Announcement: The annual Plutus Award is up for 2020 nomination. Last year I was one of the finalists for Best Canadian Personal Finance Blog. If you really enjoy reading this site, I’d really appreciate it if you could nominate this blog for Best Canadian Finance Content and Best Financial Independence or Retire Early Content. You can submit your nomination here.

Wow, it’s hard to believe that 2020 is already half over. It’s also hard to believe that we have been staying home for over three months and I have been working from home exclusively during that time.

Thanks to the warmer weather, we have been busy harvesting in our backyard garden throughout June. We have harvested a bunch of cauliflower and broccoli. Fresh cauliflower and broccoli simply taste amazing and have different tastes than store-bought ones, I gotta say.

The garden sure has been busy growing and more harvests will come soon…

With the COVID-19 second wave appearing to be hitting some US states, I hope everyone’s staying safe and practising social distancing. Mrs. T and I feel very fortunate that BC has gotten a good handle on COVID-19 and the number of cases and deaths has been flattening. However, until effective treatments and/or a vaccine are found, I don’t believe we’ll ever get back to the old “normal.”

I am optimistic, however, that once we can travel and hug each other again, we will look at the environmental improvements we’ve made during the pandemic and take a closer look at how we can continue these improvements. I do think the world will change as a result – people will probably travel less by air and people will be working from home more rather than blindly going to the office every day and burning up fossil fuels.

Dividend Income

Now back to the main topic… dividend income update. In June 2020 we received income from the following companies:

- Brookfield Renewable (BEP)

- Brookfield Property Partners (BPY)

- Canadian National Railway (CNR.TO)

- Canadian Tire (CTC.A)

- Canadian Utilities (CU.TO)

- Dream Office REIT (D.UN)

- Dream Industrial REIT (DIR.UN)

- Enbridge (ENB.TO)

- European Residential REIT (ERE.UN)

- Fortis (FTS.TO)

- Hydro One (H.TO)

- H&R REIT (HR.UN)

- Intact Financial (IFC.TO)

- Intel (INTC)

- Inter Pipeline (IPL.TO)

- Johnson & Johnson (JNJ)

- KEG Income Trust (KEG.UN)

- Coca-Cola (KO)

- McDonald’s (MCD)

- Manulife Financial (MFC.TO)

- Magna International (MG.TO)

- Metro (MRU.TO)

- Pepsi (PEP)

- Qualcomm (QCOM)

- RioCan REIT (REI.UN)

- SmartCentres REIT (SRU.UN)

- Suncor (SU.TO)

- Target (TGT)

- Unilever Plc (UL)

- Visa (V)

- Waste Management (WM)

- Wal-Mart (WMT)

- Vanguard Canada All Cap (VCN.TO)

- iShares ex-Canada index (XAW.TO)

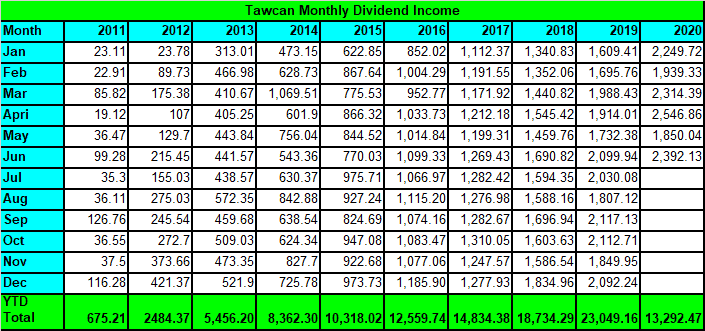

Phew what a list! In total, we received income from 34 companies that added up to $2,392.13. After a disappointing May where we received less than $2,000, it sure was nice to see a dividend income that was above $2,000.

Out of the $2,392.13 received $544.88 was in USD and $1,847.25 was in CAD, or about a 25-75 split. Please note, we do not convert the USD to CAD when reporting our dividend income. Instead, we use a 1 to 1 currency rate approach. Why do we do that? Because we want to avoid fluctuations in dividend income over time due to changes in the exchange rate.

The top five dividend payers for June 2020 were Enbridge, XAW, Brookfield Property Partners, Manulife, and Brookfield Renewable (not in order). The payout from these five companies added up to $1,202.22 or 50.2% of the June dividend income. It’s interesting to see that these top five dividend payers contributed to over 50% of the June dividend income and one of them is a REIT (Brookfield Property Partners). Given the current market conditions, I think we need to be a bit careful here and reduce our reliance on REITs for our dividend income.

Financial Independence Journey Update

The reason why I like dividend income is that it’s real money being deposited in our accounts. It is our plan to use dividend income to pay for our living expenses when we are financially independent and not working.

For now our dividend income isn’t enough to cover all the monthly expenses, but it can cover a significant part already. At $2,392.13 dividend income in June, it means our dividend income was able to cover the following expenses:

- Groceries

- Car insurance

- House insurance

- House property tax

- Hydro

- Internet & phone bills

- Natural gas

- Term-life insurance

- Household items

In fact, our June dividend income was able to cover 63.9% of our total June expenses. Living off dividend income is definitely possible and is slowly becoming a reality for us.

Dividend Growth

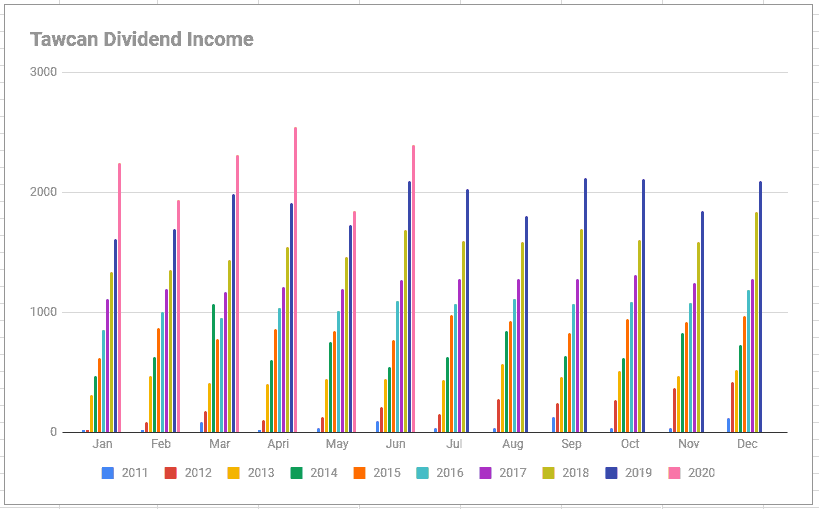

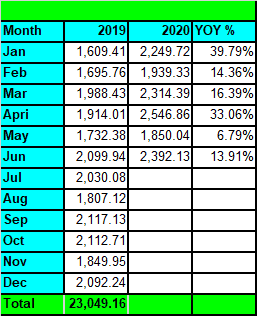

Compared to June 2019, we saw a YoY growth of 13.91%.

Given all the dividend cuts and suspensions, I think it will be challenging to see a monthly YoY growth of above 15% moving forward. We plan to continue buying more dividend-paying stocks throughout the rest of the year, so we’ll see if we can hit above 15% YoY growth again.

Dividend Reinvestment Plan (DRIP)

There are three things that we rely on to grow our dividend income and they are:

- Purchase more dividend-paying stocks with new capitals

- Organic dividend growth

- Reinvest dividends via dividend reinvestment plan and wait for dividends to accumulate to a big amount and purchase more dividend-paying stocks (see #1).

For now the key driver for our dividend growths comes from point #1 but it doesn’t mean we should ignore points 2 and 3. Therefore, we are enrolled in DRIP whenever we are eligible.

In June we were able to DRIP the following stocks:

- 2 shares of Canadian Utilities

- 13 shares of Enbridge

- 3 shares of H&R REIT

- 7 shares of Manulife

- 1 share of European Residential REIT

- 3 share of Inter Pipeline

- 1 share of Fortis

- 3 shares of RioCan REIT

- 1 share of Dream Industrial REIT

- 2 shares of Smart Centres REIT

- 3 shares of Suncor

- 1 share of VCN

- 4 shares of XAW

- 1 share of Hydro One

- 1 share of Brookfield Renewable

- 9 share of Brookfield Property Partners

- 2 shares of Coca-Cola

All these 57 shares was an equivalent of $1,523.67. In other words, we had a DRIP ratio of 63.7% in June 2020. By DRIPing these shares, we also increased our forward-looking dividend income by approximately $96.21 (it’s only an approximation because it is difficult to accurately estimate distributions from VCN and XAW).

Dividend Increases

Given the current economic conditions, we were happy to hear a dividend increase for June:

- Target increases dividends by 3.03% to $0.68 per share.

This announcement increased our forward dividend by a little over $5. It’s a small raise but we’ll take it.

Dividend Stock Transactions

Unlike May, we didn’t sell any dividend-paying stocks, and we didn’t close out any positions. We did, however, kept busy on the purchasing front and added a couple of new positions in our dividend portfolio.

- 378 shares of Algonquin Power & Utilities (AQN.TO) at $19.16 per share.

- 27 shares of Granite REIT (GRT.UN) at $67.11 per share.

These purchases added $411.05 toward our forward annual dividend income.

Below are some of my thought about AQN.TO and GRT.UN.

Algonquin Power & Utilities

Algonquin Power & Utilities Corp., through its subsidiaries, owns and operates a portfolio of regulated and non-regulated generation, distribution, and transmission utility assets in Canada and the United States. When I took a look at AQN’s 2019 annual report, I noted the company operates many renewable power plants: 774,010 solar panels, 713 wind turbines, and 55 hydroelectric generators. Since Mrs. T and I are convinced that renewable energy is the future, it makes sense for us to invest in AQN.TO.

In case you’re wondering how to read these complicated annual and quarterly reports, take a look at this guide I’ve written.

The stock currently trades at 17.6 PE ratio and yields at 4.6% which I think are reasonable for a utility stock. AQN has a 9-year dividend increase streak with a 10-year dividend annualized growth rate of 8.7% and an estimated earning growth of ~38% per year. I believe AQN will be able to continue to grow in the years to come and reward its share owners.

Unfortunately, looks like I purchased the stock a bit early as the stock price has been on a downward trend since our purchase. I may add more AQN shares later to average down our cost basis.

Granite REIT

Some of you are probably wondering why we are purchasing a REIT when REITs are being perceived as a poor performance sector during the COVID-19 pandemic. Unlike commercial REITs like RioCan and SmartCentres, Granite owns and manages predominantly industrial real estate properties in North America and Europe with its portfolio consists of multi-purpose, logistics and distribution warehouses, and special purpose facilities. Online shopping is getting even more popular during the pandemic. Therefore, companies like Amazon and Shopify will need more and more warehouse spaces to store merchandise. I believe this is where an industrial REIT like Grantie can benefit.

A few years ago, most of the Granite’s properties are dependent on one tenant. This has changed over the years as Granite has gone through its own transformation and tenant diversification. This is a positive trend to see, of course.

Granite has a yield of ~4.3% and a 9-year dividend increase streak. The dividend increase rate has slowed down over the last few years but that’s somewhat expected from REITs. Given the industrial REIT is a very small market with lots of potential growths, I believe it makes sense to invest in Granite for the long term.

Summary

With 2020 halfway over, we have received a total of $13,292.47 in dividend income. As mentioned before, I have come to the realization that is unlikely to achieve our $30,000 dividend income goal. If we could end up with over $27,000 in dividend income for 2020 I think that’d be fantastic.

Anyway, to put our dividend income into a quantitative perspective:

- We are getting paid $3.04 per hour so far in 2020. This is regardless of what we are doing, whether we are sleeping, eating, or taking a shower.

- $9,710.26 of the $13,292.47 was deposited in either our TFSAs or RRSPs so that means we have been getting $9,710.26 taxed free income or $2.22 per hour tax-free so far in 2020.

- At a $40 per hour salary, we have saved ourselves over 41 working days or an equivalent of over 8 weeks worth of work.

It feels pretty awesome to see our money working hard for us, so we don’t have to. It’s also really cool to know that we are getting paid regardless of what we are doing.

Dear readers, how was your June dividend income?

A very nice month Bob! Your dividend income continues to grow at a steady clip! Someday soon you’ll be caught up with me! 😉

Haha it’ll be a while before we are caught up with you. 🙂

We reinvest all our dividends so don’t track separately. Whether our paper assets grow by dividends or appreciation is of no matter since we look at our paper as the backstop for our portfolio and ideally something we leave for the next generation. Our cash flow needs will be met by our real estate and consulting income. I find both of these types of assets to be easier to understand and manage. The US stock market is not tethered to reality as far as I can see.

Bob,

What a list! Where do I even start? First, your dividend income continues to grow and produce impressive amounts. I love all of the expenses they cover as well. That’s what it is all about. Second, my favorite part of your update is the garden update. That is a big old cauliflower 🙂

Bert

Impressive DRIP list. Our dividend income for June was $533. Good call on AQN. I have a small holding and may add as well. The 10% dividend increase didn’t hurt either. That will give your July numbers a nice little boost. Love your updates.

Our garden tends to feed the wildlife – LOL.

Although I’m not a big dividend investor I’m always impressed by people who are.

I am looking at adding some XAW to my portfolio though so this post may have convinced me to pull the trigger.

Great update – love seeing the continuous upward trend.

Great job Bob! That XAW payment is nice, isn’t it (I don’t have XAW I have VXC but it boosted my July income nicely).

Great looking garden. This is my first year, there’s lots to learn!

June was a record breaking month for me! Also back to work so will be adding new capital soon.

Nicely done!

So you purchased AQN. Did you buy it inside your RRSP or TFSA? Just curious as it is on our shortlist.

We purchased AQN in the taxable account as we already maxed out our RRSP and TFSA for this year.

Well done, Bob. Nice to see the YoY growing passive income. I should take up gardening as well. As groceries become more expensive it makes more sense now than ever to grow your own food. How many hours do you usually spend a week looking after your plants?

I had about $1800 come in from dividends and interest in June. It wasn’t bad, but I’m expecting more for this month. 🙂

Thanks Liquid. Growing your own food definitely will reduce overall grocery expenses. But it does take up quite a bit of time to tend the garden. Probably 3 or 4 hours each week? Mrs. T does most of the tending. 🙂

wow nice Bob

A solid income and lots of new capital. Unfortunate about the algonquin timing but what can you do right?

Fantastic month. keep it up

Thanks Rob. Will DRIP AQN to lower cost basis. 🙂

We received $125 in dividends from AQN along with a few other Canadian equities just yesterday so no complaints here.

Nicely done!

As soon as things get to be more “normal”, I anticipate flying a lot more. I was never one for travel, but I think it’s going to be time to do a lot of it when we finally get a chance.

Good work on the dividend income. I always try to max out our retirement accounts first, which prevents us from getting spendable money from investments for now. At some point, it doesn’t make sense to always save for later, so we might have to make a change there.

Yea people might go on a travel spree because they’ve been cooped up for such a long time. If that does happen, it will be good for the travel industry.

Incredible, you can see the early evidence of exponential growth here. I would say in 10 years’ time Bob’s dividend income will leave his employment income in the dust. Unless he becomes a CEO or something like that (quite possible however!) his dividend income and the associated portfolio will drive his future net worth to a much greater extent than what he is earning on the job. Congratulations Bob!

Thank you J. It would be awesome when our dividend income exceeds my employment income. 🙂

Another great month Bob! That YoY is still amazing given our current economic environment. I’m sure you’ll hit 27k no problem and I’m looking forward to that year end post where you’ll say you smashed it out of the park 🙂

Your garden looks amazing, we live in a condominium so no garden for us but love looking at your harvests

-DG Capital

If we can hit $27k by the end of this year it’d be fantastic. Hopefully a little bit more. 🙂

Great month! Double digit growth is still better then single digit, especially during these times. Congrats! I’m bracing for what I hope will be the last dividend cuts of the year (WFC and D), but other then that the dividends are rolling in and I had a record breaking June. Anyways, keep up the awesome work! 🙂

That’s true, I’ll take a smaller YoY growth than no growth at all. Hopefully we won’t see any more dividend cuts. I just noticed that Evertz Technologies cut its dividends. Good thing we closed out that position a while ago.

Love so much that you list out all the line items those dividends cover!!

Such a GREAT way to put it all into perspective!

Thanks J$. It definitely motivates us to continue the FI journey when we see what our dividend income can cover.

Nice work Sir, we topped out at $2,376 (USD) in June, but that is a heavy index fund month for us. Most of our healthcare REIT dividend income happens to hits January, April, July, October which helps even things out.

Hope you are well. My wife is likely heading out to Alberta in September for a few months.

Max

Over $2,300 in June is fantastic!