After spending a hectic week in China and Hong Kong in middle of July basking in the ridiculous hot sun and extreme humidity, it was nice to spend a relaxing week with my family in the Okanagan. It was hot in the Okanangan but it was certainly not as as humid as China and Hong Kong. The best part of our Okanagan vacation? Seeing Baby T1.0 petting baby kangaroos and having a blast at the kangaroo farm. It was also great to know that we were receiving dividend income while on vacation. This is why I love dividend income so much – we receive money by simply owning shares of dividend paying companies without having to do anything else.

For those of you that are new to this site, each month I provide an update on our dividend income and our dividend growth. This is my way to keep myself honest about our dividend growth investing approach and also a way to record our financial independence journey.

Including the Target and Brookfield Energy Partners purchases that we made in July, we have purchased roughly $40,000 dividend paying stocks so far in 2016. Our stock purchases will probably slow down in the second half of 2016 as we start saving money for 2017 TFSA and RRSP.

Without further ado, let see how much dividend income we received for July 2016.

Dividend Income

In July we received dividend income from the following companies:

Pure Industrial REIT (AAR.UN)

Agrium (AGU.TO)

BCE Inc (BCE.TO)

Bank of Nova Scotia (BNS.TO)

Corus Entertainment (CJR.B)

CIBC (CM.TO)

Canadian Natural Resources (CNQ.TO)

Dream Office REIT (D.UN)

Dream Global REIT (DRG.UN)

Dream Industrial REIT (DIR.UN)

General Electric (GE)

H&R REIT (HR.UN)

Inter Pipeline (IPL.TO)

KEG Income Trust (KEG.UN)

Coca-Cola (KO)

Prairiesky Royalty (PSK.TO)

Rogers Communications (RCI.B)

RioCan REIT (REI.UN)

Telus (T.TO)

TD (TD.TO)

TransCanada Corp (TRP.TO)

Domtar Corp (UFS.TO)

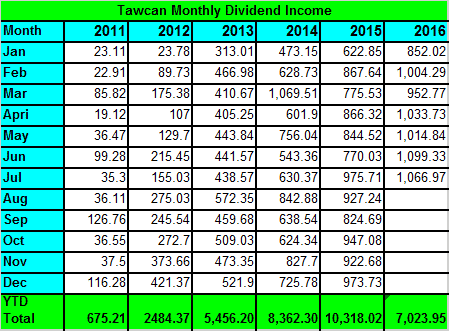

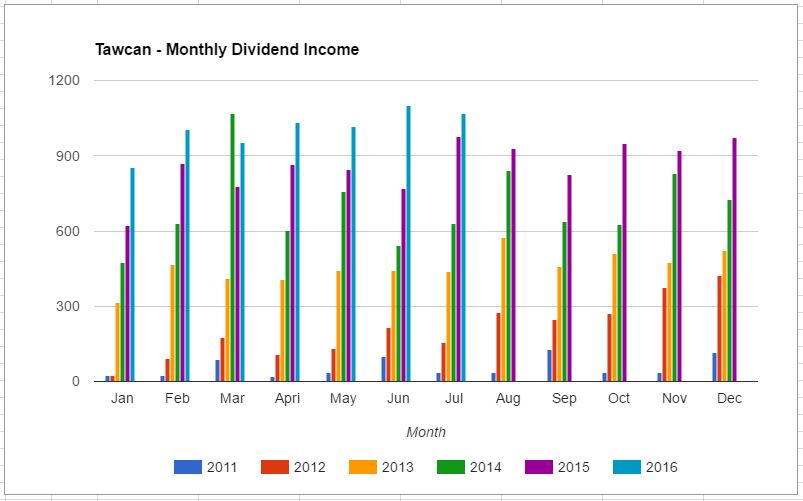

In total we received $1,066.97 in dividend income in July 2016 from 22 different companies. Essentially we received paycheques from 22 different companies in July, that’s good income diversification if you ask me. Of the $1,066.97 received, $93.3 was in US currency and the rest was in CAN currency. It’s interesting to note that most of the dividend income received in July was in Canadian currency. We use a 1 to 1 currency rate approach, so we do not convert the dividends received in US dollar into Canadian currency. Reason for doing this is to keep the math simple and avoid fluctuations in dividend income over time due to changes in the exchange rate.

The top 5 payouts came from Bank of Nova Scotia, CIBC, TD, Coca-Cola, and Telus. The top 5 payouts correspond to 53.6% of our July dividend income. Some of you might think this number is a bit high given that we want income diversification. But I disagree. Considering BNS, CIBC, and TD all have been paying non-interrupted dividends since the 1800’s and Coca-Cola and Telus have 53 year and 12 year dividend increase streaks respectively, I think it’s fine to have these solid dividend paying companies contributing large percentage of our dividend income.

Dividend Growth

Compare to July 2015 dividend income, we saw a 8.6% YOY increase. To be perfectly honest, I am slightly disappointed with the YOY growth number. However, considering the second half of 2015 was very strong for us in terms of dividend income, the lower than expected YOY percentage should not come as a surprise. Having said that, this is definitely a sign that we should probably considering adding some more dividend paying stocks in our dividend portfolio even though we are trying to save up money for our 2017 TFSA and RRSP.

Unfortunately in July we saw Potash (POT.TO) slashing its dividend for the second time this year as the fertilizer market struggle continues. Potash has cut its dividend payout by 60%. As a dividend growth investor, I hate whenever companies cut or freeze their dividends rather than increasing it. However, I do understand what Potash is trying to do – capital preservation. Luckily we only hold a small amount of Potash shares in our portfolio so the dividend cut will not reduce too much of our annual dividend income. Unlike many dividend growth investors who would sell the stock whenever a dividend cut occurs, we plan to continue holding Potash in our portfolio and perhaps add more shares in the near future to average down our cost basis. The fertilizer sector is very cyclical. The sector is facing a lot of challenges but who knows what will happen in 5 or 10 years.

Despite the Potash dividend cut, we also saw one dividend increase in our portfolio in July. Omega Healthcare Investors Inc (OHI) raised its dividend by 3.45%. Woohoo!

Thanks to DRIP, we were able to purchase additional 14 shares of different dividend paying stocks. This increased our annual dividend income by $23.35.

The Potash dividend cut is tough but it’s nice to know that overall our annual dividend is growing thanks to OHI’s payout increase and us enrolling in DRIP.

Moving Forward

So far in 2016 we have received $7,023.95 in dividend income. If we use $40/hour as the baseline salary ($83,200 annual salary), that means our dividend portfolio has saved us slightly over 175.5 hours worth of work, or almost 4.5 weeks. Pretty cool if you think about that for a brief moment.

Dear readers, how was your July dividend income?

Wow! You are doing great on the retirement quest. I can only dream of those amounts right now. It will still take me years to be even close to you.

Good job! Seem like you’re doing very good, I’m hoping to reach that day I can get up to $1,000/mo in dividends consistently too. Good luck in your journey.

Up up and away! Great to see that 2011-2016 overview of monthly dividends. Very cool graph.

Thanks Team CF.

Very good Tawcan. I look up to you when it comes to dividend.

Nice job this year, you’ve been on a crazy buying spree! I’m jealous of how stable your dividend income is each month too lol, mine is all over the place.

It’s super hot and humid here on the east coast too, makes me wish I was back in Vancouver.

Thanks misterslm. It’s kind of nice to have stable dividend income but any dividend income is good in my book.

It looks like from now on your monthly dividend income will be over $1,000 mark. Congrats!

Thanks Gemran Korb. Should be able to get over $1k each month consistently now.

congrats on another month above 1000 Dollar dividends 🙂

keep it up!

Thanks easydividend.

Really impressive Tawcan. Over $1k in dividends again. I cannot believe you’ve already added $40k this year to your portfolio. At this rate, you’ll be living the good like in no time.

Thanks Investment Hunting. I’ve been surprised that we managed to add that much money so far this year already.

Keep it up Tawcan!!

One day your kids will be so proud of you and your wife for looking so far in the future. I commend you guys travelling on this awesome journey. You’re killing it.

Thanks for sharing and don’t stop, can’t stop! Cheers.

Thanks Tyler, have a long way to catch you when it comes to dividend income.

You have both feet in the four digit club and it doesn’t sound like there is any looking back. Man oh man, what a great month Tawcan. Inspiring stuff that has me excited and motivated to find the next, best stock to dive into so I can join you one day. Keep up the great work!

Bert

Hi Bert,

Thanks, it’s pretty awesome to be deep in the four digit dividend income club.

Hey Tawcan,

I LOVE that you’re now getting over $1K every month. I know $1K is just a rounded number, but it’s quite symbolic. The fact you can say you’ve earned so many hours, for $40 an hour is great and I’m sure you’ll beat $12K total for the year. Nice use of re-investing too 🙂

Tristan

Hi Tristan,

It’s definitely neat to see how many hours we’ve managed to save. That’s the magic of dividend income for sure. I think we should hit $12k for this year but the goal is $13k. It might be a bit challenging to hit that number by end of this year but we’ll definitely give it a shot.

“that means our dividend portfolio has saved us slightly over 175.5 hours worth of work, or almost 4.5 weeks. Pretty cool if you think about that for a brief moment.”

When you put it that way, I think the dividend income stream becomes even more impressive.

Hi FinanceSuperhero,

That’s very true, dividend income stream is pretty impressive!

No reason to be disappointed with that year over year growth. Growth is growth and shows you are headed in the right direction. As our real dollars get larger it becomes more difficult to put up crazy high year over year percentage gains. Still, you have a nice long list of companies paying you and your chart shows nice progress all around.

Hi DivHut,

True, growth is growth, just hoped to see a higher growth number, like in the 20% range. That’s something we can keep aiming for. 🙂

Very strong and decent numbers you have here! keep the ball rolling.

As for the concentration: I agree with you. The companies seems to be rock solid in dividend payments. Then again, nothing is sure… Any idea what their pct contribution will be on a yearly basis? That seems to matter more I belief

Hi Ambertreeleaves,

That’s a good question, I’ll have to take a closer look at our dividend income to see their percentage contribution on a yearly basis. I don’t think any of them are over 5%.

Wow awesome stuff Tawcan! 4 consecutive $1k+ months and 5 for the year so far. Things are really going to start taking off for y’all. Y’all have done a great job investing $40k through the first 7 months but what’s really impressive, in my eyes at least, is that you’ve had $7k in dividends to push that snowball along. That’s almost an extra 20% of investment capital that you’ve put to work because of your dividends. 2016 is going to be killer year for y’all.

Hi JC,

5th $1K dividend for the year is pretty awesome. Looking forward to see what kind of income we end up with in 2016.

Another great month and three 1k months in a row! It will continue to grow. What I really enjoyed was seeing the graph from when you now started and can barely see the graph to where you are now. Hoping to put my report out sooN!

Hi Stefan,

Thanks, it’s crazy to look at that graph and see how much more income we’ve generated since we started the DGI journey.

It seems like only yesterday Potash was making new highs. The world always changes I guess.

It just goes to show how vulnerable companies focused on one product in one industry can be. They might see incredible gains when things are good, but when the tide turns it can be sooo bad.

Great dividend income last month btw! I still need to go calculate mine!

Hi Mr. Tako,

Definitely need to keep an open eye next time when we invest in a company that focuses on one particular product. Not too long ago Potash was the dividend growth investors’ darling. Funny how things have quickly changed.

Fantastic numbers you are putting up this year. $1000 a month! Awesome! Can’t wait to get to that point!

Thanks American Dividend Dream, you’ll get to the $1k per month mark soon.

Hello tawcan,

Great month. These dividends keep on pouring in

Almost 5 week of work free. Thanks to your passive income

Keep up the good work!

Cheers,

Pollie

Thanks Pollie, would have been nice to hit the $1.1k mark that’s for sure.