Why do I like dividend income so much? Because it’s our money working hard for us so we don’t have to. For example, I was on the road for 16 days in February but we still received dividend income from our dividend portfolio nonetheless.

When it comes to business travels, although having fancy dinners with customers was neat (who knew blow fish tasted so delicious and you could get delicious authentic Italian food in Taipei), it sure was nice getting back home. While on the road Baby T2.0 started walking. It was a shame I missed her taking the first step but I did see her taking a couple of steps a few days later while talking to Mrs. T and the kids on Skype. Now we got two kids walking (well one runs at 100km/hr), life is about to get even more busier. 🙂

We made some purchases in Feb but we are far from being done. Lately, I have found that it’s getting tougher and tougher finding good valued dividend stocks. I’m hoping we will see some volatility in the near future to provide some buying opportunities. Given the CAN/US exchange rate is terrible now, we probably will continue focusing on purchasing Canadian dividend stocks.

February Dividend Income

In February 2017 we received dividend income from the following companies:

AbbView (ABV)

Apple (AAPL)

Pure Industrial REIT (AAR.UN)

Bank of Montreal (BMO.TO)

Corus Entertainment (CJR.B)

Dream Office REIT (D.UN)

Dream Global REIT (DRG.UN)

Dream Industrial REIT (DIR.UN)

Emera (EMA.TO)

General Mills (GIS)

H&R REIT (HR.UN)

Inter Pipeline (IPL.TO)

KEG Income Trust (KEG.UN)

Kinder Morgan (KMI)

National Bank (NA.TO)

Omega Healthcare (OHI)

Procter & Gamble (PG)

Potash (POT.TO)

Prairiesky Royalty (PSK.TO)

RioCan REIT (REI.UN)

Royal Bank (RY.TO)

Starbucks (SBUX)

Smart REIT (SRU.UN)

AT&T (T)

Vodafone (VOD)

Verizon (VZ)*

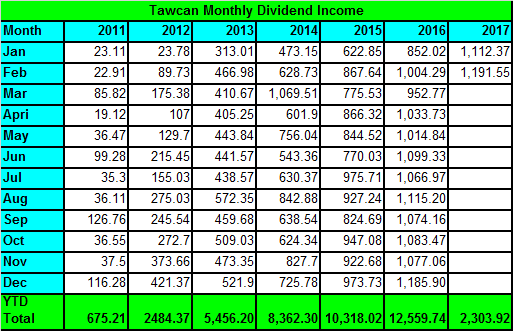

In February 2017 we received a total of $1,191.55 in dividend income from 26 companies. Oh we’re so close to breaking the $1,200 per month milestone. Hopefully next month?

Out of the $1,191.55 dividend income received in February, $332.35 was in USD while $859.2 was in CAD. This is roughly a 30-70 split. Please note, we use a 1 to 1 currency rate approach. Therefore, we do not convert the dividends received in US dollar into Canadian currency. Reason for doing this is to keep the math simple and avoid fluctuations in dividend income over time due to changes in the exchange rate.

* Note: For some reason I missed Verizon in our January report so I have included Verizon in the Feb report.

The top 5 dividend payouts were Bank of Montreal, National Bank, Royal Bank, Omega Healthcare, and Procter & Gamble. The top 5 dividend payouts account for 56.8% of our February dividend income. Am I worried that the top 5 account more than half of our monthly dividend income? Not really as these are big corporations with long dividend payout histories.

Dividend Growth

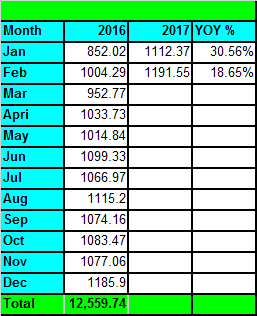

Compared to February 2016 we saw a YOY growth of 18.65%. Although not as crazy as last month’s +30% YOY growth, I’m extremely pleased how well we’re doing on this matrix.

Dividend Increases

In February a number of companies that we own in our dividend portfolio announced dividend increases:

- Suncor Energy Inc. raised dividend by 10.34% to $0.32 per share.

- Manufalife Financial raised dividend by 10.81% to $0.205 per share.

- TransCanada Corp raised dividend by 10.62% to $0.625 per share.

- Coca-Cola raised dividend by 5.71% to $0.37 per share.

- Wal-Mart raised dividend by 2% to $0.51 per share.

- Canadian Imperial Bank of Commerce raised dividend by 2.42% to $1.27 per share.

- Royal Bank raised dividend by 4.82% to $0.87 per share.

- Magna International Inc. raised dividend by 10% to $0.275 per share.

- Bank of Nova Scotia raised dividend by 2.7% to $0.76 per share.

All these raises have increased our annual dividend income by $204.12. To get the same amount of dividend increase, at 3% dividend yield, we would have need to invest $6,804 of new capital. This is yet another good example of our money working hard for us so we don’t have to.

Conclusion and Moving Forward

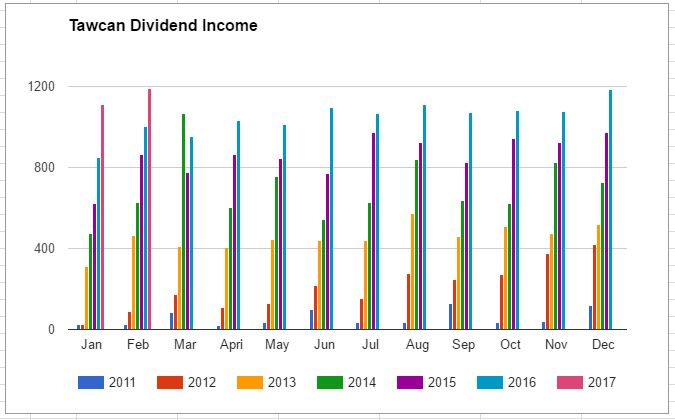

So far in 2017 we have received a total of $2,303.92 in dividend income. It’s neat to see that we are almost eclipsing our dividend total from 2012 and over 40% of dividend total from 2013. Definitely neat to see that we’ve made incredible amount of progress in the last 5 years.

Dear readers, how was your February dividend income?

you have roughly 20 dividend paying stocks? How much have you had to invest in all of them to get this kind of payback? Are they all monthly or do some of the stocks pay you quarterly? I am new to this and want to start? I am really enjoying reading your blogs and am learning a lot! instead of taking the money every month don’t you leave the money in so it keeps buying more dividend stocks?

thanks Scott

Hey Scott,

Thank you very much. You might want to take a look at the Dividen FAQ that I wrote. It should answer all your questions. And yes we reinvest all the dividend income each month. The plan is to use the dividend income once we are financially independent.

I’m in the beginning stages of accumulating a diversified collection of dividend stocks. Your chart above inspired me to create my own. It was awesome to see in 4 years how far i’d come and in 2016 I reached my first month with $100 in dividend income. I look forward soon to having ALL months be a minimum of $100. Watching the snowball accumulate is a nice feeling.

Congrats on receiving $100 in dividend income. It takes patience and persistence to build your dividend portfolio/income. Keep up the good work.

Keep up the good work Bob. It takes time but if you are re-investing the gains every year it really starts to show after five years. Last year was a down year for me in that my divs actually went down for several reasons including selling some losers plus some div cuts.

I hope to get approx. a 10% div increase per year (yoy) and it has done so up to last year. A setback in the increases is not all traumatic if you step back and look at what you still pulled in and re-invested then the future is still pretty good.

Pull backs are a good time to pick up more stock(s) if you have the tolerance for that,

Retiring this year and I will go from accumulation to pulling out money.

One always has doubts if there is enough money there. I will find out soon.

$14,5K in divs so far this year mainly within RRSP & TFSA.

RICARDO

Nice work. Your first two months of dividend income are up nicely YoY. It’s going to be a great dividend income year for you.

Just found your site via Retireby40. That’s pretty amazing growth in your dividends! Haha I guess in a few years, you can retire and live completely off of your dividend income.

Thanks Troy. That’s our FI plan – to live off dividends. 🙂

Divident Growth increase is seen clearly in your annual report. This will inspire us to opt for this type of approach in finances. As you mentioned i the comment, Patience is the most required thing to look for the returns.

Thanks Durga, patience is definitely a key when it comes to dividend growth.

I really enjoy seeing people “ahead” of me cause I can pin point where I am currently and see what it will take and the time it will take to be where they currently are! Provided I stay the course. Congrats on a record month Tawcan!!

Rome wasn’t built in one day so neither should your dividend portfolio. It takes years to build a dividend portfolio so be patient. 🙂

Looks like you’ll probably hit over $1,000 every month this year. Quite the milestone! Congrats!

Yup will be over $1,000 every month this year. Hopefully more like $1,100 every month or more.

That is a fantastic increase on last years income, you should be very pleased with that. Your forward dividend income must be growing at an amazing rate!

Thanks, the forward dividend income is growing nicely. Very happy that our money is working hard for us.

Keep up the good work. It’s updates like these that keep me motivated. I love reading about our fellow DGI’ers passive income performance. Nice long list of companies paying you too. Keep putting up numbers like these and you’ll keep amassing great year over year percentages too. Thanks for sharing.

Hi Keith,

Thanks, it’s always great to see other DGI’ers passive income performance and learn from each other.

The YOY growth is really awesome. Great job. I really should keep better record of our dividend income.

Hi Joe,

You can start keep better record of your dividend income today. 🙂

Nice work there Tawcan, pretty crazy to think you’re making more per month than you did per year just a few years ago 🙂 Even crazier to think there may come another point in the future where that’s true again!

Thanks Misterslm. It’s pretty awesome to see our progress for sure. Looks like you’re doing pretty well with your dividend income too. Congrats.

Wow, it’s so neat to see your progress over time! Way to go with building that passive income. 🙂

Thanks Mrs Picky Pincher. It’s amazing to look back and see how much progress we’ve made over time. 🙂

Another great update. I enjoy seeing your monthly YOY% increase. At what point will you stop your main work and “retire?”

We estimate that we need about $40k in dividend income to “retire.” But the thing is, I probably will end up working in some level. We still have a long way to go before we hit that number. 🙂

This report makes a great case for DGI. Stories like this help me to be more certain and to take more risk in my options strategy. Worst that can happen is to be assigned a great DGI stock.

Yup for sure. Now just need to figure out how to make our portfolio grow faster and get more dividend income.