Wow it’s hard to believe it’s February already. Where did January go? Seems that Christmas was just yesterday. I guess that’s what happens when we spent half of January in Denmark.

I always get excited to write about monthly dividend income updates. Why? Because the monthly income is money that we receive for doing absolutely nothing. Other than the initial investment and the occasional monitoring, there’s very little work involved. In my opinion, dividend income is one of the best passive income sources.

Without further ado, let’s take a look at our January dividend income.

January Dividend Income

In January 2017 we received dividend income from the following companies:

Pure Industrial REIT (AAR.UN)

Agrium (AGU.TO)

BCE (BCE.TO)

Bank of Nova Scotia (BNS.TO)

Care Capital Properties (CCP)

Corus Entertainment (CJR.B)

CIBC (CM.TO)

Canadian Natural Resources (CNQ.TO)

Dream Office REIT (D.UN)

Dream Global REIT (DRG.UN)

Dream Industrial REIT (DIR.UN)

General Electric (GE)

H&R REIT (HR.UN)

Inter Pipeline (IPL.TO)

KEG Income Trust (KEG.UN)

MCAN Mortgage Corp (MKP.TO)

Prairiesky Royalty (PSK.TO)

Rogers (RCI.B)

RioCan REIT (REI.UN)

Telus (T.TO)

TD (TD.TO)

TransCanada Corp (TRP.TO)

Domtar Corp (UFS.TO)

Vanguard Can All Cap (VCN.TO)

Vanguard All-World Ex Canada (VXC.TO)

Wal-Mart (WMT)

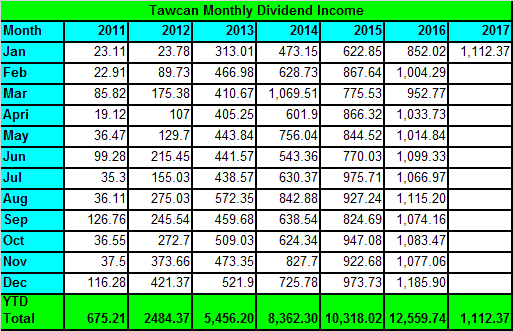

In January 2017 we received a total of $1,112.37 in dividend income from 26 companies. $32.48 was in USD while $1,079.89 was in CAD. This is one of the months that’s Canadian currency dominated. Please note, we use a 1 to 1 currency rate approach. Therefore, we do not convert the dividends received in US dollar into Canadian currency. Reason for doing this is to keep the math simple and avoid fluctuations in dividend income over time due to changes in the exchange rate.

The top 5 dividend payouts were Bank of Nova Scotia, CIBC, Rogers, Telus, and TransCanada Corp. The top 5 payouts correspond to 46.6% of our January dividend income.

Dividend Growth

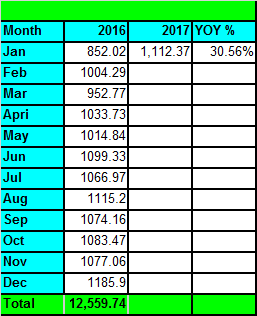

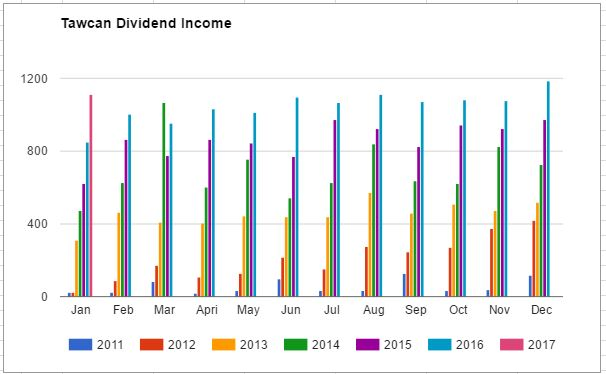

Compared to January 2016 we saw a HUGE YOY growth of 30.56!!!Needless to say, I’m extremely pleased and surprised with this number.

If you are wondering, our dividend growth is contributed by three things – investing fresh capital, purchasing of additional shares through dividend reinvesting plan (DRIP), and individual dividend stock’s organic dividend growth each year. Last year alone we added over $45,000 into our dividend portfolio. This is excluding all the additional shares purchased with DRIP and dividend reinvestment. As you can see, utilizing the power of all three of these factors have allowed us to growth our dividend income quite significantly. Can we continue such impressive YOY growth rate for the rest of 2017? Probably not, considering that we received close or over $1,000 for the rest of 2016. If we can continue the YOY growth matrix at over 20% I would be quite happy.

Dividend Increases & DRIP

In January a number of companies that we own in our dividend portfolio announced dividend increases:

- Enbridge (ENB.TO) raised dividend by 10% to $0.583 per share.

- Canadian National Railway (CNR.TO) raised dividend by 10% to $0.4125 per share.

- Exco Technologies (XTC.TO) raised dividend by 14% to $0.08 per share.

- Omega Healthcare (OHI) raised dividend by 1.64% to $0.62 per share.

- ConocoPhillips (COP) raised dividend by 6% to $0.265 per share.

- BCE Inc. (BCE.TO) raised dividend by 5.13% to $0.7175 per share.

- Brookfield Renewable Partners (BEP.UN) raised its dividend by 5% to $0.61 per share.

All these raises have increased our annual dividend income by $105.14.

To take advantage the power of compound interest, we are enrolled in DRIP for many of our holdings. In January we managed to DRIP additional 11 shares of various dividend paying stocks. This resulted in an increase of $20.47 in our annual dividend income moving forward.

By utilizing organic dividend growth and DRIP, we have managed to gain a total of $125.61 in our forward annual dividend income. To get the same dividend increase, at a 3% dividend yield, we would have to invest $4,187 of new capital. Essentially we got a pay raise for doing absolutely nothing at all. Gotta love that!

Conclusion and Moving Forward

2017 is still fresh but we have already received a total of $1,112.37 in dividend income already. As indicated previously, our goal for 2017 is receive over $15,000 in dividend income. It’s a challenging goal but we are up for a challenge. I can’t wait to see what 2017 has in store for us.

Dear readers, how was your January dividend income?

Awesome job Tawcan. I love that you’re now looking at over $1,100 each month now. That is major re-investing just on its own.

Tristan

Hi Tristan,

Yup the snowball is getting bigger and bigger. 😀

Wow, look at that trend over the past few years, looks steady. Do you get nailed with excess fees for foreign investing? I am US based and with TD and I am pretty sure I would get destroyed in commissions if I invested in non-ADR foriegn companies

We trade US stocks in RRSP to avoid tax consequences.

I just discovered that with RBC DI you can export the activity with a customized time window (I did a year) in CSV format, which is easy to import into Excel. I’ll be using the isnumber(search) and sumif functions in excel to automate dividend tracking. Check if Questrade and TD allow you to export also in CSV, should make it easier.

Great suggestion, will have to investigate.

This is one of the few impressive portfolio out there in the $1k range. It’s quite surprising to see what amount of growth by simply investing with discipline. Thanks for sharing your progress and inspiring the rest of us!

Thanks Micro Dividends. Hopefully we’ll get to $1.5k range soon.

Awesome results. Your year-over-year dividend income is fantastic. Keep up the good work.

Thanks Investment Hunting.

Sweet progress! Great to see many dividend increases as well, that’s very good sign. CAD15.000 is a pretty handsome target for this year, best of luck

We have aimed high this year, getting $15,000 in dividend will be pretty awesome for sure. Since we are not converting USD to CAD we’re just looking at the actual numbers.

Great stuff Tawcan. Over $1k and a 30% YoY increase is awesome. One thing I like to look back at now that the snowball has built up is the amount of monthly dividends you receive compared to previous years. For January you’ve already beat all of the dividends that you were paid in 2011 and nearly 50% of the dividends from 2012. That really shows the power of committing to an investment strategy and dividend growth. All the best in February.

Thanks JC. That’s a good way to look at the snowball affect.

That is a massive increase in YOY percentage wise. You would have to be happy with that for sure! Congratulations.

Thanks buyholdlong, very happy with our progress.

Well done! I just posted our income as well. Great minds…. 🙂

Cheers Bob,

Mark

Thanks Mark! 🙂

Wow that’s an amazing growth compared to last years. Congrats on making that money work for you.

Thanks The Financial Tech. Having money working hard for us is great.

Outstanding result Bob – a paycheque like that every much is sure to please, and YoY growth of 30% very nice. No dividends to report for me this month, but I’m hoping to start investing mid-year, to turn that baby around!

When I started I had a few months of $0 dividend income too. Just keep investing and you’ll soon see more and more dividend income. 🙂

Awesome month you have. And quit a few strings of 1,000 dividends a month.

Thanks dividendsandhobbies.

I just noticed that you have that same stock I was referring to: CCP. It should have paid out end of Dec but it hit the account in early Jan. Being a high yielder, it would’ve given a big boost to your Jan Div number. Try removing that (allocate that to Dec dividends) and re-calculate YOY growth. It would be good to get true organic growth numbers.

We actually didn’t receive that much dividend from CCP so it wouldn’t have made much changes to the YOY growth. Maybe reduce our number to 29 or 28%.

Woop woop! It’s so great to see such awesome growth!

Since we’re still getting out of debt, our January dividends were quite low. I think I got $12 from my IRA, which I always reinvest, since it’s still quite young.

Rome wasn’t built in one day, neither should your dividend income. Keep it up!

Great! I like the YOY growth. I’ll add that to our chart.

Thanks Joe. Would love to see your chart. 🙂

Great results. When the trend stays like this in 2017, you will smash the goal!

It alos looks like you will have 12 months with 1K or more of income…sweet!

Thanks ambertreeleaves, hopefully the trend will continue for the rest of 2017.

Wow, amazing results! Very nice to see how the organic dividend growth and DRIP can have such a big impact on your future gains. Can’t wait to see what the rest of the year will bring!

Thanks Divnomics. Glad you enjoyed the breakdowns.

Impressive results as usual. Your portfolio is really moving along quite nicely over the last year or so. Your year over year gains is what I really took notice though. Being able to put up over 30% growth just highlights your commitment to this portfolio with new buys, reinvestment and dividend raises. Congrats on a strong start to ’17!

Thanks DivHut, we have put in quite a bit of capital last year. That’s our money working hard for us!

Very nice, January over $1000 already, $1500 by end of year?

Congrats on the growth

Thanks, $1500 per month would be very awesome!

Wow, that’s some incredible growth Tawcan! Congrats! I’m really impressed by the size of the dividend increases you received – Anything 10% or over is very impressive!

At some point, that growth is going to slow down considerably. The law of larger numbers will begin to bite, as it has for me. Now I need to put in almost $100k in new capital every year to see a 10% growth rate.

Enjoy it while it lasts!

Hi Mr. Tako,

Yes I have mentioned many times on the blog that the dividend growth will eventually slow down as we reach bigger and bigger dividend income. The law of larger numbers will being to bite for sure. For now I’m going to enjoy the 30% YOY growth. 😀

Good show Bob! Mine was 40% yoy growth for Jan, but that’s due to a big dividend that should’ve hit Dec 30 but due to new year weekend, came in early Jan. If I remove that, the growth was 14%. Either way, numbers that we can literally take to the bank!

Those are pretty awesome YOY growth numbers regardless. Congrats!

Congrats on your good progress Bob!

Quick questions:

1) Which brokerage do you use?

2) How do you extract from the brokerage the totals for dividends each month into a format easy to import to excel or googlefinance?

Hi,

We use Questrade and TD Waterhouse. For dividends each month I just check the account activities at end of the month and enter the spreadsheet manually.

Wow.. impressive!

Great to see you do so well in this. Given that i just don’t have the time or the inclination to purchase individual stocks, I invest all of my savings in a couple of low-cost ETFs. Dividends are paid out semi-annually but nothing compared to what you’re able to accomplish.

Love your posts!

Low-cost ETFs is a great way to go as well. 🙂

Wow huge growth from last year. Congrats on the great start to 2017

Thanks Matthew. Very happy with our progress.