This update is a little bit later than usual as I’ve been under the weather the last few days. 🙁

When I tallied our dividend income in middle of December, I knew we already met our goal of receiving $8,000 of dividend income in 2014. Obviously both Mrs. T and I are very happy with this progress but we are very interested to know what we’d end up on the final dividend income amount for 2014.

December was a busy month for us when it comes to dividend stock purchases. We made several purchases. First we bought some Suncor shares and then ended the month by buying shares of BP PLC, ConocoPhillips, and Unilever PLC. Let’s just say January will be even busier when it comes to dividend stock purchases. We’ve already made a few purchases which I will write a blot post later.

Without further ado here are a list of stocks that we received dividend payment in December:

Pure Industrial REIT (AAR.UN)

BP PLC (BP)

Canadian National Railway (CNR.TO)

Chorus Aviation (CHR.B)

Chevron (CVX)

Corus Entertainment (CJR.B)

Dream Office REIT (D.UN)

Energyplus Corp (ERF.TO)

Enbridge (ENB.TO)

Fortis (FTS.TO)

H&R REIT (HR.UN)

Intac Financial (IFC.TO)

Intel (INTC)

Johnson & Johnson (JNJ)

KEG Income Trust (KEG.UN)

The Coca-Cola Co (KO)

Liquor Store (LIQ.TO)

McDonald’s Corporation (MCD)

Manulife Financial (MFC.TO)

MCAN Mortgage Corporation (MKP.TO)

Qualcomm (QCOM)

RioCan REIT (REI.UN)

Suncor (SU.TO)

Waste Management (WM)

In December we received a total of $725.78 in dividend! This is an increase of 39.06% compared to December 2013.

[show-rjqc id=”6″]

Please note, when it comes to monthly dividend income, I do not differentiate US and Canadian currencies. To keep the math simple, I’m using a 1 to 1 currency rate when it comes to dividend income received in US currency. This may not be accurate but it keeps life simple. I like simple life. 🙂

The biggest dividend contributor in December was Manulife Financial with $99.36

In 2014 we received a total of $8,362.30 in dividend income! That’s 4.5% over our $8,000 annual goal. What’s more impressive is our annual dividend increased from $5456.20 in 2013 to $8,362.30 in 2014. That’s a 53.26% year over year increase! I’m ecstatic to see such growth!

To put this number into perspective….

We got paid $22.91 per day for doing absolutely nothing at all!

Please repeat that last sentence again if you don’t understand how awesome it is.

If we were to work 52 weeks and 40 hours each week, the hourly wage would be $4 per hour. We’re still a long way off from BC’s minimum wage of $10.25 per hour but it’s a very good start.

Another year in dividend stock investing under my belt and I’ve learned and realized a few things:

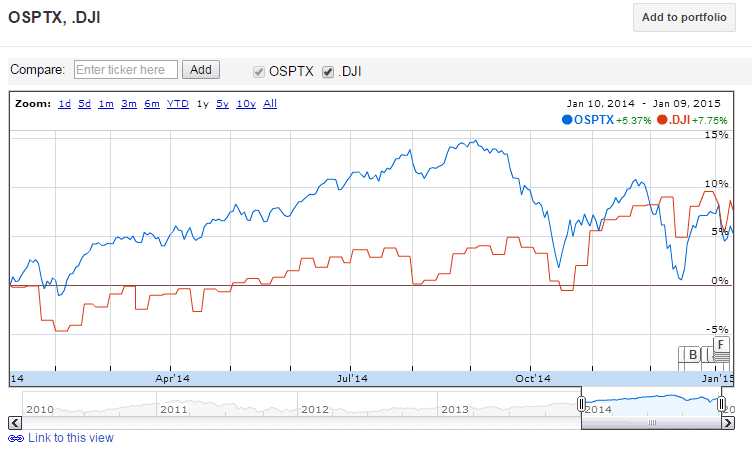

1. Continue executing the Dividend Growth Investing strategy despite the markets performance

The markets will go in either directions. We have no control over which way they’ll go. So stop worrying about how the markets are doing and just keep executing your strategy. If you’re into index investing, keep doing that; if you’re into dividend investing, keep doing that. Don’t give up your strategy half way through the year and decide to implement a whole new strategy.

2. Ignore the market stock price, focus on evaluation and future growth.

Don’t quibble over eighths and quarters on the stock price. If you think the company has great evaluation and excellent future growth, it’s important to own the stock rather than trying to save a few dollars in the transaction and end up not owning it at all. At around 52 week high of $70 in end of 2012, Johnson & Johnson may have seemed pricey back then. If you tried to wait till the price to drop to $69, you have completely missed the opportunity of owning this great company. In case you’re wondering, JNJ is around $104 and you would have missed $5.35 per share worth of dividend.

3. Finding a balance between high yield stocks and high dividend growth stock

Buying a stock that pays 4% or greater dividend yield is great. But if the company doesn’t grow its dividend, inflation will slowly decrease the real purchasing power of dividend received. On the other hand, although a stock may only pay 2% dividend yield at the time of purchase, if the stock has a yearly dividend growth of 25%, in 5 years the dividend yield on cost would be over 6%!

The key is finding a balance between high yield stocks and high dividend growth stocks. Is the mix 50/50? Or 20/80? Or 40/60? That magic number will depend on the individual and his/her circumstances. For example if you’re looking for dividend income to take over your monthly spending in the next few years, you might lean toward a higher ratio of high yield stocks; if you have 10+ years of time line before you need to use the dividend income, you might lean toward a higher ratio of high dividend growth stocks. Again this number will different per individual and is really what you’re comfortable with.

I have updated our dividend income page to reflect our October dividend income. You can find our dividend portfolio here.

I don’t know about you but I’m very excited about 2015. 🙂

Hello Tawcan,

I admire your dividend update. I am actually surprised by your numbers! With that results, I just imagine how motivated and determined you are now to go for more. Good luck! I hope you feel better now. Go for the better year! Yay!

Hi Jayson,

It’s a nice surprise that’s for sure. 🙂

Tawcan,

Great results for 2014 with over $8000 in annual dividend income!

“We got paid $22.91 per day for doing absolutely nothing at all!”

That must feel good!

Thanks for sharing and best of luck in 2015.

Hi Mr. Captain Cash,

It’s a great feeling to have. It would be even better if that amount is bigger in 2015. Thanks for dropping by.

Tawcan,

That’s a lot of companies forwarding you a piece of their profits, congrats!

Looking forward to see your income grow in 2015.

Feel better soon,

NMW

Hi NMW,

Thanks, will be very excited to report our dividend income in 2015.

That’s a pretty great year. You have a lot to be proud of.

Hi Adam,

Thanks for taking the time to comment!

Dear Tawcan,

I’m sorry to hear that you were feeling under the weather, I do hope you are better now?

Congratulations once again on achieving more than your goals for 2014. I am sure 2015 is gonna be an awesome year dividend growth and value investors, and I wish you all the best for it!

Cheers

Hi M,

I’m feeling better now, thanks for asking. Very excited about 2015. It’s going to be a great year!

Out of curiosity, how do Canadians tax dividends?

In other news, I bet those oil stocks hurt! I know, I’m employed in Oil & Gas and it sucks right now.

Hi Elroy,

Canadian tax dividends in quite favorable ways if the dividends are from eligible companies. I keep all REIT and income trusts in TFSA so avoid tricky tax calculation. Yes Oil and Gas is hurting right now but it also means great investing opportunities.

Awesome update!

“We got paid $22.91 per day for doing absolutely nothing at all!”

Repeated 🙂

I hope to provide our update within the week.

Cheers,

Mark

Hi Mark,

I’m looking forward to your update. 🙂

Tawcan,

Onward and upward! What a great increase year over year and over $700 is killing it! I wonder what December 2015 is going to be… over $1K!? I think so, I’m confident in your consistency with your portfolio.

Great job and great finish to the year, excited for us all!

-Lanny

Hi Lanny,

Thanks, we’re very happy with the 2014 dividend income results. Hoping for a great 2015. 🙂

Thanks for sharing your update, Tawcan. Congarts on the dividend income. Its been a great year for you.

I have been looking at MFC recently…..did you buy it recently or have you held it through the painful years? I think they have cleared up their depressing balance sheets and the company looks well placed for the future.

R2R

Hi R2R,

We bought MFC before the great depression, so yes we held it through the painful years. 🙂

Tawcan,

Congrats on the impressive growth yoy of the dividends.

Hi Investing Pursuits,

Thank you for your kind words!

Great job this year Tawcan. Your YOY increase is ridiculous, over 50% wow. I was happy to receive $2500 in dividends this year but over $8000 is really something. Good work.

Hi captain Dividend,

Thanks we’re hoping to have great dividend income in 2015 as well. Hopefully we can get similar kind of YOY increase this year too.

Hi Tawcan

Hope you’re feeling better.

Well done and congrats on beating your 2014 goal for dividend income!

Good luck in achieving your goals for 2015!

Hi Weenie,

Thanks I’m feeling better this week. Looking forward to 2015.

Tawcan,

You put together a very nice looking year. Are you aiming for $11-12k in 2015?

MDP

Hi MDP,

Thanks for your kind words. Haven’t figured out what we’re aiming for exactly but $11-12k range sounds about right. 🙂

Thanks for sharing your update Tawcan! It is pretty amazing the growth you’ve experienced year over year, especially given the pure numbers of it. Almost $3,000 in one year is huge and reflects the amount of capital you’ve been able to invest. Keep up the good work, five-digits awaits!

Hi W2R,

Thanks for the kind words. Very happy with 2014’s progress. Hopefully we’ll be hitting that magical five-digits mark by this time next year.