March was a special month for Mrs. T and I as Baby T2.0 turned 2! I will always remember her relatively quick birth at home (planned), holding her for the very first time, clamping and cutting her umbilical cord, and how sweet Baby T1.0 was to his little sister. We celebrated Baby T2.0’s birthday with family and friends and had a great time. It is hard to believe our little girl is 2 years old already. She is no longer a baby but a little girl with her own unique personality. She is starting to speak more and more sentences of 2 words (and sometimes 3 or 4 words). It is also really cool that she can understand English, Mandarin, and Danish and can speak words from all 3 languages. We believe her amazing language skills have a lot to do with Baby T1.0 talking to her all the time and teaching her new words. It is amazing how quickly time flies. I need to constantly remind myself to enjoy the present moment when both kids are still young. Because with a blink of an eye, they will be teenagers!

And hopefully with a blink of an eye, we will have enough passive income to cover our living expenses. We can then declare ourselves as financially independent!

March Dividend Income

In March we received dividend income from the following companies:

- Pure Industrial REIT (AAR.UN)

- Brookfield Renewable (BEP.UN)

- BP (BP)

- Canadian National Railway (CNR.TO)

- ConocoPhillips (COP)

- Costco (COST)

- Canadian Tire (CTC.A)

- Canadian Utilities (CU.TO)

- Chevron (CVX)

- Dream Office REIT (D.UN)

- Dream Global REIT (DRG.UN)

- Dream Industrial REIT (DIR.UN)

- Enbridge (ENB.TO)

- Enbridge Income Trust (ENF.TO)

- Evertz Technologies (ET.TO)

- Fortis (FTS.TO)

- Hydro One (H.TO)

- High Liner Foods (HLF.TO)

- H&R REIT (HR.UN)

- Intact Financial (IFC.TO)

- Intel (INTC)

- Inter Pipeline (IPL.TO)

- Johnson & Johnson (JNJ)

- KEG Income Trust (KEG.UN)

- Magellan Aerospace Corp (MAL.TO)

- McDonald’s (MCD)

- Manulife Financial (MFC.TO)

- Magna International (MG.TO)

- MCAN Mortgage Corp (MKP.TO)

- Metro (MRU.TO)

- Prairiesky Royalty (PSK.TO)

- Qualcomm (QCOM)

- RioCan (REI.UN)

- Saputo (SAP.TO)

- SmartCentres REIT (SRU.UN)

- Suncor (SU.TO)

- Target (TGT)

- Unilever plc (UL)

- Visa (V)

- WestJet (WJA.TO)

- Waste Management (WM)

- Exco Technologies (XTC.TO)

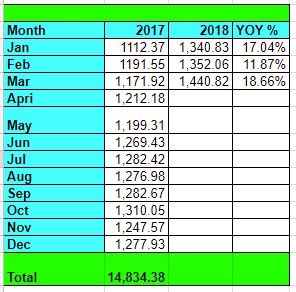

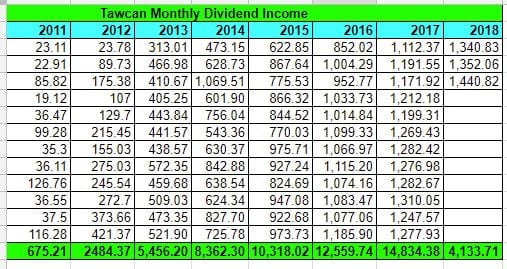

Can you believe that we received 42 different paycheques in March 2018? Talk about income diversification! The 42 different paycheques added up to $1,440.82. Another all-time record! For the first 3 months of 2018, we have broken our all-time record each month! This is absolutely amazing stuff! Can we continue this trend in April? I guess we will have to wait and see.

Out of the $1,440.82 received, $330.07 was in USD and $1,110.75 was in CAD. This was roughly a 25-75 split between dividend received in USD and CAD.

Please note, we use a 1 to 1 currency rate approach. Therefore, we do not convert dividends received in USD to CAD. We are ignoring exchange rate to keep the math simple. This is our way to avoid fluctuations in dividend income over time due to changes in the exchange rate.

The top 5 dividend payouts in March 2018 were Intact Financial, Suncor, Chevron, Manulife Financial, and Enbridge. Dividend payouts from these 5 companies accounted for 35.6% of our March dividend income, or $513.56.

Dividend Income Breakdown

We hold our dividend stocks in taxable accounts, RRSPs, and TFSAs. Every year, we maximize tax-advantaged accounts first before investing in taxable accounts.

For March 2018 dividend income, here’s the breakdown of the different accounts:

- Taxable: $436.85 or 30.3%

- RRSPs: $472.27 or 32.8%

- TFSAs: $531.70 or 36.9%

Effectively, only 30.3% of our March dividend income was taxable. We constructed our taxable accounts so we only receive from stocks that pay out eligible dividend income. Since we plan to live off dividend income when we are financially independent, we want to construct our portfolio to be as tax efficient as possible. This way, we can minimize income tax during financial independence.

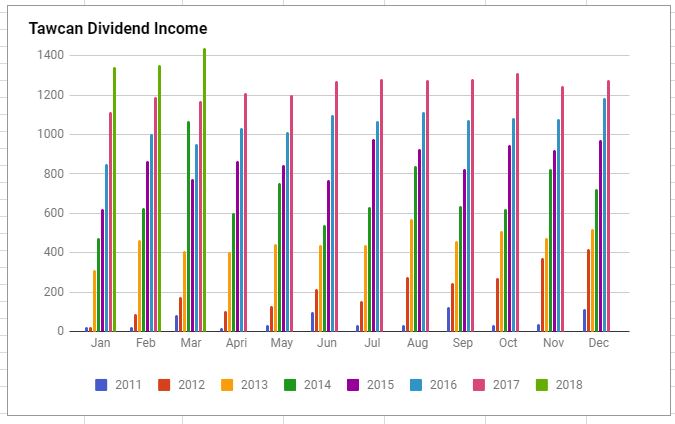

Dividend Growth

Compared to March 2017, we saw a respectable YOY growth of 18.66%. This is the highest growth parameter in 2018 so far! Given we had a record month, this shouldn’t come as a surprise. Our target is to continue having the YOY growth matrix to be above 10% for the rest of the year.

Dividend Increases

After a stellar February where we saw 17 dividend increase announcements and increased our forward annual dividend income by $430.34, March was a relatively quiet month. The only stock in our portfolio that announced dividend increase was Qualcomm.

- Qualcomm raised its dividend by 8.77% to $0.62 per share.

But a raise is a raise so I am happy to see this announcement.

Dividend Stock Transaction

Stock market volatility continued in March. Just like we did in January and February, we took advantage of the volatility and added some shares to our existing Enbridge position.

- Purchased 185 shares of Enbridge (ENB.TO)

The purchase increased our annual dividend income by $496.54.

Enbridge share price has been on a significant decline lately and I believe this a good buying opportunity. Since our purchase, Enbridge share price continued to tumble. Enbridge has a lot of debt right now but I believe the company is still quite strong as a long-term holding. Considering people will continue to use oil and natural gas for many years to come, there will always be a need to transport these natural resources from point A to point B. Enbridge will continue to provide this essential transportation service and get paid for doing so.

The stock market is seeing a lot of weaknesses in the first few weeks of April. If you haven’t heard, the USA and China have imposed tariffs on each other’s products. This has created a lot of uncertainties and turbulence. To me, I am loving the uncertainties and turbulence, because this only creates more buying opportunities. We plan to continue saving and investing whenever we can and increase the value of our dividend portfolio.

Given the recent stock market weakness, we might consider purchasing more shares of Emera, Fortis, and Canadian Utilities. We might also consider some REITs in the medical and hotel sectors. Canadian Banks might also be another sector we might consider purchasing.

Conclusion

So far in 2018, we have received a total of $4,133.71 in dividend income. At $20 per hour wage, we have saved ourselves over 206 hours or over 25 working days. That’s an equivalent of 5 weeks! Pretty awesome that our dividend portfolio is working hard for us so we don’t have to.

Dear readers, how was your March dividend income?

Great work, interested in your take on dividend strategy vs JL Collins index investing… I was in the dividend strategy camp for a while but decided to switch part of my portfolio to index investing… I really like what JL Collins is selling… I also don’t like the idea of only relying on dividend income to get to your FIRE stage… I feel the entire portfolio should be taken into account as dividends only covers a very small percentage of the market.

Keep up the great work, we’re in the same position… but based out of TO.. looking to enter FIRE in about 4-5 years.

Hi Bart,

JL Collins has some great stuff, that’s why we do both dividend investing and index investing. Kinda the best of both world I suppose.

TO and FIRE in about 4-5 years, that’s amazing to hear! What’s keeping you motivated to reach FIRE and is there one thing you think that has expedited your path to FIRE?

Hey Bob! Congrats on breaking the record for three months in a row. $1,400 in passive income is incredible man! I’m glad you’ve come so far and keep going. I like your ENB purchase. A woooooping 185 shares. That must left a little dent in your pocket. Are you willing to trim that position when ENB recovers above $50?

Thank you Dividend Income Stocks. Don’t plan to trim the ENB position once the price recovers… but that might change. We’ll see.

Incredible stuff Tawcan! The consistency in your dividend growth is amazing – roughly $200 more each month over from year to year (at least on the couple months I looked at).

Kids certainly grow up fast! Loving every minute of our first adopted child.

Keep up the great work!

Thank you American Dividend Dream. Consistent is the key. 🙂

Tawcan,

So many great things in this article. A sweet birthday, insane dividend growth, and a new personal record. What a sweet way to end Q1. I love the stat that you include showing the percent that the Top 5 payouts account for in your monthly income. Thanks for the inspiration this evening!

Bert

Hi Bert,

Thank you. Mar was indeed a great month and lots great things happened in that month.

Good job! I really like the chart showing the year-over-year growth in your dividend income. Keep up the good work!

Thank you Troy. It’s interesting to see the YOY chart. 🙂

I was looking at Dividend Diplomat’s list, and I think you have one of the largest dividend portfolios.

Congratulations on Baby T2.0 turning 2. I’m sure she’s adorable. And congratulations on the impressive dividend growth. Ten years from now you’ll be sitting pretty. Cheers, my friend.

Thank you Mr. Groovy.

Your dividend income growth is awesome. Nice job. Keep this up for a few more years and you’ll be set for life.

Kids grow up so fast, don’t they. It’s amazing your kids can speak 3 languages.

Thank you Joe. Gotta keep injecting new capital into our portfolio to grow dividend income. 🙂

Well done. It looks like we have similar dividend income and my portfolio is a subset of your holdings so good selection 🙂 I have ZERO REITs though.

Thank you Dividend Earner. Any reason you have 0 REITs?

I consider being in the accumulation year and REITs is mostly a proxy to fixed income so the total return annually cannot be expected to be much higher than the yield to some extent. There are outliers but I prefer to focus on a stable growth blue chip dividend stock.

While I want my portfolio dividend to cover my expenses for FI, I do accept that total return is the actual best performance metric. When I am ready to start withdrawing, I could look at switching to more fixed income.

It’s one of my learnings over the past few years. I dropped a bunched of stocks from a few sectors and decided to focus on growth. I consider Energy, Utilities, Real Estate and Telecom to be my income like set of sectors compared with my growth sectors.

Haha Bob!

That is just awesome! Huge increase, so many companies paying you and a nice chunk of change to boot!

Huge purchase of Enbridge, thats sweet and will drastically boost that income.

Keep it up

Cheers

Thank you Passive Canadian Income. Really happy that we were able to purchase more shares of Enbridge at a lower price. 🙂

Happy birthday to your little girl! It’s unreal she is starting to speak across 3 languages. Looks like another solid month and a nice surprise to see your monthly growth rate get a shot in the arm. My portfolio brought in $191.87 of grossed up dividends for March, which after a few quiet months was very pleasing. Good hunting in April Bob!

Thanks man. It’s really cool that Baby T2.0 is speaking all 3 languages. Pretty amazing stuff.

Keep working on your dividend income. It takes years to build up a sizable dividend machine. 🙂

Congrats on the new income record! Thanks for sharing your recent dividend stock purchase. – I own Enbridge as well!

Thanks Wally. Glad to be able to buy Enbridge at a slight discount.

Wow… you weren’t kidding about income diversification with 42 individual payments coming in March. Congrats on the sustained year over year growth as well as a new income record. Keep it up!

Hehe thanks DivHut. Income diversification is always a good thing. It just means a bit more work when it comes to book keeping.

Nice job on the dividend income Bob! You’ll break $15k for sure this year!

We did pretty good in the dividend department also in March. March is always one of those ‘big’ months for us.

Incidentally, do you keep track of which company has raised dividends the most since you’ve invested? I’m curious where you’re seeing the biggest CAGR.

Interesting question Mr. Tako. To be honest I haven’t keep track of which company has raised dividends the most since we started investing. That might be something interesting to check when I have a bit more time.

Good job on your divs. I also bought some more ENB. Picked up other stocks to when they dipped a bit.

The brokerages will send your dividend cheques by mail? Why do you get sent by mail instead of doing a DRIP or having it sent to a cash account at the brokerage? Also, you can remove dividends from an RRSP account by requesting a cheque?

Hi SH,

No brokerages do not send cheques by mail. We just get dividends deposited directly into the different accounts. 🙂

Happy birthday little one!! And 42 separate checks… that has to be a pain to have to deposit them all 😉 But the diversification is great there.

Thanks Angela. Mar/June/Sept/Dec are the months that we get dividend income from a lot of companies. Diversification is great.

Hi Tawcan, thanks for the excellent blog. I am new to investing and am looking at purchasing some Canadian bank stocks. I am a novice investor so appreciate your thoughts. When you purchase bank stocks, do you have a target dividend amount in mind for each bank that helps you to decide when to buy? They seem to be trending downward lately but what usually happens with me is that I wait too long and they bounce up again! Thanks for your advice.

Hi JB,

I usually target 2.5% yield or higher but there might be exceptions. For example, we own Visa because it has really high dividend growth. It’s trying to find the right balance between high yield low growth stocks and low yield high growth stocks. It’s not just looking at the price of the stock but you need to evaluate the stocks and determining whether it’s fair priced or not.

Here are some articles that might help:

https://www.tawcan.com/dividend-faq/

Hey Bob, you are definitely keeping that snowball moving heck, it’s even picking up speed)! Great monthly income at over $1.440. Great month for sure 🙂

Thanks Team CF. Hoping to break the record again in Apr.