much the blue sticks out above the rest – like a new skyscraper in a city skyline 🙂

Receiving over $1k every single month is amazing. Well done!

Tristan

Thanks Tristan, it’s nice to see the graph and the bars getting higher and higher.

What a great month-over-month, year-over-year chart. It really does show the power of consistent investing in dividend stocks. Nice job Tawcan.

Thanks Investment Hunting. The graph is a very good visual example how powerful dividend growth investing is.

Another milestone for you Tawcan. Congragulations! Slow and steady will win this race.

Thanks Mike, yes slow and steady will win the race.

Congrats on crossing the $10k mark for an annual total. You are pretty much at your 2015 total with two months to go. Always nice seeing your dividend income grow annually. Nice long list of companies paying you too. Just goes to show that U.S., Canadian, British, or whatever companies can be solid dividend payers.

Thanks DivHut.