It’s a new month and that means it’s time for a monthly dividend income and financial independence journey progress update. The reason for doing these monthly updates is to keep us honest and demonstrate that it is possible to build up a sizable dividend portfolio and use the dividend income to cover our expenses. When this happens, we can call ourselves financially independent. We are doing this method rather than the traditional 4% withdrawal method because we don’t want to tab into our principals.

It has been over a month since the summer solstice in June, which means daylight is starting to get shorter and shorter. I definitely noticed this change whenever I got up before 6 AM to go swimming the last few weeks because the sun was just starting to poke out from the horizon.

Throughout August, we continued to harvest produce from our backyard garden. The homegrown tomatoes taste absolutely amazing!

August was a busy travel month for me personally. I went on a few business trips then the entire family went to New York City together for eight days. If you follow me on Instagram, you probably have noticed that I posted a few pictures from New York. We had a great time in NYC and I’ll write a trip report later.

Dividend Income – Aug 2019

In August we received dividend payments from the following companies:

- Apple (AAPL)

- AbbVie (ABBV)

- Bank of Montreal (BMO.TO)

- Dream Office REIT (D.UN)

- Dream Industrial REIT (DIR.UN)

- Dream Global (DRG.UN)

- Emera (EMA.TO)

- General Mills (GIS)

- H&R REIT (HR.UN)

- Inter Pipeline (IPL.TO)

- KEG Income Trust (KEG.UN)

- Laurentian Bank (LB.TO)

- National Bank (NA.TO)

- Omega Healthcare (OHI)

- Procter & Gamble (PG)

- Prairiesky Royalty (PSK.TO)

- RioCan REIT (REI.UN)

- Royal Bank (RY.TO)

- Starbucks (SBUX)

- SmartCentres REIT (SRU.UN)

- AT&T (T)

- Verizon (VZ)

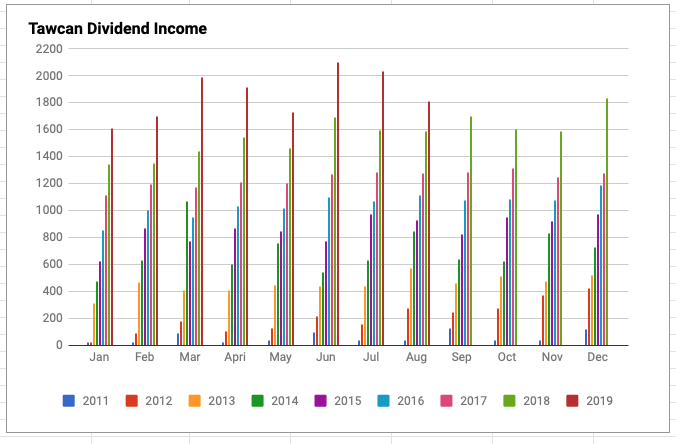

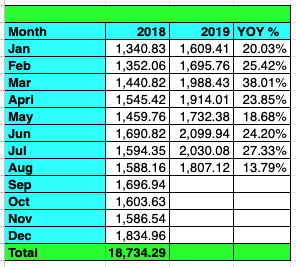

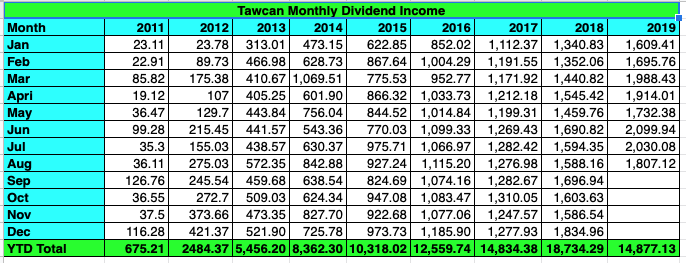

In total, we received dividend payments from 22 companies that added up to $1,807.12. Unfortunately, our $2,000 per month dividend income streak was broken in August. Darn it! However, if you look at historical dividend data, you’ll notice that February, May, and August are the “slower” months for us (excluding January). This trend is continuing in 2019. For the most part, our monthly dividend income is pretty steady. This certainly wasn’t by design (it was a pure coincidence), so it’s totally OK to have some “slower” months.

Of the $1,807.12 received, $397.29 was in USD and $1,409.83 was in CAD. That’s about a 20/80 split. Please note, we use a 1 to 1 currency rate approach. We do not convert dividends received in USD to CAD, because we want to keep the math simple. This is our way to avoid fluctuations in dividend income over time due to changes in the exchange rate.

The top 5 dividend payouts in August 2019 came from Bank of Montreal, Inter Pipeline, Emera, National Bank, and Royal Bank (not in order). Dividend payout from these 5 companies accounted for $1,080.16 or 59.8% of our August dividend income total.

Dividend Growth

Compared to August 2019, we saw a YoY increase of 13.79%. This is the lowest monthly YoY performance so far in 2019, which is slightly disappointing, especially when we had two fantastic months in June and July. It just means we need to focus on buying more dividend-paying stocks. Our dividend stock transactions throughout August will definitely help.

Dividend Increases

In August a number of companies announced dividend payout increase.

- Saputo raised its dividend payout by 3% to $0.17 per share.

- Royal Bank raised its dividend payout by 2.9% to $1.05 per share.

- CIBC raised its dividend payout by 2.8% to $1.44.

- Bank of Nova Scotia raised its dividend payout by 3.4% to $0.80 per share.

These dividend increases have added our annual dividend income by $139.56. At 4% dividend yield, that’s equivalent of investing $3,489 of fresh capital. This is a perfect example of the power of organic dividend growth – we are getting a dividend raise without lifting a finger. Nice!

Dividend Reinvestment (DRIP)

Whenever it’s possible, we automatically reinvest dividends received by enrolling in dividend reinvestment plans (DRIP) with our brokers. Both TD Waterhouse and Questrade offer synthetic DRIP, meaning we need to receive enough money in dividends to purchase a full share.

By utilizing DRIP, we managed to increase our annual dividend income by $51.28 in August alone. At 4% dividend yield, that’s equivalent of investing $1,282 of fresh capital into our dividend portfolio.

In case you are wondering, some of the stocks that we were able to DRIP included (not a full list): Bank of Montreal, Emera, Royal Bank, Inter Pipeline, RioCan, AT&T, and National Bank.

Dividend Stock Transactions

The market was extremely volatile in August. Most of the stocks that we hold saw a significant price drop throughout August. Because of that, we decided to deploy cash and purchased the following stocks:

- 15 shares of Canadian Imperial Bank of Commerce (CM.TO)

- 40 shares of TD Bank (TD.TO)

- 35 shares of Bank of Nova Scotia (BNS.TO)

The Canadian banks are under a lot of price pressure due to uncertainties in the economy and concerns with Canadian real estate, but I think the Canadian banks are simply too attractive to pass given the stock price, evaluation, and dividend yield right now. Chances are, the Canadian banking stocks will remain volatile over the next little while. But consider that most Canadian banks have been paying dividends since the late 1800’s and have never suspended their dividend payments (even during the financial crisis, the Canadian banks simply held the dividend payments without raising them), I figure I can hold the stocks, collect dividends, and wait for the price to appreciate.

In addition to these three purchases, we also took advantage of Questrade’s commission-free ETF purchase and added both VCN.TO and XAW.TO with some cash sitting in our accounts.

Not counting the index ETFs, the purchases of the three Canadian banking stocks added a total of $349.40 toward our annual dividend income.

Financial Independence Journey Progress

We received $1,807.12 in dividend income in August. This amount was able to cover 37.6% of our total expense in August. Our August expenditure was a bit higher due to our trip to New York City. When compared NYC to Vancouver, NYC was way more expensive, especially considering the exchange rate! But the trip was very well worth it and we had a great time.

The goal for this year is to have a dividend income to total expenses ratio of 50%. When I set up this goal, I knew it was very ambitious. After eight months, it looks like it is going to be extremely challenging to accomplish this goal.

Summary

So far in 2019, we have received $14,877.13 in dividend income. With four months to go for this year, we have already smashed our 2017 annual dividend income! It’s amazing to see how far we’ve come in the last few years.

At $40 per hour that means our dividend income has saved us almost 372 hours of work, over 46 days, over 9 weeks, or about 18% of the year. It’s pretty amazing to know that our money is working hard for us so we don’t have to.

Dear readers, how was your August dividend income?

Love the article Bob!

You put out some amazing stuff and it’s so great to see your journey and seeing how you are improving your system as you go!

Love the monthly updates! Keep up the awesome job! This is what consistency and sticking to a plan looks like!

Thanks for sharing the stocks to look at and also I want to know How I can reinvest my dividend and as a new investors how I can realise a decent return amidst the volatility of the UK stock market…

Hi Scarlett,

There are two ways to reinvest your dividend:

1. Collect dividends and when you have sufficient amount, buy shares.

2. Enroll in dividend reinvestment plan

Hi Bob!

Very nice vegetables, as always!

Congrats on another month of nice results on dividends. Looking at your YoY increase on the dividends I believe that by 2020 you will have all the months above C$2k.

Our August dividends came good as well, with the fourth month in a row with passive income above €1k.

All the best. Cheers!

That harvest photo looks amazing. Congrats on your work in the field 🙂 As always another solid showing for passive income earned from many great dividend paying companies and REITs. Love seeing fresh cash deployed into those Canadian banks as well. Keep up the good work.

Thank you DivHut. Very happy with our dividend income for August.

Nice progress Bob! You had a good August!

For my portfolio, August isn’t a big one — we pulled in a mere $669. September however was a different story with dividends over $12,600.

It’s lumpy like that sometimes.

Thank you Mr. Tako.

Wow that is a HUGE amount for September. Crazy stuff!

Love these updates. Inspirational. For now, my dividend income isn’t much. But that is one of my focuses in the years to come. I have included dividends in my reports, but it is so little each month that I could have waited until the end of the year and sum it up instead.

Thank you Erik. It takes time to build up your dividend income so be patient. 🙂

Consistent and well planned strategy unfolding each and every month, keep up the diligent work Bob.

Thank you Chris.

Another great month Tawcan, I really do look forward to these posts.

Also, you’ve listed”Abbvie” as AbbView. Sincerely, someone at Abbvie.

Thank you, and sorry for the typo!

Tawcan –

Man…. just wow… adding over $540 in a single month and then some!

Question – for your vanguard fund purchases, do you do just whatever cash you may have left or do you do automatic-fixed amount/routine purchases in those funds? Very curious here, of course.

Great job and can’t wait until you are well over $2k/month.

-Lanny

Hi Lanny,

Thank you, yea we’ve been hard at work. 🙂

For index funds, we either use new cash to buy more shares or use whatever cash we have left over to purchase more shares when the market is down. Hope that makes sense.

Love the calculation of how much many work hours your dividend income has saved! Makes it very enticing. Do you simultaneously invest in non-dividend producing stocks and index funds, or is most of your cash flow currently funneled into dividends only?

Thank you Elise. I like looking at things quantitatively. Do we invest in non-dividend paying stocks and index funds but I don’t write about non-dividend paying stocks on here.

Thanks for sharing your numbers and progress. It´s very inspiring for someone who is on your 2011-level regarding yearly dividend payout to see what it could become one day.

Thank you. It just takes time to build up a sizable dividend portfolio. Keep at it. 🙂

Nice Bob always love these posts.

A solid income and great buys. I’d love to add to my position in the banks but they are my 2nd highest sector atm.

Did you sell dream global or gonna let it ride?

keep it up

cheers

Thank you, we are very happy with the August dividend income. Gotta love the Canadian banks.

You’ll have to come back to check out our update for Dream Global in the Sep update. 🙂

Your dividend income chart is amazing. It’s growing so fast.

We had a good month in September. Our dividend income broke $2,000/m for the first time. It’s awesome. If we can get to $3,000/m, we’ll be set. It’ll take a few years, though.

Nice Joe. $2k per month is pretty fantastic! Yea $3k per month will take us a few years to hit for sure.

You know what would be a cool idea?

To average out your dividend income by months. This way you can easily compare the average dividend payout by month. Another stat to have at your arsenal, and then you can graph it as well. It will show you a trend (that is increasing) which is very eye-pleasing!

That’s a great idea! Something to think about for sure. 🙂