Wow, the market sure has been volatile lately. With around $11,000 saved up already for 2018 TFSA contributions, I’m hoping that the market will remain volatile over the few months so we can purchase stocks at a slight discount. If the market continues to slide, I may deploy a few thousand dollars in our taxable accounts to take advantage of the lower price. For now, I’m doing a wait and see approach when it comes to deploying more cash.

Since coming back from our 1-month vacation in Denmark in late August, Mrs. T and I have been getting up around 6 AM every day. We thought it was a good idea to start the day early to get some things done before the kids wake up. A few times a week, I would go to the local swimming pool and swim for about 30 – 40 minutes before heading to work. It was tough getting started at first but after 2 months, I’m getting decent at swimming once again. Swimming breaststroke for 1 km would take me about 30 minutes. I’m working on getting faster and more proficient at it. I still need to spend some time practicing freestyle though. I also have been hitting the gym on a regular basis. I haven’t weighed myself in a while but it feels like I have lost a few inches here and there. I need to make sure to continue with this exercise routine and watch out what I eat at the same time.

For Halloween, we all dressed up and trick or treated around the neighbourhood. I was lazy and decided to reuse my Pac Man costume from last year. It was a bit sad to find out that none of the kids knew who Pac Man was (I must be getting old lol!). Mrs. T painted her face by herself and scared a few ppl. Baby T1.0 wore home-made Viking costume and Baby T2.0 dressed up as a bunny. After 30 minutes the kids received a ton of candies and we headed home. A fun night all together.

Without further ado, let’s take a look at our October dividend income.

October Dividend Income

In October we received dividends from the following companies:

- BCE (BCE.TO)

- Bank of Nova Scotia (BNS.TO)

- CIBC (CM.TO)

- Canadian Natural Resources (CNQ.TO)

- Dream Office REIT (D.UN)

- Dream Global REIT (DRG.UN)

- Dream Industrial REIT (DIR.UN)

- Enbridge Income Trust (ENF.TO)

- H&R REIT (HR.UN)

- Inter Pipeline (IPL.TO)

- KEG Income Trust (KEG.UN)

- Coca-Cola (KO)

- Nutrient Ltd (NTR.TO)

- Prairiesky Royalty (PSK.TO)

- Rogers (RCI.B)

- RioCan (REI.UN)

- SmartCentres REIT (SRU.UN)

- Telus (T.TO)

- TD (TD.TO)

- TransCanada Corp (TRP.TO)

- Domtar Corp (UFS.TO)

- Vanguard Canadian All Cap (VCN.TO)

- Ventas (VTR)

- Vanguard All-World Ex Canada (VXC.TO)

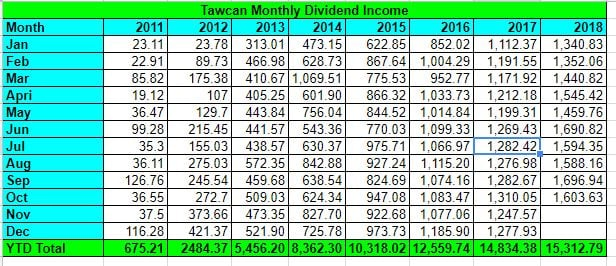

At the end of the month, we received pay cheques from 22 companies and 2 index ETFs. The 24 pay cheques added up to $1603.63! This was the third highest dividend income amount we’ve received so far in 2018. It was also the 31st straight time that we received over 4 digits in dividend income!

Pretty awesome!

In terms of USD vs. CAD break down, it was one of those months we received very little in USD. We only received $158.99 of dividend in USD. This was about a 10-90 split. If you are a long time reader to our monthly dividend income reports, you know that we use a 1 to 1 currency rate approach. We do not convert dividends received in USD to CAD. We are ignoring the exchange rate to keep the math simple. This is our way to avoid fluctuations in dividend income over time due to changes in the exchange rate.

The top 5 dividend payouts in Oct 2018 came from BCE, CIBC, Telus, TD, and Bank of Nova Scotia (not in order). Dividend payouts from these 5 companies accounted for 55.3% of our Oct dividend income, or $886.82.

Dividend Income Breakdown

We hold our dividend stocks in taxable accounts, RRSPs, and TFSAs. Every year, we maximize tax-advantaged accounts first before investing in taxable accounts.

For the Oct 2018 dividend income, here’s the breakdown of the different accounts:

- Taxable: $447.61 or 28%

- RRSPs: $433.59 or 27%

- TFSAs: $722.43 or 45%

We only hold Canadian eligible dividend stocks in our taxable accounts so we can get the maximum amount of dividend tax credit.

As a reminder, we only own US dividend-paying stocks in our RRSPs to avoid the 15% withholding tax.

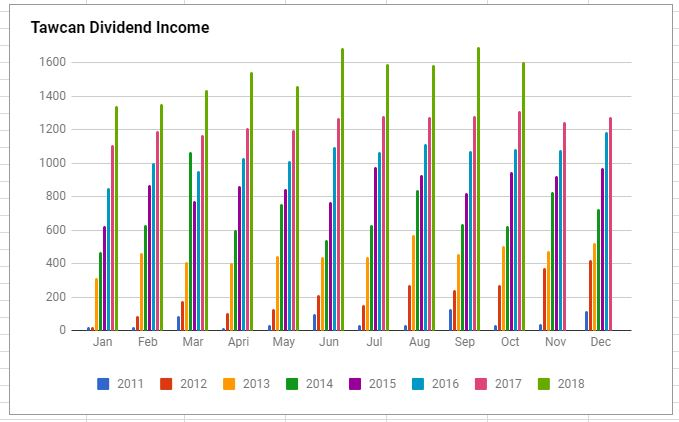

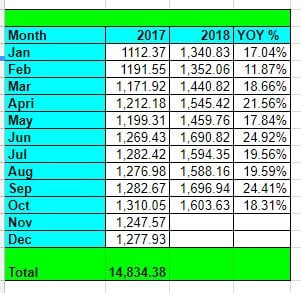

Dividend Growth

Compared to Oct 2017, we saw a YOY growth of 18.31%. Not too shabby considering Oct 2017 was the highest dividend income total for the entire year ($1,310.05). I’ll take an above 15% YOY growth any day.

Hopefully we’ll continue the strong YOY trend for Nov and Dec. It’s interesting to note that except for February, we had a YOY growth percentage that was above 15% for all the other months. I am very pleased with these numbers.

Dividend Increases

In October a number of stocks that we hold in our dividend portfolio announced dividend payout increase:

- Fortis raised its dividend by 5.88% to $0.45 per share.

- Visa raised its dividend by 19.05% to $0.25 per share.

All these dividend increases meant an overall annual dividend increase of $32.5. I was very happy to see the almost 20% payout increase by Visa. I was a little surprised that we didn’t see more dividend increases in October. However, if we look at all the dividend payout increases so far in 2018, we have already seen an increase of over $850 toward our annual dividend income. To put that in a quantitative perspective, at 4% dividend yield that meant we didn’t have to invest over $21,250 of fresh capital in our dividend portfolio.

That’s a perfect example of having your money work hard for you, so you don’t have to!

Dividend Stock Transactions

Throughout the month we were making small transactions buying VCN and VXC with cash reserves in our RRSP And TFSA accounts to take advantage of Questrade’s free ETF trading. After multiple purchases, we added 50 shares of VCN and 45 shares of VXC in our dividend portfolio.

We didn’t, however, add any individual stocks during October.

Conclusion

So far in 2018, we have received a total of $15,312.79 in dividend income. We have already surpassed our 2017 total and there are still 2 more months to go.

If we receive over $1,500 in Nov and Dec, that will put us over the $18,000 annual dividend income goal for 2018. For now, things are looking promising. Fingers crossed!

Dear readers, how was your October dividend income?

Those bars on your graph just keep getting higher and higher! Awesome to see how much you’re earning from dividends. We’re more into the ETF investing but I always look forward to the quarterly dividends!

Thank you Owen. We are investing in index ETFs too.

Hey Bob,

Looks like you had some great fun over Halloween. Pacman is a classic… I’m sure he’ll be make it for a comeback at some point.

Great job on your YOY increases. You’re hitting some serious, meaningful monthly totals at this point. The snowball keeps growing….

Take care,

Ryan

Hi Ryan,

Thank you. Yea would be great if PacMac makes it for a comeback in the near future. 🙂

Outstanding month, and it is really impressive how consistent you have been overall from month to month throughout the entire year. With my index funds included, I set a new record this month just shy of $1400. Trying to get to that level of consistency that you have here though.

Congnrats on almost hitting $1400! I’ve been surprising myself how consistent we have been over the last few years. Not by design, happened by accident.

Gosh, over $1,600 in dividends is amazing! Strong YOY growth too. Always very impressive! Those are great costumes as well, lol. Keep it up! 😀

Thank you My Dividend Dynasty, very happy with our results for Oct.

Wow. Impressive income and dividend increases year over year.

Thanks man.

Great photos. What a scary looking family!!! Looks like October was another solid month of gains. Must be nice to collect that passive income while going about your life. The benefits of DGI. Keep up the solid growth. You’re doing something right!

I think Pac Man and the funny were the most kids friendly costumes lol.

It’s nice to have our money working hard for us so we don’t have to. 🙂

Great dividend income. Not a big dividend month for me but not much seperation between the 3 months. Keep it up.

Thank you Doug.

Great Halloween costumes. You guys looked awesome. And great dividend income. I love the historical chart showing how you went from roughly $50 a month to over $1,500 a month in seven years. Wow. You make it look so easy!

Mrs. T was very proud of the home-made Halloween costumes, the kids had a lot of fun, that’s the important part. 🙂

Yea it’s pretty crazy to see that we went from $50 a month to over $1500 in seven years. Crazy stuff.

Nice to see even with the recent big stock market losses in October you were able to make some gains. Nice think about dividends if you don’t nee them, well you get to keep pumping them back into your accounts.

Yup glad to be able to take advantage of the recent stock market losses. Hopefully this pays off in the long run.

Looks like steady dividend progress Tawcan! 18% growth is great!

Our October dividends were “normal” at $1866 USD for the month of October — meaning it wasn’t one of our big dividend months. December will be a very big payout month so I’m looking forward to that.

Haha a “normal” month at $1866 USD. You are way ahead of us when it comes to dividend income.

Glad to hear you guys had a fun Halloween.

Wow, 22 companies (and 2 ETF’s) paying dividends in one month! That double digit YoY growth must feel nice when you are constantly receiving over 4 digits in dividend income.

Thank you, Halloween was fun, the kids had a great time.

just awesome Bob.

Love seeing these monster totals. Also sweet how much your dividend raises have added to your forward income. Like you stated you would need a tonne of cash to replicate that.

keep it up and congrats on surpassing your 2017 total.

cheers

Thank you Passivecanadianincome. It’s been pretty sweet for sure. 🙂