Wow, what a difference a month makes. In the middle of February, the market was breaking all-time-highs. Then a month later, we were seeing stock exchanges being halted multiple times each week because of panic sells. The novel coronavirus is certainly making an impact on the global economy. The bull has retreated and now the bear is running around like there’s no tomorrow. Given that the interest rates have been cut to nearly zero and the crude price keeps dropping, I would not be surprised to see a recession coming shortly.

Here at home, we have been practising social distance as an attempt to slow the spread of the virus (aka flatten the curve). I have been working from home and the kids have been staying at home as schools are closed indefinitely. Fortunately, the weather is getting warmer, so we can send both kids to the backyard each day and get them run around to burn off some energy.

March Dividend Income

In March 2020 we received dividend payments from the following companies:

- Brookfield Renewable (BEP/BEP.UN)

- Brookfield Property Partners (BPY)

- Canadian National Railway (CNR.TO)

- Canadian Tire (CTC.A)

- Canadian Utilities (CU.TO)

- Dream Office (D.UN)

- Dream Industrial (DIR.UN)

- Enbridge (ENB.TO)

- European Residential REIT (ERE.UN)

- Fortis (FTS.TO)

- Hydro One (H.TO)

- H&R REIT (HR.UN)

- Intact Financial (IFC.TO)

- Intel (INTC)

- Inter Pipeline (IPL.TO)

- Johnson & Johnson (JNJ)

- KEG Income Trust (KEG.UN)

- Magellan Aerospace (MAL.TO)

- McDonald’s (MCD)

- Manulife Financial (MFC.TO)

- Magna International (MG.TO)

- Metro (MRU.TO)

- Prairiesky Royalty (PSK.TO)

- Qualcomm (QCOM)

- RioCan REIT (REI.UN)

- Saputo (SAP.TO)

- SmartCenteres REIT (SRU.UN)

- Suncor (SU.TO)

- Target (TGT)

- Unilever plc (UL)

- Visa (V)

- Waste Management (WM)

- Exco Technologies (XTC.TO)

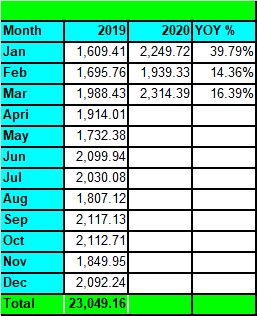

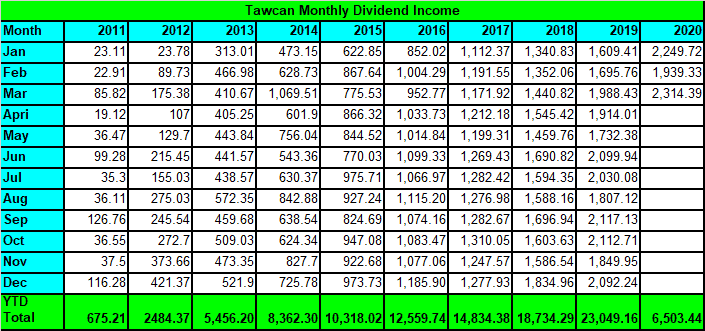

In total, we received payments from 33 different companies that added up to $2,314.39. Woohoo, we crossed the $2,300 monthly dividend income milestone and received the highest amount of monthly dividend to date. Nice! Given the chaotic time we’re in right now, it’s great to see that our dividend income is very diversified.

Out of the $2,314.39 that we received, 413.96 was in USD and $1,900.43 was in CAD, or about a 20-80 split. If we were to convert USD to CAD it would inflate our monthly dividend income to $2,489.79 CAD at a 1 to 0.70 exchange rate. But we do not convert the USD to CAD when report our dividend income. Instead, we use a 1 to 1 currency rate approach. Why do we do that? Because we want to avoid fluctuations in dividend income over time due to changes in the exchange rate.

The top five dividend payouts in March 2020 came from Inter Pipeline, Enbridge, Manulife Financial, Suncor, Brookfield Property Partners (not in order). These five companies’ dividend payouts accounted for $1,269.90 or 55.5% of our March dividend income. Interestingly, three of the five companies are in the oil & gas sector (Inter Pipeline, Enbridge, and Suncor). All three of them have crazy high dividend yields at the current market price. It is likely to see some sort of dividend cuts from these companies (in fact, IPL did cut their dividends, more on that later). We plan to continue collecting these dividends and DRIP whenever we can.

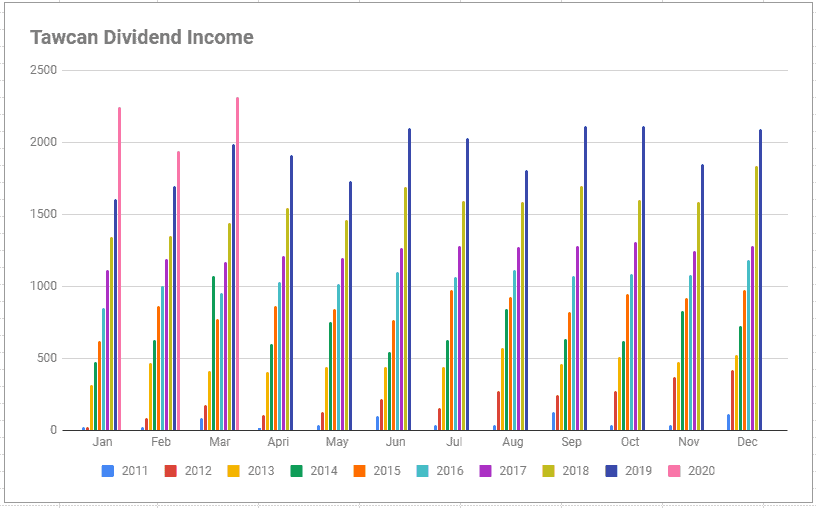

Dividend Growth

Just like February, we saw yet another disappointing YoY growth. In March, we saw a YoY growth of 16.39%. This is a bit disappointing given that we had a very challenging and ambitious goal of getting over $30,000 in dividend for 2020. If we keep this kind of mid-teens YoY growth up, we certainly won’t reach our goal. This means we need to continue to invest money into our dividend portfolio despite the downward market trend.

Dividend Increases

Compared to last month, there weren’t many dividend increase announcements. However, a few companies managed to increase their dividend payouts:

- Canadian Natural Resources increased its dividends by 13% to $0.425 per share.

- Qualcomm increased its dividends by 4.8% to $0.65 per share.

These two increases will add $31.04 toward our annual dividend income. It’s not a lot, but I’ll take any raise over no raise at all.

Dividend Decreases

Unfortunately, given the current crude price, it means the oil & gas companies are really suffering. Over the last few years, we have been closing out our positions in oil producers like Chevron and Royal Dutch Shell. The only oil producer that we own in our dividend portfolio is Suncor. Having said that, we still own quite a few stocks that are in the oil & gas sector, like Enbridge, Inter Pipeline, Canadian Natural Resources, etc. Not to mention the Canadian economy is highly dependent on the oil & gas sector. In March, PrairieSky Royalty (PSK.TO) became the first company in our portfolio to announce a reduction of dividend to $0.24 per common share from $0.78, and changing dividend payments from monthly to quarterly payments. We only hold PrairieSky Royalty because of the split from Canadian Natural Resources and we own less than 10 shares. I have been trying to sell PSK.TO but the commission would have taken a significant percentage of the overall transaction cost. Therefore, I decided to continue holding PSK.TO. Given that we own less than 10 shares, the overall impact on our dividend income is not significant at all. We are talking fractions of a dollar.

Then at the end of March, Inter Pipeline dropped the bad news and announced a 72% reduction in its monthly distributions, going from $0.1425 per share to $0.04 per share, or $0.48 per share on an annualized basis. This dividend cut definitely hurt us as the cut reduced our annual dividend income by over $1,000.

Ouch!

But I expected Inter Pipeline to cut its dividends, given the current market condition. I’d rather see a company cut its dividends than continue racking up debts. As expected, we are down quite a bit with our IPL.TO positions. For now, I don’t plan to sell any shares. I plan to continue collecting dividends and continue DRIPing.

I suspect more companies that we own may cut or suspend their dividends in the upcoming weeks. For example, The KEG’s restaurants are closed, so it would be hard for the company to continue paying out dividends. Hopefully, the COVID-19 closures will come to an end soon.

Dividend Stock Transactions

As you can recall, we made many dividend stock transactions in January and February. To recap below are the dividend stocks that we purchased in the first two months of the year:

- 12 shares of Canadian National Railway (CNR.TO)

- 450 shares of European Residential REIT (ERE.UN)

- 260 shares of Brookfield Property Partners (BPY)

- 100 shares of Brookfield Renewable Partners (BEP)

- 20 shares of Pepsico (PEP)

- 14 shares of Bank of Montreal (BMO.TO)

- 68 shares of TD Bank (TD.TO)

- 450 shares of Inter Pipeline (IPL.TO)

- 20 shares of CIBC (CM.TO)

- 36 shares of Telus (T.TO)

- 67 shares of Suncor (SU.TO)

As you can see from above, we continued to purchase the likes of CNR, TD, and Telus that are part of my top Canadian dividend stocks. I think these top dividend stocks are worth purchasing regularly.

To be honest, I have been kicking myself on purchasing these dividend stocks in January and February instead of waiting, when the market is in chaos. But the reality is, I don’t have a future-predicting-8-ball and therefore cannot predict the future. Nobody can predict when the market will go up and when the market will go down. Therefore, the best thing to do is to invest regularly and take advantage of dollar cost average.

With that in mind, we added 72 shares of CM.TO and 51 shares of SU.TO in March which added $515.34 toward our annual dividend income.

At the current prices, the Canadian banks are showing crazy high dividend yields. It is simply too hard to pass these opportunities. Given the current market condition, the banks probably won’t be raising their dividend payouts anytime soon. But given the high initial yield of 5% or higher, we can afford to wait. The Big Fives have been paying dividends since the late 1800s and have not suspended dividend payments since, therefore, I’m pretty confident that we will continue to receive dividends.

The purchase of Suncor is a bit of a gamble. With the low crude price, Suncor’s profitability will be challenged. However, it is too hard to ignore when the stock price is below the book value.

Dividend Stock Watch List

Given the current state of the stock market, we are busy saving as much money as we can, so we can deploy that cash. Although the income tax deadline has been extended, we plan to file as soon as we get the last few final forms from our financial institutions. Since we’re expecting some tax refunds, we plan to use the refund to buy more dividend-paying stocks. I know most financial experts have stated that getting a tax refund is bad but to me, this is a method of forced saving.

So, which dividend stocks are we keeping our eyes on? Well, just about everything. I’m a bit wary of investing more money into oil & gas companies but depending on the amount of cash available, we might decide to take that risk. Overall, I plan to continue adding shares of Canadian banks (TD, Royal Bank, Bank of Montreal, Bank of Nova Scotia, CIBC, National Bank), utilities (Fortis, Emera, Canadian Utilities, Brookfield Renewable Energy), consumer staples (Coca-Cola, Pepsi, PG, UL), healthcare (Johnson & Johnson, AbbVie), and telecoms (Telus, Rogers, Bell, AT&T, Verizon). The only problem? I wish we have more cash lying around!

As Warren Buffett said, “Be greedy when others are fearful.” This is the time to stay invested and keep investing during the downtime. Remember, your portfolio is not going to zero. The loss you’re seeing are only paper losses. They are not real until you sell the stocks/ETFs.

Summary

With one quarter in the books for 2020, we have received $6503.44 in dividend income. Our goal for this year is $30,000, this means we should have received $7,500 in dividend, or we’re about 13.6% behind progress. Given the Inter Pipeline dividend reduction, it is going to be extremely challenging to accomplish this goal moving forward. However, I remain optimistic.

At $40/hour, this means our dividend income has saved us almost 162 hours of work, which is the equivalent of 20 days or 4 weeks. If we were to calculate the amount on an hourly basis for all the days so far in 2020, that means our dividend portfolio generated $2.97 per hour with us doing anything at all.

We feel extremely blessed that our money is working hard for us so we don’t have to.

Dear readers, how was your March dividend income?

What an impressive dividend income stream you are putting together Bob. 16% growth on an already high dividend income base is freaking sweet! What I love here is how balanced your dividend income payments are each month. You don’t have the large increase in the third month of the quarter like I do. That’s the goal I am working towards (if these darn companies would stop cutting their dividend).

I do like how you have transitioned your company away from the oil sector. I didn’t learn my lesson from 2016 and still purchased oil companies. The yield is great, but the volatility in the price per barrel and the impact it has on company’s balance sheets and dividends make it a tougher investment than it probably should be.

Thanks for the post here. Keep up the great work.

Bert

That’s some healthy dividend income Bob! 16% growth is great too! Congrats!

We only managed 12% growth in March, but with our dividends approaching $60k/year that’s fairly sizeable growth.

So I’m happy about that. Unfortunately, I think the dividend cuts have only just begin. There is likely to be a lot more dividend-cut pain, especially among less financially liquid firms.

It’s going to be a difficult year methinks. Best of luck!

Your March dividend income was INSANE Mr. Tako! $60k/year is really awesome, wish we can get to that point in a number of years.

Those cuts and suspension do hurt but our focus is the future and we press on. Great month you had. I was hit with 1 suspension and 1 big cut.

Stay focused on the end result not the bump in the road

Keep it up.

Thank you Doug. Yea cuts and suspensions do hurt but gotta focus on the future.

The first image comparing dividend growth shows incorrect year numbers. It’s 2018/19, should be 19/20

Oops! Thanks for pointing this mistake out!

Wow a record, congrats! I have KEG too and hopefully they will hold up and continue the dividend payments. I don’t have a very large position in it though. I also bought more Suncor.

I bought too much in January, like BMO at $100. Ouch. Hah. But then bought more at $60.

Thanks GYM. Yea we’ll have to wait and see about the KEG. We only have a few hundred shares so not too worried.

Yea we definitely bought too much in January and early Feb. Oh well.

Although a bit disappointing you likely won’t hit 30K this year you are still doing amazing! Keep feeding the beast and be patient. IPL hurt. Noticed you bought several hundred shares this year and then it went down. Ouch. That is a key holding for me so it hurt a bit but I am going to hold mine as well. Stay safe.

Yea it’s a bit disappointing but with three more quarters for the year, it’s still possible to hit $30k. We’ll have to wait and see.

IPL is hurting for sure. Undecided whether to buy more or not.

wow nice Bob

That is a huge total. Gotta love that diversity and income. That ipl cut certainly dug deep. Long term it will be fine and Heartland will be fantastic for them.

keep it up/ stay healthy

cheers

Thank you Passivecanadianincome!

HI Bob,

Congrats on the new month/all time achievement. Here we had the first month below in a YoY comparison. 🙁 . The first Q does not look promising taking into account our target of €15K for 2020.

We also had 2 dividend cuts so far (WPP and MER), which no longer are in our portfolio. I understood that you plan to keep the stocks even so dividend cuts/suspensions appear. Am I correct? Is there a plan for dividend cuts/suspension?

Let’s hope for the dividend cut/suspension to remain low.

All the best.

Cheers!

Thank you Odysseus. Sorry to hear that your first quarter did not look as promising, hopefully Q2 will be much better.

Yes, we plan to continue to hold despite dividend cuts/suspensions. But will be evaluated on a case by case basis too.

I was lucky .. i had lots of cash left over and did a big buy recently and its gone very well so far

(sold my house just before the market went way up a few years back , however )

i was right to keep cash instead of bonds … it was a HI account getting average of 2.8%

i noticed that bonds have been following the stocks . they went up and down with them

bonds are supposed to do the opposite ?? especially ZDB etf

bye bye 60/40 …. i don’t need bonds . i can sleep in a downturn ok

i prefer cash …. cash is always a safety one ..

and selling for capital gains wont worry me … (to get some more cash )

That’s great you had lots of cash left to take advantage of the bear market. Congrats.

Wow, LOTS of buying.

Well done with your progress!! 🙂

I hope to post my update in a week or so, need to write it up!

Mark

Thanks Mark. Busy shopping!

As usual a nice long laundry list of companies paying you in March. Congrats on another double digit year over year gain too. Keep stacking those dividends and staying diversified to mitigate any of those dividend cuts that I’m sure we’ll all experience in 2020.

Thank you Keith. We are busy buying more stocks and taking advantage of the market discount.

How much has to be invested in the market to receive a $2300. monthly dividend?

https://www.tawcan.com/your-dividend-and-index-etf-questions-answered/

Congrats on passing a new milestone! Always nice to have double digit YOY growth as well. I am hoping by summer the worse of this pandemic is over and life can return back to normal soon after. Anyways, keep up the impressive work! 🙂

Thank you My Dividend Dynasty. Stay safe!