Can you believe that summer is half over? So far this summer we have not seen the summer scorching heat here in Vancouver. Instead, we have had rainy days occasionally. We Vancouverites actually welcome a tamer summer since that means fewer forest fires. It’s a nice change to not have to breathe in smoggy smoky air all summer, that’s for sure. For those of you are new here, the beginning of the month usually means a monthly update from yours truly. The reason for doing these monthly updates is to keep us honest and demonstrate that it is possible to build up a sizable dividend portfolio so it generates sufficient dividend income to cover our expenses. When our dividend income and other passive income exceeds our annual expenses, we can call ourselves financially independent. I have also started sharing some financial independence journey numbers for transparency reasons and to give readers a sense where we’re at on our financial independence journey. I hope these numbers are helpful.

In July, we continued to be busy with our backyard garden. We harvested the following:

- Broccoli

- Cauliflower

- Salad

- Cucumbers

- Starflowers (borage)

- Basil

- Peas

- Raspberries

- Black and red currant

- Garlic

- Onions

Needless to say, it felt amazing to be eating food that we grew ourselves. Growing produce in our backyard has also taught both kids where food came from and the importance of tending the garden.

Dividend Income – July 2019

When it comes to dividend income, July wasn’t nearly as busy as June. We received dividend income from the following companies:

- BCE Inc (BCE.TO)

- Bank of Nova Scotia (BNS.TO)

- CIBC (CM.TO)

- Canadian Natural Resources (CNQ.TO)

- Dream Office REIT (D.UN)

- Dream Industrial REIT (DIR.UN)

- Dream Global REIT (DRG.UN)

- Evertz Technologies (ET.TO)

- H&R REIT (HR.UN)

- Inter Pipeline (IPL.TO)

- KEG Income Trust (KEG.UN)

- Coca-Cola (KO)

- Nutrien Ltd (NTR.TO)

- Prairiesky Royalty (PSK.TO)

- Rogers (RCI.B)

- RioCan REIT (REI.UN)

- SamrtCentres REIT (SRU.UN)

- Telus (T.TO)

- TD (TD.TO)

- TransCanada Corp (TRP.TO)

- Domtar Corp (UFS.TO)

- Vanguard CAn All Cap (VCN.TO)

- Ventas (VTR)

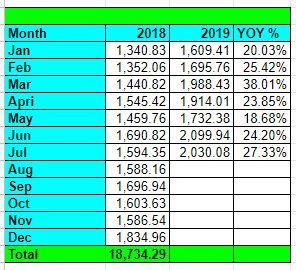

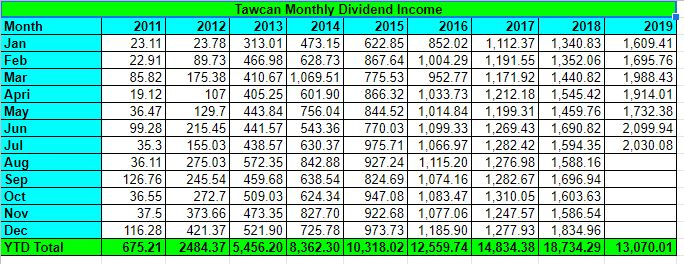

In total, we received 23 paycheques that added up to $2,030.08. Woohoo, this marked the second straight month that we received over $2,000 in dividend income! This is absolutely amazing, considering we only crossed the $1,000 per month milestone 3 years ago in 2016.

Of the $2,030.08 received, $163.06 was in USD and $1,867.02 was in CAD. That’s about a 10/90 split. July was one of those months that most of our dividend income was in Canadian currency. As long-time readers already know, we use a 1 to 1 currency rate approach. We do not convert dividends received in USD to CAD, because we want to keep the math simple. This is our way to avoid fluctuations in dividend income over time due to changes in the exchange rate.

The top 5 dividend payouts in July 2019 came from TD, Bank of Nova Scotia, Inter Pipeline, Telus, and CIBC (not in order). Dividend payout from these 5 companies accounted for $1,194.94 or 58.9% of our July dividend income total.

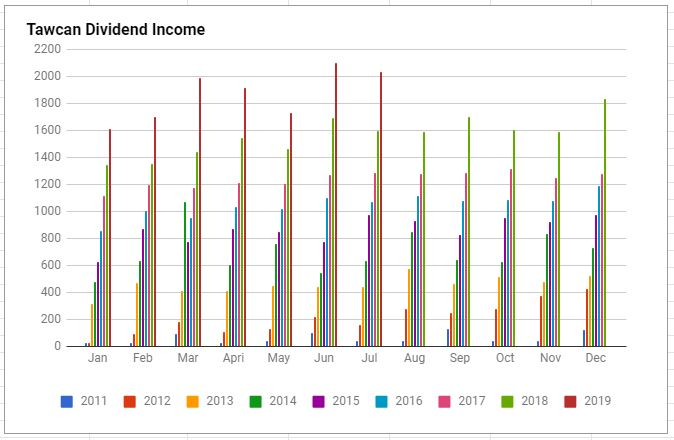

Dividend Growth

Compared to July 2019, we saw a YoY increase of 27.33%!!! It’s crazy and very nice to see a YoY growth percentage of above 25%.

So far in 2019, we are averaging 25.35% in YoY growth. I feel that our hard work of saving money and use savings to purchase dividend stocks is paying off.

Dividend Increases

July was yet another quiet month when it comes to dividend increases. We only saw one payout increase:

- Nutrien raised its dividend payout by 4.7% to $0.45 per share.

This raise increased our annual dividend a little less than $3. It certainly isn’t a lot of money but I’ll take a raise over no raise at all!

Dividend Stock Transactions

Although the market was volatile in July, we were quiet on the dividend stock transaction front. We didn’t sell or purchase any dividend paying stocks. We have some cash on the side which we are planning to deploy if there’s a small market correction. I hope that the market will remain volatile, so we can purchase some stocks on our radar at a discounted price.

Financial Independence Journey Progress

The $2,029.64 in dividend income that we received was able to cover 61.2% of our total expenses in July. Unlike the previous month, we didn’t have any major expenses. Eating produce from the garden had helped to keep our grocery bill down as well. When it comes to necessities expenses, our July dividend income was able to cover 85.2%!!! I feel blessed that our monthly dividend incomes are starting to cover a significant portion of our monthly expenses.

Living off dividend income is definitely possible!

Summary

After 7 months, we have received a total of $13,070.01 in dividend income and are averaging 25.36% YoY growth. If we continue with this YoY growth rate, that means we should receive $23,485.30 in dividend income for the entire year. This would be fantastic since it means beating our annual dividend goal of $23,000.

At a $40 per hour salary ($83,200 annually), this means our dividend portfolio has saved us over 326 hours, or over 40 days of working days. This is equivalent of 8.17 weeks of work or about 15.7% of the year. It is truly amazing to have our money working hard for us so we don’t have to!

How was your July dividend income?

Hi Bob,

Very nice outcome from your garden. The garlic looks amazing!

Concerning the dividends, you are keeping the good pace towards the FI. Congrats!

Here our dividend came higher than we expected, making our 3rd month in a row above €1000. 🙂

All the best. Cheers!

Thank you!

I think those garlics were bigger than your dividend growth this month lol

Great update and your hard work continues to pay off

Haha I know! I guess they are called elephant garlic for a reason. 🙂

I wish I could make anything grow. I’m just not good at gardening and it seems like a lot of work. I may revisit this in the future as it does seem like it could make for some good food cost savings.

I don’t currently do a lot of dividend investing. I do more indexing and then add in some dividend stocks and some growth stocks to try to be a little more aggressive. I tend to keep track of my entire investment values and see what they could make if we sold everything and went with a basket of equities that return 2.5% dividends. When we retire, we might do this just because income will be more important then.

I can’t take too much credit for the gardening, that’s all Mrs. T.

Index funds provide distributions too, we definitely get some of that every 3 months or so.

Bob you are doing great second straight $2000.00 plus month. Keep it up. if you have any garlic left ill be over to pick some up lol.

Haha thanks. We’ll put those garlics to good use. 🙂

bammmm wow nice bob.

Gardens splendors are really nice. I just picked 5 cucumbers from.mine but the tomatoes are taking their time.

dividend front – just awesome. That high of growth rate in those numbers?

keep it up man!

cheers

We’ve been eating a lot of cucumbers from the garden lately. It’s so awesome to eat fresh off the vine cucumbers. Yea, tomatoes will take a few more weeks before we can harvest.

Very happy with the YoY growth rate. I consistently surprise myself with these numbers.

Great harvest. Mine have been pretty bad this year. I blame new garden and too big ambitions.

Also great post about your dividend investment journey. I will tag along from now on.

This is my July update: https://10yeartarget.com/financial-status-july-2019/

I also created a post about dividends. Do you have details I have missed? https://10yeartarget.com/what-is-dividend-investing-and-how-does-it-work/

Looks like you had a great month 10YearTarget. Congrats.

Nice month for sure! It’s awesome to see 2K for the second straight month! I think all your months going forward will about around or above $2K as current dividends get reinvested and the snow ball is getting bigger. We start to see some market volatility in August so you might get some good deals.

Thank you German, very happy that we got over $2k for the second straight month. Not sure if we’ll be able to achieve this record for a 3rd straight month. We’ll find out. 🙂

Nice looking harvests there Bob! Both the garden and the dividends!

I really need to get my rear into gear and tally up my July dividend numbers too. I’ve been on vacation too long! Thanks for the reminder!

Thank you!

Enjoy your vacation and tally up your July dividend numbers when you return home. 🙂

Amazing month and amazing garden!

I love your style of writing. It combines “hard numbers” with everyday life 🙂

– Financialnordic.com

Thank you Financial Nordic! 🙂

Incredible work, Tawcan!

I love seeing these graphs. The most fascinating thing, to me, is how you are still able to have over 25% YOY growth. Simply amazing.

Keep up the great work, my friend. I look forward to the day when you’ve achieve your goals!

Thank you R. The graphs are very motivating for us to look at, that’s why I share them in the dividend income reports each month. 🙂

I have been following you for some time now Bob. You inspired to revamp my entire portfolio. I now enjoy significantly more growth, more dividends and have a thoughtful plan to grow my porfolio, especially when markets are down. Keep up the good work!

Thank you Brent. Happy dividend income!